Passenger Service Systems (PSSs) are the backbone of airline operations. They handle reservations, ticketing, inventory, and departure control—the everyday processes that keep flights moving and customers booked. Since modern aviation has several business models, dedicated tech solutions are needed to support them.

This article will explore PSSs targeting low-cost carriers (LCCs): How they differ from traditional products, their core functionality, and the most prominent players in the market.

LCC-oriented PSSs and their client airlines

What LCCs need from PSSs

The first PSSs were built around the needs of full-service carriers (FSCs): selling through global distribution systems (GDSs), using complex fare structures, supporting interlining and other agreements, and heavily focusing on frequent flyer programs.

Conversely, low-cost carriers require software that matches their DNA—lightweight and retail-first. The newer generation of PSSs designed for budget airlines is API-first, cloud-native, and modular (built with microservice architecture). Let’s see what aspects of the LCC business model they support.

Direct distribution. Unlike FSCs, which rely on multichannel GDS-centered distribution, LCCs build their business model around direct sales through their own websites and apps. This way, they cut distribution costs, get tighter control of the sales process, and directly access customer data, which fuels personalization.

Ticketless booking flow. Most low-cost carriers use a ticketless model, where a single booking record with a reservation number serves as proof of travel.

In the traditional flow, booking creates a Passenger Name Record (PNR), but ticketing is a separate step after payment—so the seat is held in the meantime and the e-ticket later confirms payment.

Traditional flight booking process

In the ticketless flow common to LCCs, the seat is not reserved until payment is made. The PNR itself becomes both the booking reference and payment confirmation, simplifying operations and speeding up changes or disruption management.

Ancillary revenue. Industry data show that LCCs earn roughly half or more of their revenue from ancillaries. In 2022, Spirit Airlines reported 56.4 percent of total revenue coming from extra services, the highest share among major airlines globally.

So LCCs view a flight as an opportunity to sell multiple products and services throughout the customer journey. They advertise low base fares, but profitability is driven by the high-margin, value-added extras — baggage, seat selection, in-flight meals, travel insurance, priority boarding, and more.

Real-time dynamic pricing. Defined as adjusting prices to current demand, dynamic pricing was pioneered by large airlines in the 1970s. But, in the GDS distribution, it’s never been truly real-time. LCCs, on the other hand, have the opportunity to tweak prices for flights and ancillaries right at the time of booking.

How dynamic pricing works in the airline industry

Personalization. In the legacy distribution scenario, carriers have limited ability to tailor their propositions since offers are constructed by GDSs and the airline doesn’t see who’s actually buying the ticket at the time of booking.

Selling directly, LCCs get immediate access to customer data along with full control over the booking process. For example, an LCC may recognize a frequent traveler who always books priority boarding and automatically highlight or bundle this option at checkout. Another customer who tends to travel light might instead be shown discounted seat upgrades or in-flight Wi-Fi. This level of personalization increases the likelihood of ancillary sales and boosts total revenue per passenger.

Now that we have an idea of the key LCCs’ needs, let’s look at the leading product in this category—Navitaire—and use it as an example to see how PSSs designed for low-cost carriers operate.

Navitaire New Skies by Amadeus: the exemplary LCC-oriented PSS

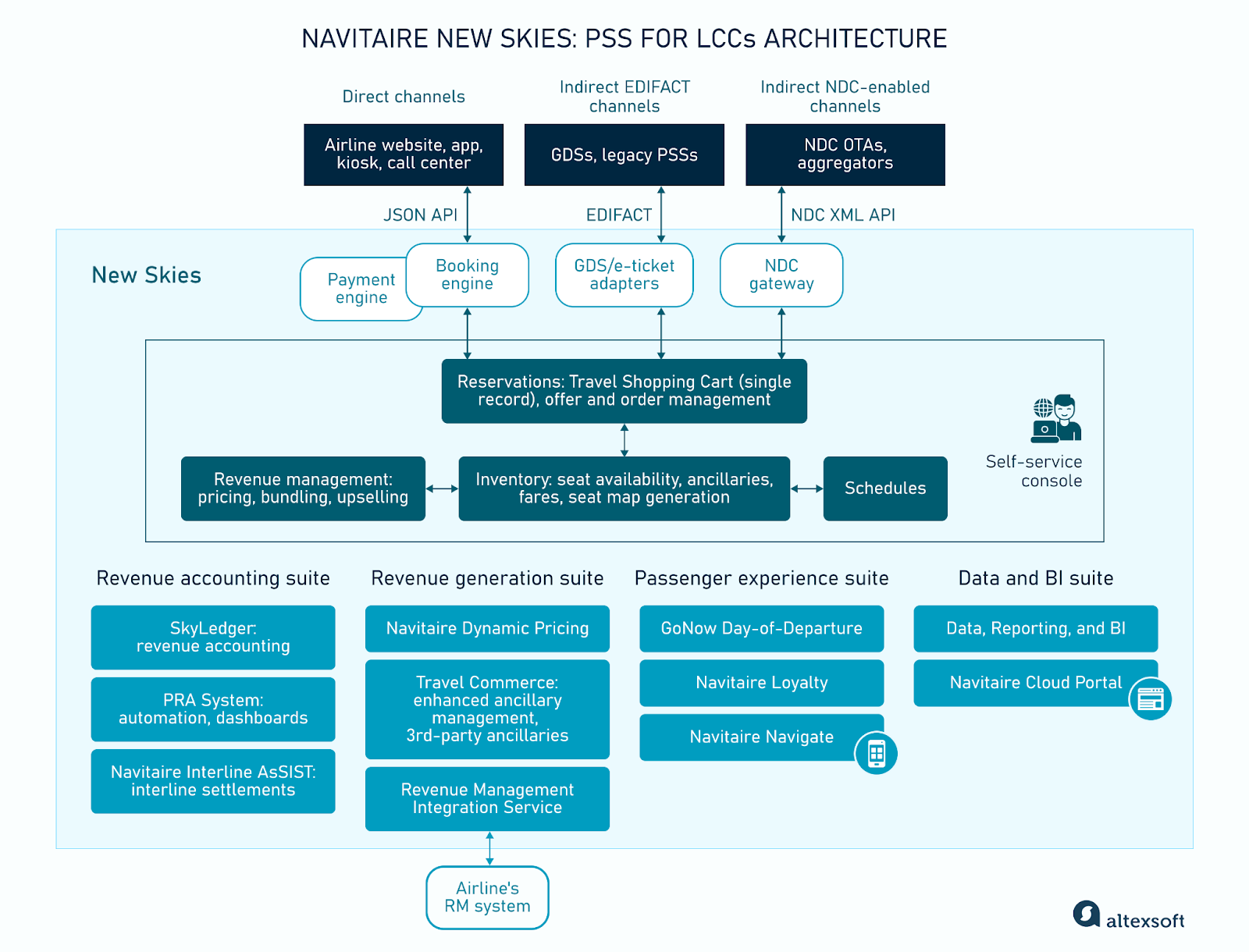

Navitair New Skies ecosystem

Why did we choose Navitaire as a model platform?

It is one of the first and most established systems, adopted by numerous low-cost and hybrid carriers, including some of the world’s leading LCCs such as Ryanair, Wizz Air, Spirit Airlines, and IndiGo.

Founded in 1993 and acquired by Amadeus in 2016, it employs a single-record approach, consolidating offer, order, and passenger transaction data into a unified record. This architecture makes it highly suitable for ticketless carriers. Currently, Navitaire participates in the IATA’s Airline Retailing Maturity (ARM) program as an airline system provider supporting the NDC framework and particularly ONE Order capabilities.

Beyond the basic PSS functionality, Navitaire provides an ecosystem of native modules, from a dynamic pricing engine to an eCommerce platform to an accounting system. All products are offered both as SaaS and via REST/GraphQL APIs so airlines can build their own front ends (web, mobile, kiosk) that integrate directly with the system.

Navitaire New Skies reservation and distribution system: core PSS functionality

The New Skies reservation and distribution platform is the core product of Navitaire, offering all the essential tools needed to run a carrier. You can access a variety of functions through a self-service console. The user-friendly interface enables easy management and optimization of schedules, pricing, distribution channels, and other key aspects of airline operations. Let’s explore the key features that power New Skies.

Booking engine. New Skies is built on top of a highly scalable booking engine that links inventory with customer-facing channels such as an airline website, mobile app, tablet, call center, and OTA booking tools. It ensures the seat is actually reserved when selected.

Payments. An advanced payment engine allows for online payment processing and is pre-integrated with many payment service providers and payment methods, from traditional card networks to digital wallets like PayPal, Apple Pay, Google Pay, and others.

GDS/e-ticket adapters. Besides direct bookings, the system leverages the distribution capabilities of its parent company, Amadeus, and other GDSs. Traditional bookings are handled by adapters optimized for legacy EDIFACT messaging. This way, carriers can tap into GDS channels and manage interline/ codeshare partnerships with carriers relying on e-tickets.

Reservation management. From the start, Navitaire New Skies was designed to provide a ticketless flow typical of LCCs. It creates a super PNR, or Travel Shopping Cart, containing all order information, encompassing ancillaries and third-party products such as hotels, transfers, or package tours. All feeds, including GDS-generated PNRs, are mapped to the same single-record structure, providing a consistent offer and order experience on both direct and indirect channels.

The reservation management module is tightly connected with an inventory database, meaning that when a reservation is made, the available seats are immediately updated. This helps to avoid overbooking and ensures that the correct inventory is shown across all sales channels.

Inventory database. It’s designed to manage and track flight availability, fares, and ancillary products (like baggage, meals, and seat upgrades) in real-time, providing the backbone for airline operations. Unlike legacy PSSs, where inventory and pricing are tightly hard-wired within fare classes, Navitaire New Sky decouples these components. Its inventory management module only shows what is available, not for how much.

The database also generates seat maps based on the aircraft type and configuration. Airlines can customize seating arrangements, display certain ancillary services (like extra legroom or premium seating), and manage different classes of services.

Schedule management. Airline operations teams can create or adjust flight schedules via a self-service console. The tool automatically updates sellable inventory, including aircraft seat maps and associated ancillaries.

Revenue management. RM functionality lets airlines create and modify fare classes, set pricing rules (based on factors like customer segmentation, loyalty status, or distribution channel), and define ancillary fees. It also allows for bundling services, upselling, and offering complementary products. For advanced capabilities such as AI-driven pricing, you can integrate with tools from the revenue management suite that extend the New Skies functionality.

Revenue generation suite: dynamic pricing, merchandising, and partner sales

These modules enable carriers to optimize fares in real time, expand ancillary and partner sales, and integrate with revenue management systems. The suit aims for a more customer-focused retail approach to strengthen revenue.

Navitaire Dynamic Pricing. The ML-driven analytics engine allows airlines to adjust fares and ancillary prices in real time. It leverages the data collected by Navitaire platforms and carriers by capturing every passenger experience. The tool also gathers information from travelers’ interactions. Airlines can run experiments with control groups to test different price points against their current pricing model to identify patterns that improve revenue performance.

Travel Commerce. Travel Commerce platform allows carriers to sell ancillaries and third-party products during booking or at any later stage of interaction. It displays rich content (images, descriptions, terms, and more) and supports both bundled sales and individual add-ons. The platform also allows the sale of non-flight products (hotel rooms, transfers, car rentals, etc.). Content from third-party suppliers can be integrated via API or downloaded.

All products, payments, and confirmations are consolidated into a single order and invoice.

Other capabilities include

- revenue management tools to support markups, markdowns, discounts, and preferred pricing strategies;

- marketing tools for customer segmentation, seasonal promotions, and prioritization of high-margin products;

- content management tools to display rich product content such as images and terms across channels; and

- post-booking servicing support enabling cancellations and changes based on product type, regardless of the provider.

The platform is designed to be adaptable, enabling airlines to add new partners and products at their own pace while maintaining flexibility in pricing and distribution.

Revenue Management Integration Service (RMIS). This module streams RM-related events from the Navitaire systems to an airline’s revenue management system (in-house or third-party) in JSON format. It delivers near real-time, actionable data on PNR, schedules, and inventory changes, ensuring revenue management tools always have the latest inputs to optimize pricing and availability. RMIS is tightly integrated with Amadeus Segment Revenue Management Flex.

Navitaire NDC Gateway. This distribution API connects airlines using New Skies with NDC-enabled partners. The gateway allows airlines to sell rich content, ancillary services, and bundled offers through indirect channels in a standardized, XML-based format. It’s fully aligned with IATA’s NDC and ONE Order concepts, enabling consistent offer and order management.

NDC explained

Passenger experience suite: tools for smoother travel

With passenger experience functionality, airlines build customer loyalty and improve operational efficiency. By providing convenience for passengers and tools for staff, carriers can reduce costs and strengthen long-term customer relationships.

GoNow Day-of-Departure. The module manages the passenger experience from check-in to boarding. Digital/mobile boarding passes are provided by default, with print as a paid option. Passengers are encouraged to use the self-service app Navitaire Kiosk and mobile tools to check baggage and print boarding passes and baggage tags. The system still handles essentials like flight load control—real-time passenger counts, weight, and balance data to support safe and efficient aircraft operations.

Navitaire Loyalty. This frequent flyer system provides integrated customer profiles that consolidate all key information in one place. It supports fare clubs, co-branded credit cards, and other aspects of loyalty programs, allowing airlines to design tiered rewards and incentives based on customer value. A rules-driven accrual engine credits rewards in real time, while built-in notifications make it easier to communicate offers and benefits throughout the travel journey.

Navitaire Navigate. This is a mobile application designed to enable airline operations agents to manage key passenger services (like check-in, boarding, or managing disruptions) from smartphones or tablets.

Data and business intelligence suite: real-time visibility for smarter decisions

Data and business intelligence (BI) instruments help airlines improve decision-making, optimize processes, and ensure reliable operations by providing real-time access to operational and commercial data and tools for monitoring system performance. The result is greater transparency and control throughout the organization.

Data, Reporting, and Business Intelligence. The BI tool replicates data from an airline’s transactional systems, providing near real-time access to reservations, passenger details, payments, fees, and agency transactions. This allows airlines to analyze and report on operational and commercial performance without impacting core system operations.

The platform supports both standard and custom reporting while enabling data extraction, transformation, and loading into other business systems. Direct SQL access and integration options help airlines convert raw data into actionable insights, streamline analysis, and support decision-making throughout the organization.

Navitaire Cloud Portal. The portal allows teams to monitor the metrics of the core systems: infrastructure usage, API method calls, response times, and historical performance trends. All the data is displayed on dashboards that can be filtered by dimensions such as time range, application, or channel. Information can be exported for further analysis or integration with other business tools.

Revenue accounting suite: accuracy, compliance, and control

Revenue accounting software gives airlines the tools to capture and reconcile every financial event. The modules automate complex processes like interline settlement, proration, and commission calculation. Analytics and reporting instruments turn accounting into a source of real-time insight.

SkyLedger. This component is Navitaire’s revenue accounting system, designed to capture financial events from the reservation system, including bookings, vouchers, and credit shells. It provides live dashboards and reporting tools for real-time sales and revenue tracking, with options for standard or custom data extraction. The system also integrates revenue accounting and settlement data sources outside the core PSS system, including BSP/ARC, GDSs, and others.

Navitaire Interline AsSISt. This module streamlines the reconciling of passenger revenue throughout interline partners, automating time-consuming tasks and ensuring compliance with IATA and ATPCO standards. It integrates seamlessly with third-party revenue accounting systems or Navitaire’s SkyLedger.

By combining automation with powerful analytics, the platform helps carriers identify pricing discrepancies, reduce revenue leakage, and maintain tighter control over receivables and payables.

Navitaire PRA System. This centralized, scalable system captures, processes, and reports the full scope of passenger revenue activity, using analytics and query tools, as well as shareable dashboards. The module automates complex calculations such as billing, proration, commissions, and interline settlements.

Now that we have examined the functionality offered by Navitaire in detail, let's examine other options in the LCC-oriented PSSs market.

Other LCC PSS platforms

Sabre Radixx: for LCCs and ultra-low-cost carriers

Airlines using the platform: Radixx serves a number of ultra-low-cost (ULCC) and low-cost carriers (LCCs), including Avelo Airlines, AirJapan, BermudAir, SalamAir, Vietravel Airlines, and more.

Orlando-based Radixx started in 1993 and was acquired by Sabre in 2019. The platform self-describes a strong focus on retailing. It has four modules that can be integrated separately—this flexible framework allows for custom configurations.

- Radixx Res is a reservation system that manages air and ancillary products using a shopping cart approach.

- Radixx Go is a departure services system with two variations: mobile-based and touchless (using biometric data and facial recognition for check-in, bag tagging, and bag drops).

- Radixx ezyCommerce is a retail solution for ancillary personalized offers and customer interactions.

- Radixx Insight is an AI-powered analytics and revenue optimization solution.

Beyond its LCC-specific features, Radixx provides a comprehensive suite of tools for offer and order management and disruption management.

Bravo Avantik: for startups, smaller carriers, and charters

Airlines using the platform: Bravo's clients include Alliance Airlines, Eastern Airways, and more.

Avantik is mainly used by smaller regional and low-cost carriers, including startups, which prioritize affordability and quick deployment. The company and platform have a long history, dating back to assets of the Swissair Group in 2002. It has been operational since 2005. Bravo states it is among the few PSS providers publishing its system uptime data, with records available for the past five consecutive years.

Besides typical LCC-centric functionality, Bravo supports up to 26 classes and an unlimited number of cabins and fare basis codes. E-tickets are automatically issued upon full payment.

The platform also has a unique automated contract management tool that simplifies how airlines work with groups, tour operators, and charter partners. Instead of manually adjusting seat blocks, the system can automatically apply contract rules to manage inventory, with settings tailored to each vendor. It also supports import of allotments in more than 18 file formats, making it easy to load or update seat allocations from external partners without rekeying data.

Hitit Crane: not exactly LCC-oriented, but still

Airlines using the platform: Hitit has a strong market presence in emerging markets in the Middle East, Africa, and Asia. Clients include A Jet, Air Montenegro, FlyArystan, Pegasus Airlines, and more.

Hitit doesn’t qualify Crane as an LCC-centered platform. It’s a modern PSS designed to support a wide range of airline business models, including LCCs. It provides multi-channel distribution (GDS, direct, agencies) and merchandising, allows for interline/codesharing (for hybrid carriers), and supports ancillary sales. It can run on either a ticketless or traditional model.

The PSS is also built to comply with IATA’s NDC and ONE Order standards.

GO7 (AeroCRS): for startups, regional, and non-IATA airlines

Airlines using the platform: The website claims 200+ clients use GO7 solutions, including Hello Fly, Lift Airline, Pearl Sky, SANSA, and others.

AeroCRS PSS was launched in 2006. It is part of the GO7 platform after the 2022 merger.

Besides the usual core capabilities, the PSS offers connectivity via its AeroCRS Network, with API integrations to more than 20 distribution channels (OTAs, metasearch platforms, etc.), enabling airlines to broaden distribution and online sales reach.

The company also provides a very convenient interlining option for non-IATA carriers. GO7 enables two-way interlining for its WorldTicket program partner airlines via its W2-coded carrier (FLEXFLIGHT) under IATA’s Multilateral Interline Traffic Agreement (MITA) framework that simplifies cooperation between airlines and enables them to settle under familiar IATA terms.

Why can’t full-service carriers use LCC-oriented PSSs?

Modern PSSs designed for LCCs are built with top-notch technologies, right? So what's the catch?

Like any specialized product, LCC-oriented solutions sacrifice some capabilities in favor of others. Here are just a few examples of what such systems lack from the FSC's point of view.

FSCs manage multiple cabin classes with distinct seat inventories, fares, and services, while LCC PSSs usually support just a single or limited cabin options.

FSCs rely heavily on alliances, codeshares, and interlining, requiring robust multicarrier support through itineraries and baggage handling, which most LCC systems treat as afterthoughts or don’t fully support.

FSC fare rules are complex, offering flexible refund, rebooking, and multi-segment conditions tied to loyalty tiers, whereas LCC PSSs simplify these with rigid policies.

FSCs manage diverse fleets with varying aircraft types, cabins, and maintenance needs, whereas LCCs operate limited fleets, so their PSSs handle less variation.

But there is an option between the two extremes. With time, some airlines recognized the advantages of both approaches and adopted a hybrid model. Some, like Vueling, now support connecting flights and have codeshare agreements with FSCs to expand their network. Southwest Airlines offers Business Select fares, a low-cost version of a business class product. Most major US low-cost carriers run loyalty programs resembling those of legacy carriers.

PSS vendors adapted to such needs, too. Nowadays, LCC-oriented PSSs like Navitaire New Skies also offer functionality for hybrid models.

Things to consider when choosing an LCC-oriented PSS

While all LCC-oriented PSSs are designed with low-cost carriers in mind, they don’t all approach the model similarly. Some emphasize rapid time-to-market, others focus on ancillary revenue optimization, while a few lean on scalability or ecosystem integration. When comparing options, it’s worth looking closely at how each system interprets "LCC-first" and whether that matches your airline’s strategy.

Apart from that, here are other essential factors to get right when selecting an LCC-oriented PSS.

Pricing model

Evaluate the total cost of ownership. SaaS/subscription or usage-based models (e.g., fees per boarded passenger, like Hitit charges) shift expenses into operating budgets. Smaller or startup LCCs prefer low upfront fees to conserve cash, while larger carriers may amortize license investments. Examine all cost components—license fees, transaction charges, integration and maintenance—and how they scale as the airline grows.

API documentation

Ensure the vendor provides clear, accessible developer resources. A modern PSS should expose APIs (often aligned with IATA’s NDC standards) for bookings, ancillary sales, loyalty, etc., and supply comprehensive reference docs, code samples, and sandbox environments. High-quality API docs help speed up integration of the PSS with e-commerce sites, mobile apps, OTAs, and other partners.

Ancillary sales and merchandising capabilities

Verify that the PSS includes strong ancillary management features. Capabilities like dynamic pricing, upsell prompts, and flexible fare-branded bundles are especially important for low-cost retailing.

Standards compliance

Choose a PSS that supports current and emerging industry standards. In particular, ensure compatibility with IATA’s New Distribution Capability (NDC) for richer offer and order exchange. A compliant PSS can participate in NDC channels and take advantage of modern retailing. Also consider One Order readiness: IATA’s One Order initiative will eventually replace the legacy PNR/EMD/ticket records with a single order record.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.