The cruise industry is currently setting one record after another.

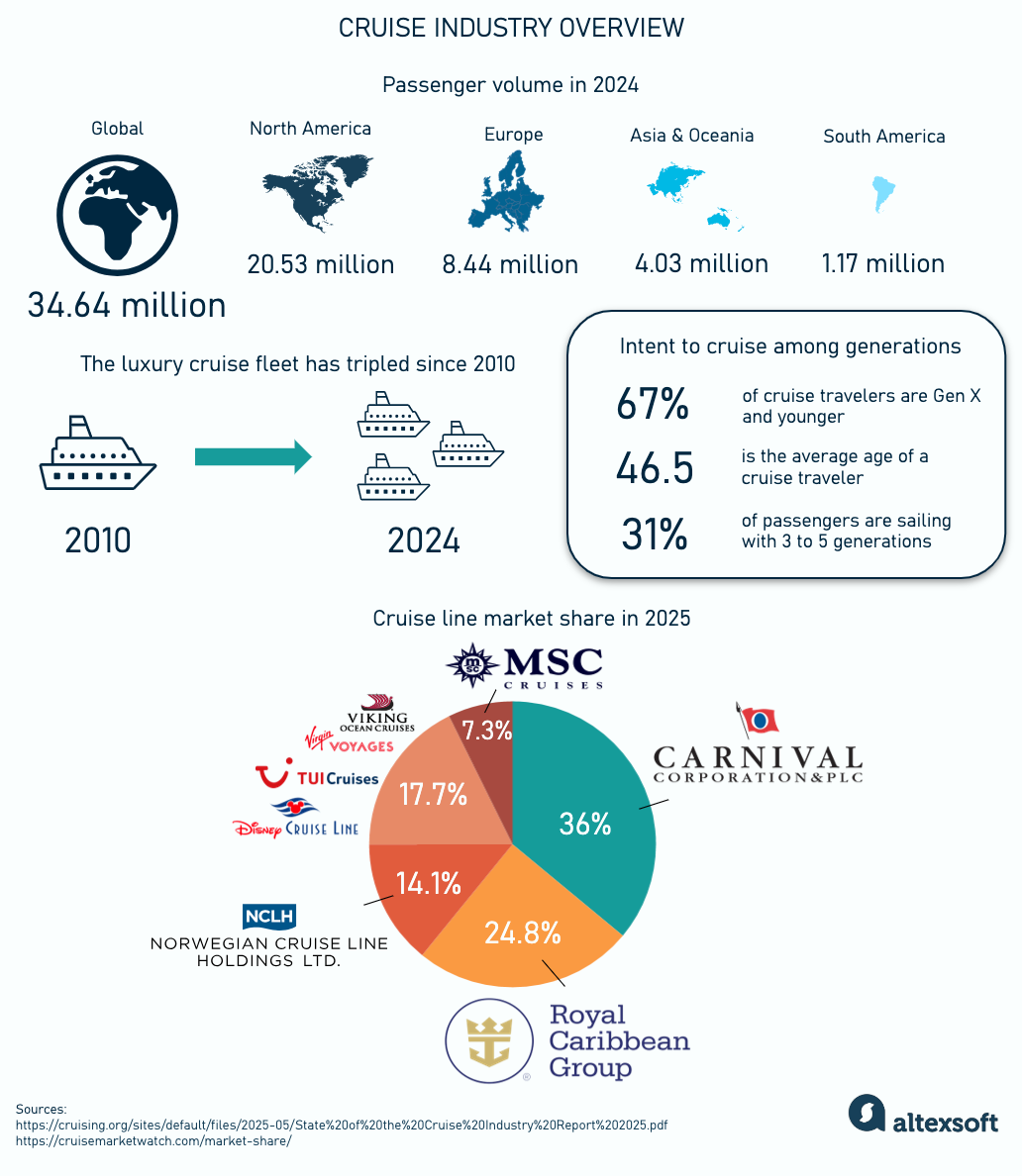

In 2024, it served approximately 34.6 million passengers. Moreover, the fleet of CLIA-member cruise lines exceeded 300 ocean-going vessels in 2024, increasing to 310 by 2025. Travel agents report that cruising is outpacing all other travel segments in growth.

Worldwide, the total revenue from ticket sales and onboard spending reached $72.5 billion, fueled by the rising demand for luxury experiences, the launch of new ships, and expansion into emerging markets such as Asia and South America.

State of the cruise industry in 2024-2025

The cruise industry also has a major economic impact, supporting around 1.6 million jobs worldwide, including those in shipbuilding, hospitality, travel agencies, and port services.

Such remarkable resilience and adaptability make cruising one of the most fascinating sectors in the travel industry. Want to learn more? Here’s our overview of the main cruise lines.

Who’s cruising? Cruise industry segments

Over the years, the cruise industry has evolved from a niche market into a significant global force, offering diverse travel experiences to millions of passengers worldwide. Its ability to combine transportation, luxury accommodations, and entertainment all in one package is a key reason for its popularity.

Watch our videos on the future of the cruise industry

The cruise industry is represented by the Cruise Lines International Association (CLIA). It’s the largest trade association in the field that serves as a voice for over 95 percent of global cruise capacity, including

- 69 cruise line members,

- 15,000 travel agencies and 64,000 agents, and

- 300 business partners.

CLIA’s core goal is to promote the cruise industry as a safe, sustainable, and rewarding way to travel. The organization advocates for policies that support environmental stewardship, passenger safety, and responsible tourism. It also aims to support the growth of cruise travel by educating the public and empowering travel agents through certification and training. To learn about CLIA accreditation for travel agencies, check our article.

Catering to a wide range of travelers, the cruise industry offers varying types of ships, itineraries, and experiences that appeal to different market segments. These segments can be broadly categorized by cruise type, ship size, and customer demographics.

Cruises by types

The cruise market is divided into several categories based on the type of experience offered.

Mass-market cruises are the most common and widely accessible. These cruises offer value with a wide range of activities, dining options, and itineraries to appeal to a broad demographic. They often feature a variety of entertainment options, including Broadway-style shows, casinos, and themed parties, as well as kid-friendly spaces and amenities.

The largest cruise ship in the world was built for the mass-market segment

Premium cruises cater to travelers seeking a higher level of service and luxury, but without venturing into the ultra-luxury price range. These cruises offer more refined accommodations, higher-end dining, and more personalized service.

Junior Suite on the Viking Expedition Ship. Source: Viking Cruises

Luxury and ultra-luxury cruises represent the epitome of lavish, indulgent travel. These cruises offer high-end, all-inclusive experiences with impeccable service, gourmet dining, and exceptional attention to detail. With smaller, more intimate ships, they cater to discerning travelers who seek privacy and customized itineraries. Ultra-luxury lines often include destinations that are off the beaten path, offering excursions to remote or unique locales.

Example of ultra-luxury cruising experience

Expedition cruises have become increasingly popular, especially among adventurous travelers and those interested in exploring remote destinations. These cruises are often on smaller ships designed to navigate challenging waters and access locations that larger vessels cannot reach. Passengers on expedition cruises might explore the Arctic, Antarctica, or remote parts of the Amazon.

Cruises by ship size

The size of the cruise ship plays a significant role in determining the kind of experience passengers can expect during their voyage.

Megaships are the giants of the cruise world, with passenger capacities that exceed 5,000 and can go up to 7,000 or more. These massive vessels are essentially floating cities, featuring a vast array of amenities such as multiple dining venues, pools, shopping malls, theaters, and even zip lines.

Mid-sized ships typically carry between 1,500 and 5,000 passengers, providing a more personalized experience while still offering a wide range of onboard activities and entertainment options.

Small and expedition ships are designed for those seeking a more intimate and exclusive cruise experience. These ships carry fewer than 1,500 passengers and are often used for specialized itineraries or cruises to less-visited ports of call.

Cruises by customer type

The diversity of the cruise industry is further reflected in its appeal to a broad spectrum of customer types.

Families are one of the largest customer groups for the industry. Cruise lines recognize this by offering family-friendly amenities such as childcare, kids’ clubs, family suites, and onboard entertainment tailored to younger audiences.

Seniors are another significant demographic. These cruises often focus on relaxation, scenic destinations, and enrichment programs, such as lectures and cultural workshops.

Solo travelers have increasingly become an important segment of the market. Cruise lines have responded to this trend by offering solo cabins and social events specifically designed to foster connections among single travelers.

Millennials and Gen Z represent a rapidly growing demographic in the cruise industry. These younger travelers are attracted to cruises that offer adventure, unique experiences, and social media-worthy moments. Shorter itineraries, immersive shore excursions, and cruises focused on sustainability or wellness are particularly appealing to this group.

Distribution in the cruise industry

Cruise distribution is different from other segments of travel, like flights or hotels, primarily because of the following factors.

Longer booking windows. Cruise bookings typically happen 6 to 12 months in advance, with travelers investing significant time and money into their decision. Unlike booking a flight or hotel for a quick weekend trip, cruises often involve international travel, multiday itineraries, and bundled services like dining, entertainment, and excursions.

Higher reliance on travel advisors. While the hotel and airline industries have steadily shifted toward direct online booking, cruise lines continue to rely heavily on travel advisors. Many travelers prefer to talk to someone when committing to a long, expensive vacation. On top of that, group travel and luxury cruise bookings that take advantage of a personal touch are commonplace in the industry.

Complex cruise ecosystems. Major cruise groups operate multiple brands in a variety of market tiers. Each brand has its own loyalty program, pricing model, and promotions, adding a layer of complexity that favors advisors who specialize in cruise travel. Advisors are also more likely to cross-sell within a cruise group, helping a client upgrade from a mainstream line to a premium one without losing them to a competitor.

All this means that a lion’s share of bookings (or 59 percent in 2022, for example) are done with a travel agent. And 20 percent – via a cruise line representative or a call center.

Top cruise lines ranked

The Cruise Market Watch recognizes top four cruise companies with the largest market shares in 2025:

- Carnival Corporation with 41.5 percent of global passenger volume and 36 percent of industry revenue;

- Royal Caribbean Group with 27 percent of passengers and 24.8 percent of global revenue;

- Norwegian Cruise Line Holdings with 9.4 percent of passenger volume and 14.1 percent of revenue; and

- MSC Cruises with 10 percent of passenger volume and 7.3 percent of revenue.

The headliners are followed by Viking (4.2 percent of revenue), Disney (3.9 percent), and TUI Cruises (1.9 percent).

In terms of brand landscape, the three biggest cruise companies – Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings – are all headquartered in Miami, Florida. This concentration isn’t just geographical, it also reflects the city’s historical role as a hub for the Caribbean cruise market.

Overview of top cruise lines

So let’s talk about the four leaders separately, focusing on their brand portfolio, fleet size, and main target markets.

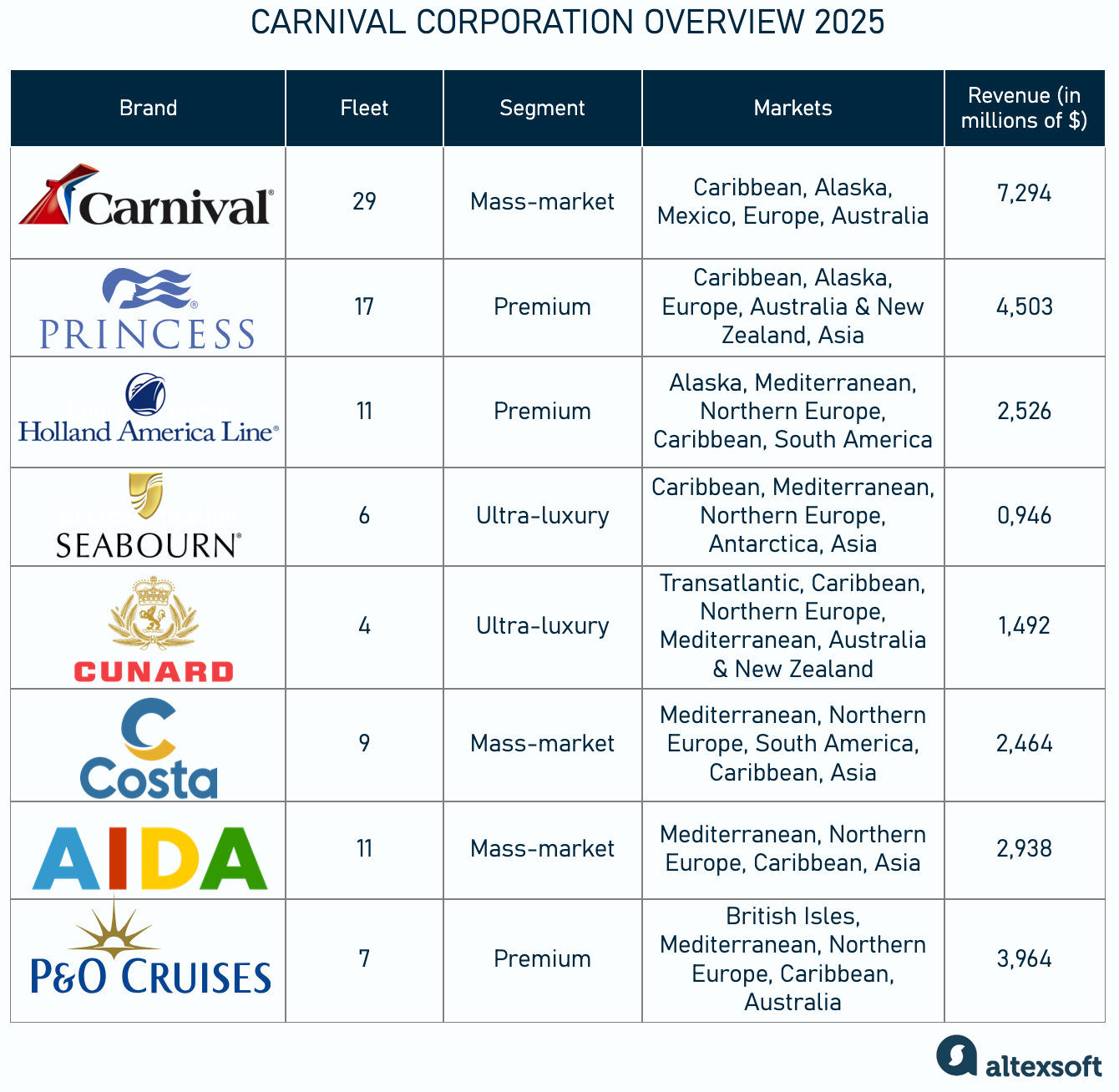

Carnival Corporation overview

Carnival Corporation is the world’s largest cruise company, known for its diverse portfolio of brands. Headquartered in Miami, Florida, Carnival Corporation operates in various segments of the cruise industry and serves millions of passengers annually. The corporation's operations span the globe, with a particular focus on North America, Europe, and the Caribbean.

Watch our video on what makes Carnival the leading cruise business in the world

The company was founded in 1972 and went public in 1987. Over time, it has grown through a series of mergers and acquisitions, creating a wide array of cruise lines that cater to different customer demographics.

Brands of Carnival Corporation overview

Key brands. Here are the key brands under its umbrella.

Carnival Cruise Line. The flagship brand of the corporation caters to the mass-market audience with affordable, family-friendly vacations. It’s the largest cruise brand in the world, providing tours to the Caribbean, Bahamas, and other popular destinations.

Princess Cruises. Known for its premium services, Princess Cruises appeals to travelers seeking a more refined experience, offering both traditional itineraries and unique destinations. It focuses on longer voyages.

Holland America. Catering to more mature travelers, Holland America offers premium cruises that emphasize fine dining, music, and cultural immersion. It is renowned for its elegant ships and voyages to a wide range of destinations, from the Caribbean to Alaska and Europe.

Seabourn. An ultra-luxury cruise line operates a small fleet of high-end ships that focus on exclusive, personalized experiences for its elite clientele.

Cunard. A historic brand is known for its luxury, transatlantic crossings. Cunard focuses on a premium experience with ships that offer an elegant, old-world charm with modern amenities.

Costa Cruises. A major player in the European market, Costa Cruises offers tours to the Mediterranean, Northern Europe, and the Caribbean. It is a more budget-friendly option but provides high-quality European-style cruises with a focus on fun and entertainment.

AIDA Cruises. Based in Germany, AIDA Cruises caters primarily to German-speaking customers. It focuses on a relaxed, informal cruising experience, with an emphasis on entertainment, wellness, and family-friendly offerings.

P&O Cruises. With a strong presence in the UK, P&O Cruises is a premium cruise brand that serves British travelers. It offers a range of itineraries in Europe, the Caribbean, and beyond, often focusing on British-style service and food.

Fleet size and capacity. Carnival Corporation operates a vast fleet of cruise ships, making it the largest cruise operator globally in terms of passenger capacity and number of vessels. As of the time of writing this, the fleet includes 94 ships across its various brands, with additional ships on order for delivery in the coming years. Their total capacity is nearly 300,000 passengers. The company’s ships range from megaships like the Carnival Mardi Gras to luxury vessels like those operated by Seabourn. The fleet also includes smaller expedition-style ships for specialized, adventurous itineraries.

Market focus and major destinations. Carnival Corporation has a broad market focus, targeting travelers of all ages and demographics in different regions. The company operates in key global markets, its largest one being North America. Carnival's European brands, including Costa, AIDA, and P&O Cruises, have a significant presence in the Mediterranean, Northern Europe, and the UK, while Costa and Princess are particularly focused on expanding in Asia.

Loyalty programs. Each brand in the Carnival ecosystem has its own loyalty program allowing customers to acquire points and redeem them for different perks from onboard discounts to early boarding. Those points are not combined throughout the entire portfolio.

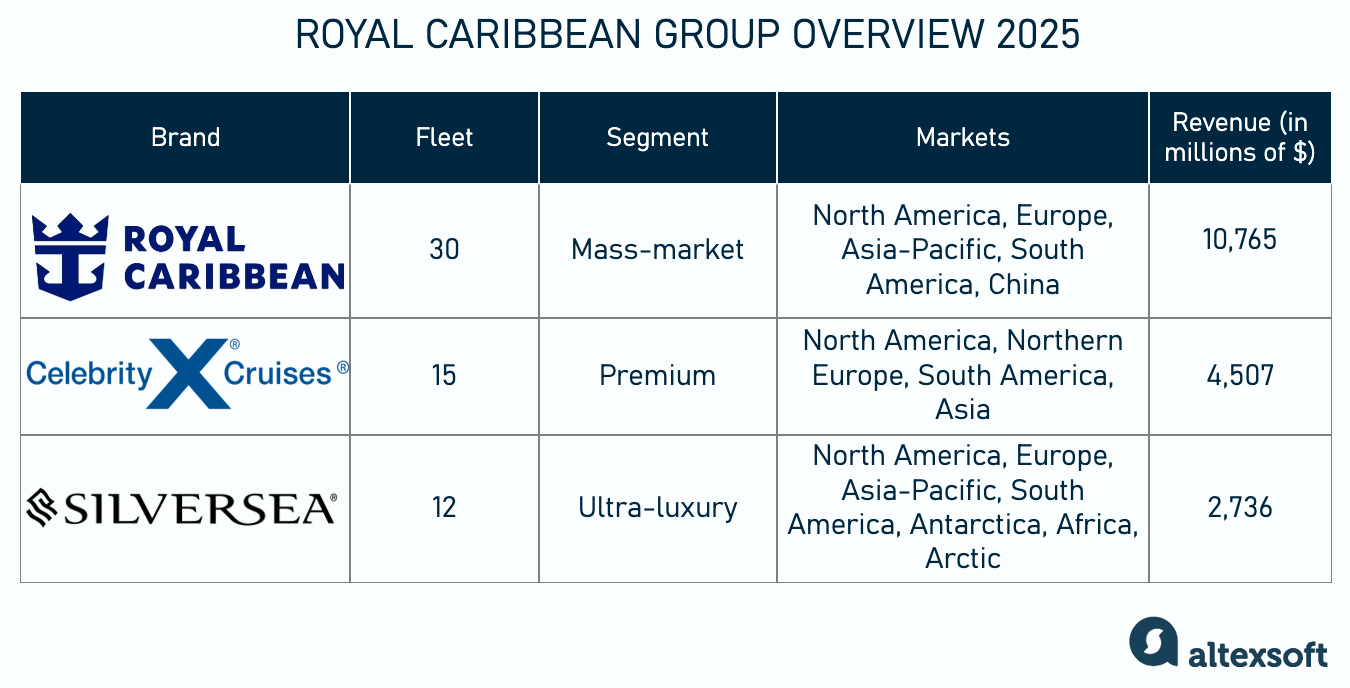

Royal Caribbean Group Overview

Royal Caribbean Group is one of the world's largest and most recognized cruise companies, renowned for its innovative approach to cruise travel. Headquartered in Miami, Florida, the company operates a range of cruise brands and boasts a vast fleet that includes some of the largest and most advanced ships in the world.

Founded in 1968, the company has grown from being a small, regional cruise operator into a global leader. It operates primarily in North America but has expanded its presence the world over, offering cruises to a variety of destinations with a strong emphasis on providing unique and technologically advanced travel experiences.

Brands of Royal Caribbean Group overview

Key brands. Here are the key brands under its umbrella.

Royal Caribbean. As the flagship brand, Royal Caribbean is known for its innovative, large ships and wide range of activities, amenities, and dining options. Royal Caribbean is famous for its “Oasis-class” ships, which are among the largest in the world.

Celebrity Cruises offers a more refined, premium cruising experience. The brand emphasizes fine dining, cultural enrichment, and wellness. Celebrity ships are slightly smaller than Royal Caribbean’s megaships, allowing for a more intimate experience while still providing modern amenities and outstanding customer service.

Silversea Cruises is the ultra-luxury arm of Royal Caribbean Group for affluent travelers. Silversea specializes in all-inclusive, boutique-style cruises with an emphasis on personalized service, gourmet dining, and exclusive itineraries. Silversea's ships are smaller, with access to both popular and remote destinations around the world. The brand is particularly known for its expedition cruises to polar regions and other exotic locales.

Royal Caribbean Group also owns 50 percent of TUI Cruises and Hapag-Lloyd Cruises. Based in Germany, these brands operate primarily in the European market, offering a more casual, family-friendly experience with a focus on the German-speaking audience.

Fleet size and capacity. Royal Caribbean Group operates 57 ships across its various brands. The fleet includes some of the world’s largest and most advanced ships, particularly under the Royal Caribbean brand, such as Icon of the Seas and Utopia of the Seas, which can carry up to 6,000 passengers.

Market focus and major destinations. North America is Royal Caribbean Group’s primary market, with a significant presence in the US and Canada, offering cruises to the Caribbean, Mexico, and other tropical destinations. With the acquisition of TUI Cruises, Royal Caribbean Group has expanded its footprint into the European market. The Group has been expanding in the Asia-Pacific region and South America, with Royal Caribbean and Celebrity Cruises targeting Chinese, Japanese, Southeast Asian, and South American ports. And through Silversea Cruises, Royal Caribbean Group offers ultra-luxury expedition cruises to Antarctica and the Arctic.

Loyalty programs. Although each cruise line in the group has its own loyalty program, the company offers cross-benefits. Since 2024, Royal Caribbean Group has had a status match among its brand portfolio. It means that once a customer reaches a certain loyalty tier on, say, Silversea, they can get equivalent benefits when sailing with Celebrity.

Norwegian Cruise Line Holdings overview

Norwegian Cruise Line Holdings is a prominent global cruise company headquartered in Miami, Florida, and domiciled in Bermuda. Originally founded in 1966 by Knut Kloster and Ted Arison, it operated a car ferry between the UK and Gibraltar. Soon Kloster left, acquired extra ships and formed Carnival Cruise Lines.

One of the hallmark innovations introduced by NCL was the concept of freestyle cruising, launched in 2000. This concept offered guests flexibility by eliminating fixed dining times and allowing them to choose from a variety of dining venues at their convenience. This model was innovative for the cruise industry, which had traditionally adhered to fixed dining schedules and more rigid structures.

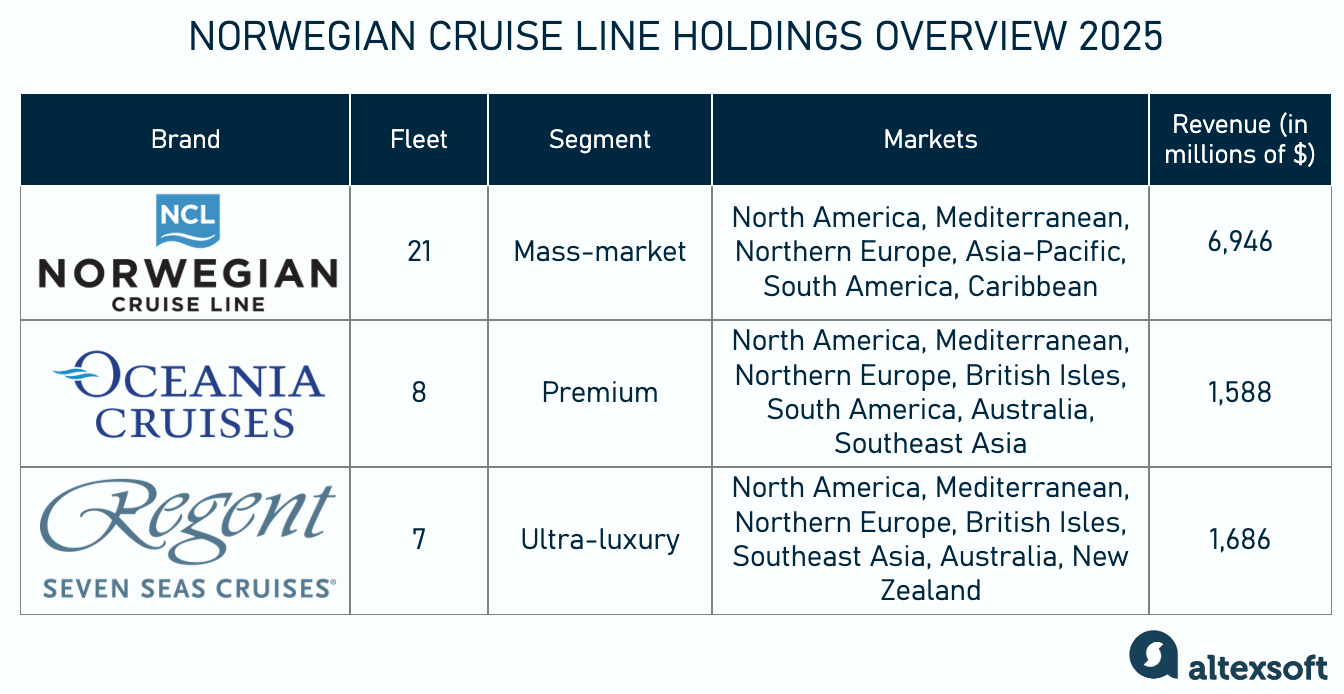

Brands of Norwegian Cruise Line Holdings overview

Key brands. There are three brands under the NCLH umbrella.

Norwegian Cruise Line (NCL) is the flagship brand of Norwegian Cruise Line, known for their large size and a broad range of activities and dining options. NCL targets a wide demographic, including families, couples, and solo travelers. It’s also well known for its extensive and diverse itineraries, offering cruises to the Caribbean, Alaska, Hawaii, and Europe. With a fleet that includes the modern Prima Class, which boasts cutting-edge amenities, NCL continues to provide a dynamic cruise experience that blends relaxation with adventure.

Oceania Cruises is a premium cruise brand, known for its luxurious and destination-driven voyages. With a focus on gourmet dining and intimate travel experiences, Oceania targets affluent travelers and couples seeking longer stays in port and extended itineraries that allow for deeper immersion in local cultures. Oceania’s fleet includes R Class, O Class, and the newer Vista Class ships.

Regent Seven Seas Cruises is Norwegian Cruise Line Holdings' ultra-luxury brand, which covers everything from shore excursions to gratuities, beverages, and flights. Regent's fleet includes the Explorer Class ships, such as the Seven Seas Explorer, regarded as one of the most luxurious cruise ships ever built.

Fleet size and capacity. As of 2025, NCLH's combined fleet consists of 36 ships with a total capacity of approximately 70,050 berths. The company has plans to expand its fleet further, with 13 new ships scheduled for delivery through 2036.

Market focus and major destinations. As with major cruise operators, North America remains NCLH’s largest market, with the company heavily focused on the US and Canada. Oceania Cruises and Regent Seven Seas Cruises have established themselves as key players in the Mediterranean and Northern Europe, offering voyages to destinations such as Greece, Italy, Spain, Norway, and the British Isles. The company also offers voyages to Japan, China, Thailand, Vietnam, India, Indonesia, and Singapore, as well as South America itineraries to the coasts of Antarctica.

Loyalty programs. Just like Carnival Corporation, Norwegian doesn’t offer reciprocity across its independent loyalty programs: NCL Latitudes, Oceania Club, and Seven Seas Society.

MSC Cruises overview

MSC Cruises is a prominent global cruise line headquartered in Geneva, Switzerland, and part of the MSC Group, which also includes MSC – a global leader in container shipping.

Founded in 1987, MSC Cruises initially operated with a single ship, MSC Rhapsody, and under a single main brand. It’s known for family-friendly “affordable luxury” offerings and a strong emphasis on Mediterranean routes. This value-driven model attracts a large number of family-oriented travelers, couples, and solo cruisers, who seek a balance between luxury amenities and competitive pricing.

MSC’s ships feature elegant staterooms, expansive public spaces, world-class dining options, and a host of onboard activities, all while maintaining reasonable pricing for its various itineraries. Guests are not required to pay premium rates for exceptional experiences such as high-end dining, spas, and theater productions, making MSC Cruises an attractive option for value-conscious travelers.

Fleet size and capacity. As of 2025, MSC Cruises operates a fleet of 26 ships, with a total capacity of approximately 50,000 berths. MSC Cruises continues to grow its fleet, with 4 new ships scheduled for delivery by 2030.

Market focus and major destinations. The brand is especially strong in its home market of Europe, where it offers extensive cruises in the Mediterranean, Northern Europe, and the Baltic Sea. MSC is also a leader in the Caribbean and South America, with ships frequently departing from Miami, Rio de Janeiro, and Buenos Aires. On top of that, MSC is increasingly focusing on the North American market, offering more cruises to the Caribbean, Bermuda, and Mexico. Additionally, MSC has made strides in Asia-Pacific and Dubai, operating luxury cruises and exclusive itineraries to China, Singapore, India, and the Arabian Gulf.

Loyalty program. MSC’s rewards program is called MSC Voyagers Club. It has six tiers, offering embarkation benefits, special events, complimentary services, and discounts.

Other cruise line companies

Although no match for the giants we discussed above, to be fair and complete, we'll mention other notable cruise lines.

Viking Cruises. Viking offers three types of experiences: river, ocean, and expedition cruises. The line is known for its stylish ships, smaller, more intimate vessels, and strong emphasis on inclusive itineraries. Viking operates a fleet of 14 ocean ships and around 90 river ships with additional ships in the pipeline. Viking offers cruises to Europe, Asia, South America, and the Caribbean, with a heavy focus on European river and ocean itineraries. Popular destinations include the Mediterranean, Norwegian Fjords, British Isles, and Antarctica.

Disney Cruise Line. As of 2025, Disney operates a fleet of 6 ships with 2 more scheduled to be set afloat in 2025. They are known for their iconic Disney theming, from kid-friendly amenities like character meet-and-greets to more refined offerings like adult-only dining and bars. Disney Cruise Line operates mainly in the Caribbean, Bahamas, and Mediterranean, with several ships also visiting Alaska, Northern Europe, and Hawaii. Disney cruises are typically centered around family-oriented destinations, often with private island stops, such as Castaway Cay in the Bahamas.

Virgin Voyages. Virgin Voyages brings a fresh, modern approach to cruising with a focus on millennials and Gen Z travelers. The brand is known for offering a more adult-oriented, laid-back cruise experience, with no kids allowed and a strong emphasis on luxury, style, and sustainability. Virgin Voyages currently operates 4 ships: the Scarlet Lady, Valiant Lady, Resilient Lady, and Brilliant Lady. Virgin Voyages sails primarily in the Caribbean, offering shorter itineraries (3-5 days), but also has cruises to the Mediterranean and Europe.

Waves of change

The cruise industry in 2025 is navigating through a wave of transformative trends, each reshaping how people experience their vacations at sea. Below are some of the most significant emerging trends.

Sustainability takes the helm. With growing scrutiny over the environmental impact of large ships, cruise lines are prioritizing green technologies. The industry is seeing a significant rise in the use of LNG-powered (liquified natural gas) ships from AIDAnova in 2018 to TUI Mein Schiff Relax in 2025. This shift is part of a broader movement toward more responsible travel practices, which we explore in depth in our article on sustainability in travel.

Expedition cruises gain traction. From 2019 to 2023, the number of passengers embarking on an expedition cruise increased by 70 percent. Just like in the late 19th century, wealthy tourists voyaged to see the marvels of the world, modern travelers hop on small, agile ships to see Antarctica, Patagonia, and the Galapagos Islands. Viking Cruises, for example, has expanded its fleet with ships specifically designed to navigate polar regions.

Technology transforms the cruise experience. Cruise lines are rapidly adopting technology to enhance the guest experience, from facial recognition to expedite boarding to smart cabins where guests can control lighting, temperature, and entertainment with a mobile app or voice command.

All the ways AI is already used in cruises

The integration of wearable technology is also growing. Passengers can use wristbands to make payments, unlock cabins, and even track their dining reservations, all without having to carry a keycard or phone. This makes the experience more seamless and user-friendly, especially for families or solo travelers who want to avoid unnecessary hassle.

Asia and South America are emerging markets. As cruise lines continue to look for new growth opportunities, Asia and South America are emerging as key markets. With MSC noticing the growth of demand in Brazil and Argentina and TUI moving into the LATAM region, South America is becoming a big player in the cruise industry. At the same time, cruise companies like Carnival and Royal Caribbean are expanding their fleets and itineraries in Asia. China is expected to become one of the largest cruising markets in the coming decade.

Cruise crowds are under fire. Cruise tourism has increasingly come under scrutiny for its role in overtourism, particularly in fragile or high-traffic destinations where ship arrivals can overwhelm local infrastructure and ecosystems. Cities like Venice, Dubrovnik, and Barcelona have implemented measures to curb cruise ship traffic, such as limiting daily passenger numbers, banning large vessels from city centers, or introducing tourist taxes. CLIA representatives note, though, that cruise ships are a small fraction of tourism traffic despite being the most visible ones. It’s clear now that these policies will continue impacting the passenger experience.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.