In May 2025, Finnair CEO Turkka Kuusisto booked a flight from Helsinki to London Heathrow on Finnair.com—Finland’s largest eCommerce store. But this wasn’t a usual booking. Mr. Kuusisto created the world’s first "Native Order." One small click for man, one giant leap for the airline retailing.

To understand why this is important, let's take a short look at the history of air distribution.

Since the emergence of Global Distribution Systems (GDSs) and migration to digital marketplaces, airlines have been constantly locked in their marketing efforts. The GDS-centric system blurred the distinction between carriers. Besides, airlines stuck with GDSs didn’t get enough customer data to offer personalization. This led the whole industry to seek new ways of selling its products.

How airline distribution works in a nutshell

In 2012, the International Air Transport Association, or IATA, announced the New Distribution Capability (NDC) initiative, which aims to bypass GDSs in the distribution chain and adopt XML for data exchange instead of the old EDIFACT protocol used by GDSs.

In 2016, IATA facilitated the further shift to a new retailing model with its ONE Order initiative. The “Native Order” mentioned above is the first ONE Order implementation in production: It enables a carrier to manage a customer's entire journey and all associated purchases in a single, unified record.

In this article, we’ll analyze a relatively new standard and the technologies enabling it. We’ll also examine the recent state of ONE Order adoption and define how it might impact the industry.

What is ONE Order in a nutshell?

ONE Order is a standard that aims to simplify data exchange between airlines and distributors. Historically, three types of records have been used for data transfer: a document containing traveler data and flight details, a document for ticketing and billing, and a separate one for ancillaries.

The core idea of ONE Order is to use a single document type instead of three to manage order exchange. Storing all the data in a single container for information interchange would simplify data updates and order management.

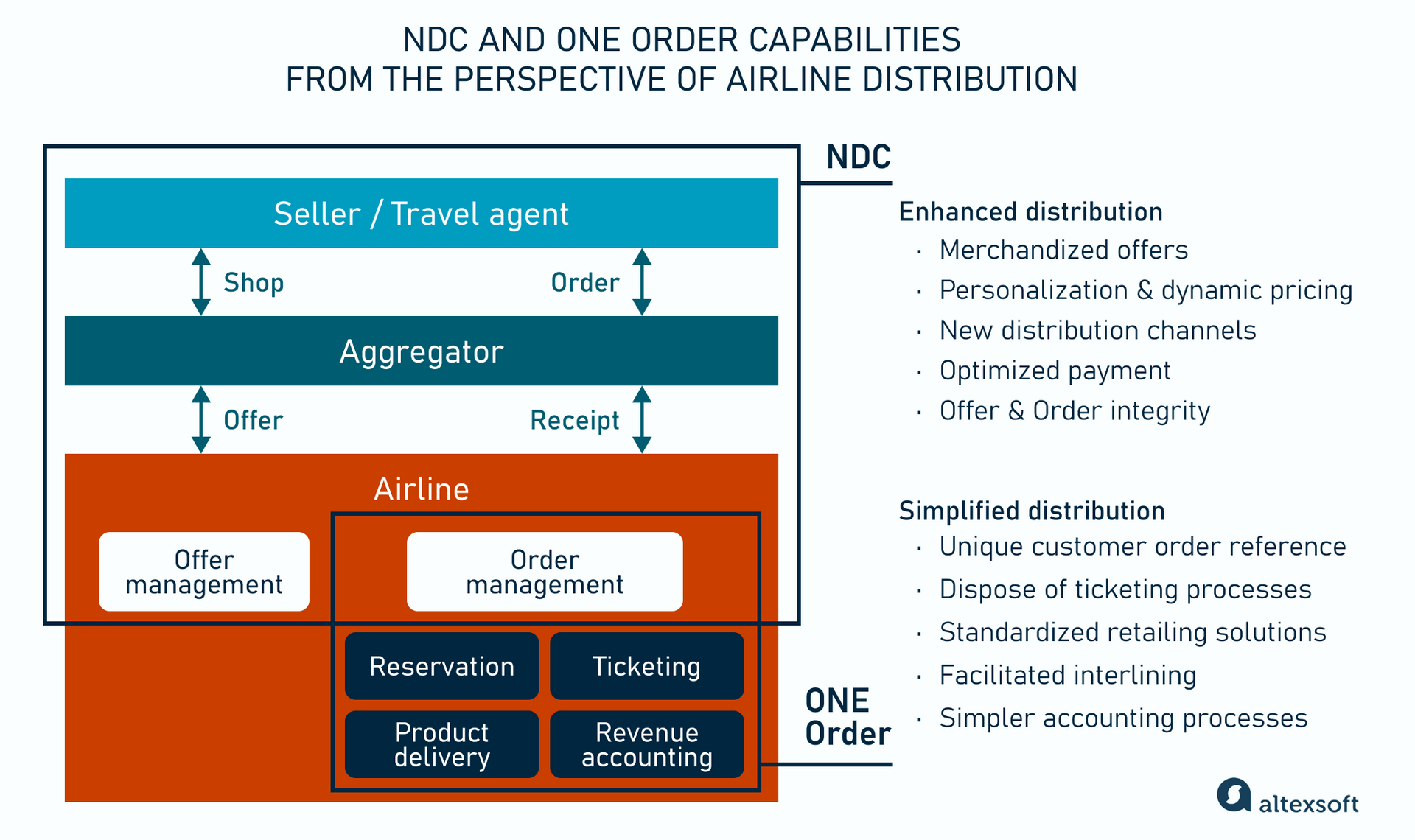

NDC and ONE Order capabilities from the perspective of airline distribution

The following section explores the concept of order management and its record types.

Order handling in legacy systems: PNR, ETKT, and EMD

Currently, the travel industry operates its offers and orders with the help of legacy systems and outdated data records passed between airline companies and distributors. When we speak about offers and orders, we refer to the way airlines send and receive data about distributed products and services.

An offer is the way an airline represents its inventory to distributors. It contains availability, prices, schedules, flight destinations, and onboard services. Everything the airline wants to present to customers is an offer.

Read our dedicated article to learn more about offer and order management in air travel.

An order is information from the customer's side. It includes items chosen and paid for, passenger personal data, payment information, additional services, dates, etc. In legacy systems, order management is handled via three types of data records.

Passenger Name Record (PNR). It’s a digital document containing the itinerary, passenger details, payment information, etc. A PNR file is built during booking. The system generates a booking reference — a unique alphabetic or alphanumeric code assigned to the PNR file. It serves as a digital address of the document in the airline’s database.

What is PNR?

A unique PNR code typically appears on the booking confirmation sent by email, e-tickets, and boarding passes. Passengers can use it to view flight details or check in on the airline’s website, but it does not grant access to the full PNR file.

E-ticket (ETKT). It is a digital equivalent of a paper ticket, which became mandatory in the airline industry in 2008 to serve as proof of payment.

E-tickets are issued either by the airline or by an IATA-certified travel agency after the payment is complete. It takes a couple of days for all the members of the payment process to validate the data. Upon the transaction confirmation, the corresponding information is added to the PNR, the ticket is generated, and the passenger receives an e-ticket via email.

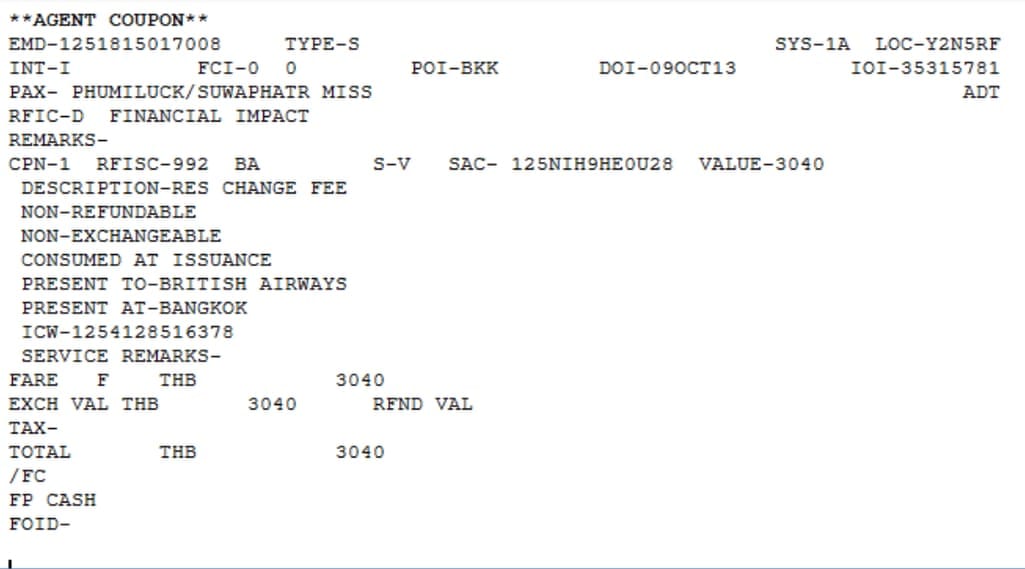

Electronic Miscellaneous Document (EMD). An EMD is a non-flight record that contains information about purchased ancillaries, which are additional services like onboard meals and luggage. You can download a complete list of codes from ATPCO.

Each record constitutes an order creation in legacy systems. Today, this is how information on products sold is passed on in the airline industry.

Order management with ONE Order

The main idea of ONE Order is to merge the aforementioned records into a single document. The unified container for all order data would have the following items:

- Order number;

- passenger personal data;

- passenger contact information (email, phone number, passport details);

- itinerary with flight details (dates, airline, city pair, time);

- payment status;

- ticketing information (ticket issuer, issuing date, expiration date); and

- ancillary information (additional services).

The data points list can differ for every airline, but the items mentioned are usually mandatory.

In this unified form, an order can serve as a shopping basket on an online retailer's website: A traveler can add multiple flights, ancillaries (e.g., priority boarding, extra legroom, Wi-Fi, etc.), and third-party products, like hotel rooms or transfers. The advantages for passengers are obvious: convenience and a smooth experience. Now let's see what the airline gets.

What ONE Order brings to the industry

What advantages does a single record bring to airlines compared to multiple documents?

Straightforward data management. A unified record is a single source of truth for each order in the sales pipeline. A carrier can easily validate/check their items. Transferring data within a single record makes accessing and updating this information easier. Storing and processing the only record type also requires fewer infrastructural resources.

Lower accounting costs. Airlines can streamline financial operations and reduce accounting expenses by eliminating manual work and duplicate records. In an order-first model, every order already includes the revenue breakdown for services as well as any interline settlement values. In both cases, the order becomes the single source of truth for financial settlement across services and partners.

Complete customer data for analysis in one place. Airlines can finally see the whole picture of what they sell and to whom. That visibility is the foundation of retailing. It allows airlines to analyze sales patterns, personalize offers, and adjust pricing—exactly how online retailers fine-tune what they show customers. In practice, this could mean suggesting a premium seat upgrade with lounge access to a frequent flyer or bundling a hotel with a flight for a leisure traveler, all managed under one order.

Technologies that enable ONE Order adoption

ONE Order is part of a larger program to transition aviation to a new retail model. The airline industry calls it “100% Offers and Orders”—or, put another way, a fully legacy-free environment. At its core, it’s about replacing decades-old processes with modern, customer-centric technology platforms built around flexible offers and a single order record.

NDC basis of ONE Order initiative

One of NDC's objectives is to allow airlines to enrich their content with XML messaging, which replaced the cryptic EDIFACT used by GDSs. "Enrichment” literally means including more information in offers, e.g., lists of ancillaries, text descriptions, photos, etc.

Airlines can provide rich content via NDC XML APIs to OTAs and TMCs. This way, carriers could break GDS's oligopoly on the travel market and reduce distribution costs, as GDSs charge significant transaction fees.

Additionally, NDC allows airlines to access customer information at the time of booking and personalize offers accordingly. A travel supplier should see what it sells and to whom, and NDC makes this possible.

NDC adoption is moving forward—slowly but surely. The Airline Retailing Maturity (ARM) index Registry, the main source of information on NDC maturity across industry players, currently lists 109 airlines and system providers for airlines that have implemented at least basic NDC capabilities.

And that number doesn’t tell the full story since participation in the IATA ARM program isn’t mandatory for NDC players, so there are more. A survey of over 150 airline executives directly involved in Offers and Orders (O&O) implementation found that about 80 percent already operate live NDC channels.

You can learn more by reading our uniquely comprehensive articles about NDC challenges for airlines and studying the infographic on NDC airlines and their retailing capabilities.

So what is needed to transition from the legacy way of managing sales records to ONE Order?

Under the hood of order management modernization

Currently, order management in airline retailing is held by legacy Passenger Service Systems (PSSs). PSS stores and processes sales data spread acrossPNR, EMD, and ETKT.

With ONE Order, airlines must transition to entirely new PSSs. What capabilities should they support? IATA provides fairly flexible recommendations: “It can be as simple as replacing the PNRs, ETKTs, and EMDs with a single identifier, i.e., an Order ID. In a more sophisticated system, Order Management could be similar to the retail world where every aspect of the order, from product purchase to delivery, is managed”.

So, an ideal order-based PSS, like any modern retail platform, should combine inventory, reservations, and order management, with advanced features such as AI-driven dynamic pricing.

For airlines that have decided to transition, a major decision is how to bring order management capabilities into their ecosystem. Broadly, there are two paths: migrating to an order-based PSS or layering an OMS on top of the existing system.

Migrating to an order-based PSS. Currently, only a few PSSs support ONE order concept: Navitaire New Skies (for hybrid and low-cost carriers), Nevio by Amadeus, TIK Systems PSS, FLYR PSS. Sabre is also developing its order-enabled Mosaic system.

Order-based PSS providers

All live systems are backward compatible and can interface with PNR-based platforms. This is extremely important in the transition period. Otherwise, carriers adopting the new approach will not be able to cooperate with PNR-centric airlines for interlining and codesharing.

Adding an Order Management System (OMS) layer to a legacy PSS. An OMS is software designed to coordinate and automate the end-to-end lifecycle of customer orders, from placement to post-sale services. It syncs up inventory, customer accounts, and logistics in real time. Instead of replacing the PSS, airlines can add a dedicated OMS to handle order-based processes for selected products or sales channels. This creates a gradual transition while the core PNR-based system continues to run. But keep in mind that this is a temporary solution.

OMSs providers in air travel

OMS platforms are typically PSS-neutral, so they can integrate with any existing setup. They power modern retailing both on airline websites and via NDC APIs. Examples include Datalex, Accelya FLX ONE, Astra by TPConnects, t-Retail NDC by OpenJaw, Retailaer, and PROS.

Whether airlines choose an order-based PSS or a standalone OMS, both options are available as commercial solutions or custom-built platforms. Some carriers even develop order capabilities entirely in-house.

The current state of ONE Order adoption

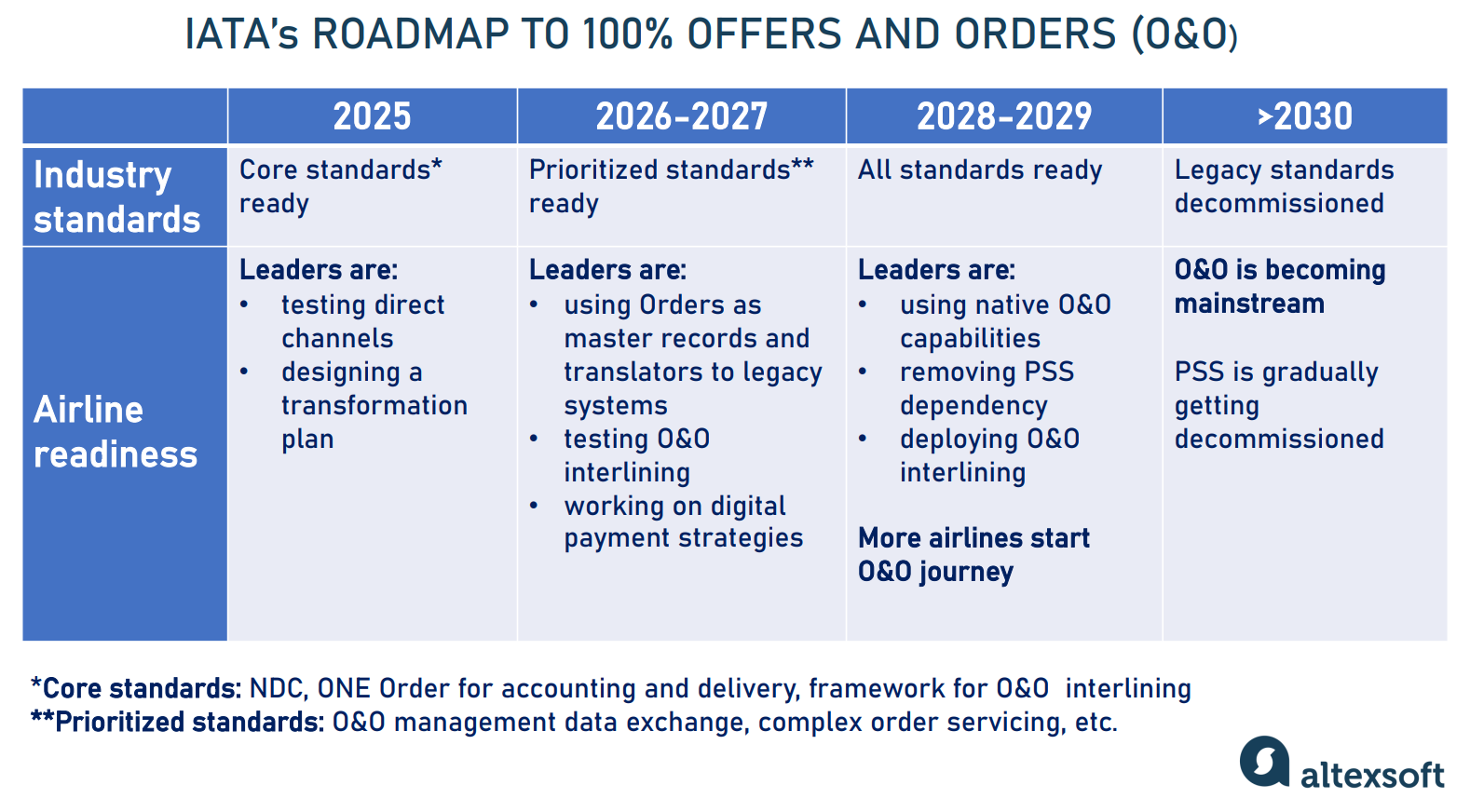

The journey toward a world of 100% Offers and Orders is well underway, but the trajectory remains a multi-year, multi-stage process. Market players recognize the IATA’s aspirational goal of having full capabilities available by 2030. However, a report from late 2024 projects a more measured timeline for mainstream adoption. Most airlines are expected to transition to Offers and Orders in the 2028-2029 timeframe, with widespread adoption unlikely to occur before 2030.

IATA's roadmap to 100% Offers&Orders

Currently, IT-providers run nearly 40 pilots and proof-of-concepts (POCs) related to the ONE Order transition. A few airlines (e.g., Lufthansa Group, Qatar Airways, Emirates) have finished pilot programs to test ONE Order logic in controlled environments or on select routes.

By mid-2025, only 27 percent of airlines had made meaningful progress toward Offer and Order transformation. And the only carrier, Finnair, as we mentioned in the beginning, officially claimed to become the first airline globally to create a “Native Order” (powered by Amadeus Nevio technology).

What hinders airlines from faster adoption?

Securing the necessary investment is a significant hurdle. The shift is projected to take anywhere from three to seven years and demand investments of $50–100 million per carrier. There is a prevalent concern that the "up-front investments won't pay off quickly," a fear compounded by the airline industry's historically thin profit margins. In 2025, for example, the industry is projected to earn a net profit of just $7.20 per passenger, leaving a very thin buffer for investments.

On the other hand, there is something to suffer for and strive for. According to McKinsey's research, improved retailing techniques could unlock as much as $45 billion in additional industry value by 2030. Any airline's exact upside will vary with its digital and organizational maturity, but for many carriers, the potential gain could exceed 2–3 percent of annual revenue.

But money and technologies are only half the battle. The real disruption lies in organizational change. ONE Order isn’t just a software upgrade—it forces airlines to dismantle long-standing silos and rewire how their businesses actually run. Once handled independently, ticketing, reservations, and accounting must now be tightly integrated.

Then there’s the coordination challenge. ONE Order cannot succeed in isolation; it depends on the entire travel ecosystem moving in sync. Airlines, tech vendors, travel agencies, and GDSs (as they seem irreplaceable in the foreseeable future) must align. But with each player following its own roadmap, orchestrating universal adoption is less like flipping a switch and more like conducting a global symphony—where not everyone reads the same sheet of music.

Some pilots are supposed to tackle this challenge specifically. For example, the British Airways and Vueling interline pilot in 2020 focused on overcoming disruptions between a traditional "ticketed" (British Airways) and "ticketless" (Vueling) carriers. According to IATA, the pilot successfully demonstrated how using NDC schemas could remove the complexities of managing different PNRs, tickets, and EMDs. The outcome was a streamlined process that allowed Vueling to rebook British Airways passengers “in just three clicks and under three minutes”.

In the end, the pace of change will not be dictated by a few leading airlines but by the collective ability of the entire travel value chain—including technology vendors, travel agents, and corporate buyers—to mature and transition together.