Online booking tools sit at the heart of modern corporate travel programs. For travel managers and Travel Management Companies (TMCs), understanding how these tools are built—and what sets them apart—is essential to driving adoption, ensuring compliance, and delivering value.

This guide takes a deep dive into the evolution, architecture, and strategic considerations behind OBTs to help you make smarter technology choices.

What is OBT and why it feels so complicated

What is OBT?

An online booking tool (OBT) is a corporate booking platform that consolidates travel content and considers policy, approvals, and expense integration. This tool enables corporate travel managers or employees to book business trips, adhering to corporate travel rules and budgets.

Online booking tool

Before the Internet, all business travel was handled via phone or in person with ticket offices. Corporate booking tools date back to the mid-1990s. In 1995, a company named Internet Travel Network (ITN) launched the first commercial OBT (later named GetThere) on top of Global Distribution System (GDS) technology. This was revolutionary: For the first time, a traveler could book an electronic airline ticket via a computer. Note that the first leisure booking platform, Expedia, went live only a year later.

Still, initially, corporate OBTs were mere interfaces: Ticket purchases and service required agent intervention. To alter or cancel trips, travelers also had to contact a travel agent at their TMC. Moreover, online booking and trip management tools couldn't automatically reflect agent-made changes once a booking was complete.

By the 2000s, online booking tools were widely seen as the inevitable future of corporate travel. Their promise was simple: easy self-booking and following corporate travel policies. Many players had entered the market: Serko Online, Rearden Commerce (later Deem), Outtask (acquired in 2006 by Concur), and Egencia (formerly Expedia’s corporate arm, acquired by Amex GBT in 2021). GetThere was purchased by Sabre in 2000, but later the OBT became a part of Serko.

There were bumps on the road to adoption. Many organizations, especially those with high-touch service cultures—like law and consulting firms—were slow to embrace the shift. Personal travel agents were still valued, and there was concern that self-booking could reduce productivity by pulling employees away from their core work.

Two factors helped turn the tide. First, lower agency fees made a strong financial case. Second, what some called the “visual guilt effect” proved persuasive: When employees saw cheaper flight or hotel options on the booking screen, they were more likely to choose them, especially when they knew their choices were visible to managers. Together, these pressures pushed many companies to move toward OBTs despite early resistance.

The next technological leap was fueled by the rise of smartphones and mobile internet, leading to a surge in mobile versions of OBTs and travel bookings made on phones. In the 2010s-2020s, dozens of new OBT products emerged globally, many built as SaaS platforms.

As a result, corporate travelers today enjoy numerous options, with solutions available for every market and almost any need.

Types of travel booking tools

Here's a closer look at the main categories of travel booking tools and who’s who in each.

GDS-owned OBTs. These are platforms developed or tightly integrated with GDSs like Amadeus, Sabre, and Travelport. They’re typically optimized for airline and hotel inventory available through EDIFACT standards and sometimes lack tech innovation speed. Amadeus Cytric and Deem (acquired by Travelport) are examples of GDS-owned tools. GetThere belonged to Sabre for over 15 years but was acquired by Serko in 2025.

TMC-owned OBTs. Many TMCs develop their proprietary tools. Examples include Neo by Amex GBT and Egencia (acquired by Amex in 2021); Lightning by CTM; BCD’s TripSource; Corporate Traveler’s Melon; the FCM Platform by FCM Travel; and more.

When you get a booking tool from a TMC, it usually comes with a package deal. The TMC will bundle it with their other services, offer support and maintenance, and charge a small fee for each booking you make online. But it also means you can’t change your TMC while using their OBT.

Independent OBTs. They are developed independently but are often distributed via TMC partnerships. The most prominent example is SAP Concur, which is a dominant force in the market primarily because it's an integral part of the SAP ecosystem. In 2023, SAP had a 49.6 percent market share for travel and expense management software.

New-age travel platforms. Tech-savvy platforms like Spotnana, Navan (formerly TripActions), Atriis, and TravelPerk deliver cloud-first architectures, real-time data syncs, and AI-powered personalization. These players position themselves as end-to-end travel platforms with dynamic content sourcing and a user experience similar to what leisure travelers expect from Booking.com or Expedia.

Spotnana and Atriis provide open travel platforms used by TMCs and their customers. While Atriis plugs into the legacy mid-office systems, Spotnana replaces most TMC technology.

Navan and TravelPerk act partly as TMCs, so the companies opting for such platforms can do without a TMC, at least that is what vendors claim.

This can be a good idea for smaller or mid-size companies. However, large businesses with thousands of business trips yearly often leverage multiple TMCs and OBTs to cover all their travel needs.

How traditional OBTs work

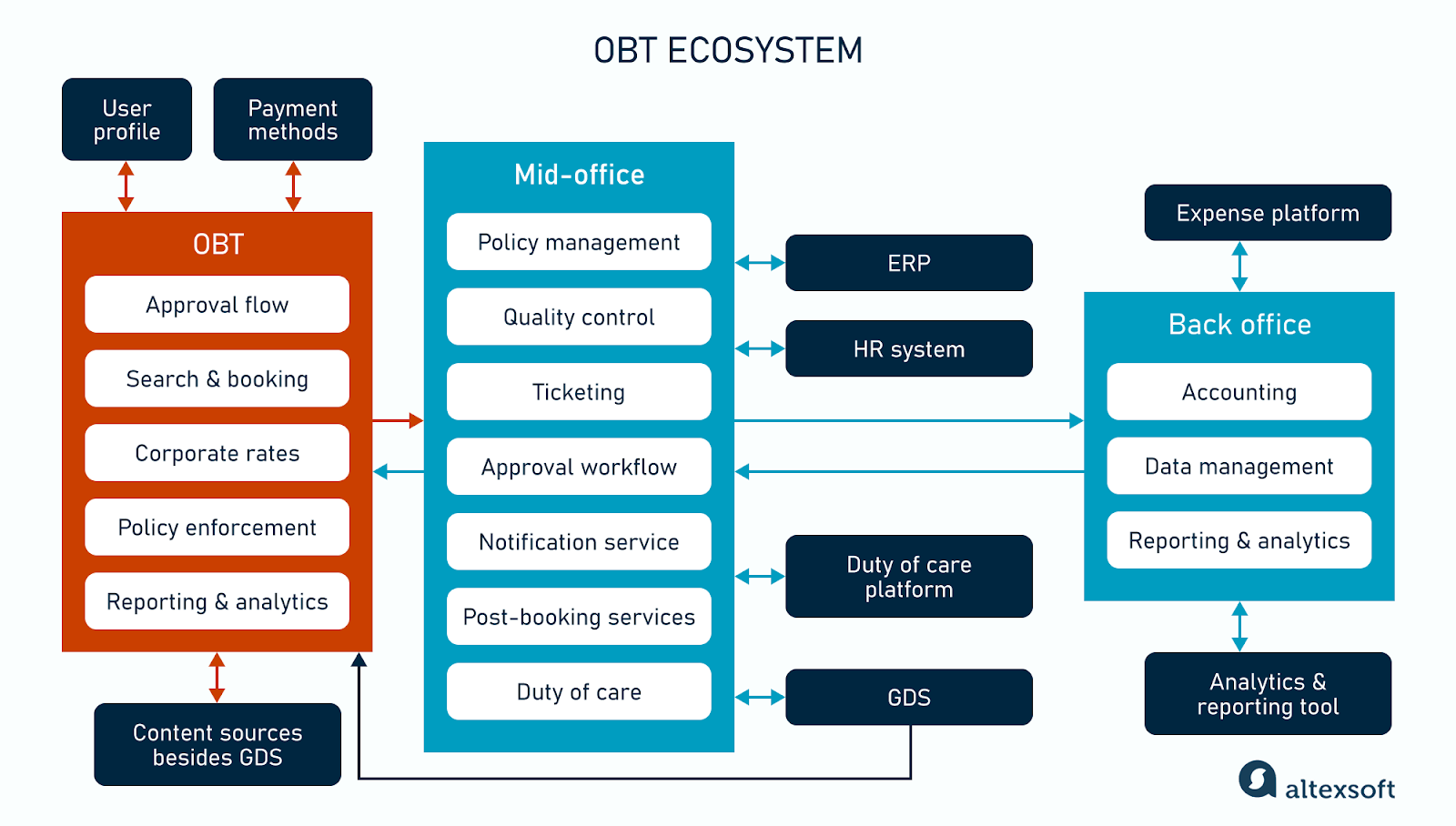

Corporate booking platforms may look like their leisure counterparts on the surface—but under the hood, they’re built to handle the added complexity of business travel. Traditional OBTs operate in a three-tiered ecosystem. Each layer handles distinct functions, altogether covering everything from the initial search for travel options to accounting for completed business trips.

So, let's break them down, starting from the top.

How OBT works: traditional infrastructure

OBT: Traveler-facing layer

“An OBT is just a front-end layer that exposes what comes from below, from mid-office and content pipes,” says Sarosh Waghmar, Spotnana's Founder and Chief Product Officer.

This layer includes the user interface (web and, in most OBTs, also mobile app) and the functions that form the basis of corporate travel booking, such as filtering travel content by company rules. It’s where employees or a company’s travel managers find and book travel services for business trips.

“Corporate travel is enabled by several distinct platform capabilities, but it is primarily the application of corporate policies, supplier preferences, and downstream connectivity to agency mid-offices that distinguish corporate travel from leisure experiences,” explains Brett Dowling, Business & Product Leader at GetThere.

Let’s look at the essential OBT features.

Search and booking. Just like online travel agencies (OTAs), OBTs let travelers search and book flights, hotels, rail, and car rentals. If you are interested, our comprehensive guide explores internet booking engines, their types, functions, and integrations.

Displaying corporate rates. Aside from available prices, OBTs display negotiated hotel rates, airline private fares, and special discounts from preferred partners, accessible for the specific company.

Policy enforcement. Unlike OTAs, OBT search results are filtered and biased according to corporate travel policies (the company’s budget limitations and rules). Travel policies can be complex or straightforward, defining all details from travel categories and specific suppliers to pricing, spending thresholds, and employee types.

For instance, a senior executive might be allowed to fly business class, while a junior employee is typically limited to economy. If a person can buy business class only for flights over 8 hours, then the booking tool shouldn’t let them book business class for a 4-hour flight. The search results are tailored accordingly.

Approval workflow. Unlike leisure travel, bookings in OBT must be approved, and different approaches can be taken.

In simpler OBTs, content that doesn't align with the policies and user profile might be hidden. More advanced tools use visual cues like color-coding, specific labels, or showing the corporation's preferred rates alongside all the available content.

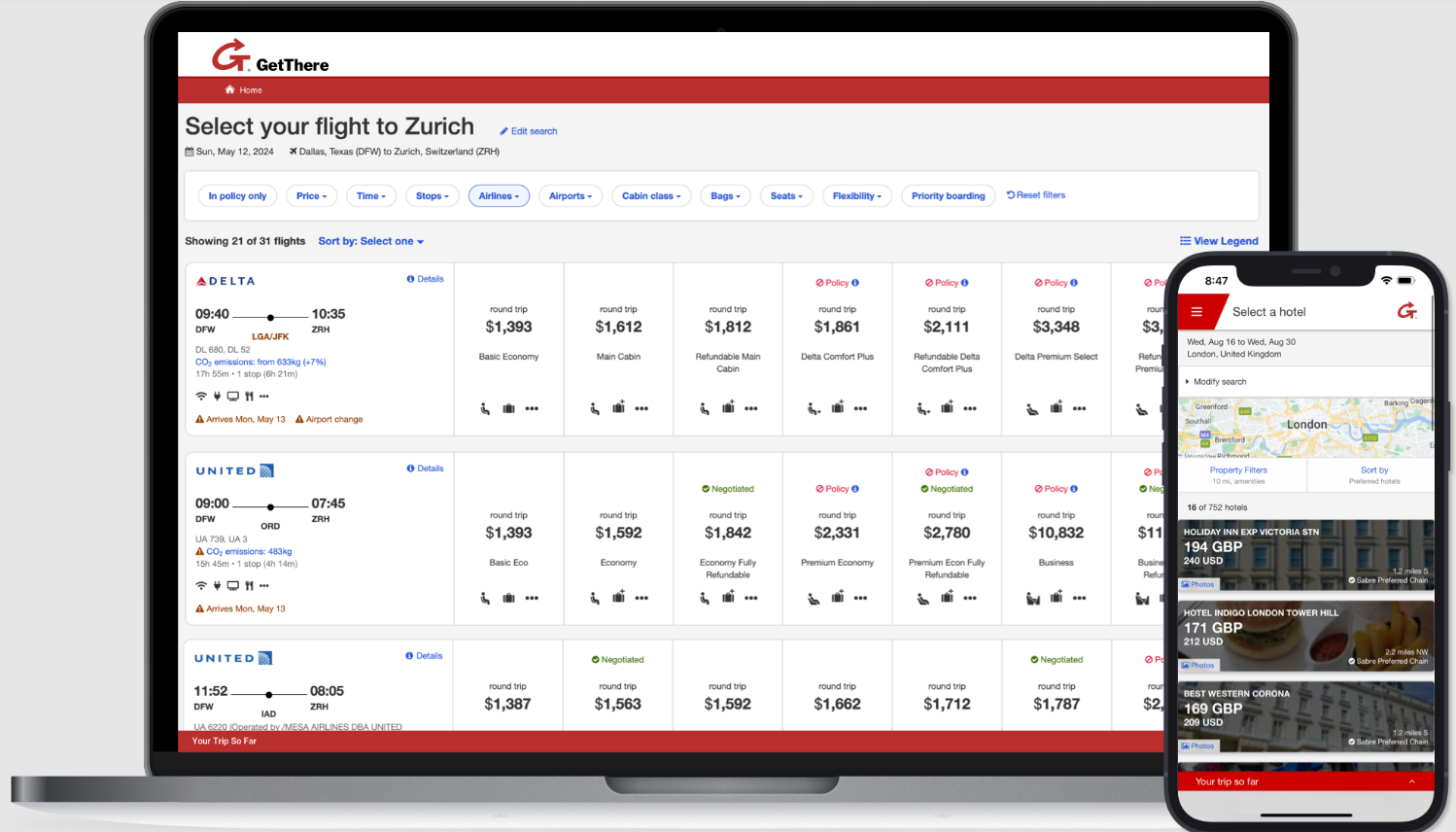

GetThere interface. Source: GetThere

Most OBTs automate the justification process for out-of-policy bookings. Travelers can either select from a list of "reason codes" or enter their explanation for needing a particular arrangement.

Here’s an illustrative scenario: Maria, a sales manager, needs to book a flight from Los Angeles to Chicago for a client meeting. She logs into her company's OBT and enters the airports and dates.

The search results—after the system applies all the filters— show no low-cost carriers (policy restriction), only economy class flights (cue Maria’s quiet sigh; she knows the rules for her job position by heart, but hope springs eternal), with fares capped at $200 per route. Flights that exceed the policy appear in red with a warning: Out of policy – requires approval.

Maria has a client meeting at 9:00 AM in Chicago on July 13, and the only in-policy flight ($180) arrives at 10:30 AM, which is too late. So she picks the option that gets her there on time ($250, arriving at 8:00 AM), types her explanation into the required fields, clicks “Submit,” and is greeted by the familiar “Pending approval” message. Once approved by the responsible person (it can take from minutes to a day, depending on the approval process), Maria pays with a corporate card and receives an electronic ticket via email.

Reporting and analytics. OBTs include a set of predefined reports that help travel managers gain insight into travel spend and policy compliance. Also, to improve reconciliation of travel expenses and reporting, OBTs have custom fields that allow corporations to capture data in the booking flow, such as the reason for travel or a project code.

OBT integrations and dependencies:

Content sources. An OBT can be connected to various intermediaries and travel suppliers, from GDSs and flight aggregators to airlines, hotels, and car rental suppliers. However, unlike leisure booking tools, most traditional OBTs rely on GDSs as the key content source.

User profile. Each traveler’s profile includes contact information, a job position, past travel details, loyalty info, and personal preferences.

Traveler profile systems were traditionally built into and managed by the GDS. However, over the past decade, some TMCs have moved away from these GDS-hosted systems, opting for independent solutions. You can leverage travelers' data while making a reservation outside the GDS if you store it at the TMC level.

Payment methods. OBTs support various forms of payment suited for corporations, including central cards, UATP cards, and delayed invoicing.

Mid-office: rules, workflows, and quality control

Please note that the terms mid-office and back office (which we’ll talk about later) are ambiguous concepts that can be interpreted differently. Still, we use them to refer to the main infrastructure components. That said, the mid-office is a TMC's operational hub (in the case of traditional mid-offices it’s often GDS-hosted ) that handles core agent functionality: compliance checks, booking management, approval workflow, and more. Here are some details.

Policy management. A corporate travel manager from TMC or a company’s team can access the administrative dashboard to configure and change various settings for a company’s travel policies.

The mid-office can also participate in policy application.“In the OBT, you've got booking policy. But mid-office can apply certain policies as well,” says Martijn van der Voort, travel technology consultant and former Director, Global OBT Product Delivery at CWT. “For example, the overarching client will say: 'OK, one of the policies is we're going to send this booking to International SOS.' You can do that in mid office."

Quality control. The system performs automated checks before a reservation is confirmed to ensure policy compliance and data accuracy.

Ticketing. After confirming the flight booking, the system sends booking data to the GDS, where the passenger name record (PNR) is generated and stored. The agency issues an e-ticket on behalf of the airline and emails it to the traveler. The unique PNR code is reflected in the ticket.

Approval workflow. In complicated cases, when an approval/disapproval can’t be automated, the mid-office systems track complex approval flow, ensuring all necessary managers or departments sign off before a trip is confirmed/ticketed.

Notification service. Near-real-time alerts or mobile app updates can vary from booking approval status to trip change notification or travel risk alert.

“Mid-office captures the itinerary data and sends it to an itinerary tool, internal or external. And the itinerary drops into the traveler’s inbox,” explains Martijn van der Voort.

Post-booking services. Reshopping for lower fares and rates within the rebooking window is usually automated. When rescheduling, exchanges, or cancellations can’t be automated, the mid-office system routes tasks to TMC agents for manual intervention.

Duty of care platform integration. Corporate travel comes with the corporation’s responsibilities for its employees’ well-being. Traveler tracking, real-time alerts, and communication tools help travel managers respond quickly in emergencies, whether it’s a strike, a snowstorm, or an unexpected safety concern. Specialized duty of care platforms are integrated with the mid-office.

Mid-office integrations and dependencies:

GDSs. It’s the core technology for a traditional OBT and the primary content source.

Duty-of-care platforms. To monitor traveler safety and fulfill legal obligations, the company can integrate an OBT with duty-of-care solutions such as International SOS, Crisis24, Anvil, and Safeture.

Want to see it in action? Check out our case study with Cornerstone Information Systems, where we helped build a 4-site platform to automate travel planning, offer smart insights, and give users full control and 24/7 support.

ERP solutions. To manage pre-trip approvals and budget control, an OBT may integrate with enterprise resource planning (ERP) systems, like SAP ERP or Oracle Fusion Cloud ERP.

HR systems. Tools like Workday, SAP SuccessFactors, and Oracle HCM help sync employee profiles, roles, and travel entitlements for quality control.

If you want to know more, our dedicated article details how mid-office and back-office systems work in travel.

Back office: finance and data backbone

This set of technical components can be implemented at the company or TMC level and handles financial and administrative functions. It determines how much the airline should be paid, how hotels are billed, how much commission a reseller earns, etc.

Key functions of the back office include:

Accounting and financial management. The back office processes invoices, manages supplier payments, reconciles corporate card charges, ACH transfers, and other payment methods, and verifies and monitors cash flows. It's responsible for the financial accuracy of all travel transactions.

Data management and reporting. The back office is where all travel data is consolidated and organized. This allows for reporting on travel spend, policy compliance, booking patterns, and overall business performance. These reports provide valuable insights for companies to analyze and optimize their travel programs.

Some platforms also offer carbon footprint reports, as measuring travel-related carbon emissions has become very important in a world that is increasingly aware of environmental issues.

You can learn more from our article about how airlines approach carbon offsetting to achieve sustainability goals.

Back office integrations and dependencies:

GDS. The back office pulls booking details and transactional data from GDSs, but not necessarily directly: The mid-office can be an intermediary.

Expense platforms. Concur, Expensify, Brex, or Emburse (formerly Certify) automatically log and categorize travel spending in real-time, even before a trip ends, reducing manual entry.

Travel data analytics and reporting tools. For example, Traxo parses booking confirmations, receipts, and invoices into data that corporations can consume.

What’s holding OBTs back? A closer look at common pain points

Many of the companies behind today’s leading OBTs have been around for over 30 years — and they’re relying on GDS core technologies that are even older. This foundation makes it difficult for established OBTs to keep up with the demands of modern business travel. Some of the key pain points of today’s OBTs include:

Missing content. In some OBTs, content is limited to GDSs. Although the three largest GDSs are known for their extensive coverage, they may still not reach everything your company needs.

“Two of the world’s largest airlines, largest by the number of passengers—Ryanair and IndiGo—their content is not in the GDS. You need to connect to them directly or get their APIs. So what does a travel management company do if such content is missing in the OBT? Go and connect to a third party,” says Sarosh Waghmar.

Also, even though most traditional OBTs have access to New Distribution Capability (NDC) content via GDSs, they often struggle to display NDC fares correctly (for instance, a legacy OBT shows different bundle offers for the same flight as different flight options) and fail to show NDC alongside GDS EDIFACT offers. “Legacy mid-office systems can only process EDIFACT-based files and are 100 percent GDS-dependent. Seat selection, class of service, and travel justification—all are built on GDS standards. So if you book outside the GDS, the mid-office system breaks”, explains Sarosh.

Another problem with the content is that TMC-associated OBTs prioritize suppliers offering TMCs higher incentives and commissions. This practice can result in companies overpaying for flights and hotels. It also undermines the ability of corporate travel programs to meet their volume commitments to suppliers, which are crucial for securing negotiated discounts and preferential rates.

Missing content issues feed into one of the most frustrating problems in travel management: booking outside OBTs, which leads to noncompliance. In a recent report by Skift and Navan, travel managers say that 40 percent of off-platform bookings happen because the tool lacks inventory, and another 32 percent because it doesn’t show the best prices available on OTAs or airline websites.

Part of the problem is addressed through a system of employee incentives and penalties—the classic carrot-and-stick approach. But fundamentally, the only real solution is to choose an OBT that offers the widest possible range of booking options.

Modern platforms use an API-first approach that allows for smooth integration with a broad ecosystem of content sources besides GDSs: from flight aggregators and OTAs to direct airline APIs, independent hotels, alternative accommodation platforms, car rentals, and train booking APIs. Deem, for example, is well known for its strong ground transportation coverage, offering access to multiple rail carriers such as VIA Rail, Amtrak, ATOK (UK), Eurostar, and others. TravelPerk in 2025 added direct access to Airbnb inventory.

It’s worth noting that the depth of content is no less important than its breadth. “GDSs have long been in the business of aggregating content, particularly achieving depth in corporate travel programs, and further up market in the enterprise segment, travel buyers tend to have more demand for breadth and depth of content,” says Brett Dowling.

Third-party tool dependency. Traditional OBTs typically require integration with dozens of external systems, from duty of care systems to T&E management platforms, to meet a company's travel management needs.

In contrast, some new-generation OBTs come with built-in, native tools that cover a large part of the travel workflow. Also, these innovative SaaS platforms often use microservices architecture, allowing them to easily add or remove functionalities to adapt to specific client needs.

Lack of a smooth user experience. In the world of Amazon and Booking.com, consumers are accustomed to booking with a few clicks, so the interface must be as intuitive and easy to use as possible. In a BTN survey, 65 percent of respondents cited ease of use as the main reason they chose their current OBT. However, not all established corporate booking tools can boast this feature.

“One of the biggest challenges with traditional OBTs is that they are clunky,” comments Sarosh. “They take 10 minutes to go from search to book, 20 steps to complete one booking. That’s a painful experience. Why can’t they capture all the information upfront? Why are you asking me to enter my name again? Why are you asking me to confirm my frequent flyer number? You should pull it from my profile, and let’s go! That kind of UI and product thinking is often lacking in the legacy OBTs.”

Lack of a flexible approach to customers’ needs. “We need to be more flexible and support cases where the travel buyer's attitude is, 'I don't care where they book, as long as I can get the data back into my program,’ retaining visibility for managers so that they can maintain duty of care,” imparts Brett Dowling.

To receive information about off-channel reservations, you can use browser plug-ins like Shed for data capture. Some tools can parse travel itineraries from an email or a PDF, or mine card data to understand what a traveler purchases.

”There are several data tools in the market to help bring off-channel spend visibility to corporate travel programs, but this is a clear-cut use case for agentic AI in the near future—especially with the emerging trend of omni-channel bookings," adds Brett.

Missing self-service options. Delays and cancellations are fundamental to travel. However, business travelers can’t always make self-service changes and cancellations on their own in their OBT. Instead, they’re required to call an agent for assistance.

In a survey conducted by the Global Business Travel Association (GBTA), 64 percent of respondents reported difficulties managing exchanges and cancellations within their corporate travel platform. This servicing hurdle is particularly acute for NDC content, where a mere 13 percent of respondents stated their OBT supported self-service NDC changes. It’s worth noting that the problem lies not only in the OBT itself, but also in the shortcomings of NDC implementation by different carriers. To put it mildly, the promises of the New Content Distribution initiative are still far from being fulfilled. Read more in our NDC challenges review.

Intricate travel rule settings. Corporate travel guidelines are often highly nuanced, and large, multinational companies like Amazon or Walmart may have hundreds of unique rules. The OBT business logic must work seamlessly so the right flights, hotels, and preferred vendors appear—and the wrong ones don’t.

However, legacy TMC/OBT policy administration dashboards don’t always allow managers to configure and change complex rules properly. Sometimes, the OBT’s developer team must build a new scenario for a particular change in travel policy.

“We have to give travel buyers the ability to dynamically deploy policies that drive desired business outcomes while considering and balancing competing needs: employee/traveler satisfaction, employee well-being, employee productivity, supplier performance, travel spend, and sustainability,” says Brett Dowling.

Poor mobile usability. Most established OBTs developed mobile versions, but often they lack functionality and don’t always show all the content available via the web interface.

These challenges force older players to evolve and contribute to the emergence of new ones.

Things to consider while choosing OBT

Companies consider various factors when choosing an OBT provider. With so many market options, buyers and consultants often recommend focusing on a few core pillars. One effective approach centers around the “three Cs”: content, customer experience, and control of policy compliance.

We’ve already touched on these common pain points in today’s OBT landscape, and you now have a clearer sense of the right questions to ask potential vendors.

What else should you be looking for?

Pricing. Understand the pricing model: subscription vs. per-seat vs. per-transaction fees. Consider setup cost (some modern platforms don’t have implementation fees) and usage volumes.

Regional or global content coverage. Many OBTs specialize in a certain region, like the South Pacific or Latin America. “They understand a particular continent, but there’s nothing at scale. If you look at multinational companies, you can be anywhere in the world, and the experience should be the same, consistent. That’s how travel software should be,” discloses Sarosh Wargham.

On the other hand, if your employees mainly travel to the same region, you can prefer the OBT with local expertise.

Easy integration and onboarding. Depending on the complexity of the deployment, you can typically go live within a month or two. For small businesses, it can take days or weeks.

Open API documentation, if relevant. Look ahead at what you'll deal with. Open API documentation means that the code is well-maintained and easier to work with. There will be fewer unexpected errors or edge cases, and you will have fewer support requests to the vendor.

SAP Concur and Spotnana are examples of openness in this field, providing comprehensive documentation for developers.

Multilingual and multicurrency support. Localization features are a must for international programs.

AI-driven features. Soon, the agentic AI in OBTs is expected to act more like a smart travel concierge than a passive search engine. During booking, AI should consider what matters to the particular traveler and give concrete recommendations, like “It's in a good, safe pedestrian area near some coffee shops, has good Wi-Fi, and it's close to your meeting.”

Now the process is only starting: Corporate booking tools often lag behind leisure travel platforms in this regard. At least, there are no chatbots that can cope with travel disruptions yet.

But progress is already noticeable. For instance, SAP Concur’s partnership with TripIt enables AI-powered itinerary suggestions and alerts. Spotnana uses machine learning to optimize content sourcing and booking flows. Navan leverages AI to recommend flights and hotels based on traveler history, peer preferences, and corporate policy in real time. Corporate Travel Management (CTM) added to its Lightning OBT an AI-powered itinerary builder, with rich media content and company-specific hotel reviews.

So, what's the overall conclusion? Corporations must focus on what matters most to their business and build their OBT evaluation criteria around those priorities.

At the same time, they should stay alert: Just like in the modern marriage market, where the words “until death do us part” should be excluded from wedding vows, in a fast-moving tech landscape, what seems like the perfect fit today might feel outdated, even stifling, tomorrow.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.