An order management system (OMS) is a core technology that enables modern retailing, and many industries have already adopted it. Yet in aviation, OMS is still at the margins of discussion—often misunderstood or seen as too complex to implement.

In this post, we take a closer look at the current state of order management in air travel , what stands in the way of broader OMS adoption, and what a realistic path forward could look like.

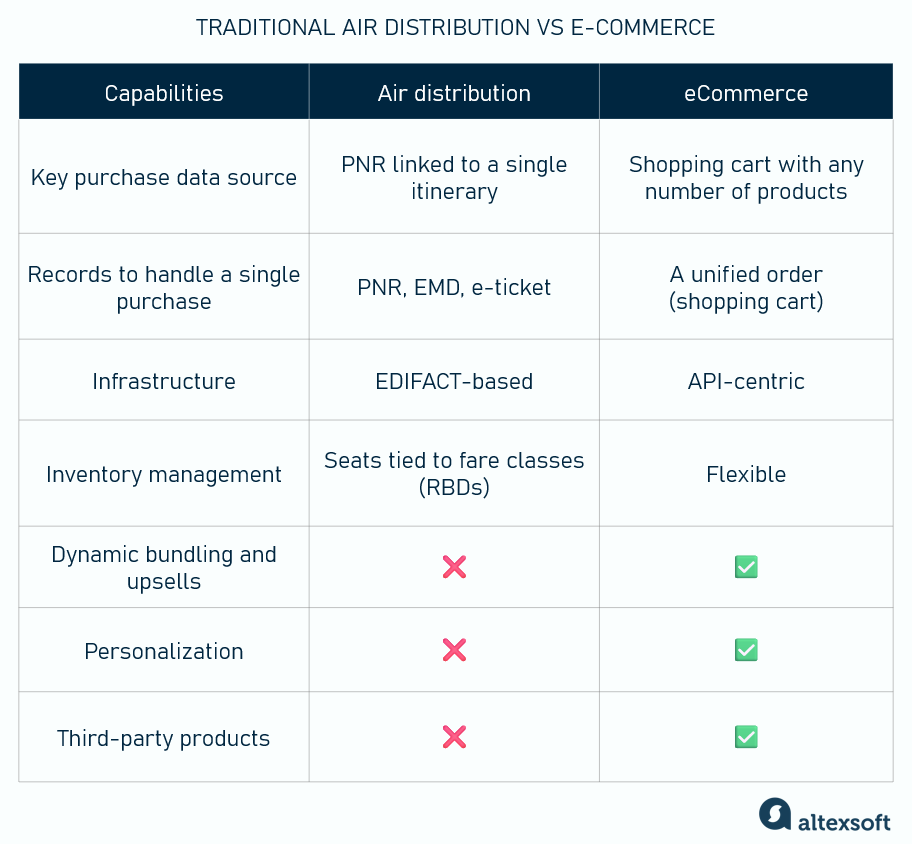

Traditional air distribution vs. eCommerce

What is OMS and order management?

Order management is the behind-the-scenes process that takes a customer’s order from placement to delivery. An order management system (OMS), in turn, is the technology that drives the whole process.

To be more precise, an OMS is software designed to coordinate and automate the end-to-end lifecycle of customer orders, from placement to post-sale services. It syncs up inventory, customer accounts, and logistics in real time. OMS typically covers order capture, availability checks, payment processing (via integration with a payment gateway), shipping, and post-sale management, like exchanges and refunds.

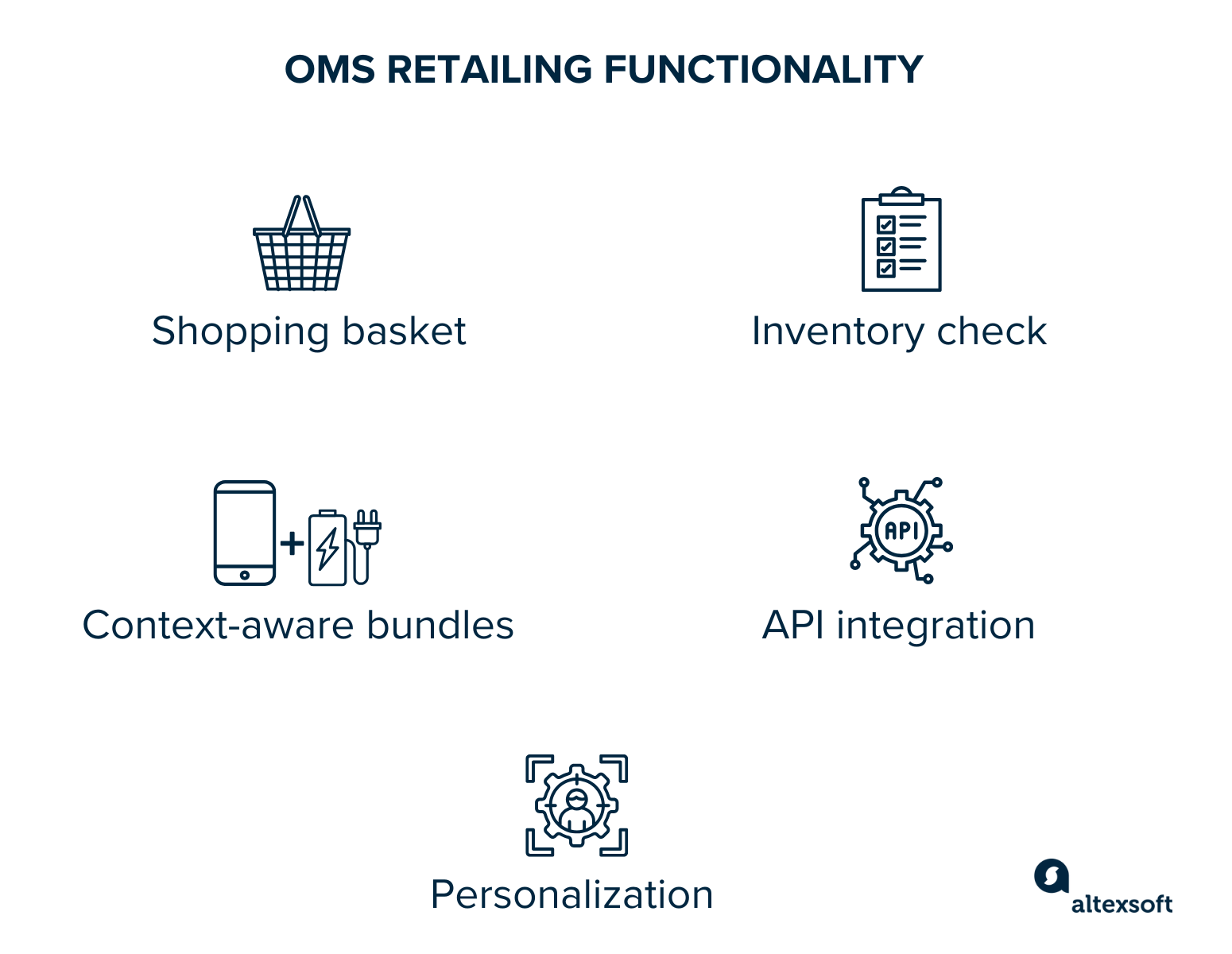

OMS retailing functionality

OMS retailing functionality

Let's focus on the key OMS capabilities that enable retailers to sell more and increase revenue.

Shopping basket. It’s a unified order record that aggregates all information related to the orders from all sales channels (web, app, in-store). While shopping online, customers can put multiple products in one basket, compare them, evaluate the selection, modify if needed, and then pay for everything in a single transaction. The order statuses (created, changed, cancelled, paid, delivered, returned, etc.) are tracked through this unified record.

Inventory check. OMS verifies whether the ordered item is available and from which location. It also tracks product performance and flags items that sell poorly so the manager can kick off a promotion campaign or a sale.

Context-aware bundles. Before checkout, a customer is offered related products (e.g., a phone, a charger, and a case) with a discount. For creating the bundles, OMS uses order context (what is viewed and put in the basket) and a business rules engine that defines logic like: “If a phone is selected, offer a charger + case bundle.”

Personalization. ORM doesn’t store and analyze customer history, but personalized recommendations (“You were looking for champagne classes last week. Now it’s almost Valentine’s Day. How about buying a romantic dinner gift set?”) can be enabled via integration with a CRM.

API integration. OMSs are designed with APIs in mind so that they can easily link to other software, such as payment gateways, analytical tools, and external retail platforms. This connectivity enables sellers to expand their product range by including offerings from third-party suppliers.

OMS examples

All big modern retailers, like Walmart, Amazon, Zara, or Best Buy, have invested heavily in robust OMS solutions (internally developed or purchased) to manage their complex operations and maintain a competitive edge in the market. Since the birth of eCommerce in the 1990s, a lot of cool stuff has been invented to provide a smooth shopping experience. Here are some examples.

In the early 2000s, a former online bookstore, Amazon, opened to third-party sellers and adapted its OMS to route orders across multiple vendors while keeping the customer experience consistent.

In 2006, Amazon launched Fulfillment by Amazon (FBA), the program that lets sellers store products in Amazon’s warehouses while its OMS handles the rest. About the same year, Best Buy became one of the pioneers of an omnichannel retail by launching Buy Online Pickup In-Store, which relied on more advanced OMS capabilities to coordinate inventory and fulfillment throughout its store network and online platform.

But that's not the case with flight shopping. Many major full-service carriers (FSCs) can’t match even second-rate online stores in terms of modern retailing. Why is that?

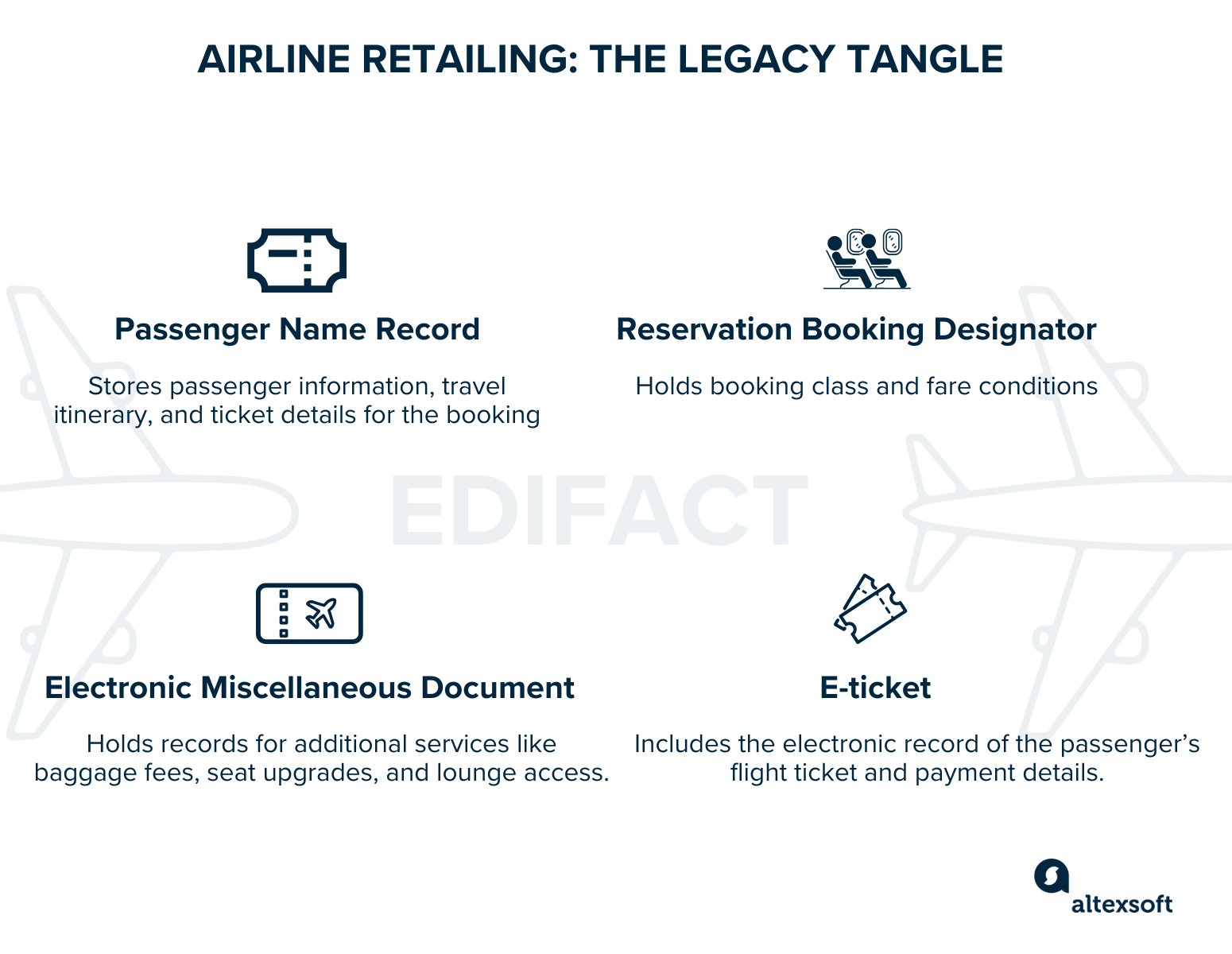

Airline retailing: the legacy tangle

Compared to eCommerce, which emerged in the 1990s, the traditional airline distribution model evolved in the 1970s, in a very different, pre-Internet context. Let's look at the main components and features.

Airline retailing: legacy infrastructure

PNR instead of a basket. A passenger name record (PNR) сontains all booking data (passenger's name, contact info, itinerary, payment details, a frequent flyer number, and more). Each PNR is assigned a unique code or record locator used by passengers to access their flight details, check in, and manage the booking.

How PNR works

The problem is that a PNR is nothing like a shopping cart. While it can handle several people traveling together, along with information on additional journey segments—like hotel reservations or car rentals—each PNR is tied to a specific itinerary, not allowing you to combine multiple trips or routes. You also can’t add a new passenger to an existing PNR after it's created, especially if it's an adult (there are exceptions for infants and sometimes children).

Three different documents to hold one booking. Although the PNR contains booking information, to fulfill the order, you need two other types of documents:

- an e-ticket, which confirms that the flight is paid for; and

- electronic miscellaneous documents (EMDs) for processing ancillary revenue from baggage, seat upgrades, and other extras.

Only ancillaries sharing the same Reason for Issuance Codes (RFICs) can be combined into a single EMD. For example, lunch and WiFi have the same RFIC, which is G (in-flight services), excess weight is marked as C (baggage), and lounge access comes under E (airport services). So, if one passenger buys all the above-mentioned services, three EMDs are issued and linked to the same PNR.

Flight Inventory limited by reservation booking designators (RBDs). An airline’s inventory stored in passenger service systems (PSSs) is divided into RBDs, which are typically one-letter codes signifying a specific class of service and rules associated with it. For example,

- Y — a full-fare economy, flexible and refundable, with luggage and drinks included; and

- Q — a discounted economy, nonrefundable, non-changeable, luggage included, and beverages not included.

The number of RBDs is limited to 26 letters of the Latin alphabet, so you can’t sell each seat as a separate product customized for a particular passenger.

No access to third-party products. Legacy PSSs are not designed to integrate with inventory sources beyond the airline industry. Also, they can’t manage products other than seats and basic ancillaries, so carriers have no way to sell hotel rooms, tours, or offer your merch, like t-shirts.

No control over the offer when selling via third parties. Traditionally, airlines sell their products via global distribution systems (GDSs) developed in the 1970s–1990s. GDSs aggregate flight information from various sources, construct the offer, and then pass it to OTAs and other resellers. So, when selling through a GDS, the airline doesn’t own its offer and cannot shape it as it sees fit.

Text-based messages instead of rich content. The traditional flight booking process relies on EDIFACT, an outdated pre-Internet protocol that can't transfer long text, images, and other types of rich content.

How traditional flight booking unfolds

And what is the conclusion? On one hand, traditional airline distribution is robust and reliable, polished by decades of experience. On the other hand, it isn’t just rigid—it’s structurally allergic to flexibility. Its built-in limitations don’t quite fit the modern idea of smooth, customer-friendly retailing.

Want to know more about how air distribution was shaped? Read our article on the history of flight bookings.

How is retail in aviation changing?

Over the past 25 years, the industry has been slowly moving towards modern retailing. Let's see what progress has already been made.

Direct distribution. Almost every airline has a website where it can sell its products directly. Theoretically, this gives carriers the freedom and flexibility to shape their offer, but if they use an outdated PSS, they are still bound by a range of legacy artifacts.

Emergence of LCC. Low-cost carriers (LCCs) cut out GDSs from the get-go and were the first in the industry to unbundle air fares linked to RBDs. Instead of buying a standardized package, their passengers can mix and match bare seats with extras they want, be it a refund option, checked baggage, priority boarding, or extended legroom.

LCCs started selling seats separately and all kinds of different products. This shook up the traditional airlines

LCCs introduced another innovation: Like eCommerce marketplaces, they leverage API-centric systems that can connect with third-party platforms to sell a wide range of products, from hotels and car rentals to branded baseball caps.

IATA New Distribution Capability (NDC). The initiative launched by IATA over a decade ago aims to replace EDIFACT with XML messaging, which allows for rich content exchange. Besides, NDC gives airlines control over their proposals when they sell flights through intermediaries. So they can, for example, bundle products or propose ancillaries the way many of them already do on their websites. Of course, as with any new standard, NDC has its flaws: You can read about the challenges of NDC implementation in our dedicated article.

However, just switching to NDC or having a website is not enough to achieve modern retailing. “For all its advantages, NDC is just a messaging standard. For personalization and proper order management, no matter direct or indirect distribution, you need a business rule engine and data,” emphasizes Ann Cederhall, travel technology strategist, advisor, educator, and airline retail expert. “You need a CRM or a customer data platform to collect and store traveler behavior. Then you can say, 'Hey Ann, we know you always buy fast track and pre-boarding. Here’s a 5 percent discount package.' That’s personalization. NDC itself has nothing to do with this – also because you can use any other messaging standard, for example JSON-based, to connect the back and front end.”

So, what is the conclusion? Progress is evident, but neither having a website nor joining the NDC program automatically means you сan sell like Amazon. Order management is necessary to make travelers happy and attract a loyal clientele.

Some airlines with GDS-hosted PSSs are in no rush to develop OMS capabilities because they expect GDSs to do it for them. But waiting could risk losing money. According to McKinsey, modernizing air retail could bring airlines an extra $7 per passenger by 2030 — about 4 percent of total industry revenue. So while the shift to modern retailing is complex and sometimes painful, it’s also unavoidable.

Order-based systems

An order-based retailing system uses a single, customer-centric record to which you can add any product not necessarily related to a single reservation. While in a PNR-centric approach, one booking is managed via a scattering of records, modern order-based retailing is about treating several bookings as one integrated transaction.

In an order-based system, the shopping basket or order, not the PNR, is the central focus. Just like in Tesco, Amazon, or Target, multiple inventory sources feed into one basket, with an OMS on top

Key capabilities of an airline order-based system should include the following functionality.

Shopping basket functionality with the ability to add multiple PNRs. It’s just like your basket on any eCommerce platform. Customers can add, remove, or modify flights, seats, meals, baggage, lounges, and even third-party offers like insurance or car rentals before checkout.

Also, the system should allow airlines to add multiple PNRs to a single order and extend frequent flyer benefits to other companions.

For example, you are a gold cardholder traveling with your colleagues who have a different PNR, since they fly from another starting point and join you somewhere in the middle. If an airline runs an order-based system, you can add them to your order, so the system gives them access to the lounge and priority boarding.

Dynamic bundling and upsells. Seat upgrades, fast-track, and lounge access can be offered as part of discounted packages tailored to the customer’s context or trip purpose. Also, the system can trigger relevant upsells, such as offering insurance to protect sports equipment during the journey, when a traveler registers, for example, a bicycle or golf bag online.

Integration with other inventory. An order-based system seamlessly connects with other platforms via API, enabling airlines to sell third-party products, from airport transfers or hotel stays to absolutely unrelated stuff, like Christmas decorations or fried cricket chips.

Business rules behind the scene. The OMS lets airlines apply consistent business logic across their inventory.

“The heart of OMS is the business rules engine that keeps track of how many products I have, what’s happening with that inventory, and when I have to restock,” explains Ann. “This is not selling very well; I need a campaign, and maybe bundle these two products and sell them together. All that intelligence behind the scenes—that is the OMS.”

Compatibility with legacy systems. Without the ability to work with existing infrastructure, the airline will find itself in a vacuum.

OMS adoption options

One critical decision point for airlines is how to implement OMS capabilities. You can either switch to a new order-based PSS or integrate the existing PSS with an OMS explicitly designed for air retailing.

Order-based PSS migration: An order-based PSS combines inventory, reservations, and order management. It should include additional functionality to optimize offers (like AI-driven dynamic pricing).

A handful of passenger service systems have order capabilities. They include

- Navitaire New Skies, which target hybrid and low-cost carriers, and Nevio by Amadeus;

- TIK Systems PSS; and

- FLYR PSS.

All four are fully backward compatible, so they can interface with PNR-oriented PSSs. One more system is on the way: Sabre is currently building its order-capable Mosaic platform.

OMS layer on top of legacy PSS: Alternatively, you can add an OMS layer on top of the existing PSS. This lets airlines introduce order-based processes for specific products or sales channels while smoothly running their current PNR-based setup. It’s a step-by-step transition rather than a full system overhaul.

An OMS can drive modern retailing, either directly on the website or via NDC API. Some examples include Datalex, Accelya FLX ONE, Astra by TPConnects, t-Retail NDC by OpenJaw (now owned by Travelsky), Retailaer, and PROS. These systems are PSS-neutral, meaning an airline can implement them regardless of its current infrastructure.

Whatever option you choose, an order-based PSS or PSS-neutral OMS, they can be off-the-shelf or custom-built. Some airlines have built order capabilities in-house.

Best examples of modern retailing and order management among airlines

Though almost all airlines now run websites to sell their products directly, that doesn’t necessarily mean they have order management functionality. As a result, their retailing capabilities remain limited — they can only offer what’s available in their PSS, without the flexibility of modern retail techniques.

Here, we’ll look at some airlines that use order management. All of them have shopping basket capability—a customer can manage a reservation using a booking number: add flight dates and personal data, change, or cancel flights, and add ancillaries.

AirAsia. The Malaysian LCC uses many elements of order management. Customers can manage bookings via the AirAsia Move website, mobile app, or chatbot. AirAsia also sells hotels and tickets for more than 700 other airlines.

Air Europa. The Spanish airline’s website was designed with customer focus in mind. Best prices, top offers, and popular campaigns are sorted by type of travel, season, specific holidays, etc.

Allegiant Air. This ultra-LCC US-based company offers bundled packages including flights, hotel accommodations, car rentals, and tourist attractions under Allegiant Vacations.

Ryanair. Europe’s largest low-cost carrier has long used Navitaire’s platform for reservations and ancillaries. While Ryanair is not an IATA member (so it doesn’t formally participate in NDC), it supports its “Always Getting Better” digital retailing, enabling very high ancillary sales per passenger.

EasyJet. On the EasyJet website or mobile app, travelers can book accommodation, rent cars, buy a package holiday (with the best price guarantee!), and choose from multiple deals sorted by travel type.

EasyJet has a tailored reservations system (Sopra Steria’s easyRes). In 2022, it also partnered with Datalex to upgrade its digital merchandising.

LATAM. The largest airline holding company in Latin America extensively uses third-party partnerships to increase the attractiveness of its offers. For example, on their site, you can book accommodation (via a partnership with Booking.com), rent cars (at Rentalcars.com), buy tour packages, and book guides. You can also spend miles on various goods in the shopping section, from clothes to microwaves.

United Airlines. A major US airline has an internally developed order management system. On the website or mobile app, customers can rent cars, book a hotel, or purchase a vacation package (in collaboration with Priceline). You can bundle offers during or after booking, adding ancillaries like preferred seating, Wi-Fi, priority boarding, etc. What is particularly convenient is that if you booked your trip through a travel agency via NDC, you can still see and change your order in the United app.

Each of these cases shows a move away from inflexible legacy commerce. However, full OMS adoption is still a work-in-progress industry-wide. Building a sleek OMS is easy on paper, but making it talk to a 30-year-old mainframe during a weather delay is where the real engineering begins. For most airlines, that means starting small, testing carefully, and keeping expectations realistic.

The future: One Order vision and reality

IATA’s ONE Order initiative, introduced in 2016, is often presented as the future state of airline retailing: a world without tickets or EMDs, just a single order reference combining all travel elements. Conceptually, One Order merges the PNR, ET, and EMD into one unified record. IATA aims to see “100 percent Offers and Orders” throughout the aviation industry by 2030. And though might come true, currently, One Order is more of a visionist project than a reality.

A small number of airlines (e.g., Lufthansa Group, Qatar Airways, Emirates) have run pilot programs to test One Order logic, often in controlled environments or on select routes. Only one carrier, Finnair, officially claimed to become the first airline globally to create a “Native Order” (powered by Amadeus Nevio technology), allowing airlines to manage air purchases in a single record.

Nevertheless, no matter how distant that prospect may seem, ONE Order’s underlying principles quietly reshape how airlines think about customer experience and operational efficiency. As order-based systems mature and early adopters share results, more airlines will likely follow — not in one giant leap but through steady integration, selective pilot programs, and a shift in mindset that sees passengers as customers, not just PNRs.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.