Uber connects drivers with people needing a ride, eBay connects those who sell stuff with those who want to buy it, Tinder connects… Well, you know. The list goes on, but the idea is the same – people need help when looking for the right match in various areas of life, personal and business.

Freight transportation is a large industry with some 3.5 million drivers moving annually almost 11 billion tons of stuff around – and that's in the US only. But for many of them, the hardest part isn’t driving – it’s finding the right load that matches both vehicle specifications and personal preferences. And for brokers, covering their load lists is definitely the greatest operational challenge.

So how can these tedious processes be facilitated and automated? In this post, we discuss load matching and take a peep under the hood of digital freight matching technologies to understand how it all works.

What is load matching?

Load matching or freight matching is connecting shippers (or anyone who needs to move cargo, e.g., freight brokers or 3PLs working on behalf of shippers) with available carriers that have capacity to carry the load. Within freight matching, several important criteria have to be considered:

- load requirements (weight, dimensions, temperature-sensitivity, fragility, loading type, etc.);

- equipment type and limitations;

- price; and

- pickup and drop off locations and time frames.

If all these aspects match – meaning that if the carrier has the right equipment, agrees to arrive at the pickup point at the required time, and consents to the price – the shipper/broker and carrier have a deal and the load gets covered. Well, in real life, it’s just as hard as it sounds.

Matching problems everywhere. Source: imgflip

When you as a broker have multiple loads to cover, manual capacity sourcing through phone calls or emails is not only inefficient, it's probably impossible. So digitization becomes unavoidable.

Load boards for freight matching

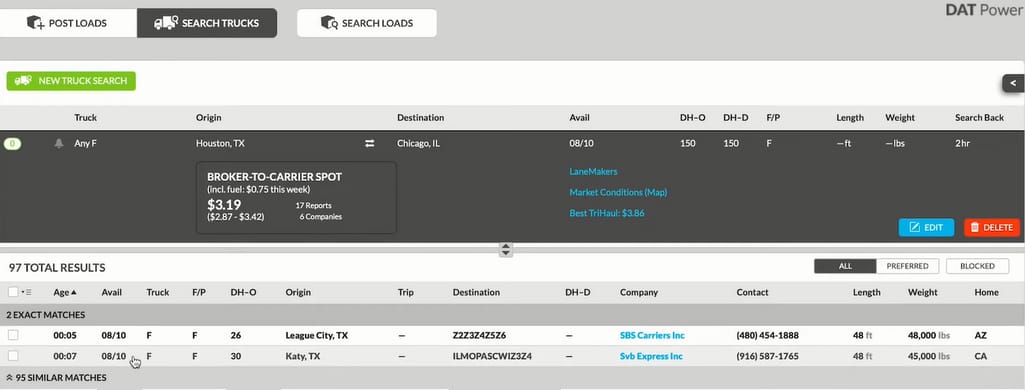

Load boards are the first step to increasing efficiency. Such online platforms as DAT or Truckstop.com take a lot of heat off both brokers and carriers, facilitating partner search and supporting other processes like vetting, negotiating the price, routing, etc.

Thanks to load boards, carriers get instant access to thousands of full truckload or less-than-truckload freight options that need to be moved, while brokers get a list of trucks of a certain type available in a certain area on a certain date (though, of course, posting loads is a much more common situation).

Truck search interface in DAT

However, there’s still a lot of human involvement when sourcing capacity through load boards, since in most cases you still have to talk to the carrier and go through all the details of the deal before you cover the load.

Also, if you don’t have an established integration with your TMS, you have to enter the load details yourself which is time-consuming and error-prone. On top of that, you have to take care about tracking, documentation exchange, payment, and a lot of other operational aspects – all that on each individual load.

Sounds a bit over the top, doesn’t it? But we all know that’s how freight transportation works... Or is there another way of doing things?

What is digital freight matching (DFM)?

Digital freight/load matching (DFM) means finding available carriers that best fit shipping requirements and – if set up – automatically booking capacity.

It works just like Uber that automatically finds and assigns you a driver from its database to take you where you need to go, although DFM systems analyze a lot more factors than just location and service class. But before we look closer at these factors and how they are matched, let’s clarify how DFM is different from traditional load boards.

Digital freight matching vs load boards

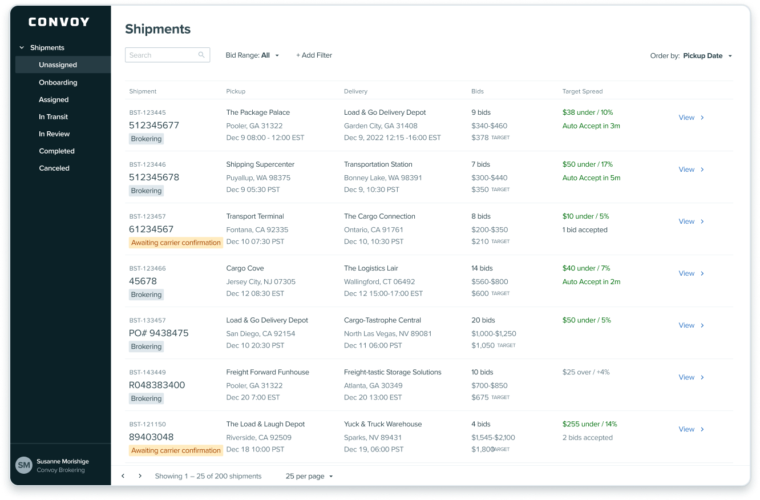

DFM platforms work similar to load boards in a sense that they have participating shippers/brokers on one side and carriers on the other, all of them trying to find the best deal. When sourcing capacity with DFM, brokers get a tailored list of recommended available drivers having suitable equipment and within sensible distance from the pickup point. As we said, depending on the platform settings, carriers can be either contacted or instantly booked.

Convoy’s Auto Accept functionality

Now the key words here are tailored and recommended, meaning that instead of getting flooded with options to sift through, you receive real, workable offers which is especially valuable in the dynamic spot freight market. For example, HTS Logistics, after working with a DFM platform, registered 38 percent of total carrier replies as viable options, which is 3 times better than other load matching tools.

The same works the other way around: Carriers see available loads that best fit their preferences and can either bid on them or secure the deal immediately with a single click.

So we can say that the main DFM difference is that such platforms, usually leveraging machine learning, instantaneously analyze all possible load-to-carrier combinations to come up with an optimal result. That streamlines capacity sourcing, reduces empty miles driven, and increases efficiency for both brokers and carriers.

Another valuable benefit of DFM is establishing meaningful, long-term relationships with carriers. Such platforms serve as a kind of CRM for trucking partners. That allows brokers to consistently cover loads on regular lanes and work with trusted carriers they already know.

In addition, DFM puts a stronger focus on digital, online interaction, minimizing the need for traditional phone calls, emails, printed paperwork exchange, and so on. The concept implies that all load booking processing (and related activities as well) can be made quickly and easily via a smartphone app, making it a one-stop-shop for both carriers and shippers/brokers.

So how does all this work in real life?

How digital freight matching works: a typical scenario for brokers

To give you a fuller picture, we outline a possible scenario of how a broker interacts with a DFM system (assuming that the TMS integration is established).

How DFM works for brokers

Upload the load list. You send your list of loads to cover to the DFM platform (usually in CSV format).

Rate loads. You set up the best rates for your loads using the spot market-based quoting functionality.

Get a list of matching carriers. You receive and review coverage offers from your in-network carriers. If set up, matching carriers get notifications of new loads in the area.

Make a deal. You either configure automatic matching or manually choose the optimal offer. The rate confirmation is automatically generated and sent to the carrier together with the detailed load information.

Track freight. You set up status change alerts and/or get real-time visibility into the driver location and ETA from pickup to delivery.

Get POD and invoice. You download a digital BOL and other documentation (if any) from the DFM platform as soon as the driver uploads it. The system also automatically generates carrier invoices and sends them to the broker.

Now that you have an idea of the process, let’s dig deeper into the technicalities and see what’s actually happening behind the curtain.

How DFM platforms function: key processes

Obviously, just like with any advanced software (well, that means a bit smarter than a calculator or an electronic alarm clock), under-the-hood processes are way more complex than they seem from the outside. We tried to decompose the DFM witchcraft into digestible steps. Please note that the order we list them in isn’t strict as many of these operations happen in parallel. So here it goes.

- Carrier onboarding (registration, vetting, connecting to the ELD/telematics for tracking, etc.) and creating a dynamically changing database.

- Building a load list with information either automatically pulled out of brokers’ TMSs or entered manually.

- Quoting loads according to current market conditions and broker preferences.

- Matching available load requirements against available capacity and building a list of relevant results for both sides.

- Accepting carrier bids and displaying offered rates to the broker (if set up).

- When the deal is made, updating the load and carrier availability, as well as sending all the deal details to both sides.

- Creating optimal routes for carriers.

- Tracking the load on the map, dynamically calculating ETA, and sending status updates to the broker.

- Storing load documentation.

- Creating carrier ratings according to reviews and metrics monitoring.

Phew, that’s a lot of operations happening inside DFM. To drill down even more, all of that is essentially based on constant data exchange. In other words, for DFM to work as it should, there must be a number of integrations established. Let’s look at the main DFM integrations and why they’re so important.

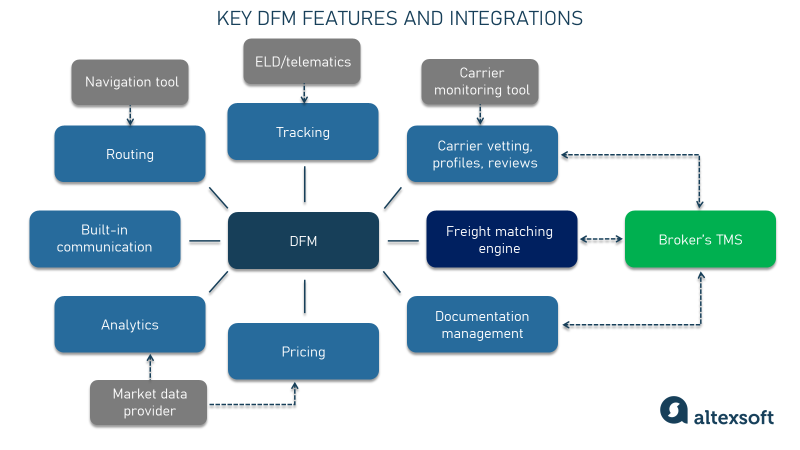

DFM essential integrations, data, and features

To build connections and ensure seamless data exchange, application programming interfaces or APIs are utilized. Here are the main systems and data providers DFM systems are connected to.

Main DFM features and integrations

A TMS to exchange load details and status updates

One of the main automation benefits of DFM platforms entails syncing with the broker’s TMS and pulling all the load details (weight, dimensions, commodity type, pickup/dropoff points, equipment type required, etc.) out of it.

These requirements are then compared against relevant parameters of available capacity that’s posted by carriers (equipment type and limitations, current or planned location, etc.). The DFM intelligent matching engine sifts through all the possible pairing options and comes up with the best fitting ones.

The machine learning component plays a key role here because, as users interact with the system, it studies their choices and learns to recommend to them the optimal ones considering their priorities, e.g., least deadhead, closest price match, etc. If you want to know how recommender systems work in more detail, check our dedicated overview.

As the load gets covered, the DFM solution sends this information back to the TMS, together with the carrier details and finalized rate. In addition, alerts about important status updates can be set up so that progress can be monitored via TMS.

Realizing the importance of this synchronization, many DFM platforms have a list of preintegrated TMS providers to facilitate the connection process.

ELD/telematics for tracking

Telematics or ELD-based tracking leverages GPS technology to send real-time location data to the DFM system. Most DFM platforms partner with multiple ELD/telematics providers like the popular Descartes MacroPoint so that they can easily connect new carriers and collect tracking data. As a result, all stakeholders can get the real-time information about the load location and the driver’s ETA right through the DFM solution.

Navigation tools for routing

Routing is one of the most important features for drivers since most commonly used navigation apps don’t work for trucks as they don’t account for related restrictions and limitations. So to provide the most accurate mileage calculations and itinerary planning, DFM systems often integrate with industry-specific navigation tools like PC*MILER.

Market data providers for pricing and analytics

Since DFM platforms offer spot market-based quoting, they must have the most current data. In addition to analyzing internal supply and demand (by monitoring the activity of their participants), DFM systems can integrate data feeds from external providers like SONAR or DAT IQ to get the fullest market information and reflect rate fluctuations.

Besides that, due to this connection, DFM users can get the latest market insights, benchmark their own performance, and support their internal analytics and decision-making processes with relevant data.

Carrier monitoring tools for vetting

Upon registration in a DFM tool, carriers are required to go through verification. Depending on the platform, it can include W9 and insurance certificate submission, license validation, vehicle check, and face scan for drivers, etc. To automate the vetting process, DFM systems can integrate with carrier monitoring tools and, for example, get company details right from the DOT FMCSA SAFER system.

As a result, brokers don’t waste time for additional vetting, know who their drivers are, and rest assured they're always working with a growing network of reliable carriers. For example, Zengistics, a full-service 3PL company, saw its carrier network expand 400 percent in just the first month of working with the C4 DFM platform. They’ve also witnessed a higher carrier quality compared to public load board options.

Additional integrations can be established with payment processing and factoring companies, fuel and maintenance businesses, and more.

More DFM features

Other important inbuilt features of DFM platforms include the following.

In-app communication. For the sake of convenience, DFM systems can include an built-in communication channel which enables the avoidance of emails, texts, phone calls, and other external contact methods.

Documentation management. As we gradually shift from relying on printed paperwork to digital documentation exchange, this feature allows carriers to easily upload BOLs and other shipping documents that brokers can retrieve at any time, serving as a safe storage and exchange platform for all load-related paperwork.

CRM. All the profiles are stored in the system, so that you can review your interaction history and all the carrier details at any time. You can also add carriers you trust to your own partner network, even if they are not registered with the DFM platform.

Review collection. Auto-vetting is great but you still want to know more about drivers you entrust valuable loads to. So DFM systems can allow for review collection as well as give access to important metrics like number of completed deliveries, percentage of delays, etc.

As a result of all this fancy automation, you get more loads covered with less time, less effort, and less paperwork. For example, Convoy digital network customers report that they manage to broker up to 30 loads a day – an amazing result in comparison with the industry average of 5-8 daily deals. So let’s look closer at how Convoy and other intelligent DFM platforms actually work.

Digital freight matching platforms

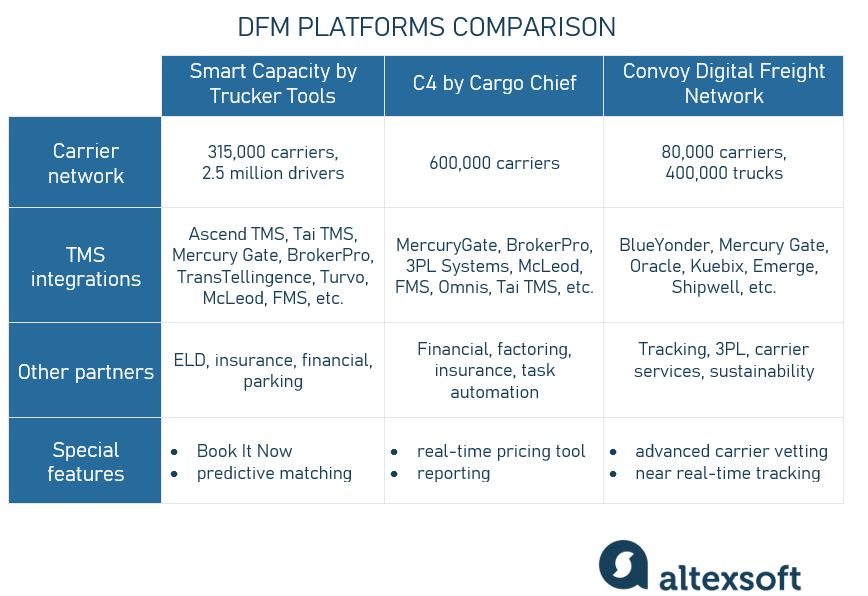

When comparing current DFM solutions, it’s important to consider their existing carrier network and smart features provided. Another crucial factor to look at is the list of preintegrated providers (like TMS, ELD, and other essential systems). We’ll provide a brief description on some of the big market players and compare their capabilities.

DFM platforms compared

Smart Capacity by Trucker Tools

Smart Capacity by Trucker Tools boasts a network of over 315k carriers and 2.5 million drivers who rely on their popular free mobile app for finding loads and getting important road information. When sourcing capacity, you can see matching carriers from both in and out of your authorized network. The platform makes real-time recommendations based on such factors as

- the carrier’s profile,

- equipment type,

- proximity to available loads,

- turn times, and

- lane and load preferences.

The Book It Now® feature allows drivers to book the load straight away if they’re okay with the price you offered. They can also make a counteroffer or contact you, all within the system. As you discuss the load with the carrier, the system automatically shows you available reloads (if any), so you can offer a backhaul.

Smart Capacity comes preconnected with over a dozen TMS providers, so that you can easily integrate it with your system and it will automatically pull load details right from your TMS. It also offers predictive matching which means you can see forecasted future capacity before carriers post their trucks.

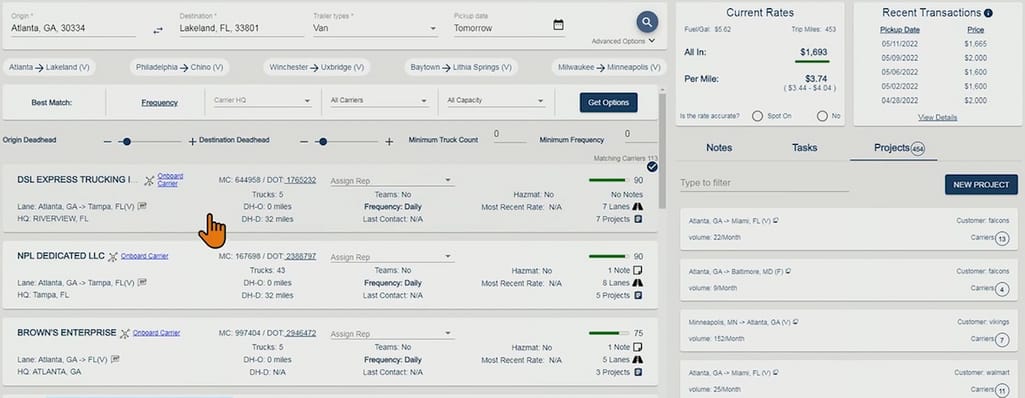

C4 by Cargo Chief

Cargo Chief’s C4 dynamic truckload procurement platform has a network of over 600k carriers. C4 includes a pricing tool based on current market conditions, automated carrier communication flows, convenient dashboards for actionable analytics, and more.

C4 interface

C4’s list of partners includes MercuryGate, 3PL Systems, McLeod Software, and other TMS providers.

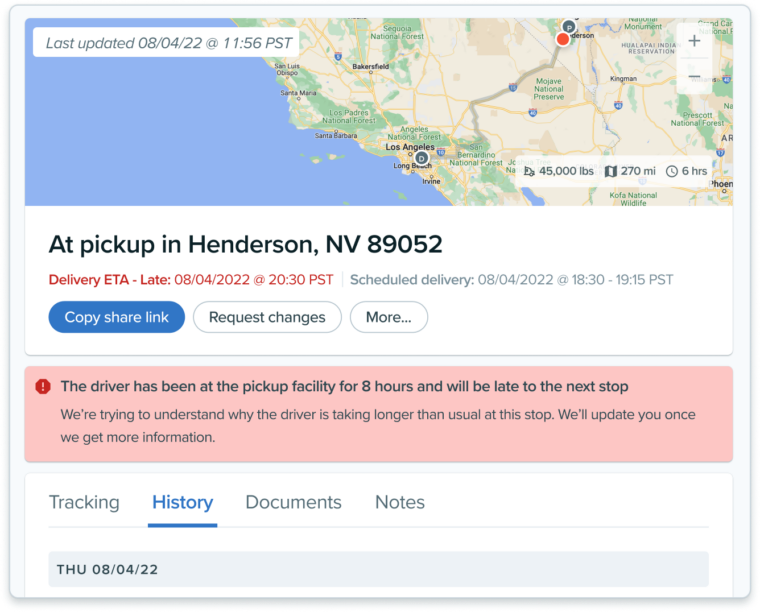

Convoy Digital Freight Network

Convoy Digital Freight Network includes 400k vetted trucks and 80k carriers. Founded in 2015, Convoy is one of the tech innovators in the trucking industry. It places its strongest focus on sustainability, carbon emissions reduction, and waste elimination. They also have high safety and quality standards that carriers have to comply with. As a result, the cargo claims/incident rate is 20 times lower than the industry average.

Convoy offers a pricing algorithm and real-time GPS tracking with 5-minute updates, predicted ETA, and shipment statuses you can monitor and share. Preintegrated tracking partners are Flexport platform, FourKites, Project44, and Macropoint. Other partners are TMS providers like BlueYonder and Mercury Gate, 3PL providers like DHL and Flexport, and more.

Convoy tracking

There’s also analytics and documentation management functionality.

Adopting digital freight matching: challenges and approach recommendations

Whether you like it or not, digitization penetrates all industries – trucking included – and is definitely here to stay. We used to rely on personal interaction, back and forth phone calls, lengthy rate negotiations, calling drivers every now and then to check on the delivery status, waiting on those BOLs…

But now we can witness the convenience, visibility, and speed of operation freight matching platforms bring. So are they that long-awaited panacea to all freight transportation related pains? Well, unfortunately, not. Not only can’t DFM prevent trucks from breaking down, it also comes with a number of shortcomings that might be a deal-breaker for some.

No personal interaction. When making digital deals, you often don’t have a point of contact to talk the details over with. It might mean misunderstanding load requirements or no one to take responsibility if something goes wrong. This issue can be solved by calling and talking to the carrier, for example, if you know that you have some special requirements like a strict appointment or oversized freight.

Limited negotiation opportunities. The bidding system is often time-efficient and convenient, but it’s definitely not the same as a personal negotiation process when you can talk the carrier into a high-margin deal. This consideration can be partially addressed by setting up custom rating rules in the DFM system.

Poor specialized freight management. If you deal with hazmat, oversized, military, or other freight with special requirements, you need carriers who know what they are doing. Permits, escorts, TWIC/SeaLink Cards, background checks – all that can be very tricky for both inexperienced brokers and carriers. If that’s your case, it’s definitely better to talk through all the load details with a carrier.

Imperfect tracking. Not all DFM systems enable real-time tracking. Some only offer limited status updates like “the driver got loaded” and “the driver arrived at the destination.” In this case, if you want fuller visibility, you’ll have to use an additional tracking tool.

All that being said, the question is: Do we have to shift to digital? And if so, what’s the best way to do it?

The answer to the first question depends on your priorities and load types. As we said, if you move a lot of specialized freight, digital matching might not be very effective for you. Same if your core value is building direct personal relationships with carriers. But in most cases, our advice is to test the DFM waters and find your own balance between the traditional and innovative approaches to sourcing capacity.

Getting to the second question, your main options would be either subscribing to the existing DFM platform or building your own by extending the functionality of your TMS. As a general recommendation, if you are a big brokerage/3PL company with an established carrier network and proprietary TMS software, it’s sensible to build your own freight matching system and keep working with your trusted partners. On the other hand, if your business is not that big, it’s worth joining one of the digital freight networks as it will give you access to thousands of carriers as well as ready-made smart load matching and other useful functionality.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.