The luxury travel sector boomed after 2020, fueled by strong high-end demand. This post explores the market landscape, evolving behaviors of affluent travelers, key trends, and the competitive ecosystem, offering actionable insights for business success.

Luxury travel market overview

What is luxury travel: market overview

Luxury travel offers exclusive, high-end experiences that prioritize comfort, personalization, and exceptional service.

In recent decades, luxury travel has shifted from ultra-extravagant experiences, such as private jets and opulent resorts, to more accessible options that still offer exclusivity. Today’s affluent travelers prioritize authenticity, personalization, and experiential travel instead of visible symbols of wealth.

The concept of luxury itself is shifting, with what was once considered luxury becoming mainstream. Brands across the entire travel industry are rolling out semi-luxury offerings. Lodging Econometrics reports upper-midscale and upscale categories consistently leading the hotel construction pipeline.

In a similar move, airlines are changing aircraft configurations and replacing economy seats with premium ones. For example, Emirates is expanding its Premium Economy service, planning to provide over 2 million Premium Economy seats, up from 1.8 million today, by the end of 2025.

So now travelers can experience premium service without the hefty price tag of traditional luxury.

Market size. Valuing the global luxury travel market is challenging, with estimates for 2024 ranging from $1.48 trillion to $2.51 trillion. This discrepancy stems from differing definitions of luxury, with some including premium services like four-star hotels – and others focusing on five-star-plus offerings and bespoke services.

This range shows that the market is not monolithic but rather spans from “accessible luxury” to “ultra-luxe.” To industry stakeholders, this presents opportunities for precise targeting. On the other hand, it poses risks for investors who have to rely on broad estimates.

Skift estimates that luxury travelers account for around 36 percent of global travel spending.

Growth rate. Despite the variance, the market is set to grow steadily, with projections indicating a CAGR of up to 8.56 percent through 2032. For example, Fortune Business Insights forecasts growth from $2.51 trillion in 2024 to $4.83 trillion by 2032.

Growth factors. The growth is driven mainly by increasing affluence: The annual UBS Global Wealth Report highlights that the world is steadily getting richer. The number of EMILLIs or “Everyday MILLIonaires” (those with $1 to $5 million in assets) has more than quadrupled since 2000, now reaching about 52 million individuals.

The US is home to the largest share of these millionaires, with their numbers growing by over 1,000 a day in 2024. Almost 40 percent of the world’s super-rich reside in the US, followed by China and Japan.

The global middle class is also steadily growing, now reaching 4.4 billion people. With higher disposable incomes, the population of emerging markets is willing to spend on luxury experiences.

Another factor is the rise of affordable luxury options, driven by competition, technology, and economies of scale, which have lowered costs without compromising quality.

Travel reasons. Leisure travel clearly dominates with an 81 percent market share. However, the business segment is expected to grow, driven by increased MICE activity worldwide and the emergence of specialized products, such as the Luxury Business Travel Program from Trip Concierge.

Amadeus estimates that 31 percent of elite travelers now fall into this category.

Destination. Domestic tourism currently holds a 74 percent market share. However, experts predict the international segment will grow as direct international flights, premium airline services, and unique, unexplored destinations become more accessible.

Regional breakdown. In 2024, North America led the luxury travel market with 32.64 percent, followed by Europe at 29.47 percent. However, the fastest growth is expected in the Asia-Pacific and the Middle East, driven by the rising affluent classes in China, India, Southeast Asia, and the MENA countries.

Who is a luxury traveler: affluent traveler profile and behaviors

Today’s luxury traveler is younger, tech-savvy, and experience-driven. To better cater to this segment, let’s take a closer look at who they are and their behavior patterns.

Luxury traveler profile

Demographics: US millennials dominate, but Asia-Pacific and the Middle East drive growth

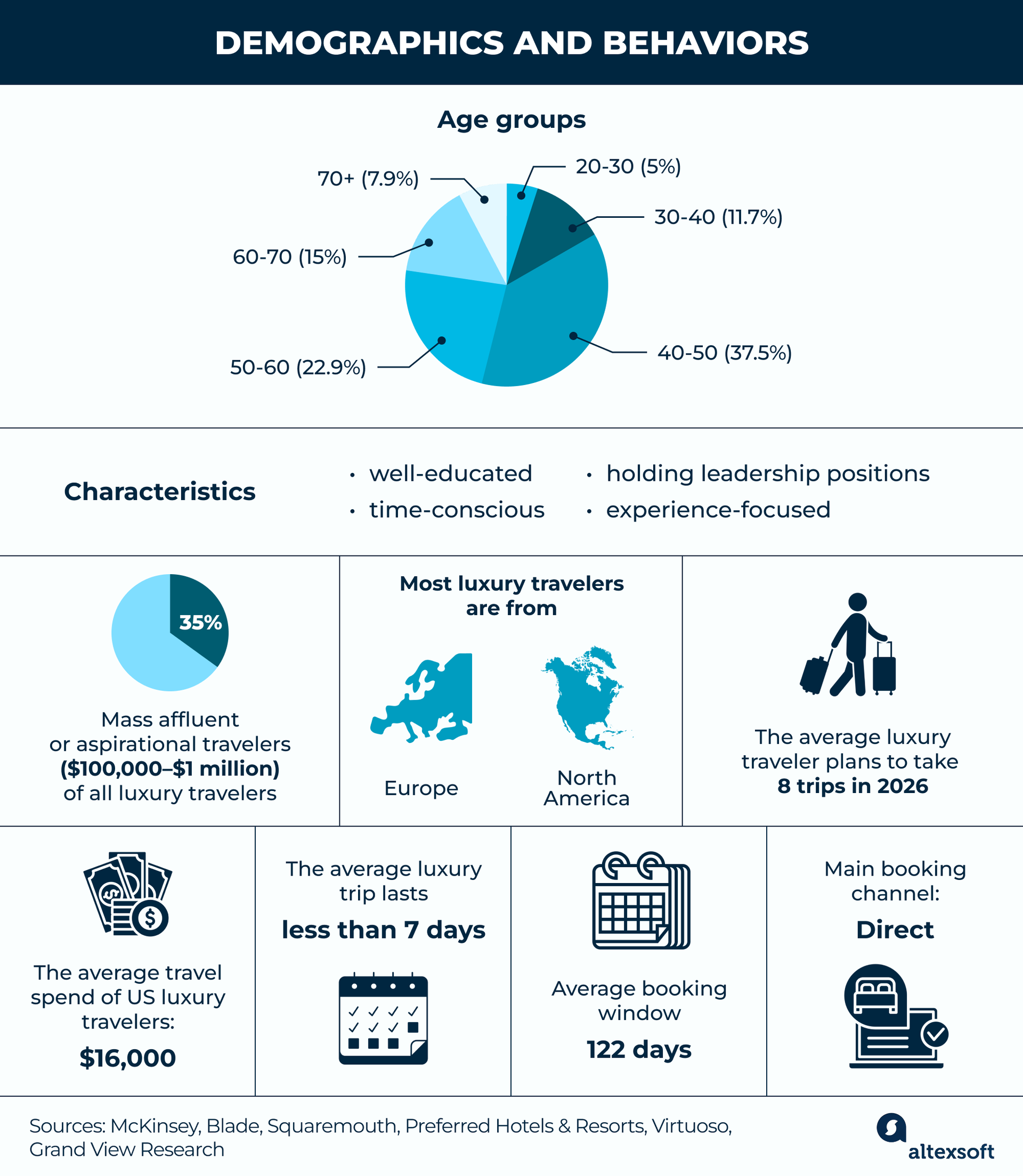

McKinsey estimates that around 80 percent of luxury leisure travelers are under 60, with spending peaking between ages 40 and 50.

Millennials and Gen Z are rapidly replacing Baby Boomers as the dominant segment, expected to account for over 60–70 percent of all luxury purchases by 2030. They value authenticity, sustainability, and personalization over traditional symbols of status.

While most affluent travelers are from developed countries (North America and Europe), the rise of new wealth in Asia-Pacific and the Middle East is reshaping the market, with travelers from China, India, and the Gulf driving growth. For example, a Euromonitor report names India, Saudi Arabia, and the UAE as countries with the highest numbers of luxury seekers.

Blade survey showed that three-quarters of these travelers hold a master’s degree or higher. Additionally, 44 percent have leadership roles such as C-level executives or business owners.

Net worth tiers and spending behaviors: the rise of mass affluent with less than $1 million in assets

Contrary to stereotypes, not all luxury vacationers have millions in net worth. In fact, 35 percent of this travel segment consists of individuals with less than $1 million in assets. So let’s look at the affluent market tiers as described by the McKinsey study.

Mass affluent or aspirational travelers ($100,000–$1 million) mix premium and budget elements. They may splurge on a few high-end elements (e.g., business class or one-night 5-star hotel) but mix with more budget components, often using loyalty programs. They also rely on brand names to validate the luxury feel.

Core high-net-worth individuals or HNWIs ($1–5 million) are sometimes referred to as everyday millionaires or millionaires next door. This group often trusts boutique agencies and seeks privacy and exotic locales.

Very-high-net-worth individuals or VHNWIs ($5–30 million) prefer large private suites and immersive local experiences, less concerned with brand names.

Ultra-high-net-worth individuals or UHNWIs (>$30 million) tend toward “quiet luxury”: remote, private destinations, such as private islands and safari camps, with white-glove, personalized service.

Luxury travel cost: the average of $16,000

Source: Squaremouth

Luxury travelers typically spend between $10,000 and $24,999 per trip, according to the Luxury Travel Advisor report, with nearly half of respondents citing this range as the norm. Another 25 percent of clients spend between $25,000 and $49,999.

When it comes to where the money goes, flights and lodging are the primary expenses. Three out of four travelers are willing to splurge most on hotels, while 64 percent prioritize excursions and curated experiences such as private tours or exclusive activities.

Travel preferences: frequent, activities-heavy, short trips in mid-season, booked in advance

Affluents tend to travel more often than average. Visa/YouGov data show wealthy consumers plan nearly twice as many trips as non-affluents over 12 months.

The Luxury Travel Report by Preferred Hotels & Resorts revealed that the average luxury traveler plans to take eight trips in the following year.

In general, affluent tourists primarily choose traditional types of trips, such as sunny beach vacations or relaxing getaways. At the same time, they are far more likely to book exotic experiences than mass travelers.

Wealthy tourists favor both traditional luxury cities and emerging hotspots. For example, London, Paris, and Dubai consistently top global luxury city lists, but cities like Tokyo, Singapore, and Bangkok are also very popular.

An average luxury trip lasts less than 7 days. Affluents prefer to book in advance, with the average booking window being 122 days. Seasonality is increasingly irrelevant, as rich people now prefer to travel during what were traditionally considered shoulder seasons. This shift is driven by a desire for greater privacy, more space, and a deeper connection to their destinations.

But privacy doesn’t mean isolation. Affluent travelers want tranquility and space while maintaining a connection to local life, culture, and human warmth.

Key booking channels for luxury travel: direct online bookings prevail, with travel advisors assisting with complex trips

A Euromonitor report shows that 74 percent of luxury seekers book their trips online.

According to Grand View Research, direct booking is the primary channel for almost half of elite US travelers. Affluents are active users of loyalty programs, making use of better pricing, personalized service, and exclusive deals.

OTAs account for around 40 percent (including focused luxury agencies such as Mr. and Mrs. Smith), with the rest done through other intermediaries.

There is strong demand for travel advisors (up to 85 percent, per Deloitte research) – not for booking flights or hotels, but for expert advice, curation, and management of unique, complex, and multi-destination trips.

Key segments of the luxury travel market

The luxury travel market can be broken down into several key segments, each offering a high-end experience to affluent travelers. Experts estimate that the airfares and lodging segment accounts for 64 percent of total luxury travel expenditure, while tours and experiences contribute over 33 percent to segment revenue.

Flights

Source: CAPA – Centre for Aviation

Luxury aviation is on the rise. IATA’s 2024 World Air Transport Statistics Report showed that international premium class travel (business and first class) grew by 11.8 percent, outpacing growth in global economy travel of 11.5 percent. The total number of international premium-class travelers in 2024 was 116.9 million (6 percent of total international passengers).

In their Q3 2025 earnings report, Delta said that in 2026, it expects premium seats revenue to overtake that of the main cabin.

Luxury flights go beyond means of transportation, offering ultra-comfortable cabins, personalized in-flight services, gourmet dining, and premium ground services such as chauffeur rides and access to exclusive airport lounges. This segment includes two key subsets.

Premium cabin offerings (first and business class) from full-service carriers, such as Singapore Airlines, Qatar Airways, Emirates, and Cathay Pacific. Airlines continuously innovate to stand out in the premium cabin, introducing features like private business class suites with closing doors, double beds, and exceptional culinary programs.

As we mentioned earlier, many airlines (including United, Emirates, American, LATAM, etc.) invest in increasing their premium seat inventory.

Private aviation (jets and chartered flights) for flexibility, privacy, and bespoke service, with the largest providers being NetJets, Flexjet, and Vista Global. This market is expanding, and evidence of that is the record demand for new jets, as noted in the 2025 Global Business Aviation Outlook.

Private jet cabin. Source: M101Studio on Shutterstock

Private aviation is undergoing its own transformation: Fractional ownership, jet cards, and on-demand charters now account for 25 percent of private jet usage, offering more flexibility than full ownership. Jet-sharing platforms, with mobile apps and real-time availability, are making private aviation more accessible to occasional travelers. This mirrors a broader shift in luxury, where convenience is valued over ownership, allowing clients the freedom to choose without the responsibilities of maintenance or depreciation.

Luxury hospitality: scale vs. niche

Source: WTFI

The luxury hospitality market is also thriving and showing the largest growth among segments. Moreover, upscale hotels are seeing increased demand and rising rates, with travelers willing to pay $1,500-$2,500 per night, while the economy sector is declining. Public brands such as Hyatt report that their high-end offerings are the key drivers of RevPAR.

The hospitality sector is defined by a strategic divide between large-scale hotel groups and highly specialized boutique properties, each with its own unique approach to luxury.

Global chains with luxury offerings. Marriott, Hilton, and Hyatt are prime examples of hospitality at scale. They have diversified portfolios that include luxury brands, such as The Ritz-Carlton, St. Regis, and Waldorf-Astoria. Six Senses from IHG is also a renowned name.

Independent luxury brands. Brands like Mandarin Oriental or Four Seasons strike a balance between global scale and a singular, powerful brand identity. While operating worldwide, these brands have maintained their reputation for exceptional service. One survey found that Four Seasons is the first luxury hotel brand that comes to mind for almost half of affluent travelers.

Niche brands. At the opposite end of the spectrum lie niche providers like Singita or Aman Resorts that embrace a strategy of extreme exclusivity and a focus on privacy. Aman, with its small footprint and properties that integrate deeply with local culture, has even cultivated a loyal following of affluent travelers, known as “Aman Junkies.”

Unique properties. Beyond global chains and niche resorts, the luxury landscape is also shaped by truly one-of-a-kind icons such as Dubai’s Burj Al Arab or the Brando Island.

Private villas. For ultimate privacy, travelers can rent luxurious villas or estates, often accompanied by a personal staff, chefs, and tailored services.

Tours and attractions

This segment has evolved beyond traditional sightseeing to include deep cultural immersion and conservation-focused activities. The safari and adventure category accounts for around a third of luxury tour revenue. Other popular activities are

- culinary and wine tours,

- cultural and historical explorations with VIP access,

- sport trips, and

- wellness retreats.

Luxury travel providers like tour operators Abercrombie & Kent and Black Tomato, or advisor networks like Virtuoso, offer expert curation, insider knowledge, and exclusive access.

Cruises and yachts

The luxury cruise industry is shifting away from large vessels in favor of smaller, more intimate ships (100-600 guests) that offer a yacht-like experience. This allows luxury travelers to access remote, less-trafficked ports that large ships can’t reach. These smaller ships often boast a high staff-to-guest ratio (up to 1:1), ensuring personalized service.

While traditional ocean cruising remains dominant (with the Caribbean being the top choice), other types of cruising are gaining momentum. For example, expedition cruising, which combines luxury with adventurous exploration of places like Antarctica, is experiencing strong growth as affluent travelers seek unique, once-in-a-lifetime experiences.

Some of the most recognized luxury cruise brands are Silversea (RCCL), Seabourn (Carnival), and Regent Seven Seas (NCLH).

Top luxury destinations

As we mentioned, affluent travelers are gravitating toward both iconic luxury destinations and exotic spots.

Perennial favorites

Virtuoso’s data disclosed that for international travel, Italy, France, and Mexico are the top luxury destinations. Japan was the only Asian country to make it into the top 10.

Ultraluxe travel preferences include expedition cruises and exotic islands (Fiji, the Maldives, and Thailand).

Kensington’s Affluent Traveler Survey reports that in the US, domestic tourism is the dominant form of travel. Places like Aspen, Napa Valley, and Santa Barbara attract high-end individuals; also, Miami and Key West are popular for luxury cruises.

Private-jet hubs, such as Palm Beach, and exclusive resorts in Cabo San Lucas and Punta Mita cater to ultra-wealthy travelers.

Emerging hotspots

Luxury Gold (while mentioning Europe as the top choice) notes the rising interest of affluent travelers seeking exclusivity in such destinations as

- Scandinavia,

- South America (Peru, Chile, Argentina), and

- Vietnam and India.

After leading the global post-pandemic recovery, the Middle East merits space as a player in the travel arena. Destinations such as Dubai, Abu Dhabi, and Doha are attracting more people for their opulent resorts and luxury shopping.

Saudi Arabia, with its mega-projects and massive reforms, is also on track to develop into a leading luxury destination in the region. It became the top travel choice of respondents to the YouGov and Visa study.

Off the beaten path

As more travelers search for unique experiences, they’re looking for less conventional places.

For example, as Virtuoso experts note, to avoid overtourism, travelers consider trips to Slovenia, Portugal, and Croatia.

Another notable trend in luxury travel is the rise of “coolcations,” or cooler-climate destinations. Places like Antarctica, Iceland, and Greenland are becoming more popular as travelers (especially baby boomers) seek to escape extreme summer heat.

Djibouti, with an average trip cost of $28,594, tops the list. Source: Squaremouth

On the other side, African safari spots, such as South Africa's Kruger National Park, Botswana, and Kenya, attract many HNWIs. Notably, the interest in the African region has shifted beyond just safaris to a deeper cultural exploration.

Also, space travel is gaining traction. Though still highly exclusive, it’s expected to grow as companies like Blue Origin and Virgin Galactic commercialize suborbital flights.

Key trends in the luxury travel market

As we already mentioned, global consumer preferences have changed: People are increasingly prioritizing experiences over possessions, reflecting a broader cultural shift towards valuing memories and personal growth. Luxury travel is no exception. Once a symbol of wealth and power, it now centers on experiences, authenticity, and sustainability.

Experiences and authenticity

According to Euromonitor, over 70 percent of affluents now place more value on experiences than material goods. And Virtuoso’s research has identified that the top emotional drivers of luxury travelers are

- curiosity and exploration (77 percent),

- joy and happiness (65 percent), and

- awe and wonder of nature (57 percent).

Moreover, wealthy travelers are reportedly rejecting standardized experiences, with nearly 70 percent feeling modern hotels have lost their soul. About 75 percent won’t pay for luxury accommodations that feel generic. Instead, they increasingly seek unique, personalized destinations.

Sustainability and wellness

Sustainability and wellness have become integral to luxury travel. Affluent consumers are seeking eco-friendly accommodations, carbon-neutral travel options, and responsible tourism practices.

Virtuoso reports the growing interest of its clients in sustainable travel options, with supporting local economies emerging as the top reason.

This shift is accompanied by a growing interest in wellness tourism, including luxury spa retreats, fitness vacations, and health-focused experiences.

Hyperpersonalization

Marriott reports that 93 percent of elite travelers expect personalized experiences.

Data-enabled hyperpersonalization is now at the core of luxury travel, where every detail of a trip is tailored to the individual, from room preferences to dining choices.

But here’s the trick: As brands use AI to suggest "authentic" local experiences based on traveler data, there's a risk that these recommendations become repetitive – a so-called authenticity paradox.

A “hidden gem” or unique activity recommended to one traveler may be suggested to others with similar profiles, resulting in “standardized authenticity.” For the ultra-luxe market, true differentiation will come from human insight and exclusive access that AI can’t replicate.

That’s why, despite the growing role of digital tools, luxury travel advisors remain crucial.

Luxury travel advisors

Deloitte reported that 85 percent of travelers are willing to employ the expertise and personalized service of an advisor, particularly for complex, bespoke trips.

“One of the simplest definitions of luxury goes like this: ‘Of course I can do it myself. I don’t want to,’” said Matthew D. Upchurch, Chairman and CEO of Virtuoso. “Travellers want to find someone who really knows what they’re doing, has great connections, saves time and has their back.”

Travel advisors deliver that human service that tech just can’t replace. Hence the next trend.

Balancing technology and human connection

The “magic” of luxury happens through genuine service delivered by people: the warmth of a greeting, a remembered detail, or a gesture that feels entirely unprompted – something algorithms can’t do.

So the luxury travel industry is embracing technology to enhance the guest experience – but without replacing human connection. Digital tools streamline processes like check-ins and communication, allowing staff to focus on delivering personalized, authentic service.

Other trends noted by luxury travel advisors and various researchers include the rise of multigenerational, culinary, and solo female travel.

How to succeed in the luxury travel field

To thrive in the luxury travel market, businesses must innovate and differentiate. Obviously, you have to be mindful of the key trends we listed above, embrace digitization, and provide travelers with personalized, sustainable experiences.

Here are a few additional tips that may help you cater to elite consumers.

Master storytelling. Luxury travelers don’t buy trips — they buy emotions. Replace sales pitches with narratives that emotionally engage travelers and inspire them to envision themselves in the experience. Use powerful visuals, immersive videos, and evocative writing that communicate the mood, transformation, and identity behind each journey.

Take inspiration from Black Tomato, renowned for its storytelling expertise. Brand campaigns like “Pursuit of Feeling” and the AI-powered “Feelings Engine” redefine luxury marketing by asking “How do you want to feel?” instead of “Where do you want to go?”

Read about some of the most successful hotel marketing strategies in our separate post.

Segment and tailor. Luxury travelers do not comprise a monolith. So invest in a deep understanding of your customer. Segmenting by age, nationality, and wealth tier can reveal diverse preferences and expectations.

For example, demand for luxury travel is growing rapidly across Asia, the Middle East, and Latin America. To tap into these regions, tailor offer to local tastes — think multigenerational family trips for Asian travelers or exclusive desert retreats for MENA guests.

Another possible strategy is to develop tiered products for different budgets. This way, you can target the growing category of aspirational travelers seeking attainable luxury while still appealing to UHNW clients who expect the rarest, most exclusive experiences.

Form exclusive partnerships. Alliances with top-tier hotels, local guides, and premium experiential providers will allow you to offer unique perks, upgrades, and rare experiences unavailable elsewhere.

Embrace flexibility. Flexibility is essential in luxury travel, where high-profile clients often change plans at the last minute. So design operations and partnerships that allow for quick, seamless adjustments — whether rescheduling private charters or arranging spontaneous experiences. These changes should feel effortless to the guest, maintaining service quality without disruption.

Engage post-trip. Send personalized follow-ups thanking guests for their stay, request feedback, and offer exclusive perks for future bookings—such as priority access, complimentary upgrades, or early invitations to new experiences. Consistent, thoughtful post-trip communication reinforces the relationship and keeps your brand top of mind for their next journey.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.