The pandemic has forever changed our traveling habits. During their 2021 summer vacations, 28 percent of travelers chose to stay at a private rental. And eight out of ten of those travelers expect to stay in rentals for at least half their future trips. Influenced by the need to control their COVID exposure and having to travel only locally, people have unintentionally shifted the accommodation market share.

For agencies providing vacation rentals and private apartments, this is the time to grow and join the digital travel distribution landscape. For OTAs that previously only worked with hotels, this is an opportunity to extend their inventory with alternative lodging suppliers. In this article, we’ll cover the alternative accommodations (AA) market, explain the back-office components of AA distribution, and give tips on growing your vacation rental presence.

What is considered alternative accommodation?

The term alternative accommodations may be a bit inaccurate these days. With alternative lodging representing a whopping 40 percent of all new bookings on Booking.com alone, is it still alternative?

When talking about alternative lodging we mean anything that’s not hotels. This includes vacation rentals, guest houses, homes and apartments, villas – basically, everything else that doesn’t fit under the umbrella of traditional, organized, short-term lodging. Popularized and normalized by marketplaces such as Airbnb, Vrbo (previously HomeAway), and Booking.com, vacation rentals and homes are threatening to overtake hotels.

Vacation rentals, explained

In 2021, hotel bookings almost rebounded from the previous stressful year, but consumer interest in non-hotel options will remain. We can see the change everywhere. In travelers embracing the trend for staycations and workations. In online travel agencies increasing their alternative listings numbers. Even by Google now listing vacation rentals together with hotels in their search results.

Let’s look at the current (and growing) distribution landscape of vacation rentals.

The alternative lodging distribution landscape

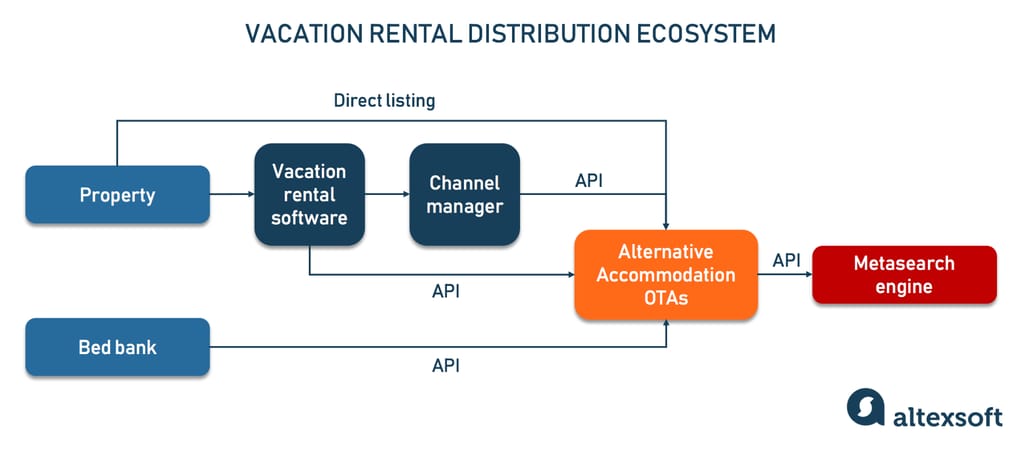

Alternative accommodation platforms are new players in the travel distribution field. They don’t have the history and advantage of decades-old connections built between hotels and OTAs. But by following the hotel example, AAs can expect to penetrate the lodging market very fast.

Like hotels, the alternative accommodation ecosystem consists of the following players.

Property owners and managers. As we already mentioned, the accommodations themselves can range from villas and apartments to guest and beach houses. Either managed individually or under a vacation rental management company, these are suppliers for AA-distributing OTAs.

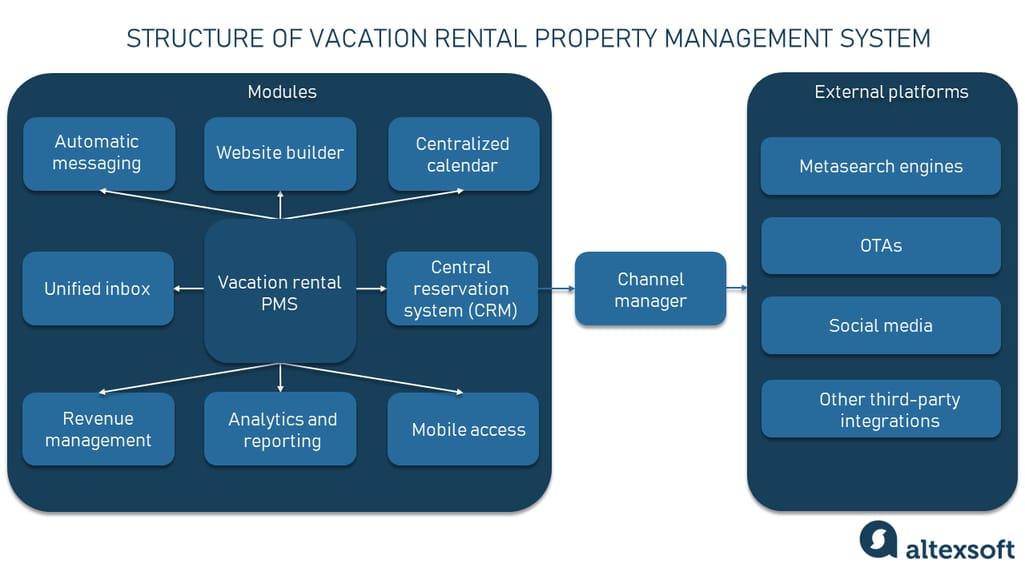

Channel managers. A channel manager is a software tool used by hotels and vacation rentals that allows them to distribute their listing to multiple channels in a single interface. It’s one of the ways an OTA connects with its suppliers. For example, Airbnb recommends its providers a selection of top-performing channel managers with the best integration quality. It’s important for an AA platform to build solid connections with channel managers to drive more listings to the site.

Wholesalers/bedbanks. Although not as prevalent in the vacation rental market, bedbanks are getting access to huge AA inventories and providing them to travel marketplaces in bulk. One big player in the vacation rental scene is Holidu, which combines inventories from 1,500+ partners on its several brands, resulting in over 30 million users.

Alternative accommodation marketplaces. In the center of AA distribution is a marketplace of vacation rentals. They can be specialized like Airbnb, Vrbo, or FlipKey or exist within a general OTA, divided by property type. To connect with its partners on both ends, it needs strong integration and distribution technologies, as well as the search and booking functionality that matches customer demand. We will talk about those further in the article.

Metasearch engines. Platforms like Google, Kayak and TripAdvisor are many OTAs’ main sources of traffic. They aggregate listings from around the web and are commonly used by travelers to compare available options. Connectivity with these players allows AA platforms to reach the end customer and drive bookings to the website.

Now, how do you run distribution and connect with your partners as an agency? Let’s talk about the technology and digital back office of an alternative property marketplace.

Alternative accommodation agency building blocks and back office

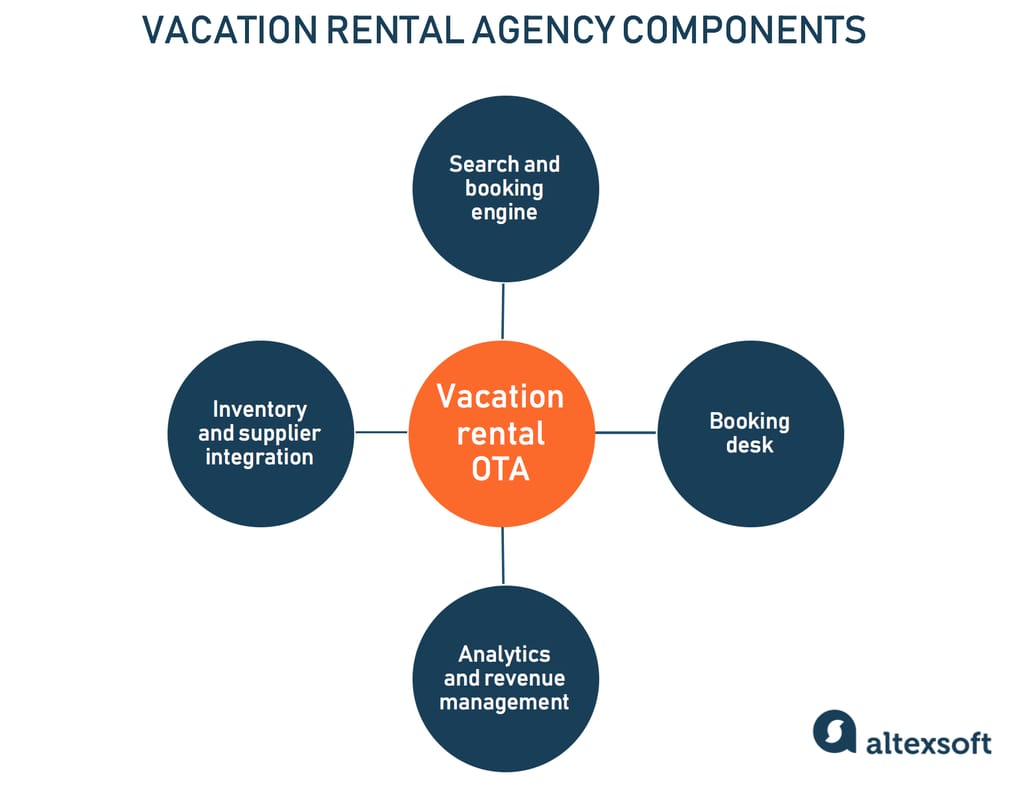

A travel distribution platform is a complex mechanism of tools serving customers, agents, and property owners. To compete in the market, this mechanism must use industry-wide technologies and support all main functions that providers and customers are used to. We’ve divided these tools into a few categories.

Inventory and supplier integration. These are the mechanisms supporting communication with different types of suppliers and their own systems.

Search and booking engine. At the heart of distribution capabilities is a booking engine that’s able to find exactly the listings the person is looking for by rummaging through different suppliers and applying complex pricing rules.

Booking desk and cancelation management. While most booking operations are automated, agents also need tools to perform less trivial tasks: manage cancelations and changes to the bookings, mitigate conflicts between property owners and guests, and stay in contact with both groups to ensure they’re satisfied.

Analytics and revenue management. Widely used in hotels to predict demand and optimize pricing, revenue management allows you to gain control over your data and maximize your and property owners’ profits.

Let’s go through these components and explain what’s required.

Inventory and supplier integration

Growing their supplier network is something even large marketplaces are constantly occupied with. Being your most important asset, hosts also introduce diversity and variety to your inventory that customers are looking for. So, the platform must be an attractive and convenient place for them to place their listing on. Let’s talk about the main sources of inventory and their integrations.

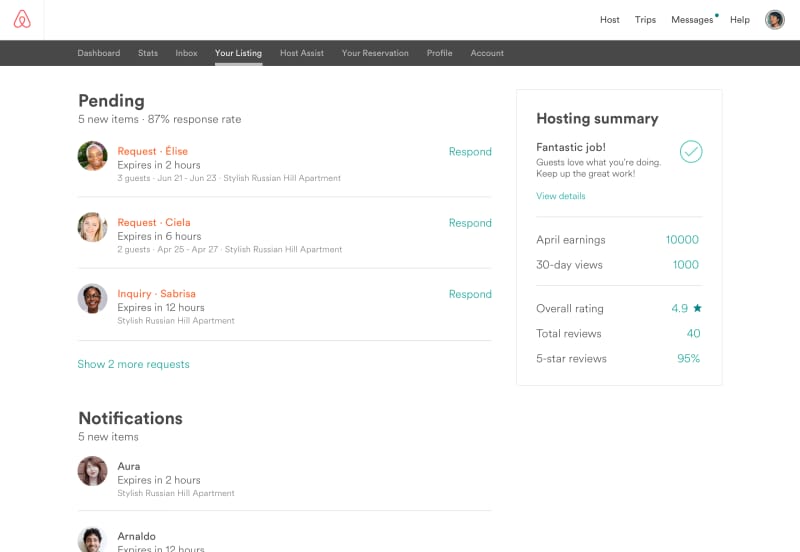

Property connection via extranet. An extranet is a website within your website available to a specific group of users. The whole experience is self-service. Hosts create an account, add photos of their property, write descriptions, and set up the calendar and pricing. If they have the same property listed on a different website, they’d have to manually enter the availability changes and approve reservations. The extranet technology is a separate product that must be developed and properly maintained, but it’s an important feature for many individual property renters as it allows them to easily create a listing on your platform.

Property connection via vacation rental software. A more sophisticated way for property owners to run their rental activities is vacation rental software. Similar to hotels’ property management systems, it allows managing calendars and reservations, performing customer relationship management, creating complex analytics, and integrating with tons of third-party tools. It’s basically an extended version of an extranet, which used along with the channel manager, helps owners see the full picture and automate many routine tasks. Vacation rental software must be tightly integrated with your OTA to ensure that you have current availability listed on your platform and hosts can reply to guests instantaneously. This is usually done via APIs – pieces of code responsible for information exchange. For example, Hostaway has API integrations with Airbnb, Vrbo, Expedia, Booking.com, among others, meaning that their users have an easy time managing their listings on these platforms. To partner with vacation rental software providers, you’ll need their APIs, which are either open (like Lodgify API) or require messaging the provider directly.

Property connection via channel managers. Often, vacation rental software comes with channel management functionality, but sometimes, property owners choose to use a separate tool. Guesty, Your.Rentals, Avantio, and other channel management products partner with distributors to build strong integrations and allow hosts to connect with your OTA in just a few clicks.

Bed banks connection. The indirect way to get rental inventory on your website is by partnering with a bed bank. Bed banks or wholesalers are B2B platforms that collect inventories by exclusively partnering with suppliers. For example, HomeBeds, a division of vacation rental software CiiRUS, hooks you up with 25,000+ properties run using their product. Some hotel-focused bed banks also have alternative stays. For example, Hotelbeds provides apartments and homes inventory, as dies HProTravel. Typically, you can connect to bed banks either via an extranet (useful for traditional travel agents) or an API.

Search and booking engine

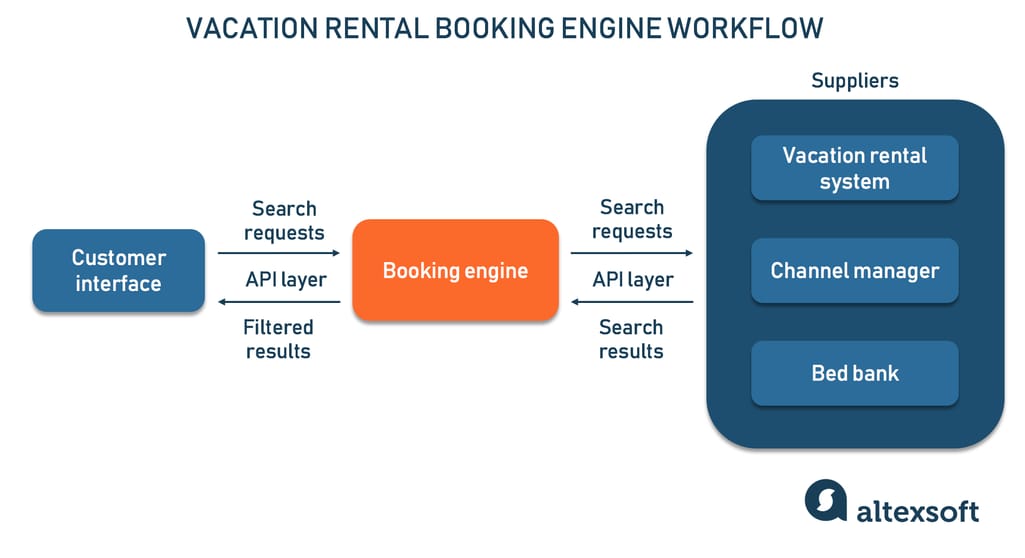

A travel booking engine performs two roles. It’s your website’s main tool for interacting with users. And it’s also an intermediary between travelers and providers because it transforms people’s search queries into requests for supplier inventories.

A booking engine automates many human agent tasks in traditional agencies. Using predefined business rules, it can

- process inventory lists, eliminate duplicates, and display search results in the desired way;

- create custom dynamic packages allowing people to book different products in the same flow;

- process payments via integration with a payment gateway; and

- provide functionality for booking management and configuration, such as changing dates and making cancelations.

Booking engines are often built in-house, but they can be acquired from a software provider. Either way, it must be customizable because every website’s engine works differently depending on your choice of suppliers, pricing and search rules, and specifics of a particular travel agency. Read our overview of building a customizable booking platform to learn about the challenges and tasks that need to be solved.

Booking desk and cancelation management

While a modern OTA must be at least partly automatic – a booking engine is responsible for that – your travel agents also need back-office tools to book from the other side, create and publish packages, access supplier inventories manually, and many more. The following functionality can be summed up in the booking desk component.

Supplier inventory access. Either posted through an extranet or available via API, vacation rental listings must be viewed and, if needed, managed on agent interfaces. Although most disagreements are typically solved by owners and guests in private, sometimes a third party must engage to make sure there are no fraudulent patterns on either side. An agent can also help with cancelations. Since property managers don’t have access to all platform capabilities, they may not be able to make changes to the booking even if they agree to them. By contacting a human agent, they can solve troubling issues and help both parties feel satisfied with the interaction.

Content management. In our article on online travel agency marketing, we talk a lot about the importance of catering to search engines. There, we list blogging, targeted landing pages, and SEO activities as the main strategies to drive organic traffic. Using a content management module, agents can market packaged deals, drive attention to seasonal offerings, and highlight properties and destinations for different demographic groups.

A booking desk is one of the components you can get creative with by giving your back-office staff the tools they require or helping them better fulfill the agency’s goals.

Analytics and revenue management

In 2015, Airbnb made headlines by introducing Smart Pricing – a revenue management (RM) module for their hosts, allowing them to automatically adjust prices depending on demand. At that time, RM was the prerogative of select hotels only. Today, it’s more of a must to stay competitive in the growing travel market.

Watch a detailed explanation of revenue management

Many vacation rental and channel management software providers already provide RM functionality to property owners, but you might consider following the Airbnb lead since increasing your hosts’ revenues will bring more revenue to you too. So, consider building or integrating an existing revenue management module.

Another important analytic for OTAs to track are sales reports, divided by suppliers, dates, destinations, and traffic source. This information is crucial in helping to determine the size of commissions.

Learn about commission engine technology from AltexSoft’s Andrey Chebotarov

While many businesses set up flat fees, it makes a lot of sense to incorporate a commission engine that will adjust the final price to maximize revenue. For example, you may write commission rules that will increase the fee in high season or give a discount to your most successful suppliers or cut the commission for users of the metasearch website to win the fierce competition.

Now, if you want to read more about the back office of an online travel agency, you will find a lot of useful info in our OTA business article and a series on YouTube run by AltexSoft’s Travel Technology Competence leader Andrey Chebotarov. Both will give you a detailed look behind the scenes of travel distribution. But we want to take this conversation a bit further and talk about gaining a competitive edge in the alternative lodging market, where such giants as Airbnb and Expedia run the show.

How to grow as a vacation rental agency

Let’s talk about some things for you to consider when approaching this market.

Determine your market niche

How do you compete with Airbnb’s 5.6 million listings? Well, first, by not competing with their whole network of 100k cities. Or by trying to narrow all alternative accommodations down to just one type. Or by targeting a specific demographic. For example, Hipcamp was created specifically for campers, MakeMyTrip offers holiday homes only in India, and the name SabbaticalHomes speaks for itself – it provides temporary homes to academics and artists.

Another opportunity is having a unique feature or technology not available on mainstream sites. For example, FlipKey has a detailed filtering system, which helps to make the choice easier.

Find and understand a unique user group: their demographics, desired destinations, booking habits, and travel patterns, which will help you create a user portrait that’s much easier to cater to. But the guests are just part of the equation. How do you attract property owners?

Enter the dialogue with property owners

One of the growing trends in alternative stays is the shift to longer stays, for up to 30 days. While this guarantees hosts income, it may lead to fewer bookings overall and a smaller inventory available at a time. This is why big and small platforms alike hunt property owners and create elaborate marketing strategies to attract them.

Vacation rentals are different from hotels in that they require personal touch – you need to talk directly to the person with concerns about letting strangers into their house and needs reassurances, guarantees, and support. Some services like Vacasa, for example, are solving this problem by hiring property managers and sales reps that personally work with owners and help them handle new responsibilities. In other cases, branding and messaging might be enough.

Find your way to metasearch websites

It’s not entirely clear in what ways alternative stays distribution is different from hotels. In 2021, Expedia pulled Vrbo from Google’s metasearch, saying that this investment wasn’t productive for them. Now, since Google combined hotel and vacation rental listings on the same page, this may change. So, we recommend you not to be as definitive as Expedia and turn to vacation rental metasearch engines to drive bookings to your website. Here are some to consider.

Google Vacation Rentals. There are two ways to connect to Google’s platform: direct integration by filling in the form with your business details or, if you have less than 5,000 properties listed, going with an approved connectivity partner. If you go the first way, you can find all the details in Google Hotel APIs docs.

HomeToGo. A global vacation rental distributor, HomeToGo also operates brands such as Tripping.com, Casamundo, and Wimdu. Overall, it manages 23 local apps with short-term rental selections. To distribute with them, fill in the form or contact directly with your questions.

Peakah. Displaying both hotels and vacation rentals, Peakah shows average ratings and reviews before transferring users to a booking website. They work both with bigger and smaller OTAs, so contact them to learn what’s required to integrate.

Holidu. Holidu owns several European brands for apartment price comparisons: Bookiply, Hundredrooms, Vakatienhuizendirect (operating in the Netherlands), Bodensee (for the German market), and Toplocationsdevacances (France). If these are your desired markets, contact them by submitting a form.

Joining the vacation rental landscape

The distribution landscape of alternative lodging is still in early days, particularly because some of its details haven’t been figured out yet. This includes:

- Regulatory pressure and uncertainty as in many areas, short-term lodging has been met with opposition, including specific licensing requirements.

- Lack of standards for categorizing different types of rentals, which makes it difficult for metasearch sites to filter and display search results. Basically, two similar accommodations can be listed separately, i.e., as a guest house and a vacation home.

- Delays in the reservation process compared to instantly bookable hotels can be problematic as guests expect the same experience they’re used to with more traditional stays.

- Poor UI differentiation when displaying hotel and apartment listings. Appearing in the same search results, they can create confusion and skew travelers’ expectations about the service or check-in process.

In short, the industry’s biggest hurdle when handling alternative accommodation distribution is finding the best way to aggregate the inventory, accurately compare the offerings, and provide the booking experience travelers are already used to.

If you’re an operating OTA that wants to get into the alternative lodging market, here’s what you need to do to adapt to the new segment.

Develop an extranet and/or integrate with vacation rental software. Chances are, you already have an extranet for hoteliers, but you’ll need to make changes to the functionality to reflect rental homes specifics – amenities, services, and policies will be different for hotels and apartments. If you’re pulling data from external sources, reach out to vacation rental software providers and make your OTA available in their product, so that all their users can join you by simply clicking the switch button.

Consider UI redesign. Will you be displaying private properties in search results automatically or only if the person chooses this option? How will you distinguish between different types of properties? What will the description page contain? You will have to answer a lot of user experience and interface questions since this is almost launching another product on your platform. If you simply jam all the listings together, you will create confusion for guests and won’t give hosts the control they require.

Update your messaging and develop a strategy to attract hosts. The world is fighting for vacation homes inventories and new property managers must know that your OTA is the place to be. Create a knowledge base to explain how this will work and how owners will benefit from collaboration with you. Add landing pages, invest in marketing, and consider implementing extra tools like revenue management that will give you a competitive edge.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.