By the end of 2024, the Airline Reporting Corporation (ARC), the mastermind behind commercial transactions between US-based travel agencies and airlines, reported that 20 percent of air ticket sales were powered by New Distribution Capability or NDC. That’s double the amount from the previous year! While we’re still a long way from 100-percent adoption of NDC, its growth is certainly picking up speed, and putting some pressure on travel agents who are still sitting on the fence, either hesitant, unwilling, or just not ready to make the switch.

How NDC improves airline retailing

So what’s holding back flight resellers from jumping on the transformation bandwagon? If NDC is such a game-changer, why aren’t they all in? As many industry experts would say, “Great question!” Our team studied recent reports from key industry players and chatted with specialists representing corporate travel companies, travel tech providers, GDSs, and airlines. Here's what we discovered.

NDC obstacles overview

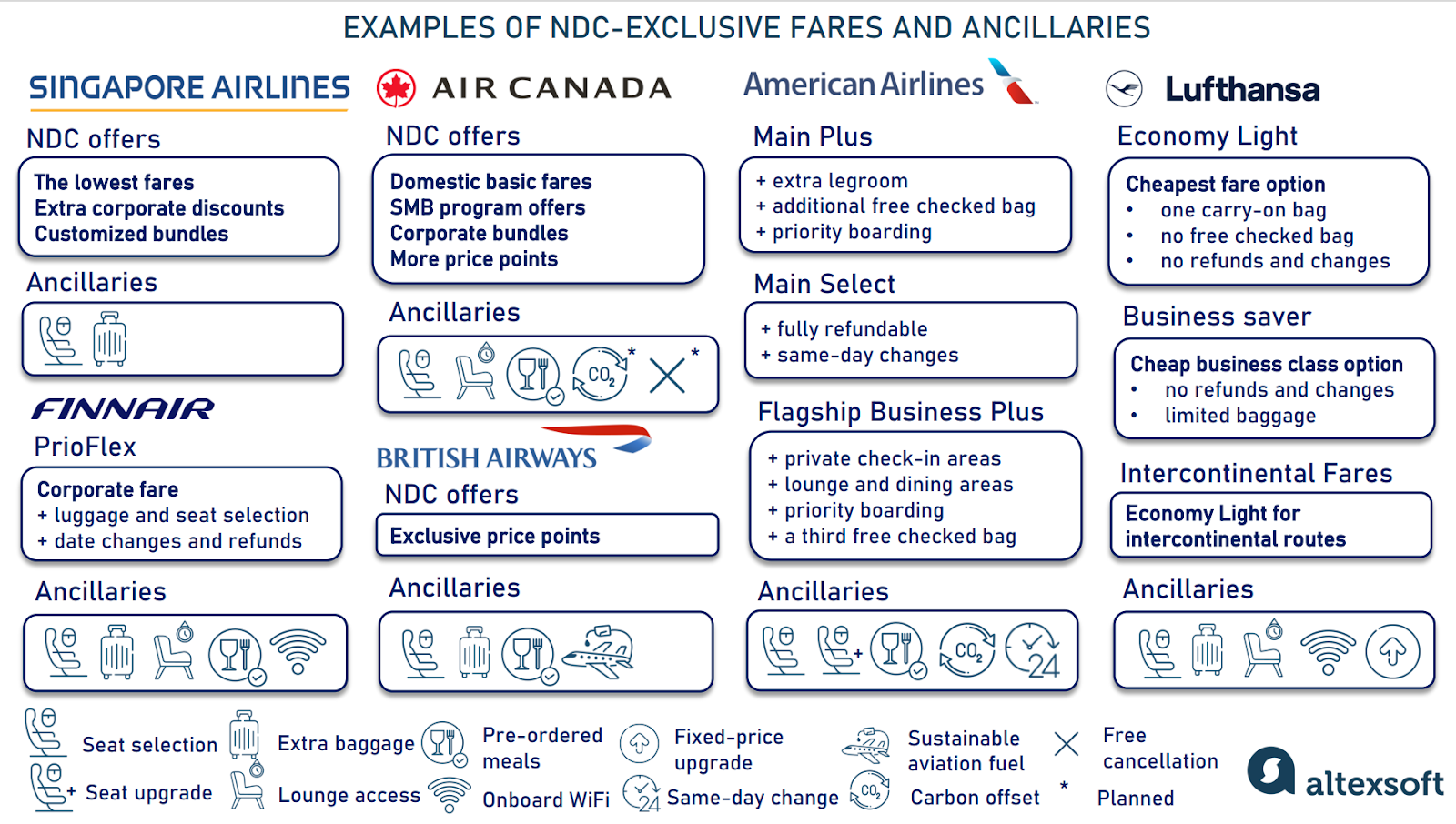

It’s hard to argue with facts and numbers, and they clearly support NDC. The NDC Savings Index by Navan, an all-in-one travel and expense management platform, reported potential cost-cutting from 3.3 to 16.6 percent, depending on the airline. These savings come from lower to no surcharges on the NDC content, plus access to exclusive NDC fares, and a variety of price points adjusted to the actual demand.

Examples of NDC offers

Among the main beneficiaries of NDCs are large tech-savvy online travel agencies (OTAs), which readily take advantage of the new framework. At the same time, traditional, offline-oriented travel management companies (TMCs) often resist change. Experts we spoke to point out several key obstacles slowing down NDC adoption in the corporate sector:

- EDIFACT mindset,

- GDS incentives,

- legacy infrastructure,

- NDC API inconsistencies,

- limited servicing capabilities,

- content fragmentation, and

- scalability issues.

There can be more aspects, but we only focus on the most common ones, starting with the psychological barrier of the EDIFACT mindset.

EDIFACT mindset

The NDC concept was conceived to replace the old EDIFACT-centered infrastructure, and has been around for over a decade. Yet, the old protocol still rules the industry — and people’s minds.

Loredana Cobzariu, Digital Product Owner of NDC Transformation at Scandinavian Airlines (SAS), explains it like this: “Many EDIFACT experts are hesitant to adopt NDC due to unfamiliarity with its processes, much like transitioning from rotary phones to smartphones. Airlines should support this shift by highlighting that while EDIFACT served its purpose well, NDC offers new opportunities for advancement.”

Even though NDC lets you do in one click what used to take five or six manual steps with EDIFACT, many agents stick to the old way. Why? Because they don’t fully understand what happens after that click. They’re used to building and controlling offers themselves, but with NDC, airlines take control. Agents worry they won’t be able to handle what the airlines send back — and those worries aren’t unfounded.

Because of this, there’s often tension inside companies. “Management wants to implement NDC, but agents resist because they don’t trust the new process and fear it might hurt the customer experience,” says Viktor Nekrylov, Co-Founder of DRCT, an IATA-certified tech provider and NDC aggregator.

One thing that frightens both management and agents is the loss of GDS incentives.

GDS incentives

With EDIFACT, airlines pay GDSs fees to distribute their tickets, and the GDSs share some of that money with travel agencies. “There are two key challenges that TMCs have had with NDC,” explains Sarosh Waghmar, a founder and chief product officer of Spotnana, a travel-as-a-service platform for corporations, TMCs, and other players. “The first is they are concerned that NDC is not mature, and that’s partly true. And the second is if content is consumed outside the GDS, a TMC loses its GDS payment.”

How GDSs work

You might think that losing the incentives is balanced out by cheaper NDC fares, which are not available via traditional GDS channels. That works well for OTAs who serve budget-focused leisure travelers. But business clients don’t mind paying more, so TMCs aren’t in a rush to switch and deal with all the hassle of changing systems just yet.

The good news is that airlines are starting to see how important it is to encourage NDC bookings. Viktor from DRCT admits, “Some airlines now offer bonus programs and flexible deals through their NDC channels. That’s a big step toward making NDC more popular.”

Legacy infrastructure

The technical challenges TMCs face when switching to NDC are pretty big. While OTAs were built on modern tech platforms, TMCs have to work with outdated systems, incorporating a mix of third-party technologies.

“NDC was not on the radar when these systems were built,” comments Nancy Delgado, Product Marketing Director at Accelya Group, who focuses on accelerating NDC adoption among travel sellers. “They weren’t designed to handle rich content, continuous pricing, personalization, and other things NDC brings to life.”

Take, for example, online booking tools (OBTs), which have been around for decades. Built for text-based fares, they struggle to display high-quality images of lounges and meals or compile and compare bundles. Neither do they properly support NDC bookings. According to a survey by the Global Business Travel Association (GBTA), only 13 percent of travel managers based in the US and Canada say their OBTs allow them to self-service NDC changes.

But cryptic user interfaces are only the tip of the iceberg. “Because of the EDIFACT-based infrastructure, TMCs can’t easily ingest content from direct NDC integrations with, say, 15 different airlines,” Sarosh from Spotnana explains. “TMCs also find it difficult to manage reporting and track any payments that are due. Travelers may be happy with a cheaper fare, but if, as a company, you can’t collect money, you’re out of business.”

Martijn van der Voort, director at travel technology and strategy consultancy AstraNomad, sums it up: “Integrating NDC APIs with legacy systems, not designed for NDC, requires significant technical efforts and investments.” He previously worked for 16 years at CWT, one of the largest TMCs.

Business travel and corporate travel management explained

Platforms like Spotnana make the transition easier and cheaper by replacing “thirty tools with one horizontal tech stack directly integrated with a wide range of content sources, including GDSs and airline NDC APIs.” However, Sarosh admits that even though they address many implementation challenges, “We’re still dependent on APIs exposed to us,” and NDC APIs are notoriously inconsistent.

NDC API inconsistency

NDC is often called a standard, but that’s not exactly true. Right now, eleven “standard versions” of the NDC API coexist. Some early adopters still use pre-COVID 17.2 schema while newcomers use the latest 24.3 release.

But the schema variety is just part of the problem. Another big challenge is a diversity of implementations — even within one version. Each airline takes its individual approach to adopting NDC, progresses at its own speed, and decides for itself what functionality to launch first. Some carriers build their own NDC APIs. Others reach out to a third-party tech provider like Accelya, which actually powers more than 50 percent of the world's NDC transactions, Datalex driving NDC for Aer Lingus, or TPConnects rolling out NDC for Egypt Air and Air Cairo.

So, even if two airlines use the same NDC version, their setups can be very different.

It's a schema, but there are no guidelines everyone must follow, and, as a result, each TMC must adopt something different for each carrier. After we built a few direct integrations, we decided we had to develop a comprehensive NDC integration framework to account for these differences.

Loredana noted that agencies sometimes encounter difficulties with one airline’s NDC API, which can make them cautious about adopting NDC with other airlines. “This highlights the need for clear and open communication about the capabilities and limitations in each case.”

For TMCs, knowing “what is possible” matters most. Even when they get the best price, they risk losing customers if they can’t handle the booking properly. “At the end of the day, they make money by servicing bookings,” Martijn van der Voort says.

Lack of servicing capabilities

In the EDIFACT world, most servicing is done manually, with hundreds of call center staff, which makes up a big part of traditional TMCs’ costs. NDC promised to automate the whole flight booking process and cut these expenses a lot — but that promise hasn’t been fully delivered yet.

How a traditional flight booking process unfolds

A recent study by Atmosphere Research Group and Accelya shows that though 72 percent of airlines say modern retailing is important or very important, only 27 percent (or fewer than 1 in 3) have significantly advanced in their offer and order transformation.

Sarosh points out that “some airlines lack the resources to invest heavily in NDC.” The pioneers that started over a decade ago “were very focused on leisure travel” and didn’t initially provide sufficient post-booking support, which is critical for TMCs. Out of 77 retailing capabilities available in the NDC schema, most airlines have only rolled out the basics — searching and shopping for flights and ancillaries, creating orders, and collecting payments.

How flight payments work

After the ticket is paid for, agents often have to do extra work, especially in corporate travel. “Flight changes, cancellations, and refunds often end up being manual or error-prone processes. Travelers usually don’t notice this because the TMC handles all the servicing,” admits Martijn van der Voort.

Sometimes, the only option to fix an issue is to contact the airline. But many carriers don’t even have proper systems to track and manage problems. “They don’t even use tools like Jira,” Mohandas P. Unni, CEO at NuFlights, a Qatar-based NDC aggregator, admits. “It’s all done through email.”

While airlines are starting to realize the problem and invest more heavily in technologies, misalignments between NDC rollout and platform readiness can still create headaches for TMCs and their customers. Martijn gave an example of an airline that began to offer NDC content several weeks before launching an agent platform, leaving a brief gap during which those bookings couldn’t be properly serviced.

Besides servicing issues, the variety of implementations and approaches leads to another big challenge — content fragmentation.

Content fragmentation

Sometimes TMCs maintain native connections with a carrier’s API, whether it’s the carrier’s own system or a third-party one. But usually, travel agencies get airline content through middlemen like GDSs, aggregators, or air consolidators, which, in turn, could link to airlines directly or through other intermediaries.

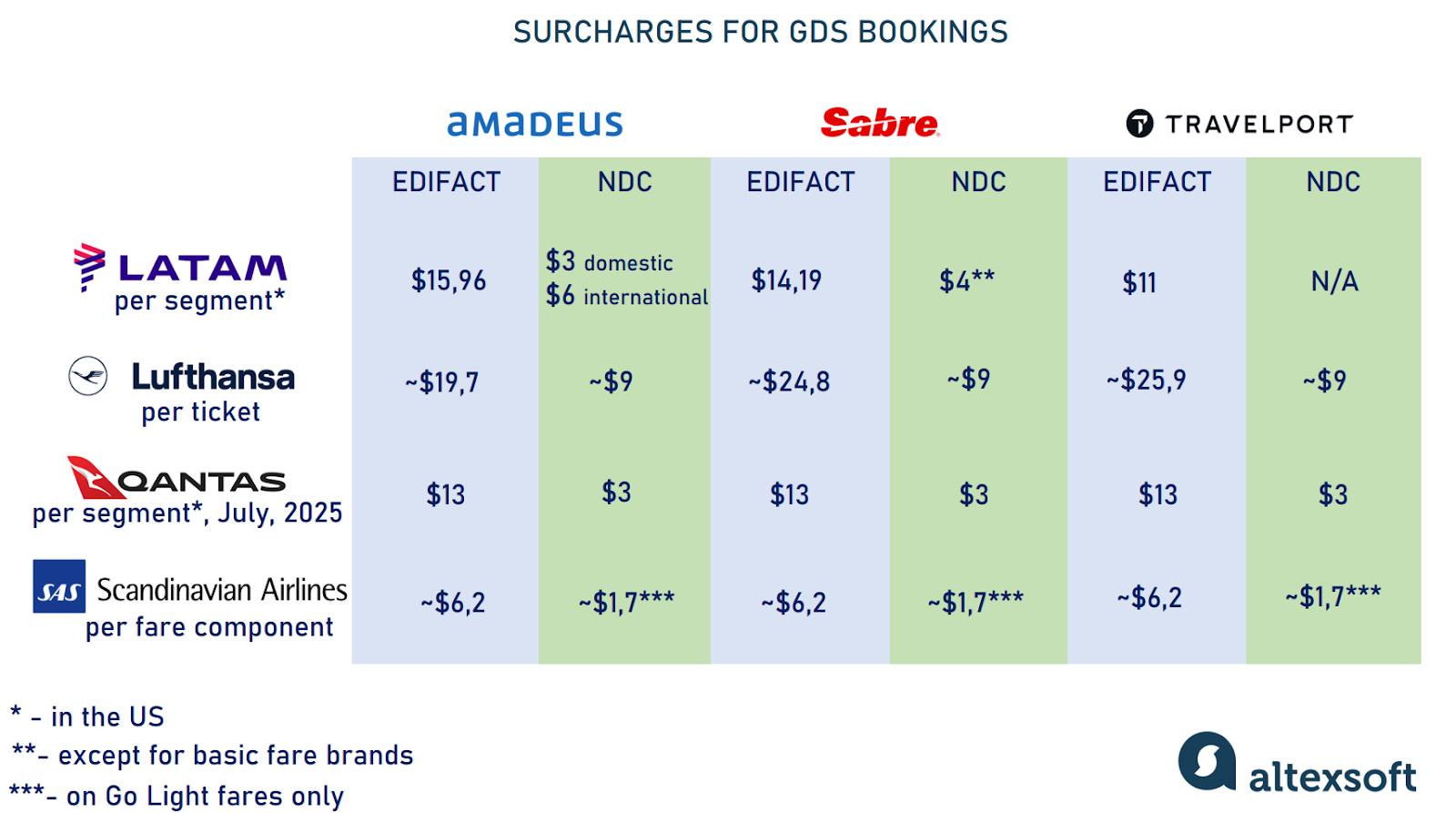

While content sourced from the supplier is typically the same as on the airline’s website, middlemen can have certain content restrictions or extra fees. For example, some airlines still impose surcharges on NDC content distributed via GDSs, though these fees are lower than for the EDIFACT tickets.

Surcharges on EDIFACT and NDC bookings for GDSs

“If someone tells you they’ve connected to NDC for a specific carrier, ask: Is it a direct connection or through an aggregator?” Sarosh from Spotnana recommends. “Because airlines don’t necessarily show the same content or support the same servicing options across all NDC distribution channels. If you don’t check first, you might see a certain fare on a carrier’s website but not on your booking tool.”

So NDC content comes in many different flavors. A schema version, the level of an airline's merchandising maturity, tech providers in between, restrictions, and special terms for certain middlemen… See how many factors impact the output? No wonder people often call the current state of things NDC chaos!

There can be a direct connection, a GDS in the middle, or another tool that is not NDC-ready yet... This makes it very difficult for TMCs to provide truly comprehensive options.

Connectivity through several NDC channels also contributes to the overall confusion. For example, a TMC can leverage NDC connections with a GDS, a couple of aggregators, and directly via an airline portal. This means jumping between different booking interfaces, and sometimes NDC tickets can only be serviced through the airline’s own portal.

Besides, since the industry is still far from a 100-percent transition to the new standard, TMCs still have to manage both GDS and NDC content, each time choosing between similar fares coming from different channels, weighing incentives versus better deals. “Imagine this occurs multiple times a day, on different routes, across airlines,” Sarosh summarizes.

Scalability issues

Scalability is another big challenge for TMCs trying to modernize. Some airlines can’t handle the growing number of adopters, which means agencies sometimes wait months just to connect to NDC APIs. Even after connecting, airlines still struggle with NDC-related problems that affect travel agencies.

An example illustrating scalability issues is polling or real-time availability checks. With so many people booking travel online, these requests have exploded, resulting in two major issues. The first is polling message cost: Carriers who pay for API calls to their passenger service systems (PSSs) see an increase in expenditures. The second is that an API’s transaction volume becomes too high. This slows down the system and makes response times longer.

“GDSs have built availability caches to store polling responses and reuse them, which helps protect airlines’ inventory systems,” explains Hyowon Kim, a travel tech expert and enthusiast who’s worked for Korean Air, Amadeus, and Sabre. “But in the NDC world, it’s no longer the GDSs sending polling requests to the airlines; it’s NDC IT providers. It’s still unclear to all parties involved who should be responsible for storing what. That’s why some airlines suddenly get huge polling bills from their passenger service systems.”

To address this challenge, some carriers closely track a look-to-book (L2B) ratio that compares search requests to actual reservations. This way, they pinpoint so-called unproductive agencies and may even limit those agencies’ access to NDC.

“We work closely with airlines to spot system misuse,” according to Nancy Delgado, who describes how they approach the problem in Accelya. “We teach agencies not to query airlines if they don’t fly to a certain destination. We also try not to send back hundreds of results, only what the airline thinks is relevant.”

Even with a good L2B ratio, agencies shouldn’t expect tremendous sales growth right now. Mohandas of NuFlights warns, “If you want to sell tons of tickets, like 100,000 a month, you won’t be able to serve your clients properly at this stage. NDC products aren’t ready for that yet.”

Moving towards NDC

There’s no one-size-fits-all fix for this kind of complex project. Every TMC needs to find its own way while moving gradually away from old systems.

Long-term modernization strategy. Experts agree it’s smarter to build a long-term strategy and switch to a modern, unified tech system you can control, instead of juggling lots of vendors and patching up old systems. “To survive for the next 10, 15, or 20 years, as airlines continue to make changes, TMCs must take stock of their business and define what technology to invest in so that they can not only reduce their costs but be relevant in times to come,” Sarosh of Spotnana says.

Martijn van der Voort observes that incumbent TMCs still haven’t figured out how all the pieces fit together—or recognized that their current models won’t endure. “In some five to ten years, with AI agents, the landscape will be transformed,” he predicts. “Those scaled to win will operate through an AI core orchestration engine, a brain, so to speak. The TMCs that adapt first will dominate, because it won’t matter in the future if it’s GDS, aggregator, direct-channel NDC, or any other content source.”

Step-by-step approach. Since TMCs have big, complex systems, they can’t change everything overnight. It’s better to break the project into smaller, manageable steps. “This could mean going airline by airline, or market by market,” Nancy of Accelya Group explains. “Some TMCs start with simple bookings for one passenger on domestic flights.”

Change management and continuous learning. Educating travel agents is crucial for NDC to succeed, and airlines should take a more active role in this. “They could do better on training to make the transition for TMCs a bit more measured and confident,” Martijn suggests. “And that is not just on a commercial level, but also on a technical level with what airline APIs can do.”

Some airlines are already doing well here. Nancy gives Lufthansa Group as an example: “They don’t just train agencies once and send them off. They have ongoing learning programs so agents can keep improving their NDC knowledge. Not every airline puts in this effort, but if we want NDC to work, the whole industry needs to collaborate.”

Accelya reminds everyone not to call these “problems” but challenges to solve. In upcoming articles, we’ll explore NDC challenges from the airlines’ perspectives and examine what’s being done to train agents. Stay tuned!

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.