In today's cutthroat travel industry, independent agents face fierce competition from big OTAs and TMCs – yet many thrive by joining forces through travel consortia. These networks help level the playing field by connecting agents to a wealth of resources – from enhanced commissions and preferred supplier deals to technology and marketing support. Dive in to discover top players, benefits, and how to pick your perfect match.

What is a travel consortium and a co-op?

A travel consortium is a network of independent travel agencies/advisors that join forces to increase their purchasing power and marketing reach.

By pooling their sales volume, members can access better supplier deals, negotiate higher commissions, and share marketing resources. This allows individual agencies to compete with larger, more established players in the travel industry.

You might have also come across the term co-op – this refers to a specific type of consortium. In a co-op, members own a stake in the organization, often by purchasing shares of stock. This model not only provides the benefits of collective bargaining but also gives members a share of the profits and a voice in the decision-making process.

In contrast, traditional consortia (often privately held or equity-backed) retain profits for the parent company, rather than distributing them to members as patronage dividends.

For simplicity, in this post, we'll refer to both types of organizations as consortia.

Travel consortia benefits for agents, suppliers, and travelers

Travel consortia offer a range of valuable benefits to independent travel advisors and agencies.

Access to higher commission tiers. Suppliers use a tiered commission structure to incentivize volume. A standalone agency booking $50,000 in annual cruise sales might remain stuck at the 10 percent base tier.

However, when that agency joins a consortium that collectively books $10 billion, the cruise line recognizes the agency as part of that $10 billion block. Consequently, the agency can see its commission jump to 15 percent, resulting in a 50 percent increase in revenue.

Exclusive supplier deals. Besides higher commissions, consortia leverage collective buying power to negotiate exclusive rates and special perks (like upgrades and additional amenities) with suppliers. For example, bookings made through Virtuoso’s preferred hotel program may include benefits such as complimentary breakfast, property credits, or room upgrades.

Marketing support. Members benefit from advertising, printed materials, digital marketing tools, and branded collateral that boost visibility and attract new clients without the high costs of individual promotions.

Technology. Many consortia offer access to proprietary booking platforms, itinerary builders, CRM systems, and lead-generation tools that streamline operations and improve client service.

Training and education. Consortia often provide ongoing training through webinars, conferences, and certification programs, ensuring members stay informed about the latest industry trends and best practices.

Networking and collaboration. Being part of a consortium means connecting with other travel professionals, sharing insights, and collaborating on strategies to grow your business.

Additionally, being part of a large consortium boosts your agency's credibility—while your agency may be unknown, your consortium membership lends you a certain level of status.

Note that consortia typically do not provide accreditation or back-office support (such as commission reconciliation or tax reporting).

But agents aren’t the only ones who benefit from partnering with a consortium. On the other side of the coin, suppliers gain greater visibility and increased business volume. Plus, managing relationships with a few large consortia is more efficient than dealing with thousands of small agencies individually.

Travelers benefit as well. When booking through a consortium-affiliated agent, they often enjoy better pricing and additional perks not available elsewhere.

General eligibility requirements to join a travel consortium

While specific membership requirements vary, most travel consortia share some common eligibility criteria.

Business status. You must operate as a legitimate travel agency or independent business. This typically means having a legal business structure (such as an LLC, sole proprietorship, or corporation) and valid business licenses.

Experience. Many consortia prefer members with industry experience or a proven track record. Some consortia may require agencies to have been in business for a certain period or meet a minimum sales threshold.

Accreditation. Some consortia require certain industry credentials, such as IATA, ARC, or CLIA. However, others may allow you to join through a host agency or professional network that already holds these credentials.

Sales volume. Higher-end or more exclusive consortia may set minimum sales volume or business growth targets to ensure agencies can generate the required business to justify membership.

Financial stability. A credit check or proof of financial health may be part of the application process, especially for consortia that involve profit-sharing or performance-based fees.

Each consortium has its own set of specific requirements, and we'll dive deeper into the membership criteria for each one in the following sections.

Travel ecosystem: consortium vs host agency vs franchise vs association

Before deciding whether to join a travel consortium, it’s essential to understand how it fits in the broader ecosystem of travel industry structures.

Host agencies: ICT, Travel Planners, Outside Agents, KHM, etc.

Host agencies act as the operational and legal umbrella for independent contractors (ICs). They provide critical industry credentials from ARC, IATA, and CLIA—essential for booking travel and receiving commissions.

Also, unlike consortia, hosts can manage back-office functions such as commission tracking, tax reporting, and initial training.

Importantly, most hosts are members of a larger travel consortium. For instance, such leading hosts as Nexion, Outside Agents, and KHM are all members of Travel Leaders Network, meaning advisors who join them gain automatic access to that consortium’s benefits.

Travel franchise: Cruise Planners, Dream Vacations, Expedia Cruises, etc.

A franchise model offers a turnkey “business-in-a-box” solution in which the agency operates as an independent business entity while leveraging the franchisor's branding, accreditation, and standardized operating procedures.

Unlike a consortium member, which operates under its own brand (e.g., “Smith Travel, a member of Virtuoso”), franchisees adopt the franchisor’s branding and marketing protocols.

While this provides strong structure and brand recognition, it also limits operational autonomy.

Franchises may hold their own consortium memberships or operate with hybrid models that blend both frameworks.

Trade associations: ASTA, CLIA, ARTA, etc.

Organizations like the American Society of Travel Advisors (ASTA) and Cruise Lines International Association (CLIA) are not consortia. Travel associations do not negotiate commissions or consumer perks, but they do play an important role in legitimizing and advancing the profession.

For example, ASTA advocates for travel agents/advisors, tour operators, and suppliers by lobbying on regulatory issues, providing education (e.g., Verified Travel Advisor certification), hosting networking events, and promoting ethical standards to enhance profitability and professionalism.

How to join a travel consortium

The decision to join a travel consortium depends on how you want to access its benefits: through a host agency or directly. This choice is often influenced by your agency’s size and sales volume.

The host agency route for smaller agencies

For new or small-to-mid-size agents, joining a host agency is typically the most practical entry point. The host holds the consortium membership, and agents access the benefits through the host’s credentials.

Pros:

- Low overhead with minimal fees (e.g., $50/month) and commission splits (e.g., 80/20)

- No large consortium fees or sales quotas to meet

Cons:

- Revenue dilution as agents give up 10-30 percent of each booking

- Limited visibility, as agents are listed under the host's profile

Best for: agents with sales under $1-2 million or those focused purely on sales without managing back-office operations.

The direct membership route for large agencies

For larger, established agencies, direct membership offers full control over revenue, branding, and supplier relationships. Agents obtain their own IATA/ARC accreditation and manage their back-office systems.

Pros:

- 100 percent commission retention and full control over branding

- Direct relationships with suppliers

Cons:

- High fixed costs (IATA fees, insurance, bonds, and consortium dues)

- Significant back-office management required

Best for: agencies with $2-5 million in annual sales, where direct membership becomes more financially viable.

The important difference here is that in a host agency model, suppliers see only the host agency's total volume, not the individual agency's sales. This means that while the agent benefits from the host’s relationships, their individual performance doesn’t directly influence the supplier’s view or negotiations.

In contrast, with a consortium, suppliers typically see each agency’s individual production alongside the consortium’s aggregate volume. This allows individual agencies to negotiate based on their own sales and performance.

Still, recent industry trends show that a number of travel agency owners are reevaluating their consortium affiliations and opting to join host agencies that provide consortium access. The main reason for this shift is high consortium fees, coupled with concerns about their perceived value.

Travel Weekly’s Travel Industry Survey 2025 estimates that 55 percent of travel agents/advisors belong to at least one consortium and 49 percent work with a host agency. Only 6 percent of travel professionals report having no affiliations.

Largest travel consortia

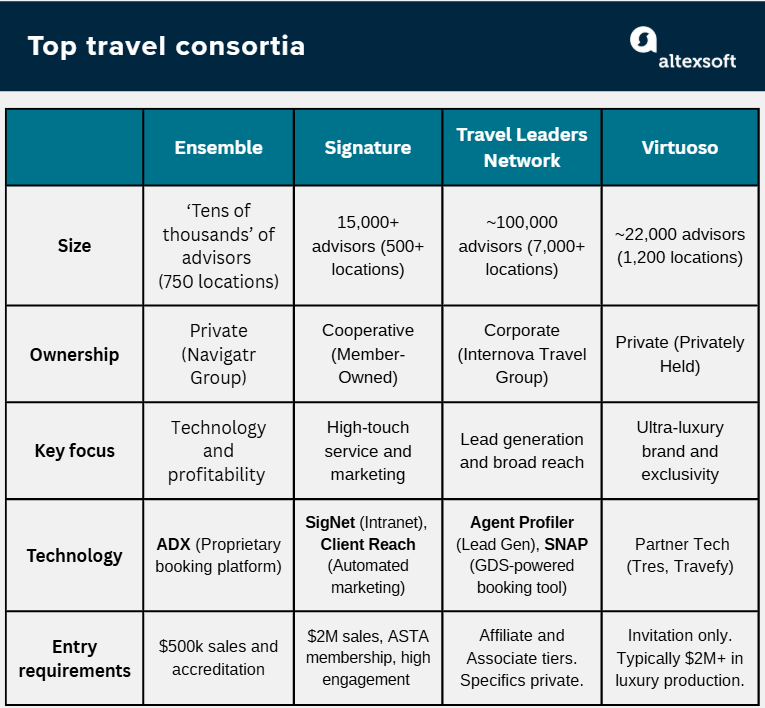

While there are numerous smaller networks, the market is dominated by four major players.

Top travel consortia compared

Ensemble: the tech-forward challenger

Ensemble was founded in 1968 and operated as a cooperative before being acquired by Navigatr Group (parent company of Kensington Tours and Travel Edge) in 2022. This acquisition sparked a pivot toward a technology-centric, profitability-focused model.

In the 2024 interview, Michael Johnson, president of Ensemble, estimated the number of member advisors as “tens of thousands.”

Culture. Post-acquisition, Ensemble is rebuilding its identity around modernizing travel agency workflows and helping agents make more money per transaction with better tools.

Offers and benefits. The Ensemble Cruise Program includes connections to 30 cruise lines. The number of suppliers in the Air Program and Hotel Program is not disclosed.

In addition to their Universe of Ensemble (UofE) training platform, in January 2026, Ensemble launched the Fastrack educational program, designed specifically to help new-to-industry agents start their businesses. Fastrack offers two membership tiers, both priced at $85 per month.

- Fastrack Basic includes a self-guided course on agency set-up, access to Ensemble’s full learning library, business resources, and ADX.

- Fastrack Pro (monthly payments plus a one-time fee of $1,999) adds one-on-one support, registration for Horizons (Ensemble’s annual conference), and custom website design with one year of support.

In total, Fastrack provides 38 core courses, with more than 100 additional courses available for continued learning as your business grows.

Technology. Their proprietary Agent Digital Experience (ADX) tool allows agents to book air, hotel, and activities in a single platform that displays commission levels upfront. Agents can bundle services and manage margins effectively, a capability often lacking in other consortia that rely on third-party tools.

Ensemble also provides ClientSites – a website builder for travel agents.

Cost and requirements. To join, the agent must have $500,000 in sales and industry accreditation. Other requirements and fees aren’t publicly available.

Affiliated host agencies. Travel Network, TravelOnly, Travel Edge, Fareconnect.com, etc.

Signature Travel Network: the member-owned cooperative

Created in 1956, Signature – the only among the top four – operates as a cooperative, meaning it is owned by its member agencies. The Network collectively generates $11 billion in annual sales and includes over 15,000 travel advisors.

Culture. As a co-op, members receive a patronage dividend (profit share) at the end of the year, effectively lowering the net cost of membership. The culture is described as “family-like” and highly collaborative.

Offers and benefits. Its Hotel & Resorts Program includes perks at 1,300+ properties. There’s also a Cruise Program, Land & Tour Program, and Specialty Suppliers Program (including travel insurance, car rentals, rail, etc.). The full list of partner suppliers is available on the website.

Also, Signature is renowned for its high-touch marketing, including the sophisticated The Travel Magazine, personalized direct mail campaigns that appear to come directly from the agency, and an extensive digital marketing suite.

Technology. Signature offers a suite of tech solutions, including

- SigNet (member intranet),

- SIG Cruise Pro (cruise booking tool),

- Client Reach (marketing tool),

- Pocket Travel (a white-labeled mobile app), etc.

It has also been incorporating AI into its solutions to increase agent efficiency.

Cost and requirements. To join as a US or Canadian agency, the requirements include $2 million in preferred supplier sales (or $1 million for our International Affiliates program), ASTA membership, a CRM that integrates with Signature's web service, annual attendance at Signature events, and the use of Signature’s marketing and technology tools.

Affiliated host agencies. Travel Planner, Cruise Planners, Oasis Travel Network, ATHome, etc.

Travel Leaders Network (TLN): the scale giant

Part of the massive Internova Travel Group, Travel Leaders Network is the largest consortium by member count and sales volume. It includes nearly 7,000 travel agency locations – around one-third of North America’s agencies – representing over 100,000 advisors. And its network actively scales – in 2025, 300 new member agencies joined.

TLN generates over $17 billion in annual sales volume. The broader Travel Leaders Group reports gross travel sales approaching $21 billion annually.

Culture. TLN leverages its massive size to negotiate aggressive commission tiers across all price points, not just luxury. It is less “exclusive” than Virtuoso but arguably more powerful in terms of raw market share.

Offers and benefits.

TLT partners with over 120 suppliers across cruise, tour, air, car, rail, and insurance. It has a robust suite of cruise programs with access to 21 suppliers, including Distinctive Voyages, Amenity Departure Dates, and the Culinary Collection.

Its SELECT Hotel Program includes a range of offerings from broad global inventory to curated luxury and boutique collections, high-end resorts, and private villas.

TLT also provides training and holds regular events.

Technology. TLN provides

- Cruise Complete – a dedicated, web-based cruise booking system;

- AgentMate – an agency management and accounting system;

- Agent Profiler – a lead-generation and client engagement tool that helps agents build an online profile, capture leads from supplier programs, and grow their customer base; and

- SNAP – a web-based platform built on top of Sabre GDS that lets agents search and book air, hotel, and car reservations.

In 2025, TLT reported the exceptional success of Agent Profiler, with the average booking value per lead increasing from $6,500 the previous year to $10,655.

Besides, in recent years, the consortium has been moving toward a CRM-agnostic approach, expanding integrations so that a wider range of CRM platforms can communicate with its systems. This gives agencies greater flexibility to use the tools that best fit their workflows, rather than being locked into a single CRM solution.

Cost and requirements. TLN offers two options to join: an Affiliate Membership for independents and an Associate Membership (a franchise-like model). However, specific requirements are not publicly available.

Affiliated host agencies. TLN has an extensive list of affiliated host agencies that includes Avoya, Nexion, Outside Agents, Dream Vacations, etc.

Virtuoso: the luxury titan

Virtuoso is widely recognized as the most prestigious consortium, functioning almost as a consumer-facing luxury brand. It is an invitation-only network of over 1,200 travel agency locations with more than 22,000 advisors in 58 countries. Its network sales total $35 billion.

Culture. Virtuoso focuses exclusively on luxury and ultra-luxury travel. Its brand promise is “the best of the best,” and it invests heavily in consumer awareness, training travelers to specifically seek out a Virtuoso Advisor.

Offers and benefits. Virtuoso works with over 2,300 preferred partners, including hotels, cruise lines, tour operators, and even Virgin Galactic as an exclusive space travel provider.

Its Hotel program includes over 1,700 hotels, resorts, lodges, villas, camps, and private islands. The Cruise program (Virtuoso Voyages) offers hosted sailings with exclusive shore events and shipboard credits from 30 cruise lines.

Technology. Virtuoso has a preferred partnership with Tres Technologies for agency back-office management. In 2025, it also announced a direct integration with Travefy, a CRM and itinerary builder designed for the travel industry.

Cost and requirements. Virtuoso does not publicly disclose standard membership fees or requirements. Non-official information suggests that direct membership may involve annual dues and minimum performance commitments ($2 million in luxury production specifically), but specifics vary by agency and region and are usually disclosed only during the invitation/application process.

Affiliated host agencies. Host agencies that have Virtuoso membership include Gifted Travel, 1000 Mile Travel, The Travel Society, Global Travel Collection, etc.

Other travel consortia worth mentioning are NEST, TRAVELSAVERS, MAST, and Traveller Made, though they definitely lag behind the big 4. The ones more focused on corporate travel are ABC Global and Thor.

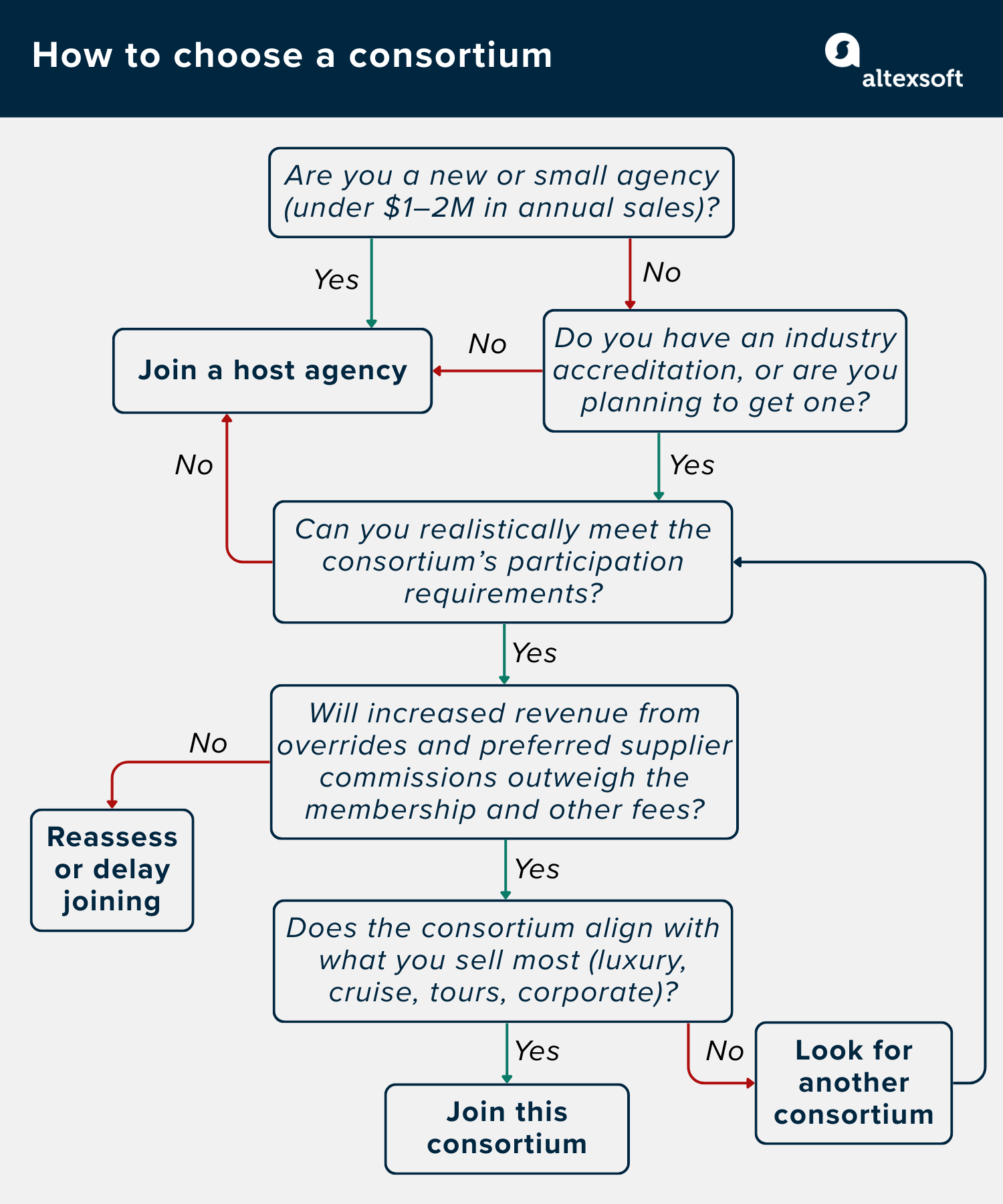

How to choose a travel consortium

As we explained above, in many cases, joining a consortium directly only makes sense once you’ve outgrown the host model. The key question is: What incremental value does direct membership provide beyond what your host already offers?

But IF, after all, you decide to join directly, evaluate how a consortium aligns with your business model, growth stage, and long-term goals. Here are the key factors to consider.

A simple checklist for choosing a travel consortium

Size, niche, and region

Look at how many member agencies and advisors belong to the consortium and what their total annual sales volume is. Larger networks generally have more negotiating power with suppliers—but smaller, more curated consortia may offer deeper relationships and stronger support. Size alone isn’t a guarantee of value.

Some consortia are luxury-focused, others specialize in cruises, tours, or corporate travel, while some are broad-based. The best consortium for you is the one that aligns with what you sell most. A luxury-heavy consortium may offer little value if your core business is mass-market cruising or FIT travel.

If the consortium operates regionally, confirm which markets it serves and whether it has local or regional chapters. Regional events and peer communities can be a meaningful source of support and collaboration.

Once you confirm that the consortium meets your requirements, see if you meet theirs.

Membership requirements, eligibility, and costs

Many consortia have minimum sales thresholds, preferred-supplier production requirements, or geographic limitations. Some are open to independent agencies only, while others work primarily through host agencies. Be realistic about whether your current sales volume—and your growth trajectory—fits their expectations.

As for the cost, consortia can charge in different ways: a one-time setup fee, an annual membership fee, or, for co-ops, a required stock purchase. Ask whether fees are fixed or scale with production, and whether additional costs apply for training, marketing programs, or technology. The key question is not just the cost but how long it will take to break even.

Supplier programs, commissions, and perks

Review the consortium’s preferred suppliers, commission tiers, and client perks. Ask how commission levels are earned, whether higher tiers are performance-based, and what tangible benefits (upgrades, amenities, onboard credits) your clients actually receive.

Note that while joining a consortium can offer valuable perks, preferred partner agreements with suppliers often outweigh the benefits of consortium membership. Additionally, in many cases, direct relationships with hotel sales managers lead to better upgrades and benefits than those tied to consortium status.

Technology and data ownership

Technology can be a major differentiator—or a hidden burden. Evaluate

- what booking, CRM, marketing, and reporting tools are included;

- how complex the setup and onboarding are;

- whether there are additional fees for using the tools;

- and most importantly, who owns the data.

If you leave the consortium, can you take your data and continue using the platforms for a fee, or do you lose access entirely?

Marketing, lead generation, and mailing lists

Understand what marketing support is available and how flexible it is. Are programs optional or mandatory? Can you pick and choose campaigns, or are there required contributions? Ask whether the consortium offers a lead-generation program or agent directory, and how visible individual advisors are within it.

Also, clarify how marketing lists are built. Are leads generated by the consortium, or does participation require sharing your own client database? Always understand what data you are expected to provide—and what you get in return.

Training, education, and reviews

If you’re a newbie, look at the quality and depth of training offered. Is it introductory or advanced? Product-focused or business-building? Strong consortia provide ongoing education, not just onboarding materials.

Before committing, talk to current members, not just the consortium’s sales team. Ask what benefits they actually use, what they stopped using, and what surprised them after joining. A good consortium should feel like a strategic partner—not just another line item on your expense sheet.

And at the end of the day, remember that you don’t have to join a consortium to succeed as a travel agent. Often, it’s your experience and exceptional service that travelers value most—far beyond flashy perks or affiliations.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.