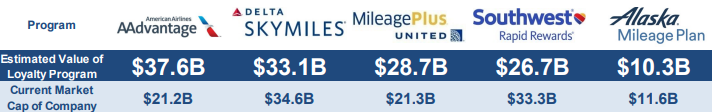

A few years ago, Joe DeNardi, a Stifel analyst, published a sensational report that contained estimated values of some of the biggest US airlines’ loyalty programs. According to it, American Airlines’ AAdvantage was worth $37.6 billion, Delta’s SkyMiles was estimated at $33.1 billion, United’s MileagePlus – $28.7 billion, and so on.

If those whopping figures aren’t enough, it turned out that in many cases, the loyalty program was worth more than the market value of the airline itself.

Joe DeNardi’s estimations

A bit over two years later, in 2020, AAdvantage – appraised at between $18 and $31.5 billion – was used as collateral for a federal loan to survive the COVID-19 crisis.

All these impressive numbers unveil the hidden power behind airline loyalty programs. And that’s what we’re going to discuss in this article how those programs work, what makes them so valuable, and how airlines manage them.

How do airline loyalty programs work?

Airline loyalty programs or frequent flier programs (FFPs) are incentive schemes run by airlines to reward their passengers, foster traveler loyalty, and support retention. The initial idea was simple and straightforward: The more people fly, the more points or miles they earn, the more perks they get. Now, let’s look into details.

How do airline passengers accrue points?

Until recently, the number of accrued bonus points was based on the number of miles flown. Some travelers used it as a loophole to game the system and took longer, often multi-stop flights (which were usually cheaper too) instead of short, direct ones to get more points.

So, today most FFPs are revenue-based, meaning that points are accrued according to the member’s actual spend. This way, airlines not only prevent cheating, but also make a step towards sustainability goals by discouraging unnecessary flights known as mileage runs, and prioritize the most profit-generating fliers – those who buy first-class and travel for business.

How can travelers redeem points?

The points earned can’t be exchanged for money, but they can be used to get a range of sweet perks. Those include

- free tickets (only a small amount of taxes and carrier-imposed fees have to be paid),

- flight class upgrades,

- access to airport lounges,

- access to fast-track service,

- extra baggage allowance,

- priority booking,

- travel products, and other rewards, discounts, and insider perks.

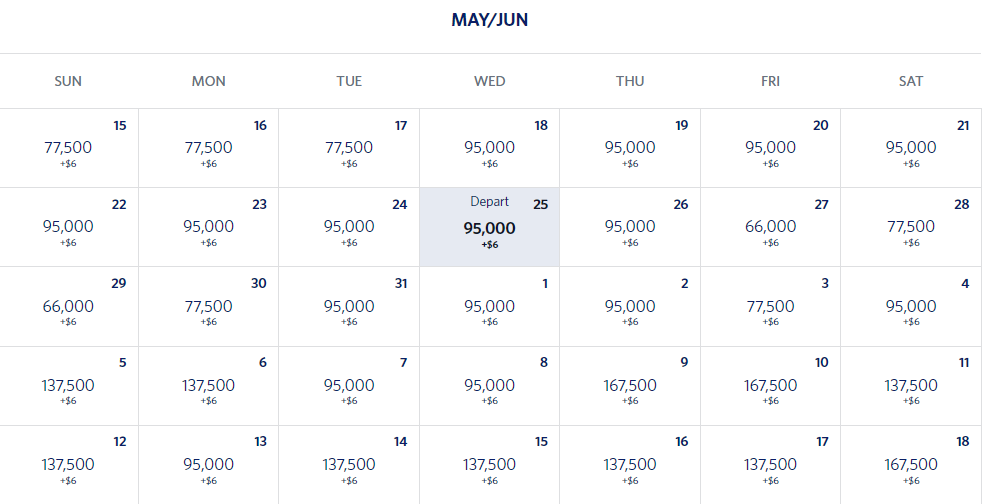

It’s important to note that most airlines today either have a list of blackout dates or utilize dynamic award charts to make point redemptions correlate to the ticket rates that change according to demand fluctuations.

Delta Airlines price calendar

Besides earning and spending points with a specific airline, members can take advantage of partner networks.

What is a partner's role in airline loyalty programs?

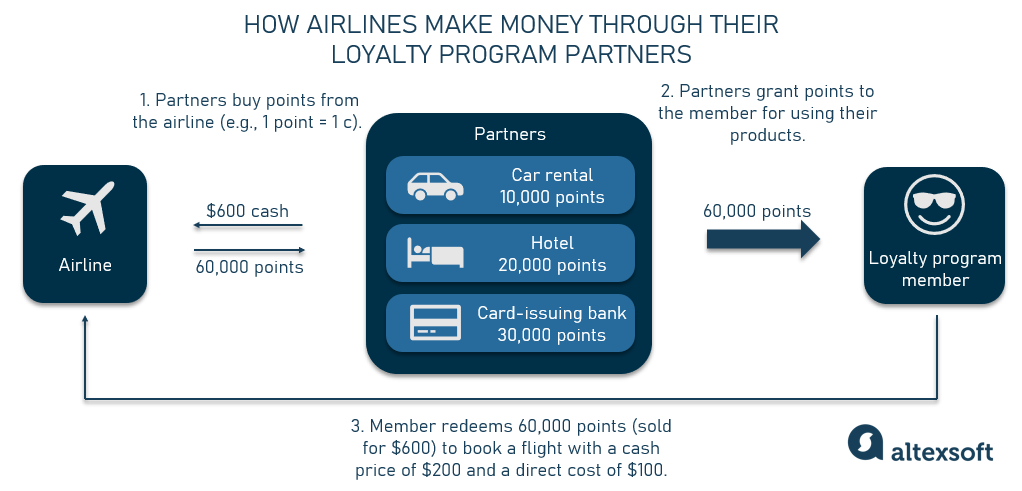

Flying isn’t the only way for members to earn points – a “points fortune” can actually be made without ever stepping on a plane. Most airlines partner with a large number of travel and non-travel companies that take advantage of FFPs to attract and retain their own customers. So how does it work?

Hotels, car rentals, cruise companies, retail outlets, and other businesses buy points from airlines (the price ranges but on average it’s 1 to 2 cents per point) and then grant these points to their own customers as a reward for transactions.

In addition, the airlines’ partnership with financial, card-issuing organizations allows FFP members to earn points just by using the co-branded credit and debit cards – with huge sign-up bonuses being a common extra lure. For example, British Airways and United have a welcome offer of a whopping 100k miles (credited after spending $5,000 within 3 months).

And now we come to the answer to our initial question. These partnership programs and selling virtual points for real money are what makes FFPs such a valuable asset. Airline earn a lot more through their own made-up currency use than through ticket sales. Here’s a hypothetical to illustrate the principle.

How airlines loyalty programs work through partner networks

A 2020 Mileage Plus Investor Presentation by United revealed that in 2019, the company got $5.33 billion of revenue from cash sales through its loyalty program. Importantly, 71 percent of loyalty miles were bought by its 100+ third-party partners to be granted to their customers (as we just explained, that’s the most lucrative part of the FFP). Remember that 100k sign-in bonus for a co-branded credit card? Banks also have to buy it for cash – just to pay it out as a reward.

At the same time, about 80 percent of bonus miles were redeemed for United products. So, that’s what makes this whole rewards endeavor more profitable for airlines than actually carrying passengers. And this is how airlines act like banks in the sense that they issue their own currency, control its flow and availability, as well as the availability and price of goods it can be spent on.

What else to know?

To get a complete picture, here are a few more FFP aspects worth mentioning.

Membership cost. Enrollment and participation are usually free of charge, though some fees can be applied later on, e.g., to redeem points or reactivate the membership account.

Points expiration. Expiration policies differ across airlines, but typically points either don’t expire at all or some periodic activity (like once every 18 or 24 months) is required to keep membership active.

Business travel. A common practice is that passengers who travel with business purposes get points on their personal account despite trips being paid for by the company – just another incentive to compensate for the necessity to fly for work (tax-free by the way).

Elite status. Typically, FFPs have a multi-tiered structure, offering more benefits and rewards to members with higher status. These upper levels are achieved through collecting a certain number of points or, in some cases, through other activities, like acquiring a premium-status co-branded credit card.

Airline alliances. Most major airlines join together into partner alliances to share routes, reduce operating expenses, keep planes full, and offer more travel destinations. Today's biggest alliances are

- Star Alliance (26 airlines serving 1,300 airports),

- SkyTeam (19 members serving 1,000+ airports), and

- Oneworld (14 partners serving around 1000 airports).

Here, the benefit for travelers lies in redeeming their points received from one airline to get perks from its alliance partner – with some limitations of course.

Frequent flier programs evolution and types: legacy, advanced, and autonomous

Since their introduction in 1979 (some believe it was 1981, depending on what should be considered an FFP), airline loyalty programs have come a long evolutionary way and undergone lots of changes. We’ll briefly cover the main stages, though the distinctions are often a bit blurry.

Stages of loyalty programs evolution

Legacy loyalty programs were mainly focused on rewarding frequent fliers. Airlines were also cooperating with other companies, but most partners were from the travel industry, plus a few financial institutions. At this stage, FFPs completely belonged to airlines and were basically a part of the marketing division.

The main limitations of this model concerned the airlines’ lack of capacity and inability to issue requested rewards as the popularity of FFPs grew. Changes were needed.

Advanced loyalty programs implied a new approach to the issuance and redemption of points to address the legacy model’s constraints. As we mentioned above, points accrual shifted towards a spend-based model, while the system of rewards became much more dynamic, with blackout dates, fluctuating seat pricing, and other tricks.

Other changes concerned affiliate networks that gradually started involving more non-travel partners, and also the ownership aspect since FFPs were becoming a separate business unit.

Autonomous next-generation programs or NGPs are FFPs that were disconnected from the core airlines, becaming completely separate commercial entities, selling loyalty points to partners including the airline. In this case, outside investors can be engaged, making the core airline company not the only owner of its FFP.

Besides being a different business model, autonomous NGPs shifted their focus far beyond frequent fliers (realizing their number is finite) by tangibly widening their partner network. As a result, points can be earned via grocery/retail shopping, restaurant dining, taxi rides, fuel purchases, and other everyday spend.

Airline loyalty program management: main aspects and challenges

Multiple studies prove that, if properly motivated by a brand, customers are willing to stick with it and spend more – bringing more profit. Thousands of travelers go out of their way to get that sought-for elite status (remember that movie Up In The Air where George Clooney’s character was obsessively notching up 10 million miles?).

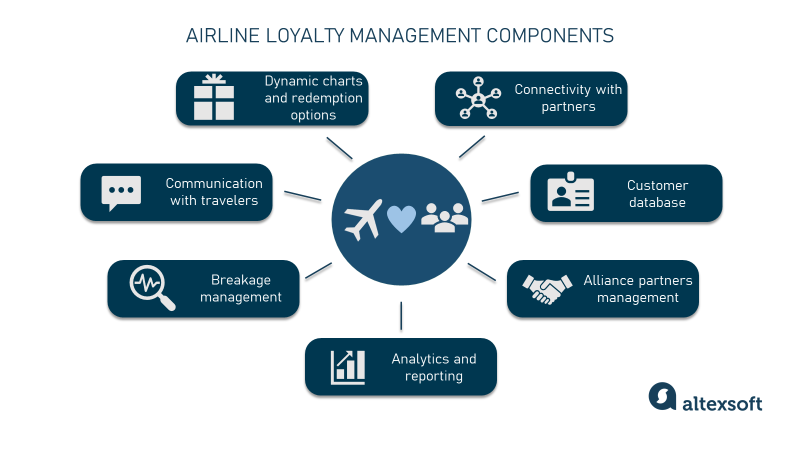

Since customer loyalty turns out to be such a valuable, revenue-generating resource, airlines bend over backwards to cultivate and cherish it. So, let’s look at the key components of airline loyalty programs management – or what has to be done.

Airline FFP management elements

Dynamic award charts and redemption options creation

As we mentioned above, most major airlines now implement a dynamic approach to points redemption, meaning that redemption rates should correlate with always-changing seat prices which, in turn, are set with the help of dynamic pricing techniques.

Dynamic pricing is a complicated process that utilizes ML-based demand forecasting methods to adjust airline fares to market conditions. To avoid losses, revenue managers should set varying redemption rates depending on demand levels and cash fares.

Watch how dynamic pricing works in aviation

Besides flight tickets, airlines have to tender other redemption options, look for internal upselling opportunities, build diverse partnerships to extend its non-aviation product portfolio, and develop new offers to engage members. To create a catalog of redemption options and set profitable (yet affordable) redemption rates, the market and customer demand have to be deeply analyzed.

Communication with travelers

If airlines want to fully engage their FFP members, they have to build an efficient, multi-channel communication system to notify them about current offers, provide status updates, allow them to redeem or transfer points, and so on. It can be realized via online customer portals, brand mobile apps, integration with third-party apps (like TripIt or AwardWallet), and direct communication channels like email or messengers.

Connectivity with a partner network

The bigger the FFP partner network is, the more diverse the product portfolio would be – and the harder managing partner relationships becomes. From contracting and onboarding to billing, there’s a wide range of related activities to handle: Point accrual and redemption have to be processed in real time, monetary transactions securely set up and monitored, then comes reporting, analytics, and so on.

Customer databases maintenance

Creating a 360-degree view of the customer is a crucial part of any consumer-oriented business. Collecting personal information, carefully analyzing it, and segmenting travelers allow airlines to tailor their marketing activities, promotions, and offers, taking personalization to a higher level – thus nurturing customer loyalty.

Breakage management

It’s obvious that not all the points/miles are going to be redeemed (e.g., due to expiration or other reasons like a member's death). In fact, 15 to 30 percent of loyalty points go unspent, which means that airlines just get cash without having to pay out anything. This concept is called breakage and it’s a critical profitability factor.

But even though it might seem that a quick buck would be welcomed, it’s not that simple. Expired miles might mean lost engagement opportunities, and strict expiration policies might turn away potential members. So, it’s worth thinking about how to make it right.

Alliance partners management

Even for a direct flight on a single airline, booking is a complicated process. And when more than one airline is involved, the flow becomes even more complex. Read more about how connecting and codeshare flights work in our dedicated overview while we try to squeeze the related loyalty points issue into a few words here.

- Airline A and B are in the same alliance and have a partnership agreement. They also have an online interface that presents each other’s inventory with rates and availability.

- A passenger books a flight with airline A by redeeming points received via FFP from airline B.

- Airline B pays airline A for the ticket as compensation.

Needless to say, all these intricate B2B interactions have to be accurately managed.

Analytics and reporting

Loyalty programs generate massive amounts of data – and can in turn benefit from data received from other airline operations. Knowing whether a passenger wants extra legroom or wi-fi on board allows loyalty managers to create the most tailored offers for frequent fliers.

Customer segments and behavior, partners’ profitability, campaign efficiency, overall performance, breakage, and financials – all require advanced analytics algorithms to get valuable insights and make effective decisions.

As you can see, there’s a lot of stuff to deal with. Let’s now talk about how.

Airline loyalty management software: main features

Implementing technology is a way to increase management efficiency and make the most of data to optimize operations. Funny enough though, that same data stands in the way of loyalty program members – in a sense that today airline operators are so good with advanced travel analytics, pricing strategies, and inventory management that the plane seats are getting sold out for cash making it harder for passengers to redeem points for tickets.

Anyway, technology is essential to manage the exceptionally complex systems FFPs are. Let’s see what features loyalty management software must have to make the lives of the airline’s FFP team easier.

How software tackles loyalty management challenges

Business rules management

Challenges addressed: Dynamic award charts and redemption options creation, communication with travelers, alliance partners management

That’s the main part of any loyalty tool. You must have a convenient mechanism to set up and manage business rules to organize your workflow of how points are accrued and redeemed, how member statuses are achieved, how rebookings/returns are handled, which email notifications have to be sent (and when), and much more.

Customer database

Challenge addressed: Customer databases maintenance, analytics and reporting

Member personal information, as well as behavior patterns, redemption preferences, and other details have to be collected and securely stored in a dedicated database. All this data, if analyzed properly, can be of great business value and the source of important, actionable insights regarding both overall marketing strategy and individual, tailored offers.

Marketing campaigns management

Challenge addressed: Dynamic award charts and redemption options creation

Closely interrelated with other modules, the marketing component should help plan, execute, and analyze promotions, considering customer segmentation and behavior trends (that’s what the member database is for). This module should also help send personalized notifications, track responses, evaluate campaign results, and so on.

Partner management

Challenge addressed: Connectivity with a partner network

As airlines widen the range of their FFP partners (today, redemption options even include newspaper subscriptions and COVID tests), it’s essential to streamline this cooperation. Airlines need access to their partners’ inventory, set accrual/redemption business rules, monitor transactions, analyze performance, and so on.

A partner self-service portal is one of the options to facilitate the process. Via a convenient online interface, your partners can manage their inventory and buy points.

Analytics and reporting module

Challenges addressed: Dynamic award charts and redemption options creation, breakage management, analytics and reporting

A powerful analytics module and a convenient array of dashboards and reports would allow loyalty managers to have complete visibility into operations and make efficient, data-based decisions. Consider building a machine-learning-based analytics platform to effectively harness data and take advantage of predictive capabilities in strategic decision-making.

Internal and external integrations

Challenge addressed: Alliance partners management, customer databases maintenance, analytics and reporting

It’s crucial to establish seamless connectivity between all business departments and IT modules to ensure smooth data exchange. Loyalty programs must be connected to

- reservation software (to share inventory information, enable points accrual/redemption, and record passenger information in case of booking),

- a CRM system (to exchange travelers’ details),

- marketing software (to synchronize promotion campaigns),

- an airline’s eCommerce platform (to enable online sales for points),

- an onboard point of sale system (to enable in-flight sales for points),

- accounting software (to properly manage financial aspects), and so on.

In addition, if your airline belongs to one of the alliances and you want to provide redemption opportunities with other carrier(s), you’ll have to integrate your reservation and loyalty management systems to share inventory, rates, and availability information.

Since ready-made software sometimes comes pre-integrated with a number of systems, it's worth discussing connectivity opportunities with a potential provider. In the case of custom development, all the integrations we listed above will have to be built from scratch.

User-facing solution

Challenge addressed: Communication with travelers

As we said, it’s important to reach out to members via different communication channels throughout all the touchpoints. To enable efficient interaction, there has to be an online member portal and/or a linked mobile app. These tools have to be super-intuitive, engaging, and convenient to use (e.g., offer sign-in with social media accounts and include gamification elements to keep members interested).

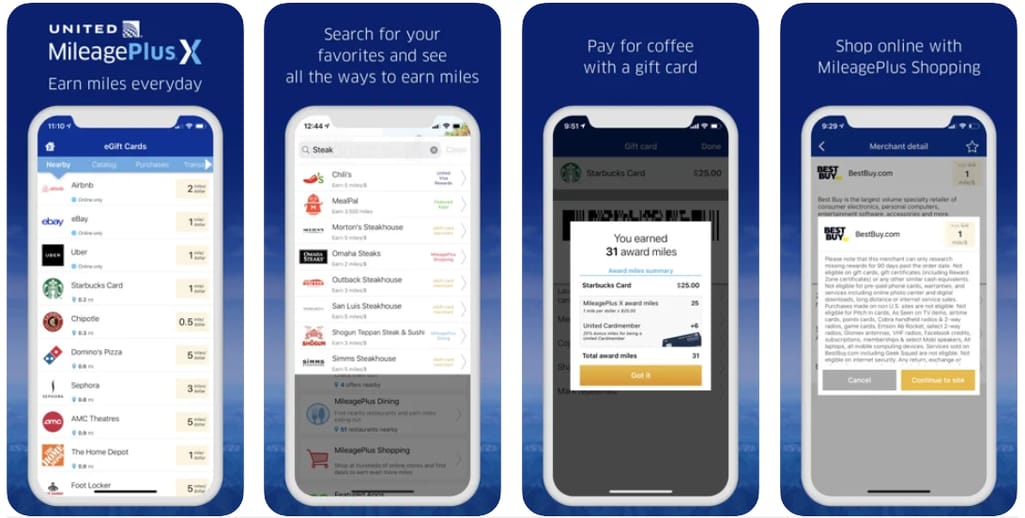

United’s MileagePlus X mobile app

If you want your customers to manage their rewards via your airline’s app – you’ll have to engage developers to add this functionality. Plus, you’ll have to provide options for support requests, i.e., chatbots, inbuilt messaging, call center, etc.

Loyalty management software implementation approaches

To optimize and streamline FFP management, there are three main technology adoption options.

A module of airline passenger service systems. A passenger service system or PSS is a piece of software that manages airline inventory and reservation processes. Major off-the-shelf PSS products include an in-built (or optional) loyalty management module, e.g., Crane PSS, Takeflite, or Sabre.

This option allows the airline to manage its core processes in a single system with no additional integrations but offers minimal customization opportunities.

Specialized loyalty management software. Focused loyalty management solutions (from a simpler Loyera app to a more sophisticated, industry-specific iLoyal) allow airlines to take advantage of richer functionality, especially if their own business systems don’t have any.

However, acquiring a separate tool entails building integrations to fit the new solution in the existing IT infrastructure and conducting additional training for employees.

Custom development. A bespoke management solution always offers the highest level of customization and can be designed to meet all the unique business requirements. However, this convenience comes at the price of bigger investment and a laborious development project.

What else to look for

In addition to the main functionality, there are a few more aspects to remember when considering a loyalty management software.

Localization. Since airlines deal with travelers from all over the world, they have to provide the best user experience for their diverse assortment of FFP members including multilingual support, automatic currency converters, customized product portfolios, a range of payment options, etc. Learn more localization tips from our dedicated article.

Privacy and fraud prevention. When dealing with sensitive information such as members’ personal details and card transactions, it’s crucial to ensure the privacy and security of your IT systems as well as compliance with GDPR and other regulations.

Scalability. A loyalty management system has to handle even the boldest development plans and the most rapid growth of the FFP.

With legacy IT systems and technology limitations, you can’t bring as much value to your members as you could have with the right software in place. Loyalty programs are too valuable of an asset to neglect and not exploit to the full extent. So, it’s worth adopting cutting-edge, customized technology, integrating it into your ecosystem – and unlocking the revenue-generating potential.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.