In this article, we examine the core revenue streams of travel agencies, identify who actually pays the reseller (the supplier, another intermediary, or the traveler), track how these revenue sources have evolved over time, and explain how new technologies have reshaped the travel distribution landscape.

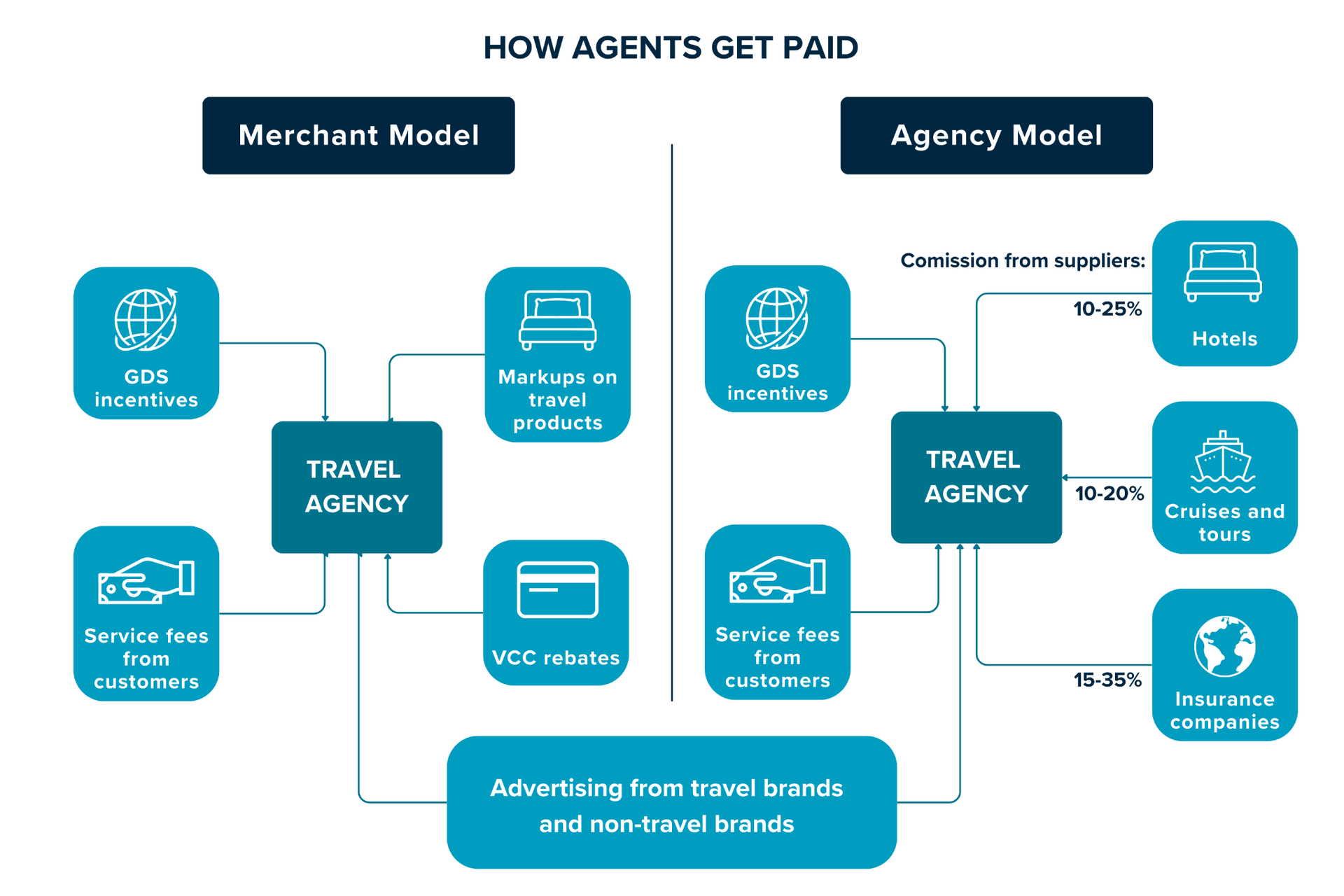

Agency vs merchant model: two ways to earn money in travel

Agency vs merchant model: two ways to handle payments in travel

When an agency acts as the merchant of record, it sells the travel product—whether a hotel room, cruise, vacation package, or airline ticket—in its own name. The agency sets the price, collects payment from the customer, and then settles with the supplier (such as a hotel, airline, or cruise line). In this case, the agency earns money primarily through a markup—the difference between the selling price and the supplier’s net rate.

While the merchant model is gaining popularity, most travel intermediaries worldwide still operate, at least partially, under the agency model. In this setup, a reseller (for example, an OTA platform) connects travelers with travel content but does not process payments. Instead, end customers pay suppliers directly, either during the booking (for airlines) or at check-in/checkout (for hotels). The agency earns revenue through commissions and overrides. It can also combine both models to enjoy the diversity of earnings.

If you’d like to explore in depth how the agency model and merchant model work in travel, see our dedicated articles.

Below, we’ll examine different travel-specific revenue streams in more detail.

How travel agents get paid: revenue sources and streams

Commissions: like in the good old days… Well, almost

A commission is a fixed amount or, more commonly, a percentage of the gross booking value that a travel supplier pays an agent as compensation for selling its products or services. Before online sales became widespread, commissions were the primary, and often the only, source of income for travel agencies. Today, around three-quarters of agency revenue still comes from commissions and overrides, which are a specific type of commission (we’ll explore them later).

Let’s look more closely at how commissions work across different travel sectors—starting with airlines.

Airlines: the long goodbye to simple economics

Passenger air travel remains the foundation of the modern travel market (which is why we begin with it)—yet airlines pay little to no commission on ticket sales. Rare exceptions exist for some international routes, but even then commissions are small, highly route- and contract-specific, and not publicly standardized.

For example, American Airlines pays zero commission on flights to the Middle East, between zero and one percent on flights to Europe (depending on the country), but 7percent on flights to destinations such as Fiji, Benin, Cameroon, and Ghana.

Porter Airlines, the third-largest carrier in Canada, pays commissions only on tickets purchased in Canada via global distribution systems (GDSs), ranging from 0 percent to 5 percent, depending on fare value.

Now, a bit of history. Before the mid-1990s, air travel was the financial backbone of US travel agencies. Airline tickets were expensive, in high demand, and could only be issued by agents or carriers themselves. As a result, they generated up to 80 percent of agency revenue. Standard base commissions were a flat, uncapped 10 percent of the ticket price. Selling air was widely seen as “easy money”—fast transactions, minimal effort, and predictable margins.

That model began to collapse in the late 1990s and early 2000s. The first decisive move came in 1995, when Delta Air Lines capped commissions at $50 for a round-trip domestic ticket with a base fare of over $500 and $25 for a one-way ticket with a base fare of over $250. The decision triggered a rapid, industry-wide chain reaction. Other airlines followed, cutting commissions aggressively.

In the same year, late December 1995, Alaska Airlines became one of the first major carriers in the world to sell flights without creating paper tickets. The company launched an “Instant Travel” option on its website, allowing anyone to book a flight, pay by credit card, and receive a booking reference (a unique identifier assigned to a reservation) via e-mail. With this number and a passport, passengers could get a boarding pass at the airport.

By the early 2000s, most major airlines had built their websites and started selling flights directly online.

In 2008, the International Air Transport Association (IATA) mandated electronic tickets (e-tickets) for all member airlines, ending the era of paper proof of purchase in commercial air travel.

And since the carriers’ dependence on intermediaries dramatically decreased, standard base commissions on domestic and most international flights disappeared entirely. Agencies built around airline revenue were forced to reinvent their business models — or shut down altogether. The scale of the disruption is clear in the numbers: Airlines Reporting Corporation (ARC)-accredited agency locations fell from nearly 47,000 in 1998 to just over 12,000 today. (US-based travel agencies need ARC accreditation to sell flights; it’s equivalent to IATA accreditation outside the US.)

However, here is an interesting fact: The remaining agencies are handling much larger individual volumes, with a 2024 total of $99.2 billion representing the highest annual total ever recorded in ARC’s history.

Obviously, resellers continue to sell air, but they have to rely more on other travel suppliers, and alternative revenue streams.

Alternative revenue streams in travel

Hotels: the cash flow stable but slow

Large OTAs usually sign direct contracts with hotels. As the most significant online distribution channel that captures about 35 percent of all hotel bookings globally, online travel agencies are in a strong negotiating position and charge substantial commissions for their services.

Booking.com commissions range from 10 to 25 percent, depending on the property’s location, size, and cancellation policy. Expedia’s commission varies from 15 to 30 percent. Airbnb shifted from a split-fee model (guest 14–16.5 percent, host 3 percent) to a single fee (15.5–16 percent paid by the host) in December 2025.

Brick-and-mortar agencies and TMCs typically work through intermediaries—bed banks and GDSs. In this case, agencies also earn a commission, but it is usually lower than what large OTAs receive.

GDSs charge hotels a fee for their services, “but, additionally, there may also be a commission, usually 10 percent of the booking value, which the hotel pays to the GDS and the latter passes it to the travel agent, who makes a reservation,” explains Ira Vouk, hospitality tech consultant, speaker, and lecturer.

Wholesalers earn money through markups and also pay a commission to the travel agency if it operates under an agency model.

An important fact that a novice agent or OTA startup should consider (experienced players are already well aware of this): Commission flows are slow and error-prone. Аgencies may wait weeks/months for hotel commissions and sometimes need help from commission collection firms; cancelled stays yield no commission at all.

However, unlike airlines, hotels do not “rebel”—they don’t have the power to refuse to reward the travel agents’ service.

Tour packages and ancillaries: the agent's favorites

Travel agents have developed the most loving relationships with tour package suppliers (tour operators, airline holidays divisions, and some large hotel chains) since a complex and expensive product is easier to sell if an interested agent puts in a good word for it with the traveler. Compensations typically range from 10 percent to 15 percent, but can go higher (up to 30 percent or more) for specialized, luxury, or high-volume sales.

Additionally, agents can earn commission on transfers, car rentals, guided tours, and other ancillaries. The effective commission rate on a total trip package can be significantly enhanced by selling travel insurance, which is the highest-margin component; commissions can range from 15 percent to 35 percent. For example, Allianz Global Assistance pays 25 percent for its most popular product, “Classic,” and 35 percent for the “Premier” product, which offers a higher level of coverage.

Read our article dedicated to travel insurance—how it works, what it covers, and the major providers in the market.

Ocean cruises average around 10-16 percent commission. And what's even more pleasant is that most major cruise companies pay commissions immediately after full payment by the customer, which typically occurs 90-120 days before the journey.

There is also a dark side. Many major cruise lines apply non-commissionable fees (NCFs) to their fares. These are mandatory charges that do not generate agent commission. As a result, a cruise that retails for $2,500 may leave only $1,800 of that amount eligible for commission, with the remainder excluded from agency earnings.

Volume bonuses (overrides): catch me if you can

Overrides are performance bonuses paid by suppliers or host travel agencies when certain sales thresholds are met. Major travel providers and intermediaries (cruise lines like Carnival and Royal Caribbean, luxury resorts, vacation packages, bed banks) run such programs.

The cruise sector is highly conducive to volume-based override agreements, which can push commission rates to the highest tiers. For instance, a cruise line might offer a standard base commission of 10 percent. But an agency can earn more if it achieves sales beyond predetermined thresholds (e.g., an additional one percent for every $1 million in sales), raising the effective commission rate on all subsequent sales.

From the override perspective, the benefit of collective buying power is clear: An independent agent might struggle to meet the $1 million sales threshold, but a host agency that aggregates the sales volume of hundreds of agents secures the highest possible commission tier for the entire collective.

GDS and airline incentives: love-hate games

GDSs pay agencies incentives, a few dollars for each ticket sold, which are part of the fees received from airlines. It’s a long-standing industry practice. For instance, one of the biggest digital TMCs in the US, AmTrav, receives 14 percent of its revenue as GDS incentives. Incidentally, this is one of the reasons why TMCs prefer GDSs to other intermediaries.

As mentioned above, airlines pay agencies virtually nothing for ticket sales. But there are exceptions. Some carriers, like the Turkish low-cost airline Pegasus, offer bonuses for ancillary package sales. Each package has a certain number of points; the agency can use earned points to buy tickets.

Also, a growing number of airlines reward travel agents for purchasing tickets through NDC (New Distribution Capabilities) channels, which were created to reduce reliance on GDSs, cut distribution costs, and give carriers more control over how they sell their products.

For agents, NDC is both an opportunity and a challenge: They can access NDC-exclusive flights and ancillaries, but switching to new technology requires investment and means no more GDS intensives.

For OTAs focused on price-sensitive leisure travelers, the loss of traditional GDS incentives is largely offset by cheaper NDC fares that are simply unavailable through traditional GDS channels.

The same logic does not apply to corporate travel, which is generally less price-sensitive. This means TMCs have little immediate motivation to absorb the operational disruption.

That said, the dynamics are beginning to shift. Airlines are increasingly recognizing that NDC adoption will not scale on its own. “Some airlines now offer bonus programs and flexible deals through their NDC channels. That’s a big step toward making NDC more popular,” says Viktor Nekrylov, Co-Founder of DRCT, an IATA-certified tech provider and NDC aggregator.

To encourage resellers, American Airlines offers agencies a 10 percent incentive on NDC fares, while Air Canada pays $2 for each NDC booking.

And yet, and yet... Commission (overrides, incentives) is king, but it has been shrinking on some products for a long time. This long-term erosion has forced travel agencies to rethink how they operate.

Fees: when the service has a price tag

Until now, we have only considered payments from suppliers. Unlike commissions and bonuses, service fees constitute charges paid directly by the client for the agent’s time and expertise.

For years, travel agents typically offered services at no direct cost to customers. Today, this traditional model is undergoing a significant transformation for two key reasons.

- Commissions are being reduced and delayed.

- Increasingly, travelers are demanding personalized itineraries supported by in-depth destination expertise, particularly in the luxury travel segment.

The latter is growing steadily: The US travel agency market is driven by high-end leisure demand.

That said, professional fees provide a stable and transparent mechanism to align compensation with these elevated service expectations, to demonstrate professional value, and to reduce dependency on delayed or inconsistent supplier payments.

In the US and other developed markets, travel agencies are progressively adopting professional service fees, adding them to the commission earnings. Survey data from World Travel Agents Associations Alliance (WTAAA) reveals that 55 percent of US traditional agencies and 50 percent in Canada charge fees. In Europe, the adoption rate is even higher, 66 percent.

The corporate sector has progressed the farthest on this path. In 2024, approximately 71 percent of corporate travel buyers paid transaction-based fees to their travel management companies. Although the lion's share of TMC revenue still comes from commissions and GDS incentives, client-paid charges are also becoming a significant revenue source (for example, in AmTrav 25 percent came from customer fees in 2023).

What types of fees can agents charge?

There is no one-size-fits-all fee structure. Common fee models include:

- Consultation or planning fees: Upfront charges covering research, itinerary development, and destination expertise, typical for Fully Independent Travelers (FITs), and group travel. Works well for complex, multi-destination trips with clearly defined scopes—destination weddings, safaris, etc.

- Ticketing and servicing fees: Per-ticket or transactional fees for air bookings, changes, and special services. For instance, in 2023, the median international air service fee was ~$60, and ~$40 for domestic air.

- Retainers and subscriptions: Recurring fees—annual or monthly—for ongoing service to luxury travelers and corporate clients.

Agencies can tailor and mix their pricing models to match service offerings, client expectations, and trip complexity.

Practical checklist for introducing fees

First, travel resellers operating on an agency model must open a merchant account to charge customers a booking fee.

The next challenge you must tackle is customer resistance. For many years, travelers believed that an agent’s services should be free. Today, that lingering perception is reinforced by online self-service platforms. Here are a few steps that can help clients adjust to this new reality.

- Establish distinct service tiers, ranging from basic ticketing to comprehensive trip design and risk management.

- Publicize fee ranges and scope inclusions early to set clear expectations.

- Illustrate the value delivered through concrete examples, such as handling complex reissues, last-minute emergencies, or supplier negotiation leverage.

- Track service time for all trip types to ensure fee structures accurately reflect effort and responsibility.

- Review and adjust fees regularly to keep pace with evolving airline distribution methods (e.g., NDC adoption), supplier policies, and expanded service scopes.

Agencies that clearly articulate the value delivered, align fees with trip complexity, and communicate openly with clients can foster deeper client relationships.

VCC rebates: when payments start paying back

A virtual card (VCC) is a one-time card number linked to a real account, created to pay a specific amount, in a specific currency, to a particular supplier. In travel, this payment method is gaining popularity due to its enhanced security and the convenience of accessing data for accounting purposes. Agencies with a MoR account can pay suppliers using virtual cards.

How virtual credit cards transform travel

For travel agencies, virtual cards offer a clear benefit: Many VCC providers return a portion of the card acceptance fee to resellers in the form of rebates, typically amounting to a few percent of the transaction value. If that fee is around 2.5 to 3 percent of the transaction amount, the rebate typically falls in the 0.5–2 percent range.

In simple terms, the more virtual card payments an agency processes, the more revenue it generates.

Advertisement: monetizing eyeballs

Big OTAs and travel consortiums (networks of affiliated independent travel agencies) are powerful travel media platforms. They monetize their massive traffic and "first-party data" (direct knowledge of traveler behavior) through sophisticated advertising models.

OTAs like Expedia and Booking.com function similarly to digital marketplaces or social networks, charging suppliers for visibility.

Sponsored listings and performance ads. Just as Google uses pay-per-click (PPC), OTAs offer hotels and other providers "Featured Listings." “Then, in addition to the standard commission of 20-25 percent, the hotel pays extra, let's say 3 percent for special placement,” says Ira Vouk.

Retail Media Networks (RMNs). This is the fastest-growing segment. Major players like Expedia and Marriott have launched their own media networks to capture advertising dollars from both travel-related (endemic) and non-travel (non-endemic) brands.

In 2024, Expedia became Netflix's first global advertising partner for its ad-supported tier, launching localized campaigns across 10 countries to leverage the "set-jetting" trend (traveling to filming locations). The same year, Amazon Prime partnered with Booking.com to market the film The Idea of You by creating an interactive map of all the characters' travel locations, turning viewers into potential bookers.

As for the results, Expedia Group’s "Advertising and Media" segment generated $954 million in 2024, representing a 16.2 percent increase year-over-year—making it their highest-growth segment.

Multichannel campaigns. Large consortiums like Virtuoso or Travel Leaders Network offer suppliers the opportunity to pay for placement in high-end print publications, branded direct mail, and email campaigns sent to the agency’s affluent client database.

So… how do agents actually get paid?

The short answer: in many small, overlapping, and constantly shifting ways.

Commissions didn’t disappear — they migrated. Fees stepped out of the shadows. Payments quietly started generating their own margins. For agents, income today is less about a single reliable stream and more about assembling a diversified portfolio.

Everything will become even clearer if we ask the question, “What are agencies paid for?” In the past, revenue was driven by the execution of travel sales on behalf of suppliers. Today, it is increasingly tied to expertise — from global market reach and local insight to negotiating power and access to exclusive inventory.

To be succinct, agents are paid to stand in the gap between a traveler and a truly chaotic global travel infrastructure. As J.W. Marriott, the founder of Marriott International, once famously noted, "Service is the only thing we have to sell."

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.