Before the invention of the combustion engine, overland freight transportation was by rail or horse-driven vehicles. The first truck was created at the end of the 19th century, but it wasn’t until World War I that people started using trucks extensively to transport cargo. Today, the trucking industry is a critical component of the US economy, moving almost three-quarters of American freight and employing millions of people.

In this article, we provide a comprehensive overview of the trucking sector, explore the interconnections between its key players, delve into technologies that support freight movement, and discuss the main industry trends and challenges.

General trucking industry overview

As a fast, efficient, and reliable means of transporting freight, trucking significantly impacts various industries and the overall economy.

Primarily, trucks haul loads from production facilities to distribution centers – and onward to stores or end consumers. So, sectors such as manufacturing, food products, retail, and eCommerce could barely exist without trucks moving raw materials, components, and finished goods. The construction industry also depends on trucks and specialized heavy machinery like concrete mixers to transport building materials.

To every community in the country, trucks deliver the most essential supplies, such as food, drugs, gas, and even cash to ATMs. The role trucking plays in the economy of the United States can’t be overstated, so let’s look at the key numbers that reflect its size and importance.

Trucking market scope

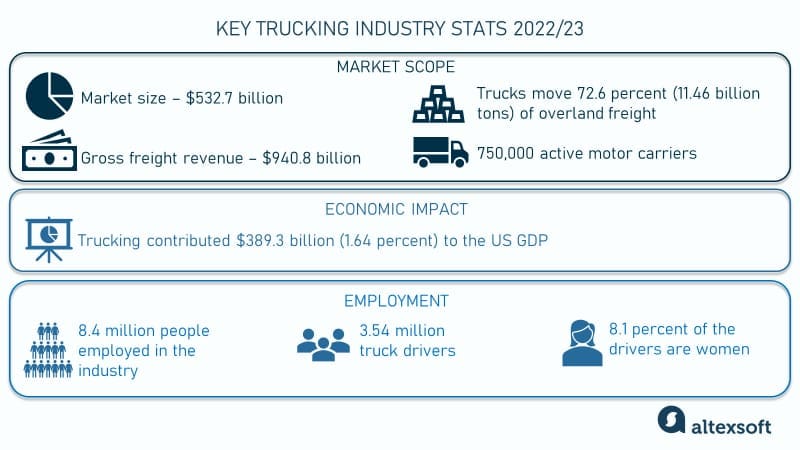

In our overview, we used the official statistics provided by American Trucking Associations (ATA), the Bureau of Transportation Statistics, and the latest Freight Trucking Report by Research and Markets. All the numbers are for 2022 unless stated otherwise.

Trucking industry statistics

Scope. The freight trucking market size in the US was estimated at $532.7 billion. The sector’s gross freight revenue was $940.8 billion.

Trucking was responsible for 72.6 percent (11.46 billion tons) of the nation’s overland freight movement.

As of April 2023, there were 750,000 active motor carriers that owned or leased at least one tractor in the US.

Economic impact. Trucking (for-hire and in-house) contributed $389.3 billion (1.64 percent) to the US GDP.

Employment. Approximately 8.4 million people were employed throughout the economy in jobs that relate to trucking activity, excluding the self-employed. Of them, 3.54 million are truck drivers. Women comprise 8.1 percent of the drivers.

Types of trucking operations

There are several approaches to segmenting the trucking market. The main ones are based on load size, cargo type, commodity, distance of operation, and truck type.

Load size. The three big sectors in the trucking industry are

- full truckload or FTL (a single shipment that occupies the entire space of a trailer),

- less than truckload or LTL (consolidated loads from several shippers), and

- courier (parcels or packages).

Cargo type. Trucks carry different types of freight that can be grouped into

- general (or break bulk) cargo – any freight that consists of individual items, packages, containers, etc.;

- bulk dry cargo – loose, unpackaged load of dry goods such as grain or coal; and

- bulk liquid cargo – loose, unpackaged liquid cargo such as oil or liquified gas.

Commodity. This segmentation approach considers what exactly trucks move. The main commodities hauled are

- dry goods (packaged foods, clothing, electronics);

- temperature-sensitive cargo (perishable foods, pharmaceuticals, chemicals);

- construction materials (lumber, cement, steel, roofing);

- oversized/heavy loads (construction machinery, industrial equipment, houses, boats);

- hazardous materials (flammable liquids, explosives, toxic chemicals);

- livestock (cattle, pigs, poultry); and

- automobiles.

Distance of operation. Depending on how long the route is, there is

- local trucking (mostly within a city),

- regional trucking (within one or several states), and

- long-haul trucking (cross-country).

Truck type. Different truck and trailer modifications exist to carry different cargo. In the US, the most common truck type is the semi-truck. It can pull different types of trailers, such as dry vans, reefers, flatbeds, step decks, and tankers.

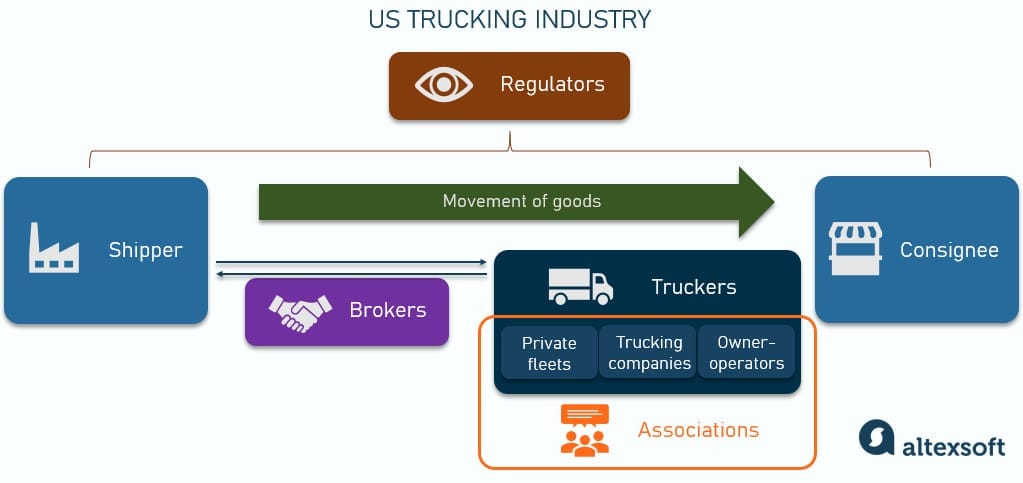

Key players

There are several key groups of stakeholders in the US trucking industry. Besides trucking companies that do the actual job of moving freight, there are also regulators that develop industry policies and ensure safety, trucking trade associations that serve as advocates and provide useful resources to their members, and brokerage firms that connect shippers and carriers. In the next sections, we explore each of these groups in more detail.

Key players in trucking

Regulators

Various federal and state agencies regulate trucking in the United States. These agencies work together to ensure the safe and efficient operation of the industry, with a focus on security, environmental regulations, and the overall transportation infrastructure. Here are the main ones:

- Department of Transportation (DOT),

- Federal Motor Carrier Safety Administration (FMCSA),

- State Departments of Transportation,

- State Motor Carrier Safety Assistance Programs (MCSAP),

- Environmental Protection Agency (EPA),

- Occupational Safety and Health Administration (OSHA),

- US Customs and Border Protection (CBP),

- National Highway Traffic Safety Administration (NHTSA), and more.

DOT and FMCSA are the key federal agencies playing crucial roles in regulating and overseeing transportation in the US, so let’s take a closer look at these structures.

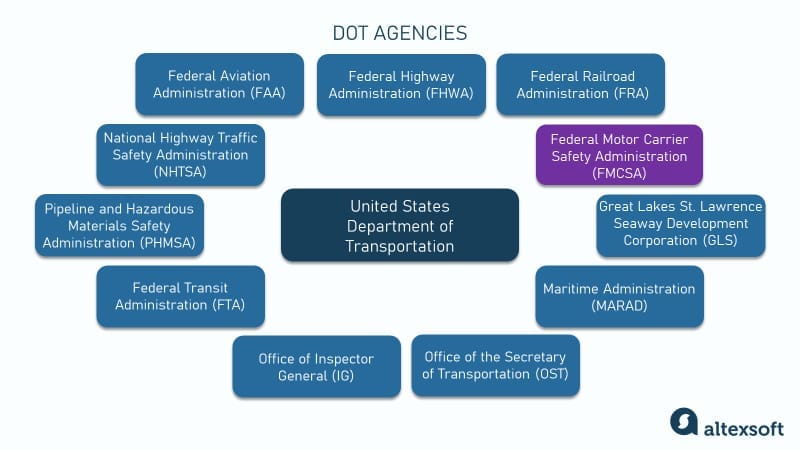

Department of Transportation (DOT)

The United States Department of Transportation (DOT), established in 1966, aims to ensure a fast, safe, efficient, accessible, and convenient transportation system. One of the executive departments of the federal government, the DOT develops and enforces policies that regulate all modes of transportation.

Its other functions are

- infrastructure development – it oversees federal funding for the construction and maintenance of highways, railroads, and airports;

- innovation and research – it promotes and funds research and development in transportation technologies and systems; and

- environmental stewardship – it addresses environmental issues related to transportation, including emission standards and noise pollution.

The DOT is a federal agency overseeing the entire spectrum of transportation modes in the US, so it has specialized subagencies, including the

- Federal Aviation Administration (FAA),

- Federal Highway Administration (FHWA),

- Federal Railroad Administration (FRA),

- Maritime Administration (MARAD),

- Federal Motor Carrier Safety Administration (FMCSA), etc.

DOT subagencies

The FMCSA is the one that looks after the trucking industry as it’s focused on the safety of commercial motor vehicles – aka trucks and buses.

Federal Motor Carrier Safety Administration (FMCSA)

The Federal Motor Carrier Safety Administration (FMCSA) was established in 2000 as part of the DOT. Its primary mission is to reduce crashes, injuries, and fatalities involving large trucks and buses. Its key functions include

- regulation of commercial motor vehicles – establishing standards for commercial motor vehicles and drivers to ensure safety;

- data collection and analysis – gathering and analyzing information on motor carrier safety and using it for policy making;

- education and awareness – providing training and educational resources to stakeholders about commercial vehicle safety; and

- safety enforcement – conducting inspections and audits to enforce regulations.

The FMCSA performs its functions through various programs and regulations. Here are some of them.

The Medical Program sets standards for medical examiners who certify the physical qualifications of commercial vehicle drivers.

Hours of Service (HOS) Rules are the regulations that limit the number of daily and weekly hours drivers work. Electronic logging devices (ELDs), now mandatory in every truck, help record driving time and comply with HOS rules.

Compliance, Safety, Accountability (CSA) is a program that holds motor carriers and drivers accountable for their role in safety.

The Commercial Driver’s License (CDL) Program establishes standards for testing and licensing commercial drivers.

The Innovative Technology Deployment (ITD) Program develops and deploys cutting-edge roadside and onboard technology to improve highway safety.

See Also

The FMCSA works under the umbrella of the DOT, focusing specifically on safety in motor carrier transportation. Both agencies collaborate on national transportation safety initiatives and policy development. Their roles are complementary, with the FMCSA implementing and enforcing safety regulations that align with the DOT's overarching transportation policies.

Truckers

Now, let’s talk about truckers. They are the ones who do all the hard work moving freight around the country and beyond, ensuring that goods are delivered safely and on time.

All truckers in the US can be divided into two big categories: in-house or private fleets and for-hire carriers.

In-house (private) fleets

The National Private Truck Council defines a private fleet as “an in-house truck fleet operation, often incorporated as a separate company, in service to a parent corporation whose primary business, such as manufacturing or retailing, is not trucking.”

According to the research on outsourced supply chains by Coyote and Check Market, 71 percent of shippers operate their fleets. At the same time, 75 percent of respondents outsource at least some of their supply chain operations (it can be delivery, warehousing, distribution, etc.), and 82 percent rely on external logistics providers to move at least some of their freight. In other words, many businesses needing to move their goods prefer a combined approach, using both in-house and third-party carriers.

The main reasons companies invest in private fleets are more reliable service, greater visibility and control over transportation, and cost-effectiveness.

Companies with the biggest private fleets in the US are Walmart, PepsiCo, US Foods, and Sysco.

A private fleet is not the same as a dedicated fleet. While private fleets are owned by the shipper, a dedicated fleet is operated by an external logistics company that provides dedicated services on a contractual basis. So let’s move on to the for-hire model.

For-hire carriers

For-hire carriers are companies that own or lease vehicles and provide cargo transportation services for a fee. Interestingly, the US trucking industry is very fragmented, meaning that there’s no leading carrier – or group of carriers – that controls the market. Such fragmentation developed mostly due to low entrance barriers that allow new companies to easily start the trucking business – and compete for their share of the market.

Depending on their size and operational model, carriers in the trucking market can be divided into two groups, i.e., trucking companies and owner-operators.

Trucking companies typically operate on a larger scale, owning multiple trucks (sometimes hundreds or even thousands) and employing numerous drivers. They often have a diverse fleet to handle different types of cargo.

Besides transportation, many trucking companies offer other logistics and supply chain management services, such as warehousing, distribution, order processing, freight forwarding, and so on. If they provide such services to other businesses, they are called third-party logistics – or 3PL companies.

Some of the major players in the market include FedEx Freight, J.B. Hunt, Schneider National, Knight-Swift Transportation, and XPO Logistics. Each of them has operated for decades, owns thousands of vehicles, and has billions of dollars of revenue.

However, as big as they are, the top ten FTL carriers only account for around 5 percent of total market revenue. All the rest are smaller companies and owner-operators.

An owner-operator is an individual running a smaller, more personal business, managing their own truck and operations. According to different sources, there are currently 350,000 to 800,000 owner-operators in the United States.

Owner-operators are self-employed, not employees of a larger company. This provides them more autonomy but also means they don’t receive employee benefits. They can also work as contractors for other carriers.

Since they manage their own routes and logistics, owner-operators often have more flexibility in choosing their loads and schedules. However, they are also responsible for all expenses related to their truck and operations, including purchase, maintenance, insurance, and fuel.

Freight brokers

Freight brokers are intermediaries between shippers and carriers who facilitate the transportation of goods. They negotiate rates, ensure stable communication, supervise delivery, settle financial transactions, and help with paperwork.

According to Gartner, 20 percent of all freight transportation in the US goes through brokers. Having extensive market expertise and established connections, brokers match shippers with the most suitable carriers to move their cargo efficiently and cost-effectively. That is why they are an indispensable part of the trucking industry.

The biggest brokerage companies in the US are C.H. Robinson, TQL (Total Quality Logistics), XPO Logistics, Coyote Logistics, and so on. Some focus solely on brokerage operations (like TQL), while others offer a wide range of logistics services (like C.H. Robinson).

American trucking associations: ATA, OOIDA, TCA, and others

Associations represent the trucking industry's interests and serve as advocates for trucking companies, drivers, and related businesses. These associations work on various issues, including safety, regulatory compliance, policy advocacy, and industry education.

American Trucking Associations (ATA), with over 37,000 members, is the largest industry trade association in the United States. It represents the interests of carriers, industry suppliers, allied companies, shippers, and individual professionals on a national level. ATA advocates for policies and regulations, provides educational resources, offers legal support, and so on.

Owner-Operator Independent Drivers Association (OOIDA) is a community of 150,000 owner-operators, small trucking businesses, and professional truck drivers. They defend trucker's rights in lawmaking bodies, offer insurance, and provide various resources and services to their members.

Truckload Carriers Association (TCA) unites over 220,000 truck operators, focusing solely on the truckload segment. TCA advocates on behalf of its members and is concerned primarily about safety issues and industry advancement.

Besides these largest ones, there are smaller associations that represent diverse interests and needs of different industry segments. For example, there is

- the Women In Trucking Association (WIT),

- the Minority Professional Trucker's Association (MPTA),

- the National Association of Small Trucking Companies (NASTC),

- the National Association of Independent Truckers (NAIT), and so on.

See Also

Digital technology in trucking

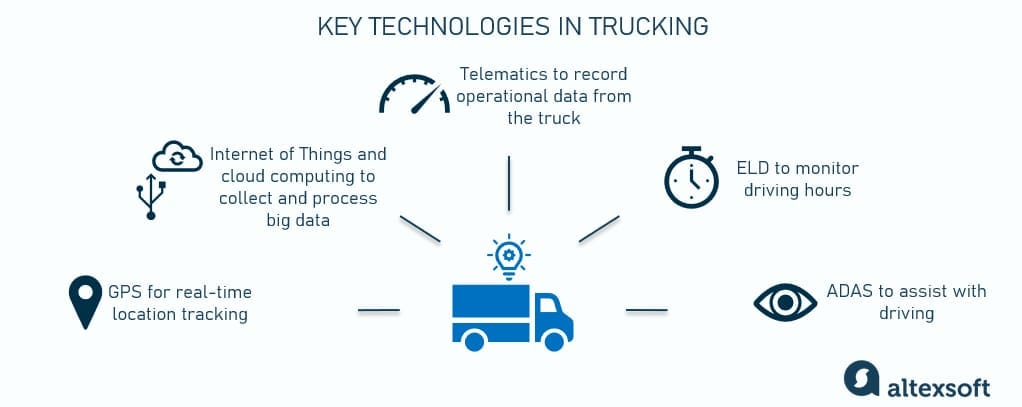

In the last decade, digital technologies have permeated the trucking industry to enhance efficiency, safety, and overall logistics management.

Technologies

Technology helps manage routes, monitor vehicle conditions, and even keep an eye on driver behavior. Here are the key innovations that have been transforming and digitizing trucking.

Technologies used in trucking

GPS tracking. GPS-based systems provide real-time data on vehicle locations, helping to optimize routes, predict delivery times, and ensure better visibility for all stakeholders.

Internet of Things (IoT) and cloud computing. IoT devices in trucks can monitor various aspects like cargo condition, vehicle health, and environmental parameters, providing insights for better fleet and cargo management.

Widespread IoT usage became possible due to advancements in cloud computing and big data analytics. Cloud-based solutions enable advanced data analytics, helping companies make informed decisions based on large datasets. Some of the areas of application are route optimization, demand forecasting, and increasing overall operational efficiency.

Telematics. Telematics technology collects and transmits data from the vehicle, such as speed, engine performance, and fuel usage. This information is used for preventive maintenance, improving driver behavior, and reducing operational costs.

Electronic Logging Devices (ELDs). ELDs record a driver's driving hours and duty status. This helps comply with the Hours of Service regulations mentioned above, ensuring drivers aren't overworked and reducing the risk of accidents due to fatigue.

Advanced driver assistance systems (ADAS). These IoT-based systems include features like lane departure warnings, collision avoidance systems, and adaptive cruise control, which enhance road safety by assisting drivers in navigating and responding to road conditions.

Trucking software

With each of these technologies in place, all the industry players benefit from using diverse software tools to streamline their operations. Here are the main solutions.

Fleet/transportation management systems help trucking companies and shippers with in-house fleets to plan and execute freight movement. These platforms help manage all business aspects, from shipment tracking to routing to fuel management to reporting.

Load boards and freight matching platforms connect shippers/brokers with carriers, improving the efficiency of finding and booking freight. They help carriers, especially smaller ones that don’t work on an ongoing contractual basis, to find loads and keep themselves busy. Meanwhile, shippers and brokers have access to huge carrier databases where they can compare rates and select reliable partners.

Load boards are also useful tools for market analytics and monitoring rate trends. The most popular trucking load boards are DAT, Truckstop.com, and Trucker Path Truckloads.

Digital freight matching platforms, in a nutshell, work as advanced load boards. Leveraging machine learning technology, they analyze all possible load-to-carrier combinations to come up with an optimal result. They provide tailored recommendations to shippers/brokers that source capacity or for carriers looking for the next loads.

Brokerage software helps freight brokers do their job of connecting shippers and carriers as they arrange loads, track freight, manage shipping documentation and payments, and so on. These tools are often integrated with load boards for easy load list posting. They also typically have customer and carrier portals to interact and exchange information with broker’s partners.

Specialized solutions improve operational efficiency and contribute to safer and more sustainable trucking practices. As the industry continues to evolve, we can expect even more innovative uses of digital technology in trucking. So let’s say a few words about what the future might hold.

Trucking industry trends

The trucking industry is a dynamic sector encompassing different trends that are shaping its future. Let’s first see what the main current trends are.

Fleet electrification. There's a growing shift towards electric vehicles (EVs) in the trucking industry, driven by environmental concerns and the push for sustainable transport solutions. Regulators also incentivize the shift to greener trucking.

Data shows that EV sales volume keeps growing fast. In Q3 2023, over 313,000 electric cars were sold in the US, which is almost 50 percent greater compared to last year. Electric trucks are just getting traction with such models as Freightliner's eCascadia, Volvo's VNR Electric, and Tesla's Semi.

Increased use of telematics and IoT. As we described earlier, technologies are being increasingly employed in trucking for multiple purposes, such as real-time tracking, optimizing routes, and improving overall fleet management. IoT sensors monitor vehicle health to enable cost-efficient predictive maintenance, while telematics makes compliance easier by storing records of drivers’ working hours.

Watch our explainer about how predictive maintenance works

Currently, IoT-based technologies are also used to develop fully autonomous trucks.

Autonomous trucking. Advancements in autonomous driving technology are poised to revolutionize the trucking industry. Companies are heavily investing in developing camera-equipped self-driving trucks to increase efficiency and reduce labor costs.

In 2021, TuSimple demonstrated the work of a fully autonomous semi-truck on open, public roads without a human on board. Other manufacturers like Waymo, Volvo, and Tesla also presented their driverless trucks. The transition will not be fast and easy as federal regulations must be developed and technology perfected to avoid accidents. However, autonomous equipment has already been implemented, for example, to streamline yard operations.

Some other trends worth mentioning are

- exploring blockchain technology for its potential to enhance supply chain visibility, security, and efficiency;

- growth of eCommerce sector that leads to increased demand for last-mile delivery freight services; and

- the focus on sustainability that puts emphasis on reducing the trucking industry's carbon footprint through alternative fuels, improved aerodynamics, and more efficient logistics management.

But just like any other industry, trucking faces multiple challenges on multiple fronts. So, to complete the picture, we must mention the industry problems as well.

Trucking industry challenges

There are many challenges that impact the trucking industry and restrain its development.

Driver shortage. The industry continues to face a significant shortage of qualified drivers, made worse by an aging workforce and the demanding nature of the job. ATA representatives estimate the shortage to be around 60,000 in 2023.

Maintenance and upkeep. Keeping a fleet of trucks well-maintained and up to date with the latest technology is a costly and challenging endeavor, especially given the parts shortage. Carriers have to find ways to procure equipment and parts and implement preventive/predictive maintenance practices.

Infrastructure challenges. Inadequate and aging transportation infrastructure leads to delays and increased vehicle maintenance costs.

Adapting to technological changes. Keeping pace with rapid technological advancements and integrating new technologies into existing systems can be demanding for trucking companies.

Other challenges that pose problems for market players (mainly truckers) are

- regulatory compliance,

- fuel cost volatility,

- adapting to technological changes and integrating new technologies,

- cybersecurity risks related to keeping data confidential, and

- market competition.

Navigating these trends and complications requires strategic planning, wise investment in new technologies, and a focus on sustainability and efficiency. The industry is at a critical juncture where embracing innovation and addressing workforce issues are key to its future success.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.