Insurance has always been about timing: offering the right protection at the right time. But in today’s crowded retail landscape, timing alone isn’t enough. Customers expect insurers to anticipate their needs, personalize offers, and remove friction from every interaction. This is where Next Best Action (NBA) comes in – a data-driven approach that helps insurers decide not just what to offer, but when and how to engage. Done well, NBA can transform distribution, boost retention, and make customer relationships feel less transactional and more trusted.

What is the Next Best Action (NBA) and how it affects insurance

Next Best Action (NBA) is a customer-centric approach to engagement. It means identifying the single most effective action a company can take during a customer interaction – one that’s most likely to move the relationship forward. That “action” could be anything from displaying a personalized banner, congratulating on a new home purchase, or, sometimes, doing nothing at all.

The brain powering this strategy is the Next Best Action system. It’s often built as part of a customer decision hub or CRM platform. Typically using machine learning algorithms, it analyzes a customer’s past, current, and expected future behavior, predicts what might motivate them, how their needs have evolved, and helps decide whether to send a personalized reminder, a limited-time discount, or simply wait a few hours before nudging again. Which brings us to how this approach is transforming one of the most relationship-driven industries: insurance.

Traditionally, relationships between insurance carriers and customers have been distant and transactional. Customers hear from their insurer only when it’s time to renew a policy, pay a premium, or file a claim. That leaves little room for meaningful engagement or loyalty.

So how exactly does the Next Best Action system change that dynamic?

The Next Best Action technology provides design support for insurer and distributors

Maximizing the effect of limited touchpoints. Customers typically interact with their insurer only a few times a year – during quotes, claims, or renewals. NBA ensures each interaction is meaningful, turning these rare touchpoints into opportunities for engagement and conversion.

“The focus on next best action at the consumer level is really about identifying moments of opportunity. Whereas in retail, it's more about demand generation, in the insurance industry, it's about capturing very specific moments of demand,” says Matt Clifford, life insurance expert and consultant.

Personalizing the customer experience. By continuously learning from behavior and context, NBA delivers tailored recommendations and actions, making interactions feel relevant and thoughtful. Adjusters, underwriters, and service teams are prompted with the precisely correct and timely next step – whether it’s suggesting additional coverage, guiding a complex claim, or providing proactive support.

Driving sales and cross-selling opportunities. NBA recommendations help agents and digital channels present the most relevant offers.

Improving retention and reducing churn. By identifying at-risk customers and suggesting timely retention actions, NBA can save policies from lapsing.

Enhancing operational efficiency. NBA streamlines decision-making for agents and service teams, reducing guesswork and enabling faster, more informed actions.

It's all about how you can translate data-driven insights to help identify and close sales – or how the carrier can help inform the agent of when a sale is most likely, that the demand is highest, and there's the greatest opportunity to close a sale.

If analytics show a client recently bought a home but doesn’t yet have life insurance, the NBA model might recommend that the agent reach out with mortgage protection options. Or, if an auto-insurance customer has submitted a travel-related claim, the system might prompt an offer for short-term travel coverage or personal accident insurance.

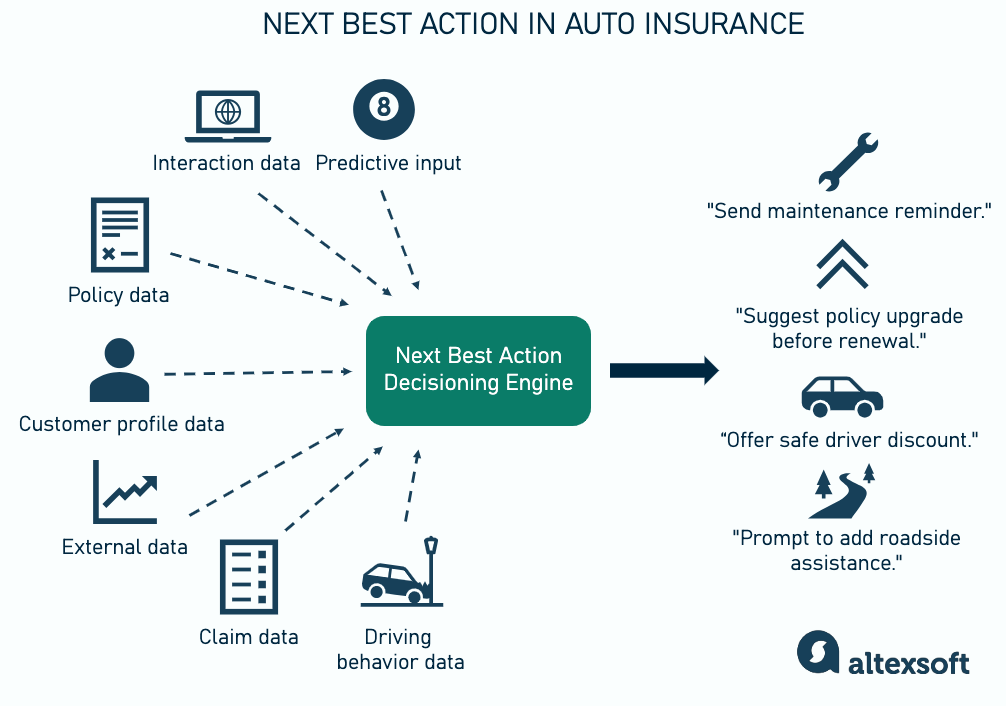

How does NBA work?

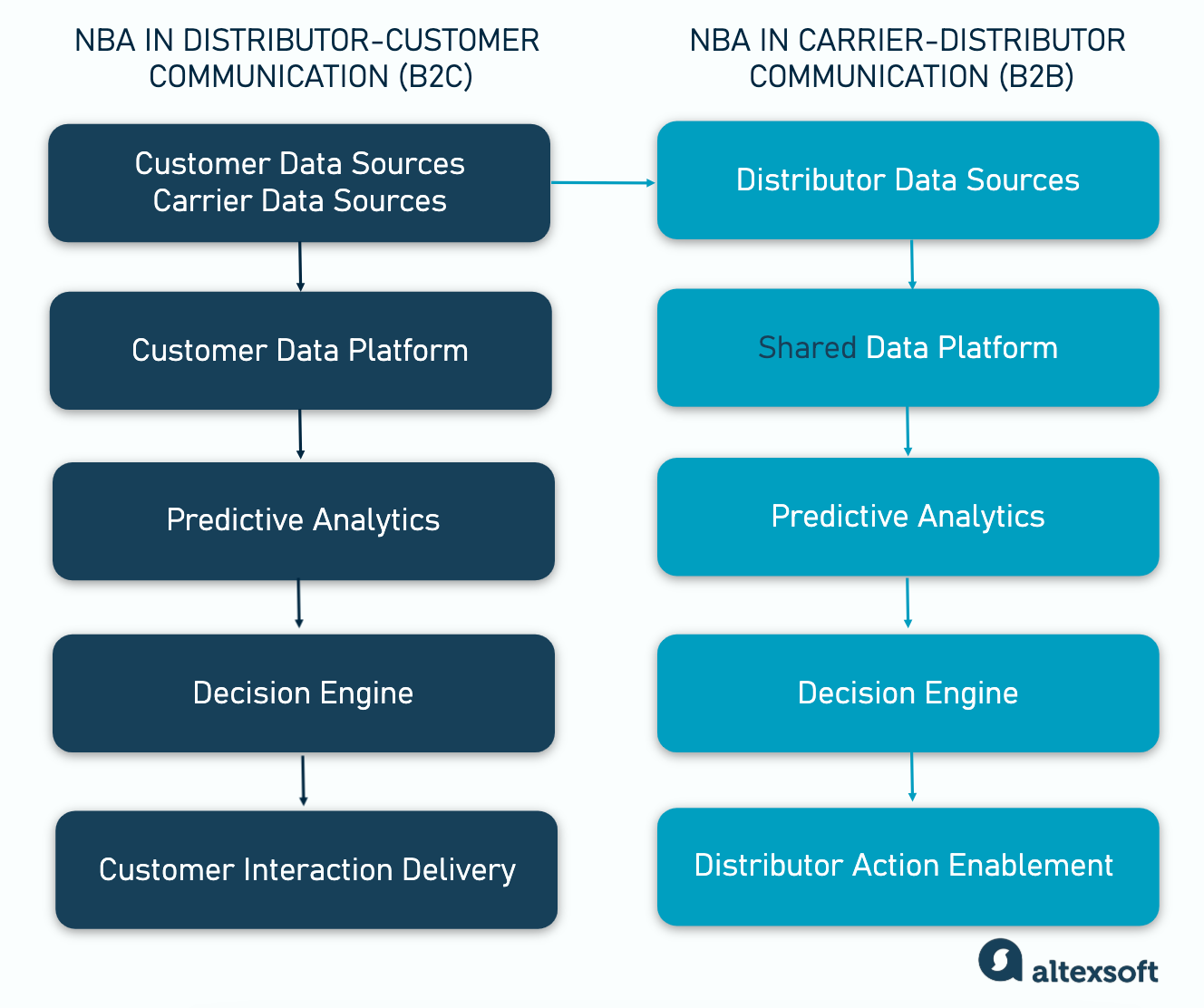

At its core, Next Best Action combines data, analytics, and decision logic to determine the most effective action at any given time. In insurance retailing though, it can occur on two different levels: between the carrier and distributor (B2B), and between the distributor and end customer (B2C).

Layers of the Next Best Action approach

NBA in distributor-end customer communication

In the B2C context, NBA helps distributors such as agents or brokers interact with customers more effectively by recommending what to do next based on behavioral and contextual signals.

Data collection and integration. Customer data flows in from multiple touchpoints: policy information, claims, quote requests, web and app activity, call center logs, and even external data like life events or location-based risk factors. These inputs are unified in a Customer Data Platform (CDP) or data warehouse, ensuring a single customer view.

Predictive analysis. Once the data is centralized, predictive models and machine learning algorithms analyze it to estimate probabilities, such as the likelihood a customer will renew a policy, purchase an additional product, or churn. These models may include propensity scoring, churn prediction, or personalized product recommendations. Advanced setups can also leverage reinforcement learning or generative AI to continuously refine recommendations.

Watch us explain how predictive analytics is used to forecast demand

Decision engine and delivery. The model outputs feed into a decision engine (e.g., Pega Customer Decision Hub, FICO Blaze Advisor, or SAS Real-Time Interaction Manager), which evaluates multiple possible actions – send an offer, schedule a call, wait for a better time – and selects the one with the highest predicted impact. Recommendations are then delivered directly to customers through their preferred channels: mobile apps, websites, or personalized email campaigns.

Continuous learning. The system tracks customer responses and feeds those outcomes back into the model, allowing the algorithm to learn which actions drive engagement and conversions over time.

NBA in carrier-distributor communication

In this B2B layer, NBA helps carriers translate data-driven insights into practical, revenue-impacting guidance for their distribution partners – wholesalers, brokers, or agents.

Data collection and integration. Carriers contribute data such as product information, underwriting rules, pricing, and historical quote, bind, and renewal outcomes.

Distributors add their own data: sales interactions, client inquiries, and regional or segment-specific insights.

Any insight that you can get into what's going on in that person's life is one set of data. Another set of data is a service interaction: somebody placing an inquiry about their policy or changing a beneficiary, checking an account balance. And then, when you think about the information that the wholesaler has about the distribution partner, things to look for are things like requests for an illustration. If you have insights into their client appointment activity, obviously that's a critical time.

These streams are merged in a shared data platform hosted by either party – often connected via secure APIs to ensure compliance and visibility. Real-time signals, such as quote submissions or broker inquiries, may be captured using event-streaming tools like Kafka or AWS Kinesis.

Predictive and decisioning layers. Predictive models identify where demand is likely to rise or when a broker is most likely to close a sale. The decision engine then prioritizes which distributor should be nudged, with what message, and through which channel (CRM, portal, or email).

Distributor enablement. These recommendations are delivered through the tools distributors already use – CRMs, broker portals, or automated email workflows. This “enablement layer” ensures insights turn into action by embedding prompts and materials directly into the agent’s workflow. For instance, an agent might see a prompt in their CRM suggesting they follow up with a small-business client whose renewal window is approaching, along with the best product to offer and timing for contact.

Key use cases of NBA in insurance

Next Best Action technology brings intelligence and timing to every key point in time in the insurance lifecycle – from prospecting and quoting to claims and renewals. Let’s get into the details.

Distribution: from quote to bind and beyond

In insurance distribution, Next Best Action helps insurers and agents convert prospects faster and sell more effectively. Real-time lead scoring identifies high-intent customers, while decision engines surface tailored bundles at the perfect time. If a quote is abandoned, NBA can trigger a personalized follow-up, and when data shows strong purchase signals, it recommends complementary products such as roadside assistance or travel insurance.

The results speak for themselves. According to a BCG case study, a Singaporean insurer used AI to match leads, agents, and products boosted advisor productivity by 25 percent and added 5-6 percentage points to growth. In another case study, BCG’s work with a Belgian client showed that personalization engines cut churn by 30 percent and lifted cross-sell by 40 percent, adding €20M (~$23M) in revenue, while a Turkish insurer achieved 2.5x higher conversion and 30 percent more product sales with AI-driven matching.

Customer service and claims

In customer service and claims, NBA can turn reactive interactions into proactive, intelligent workflows.

During live service calls agents are given next-best prompts (clarify coverage or offer an add-on) so conversations are both more efficient and personalized. For example, Achmea’s system immediately informs the agent of an online cancellation attempt so the agent can respond with the right offer. Achmea has achieved impressive results, including an 85 percent save rate using next-best-action recommendations, a 27 percent increase in online upsell and cross-sell, and a 41 percent web-to-call center conversion rate.

Renewals and retention

Renewals represent one of the most strategic touchpoints in insurance and NBA ensures they’re never wasted. Using churn prediction models, the system identifies which customers are at risk of leaving and tailors retention strategies accordingly.

Insurers report that targeted retention offers (e.g., loyalty discounts or bundled upgrades) deployed only to at-risk segments significantly boost retention. For instance, BCG reports in its analysis of "orphan" customers that a North American insurer achieved a 50 percent contact rate, significantly reducing churn and increasing long-term customer value.

Challenges and considerations of applying Next Best Action in insurance

While NBA promises smarter, more personalized customer engagement, bringing it to life in insurance is far from simple. The industry’s reliance on legacy systems, strict regulation, and complex human workflows means even the smartest algorithm can stumble without the right foundation. To make NBA truly effective – and trusted – insurers must navigate several key challenges.

Compliance and fairness

NBA depends on personal and behavioral data, making compliance with GDPR, CCPA, and other privacy laws essential. Strong governance around consent, transparency, and explainability is nonnegotiable. Privacy limits on third-party data use also mean insurers must clearly communicate how customer data powers recommendations. Models must be regularly tested and audited to prevent bias and ensure compliance, protecting both the insurer’s reputation and customer trust.

“Always making sure that there's a monitoring program in place, back-testing models –, testing what the model predicted versus what the outcomes were,” Matt stresses. “And I think it's always critical to maintain human-in-the-loop oversight so that there's that softer judgment and discretion that can be placed.”

Legacy systems and integration

As Matt emphasizes, “So much insurance carrier data is held in data silos. It's on hard drives or legacy mainframe systems.” Many insurers still run on decades-old policy and CRM systems that weren’t built for real-time decisioning. Integrating modern NBA platforms often requires major IT effort and removing long-standing data silos between departments like underwriting, marketing, and claims. A unified data view is critical for delivering consistent recommendations.

Data quality and accessibility

“Agents across the United States life insurance distribution landscape contract with multiple distribution companies,” observes Matt. “So you end up with these hierarchical issues, which can make knowing how to direct that next best action very complicated.”

Before NBA can deliver meaningful insights, insurers must ensure data is centralized, cleaned, and accessible so that models can generate accurate or actionable recommendations.

“Many carriers are wrestling not just in their data or their tech operating models, but more broadly many carriers are struggling with what's centralized versus what stays in the business. And while keeping operating models decentralized and in the business has many advantages, it does become a disadvantage to gaining the types of insights and creating predictive models that are needed to drive effective next best action at the enterprise level.”

Talent and change management

“Talent is huge, right? The ability to find data scientists who understand how to build and operate and govern these models is extremely hard.” Data scientists, ML engineers, and business analysts who understand both data and insurance are essential for NBA implementation.

Roles in Data Science Teams

The future of Next Best Action in insurance

As insurers continue exploring how to personalize engagement and improve outcomes, it’s clear that the future of Next Best Action lies not in replacing humans — but in empowering them. In life insurance especially, where trust and empathy define the customer relationship, technology’s role is to enhance, not substitute, the human touch.

I don't think you can replace the human interaction in life insurance with digital interactions. There's a tremendous opportunity to continue to refine the hybrid model, where digital insights can help better empower agents.

NBA, in this view, isn’t a revolution that transforms the nature of insurance sales – it’s an optimization layer that sharpens the instincts and timing of advisors.

The strength of NBA insights, he adds, comes not from external consumer signals but from the wealth of internal data insurers already hold. “Having a clear aggregated view across the contact center, across the sales desk, across the app – any app or website or portal interaction that the consumer is triggering – those data sources are much more powerful and predictive.”

Looking further ahead, the evolution of NBA may depend on how the industry organizes itself. Matt points out that while many carriers are investing in building their own NBA systems, this fragmented approach may not be sustainable. “If you imagine a universe where ten carriers are all building next best action technology, those ten carriers are all going after a fixed pie.” Longer term, industry-wide platforms may prove more efficient – pooling data and delivering ready-to-integrate decisioning models. That could lower costs and improve predictive accuracy. But it also raises new questions about data ownership and governance.

Such a shift could enable access to broader, richer data, unlocking insights that no single insurer can achieve alone. But it also raises questions of control. “Platform providers tend to be the powerhouse in the value chain,” Matt cautions. “They’re going to own the data – and they’re going to sell insights from the data.”

Ultimately, implementing NBA is less about technology itself and more about alignment – aligning data, systems, and people to make every customer interaction count. The insurers that succeed won’t just predict the next best action; they’ll make it easy for agents to take it.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.