In our article on flight aggregators, we outlined their expanding role in modern air distribution and shared guidance for travel resellers on selecting intermediaries for NDC and non-NDC content. Building on that, AltexSoft has compiled a datasheet summarizing leading NDC aggregators and their direct airline connections.

How to use the datasheet:

- Click on images to open them.

- Left-click on the Download Infographic button in the upper right corner to access the full version of the datasheet.

- Go to the spreadsheet at the very end of the article, which contains the same information as the full datasheet.

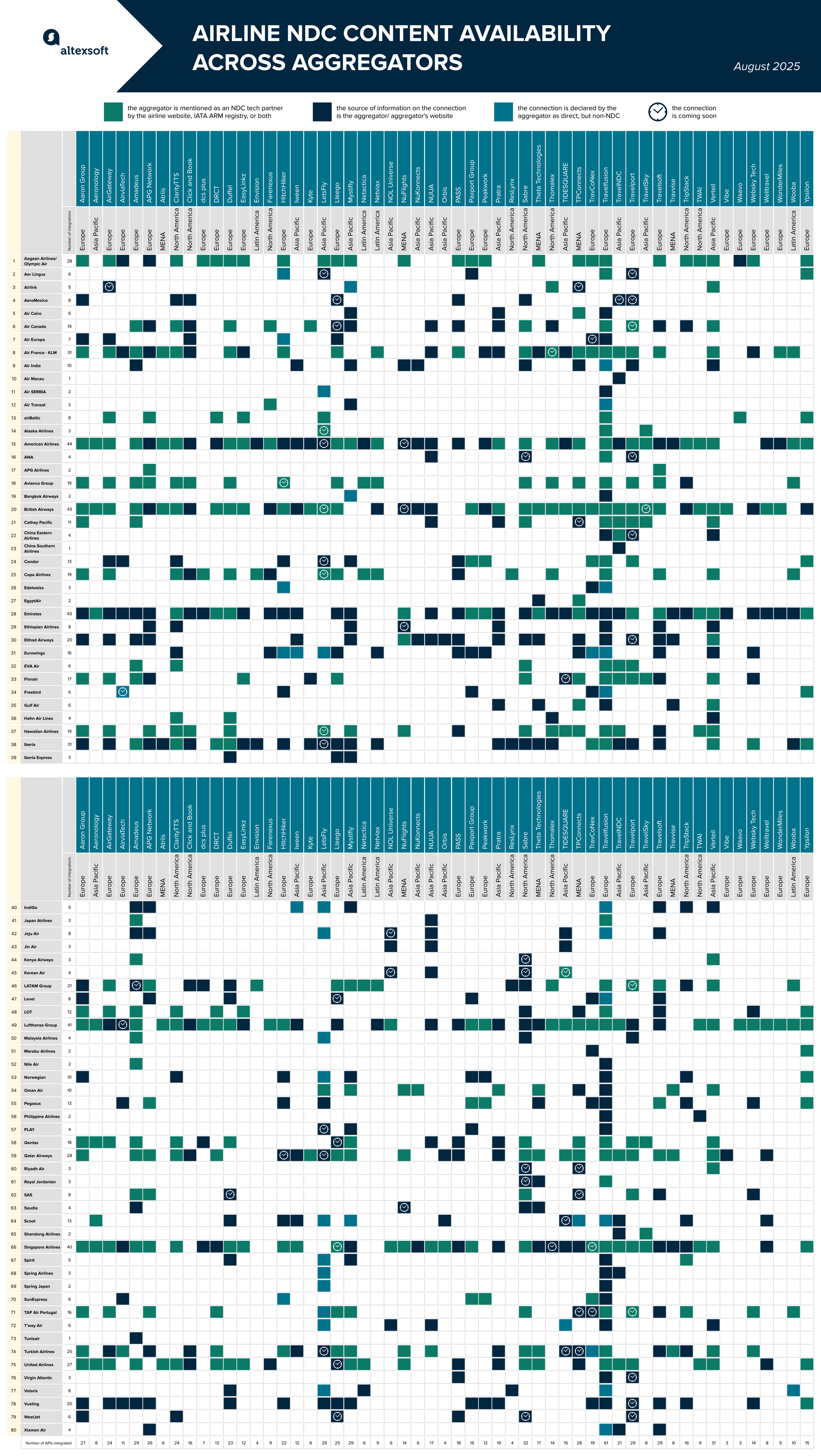

Airline NDC content availability across aggregators (Aug 2025)

Our approach

We reviewed around 100 companies that are

- listed as NDC system providers for sellers in the ARM index registry;

- mentioned as approved aggregators/tech partners by NDC airlines; or/and

- positioning themselves as NDC aggregators.

From this pool, only 55 candidates made it onto our datasheet. These platforms either provide detailed information about their available NDC content on their websites or were able to share their NDC connection list with AltexSoft upon request. Additionally, we included four global distribution systems (GDSs) — Amadeus, Sabre, Travelport, and TravelSky.

Amadeus vs Travelport vs Sabre: what’s the difference?

We excluded companies when data on their actual integrations was unavailable or when their market positioning differed significantly. For instance, Spotnana, which maintains direct connections with approximately 20 NDC airlines, distinguishes itself from other aggregators by positioning itself as a travel-as-a-service platform tailored for travel management companies (TMCs), corporations, and other stakeholders.

Our table features 80 NDC APIs, fewer than the total number of NDC airlines, as several carriers share the same API. The list includes:

- Aegean/Olympic API

- Air France-KLM API

- Avianca Group API (Avianca, Avianca Costa Rica, Avianca Ecuador, TACA)

- LATAM Group API (LATAM, LATAM Brazil, LATAM Colombia, LATAM Ecuador, LATAM Paraguay, LATAM Peru)

- Lufthansa Group API (Air Dolomity, Austrian, Brussels, Discover, Lufthansa, Swiss)

As a result, the total number of airlines with NDC content covered in our study is 95. It’s important to note that integration with a particular unified API doesn’t guarantee access to all carriers, as it depends on the platform and its agreements with the airlines.

Some platforms (for example, Duffel) don’t distinguish between NDC and non-NDC direct connections, while others clearly articulate whether an API they consume follows NDC standards (HitchHiker, LetsFly, Travelfusion, etc.). If we have an airline in our NDC API list but the connection with a particular aggregator is declared non-NDC, we mark this in our datasheet.

Aggregator facts and figures

Of the 55 companies listed, more than half (30, or approximately 55%) participate in IATA's ARM Program, while one (TWAI) has had its accreditation expire as of this writing.

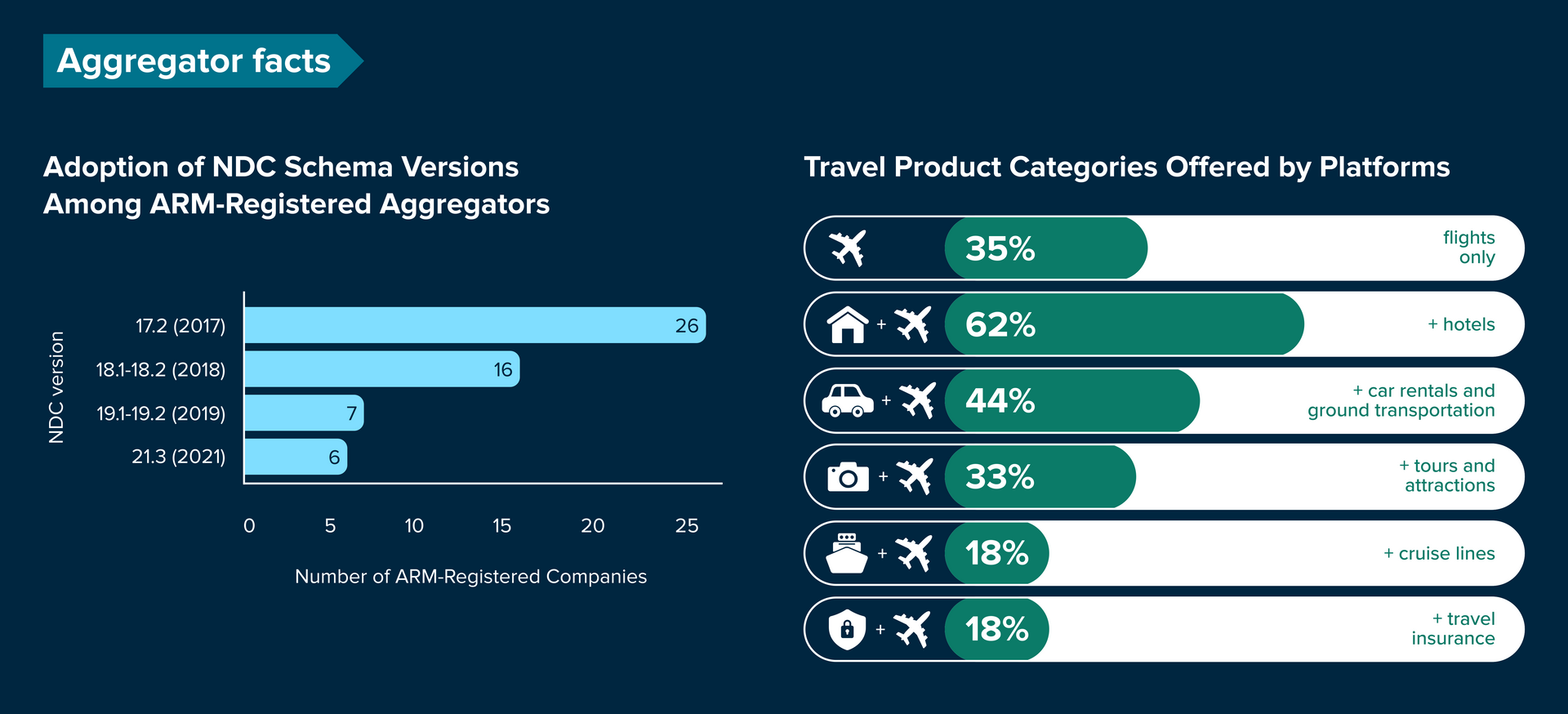

Aggregator facts

-

The majority (26) have their air retailing functionality verified against the 17.2 NDC schema, the first fully mature version released in 2017.

-

Sixteen system providers use versions 18.1/18.2 (2018), which introduced a shopping basket flow and improved payment processing.

-

Seven platforms support the 19.1/19.2 schema (2019), which added features such as cancel and change restrictions, payment redirections, and credit card encryption.

-

Six participants (Amadeus, LetsFly Group, NuFlights, Theta Technologies, TravelSky, and TripStack) work with the 21.3 version (2021) which brought built-in notifications, split PNR logic, and enhanced ancillaries.

It’s important to note that many platforms support multiple versions, each updating specific features. Leading providers help airlines transition to newer NDC releases and address version differences to maintain a consistent experience for travel agencies.

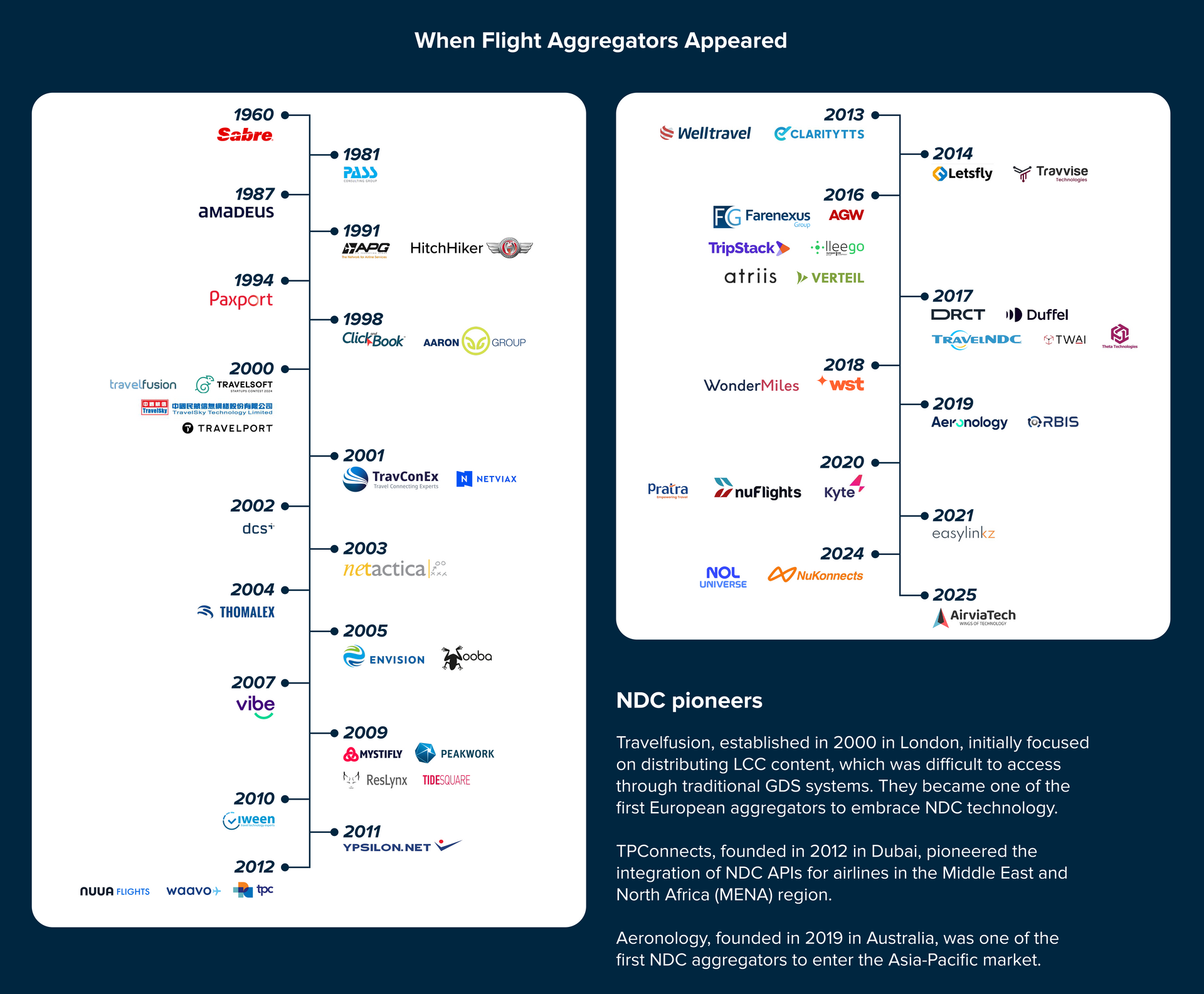

Approximately 53 percent of the listed platforms (29) are either the same age as, or younger than, NDC, which was introduced in 2012.

The rise of NDC aggregators began a decade ago, following the release of IATA’s first official NDC standard in 2015 and the introduction of the NDC certification program in 2016. Among the companies on our list, 22 (approximately 40 percent) were founded in the last decade. This includes leading startups like Aeronology, AirGateway, DRCT, Duffel, NuFlights, and Verteil. The years 2016 and 2017 were particularly notable, with six and five aggregators established, respectively.

When flight aggregators appeared

The 26 companies that emerged prior to NDC include all four GDSs and several travel tech platforms that now lead in NDC integrations, such as Aaron Group (1998), APG Network (1991), Travelfusion (2000), Travelsoft (2000), and Mistifly (2009).

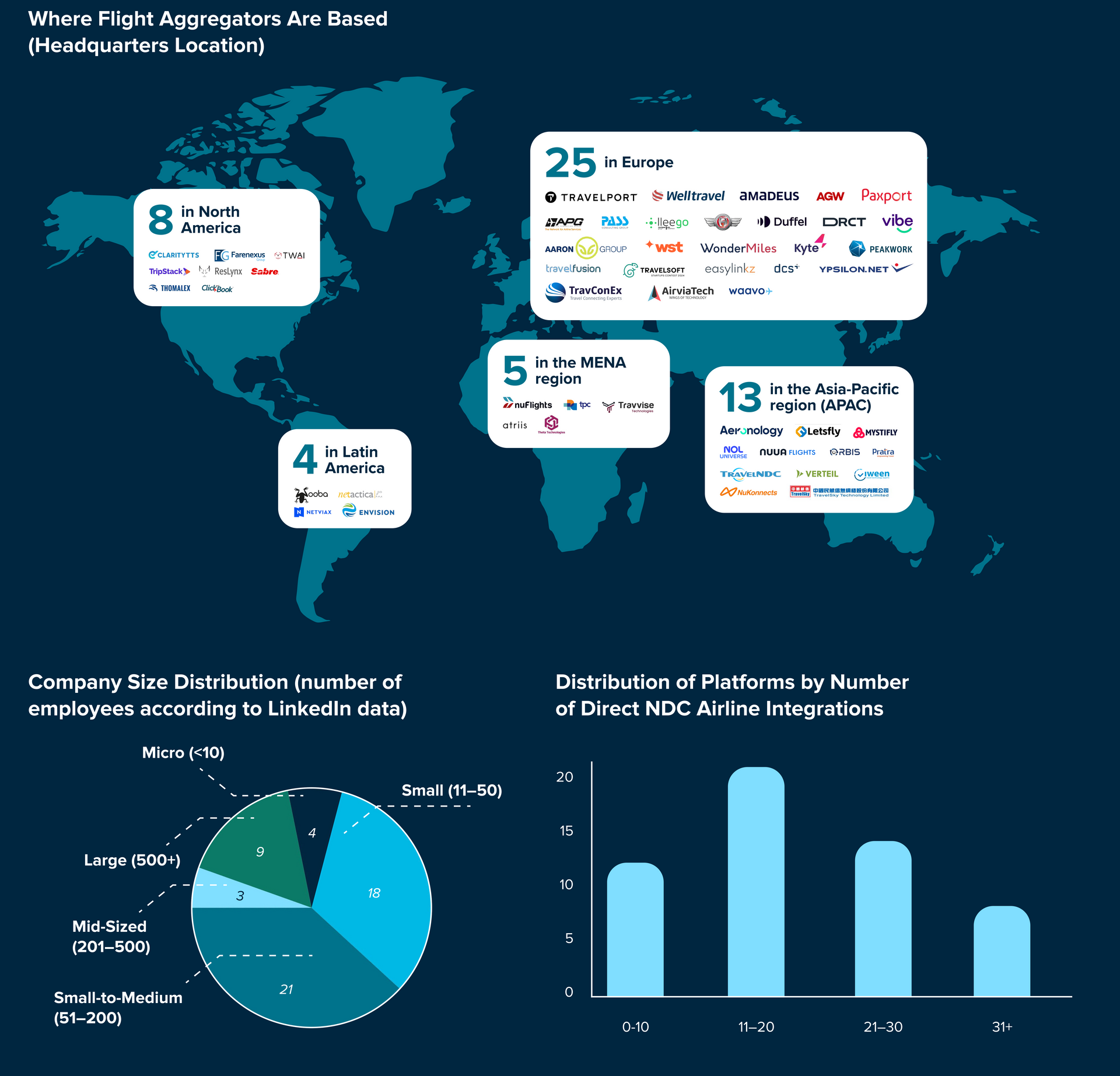

About 45 percent of the listed platforms (25) are headquartered in Europe, 13 in the Asia-Pacific (APAC) region, 8 in North America, 5 in the MENA region, and 4 in Latin America.

Nineteen platforms (around 35 percent) focus exclusively on flights. The rest offer a broader range of travel products, including hotels (34 platforms or ~62 percent), car rentals and ground transportation (24 platforms or ~44 percent), tours and attractions (18 platforms or ~33 percent), trains (16 platforms or ~30 percent), cruise lines (10 platforms or 18 percent), travel insurance (10 platforms or ~18 percent), and other services.

Geography, company sizes, number of direct NDC integrations

The number of individual airlines integrated via NDC APIs ranges from 3 (Vibe) to 55+ (Travelfusion). The distribution of connections is as follows:

- 0–10 NDC airlines: 12 platforms (~22 percent)

- 11–20 NDC airlines: 21 platforms (~38 percent)

- 21–30 NDC airlines: 14 platforms (~25 percent)

- 31+ NDC airlines: 8 platforms (~15 percent), including Amadeus and Sabre.

As shown, most aggregators have between 11 and 20 NDC airlines onboarded.

Based on LinkedIn data, the majority of listed companies are small (11-50 employees) or small-to-medium-sized (51-200 employees), with 18 and 21 platforms in each category, respectively. Additionally, there are four microbusinesses (fewer than 10 employees), three mid-sized businesses (201-500 employees), and nine large businesses or global corporations.

Airline facts and figures

The majority of airlines and airline groups on the list participate in the ARM Index Program. However, 25 airlines (about one in four) have yet to verify their API with IATA.

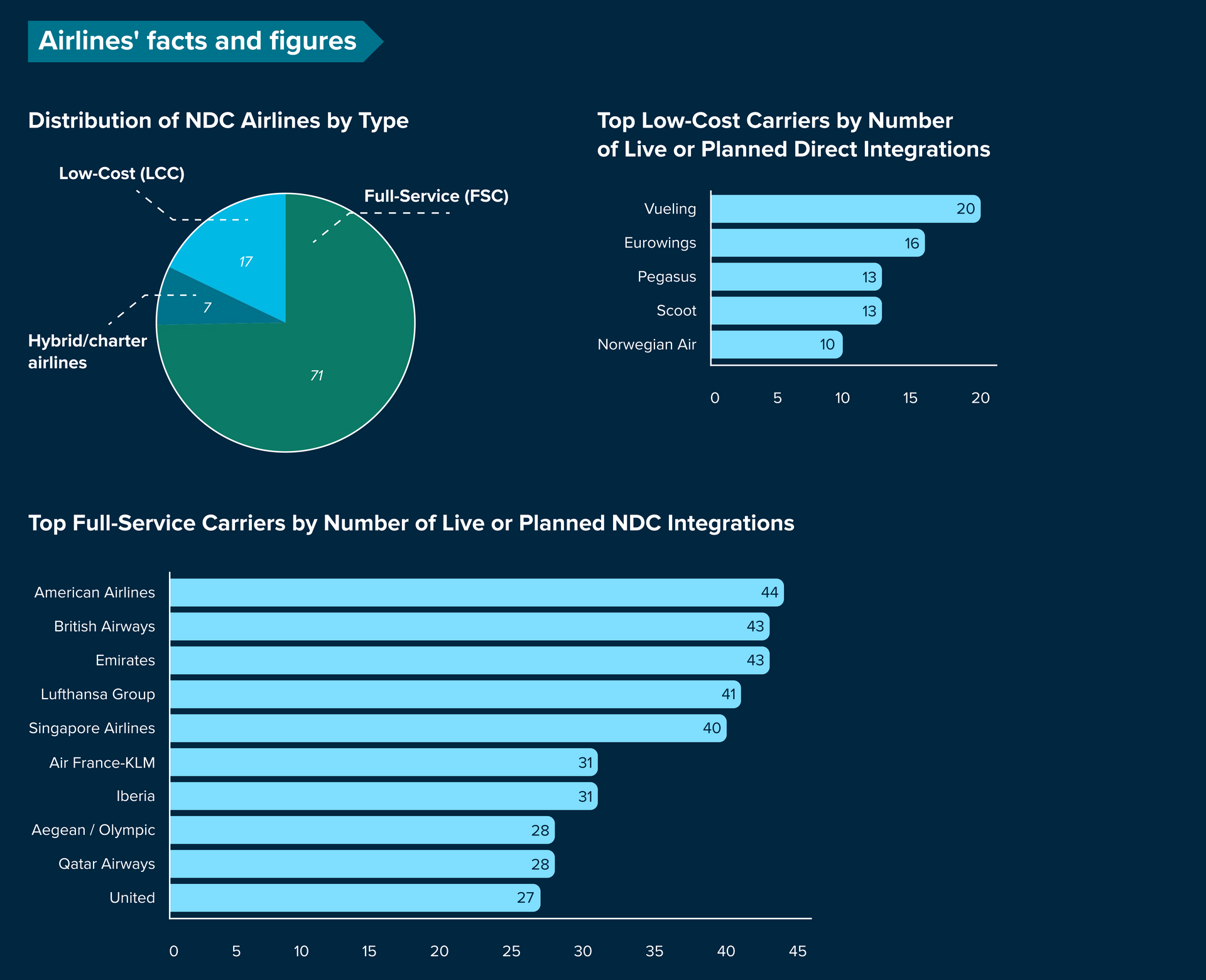

Distribution of NDC by airline type, top LCCs and FSCs by number of direct NDC/non-NDC integrations

Out of 95 NDC airlines (including those sharing the same API), 71 (around 75 percent) are full-service carriers (FSCs), 17 (around 18 percent) are low-cost carriers (LCCs), and 7 are hybrid/charter airlines.

These are the top airlines by the number of live or planned NDC integrations: American Airlines (44), British Airways (43), Emirates (43), Lufthansa Group (41), Singapore Airlines (40), Air France-KLM (31), Iberia (31), Aegean Airlines/Olympic Air (28), Qatar Airways (28), United (27).

Among LCCs, the most active in third-party distribution via NDC and non-NDC APIs are Vueling (20 connections), Eurowings (16), Pegasus (13), Scoot (13), and Norwegian(10).

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.