Back in 2011, Scott Brinker, a marketing technology analyst, unveiled his first version of the Marketing Technology Landscape Supergraphic with about 150 companies. In 2020, the Supergraphic contained about 8,000 companies. The Supergraphic has become “a desk companion” of every marketer out there.

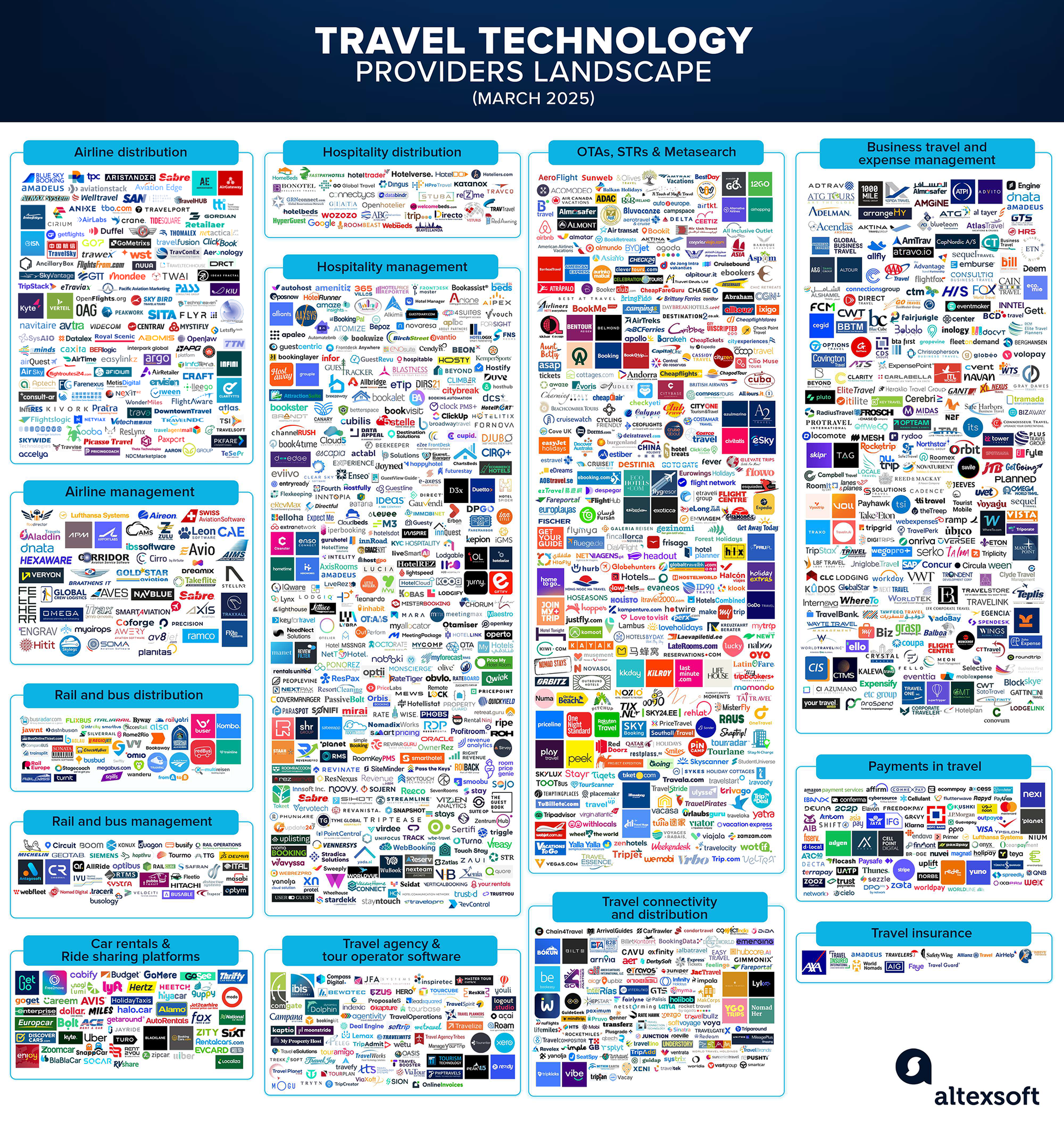

So in 2018, we at AltexSoft decided that the travel tech sector deserved a similar map. The first version of the Travel Technology Providers Landscape consisted of 162 providers within ten travel tech product categories. Since then, we’ve received tons of feedback from readers and travel tech professionals about the companies we’ve missed, and justifiably so.

Today, in March 2025, we compiled the most recent version of the map containing over 1500 companies in 13 categories covering different areas of the travel technology landscape. It includes players in:

- Airline distribution

- Airline management

- Business travel and expense management

- Car rentals and ride sharing platforms

- Hospitality distribution

- Hospitality management

- OTAs, short-term rentals, and metasearch websites

- Payments in travel

- Rail and bus distribution

- Rail and bus management

- Travel agency and tour operator software

- Travel connectivity and distribution

- Travel insurance

Disclaimers:

- Please note that the providers have been assigned to specific categories, but they may belong to multiple categories, as their services can be represented in various ways.

- We tried our best to create a comprehensive industry landscape and are determined to update it continuously. So if you don’t see your travel business in the infographic, please let us know by emailing marketing@altexsoft.com, so we can include it in the next iteration.

How to use the infographic:

- Click on the image to open it in a new tab.

- Left-click on the Download Infographic button in the upper right corner to access the full version of the landscape.

- To explore the providers directly, you can use a spreadsheet right there where the companies are grouped by categories and alphabetically with links to their websites.

Travel Technology Providers Landscape 2025

You are also free to read our transcript, decoding the categories in more detail.

Transcript – What’s on the infographic?

Currently, we’ve identified 13 product categories in the travel technology landscape.

Airline distribution

The difference between this and the general travel distribution section is that it comprises providers that cover specific needs of the aviation market, including the following.

Global distribution systems (GDSs). GDSs are computerized networks that aggregate travel product inventory and enable reservations. Sabre, Amadeus, and Travelport are perpetual monoliths in the travel technology ecosystem. Although there are dozens of GDSs in the world, these three own over 90 percent of the market and keep expanding their distribution reach with a growing number of agreements with airlines and hotel room sellers.

Comparing main GDSs

Airline reservation systems. Like CRSs, airline reservation systems store information about a carrier’s inventory, fares, schedules, PNRs, e-tickets, etc. Many airlines use CRSs provided by a GDS (Amadeus Altea, Navitaire, SabreSonic), but there are popular independent providers, too, including SITA, Kiu, and more.

Airline schedules, pricing, and information providers. There are global connectivity solutions that provide technical or specific flight data. For example, Cirium and OAG provide flight scheduling information, ATPCO provides fares, and SITA is useful for airport, baggage, and boarding data.

Airline consolidators. Consolidators are aviation’s bedbanks, serving as middlemen of flight distribution. Providing bargain prices for resellers, they have been relevant for decades. Most of them, including Picasso, Centrav, GTT Global, and others, have been around since the 1980s, though the undisputed leader in North America is Mondee Group.

Airline management

Software for airlines includes a wide range of services from scheduling and load control to crew management and maintenance documentation. These products come both from big aviation companies, such as Airbus’ NAVBLUE and Lufthansa Systems, but also from specialized providers such as IBS Software, AMS, and Coforge.

Business travel and expense management

The world of business travel has undergone the greatest transformation since the pandemic. And our selection of players includes different categories of corporate travel providers:

- travel management companies (TMCs) such as CWT, BCD Travel and AmexGBT;

- corporate travel booking platforms such as Egencia and SAP Concur;

- productivity software such as Tripgrid;

- expense management from Navan, Expensify, and Emburse.

Car rentals and ride sharing platforms

Car rental services offer customers the flexibility to rent vehicles for short or long-term use, providing convenience for travel and mobility. Ride sharing platforms, on the other hand, allow users to book rides through mobile apps, offering a more affordable and immediate transportation option without the need of owning a vehicle. Here we include a variety of tech products facilitating car rentals or signing up as a driver.

Hospitality distribution

This section outlines products that help deliver rooms to the end customer via the complex distribution flow, including the following.

Bed banks. Hotel wholesalers or bed banks buy rooms in bulk at discounted prices and resell them to OTAs, travel agents, and other distributors. The market is relatively small with a few leaders such as Hotelbeds, WebBeds, and HPro.Travel.

New direct distribution providers. Players such as Katanox, and HyperGuest provide a hospitality marketplace – a hub where hotels and distributors can meet and integrate directly, without intermediaries.

Data mapping tools. Hotel mapping is the process of merging property IDs from different sources into a single property record to avoid inconsistent naming and duplication in listings. Such providers as GIATA, crucial for adequate data exchange, fall into this category as well.

Hospitality management

Under the hospitality management umbrella, we’ve gathered providers of tools used by hoteliers, vacation rental managers, and short-term property owners to fulfill different functions for running a successful hospitality business.

Hotel PMSs. Property management systems (PMSs) are solutions that facilitate a property’s reservation and administrative tasks. They can include everything from front-desk operations, reservations and housekeeping to hotel CRM, reputation management, and so on. They include such providers as Mews, Hotelogix or Flexkeeping.

Hotel Property Management System (PMS): Functions, Modules & Integrations

Vacation rental software. A sibling to hotel PMSs, vacation rental software helps property owners, managers, and vacation rental companies to carry out administrative and reservation tasks. Examples of such software are Escapia, iGMS, and Hostaway.

Revenue management systems (RMSs). Revenue management is the practice of setting the optimal price for the product considering consumer demand and other factors. Here, we list both hotel RMSs (Fornova, Infor, Duetto) and vacation rental RMSs (DPGO, Wheelhouse, Beyond).

Revenue Management - the science of ultimate hotel success

Central reservation systems (CRSs). Operating at the heart of a hotel, a central reservation system hosts its availability, rates, and inventory data; used to manage bookings. Often integrated with a channel manager, a CRS can be included with a PMS (Yanolja) or purchased independently (Sabre SynXis, OTRAMS).

OTAs, short-term rentals, and metasearch websites

This massive category basically includes websites where you can search and book properties, both hotels and vacation rentals.

Online travel agencies (OTAs). OTAs shape the modern travel experience. There are so many online booking sites that they may deserve their own graph. These are classic hotel search OTAs such as Booking.com, Expedia, Trip.com, and Despegar. Many popular brands are owned by Booking Holdings and Expedia Group, but smaller, local OTAs like Yatra (India), eDreams (Spain and Europe), and Webjet (Australia and New Zealand) are just as influential in their respective markets.

Short-term rentals OTAs. There are many specific travel agencies for alternative accommodations including Airbnb, Vrbo, Hostelworld, and many more.

Metasearch websites. Metasearch engines like Kayak, Google Hotel Ads, and TripAdvisor aggregate tons of offers across the web for easy comparison.

Payments in travel

The travel payments industry involves the processing of financial transactions between travelers, travel agencies, airlines, hotels, and other service providers. It has evolved significantly with the rise of digital payments; And innovations such as contactless payments, currency conversion services, and blockchain technology are shaping the future of travel payments, making transactions faster, more secure, and globally accessible. Here we included providers of digital wallets, virtual credit cards, and other facilitators of B2C and B2B payments in travel.

How Flight Payments Work: IATA BSP, ARC, and Beyond

Rail and bus distribution

Rail and bus distribution providers play a crucial role in the modern transportation ecosystem, acting as vital connectors between travelers and service operators. These providers ensure seamless access to schedules, ticketing, and route information, enabling passengers to plan and book journeys efficiently.

In this section, we highlighted rail and bus booking websites like Trainline and Omio, as well as software providers that help rail and bus operators create their distribution network, such as Sqills and SilverRail, and other connectivity businesses, including AccesRail and Distribusion.

Rail and bus management

Companies providing software for rail and bus operations provide support for ground transportation providers in areas such as fleet maintenance, routing, planning and scheduling, and much more. Among those companies are RailCube, Busology, Tracsis, PUBBS, and many more.

Travel agency and tour operator software

In addition to hotel, rail, and airline management, we have travel agency management providers. These companies offer booking, payment, tour building, analytics, and more capabilities and include such companies as Rezdy, Hero, and Dolphin.

Travel connectivity and distribution

In this massive section we wanted to include industry players taking part in the distribution of travel products that haven’t been included in airline and hotel distribution segments. These are various software vendors providing travel API integration services, booking solutions, tour reservation systems, and more.

Travel insurance

Covid-19 brought home the benefits of travel insurance to travelers and the market has experienced a major upturn. Both travel-specific businesses and general insurance providers with APIs have been included on the map.

Emerging trends and predictions

This map allows us to follow the evolution of the travel tech world and here are a few important updates that we’re noticing today.

Generative AI. The advent of large language models like ChatGPTand Google’s Gemini is bringing massive opportunities to business efficiency and customer communication. APIs and widgets are available to everyone, and that paves the way for quicker adoption. This trend will only keep growing and become more normalized, so we’re bound to see many AI startups appearing in traveltech.

Traditional tours. Popularity of experiential, luxury, culinary, and other trendy types of tourism calls for more personal approaches to travel. People want to experience something few have tried before, which is where touring companies with local guides and travel assistants are needed once more. It’s likely that traditional travel agency technology will grow to meet the new demand.

Vacation rentals. Alternative accommodations, short-term rentals, and other types of non-hotel lodging are thriving and even traditional hotels are joining in. This is no longer a niche, but a separate sector in the travel world, so every type of software will soon exist to cover specific needs of vacation rentals.

Let us know in the comments what you think the current graph is lacking and what trends you can pinpoint from it. We’ll keep all suggestions in mind when working on the next iteration.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.