Insurance companies handle enormous amounts of paperwork — claim forms, medical reports, invoices, and policy applications — all of which arrive in different formats and often require hours of manual review.

Intelligent document processing helps optimize workflows and save on manual labor. Let’s talk about how it works and the technologies behind it.

What is intelligent document processing (IDP)?

Intelligent document processing (IDP) is a combination of technologies that enable computers to capture, classify, and extract data from documents.

Document processing automation itself isn’t a new concept. Traditionally, it relied primarily on Optical Character Recognition (OCR) – a technology that converts printed text from scanned images, PDFs, or other document formats into machine-readable data. More advanced OCR can even process poor-quality scans or handwriting, handling slight distortions or variations in text.

Sample invoice. Figure from Douzon et al., "Improving Information Extraction on Business Documents with Specific Pre-Training Tasks," 2023. Source: ResearchGate. Licensed under CC BY 4.0. No changes were made to the image.

Traditional OCR systems rely heavily on templates to interpret the extracted text, so they work well for structured documents with fixed layouts, such as standardized forms or invoices, where the information is consistently placed in defined sections (e.g., addresses, dates, or amounts). However, OCR tends to struggle when processing semistructured or unstructured documents, where layouts can vary and when an understanding of context is required.

This is where IDP takes it a step further. It extends OCR by incorporating advanced ML-based technologies, such as computer vision and natural language processing (NLP), which enable it to read a broader range of formats (e.g., semi-structured invoices) and understand the text even if the document lacks a clear structure (for example, emails).

In the insurance industry, IDP helps process claims forms, medical reports, policy applications, invoices, and many other documents from various sources. The benefits of implementing IDP include

- labor cost savings,

- faster turnaround,

- higher accuracy,

- better customer experience, and

- scalability without linear cost growth.

Due to IDP, insurers get closer to straight-through processing (STP), enabling claims or applications to be processed from receipt to resolution without manual intervention.

Technical architecture and core technologies

The effectiveness of IDP stems not from a single algorithm, but from a combination of different technologies working together.

Key IDP technologies

Computer vision for image analysis and document preprocessing

Computer vision (CV) is a technology that allows computers to “see” and understand images or videos. It analyzes what’s in a picture, so the system can make sense of visual information.

Essentially, CV helps convert visual documents — scans, photos, screenshots – into digital formats. CV algorithms

- review the document,

- detect text areas,

- identify visual elements such as stamps, logos, or signatures, and

- enhance document quality, thereby preparing it for further processing.

Computer vision also allows IDP systems to process images, such as photos of damaged property.

OCR and ICR for text extraction from scanned and handwritten documents

IDP employs OCR to extract text from documents processed by computer vision. A more advanced form of OCR — Intelligent Character Recognition (ICR) that uses deep learning networks — can be applied to read handwriting, which is often found in claim forms, accident reports, and medical statements.

NLP and NER for context understanding in unstructured data

Natural Language Processing (NLP) is a field of AI that enables computers to understand, interpret, and work with human language. It provides the “reading comprehension” layer of IDP.

Within NLP, Named Entity Recognition (NER) is a key technique that identifies and tags specific categories of information. It provides a foundation for converting both OCR/ICR-extracted text and free-form digital documents (emails, chat messages, Word files, etc.) into structured data.

In insurance, IDP systems use models trained on domain-specific taxonomies to recognize key entities such as “Policy Number,” “Date of Loss,” “ICD-10 Code,” “VIN (Vehicle Identification Number),” and “Claimant Address.”

For example, from a claim email that says

“My car was hit on June 14, policy #AF12987,”

NER extracts:

Date of Loss = June 14, Policy Number = AF12987.

RPA for further workflow automation

Robotic Process Automation (RPA), while not inherently part of IDP, often complements it in end-to-end automation workflows. RPA bots can use the data extracted by IDP to automatically initiate downstream tasks. They can log into systems, complete forms, check information, and send notifications—handling these steps end to end without human involvement.

How document processing automation works in insurance

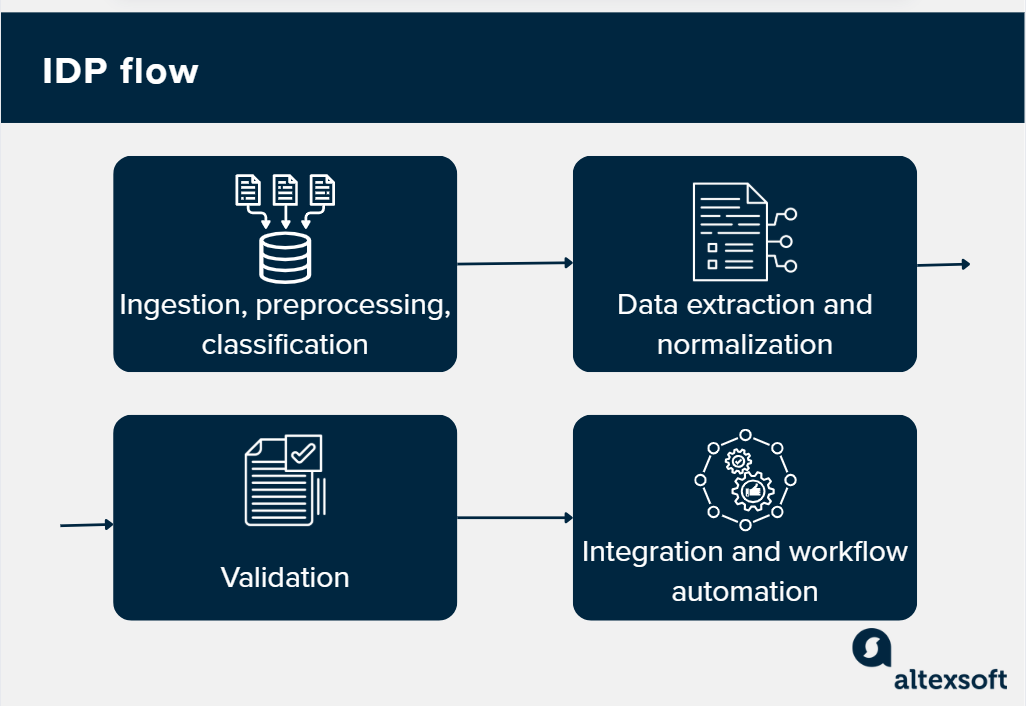

IDP operates through a multistage workflow.

IDP flow

Document ingestion, preprocessing, and classification

IDP begins by collecting documents from diverse sources, including faxes, emails, mobile applications, and connected cloud storage platforms.

Then computer vision enables automated preprocessing to clean and standardize documents, which includes

- binarization (converting grey-scale to black and white),

- deskewing (straightening tilted images), and

- noise removal (removing salt-and-pepper grain).

At this stage, the system also standardizes file formats (TIFF, JPEG, PNG, DOCX) into a uniform machine-readable structure that the core processing engines can handle effectively.

The system then classifies each document using AI-based models or rule-based logic to determine its type. For insurance, this might be distinguishing between claim forms, policy applications, repair invoices, medical records, or loss documentation.

Data extraction and normalization

This is the key IDP stage. As we explained earlier, OCR and ICR extract textual data from images, scanned PDF files, and other sources and convert it into machine-encoded text.

Then NLP/NER tools identify specific data points (names, dates, amounts, policy numbers, damage descriptions, etc.) and tag them accordingly.

If necessary, mapping mechanisms are applied to align the extracted elements with standardized data formats and field definitions for downstream integration (e.g., converting "Nov 1, 2025" and "01/11/25" to a standard ISO format of 2025-11-01).

At this step, unstructured raw text is converted into a structured dataset that computers can process further.

Validation: error checking and fraud detection

Extracted data is validated against configured business rules and cross-referenced with existing systems and external databases. When the system identifies inconsistencies, missing information, and potential anomalies, the document is routed for human review and validation.

For instance, if a property address in a claim document mismatches policy records or shows discrepancies with property databases, the system flags these issues for investigation.

This capability extends to fraud detection, where IDP identifies tampered documents, forged signatures, inconsistent data patterns, and suspicious layouts. For example, ML-powered computer vision models can detect if a part of an image (like a dent on a car bumper or a date on an invoice) has been cloned and pasted over another area.

Integration: syncing data between systems

Once validated, structured data is synced directly into core insurance systems—underwriting platforms, policy management databases, claims management systems, or CRM tools—without manual data entry. Cases and exceptions are automatically routed to appropriate teams based on complexity, claim value, or confidence scores.

Major IDP vendors offer prebuilt connectors for core insurance platforms like Guidewire, Duck Creek, and Salesforce.

Further on, insurers can build an LLM-based AI agent that can query this extracted data to summarize case histories, suggest next steps, or generate draft communications for underwriters or agents.

Alan Walker, a business consultant on insurance digital transformation, believes it’s a great use case for agentic AI: “A powerful next step is using agentic AI to support underwriting and operations. Every insurer has massive stores of guidelines, cases, treaties, and underwriting manuals—often hundreds of pages long. Traditionally, you need years of expertise to navigate them.

“But once you ingest this content into an LLM, an agent can query it instantly: ‘Does this risk fit our appetite?’ ‘Are there inconsistencies in this application?’ ‘What follow-up questions should we ask?’ It’s a relatively simple use case to implement, yet it delivers huge value by giving teams fast, expert-level guidance at the point of decision.”

Key use cases of IDP in insurance

IDP can be applied at every stage of the insurance process. Here are the most common use cases.

Underwriting and policy application processing: Streamlining risk assessments and application reviews

Underwriters analyze a large volume of documentation, including risk assessments, medical histories, financial statements, inspection reports, credit profiles, etc. This manual review process often leads to bottlenecks and inconsistencies in evaluating risk.

IDP addresses this challenge by automatically extracting data from a variety of formats, such as PDFs, Excel files, medical scans, lab reports, and even email chains. It also understands contextual indicators of risk—like language related to pre-existing conditions, lapse history, or asset ownership.

Additionally, IDP performs semantic classification, distinguishing between different types of content, such as separating lab values from physician remarks or identifying reinsurer clauses. The extracted and categorized risk attributes are then fed directly into rating models and underwriting engines, streamlining the entire process.

Claims processing: Automating data extraction

Claims usually involve the most paperwork, so they benefit the most from IDP. Current research estimates that claims automation drives a 40-60 percent increase in settlement speed.

First notice of loss (FNOL). FNOL initiates the claims process, and any delays here affect the entire workflow. Insurers typically receive FNOL data in formats like PDFs, emails, mobile app photos, or scanned handwritten forms. Manually extracting details like incident information, policy numbers, claimant data, and accident descriptions is time-consuming and prone to errors.

For example, in the case of a car accident, customers can submit FNOL via an app or chatbot. IDP reads the application, extracts details like date and location, and matches them with the policy. And computer vision models enhance IDP by analyzing images.

As Alan explains, “Insurance companies already use computer vision models to support assessment and adjudication. When customers submit photos or videos of vehicle or property damage, these models analyze the images, see what's going on, identify what damage has been done, what materials need to be used to replace it – and start the estimating process.”

This streamlines triaging, allowing simple claims to be paid quickly while complex ones are routed to senior adjusters.

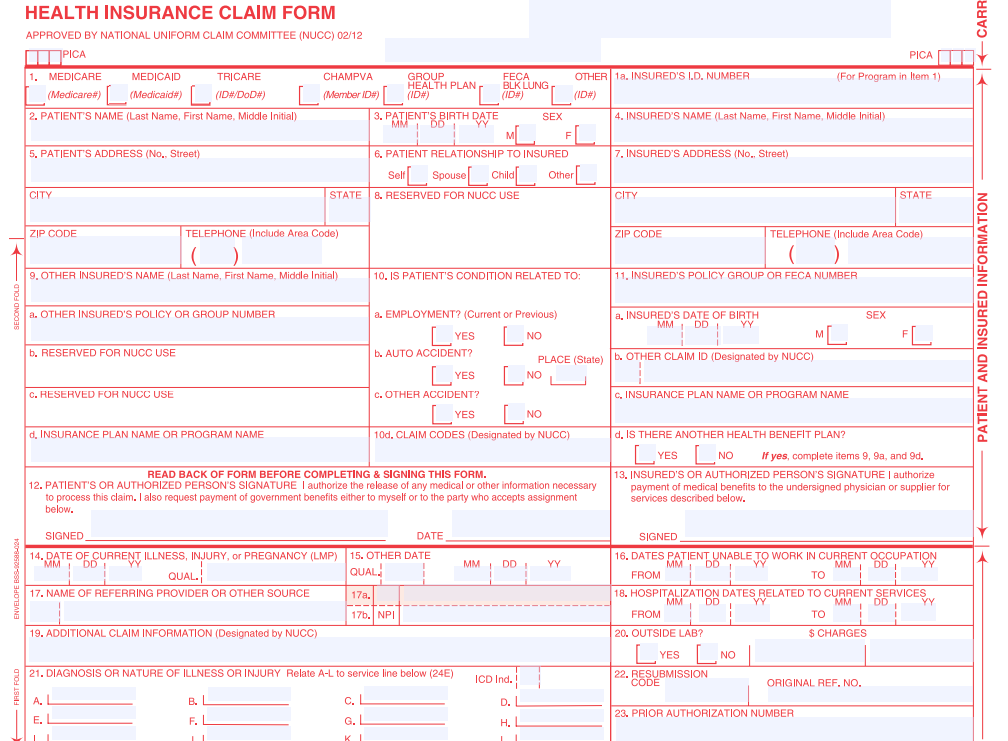

Medical claims (CMS-1500, UB-04). Health and workers’ compensation claims rely on standardized forms. IDP systems utilize "color dropout" techniques to accurately process red-dropout forms (like standard CMS-1500s), extracting codes like CPT and ICD-10 before validating them against coverage rules. If everything matches, the claim can be approved automatically.

IDP processes red-dropout insurance CMS-1500 forms. Source: Blue Summit Supplies

Read more about automated claims processing in a dedicated post.

Fraud detection and compliance: Identifying anomalies, preventing fraud, and ensuring audit traceability

Insurance fraud is a $300 billion problem in the US alone. IDP strengthens fraud prevention through sophisticated anomaly detection. The system

- identifies inconsistencies across documents (such as policy number discrepancies or address mismatches),

- uses image forensics and visual AI to identify manipulated scans or digitally altered documents,

- flags unusual patterns in financial data, and

- cross-validates information against trusted external databases.

All processing activities create tamper-proof audit trails with automatic logging and timestamping, supporting regulatory compliance requirements and enabling comprehensive review for audit purposes.

Policy management and renewals: Automating document updates

Policy management often requires gathering a range of documents, including identity proofs, income statements, signed proposals, risk declarations, and endorsements during policy onboarding. For servicing and renewals, insurers must revalidate KYC, check for coverage gaps, and stay updated on regulatory changes.

IDP simplifies this by automating the extraction of data from multipage policy documents, ensuring efficient ingestion. It uses business rule engines to identify missing documents, expired IDs, or outdated medical statements. Automated notifications are triggered for document collection or e-signature completion, streamlining the process.

Additionally, IDP supports multilingual processing and works with various templates, making it ideal for global insurers or those serving regional clients.

IDP providers overview

The 2025 Gartner Magic Quadrant recognized these six platforms as leaders in the IDP segment.

- ABBYY – a veteran in OCR and document capture, with its Vantage and FlexiCapture platforms delivering versatile AI-powered extraction and pretrained skills for various document types.

- UiPath – which combines IDP with its strong RPA ecosystem, offering seamless integration and scalable deployment across cloud, on-premises, and hybrid environments.

- Kofax (now part of Tungsten Automation) – a comprehensive intelligent automation platform offering document classification, multichannel capture, and compliance reporting features.

- Hyperscience – AI-powered IDP platform known for its industry-leading accuracy (99.5 percent) and automation rates (98 percent).

- Infrrd – a no-touch automation solution that can handle diverse document formats and includes automation features like smart image detection, document classification, error flagging, risk spotting, and automated compliance tracking.

Several IDP providers offer tailored solutions specifically designed to address the needs of the insurance industry, including

- Hyperscience,

- Automation Anywhere,

- ABBYY FlexiCapture for Insurance,

- Rossum, and

- Tungsten Automation (Kofax) TotalAgility.

These platforms manage insurance-specific documents, including claim forms, policies, underwriting applications, and loss reports. They focus on improving accuracy in data extraction, enabling faster claims processing, enhancing fraud detection, and ensuring regulatory compliance through secure, audit-ready workflows.

Challenges and considerations

Apart from initial costs and tech implementation challenges, IDP faces several considerations that companies should be aware of.

Complex and diverse document formats

IDP solutions need to process a wide variety of document types. If the system is not well-trained or adaptable, it can lead to misclassification, incomplete extraction, and errors.

IDP technologies rely on machine learning models that need ongoing training with diverse and updated document samples. Continuous learning helps the system adapt to new document formats and languages, improving accuracy and reducing errors over time.

Data privacy and security compliance

Since IDP deals with sensitive information (e.g., personal data in insurance claims), maintaining strong data security is critical. Measures include access controls, encryption, secure storage, and adherence to regulatory standards like GDPR or HIPAA, especially when cloud services are involved.

Exceptions and edge cases

Despite automation, some documents or extracted data may have ambiguities, missing fields, or low-confidence recognition results. Efficient workflows must enable human review and correction to maintain accuracy and compliance.

Algorithmic bias and ensuring ethical AI

AI models may inadvertently learn biases from skewed or unrepresentative training data, leading to unfair or discriminatory processing outcomes that affect certain groups. This can perpetuate inequality, result in legal liabilities, damage reputation, and erode trust.

Mitigation requires careful data governance, diverse and balanced training datasets, ongoing bias monitoring, transparent model design, and human oversight to ensure fairness and accountability throughout the AI lifecycle.

Read our dedicated posts about responsible AI and AI guardrails to learn more on the topic.

Operational risks

Operational risks in AI deployments include system downtime, integration failures, and maintenance gaps.

- System downtime—due to hardware issues, software glitches, or cyberattacks—can disrupt critical processes like payment clearing or fraud detection, leading to lost transactions and potential financial losses.

- Integration failures happen when AI systems are incompatible with existing infrastructures, causing data silos or performance issues.

- Maintenance gaps, such as delays in model updates or system patches, can degrade AI performance over time, affecting forecasting, risk modeling, and compliance.

Mitigation strategies for these risks include redundancy planning, stress testing, and automated monitoring to detect anomalies early.

Future trends and innovations

Tech advancements are expected to further transform insurance and other document-intensive industries.

One key trend is the increased use of predictive analytics and AI-driven decision-making, where IDP platforms not only extract data but also analyze historical patterns to forecast risks, detect fraud, and optimize workflows proactively.

Another innovation is the convergence of IDP with multimodal AI, allowing systems to process audio recordings and video content alongside traditional documents for richer insights.

Alan believes it’s in the very near future: “Voice recognition in insurance isn’t widely deployed at scale yet, but the foundations are already here. We all use tools like Teams that generate meeting transcripts—not perfectly, but good enough for AI to extract key points with high accuracy. The same idea applies to claims. You can interview a customer electronically, record their answers, transcribe the conversation, and then pull structured data from it. Some insurers are already piloting this, and it’s only a matter of time before it becomes mainstream.”

Blockchain and secure digital identities are emerging as a means to enhance document security, verification, and compliance through immutable and transparent records.

These trends signal a move toward more adaptive, context-aware, and comprehensive document processing ecosystems that bring efficiency, accuracy, and enhanced risk management.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.