If you sell air but don’t offer NDC content yet, you may lose out to competitors as more and more airlines offer better deals and a range of ancillaries through NDC channels. Get started by figuring out what NDC content provider suits you better.

We have scoured dozens of websites, studied official sources, and talked to insiders. Now, we present our guide to NDC systems for resellers, focusing on flight aggregators. You will learn how they differ, what capabilities and additional services they offer, how much they cost, and what else to pay attention to when choosing an aggregator to establish a partnership.

If you're looking for a detailed breakdown of what's available with these providers, check our datasheet on NDC aggregators.

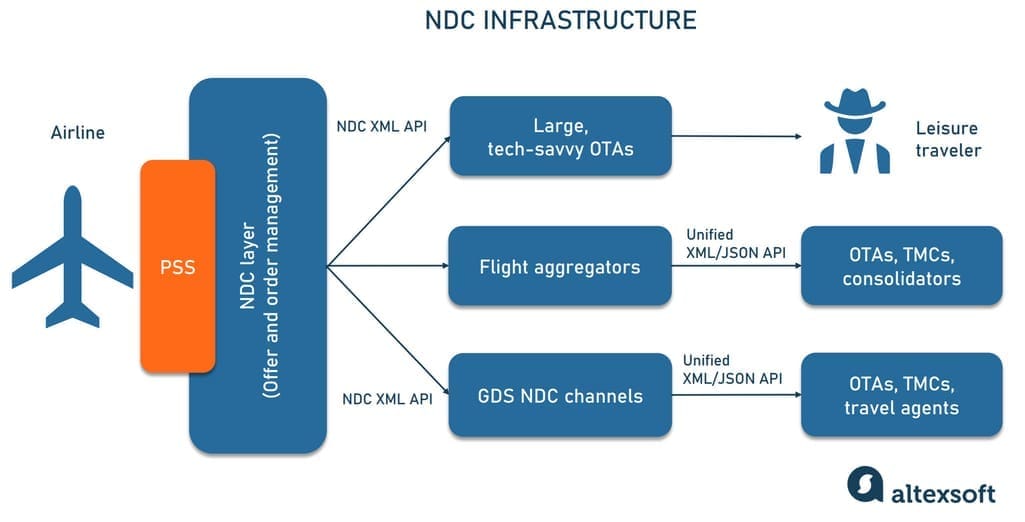

NDC infrastructure

NDC content sources

Resellers have two options to access NDC fares: directly from airlines or through content aggregators.

The first scenario lets you stay independent from third-party platforms, gives you more control over the booking process, and potentially ensures better deals since carriers tend to encourage direct purchases. At the same time, you will need to build and maintain integrations with multiple airlines, handling discrepancies across different NDC API schemas and workflows of individual carriers—a set of tasks feasible for large tech-savvy OTAs and TMCs only.

No wonder most resellers prefer to partner with content aggregators, who consolidate offerings from numerous suppliers, bring them into a standard view, and make them available via a single access point. Besides, middlemen typically take on the certification process with each airline separately to ensure that a particular direct connection works as expected.

Intermediaries providing access to NDC content fall into two large groups —global distribution systems (GDSs) and smaller flight aggregators.

GDSs as NDC providers

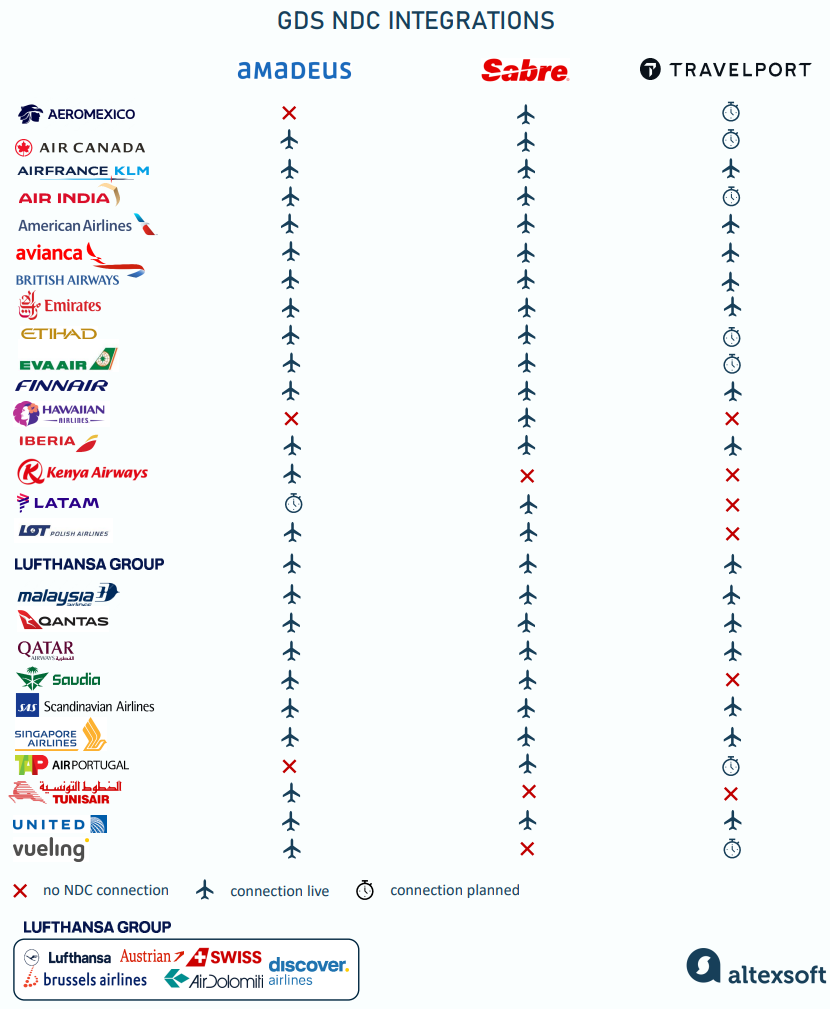

IATA's New Distribution Capability initiative aimed to replace GDSs in the flight distribution chain with leading content aggregators adapted to modern standards. Today, three companies running major GDSs—Sabre, Amadeus, and Travelport—are certified NDC content and functionality providers for resellers, each offering about 20 NDC integrations.

GDSs are a natural choice for larger resellers, especially in corporate travel. They provide many technical solutions, including mid- and back-office systems, crucial for travel management companies (TMCs). At the same time, the tech giants still lag behind many aggregators in terms of the number of live connections with NDC airlines.

NDC offerings from GDSs

Flight aggregators

Flight aggregators are relatively new players that already claim the role of GDS 2.0 in air distribution. They typically integrate with at least one global distribution system to access traditional (EDIFACT-based) air offers that still dominate the market. Yet, their main focus is placed on content sourced directly from suppliers. This is primarily NDC tickets and ancillaries, but also fares from non-NDC full-service airlines and low-cost carriers, which typically don’t publish their fares on GDS channels.

Though actual GDSs boast a wide range of tools and massive market coverage, aggregators have certain advantages for small or mid-sized travel companies.

Swift implementation. To start working with a GDS, an agency must meet strict parameters and enter into a multi-stage agreement. Business negotiations, API integration, and technical verification can take months. Meanwhile, with an aggregator, an agency will go live with NDC content much faster.

With our solution, travel sellers can be up and running in under 2 weeks

More flexibility. Aggregators are more responsive to the needs of individual customers. For example, the Iris platform by TPConnects “allows for easy agency hierarchy and permissions management, more flexible pricing engine rules, the ability to steer the distribution channel, and commission management, compared to traditional GDS channels,” says Namrata Balwani, chief marketing officer at TPConnects, a global travel content aggregation and distribution technology company.

Access to non-GDS content, including LCCs. “A key advantage of aggregators is the availability of content you can’t find in GDS,” emphasizes Viktor Nekrylov, managing partner and co-founder of DRCT, an IATA-certified tech provider and NDC aggregator.

No content restrictions. Aggregators provide the same products you can buy on airline websites, while GDSs may restrict NDC content depending on the region. “If a GDS has Lufthansa integrated, it does not mean it's available everywhere. This is based on the GDS's bilateral agreements with the airline. But we don't impose any restrictions. If the provider has the NDC program active in that given market, we also have it. If you can access your content via the Air France portal in your country, it will be available via us as well,” says Adam Mikolas, sales & marketing manager at AirGateway, one of the NDC content aggregators.

Cost efficiency and better NDC deals. “Using aggregators with direct NDC connections results in significantly reduced distribution costs,” Namrata from TPConnects explains. “Airlines maintain control over compensation models, whether directed toward agencies or aggregators.”

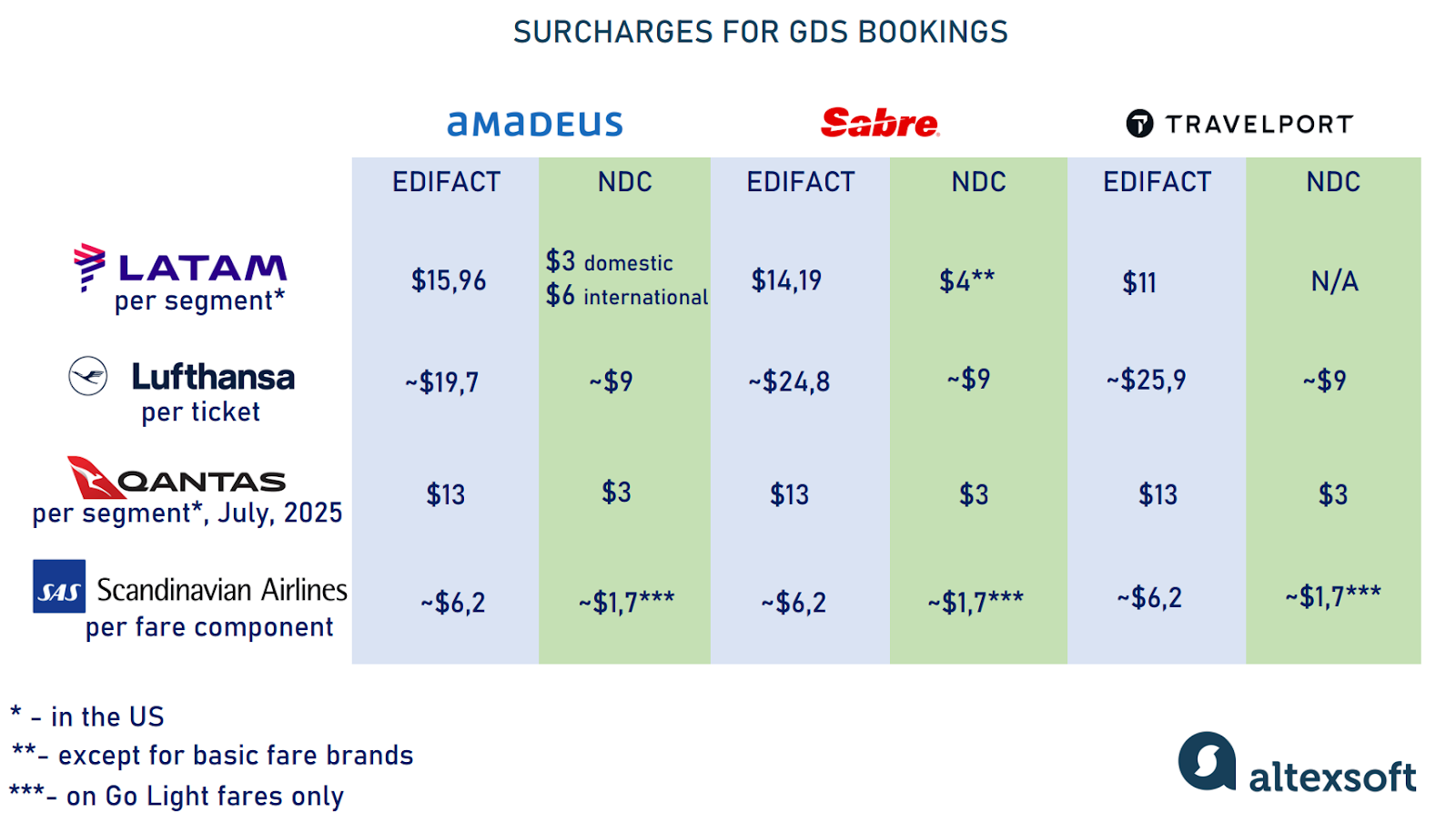

NDC offers from aggregators often cost less than those from GDSs. Why? As part of a broader strategy to encourage bookings through other channels, many full-service airlines impose surcharges not only on EDIFACT but also on NDC offers purchased with GDS. This policy typically doesn’t apply to non-GDS aggregators.

Surcharges on GDS bookings

In a competitive environment like selling flights, a price difference of a few dollars can alienate or, on the contrary, attract customers, which definitely plays into the hands of aggregators and their clients. The T2RL Travel Distribution Aggregator Market 2023 Report states, “The more airlines remove content from the GDS and implement surcharges, the more opportunity the aggregators have to drive value to their subscribers and users.” It also predicts that by 2027, the aggregator market will serve 17 times more passengers than in 2022.

How many non-GDS aggregators are there? IATA’s ARM (Airline Retailing Maturity) Index Registry– the main source of information about NDC maturity across industry players—lists 48 NDC system providers, including three GDSs. It’s worth noting that the IATA ARM registry is not mandatory for NDC players. Is it helpful, though? We addressed this question to Mohandas P. Unni, CEO at NuFlights, a Qatar-based aggregator.

“Having a trusted and well-maintained central registry is valuable,” answers Mohandas. “However, the IATA ARM registry must go beyond being a listing tool—it should ensure all entries are vetted for technical competency, capability, and trustworthiness. Regular re-evaluations and audits would add credibility and help the industry identify capable partners.”

In fact, many highly regarded aggregators, such as Aaron Group, AirGateway, Duffel, Lleego, WebSky, Wooba, and others, have yet to join the registry. For this reason, the total number of platforms providing this service can only be estimated as around 100–a pretty decent selection.

As the number of aggregators is growing rapidly, it is difficult to keep track of them, unlike GDSs, whose names are well-known throughout the travel market. So what should a travel agency focus on when choosing the right partner?

Choosing an aggregator: things to be considered

How do you decide which aggregator is the best fit for your business?

If I were in a travel agency, I would definitely ask for actual volumes of transactions. That's the final KPI that proves the platform is doing its job

However, since this data is normally kept hidden, here are other questions to ask when selecting an NDC IT partner for a travel agency.

Does the aggregator work with non-IATA agencies?

IATA accreditation is essential for selling air because it enables travel agencies to issue tickets on behalf of airlines and settle payments through the Billing and Settlement Plan (BSP). In the US, the Airline Reporting Corporation (ARC) handles IATA and BSP functions.

Suppose you are a small business and can’t afford costly accreditation. In that case, you must rely on a third party, such as a flight consolidator or host travel agency, to access airline inventory under the larger player’s credentials. Some NDC intermediaries (for instance, ClarityTTS, Duffel, and NUUA) work with both IATA and non-IATA agencies, which means they combine the functions of aggregators and consolidators. Some are planning to take this approach. “We are working on a model which will enable us to work for non-IATA agencies,” says Namrata from TPConnects. Still, most aggregators restrict their partnerships to IATA/ARC-accredited entities (keep in mind, though, that you don’t need IATA credentials to book LCC offers.)

Read our step-by-step guides on how to get an IATA accreditation and ARC accreditation options.

What content does the aggregator provide?

As mentioned, aggregators combine GDS, NDC, non-NDC, and LCC content into a single access point. Some, like the US-based Thomalex and San TSG, additionally offer charter flights.

It’s worth noting that some aggregators go beyond flights, offering a full range of travel services, including hotels, cruises, trains, and car rentals. Such platforms include Orchestra, Thomalex, WebSky Tech, Aeronology, and Wooba.

What is the NDC inventory coverage?

Check the platform's portfolio of partner airlines. Global aggregators like Aaron Group, TPConnects, AirGateway, Verteil, or Duffel have about 30 NDC connections; while Travelfusion lists more than 50 NDC suppliers—both full-service and low-cost carriers.

But the number itself is not the most crucial selection factor. If you work for specific markets, ensure your aggregator covers the target region. For example, Wooba specializes in the Latin American market; NUUA and LetsFly have massive reach in Asia Pacific, while NuFlights and Travvise maintain a strong presence in the Middle East and Africa.

What NDC functionality is supported?

Another crucial factor to consider is the NDC functionality a particular aggregator has and how much of the end-to-end booking flow is actually automated. Some points you may be interested in.

- Can you search for and book multi-city/open-jaw itineraries, or only point-to-point flights?

- Can you shop for additional ancillaries — like meals, lounge, or in-flight WiFi?

- Does the platform support payment methods other than BSP/ARC cash, such as credit cards, IATA EasyPay, or vouchers?

- Can you create a reservation first and pay for it later?

The capability to book a flight without instant payment is crucial for corporate travel. When buying business trips, you often need to discuss and validate details with authorities before paying, and in the meantime, the reservation can be canceled.

Also, ensure that the aggregator has automated everything that happens after the flight is booked and paid for: changes to an order, shopping, cancellations, refunds, etc. In the EDIFACT ecosystem, all the post-booking servicing is heavily manual, but shifting to NDC can change this.

“Currently, EDIFACT distribution produces a huge amount of operational efforts and risks both for the seller and the airline that NDC is aimed at replacing with full automation and risk-free fare calculations, which will simplify how these actors interact today. Avoiding fare calculation mistakes will help to enable travel consultants using modern and accessible work tools,” explains Jorge Díaz.

Of course, the level of automation depends not only on the aggregator but also on an individual airline, since the corresponding functionality must be set up and activated on the supplier’s side as well. So far, many airlines that joined the NDC initiative have only implemented the basic stages of the booking process, such as flight and ancillary shopping, order creation, and payment. In contrast, the post-servicing stage leaves much to be desired.

Check our datasheet with NDC airlines and their verified capabilities to know what carriers can do in terms of modern retailing.

It’s worth noting that some aggregators handle post-booking changes via their customer support as an additional service. Examples are DRCT and EasyLinkz.

No NDC airline and no aggregator covers all the abilities GDSs provide, but the aggregator must support the maximum number of available operations, even if the functionality is partially limited on the airline’s side. It’s important to choose a partner who works in the same market and can help you out 24/7.

Others, like NuFlights, don’t onboard airlines unless they meet a minimum set of capabilities. “We conduct technical evaluations to ensure the post-booking processes are functional and automate whatever we can through API transformation and orchestration. This gives agents a consistent experience, even when underlying airline systems vary in maturity,” says Mohandas P. Unni.

How can you discover what capabilities a particular aggregator supports?

Many intermediaries present brilliant visualizations of what can and can’t be done in terms of NDC bookings, airline by airline, on their websites. Some of the best examples are Iris Supplier Capabilities (the above-mentioned platform by TPConnects), AirGateaway list of providers, and EasyLinkz suppliers list.

You can also look through the list of system providers for resellers on the ARM Index Registry. But remember that by far, not all aggregators bother verifying NDC functionality with IATA, and those who do not necessarily keep the information updated.

Another option is to check with the airline whose flights you plan to sell. Often, carriers provide a list of their partner aggregators (both present and not present in the ARM Index registry) along with detailed information on implemented NDC capabilities and API schema. For instance, Lufthansa Group, British Airways, LATAM, and Air France-KLM have complete datasheets on available functionality depending on the aggregator.

What interfaces are provided?

Aggregators can offer access to NDC content via a unified API, a booking interface, or both. Let’s explore each option in more detail.

API. Almost every aggregator provides a single API that grants access to NDC content from various airlines, along with content from LCCs and GDSs. Such unified APIs include Symphony API by Aaron Group, Iris API by TPConnects, Travellink API by Wooba, and more.

When considering an API integration, pay attention to API documentation. Some aggregators give public access to guidelines for implementing and using the system. AirGateway, ClarityTTS, DRCT, Duffel, and Wooba are examples of openness and comprehensiveness. Some companies also provide a sandbox for testing.

Booking UI. For offline agencies and trip advisors, most aggregators offer a B2B interface (agent desktop) enabling access to all types of airline content and compare fares for the same flight in GDS and NDC channels in a single view. Among these products are Booking Pad by AirGateway, Aeronology Direct Connect platform, Iris Portal by TPConnects, Verteil Direct Connect (VDC), etc.

Aggregators can also have other specialized products preconnected with NDC content, such as corporate self-booking tools (like Symphony Corporate from Aaron Group) and white-label solutions for OTAs. The latter means you don’t need to build your own website: The provider equips you with a ready-to-use platform that can be customized with your branding, logo, and design.

Other types of interfaces include customizable widgets that you can easily integrate into your website (like Link from Duffel) or extensions for GDS interfaces. For example, DRCT and EasyLinkz offer plugins that allow you to search for and book NDC flights without leaving the GDS environment.

How much does it cost?

Aggregators either provide a paid subscription or capitalize on the pay-as-you-go model, though these approaches are sometimes combined. Unfortunately, only a few players openly publish their prices.

For example, Duffel charges $3 plus 1 percent of total purchase value per confirmed order, $2 per paid ancillary, and $0.005 per search if you exceed a search-to-book ratio of 1500:1.

AirGateway leverages a subscription (around $108/month) but also charges fees per issued booking (around $1).

DRCT doesn’t sell a subscription: It collects a fixed service fee only if the reservation is ticketed. “Our service fee depends on the price difference between GDS and NDC fares of a particular airline, a specific market, and a customer type — OTA, TMC, consolidator, IATA, or non-IATA agent,” says Viktor Nekrylov.

And what about paying incentives for travel agents, which are common in the GDS-centered world? While aggregators don’t follow this practice, some airlines experiment with financial rewards for agencies shifting to NDC.

For example, Air Canada introduced an NDC coupon incentive for all bookings made directly with the airline or via certified technology partners, including ClarityTTS, Farenexus, and Travelfusion. The coupon's value depends on the region: 2 CAD in Canada, 2.50 euros in Europe, or $2 in the US and other countries.

American Airlines, in turn, rewards agencies that purchase some bundles with 10 percent commissions, no matter if the booking was made directly or through a middleman.

While a reseller usually pays an aggregator, not vice versa, some middlemen are considering perks for their partners. For instance, AirGateway is exploring ways to remove the transactional cost of NDC bookings for resellers via its platform.

Any additional services?

For some companies, consolidating NDC content is just part of the business, as they have a long history of creating tech travel products. These platforms can offer a number of valuable tools that are already integrated with their NDC solutions.

Mid- and back-office. As mentioned before, most established TMCs have their mid- and back-offices on GDSs, which is one reason why they remain loyal to GDS.

GDS systems have been around for decades, and agencies have built their business processes, people, and systems around them. As a result, migrating away from GDS is difficult unless there's a strong incentive or need. One of the challenges with NDC adoption has been its lack of back-office readiness, which GDSs handle well

That’s why some aggregators, like AirGateway, APG, NuFlights, NUUA, EasyLinkz, and others, provide mid- and back offices pre-integrated with their NDC APIs. Transferring from one tool to another is a massive headache anyway, but at least you will have something to move to.

If the aggregator doesn’t supply such products, ensure its compatibility with your existing mid- and back-office infrastructure.

Payment and fraud detection solutions. Some platforms have additional B2C and B2B payment tools tailored to travel payments unique needs. Examples are

- Aeropay, an independent payment gateway by Aeronology, allows for the acceptance of different types of cards, transfers, and other methods preferred by a reseller;

- Pax2pay, a B2B tool from Paxport, supports the issuance of virtual cards, bank transfers, and invoice payments;

- Woopay by Wooba combines a proprietary B2B digital wallet and a range of pre-integrated payment methods (PayPal, local payment services, etc.); and

- Duffel Payments, integrated with Duffel Flight API, enables a reseller to mark up air products and accept payments even if working on an agency model. In this case, Duffel acts as a merchant of record and distributes funds between resellers and suppliers.

Watch our video to learn about agency and merchant models in more detail.

Agency vs merchant model: Two ways to handle payments in travel

Some platforms also take care of transaction security. For instance, the Risk Management System by ClarityTTS and the SafeGuard app by Wooba help merchants detect and eliminate payment fraud.

It’s worth noting that some aggregators also have solutions for airlines, like Astra platform by TPConnects.

Okay, we've made our choice. What are the next steps?

Let’s break down the preparations needed to start booking flights via an aggregator.

Contract negotiation. To book NDC content, you must have a commercial contract with every airline of your choice. Moreover, in most cases, you must request separate NDC credentials for each distribution channel/system provider, and it takes a carrier several days to issue them.

“While airlines typically require agencies to agree on each connection individually, the activation process can be much simpler in practice,” elaborates Mikolas from AirGateway. “Experience plays a great role in this process; the specifics vary by carrier, but once contractual alignment is confirmed, we can usually activate the content and fully onboard the agency within just a few days."

It’s worth noting that when booking NDC content through GDSs, the latter takes care of the formalities. However, some airlines may still require a direct agreement.

Agency desktop configuration. Once credentials are ready, an aggregator makes the required configurations in an agency desktop or other interface. After that, you can start selling almost immediately.

API integration and certification. If you opt for API integration, you need an engineering team to run the project. Before going live, the connection undergoes a certification process with an aggregator to ensure that the recommended workflow is followed and the integration is stable. After that, “The airline approves the connection by enabling access on their end (for example, by whitelisting the IATA),” according to Mikolas.

How long does the whole thing take? "This is a much faster onboarding process than traditional GDS integrations, in the range of days to weeks rather than months, enabling rapid time-to-market", says Namrata Balwani.

“This greatly depends on the experience of the agency's development team with NDC, with the size of the team also being a relevant factor. At AirGateway, we've had several successful integrations being certified and going live with multiple airline NDC connections after 1-2 months of development,” adds Mikolas.

For more details, consult the particular aggregator and take a test drive. Talking to the support team will give you a sense of how the aggregator handles concerns and resolves issues as they come up in your daily workflow.

Aggregators from the airline's perspective

So far, we have examined the aggregators’ potential value for travel buyers. But lastly, we suggest you look at things from the airline's angle and see how they select partner intermediaries.

We asked an expert, Loredana Cobzariu, digital product owner of NDC transformation at Scandinavian Airlines, who previously worked with Qatar Airways and Flyr, about the key criteria airlines consider when selecting an aggregator to partner with.

Connectivity and market reach. Airlines prioritize aggregators that can effectively cover key markets. “Carriers focus on ensuring NDC content reaches the regions that drive demand,” says Loredana Cobzariu.

Capabilities. Airlines evaluate aggregators based on their ability to support the full NDC booking process, from initial search to post-booking services.

It’s critical for airlines to partner with aggregators that enable seamless end-to-end servicing for travel agencies. NDC adoption helps airlines manage their offers and reduce distribution costs. The aggregator’s technical capabilities are key to ensuring a smooth experience for agencies, especially for post-booking management, which may otherwise require additional airline resources.

Performance metrics. Operational efficiency is another important factor. “Aggregators must maintain reasonable API transaction volumes to align with commercial agreements,” Cobzariu notes. “Airlines often monitor metrics like look-to-book ratios to assess the performance of aggregators and their associated agencies.”

Number of NDC distribution partners. Why do some airlines work with many aggregators while others partner with a few?

Again, the decision depends on the carrier's profile and market needs. Larger brands with extensive global networks, like Lufthansa, British Airways, or Qatar Airlines, benefit from partnering with numerous B2B resellers to reach diverse markets. Often, these carriers have extended teams working exclusively on NDC content integration and can afford to partner with dozens of intermediaries.

In contrast, regional airlines may find it more practical to maintain fewer partnerships focused on specific regions or strategic alliances like codesharing and interlining. Suppose you operate mainly in Europe. Then there's no point in spending money on integration with aggregators in Asia.

The same principle applies for travel agencies: There's no one-size-fits-all solution for choosing the right NDC aggregator—what works for a global airline won't necessarily work for a mid-sized regional agency. Instead of casting a wide net, it may be better to focus on aggregators that offer reliable technical capabilities, support the markets you serve, and align with your servicing model.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.