Europe has a dense, well-developed railway network that connects countries, major cities, towns, and rural areas. This makes trains highly accessible and convenient for many people. For OTAs, travel management companies (TMCs), and other travel platforms, integrating rail booking is a must to remain competitive in the EU market.

This article shares our lessons learned from integrating train booking into a corporate travel app of a major TMC — from conducting market research to designing booking flows that can handle the intricacies of rail travel.

A market overview of modern rail travel in Europe

EU investment in railways has been robust, with the annual spend increasing from $42.4 billion in 2015 to $45.3 billion in 2020, covering maintenance, renewals, upgrades, and new infrastructure.

These investments align with the interest in rail fueled by several factors, one being the heightened awareness of environmental issues. Travel by train produces 10 times fewer carbon emissions than car travel and 13 times fewer carbon emmissions than travel by plane. Since Europe strives to meet its climate goals, both governments and consumers are turning to rail as a sustainable alternative.

Several European countries are implementing policies to support this shift. For example, France banned domestic flights on routes where a train journey of no more than 2.5 hours is available.

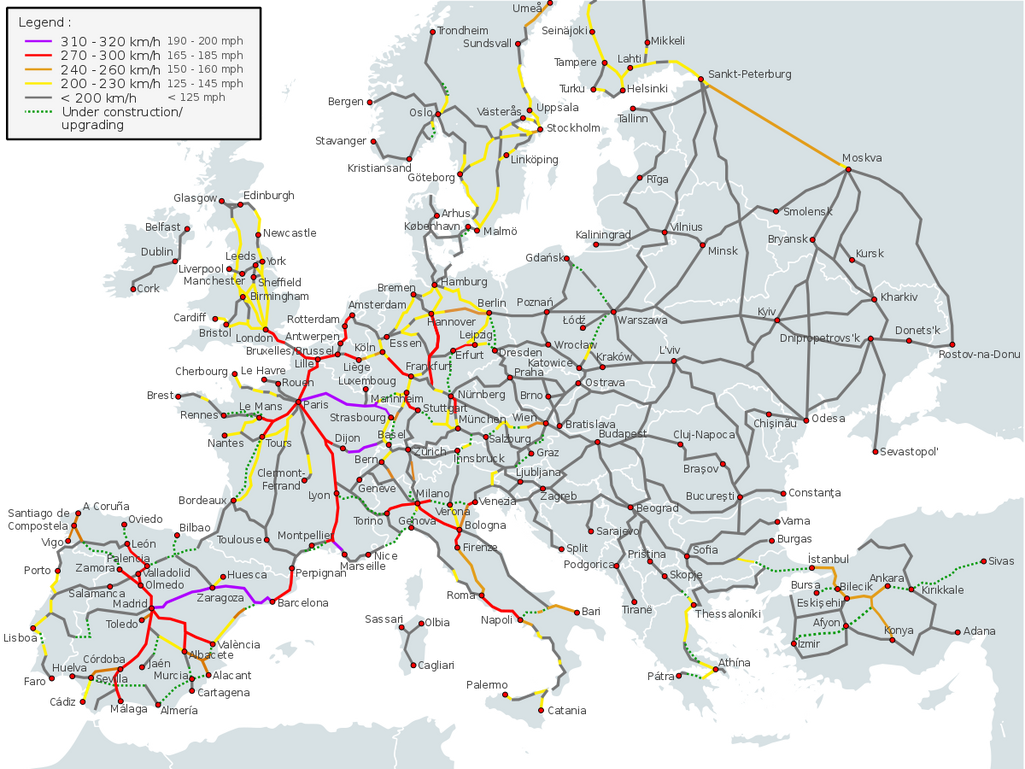

Another reason the railway is popular in Europe is its convenience. High density of lines and multiple train connections make it fast, safe, and easy to reach any destination across the EU. Unlike air travel, train journeys usually involve no stringent security checks and have short wait times and central city arrivals and departures. Moreover, out of almost 300 routes served by both rail and air trains are faster on nearly 70 routes.

Besides that, European railways are well-integrated with other transport, such as buses, trams, and metros, providing seamless connectivity within and between cities.

High-Speed Railroad Map of Europe 2016 by Jklamo, CC BY-SA 3.0. No changes to the image were made

Understanding the attractiveness of trains for business trips across Europe, our client, the world’s leading TMC, decided to automate rail booking, which was previously done manually via a call center. They added a rail module to their existing app, alongside air, hotel, and car rental services, which made them a one-stop shop for all corporate travel needs.

The following sections will discuss the main steps of integrating rail booking automation and how we addressed the challenges we faced along the road.

Business analysis: Navigating the intricacies of the European railway market

The project presented certain challenges due to the complexity of the rail market in Europe. To explain it better, let's compare it to aviation. Air travel distribution is highly centralized with three global distribution systems (GDS): Sabre, Amadeus, and Travelport. These systems aggregate flight information from airlines worldwide, providing a single access point for checking schedules, fares, availability, and booking flights.

The International Air Transport Association (IATA) sets comprehensive guidelines covering everything from air ticketing and coding (airport and airline codes) to some safety regulations and operational procedures. Because of these standards, processes are relatively uniform across the industry.

Major rail providers in Europe

Unlike aviation, there is no single distribution system that covers all rail providers. Each country or region has its own rail operators, both public and private, with specific rules, booking systems, and operational practices.

While GDSs do offer rail booking capabilities, the coverage and integration are not as comprehensive or standardized as in the airline industry. Later in the article, we'll explain in more detail why GDSs are not the ideal aggregators for rail integration.

The railway industry lacks a central body like IATA that enforces uniform standards. This means there is a wide variation in procedures for ticket issuance, pricing, refunds, and other customer service aspects. That’s why it is crucial to thoroughly explore key players before integrating with them. This process includes two main stages.

Comparing providers against essential parameters

Since there are no clear standards, you must thoroughly explore each player's specifics and choose those that best meet the needs of your audience. Here are the key parameters to guide you.

Provider coverage. Different rail providers operate in various regions and countries across Europe. Understanding which carriers serve which routes and destinations is essential for offering comprehensive rail booking options to clients.

For example, Trenitalia is a railway operator covering only Italy, while Eurostar provides a wider range of high-speed routes connecting the UK, Belgium, France, Germany, and the Netherlands.

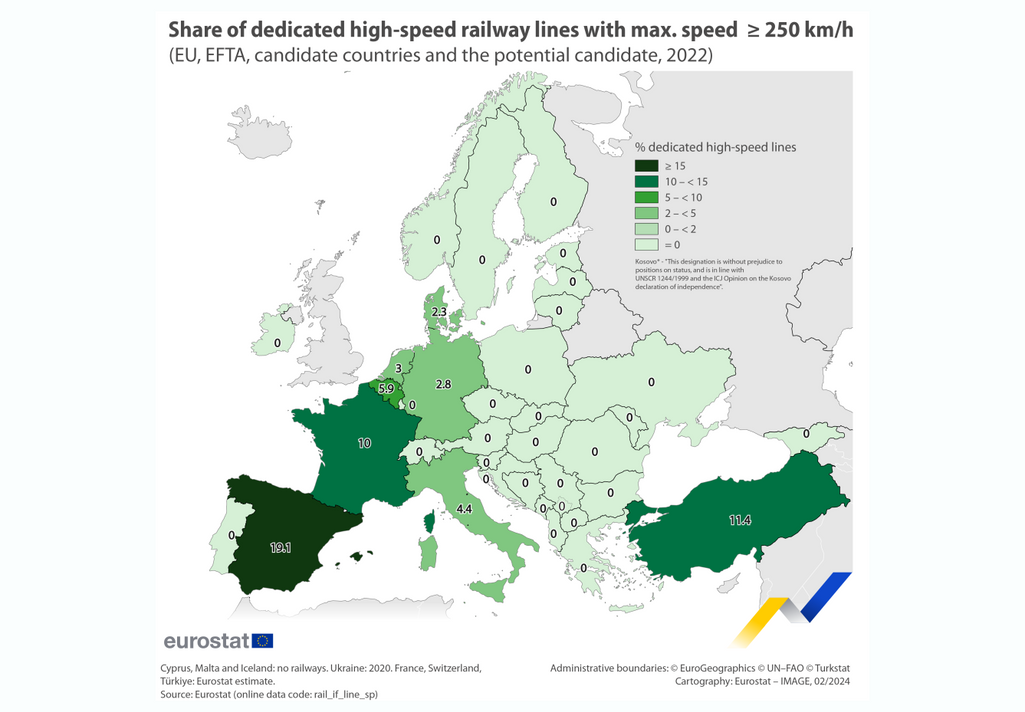

Speed and service levels. Understanding rail speed and service levels across routes is required to align your customers’ expectations and notions of convenience with reality. For example, the Western Europe is the home of seven of the ten world’s densest and best high-speed networks which excel in safety, eco-friendliness, and service, offering premium amenities. On the other hand, the speed on 30 percent of routes between large and medium European cities is below 60 km per hour, with only basic facilities provided.

High-speed railway line shares in 2022. Source: Eurostat

Ticket types. Rail providers offer a variety of ticket types with different classes (e.g., standard and first class), tariffs (e.g., off-peak, advanced, anytime), and discounts for specific passenger categories (e.g., seniors, students, and children). You must understand the range of options available and their respective conditions (e.g., refund policies and seat reservations) to present accurate and relevant information to users.

Communicating with providers

After checking providers against basic factors, you can narrow down your research to those you choose to partner with. How can you learn more about their systems, policies, workflows, requirements, and other specifics? The simple and right answer is to contact them directly.

The main part of the research is communicating with carriers directly, learning their standards, guidelines, and documentation.

Here’s how we recommend approaching the communication:

- Compile a list of rail providers that are relevant to your target markets and customer base.

- Find each rail provider's relevant decision-makers or partnership managers.

- Create a proposal outlining the partnership opportunity, value proposition, technical integration plan, and anticipated outcomes.

- Introduce your company and request a meeting for further discussion.

It is generally easy to connect with rail providers because they are also interested in collaborating. Their main goal is to sell more tickets, and partnerships with resellers help them reach more customers. However, it’s important to remember that distributors should still take the initiative because integrating rail booking features is crucial for their business growth and competitive positioning first and foremost.

Providers may have certain customization needs or branding guidelines that need to be reflected in your app. Regular communication ensures that the expectations for technical standards, service levels, and user interface design are met. For example, there could be strict requirements on how the layout of timetable information is presented or when to include loyalty program discounts during the booking.

Overall, it makes the integration process more efficient and reduces potential disruptions.

Train API connection: direct or via aggregator?

Once you've finalized your choice of rail providers, it's time to decide how to approach the integration. While direct integration may sound most convenient, it is not the optimal choice if you're aiming to incorporate numerous carriers across companies.

Opting for an aggregator can be advantageous. Aggregators act as intermediaries, consolidating data from various sources, simplifying the integration process, and eliminating the complexity of managing multiple API connections. It's also worth noting that some rail providers, like Deutsche Bahn, do not allow direct integrations, meaning you’ll have to connect via a partner regardless.

There are two main types of aggregators offering rail booking: Global Distribution Systems (GDSs) and smaller B2B platforms with a focus on trains and other ground transport.

Train booking via GDSs

As we mentioned earlier, GDSs are key players in air travel distribution. Yet, they also aggregate data from other travel suppliers, including hotels, car rental companies, and more. Let's see what they offer in terms of rail booking.

Amadeus provides a set of SOAP APIs that let you connect to over 90 railways worldwide to get information on availability, pricing, fares, supplements, and ancillaries, book tickets, and add them to the corresponding segment in the PNR.

Sabre offers a set of REST APIs to access real-time content and book from nine major national rail networks across Europe and North America, covering France, Italy, Switzerland, Germany, and the USA. Among the services available are rail card shopping, modifying, void and cancel options, and more. All operations are recorded in the Sabre PNR.

Travelport gives access to large US, Canadian, and European rail operators via its Universal SOAP API. In addition to searching and booking features, the GDS enables low-fare shopping (returning the lowest fares available for a specific itinerary and date), order modification, and cancellations.

Interestingly, both Sabre and Travelport recently partnered with Trainline, Europe’s leading online rail and coach ticket provider, to extend their train content.

Amadeus vs Travelport vs Sabre: Explaining Main Global Distribution Systems

GDSs are a natural choice for a large OTA or TMC as travel content providers. However, their primary focus is on the airline industry, which leaves the railway a suboptimal service with somewhat limited booking functionality. Besides, as in the case of Amadeus and Travelport, rail is available via legacy SOAP APIs, which are difficult to implement and maintain, requiring more IT effort.

So, even though our client is a major TMC that already integrates with a GDS for airline booking, they still decided to find a new partner for rail.

Other rail API providers overview

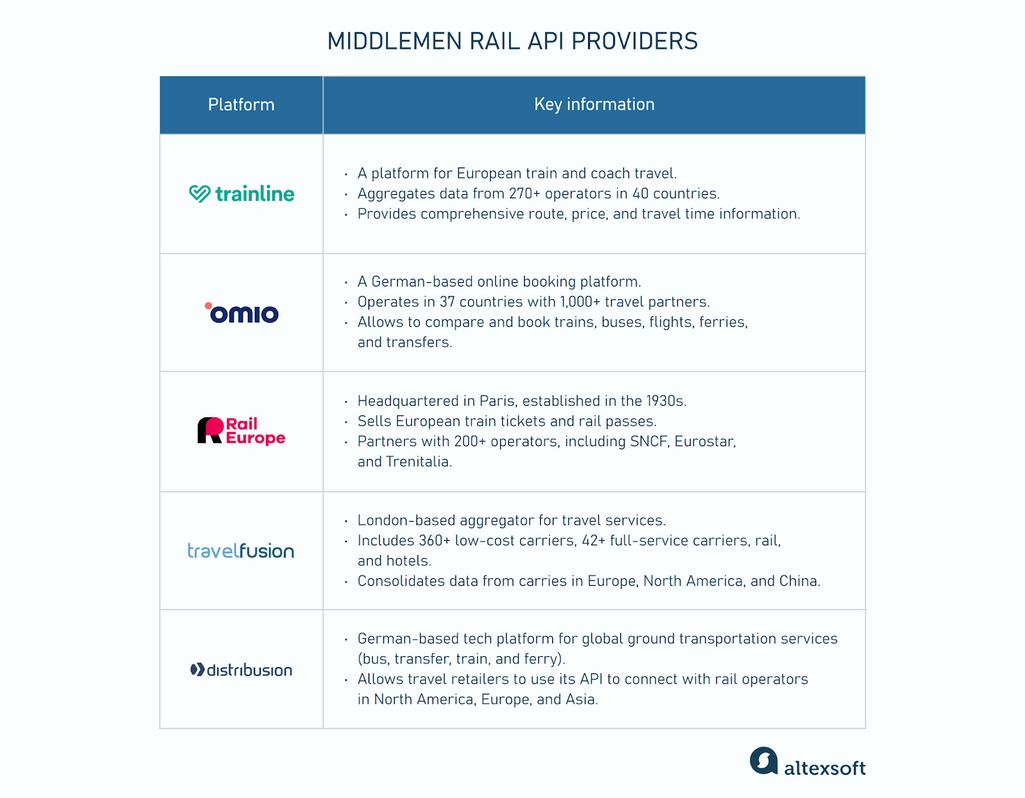

Aggregators specializing in rail can offer access to a comprehensive range of carriers with higher-quality data, better tech support, and a wider range of services. Let’s briefly review some rail API providers.

Middlemen rail API providers overview

Trainline is a platform for train and coach travel across Europe. Its website and mobile app facilitate the booking of train tickets, railcards, and coach tickets. One of Trainline's key features is its extensive coverage, aggregating routes, prices, and travel times from over 270 rail and coach operators spanning 40 countries.

Omio, previously known as GoEuro, is a German-based online platform specializing in booking services. It operates in 37 countries worldwide and has over 1,000 travel partners. Through its website, Omio allows users to compare and book various modes of transportation, including trains, buses, flights, ferries, and airport transfers.

The Omio Affiliate Program allows booking platforms to integrate with major European railway providers, enabling them to earn commissions on bookings made through their platforms.

Rail Europe, headquartered in Paris, dates back to the 1930s. Its founding mission was making trains in Europe more accessible to international travelers. Over the years, Rail Europe has become a leading distributor of European train tickets and rail passes.

It spans over 200 train operators, including SNCF, SBB, Eurostar, Thalys, Trenitalia, Italo, DB, Renfe, ÖBB, and National Rail. Rail Europe provides API solutions for integrating rail services into travel platforms.

Travelfusion, based in London, is an aggregator with offerings from over 360 low-cost carriers (LCCs), more than 42 full-service carriers (FSCs), as well as rail and hotel operators. tfRail API provides intelligent search capabilities for rail travel. By consolidating data from major rail operators across Europe, North America, and China, tfRail serves as a comprehensive source for shopping, booking, and servicing rail travel needs.

Distribusion is a German-based technology platform facilitating access to ground transportation services worldwide. The company enables connections between global travel brands and an extensive network of bus, airport transfer, train, and ferry providers. Travel retailers leverage Distribusion's API to access a wide range of rail operators in North America, Europe, and Asia.

After evaluating several options, our client chose Trainline as the aggregator that best aligned with their business needs, customer base, and desired service offerings.

UI/UX design: How to build seamless rail booking flows

AltexSoft experts took part in building frontends for rail booking functionality to be run on iOS, Android, and the web. The most challenging part was creating a booking flow since this process varies greatly across European countries in terms of tariffs, passenger information requirements, additional services, and more. Here are some tips from our UX designers on how to ensure a seamless user experience regardless of the provider.

Use existing booking platforms for a reference

Creating an intuitive interface means breaking down the booking process into manageable steps, presenting one task at a time to users, and guiding them to their goal — a completed booking.

Before building rail booking flows for your app, we recommend first examining other existing travel apps. This can provide valuable insights and streamline your design process.

By analyzing successful products, you can identify effective UX patterns that make the booking process intuitive. This includes layout design, navigation, and interactive elements. Also, look at how other apps integrate additional services (e.g., seat selection, luggage options, travel insurance). Identify key steps and decision points that contribute to a seamless experience.

Start with one provider

As we keep reminding you, each rail provider has unique characteristics and requirements, creating a complex integration process. We recommend starting by connecting to a single rail company via an aggregator’s API and then gradually adding others.

From a design and development perspective, it's much easier to incorporate or remove new features from something already developed than starting from scratch. Existing frameworks provide a foundation, saving time and resources.

Since our client chose the UK as their primary focus, so, in the first place, AltexSoft's designers first incorporated the booking flow of the Rail Delivery Group (RDG) (formerly ATOC) that unites about 25 passenger train companies operating in the UK.

Add or remove features as needed

Once you’ve developed the core UI and addressed the unique aspects of the first provider, you can adapt it for subsequent suppliers by adding or removing components and features. This incremental approach ensures that the system remains consistent and less prone to errors.

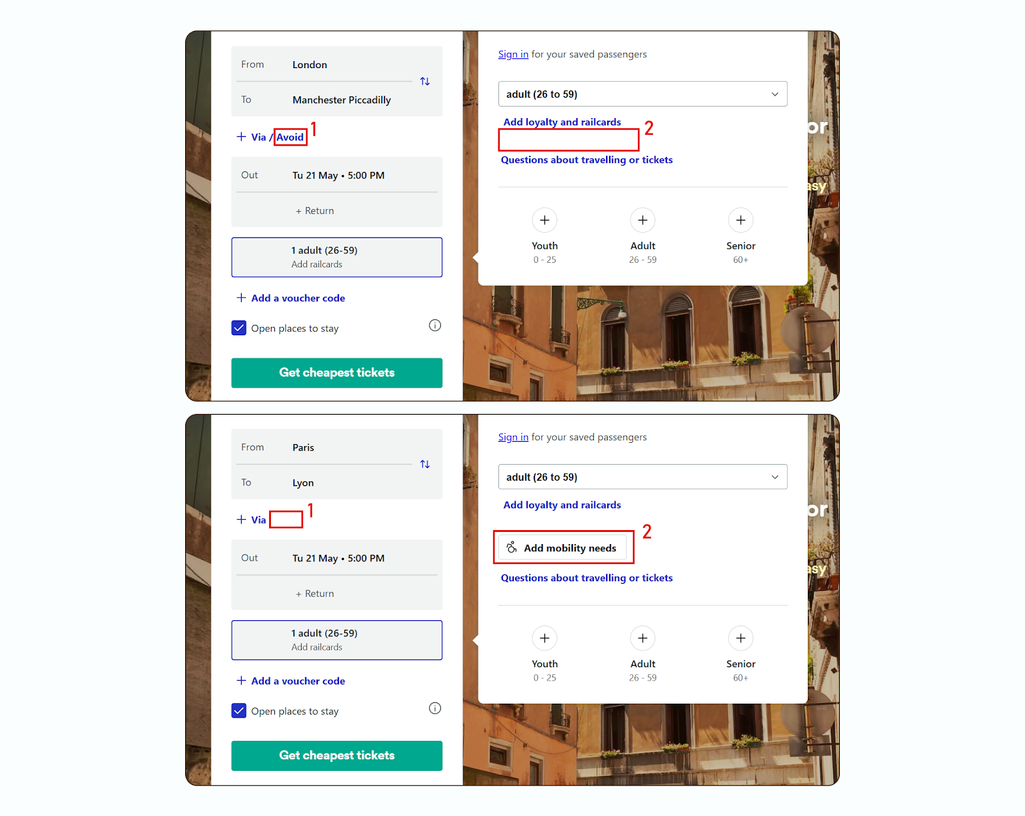

The differences in booking options between the UK and France. Source: Trainline

In the screenshots above, you can see the differences in booking between the UK and France — the second country our client wanted to see in their rail automation pipeline. When buying a trip "from London to Manchester," users can customize their journey by selecting which stations to avoid— an option absent for France. Conversely, French carriers leverage features that address mobility needs, allowing users to book assistance or secure wheelchair spaces.

Other examples of such specifics include

- pet policy,

- discounts,

- luggage limits,

- stopover options,

- online ticket validation (e.g., whether you have to print it or not),

- the order of adding amenities, and more.

Train providers may also have varying definitions of the age at which a person is considered a child and is eligible for corresponding discounts. This info — along with other details — should be clearly conveyed to a traveler during the booking process.

After adding Rail Delivering Group, we adjusted the initial booking flow for SNCF, which operates almost all of the railway traffic in France, and Renfe — Spain’s national state-owned railway company.

Make UI/UX consistent across all platforms

Another tip to mention is harmonizing development approaches for iOS, Android, and web apps. Although there are differences in standard native components, like the position of navigation arrows and date picker formats, you must maintain a consistent UI/UX.

Establish a continuous feedback loop

In an ideal team dynamic, specialists are continuously exchanging feedback and opinions with each other and with a client. Increased stakeholder engagement leads to better-informed decisions and higher-quality outcomes.

Having our designers involved in sync-up meetings with our client facilitated smooth progress and minimized the need for corrections and revisions. The TMC representatives were well-informed about all minor details. As a result, the workflow remained efficient, and the final deliverables were more aligned with expectations.

As for the communication with rail providers, we shared parts of our work with them as we progressed. They then provided feedback by adding comments and suggesting improvements.

Certification: getting verified by railway companies

Even though technically you can connect to multiple providers via one unified API, you still must get approval from each one whose tickets you will resell. So, once the backend and frontend parts of integration are complete and tested, the next and final step is to submit your app for a supplier’s review. This process involves ensuring that your booking module complies with the specific requirements and policies set by a certain company.

Some railway providers offer accreditation manuals right on their websites. For example, RDG guidance clearly states the conditions of getting certified by them. You must ensure that

- passengers are provided with the appropriate ticket choice at the correct prices;

- the payment method is secure;

- the details of the ticket sale are recorded accurately and submitted for settlement so that the revenue is correctly distributed between about 30 train operators and hundreds of other parties; and

- the tickets are produced in a consistent format, clearly recognizable as valid by staff and passengers, secure against fraud, and can be read by people and machines throughout the journey.

You must engage with the accreditation and licensing teams of the provider early in the process to understand the regulatory environment and industry requirements.

The initial deep research and continuous communication with suppliers helped us gain the necessary approval and make rail booking functionality for the UK, France, and Spain go live on time.