A study by Expedia Group and Luth Research found that the average traveler views 141 travel-related pages before booking – American travelers browse even more, averaging 277 pages. When it comes to booking, 51 percent choose an OTA, primarily for the convenience of comparing options and prices in one place. This preference has encouraged modern travel brands to embrace data sharing, benefiting both consumers and businesses through enhanced connectivity and increased revenue.

At the heart of this connectivity is the Application Programming Interface (API) – the key technology driving seamless integration across platforms. In this article, we’ll explore essential travel APIs that every travel business should know. While not an exhaustive list, this selection has already proven valuable to many industry startups.

Travel APIs: main types and how they work

An application programming interface allows for sharing data streams and functionalities between different systems. APIs work as control panels for developers to link software components without dealing with source code.

Watch our explainer on the technology of APIs

What does this mean for the travel industry? If you run a hotel business, you can let your customers rent a car straight from your website by integrating your booking website with available local car rental services. This may put a car-rental commission in your pocket or just spare your customers the trouble of browsing the web to rent a car.

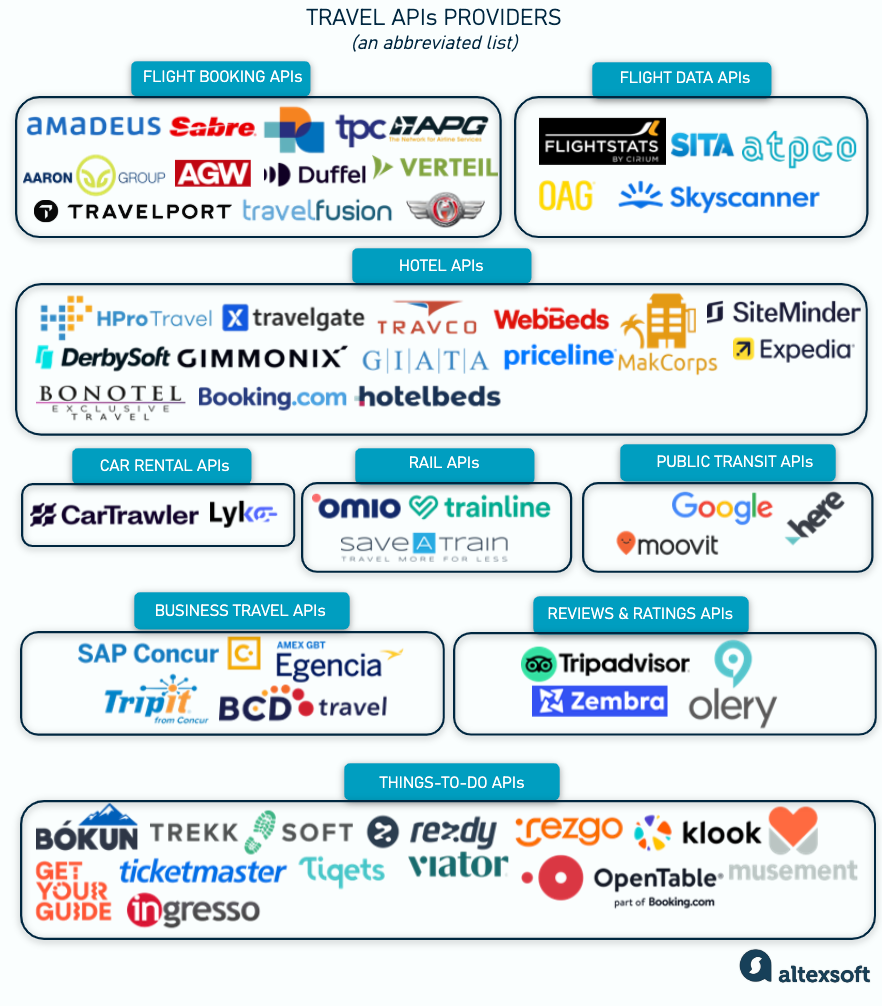

An abbreviated list of travel API providers

So, let’s talk about the most important types of APIs used to unify travel industry features and information. Warning, it’s going to be a long read, so you may hop to one of the following sections that seem interesting by navigating the menu to the right if you’re on a desktop:

- Flight booking APIs

- Flight data APIs

- Hotel APIs

- Car rental APIs

- Rail APIs

- Business travel APIs

- Reviews and ratings APIs

- Things-to-do APIs

- Public transportation APIs

Let’s start from APIs for air distribution.

Flight booking APIs

Historically, global distribution systems (GDSs), the main aggregators in the industry, have been the type of player that would help you the most with flight booking. A GDS collects and consolidates data from a wide spectrum of service providers and allows agents to reserve not only airline seats, but also hotel rooms, cruises, railway tickets, etc.

With the advent of the New Distribution Capability (NDC) came many new players allowing bypassing GDSs for air distribution. These air content aggregators provide APIs and also booking portals, where agencies, travel advisors, corporate travel managers, and TMCs can get instant access to flight deals.

Of course, there’s also an option of direct API connection with airlines, and it’s a solid choice for smaller companies who only book from one or two carriers or OTAs of any size that want to build close partnerships with a particular airline. For the rest of you, who want access to the largest airline network, we will cover GDSs and other providers (NDC and non-NDC) below.

For a separate overview of flight APIs, go to our dedicated article.

Amadeus flight APIs

Amadeus is one of the major GDSs and originates from Europe. Currently, Amadeus flight APIs are shipped in two flavors.

Self-Service APIs meet the needs of startups and travel businesses without ARC or IATA certification. These APIs use JSON format for data exchange and modern REST architecture which makes them easy to integrate. The suite allows you to

- search and compare flights and fares (including lowest fares, most booked destinations, cheapest dates, and so on);

- book flights; and

- analyze flight prices, predict arrival and departure delays, and more (AI-based services).

However, ticketing can only be done through consolidators, and you don’t get access to corporate or negotiated fares. Self-service APIs support only public fares.

Enterprise APIs target mature businesses building large travel applications. The Enterprise subscription connects you to nearly 200 APIs, including

- new REST APIs from the Self-Service suite; and

- older SOAP APIs that rely on the XML data format and provide broader functionality. For example, only this catalog gives you access to flights operated by low-cost airlines.

Amadeus also provides NDC capabilities in their Enterprise subscription, via XML/SOAP APIs. Upon establishing this integration, you’ll be able to:

- search for NDC flight offers and combine them with non-NDC content;

- get prices and enable users to customize flights;

- create bookings (orders) and generate booking references (PNRs); and

- handle payments and ticket issuance.

Now, let’s compare these capabilities with other GDSs.

Learn more about the subject from our Practice Guide to Amadeus API Integration.

Sabre flight APIs

Sabre is another major GDS and the pioneer in the world of automated booking. There are literally hundreds of Sabre APIs in REST and SOAP formats that cover pretty much the same set of functions that Amadeus provides. In terms of flight distribution, Sabre offers:

- flight search, including alternate dates or airports, basic fares, rules, etc.;

- flight booking and ticketing;

- payments and pricing;

- reservation management (itineraries, PNRs, etc.)

- seat maps; and

- reporting and data analytics (e.g., top destinations, low fare history, and others)

If you’re considering Sabre API integration, you can contact us. In September 2020, AltexSoft became Sabre’s authorized development partner after we had completed a number of integrations for agencies and other businesses.

Read our article Sabre API Integration: Hands-On Experience with a Leading GDS to dive deeper into details.

Sabre provides NDC connectivity via Offer and Order APIs. Yet, to use them you need special credentials, so contact your Sabre Account Representative for assistance. Once you gain access to NDC-enabled APIs, you’ll be able to

- shop for airline NDC and non-NDC air offers (including LCC flights), hotels, and car rentals;

- validate prices;

- create, view, change, fulfill and cancel orders (the API doesn’t support ancillaries though); and

- refund tickets where fare rules allow for this.

Depending on a specific airline, you can get rich content and personalized bundles. While carriers push their offers in XML – which is what NDC requires – Sabre provides the REST/JSON interface for using them.

Travelport flight APIs

Travelport unites three GDS systems: Apollo, Worldspan, and Galileo. It provides a single point of access to the inventory of the three GDSs:. Travelport Universal API uses SOAP/XML formats and embraces

- air shopping and booking;

- fares and ancillaries;

- air content and merchandising; and

- seat maps.

Travelport also offers RESTful JSON API collections that generally overlap with the Universal API, but are more lightweight, faster, and optimized for mobile search and booking. In terms of flight services, they cover

- air search and booking,

- ticketing, and

- payment support.

Travelport made NDC content accessible via their Air APIs, in addition to standard GDS offers.

TPConnects API

TPConnects is a tech provider that offers tools both for airlines and resellers. Their Iris API is directly integrated with a number of airlines, such as Lufthansa, British Airways, Emirates, Ryanair, and many more. It supports a wide range of retailing capabilities including

- comparing and shopping for GDS, NDC, and LCC offers,

- seat selection,

- booking with instant and deferred payment,

- managing changes, refunds, and upgrades,

- upselling ancillaries, etc.

The API is based on IATA NDC schema 18.2 and 21.3 and targets three types of potential clients— OTAs, TMCs, and corporate booking tools.

Travelfusion API

Travelfusion is a flight and accommodation aggregator that works with over 370 low-cost carriers. The company offers

- Direct Connect XML API that ensures real-time availability and a fully automated booking process; and

- Fast API, a new and lightweight product for rapid integration with any platform and creating a wide range of solutions, including widgets and mobile services.

Flight search and booking functionality can be also provided in JSON format.

They also have a flagship product tfFlight API – a one-stop solution for booking flights and ancillaries from LCCs, full-service carriers, and consolidators. The API supports NDC, sourcing rich content from over 42 carriers.

Aaron Group API

Aaron Group provides deals from 580+ GDS, NDC, and low-cost airlines. With their unified Symphony API, you can

- access airline content and offers,

- book ancillary services and travel insurance,

- provide flight delay compensation, and

- sell = hotels as part of a flight shopping cart.

They also allow you to use various payment and settlement options including IATA BSP, IATA EasyPay, ARC, and credit cards.

How flight payments work

Verteil API

Verteil is an NDC aggregator dedicated to replacing legacy airline distribution scenarios with direct bookings. Its unified API connects travel agencies to rich content from 40+ airlines. Though capabilities may differ from carrier to carrier depending on their NDC readiness, the standard set of available features includes

- shopping for flights, branded fares, and ancillaries (seats, meals, baggage, and more);

- putting the booking on hold and ticketing later;

- support for frequent flyer programs,

- multi-payment options (credit cards, Verteil wallet, PayPal, and so on);

- Book Now, Pay Later scenario;

- automated itinerary modification, ticket re-issuance and cancellation, and void and refund workflow.

Note that travel agencies will automatically get access to inventory from all new airlines onboarded.

APG API

The APG Platform has a solution for selling air products compliant with NDC standards. It can be used via a B2B tool or an API for

- shopping and booking air fares and ancillaries,

- selling dynamic packages (flights plus accommodations, car rentals, etc.),

- creating personalized offers, and so forth.

Besides content, it supports access to a network of hotels, rail, car rentals, activities, and insurance. APG also cooperates with both IATA-accredited and non-IATA travel agencies.

HitchHiker API

The HitchHiker API distributes flight fares and ancillaries from all major GDSs, consolidators, and over 120 low-cost and full-service carriers it connects directly, including over 20 NDC airlines. Besides ancillaries and fares, it allows for flight booking, reservation management, and payment. The content and functionality is also available as a SaaS solution.

Duffel API

Duffel links travel distributors to over 300 carriers via a unified Flights API. It maintains direct connections with nearly 30 airlines, while all others are accessible through Travelport GDS. Depending on a particular airline, the API enables you to

- add ancillaries,

- pick seats,

- change and cancel orders,

- add loyalty program accounts, and more.

If you don’t have an IATA/ARC accreditation, Duffel allows you to directly access NDC content using their credentials and ticketing authority.

AirGateway API

AirGateway provides aggregated content from over 30 NDC and LCC airlines via direct connections, as well as consolidator and GDS deals (Travelport). Agencies can access the platform via a desktop tool called BookingPad or a direct API. Besides basic NDC capabilities, such as shopping and booking, AirGateway’s API also allows for

- automated order changes, refunds, voids, and disruption management,

- multi-currency conversion,

- accessing order history,

- adding and removing ancillaries, and so on.

Also, if you’re already connected to one of AirGateway’s partner providers, you can access NDC content there.

Flight data APIs

This group of air travel-related APIs embraces connectivity options that help gather technical and specific flight data. For instance, Cirium (now owns Innovata and FlightStats) and OAG are global sources of flight scheduling data. Most of this information comes from the key technical players on the market. But let’s also mention one fare aggregator (or metasearch engine) — Skyscanner.

Skyscanner flight prices APIs

GDSs send general flight data, while Skyscanner provides more precise fare returns for a lower cost. To use Skyscanner API you need to enroll in an affiliate program. If you pass the vetting process, you get access to a set of APIs for free. Once you reach a certain revenue threshold, the service allows you to negotiate a commission based on your traffic and market proportion.

While Skyscanner also provides car rental and hotel APIs, its strong point is its flight fare search. It comes in two main versions.

Flights Indicative Prices API. This set ships the cheapest quotes from cached prices for an aggregated variety of origin-destination and time-frame queries, meaning that you can set up a flex search. The drawback is the cache doesn’t update frequently for less popular route and date combinations. If the prices change, sometimes your users won’t be able to see fresh info.

Flight Live Prices API. The live pricing API, on the other hand, returns exact fares for any given moment. But you must query the exact time and route to retrieve prices. This feature comes in handy whenever you need to compare prices for specific dates and routes.

The default response format in both cases is XML, but you can switch to JSON.

Cirium and FlightStats APIs

Another popular API in this segment is provided by FlightStats, a global flight tracker and travel applications provider owned by Cirium. FlightStats APIs are designed with REST, support JSON, JSONP, XML/SOAP. They include responses in English, German, Spanish, French, Portuguese, Arabic, Japanese, and Simplified Chinese.

The set includes

- airlines data such as codes, names, active status,

- airport delay index,

- airports data,

- connections,

- data reports by Cirium,

- airline equipment,

- data for FIDS (Flight Information Display Systems),

- flight alerts,

- flight status,

- flight track,

- historical flight status,

- flight’s performance ratings,

- schedules, and

- weather.

Another useful service is the Trips APIs. This set focuses on the ability of travel providers to improve the itinerary experience of their customers by keeping them informed about their trips. These include alerts about important changes, especially delays, cancellations, and other travel disruptions to enable proactive reactions to these events.

FlightStats APIs are known in the development community as well-documented and coherent. They allow for deep customization to tailor travel software to specific business and UX needs.

OAG APIs

- Carriers API grants access to IATA and ICAO carrier codes;

- Equipment API provides access to IATA and ICAO equipment codes;

- Flight Info API returns schedules and granular status data showing all changes during the flight;

- Flight Info Alerts provides near real-time scheduling changes;

- Flight Info Connections returns weekly updates on passenger and cargo flight connections;

- Locations returns airport codes; and

- Schedules provides, well, schedules data from OAG.

OAG content covers 97 percent of flights worldwide.

SITA APIs

SITA is one of the major flight market technology providers that offers a decent set of APIs that mostly revolve around airport, baggage, and boarding information. Via SITA APIs, you can get timely information on

- airlines,

- airports (location, IATA/ICAO codes),

- flights (including real-time data),

- weather at a particular airport; and

- the average waiting time in a specific area of the airport (customs queue or security line).

SITA Flex APIs allow you to create mobile apps interacting with Self Baggage Drop Devices, Self Boarding Gates, scanners, and other airport technologies. Boarding Pass API streamlines the creation and distribution of mobile boarding passes. And Bagjourney API facilitates baggage tracking using a bag tag number or passenger surname. Yet, this functionality is available only if you have an agreement with a particular airline.

ATPCO Routehappy APIs

Routehappy APIs offer content for sales channels. These JSON APIs provide information about amenities and distribute product and ticket attributes from 477 airlines. Some of this data comes via NDC channels. All Routehappy content can be divided into three groups:

- UPAs (Universal Product Attributes) – images, cabin descriptions, seat infographics, language translations, etc.;

- Amenities – food and beverages, Wi-Fi, seatback videos, power outlets, etc.; and

- UTAs (Universal Ticket Attributes) – all ticket rules, including consolation allowances, upgrades, priority check-in, etc.

Hotel APIs

If you’re new to the world of hotel room distribution, spend five minutes to understand how the ecosystem works before diving deep into the APIs. We’ve made a video for that. If you know the basics, just skip our explainer.

If you haven’t subscribed after the first video, now's a great time to do it

There are a few ways to gain access to hotel data and booking capabilities:

- direct connection via property management (PMS) and central reservation systems (CRS),

- connection via channel managers,

- connection via aggregators, such as GDSs,

- connecting via wholesalers (bed banks), and

- partnering with big OTAs.

Since we already covered GDSs in the previous section, here are quick links to the hotel booking functionality in their APIs: Amadeus hotel APIs, Sabre hotel APIs, Travelport hotel API.

Also, considering that you’ll likely be pulling hotel information from various sources, you’ll need to set up hotel mapping functionality. For this, consider two API providers.

GIATA leverages AI to assign unique IDs to each accommodation in its vast database. Its mapping solution, available via XML API, matches addresses, geocodes, GDS/CRS codes, and other details from different suppliers with its internal IDs to avoid duplication. GIATA also has a room-level mapping API that addresses descriptions and other hotel content.

Mapping.Works by Gimmonix employs ML-based text analysis to extract meaning from various inventory descriptions and also operates on two levels: hotel mapping and room mapping.

Click on a dedicated article on hotel booking APIs, if you’re interested.

SiteMinder API

SiteMinder is one of the largest channel management providers for hotels. It allows hoteliers to connect their properties to the leading OTAs and GDSs via the cloud interface, increase direct bookings, and analyze performance.

While their packages can be extremely useful for hotels that strive for market visibility, SiteMinder’s SiteConnect API serves both hoteliers and OTAs ensuring seamless data exchange between resellers and suppliers.

MakCorps API

MakCorps has been collecting information about hotel prices of different vendors since 2010. Its Hotel Price API covers not only current rates but also reviews, ratings, and other data from over 200 OTAs including Booking.com, Agoda, Expedia, and Hotels.com. Besides that, MakCorps offers historical hotel pricing data which enables travel agencies, hotel chains, and other clients to understand buying patterns and adjust rates to secure a competitive advantage. All data is received in XML format but MakCorps transfers it into JSON for customer convenience.

DerbySoft API

DerbySoft is a connectivity provider that acts as a single point of contact both for hotels and travel sellers. It maintains a network of 750 partners including

- large hotel groups (Marriott, Hilton, Hyatt, Accor, and more),

- PMSs like Oracle Opera,

- destination management companies,

- bed banks,

- online travel agencies, and

- other distributors.

To initiate the connection process, choose businesses you want to link and complete the online form.

Travelgate APIs

Travelgate is a travel marketplace by Travelsoft with over 1000 suppliers. It is accessible via a customizable API.

Hotel-X is a GraphQL-based API for accessing static information, making bookings, and managing reservations. In addition, Travelgate offers plugins to customize your requests and responses. Some of the plugins include

- a Mapping plugin to convert supplier’s codes to buyer’s codes,

- a Blacklist plugin to exclude specific hotel codes,

- a Cheapest Price plugin to find the best price,

- a Currency Converter plugin,

- a Virtual Credit Card plugin to connect with a VCC supplier, and more.

Travelgate has detailed docs with an AI assistant for easy installation and making requests.

Hotelbeds APIs

Hotelbeds is one of the largest accommodation, transfers, and activities distributors. Its API Suite covers more than 120 markets globally operating in about 185 countries. There are three main hotel-related APIs that Hotelbeds suggests, connecting to about 300,000 hotels worldwide.

Hotel Content API returns both static and dynamic information. Static info includes hotel descriptions, pictures, addresses, etc. The dynamic part retrieves data that can be changed at any moment: availability details, prices, fees, etc.

Hotel Booking APIworks in combination with the previous one enabling all aspects of the booking procedure, from requesting room availability to receiving booking lists and making cancellations.

Hotel Cache API is aimed at providing massive amounts of data for travel packages or flex room searches. Thus, the API returns a specific snapshot of data captured at a given moment.

It’s worth mentioning that Hotelbeds also has APIs for booking activities and transfers.

Read our dedicated article on Hotelbeds API integration based on AltexSoft experience.

WebBeds API

WebBeds is another large bed bank, boasting a portfolio of over 500,000 hotels in over 39,000 destinations, not to mention thousands of transfer services, excursions, and attractions. It owns several smaller wholesalers as well as two niche brands:

- JacTravel DMC specializes in the UK, France, and key mainland European destinations; and

- UmrahHolidays International organizes religious travel to Saudi Arabia.

OTAs, tour operators, and other travel providers can tap into WebBeds inventory through their branded booking websites or API connectivity (contact them directly via an online form for more details).

Bonotel API

Bonotel is a niche wholesale distributor solely working with luxury and boutique hotels. Currently, Bonotel API provides access to more than 2,600 travel suppliers globally that operate within the luxury segment and offer access to hotel content and data. There are two versions of the API: the light API using XML format and the complete API using JSON.

To explore the API that Bonotel suggests, you should contact the supplier directly.

Travco API

Travco, one of the oldest hotel wholesalers, focuses on the European market and provides accommodation bookings from over 12,000 hotels at over 1000 destinations. Their XML API gives access to hotel properties (including hotels, resorts, and retreats) and travel ancillaries (like transfers, tours, and restaurants). Also, this API allows for displaying content in nine languages.

HPro Travel API

HPro Travel (formerly HotelsPro) is a bed bank with a focus on tour operators and travel agencies, selling properties of different sizes and types, including resorts and luxury hotels. You can also source travel ancillaries. It provides access to over 1,000,000 hotels across 70,000 destinations. Other available inventory types include car rentals, transfers, tours, attractions, and events.

The bed bank offers hotel APIs that support REST and JSON.

Coral API allows you to get up-to-date inventory and hotel information, cache results, check availability, book rooms, and cancel reservations.

Cosmos API returns hotel static data — information on properties and locations, images, room, and meal types, and more.

Expedia Rapid API

The Expedia Partner Solutions API named Rapid is created for online travel agencies that want to incorporate hotel booking support into their products. The Rapid API will allow for:

- receiving geographic definitions and property mappings for over 600,000 regions;

- retrieving property IDs and content;

- getting live rates and availability for over 700,000 properties globally; and

- booking and booking management (changing and canceling reservations).

You can also access the Vrbo inventory, which is an alternative accommodation OTA that connects travelers with homeowners in about 190 countries. Over 2 million Vrbo vacation rentals are exposed via Rapid API.

Booking.com APIs

Booking.com provides two sets of services - for their affiliate partners and for channel managers.

Demand API for affiliates allows for retrieving and booking hotel rooms from the Booking.com inventory. You may send visitors to Booking.com to complete a transaction. If you want to process bookings on your side, you must be compliant to PCI DSS.

Booking Connectivity APIs are an entirely different beast. They are created for channel managers and property management system providers. Basically, if you build channel manager software, these APIs are a must... given that you want to connect your clients to Booking.com. In brief, Connectivity supports

- content,

- rates and availability,

- reservations,

- promotions, and

- problem reporting.

Currently, they're not integrating with new partners, but keep checking for when they decide to re-open integrations.

You can read more about Booking.com APIs and other partnership solutions in our dedicated article.

Another OTA owned by Booking Holdings is Agoda. It’s worth contacting the Agoda team separately to understand how their supply differs from what Booking already offers.

Priceline API

Priceline focuses on OTAs and tech suppliers that help their customers find travel-related data. Currently, the Priceline Partner Solutions API allows for retrieving and booking:

- hotels,

- cars for rent,

- flights,

- vacation packages, and

- travel insurance plans.

Owned by Booking Holdings, Priceline leverages a separate collection of travel deals which includes over 1 million properties and exclusive discounts. Learn more about how to start building an API connection on their website.

Car rental APIs

As you’ve noticed, multiple market players are bundling their services with car rentals. GDS systems and main OTAs already support car rentals, so we won’t be repeating them here. Instead, here are some more sources of car rental data.

You can read our dedicated article on car rental APIs for more integration information.

CarTrawler API

CarTrawler is a total B2B service that connects over 500 mobility suppliers and 1700 car rental suppliers. Currently, the company operates in 50,000+ locations in over 150 countries.

The CarTrawler API allows travel brands to design their own car rental interfaces and connect to their car rental feed, requesting data on

- vehicles,

- best daily rates,

- booking reservations.

You can learn about integration options by applying for a partnership agreement.

Lyko API

Lyko is a mobility technology enabler with a suite of APIs offering connection to over 500 mobility providers, including 25+ car rentals, trains, long-distance buses, transfers, taxis and ride-hailing services with ferries and EV charging stations coming soon.

Their suite is divided into three parts:

- Lyko Book for selling offers,

- Lyko Plan for planning door-to-door trips by combining various modes,

- Lyko Pay for integrating secure payments worldwide.

Based on your needs, you can combine or omit any of the modules. Say, if you need to access search and comparison for a single mode of transport, Lyko Book might be enough.

Note that as a European business, it currently provides prices only in the Euro.

Rail APIs

With train travel on the rise, you may want to consider integrating rail booking functionality. Apart from GDSs, which already offer rail booking, and direct APIs from railway companies, there are train travel marketplaces to tap into as well.

Watch more about the growing trend for rail travel

You can also read a detailed overview of railway APIs in a separate article.

Trainline API

Trainline is a leading train booking app in Europe, connected to over 270 rail and coach operators in 40 countries. You can team up with Trainline as an affiliate or an ancillary partner, but their Global API is perfect for distributors like OTAs, TMCs, etc. It’s a single API to get access to

- predictive real-time information,

- various payment methods,

- live data from international carriers, etc.

It’s complemented with an Agent Tool that allows agents retrieve bookings, do refunds, and book tickets. To get access, fill out the special form.

Omio Affiliate

Omio is an OTA for booking trains, buses, flights, and ferries. Overall, they access over 1,000 transportation providers.

You can join their Affiliate Programme and earn commissions by promoting Omio’s travel options. Beside website widgets and banners, the program gives you access to a Search API. Omio doesn’t have much competition in terms of bus or ferry booking, so you will need access to their program if you want to cover that on your side.

Save a Train API

Save a Train is a train-connectivity technology provider operating in France, Italy, Netherlands, Luxembourg, Austria, Germany, Belgium, Switzerland, Denmark, Sweden, Norway, Hungary, Czechia, Ukraine, and China. It’s also expanding into the US, Canada, Spain, Poland, and Japan. Save a Train provides technology integration through three options:

- Rail APIs with direct connectivity to numerous railway providers and ticket sellers with booking and searching options,

- Rail Affiliate that provides banners and clickable textual links to be integrated into a travel platform,

- Rail White Label that provides all Save a Train technology solutions with a travel business’ logo.

Contact the team directly for more info.

Business travel APIs

All major travel management companies have APIs with access to employee profiles as well as to travel and expense management functionality. Let’s go through connections facilitating corporate travel programs.

Corporate travel management explained

SAP Concur API

SAP Concur strives to engage the development community in building and incorporating their applications with Concur business profiles. How does this work? SAP Concur API aims at two main use cases.

Travel and itinerary support for business travelers. As business travelers book hotels and flights through providers’ apps, their travel data synchronizes with an SAP Concur traveler profile. For instance, if a user has a business trip flying United Airlines, he or she may connect a United MileagePlus profile to SAP Concur to make reservations straight from the United Airlines website, with all data sent directly to SAP Concur.

Expense management. All payments that business travelers make during their trips are automatically synchronized with an SAP Concur profile to track expenses or pay from a corporate bank account. Uber, for instance, has integrated Concur for these purposes.

All apps with SAP Concur API integration are featured in the dedicated App Center.

Tripit API

Tripit is a product by SAP Concur which doesn’t limit its target audience to business travelers only and aims at all types of users. The system consolidates a user’s travel data like hotel, flight, and restaurant confirmations and turns it into a neatly organized itinerary. Also, they provide weather data and points program information.

Tripit API works pretty much the same as the main SAP Concur API. For instance, it allows for embedding an “Add to Tripit” link on the travel booking confirmation page of your website or adding Tripit travel plans to a website or application, enabling users to configure itineraries without leaving your platform.

Amex GBT Egencia API

Another global TMC, Amex GBT has an open API platform that allows its partners to programmatically access its corporate management solution and combine all business travel functionality in a single interface.

The list of services includes

- User Sync API for user management,

- Company Info API for retrieving company name and other details,

- Expense API for sharing live booking and expense data,

- Booking API for getting real-time booking details,

- Approval API to approve and deny booking requests,

- Receipts API for automating payment processes,

- Reporting API, etc.

To work with the APIs, you’ll need client credentials from Egencia.

BCD Travel API

BCD Travel has a robust set of APIs to review travel activity for flight, hotel, rental car, rail, cruise/ferry, tour, and bus trips. Here what services they offer:

- Itinerary API allows viewing itinerary data in real time;

- Invoice API returns transaction data that can be used to view corporate travel expenses;

- Profile API gives access to company and traveler data, such as preferences, rewards memberships, contact details, and more; and

- Air API, Hotel API, and Car API allows you to shop, book, and cancel reservations, while applying specific corporate policies.

BCD Travel encourages third-party developers to partner with. Do that by filling out the form.

Reviews and ratings API

According to Skift, 36 percent of travelers use travel review websites for guidance. This social proof is hard to achieve with your own reviews system if you are a hotel, for instance, or another property provider. Here are a few handy sources containing reviews and opinions.

Tripadvisor API

Tripadvisor Content API allows businesses to incorporate reviews, opinions, and other data that the service collects from its users. The platform works with accommodations, restaurants, and attractions providing the following types of content about different locations (hotels, restaurants, attractions, and points of interest) through their API:

- location details (name, address, and rating),

- location photos (up to 5 high-quality images),

- location reviews (up to 5 most recent reviews),

- location search (up to 10 locations found by the given query), and

- nearby location search (up to 10 locations found near the given latitude/longitude).

TripAdvisor supports 29 languages and covers over 8 million locations globally.

Olery API

Olery provides review data from hotels and restaurants, augmenting it with AI-based sentiment analysis in 15 languages. Their API products return outputs in the JSON format.

If you want to simply display reviews, you can utilize their widget, but the API will provide you with more capabilities, including

- building an interface for editing, filling, and delivering surveys,

- accessing names and pricing of different properties,

- creating a reputation management module where businesses can react to guest reviews,

- accessing review count and average overall rating of the property,

- showing sentiment ratings, and more.

All reviews are returned in a structured format and are updated frequently.

Zembra API

Zembra scrapes reviews from over 60 companies, including Tripadvisor, Foursquare, and even Reddit. In just one call with a business name or address, Zembra delivers all reviews, comments, and reactions in a standardized format.

Zembra API supports common HTTP verbs, returning responses in JSON. You can build API integrations using SDKs available in several popular languages, like C#, Python, and JavaScript.

They have flexible pricing plans as well.

Things-to-do APIs

Like hotels, tours-and attractions (T&A) supply is broad. There are OTAs and niche companies that specialize in connecting travel agents with suppliers, suggesting interfaces, APIs, or both options to configure and source tours. On top of that, these services let you configure custom travel packages that include T&A, accommodation, and even car rentals.

To get more information on tours and attractions APIs, check out our comprehensive article on the topic.

There are two main sources for finding attractions and things to do for your customers:

- local services like London Theatre API, and

- larger vendors that aggregate and share data combined with ticket purchasing support.

We will focus on the latter type.

Bókun API

Bókun is a tourism reseller platform that partly operates as a marketplace where local travel providers and property owners connect with OTAs and agents. In addition, it provides channel management services. Bókun API allows travel agencies to

- get a list of activities;

- check availability, capacity, and pricing for an activity;

- book activities;

- edit booking details; and

- cancel bookings.

This set of features enables configuring custom travel packages via the API interface.

TrekkSoft API

TrekkSoft focuses solely on tours and activities. The company provides graphical interfaces for local T&A companies and tourism offices. TrekkSoft API can be configured to supply resellers with all available T&A, including booking capacities.

Rezdy API

Rezdy is another T&A service for channel management that connects suppliers with travel agents. It offers three REST APIs.

Agent API allows OTAs and other resellers to query products by tour operators, check their availability and pricing, and make bookings and cancellations.

Supplier API is designed for tour operators who sell their products via the Rezdy platform. It lets them manage their inventory and booking capabilities.

RezdyConnect API serves external suppliers who have their own booking platforms. The API facilitates reselling their products via Rezdy channels. It pulls availability and pricing from a supplier’s system and returns bookings and cancellations.

Rezgo API

While Rezgo may look like a common T&A channel management solution, it provides an open-source frontend booking engine fueled by Rezgo API. It supports both XML and JSON formats and is dedicated to building T&A booking solutions that don’t exceed 4,000 requests per hour.

Ticketmaster APIs

Ticketmaster is the largest events booking provider in the market. It covers concerts, festivals, plays, and sports across the United States, Canada, Mexico, Australia, New Zealand, the United Kingdom, Ireland, other European countries, and more. The service claims to reach about 230,000 events worldwide.

There are two main Ticketmaster APIs.

Discovery API is aimed solely at information search. You will be able to source events, filter them by location and type, and retrieve images. There’s also an International Discovery API for European events. It doesn’t work for the UK, Ireland, the US, and Canada.

Partner API allows your customers to directly book and buy tickets from your resource. But unlike Discovery API, it’s not open: You have to enroll in the Ticketmaster affiliate program to use it.

Ingresso API

Ingresso platform provides information on events and seating availability from over 60 global distributors and supports ticket booking and purchasing. Ingresso sources data and sends reservations directly through venue ticketing systems, which ensures real-time updates. Its API is used by Amazon Tickets.

Viator APIs

Viator is a T&A agency acquired by Tripadvisor in 2014. The OTA accesses over 300,000 experiences around the world, including unconventional ones (e.g. “real Prague, a 3-hour tour to see the reverse side of the city”).

Its Affiliate API allows you to merchandise Viator inventory, complementing your offerings with tours and activities. However, Viator will handle customer service and transactions. If you want to preserve more control over the booking process, opt for their Merchant API (the implementation takes up to 3 months while Affiliate API can be integrated within 1-4 weeks).

GetYourGuide API

GetYourGuide is another T&A OTA with access to about 33,000 activities in more than 2,500 destinations. GetYourGuide’s power side is linking specific attractions and activities with locally related ones. For instance, Manhattan cruises will be connected with Empire State Building visits. If you’re a local travel provider, the service requires you to have live-streaming T&A availability. GetYourGuide API is available to partners only.

Klook API

Klook is a T&A provider that mostly focuses on Asian tours with destinations ranging from China and Shanghai to Japan and Singapore. The company suggests OTAs enroll in an affiliate program and get access to the T&A database via either a SaaS solution or an API.

Musement API

Musement is a wide-range T&A platform that combines attractions, tours, nightlife activities, local food and wine places, sports, and music events. The company’s partners can integrate with a REST API to sell products from the Musement catalog containing more than 5 thousand deals in 300 cities in 60 countries around the world.

Tiqets API

Tiqets is an agency that focuses on the digital distribution of museum and attraction tickets. It offers OTAs, travel site owners, and other travel distributors a REST/JSON API for accessing and booking 4,500 products and 2,500 venues in 250 popular destinations across 50 countries.

The Tiqets Distributor API enables you to access up-to-date ticket information, manage inventory and place orders. You can go for full integration where the customer remains on your platform throughout the ordering process, or a partial integration, where you only provide information and the customer is redirected to Tiqets to complete the booking.

OpenTable API

OpenTable maintains access to over 50,000 restaurants worldwide. The main option for those who want to add table bookings to their services is to become OpenTable partners and use their API. It will allow you to source all OpenTable options, but users will still book through OpenTable.com. Once you reach over 100 monthly reservations as an affiliate, you will be able to leverage revenue-sharing opportunities.

If the restaurant industry is your primary interest, check out our article on restaurant reservation APIs.

Public transportation APIs

With the recent trend of making cities more pedestrian-friendly, especially in Europe, the use of public transport is a big part of the travel experience. So what about public transport APIs? There are multiple options to consider.

For a detailed overview of public transportation APIs, go to the linked article.

Google APIs

Embedding Google Maps is quite common today. The Google APIs are open, well-documented, and widely used across industries. However, Google also provides APIs for tracking public transport routes and schedules.

General Transit Feed Specification (GTFS) API is used by both application providers and – very importantly – transit agencies that share public transport data to let users instantly configure their get-around experience. This API sends static-only data, which means users can see schedules and routes, but can’t track disruptions.

GTFS Realtime is the extension to the main service, providing real-time data fabout delays and schedule changes from transit agencies.

HERE APIs

HERE is a technology provider for building custom maps. They have a plethora of APIs, handy for public transit implementation. For travel companies, the most useful one would be the Public Transit API, which includes three REST APIs:

- a Routing API for defining routes by travel times and transit modes,

- a Next Departures API for accessing the list of departures from a given station, and

- a Station Search API for getting station info like name, location, what transport lines serve a given station, etc.

HERE's base pricing plan chargs per transaction and its enterprise plan -- bills per monthly active users or assets.

Moovit API

Moovit is a B2C commuter app that offers different mobility-as-a-service solutions from branded apps along with trip planning capabilities. Their repository of transit data from 7,000+ transit agencies also powers its APIs that can be integrated for multimodal trip planning, routing, and real-time transit data everywhere.

They offer six APIs:

- Multimodal trip plan API for creating multimodal routes,

- Nearby API for showing nearby stops and transport,

- Stops API for displaying stop names and info,

- Lines API for showing transport lines and stops,

- Real-time APIs for updating information live, and

- Service Alert API for notifying about road services.

Among Moovit API users are Microsoft, Uber, and Lyft.

Local APIs from owners and consortiums

You can expect to find decent APIs from companies operating in your target regions. While the quality and standards alignment of these APIs vary, they can provide real-time updates and even additional information like the availability of car sharing or bikes near a railway station. Some examples of these are APIs from Dutch Railways and French National Railways, which update information about disruptions and engineering work in real time.

Sometimes the APIs are born as a result of a consortium of data owners and reusers. One such example is OpenTripPlanner, the API providing an in-depth understanding of city transportation.

How to choose the right travel API

We’ve covered just the tip of the available travel API iceberg to provide you with basic information on the integration capabilities that the travel community shares. So, regardless of whether you use one of the products mentioned above or look for something specific, there are general recommendations for choosing a suitable API for your travel business.

Consider popularity. Look at Google Trends to understand how popular the product is. Popularity isn’t only a proof of quality but also the foundation for a community that builds around a product. The more developers use the API, the more pitfalls your team will be able to resolve through communication with fellow engineers. Another good sign is a dedicated forum letting developers discuss issues there.

Evaluate documentation. Look for elaborate documentation with FAQs. Some providers don’t showcase the documentation upfront, requiring additional contracts. If the documentation is not public, make sure that you’ll be able to play with a demo. Expedia, for instance, allows you to try its public APIs right in the documentation section.

Check for standards compliance. Even though an API may provide a great feature list and functionality, ensure that your developers have checked the main REST and SOAP standards compliance.

Consider customization. How customizable is the API or a set of them? Must you use the entire bundle or you can choose specific data records that you want to retrieve? FlightStats, Sabre, and Amadeus APIs are well-recognized for their customization potential.

Notice limitations. These may be regional, language, or partnership-related limitations. Most owners provide this information, asking you to contact their support teams or describing what kinds of limitations are there.

As the world and the travel industry grow more connected application programming interfaces appear. The right approach to working with them defines whether you source the right data and eventually deliver enough value to your customers.