Business travel is back — and so are the headaches that come with managing it. Whether your team is heading to conferences, meeting clients, or visiting satellite offices, keeping track of travel bookings, expenses, and reimbursements can quickly become overwhelming. Even for smaller teams, scattered receipts, out-of-policy purchases, and manual approvals create friction.

That’s where a good travel and expense (T&E) management system comes in. Let’s explore how you can simplify and optimize your company’s T&E processes with the best tools on the market.

What is travel and expense management?

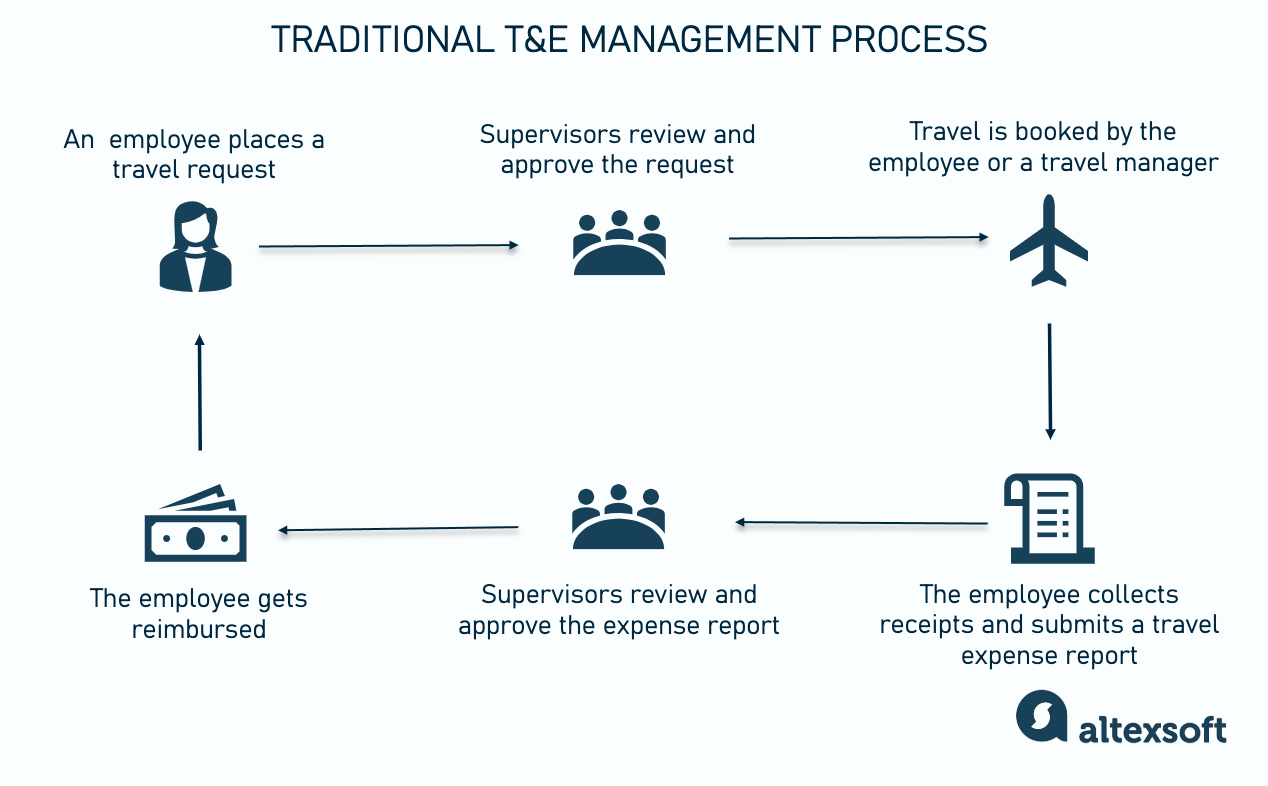

Travel and expense management (often called T&E) is the process of controlling the business travel budget to have visibility over costs and preemptively minimize them. The end-to-end T&E flow embraces the following stages:

- placing a travel request,

- approving the request by supervisors (T&E, HR, and/or finance departments),

- travel booking,

- collecting receipts and reporting travel expenses,

- reviewing the report and checking it against the company’s expense policies, and

- reimbursing travel expenses to the employee.

How a T&E flow unfolds

To regulate T&E activities, organizations create a travel and expense policy that dictates how much employees can spend and on what.

We have a separate article diving into the anatomy of the T&E management process, so check it out.

Business travel expenses components

On average, a three-day trip in the US costs $1,771 for business travelers and $1,986 for decision-makers. The lion’s share of these sums are made up of

- lodging (around 30 percent of all travel expenses),

- airfare (36 percent), and

- food (over 20 percent).

Total trip costs can significantly add up with other expenses — like

- travel at destination (car rentals, etc.),

- communication,

- MICE event fees,

- gifts for business partners,

- entertainment,

- duty of care costs, and more.

The complex structure of travel expenses spread across multiple receipts makes them difficult to collect, report, and analyze. Below, we’ll look at the main challenges associated with inefficient, manually conducted T&E management.

Business travel and expense management challenges

Paper receipts, badly organized Microsoft Excel spreadsheets, and manual information input all weaken the travel management process, especially if you have dozens of employees traveling regularly. The Travel and Expense Management Trends report by Emburse highlights five pain points of T&E departments:

- employees losing paper receipts and submitting reports without receipts,

- employees failing to submit reports on time,

- errors on the reports (incorrect payment amounts, codes, etc.),

- problems with data reconciliation, and

- time needed for reviewing and approving reports.

The same report clearly shows what induces companies to modernize their T&E management process. The main pressing factors are the high cost of the expense reporting process, disconnected systems, lack of control over T&E spending, inconsistent and lengthy reimbursement cycle, and poor visibility into T&E data.

Travel and expense management automation benefits

When organizations automate at least some of their essential T&E processes, they can expect the above-mentioned challenges to be minimized if not completely solved. The immediate benefits of eliminating manual tasks include but are not limited to the following.

Improved accuracy. By removing manual data entry from the process, you automatically avoid many mistakes. And even if they happen, you can quickly detect and address them since all the data is stored in one place.

Better spending visibility. Automation enables you to track how much your employees spend on different aspects of business travel in different locations. Your system can promptly generate relevant reports, compare KPIs, and make information accessible and readable for T&E managers in the form of data visualization dashboards.

Strict compliance with expense policies. With automated T&E management processes, you don’t need to manually check receipts against your internal rules and policies. They are built into the system, which highlights extra expenses and makes it easier for you to stay on budget.

Fraud protection. Staying compliant with policies helps minimize occupational fraud. The automation tools only approve those payments that fall under the category of "business expenses."

Fast reimbursement and better employee satisfaction. If your company takes a long time to approve and reimburse employee travel expenses, it may majorly affect their trust and make them avoid corporate travel altogether. Automated expense submission and reporting ensure that travelers get their money faster while businesses have a clear picture of spending.

Travel and expense management automation approaches

Depending on your budget and how often your company has to perform T&E processes, you can approach modernization in four ways.

Travel management companies (TMCs). Large corporations with thousands of employees worldwide typically use the services of travel management companies. Global TMCs such as American Express, BCD Travel, and CWT provide branded software and have a division of skilled travel agents at your disposal. The services of TMCs include special pricing agreements with major airlines and hotel chains, travel policy development, crisis management, and, of course, travel and expense management.

Business Travel and Corporate Travel Management, Explained

Note that many companies employ a TMC but continue to use their existing software. In this case, the travel management company adapts to the third-party systems.

See our dedicated article, where we compare four main TMCs.

Travel and expense management platforms. Companies of all sizes can benefit from T&E products as they cover the entire travel and expense management process, have a modular architecture, so you can buy features separately, as needed, and often provide low-cost pricing plans for small companies. This approach is popular among businesses that either don’t require full corporate travel support or can’t afford it. But, as we said before, T&E software can be combined with TMC services.

Multi-goal expense management modules. There are a lot of expense management platforms not specifically designed for T&E management purposes. They don’t provide capabilities like booking, travel tracking, etc. Still, many companies find this option useful, integrating an off-the-shelf expense module into their ERP systems.

Proprietary or custom solution. While custom solutions allow you to cover all your unique business needs, it’s too time-consuming and resource-intensive to be feasible for most companies, especially small and medium-sized ones.

Travel and expense software functionality

According to a recent study by Forrester Consulting, 78 percent of decision-makers would prefer a single, end-to-end platform to manage all the company’s T&E activities. So dedicated, turnkey solutions are now the most popular choice for companies shifting from manual to automated T&E processes. Let’s see what features such platforms usually offer.

Self-service booking

An end-to-end travel and expense management platform allows your employees or travel managers to seamlessly book flights, hotels, and other business travel components via a mobile app or website. The system will store itineraries and other travel details so you can easily check and manage them.

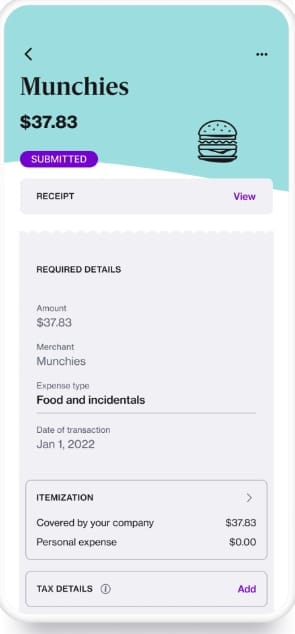

Travel expense submission and reimbursement

With T&E tools in place, employees can submit expenses via a mobile app by scanning receipts with a camera. The system uses Optical Character Recognition (OCR) to capture paper receipts and convert them into digital text. Many platforms also employ natural language processing (NLP) to categorize expense entries. These entries are automatically checked against embedded policies, which simplifies the approval process and leads to quick repayments.

Submitting expenses via the mobile app during the business trip. Source: Navan

Business travel tracking

A tracking feature lets managers continuously monitor their employees wherever they are. You can categorize travelers by location or other characteristics and get detailed real-time information on each trip — like hotel stays, car hires, etc. This enables you to give your teams immediate support as well as ensure their safety and compliance with the travel policies.

Issuing corporate virtual credit cards

Many T&E management platforms support issuing corporate virtual credit cards (VCCs), which offer enhanced control over spending and strong fraud protection. When connected with the expense management software, VCCs sync expense tracking and reporting, streamlining reconciliation.

Read our article on B2B virtual credit cards to learn about the pros and cons of this payment method for travel businesses. Also, our article on corporate travel cards covers how businesses use these cards to handle employees' travel and expense (T&E) management.

Corporate Travel Payments: What Really Works

Travel expense reporting and analytics

Advanced T&E platforms come with real-time reporting and analytics capabilities that cover but are not limited to:

- expense classification and reporting by expense type,

- insights into employee- and department-related spending patterns,

- alerts on policy violations and suspicious behavior, and

- visualization of business travel KPIs.

Analytical features help you avoid unnecessary expenses, prevent fraud, and ensure policy compliance.

T&E software must also support integrations with accounting, HR, and travel products to streamline existing processes.

Business travel and expense software examples

For our overview, we selected platforms featured in G2’s Grid for Expense Management Software as Leaders: products that are both rated highly by G2 users and have substantial Market Presence scores. We compared them by essential criteria — such as payment options, pre-built integrations, pricing, and target audience. We also studied what real users like and dislike about those instruments. But, of course, you need to conduct your own investigation before making a final decision on the platform that will suit you best.

Comparison of top T&E management platforms

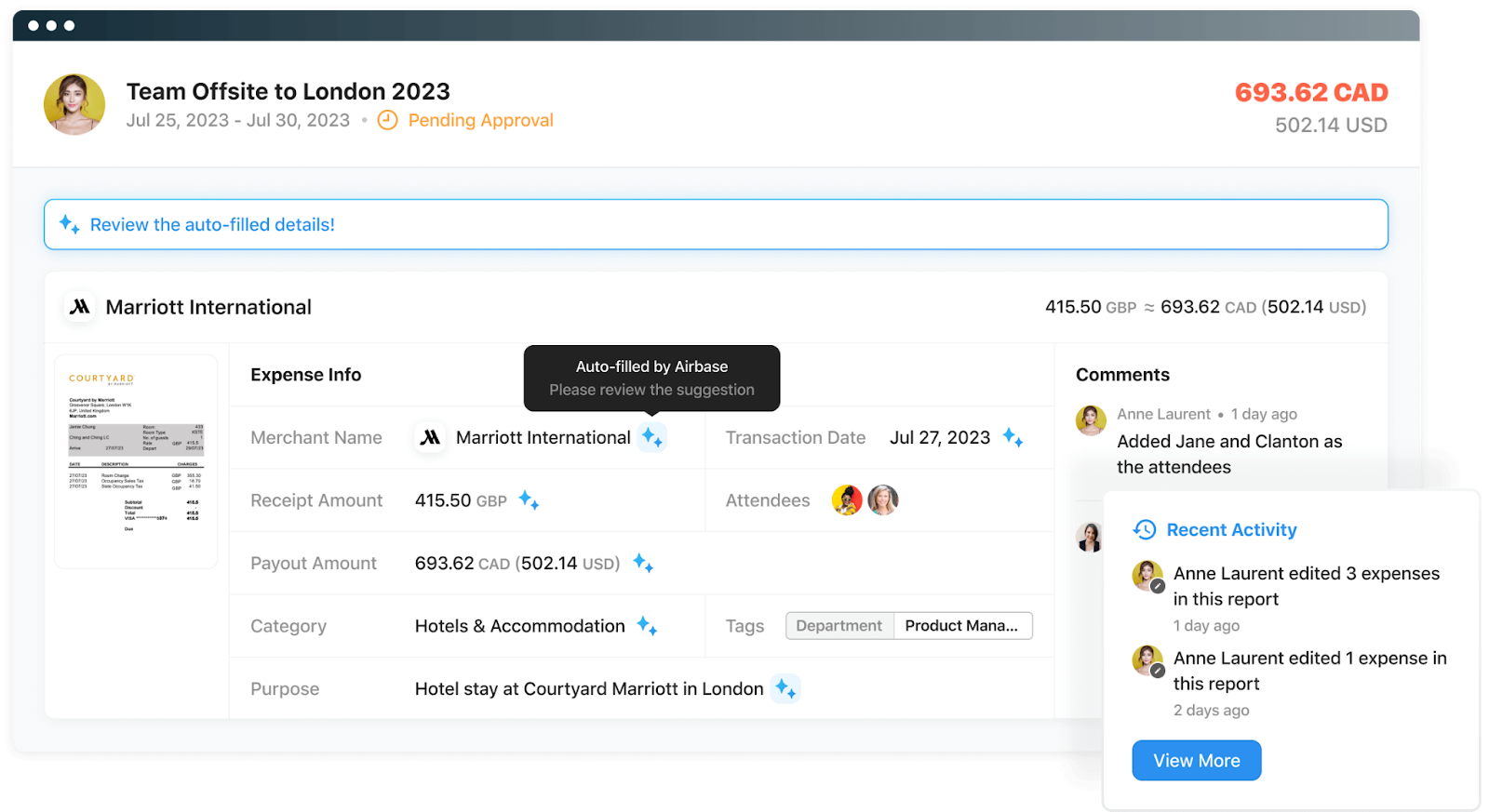

Airbase: Unified spend management for modern finance teams

Airbase offers a comprehensive spend management platform that unifies expense management, accounts payable automation, and corporate card functionality into a single solution. Scan receipts, populate expense reports using OCR, and easily comply with company policies. Airbase supports reimbursement from US-based subsidiaries in 44 countries and 14 currencies.

Interface of T&E features. Source: Airbase

Payments. Airbase issues Visa corporate cards and supports ACH, check, and international wire transfers. Both physical and virtual cards are supported and you can integrate your existing cards without switching.

Integrations. Airbase offers native integrations with leading accounting systems like QuickBooks Online, NetSuite, and Sage Intacct. It also connects to Perk in one click and supports custom integrations through API.

Pricing. Airbase provides tiered pricing with three plans: Standard (for up to 300 employees), Premium (500 employees), and Enterprise (10,000 employees). Pricing is customized based on company size and required features.

Customers. Airbase is used by a wide range of venture-backed startups, tech companies, and mid-market organizations. Notable customers include GoFundMe, Postman, and 15Five.

What users like about the product: seamless user experience, tight accounting integrations, real-time spend control, and proactive compliance with company policies.

What users dislike about the product: learning curve for advanced features, limited international payment options in lower-tier plans, and occasional lags in customer support response.

Bill: A streamlined solution for AP/AR automation with free expense management

Bill (formerly Divvy) is a leading cloud-based platform for automating accounts payable (AP) and accounts receivable (AR) processes. While not specifically designed for T&E processes, it has features that can be easily applied in travel scenarios. Bill supports company card creation as well as virtual cards and a mobile app for easy reporting. They also provide an API for simplified integrations with third-party platforms.

Demo of Bill’s spend & expense features

Payments. Bill supports domestic and international payments via ACH, wire transfer, check, and virtual card. Its built-in payments network includes a myriad of vendors, allowing for quick onboarding and secure transactions.

Integrations. The platform integrates with leading accounting systems including QuickBooks, Xero, Sage Intacct, NetSuite, and Microsoft Dynamics.

Pricing. Bill’s spend & expense features are provided as a separate plan and free of charge. It includes spend controls, as many virtual and physical cards as needed, transaction tracking, access to APIs and more.

Customers. Bill serves small and mid-sized businesses, accounting firms, and nonprofits, with some expansion into mid-market and enterprise segments. Customers include TED, Thumbtack, and Tower 28.

What users like about the product: clear audit trails, time-saving automation, secure vendor payments, and strong accounting integrations.

What users dislike about the product: occasional syncing issues, a dated interface, and high costs for international wire transfers.

Brex: Corporate cards and spend management for startups and enterprises

Brex started as a corporate card solution for startups and has since evolved into a full-fledged spend management platform. It combines credit cards, expense tracking, reimbursements, and travel into one integrated ecosystem. Apart from standard T&E features like spending policies and expense reporting, Brex can also be used to book group travel events with invites, RSVPs, spend limits, and reconciliation all in one self-service platform.

Payments. Brex issues cards with no personal guarantees, enabling companies to manage both physical and virtual card spend. Payments can also be made through ACH and wires, with robust controls for approval and tracking.

Integrations. Brex integrates natively with accounting software like NetSuite, QuickBooks, Xero, and Sage Intacct. It also connects with HR tools, ERP systems, and communication platforms like Slack. Its open API allows for custom automation and deeper integration with enterprise systems. It also has a direct integration with Navan.

Pricing. Brex offers a free tier that covers basic expense management features. Group event booking and other features are available via Premium ($12 per user per month) and Enterprise (custom pricing) tiers.

Customers. Brex serves high-growth startups, tech companies, and global enterprises. Clients include DoorDash, Scale AI, and SeatGeek.

What users like about the product: fast onboarding, generous credit limits, flexible card controls, and strong user experience.

What users dislike about the product: occasional bugs in the mobile app and inconsistent customer service response times.

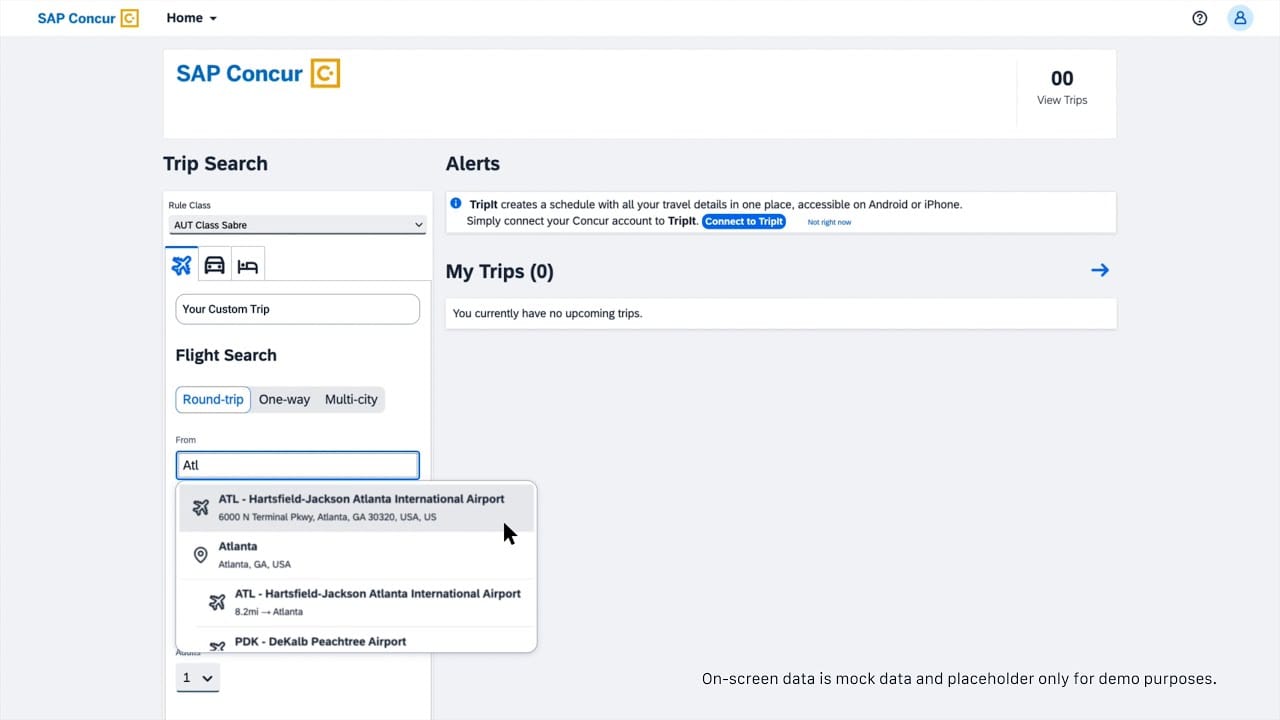

Concur Travel & Expense: A mature and easy-to-integrate platform for global players

SAP Concur offers a suite of SaaS tools for end-to-end expense tracking. Its T&E solution comprises four key modules.

- Concur Expense gives you a real-time view of trip spending and facilitates reimbursement. It comes with a mobile app to enable employees to submit expense reports and manage itineraries. For international trips, the module automatically calculates currency exchange rates and value-added taxes (VAT).

- Concur Travel is a mobile-friendly solution that allows employees to book flights, hotels, cars, and trains while travel managers can track mileage and expenses.

- Concur Invoice automates payments to suppliers.

- Concur Detect uses AI and machine learning to extract meaningful data from receipts, automatically approve low-risk submissions, track errors, and flag possible fraudulent activities.

Travel & Expense platform collects expense, travel, and invoice data to generate reports and create business intelligence (BI) dashboards. The software supports multi-currency and multi-language features, which makes it convenient for companies operating in several countries.

Concur Travel overview

Payments. The platform is pre-integrated with a lot of banks and other financial institutions, allowing companies to set up their preferred payment methods. This includes virtual credit cards issued by American Express, Comdata (Mastercard), or U.S. Bank.

Integrations. Concur integrates with more than 700 ERP, HR, and CRM systems, including Oracle, Sage, Microsoft Dynamics 365, and more. It also connects to apps by various payment providers and travel suppliers (Lufthansa, Lyft, Uber, etc.). And, of course, the T&E suite seamlessly works with other SAP Concur offerings.

Pricing. You have to contact SAP Concur directly to get pricing details. The final sum will depend on a combination of features you choose, the number of users, the region where your business operates, contract duration, and other factors. Also, training, implementation, customization, and other services contribute significantly to the total cost. In any case, the product can be too expensive for small businesses.

Customers. Providing an abundance of features and covering end-to-end T&E management flow, SAP Concur suits large and mid-sized businesses with frequent travelers, government and non-profit organizations with strict T&E rules and regulations, and global players. It is also widely used by universities. Among Concur’s key clients are Hilton Worldwide, CWT, and Airbnb.

What users like about the product: easy access to information from any location, seamless approval flow, solid controls on travel, and outstanding integration capabilities.

What users dislike about the product: slow-to-respond customer support, archaic UI, hard learning curve, and no affordable pricing plan for small businesses.

Emburse: Offers modules for companies of all sizes

Emburse, the global leader in spend optimization, provides tools to cover end-to-end T&E management flow. You can combine different instruments depending on your business size and needs.

In 2023, Emburse partnered with Amadeus Cytric to bring together the expense management of the former and travel capabilities of the latter and deliver a fully-integrated T&E solution for global corporations with complex travel programs.

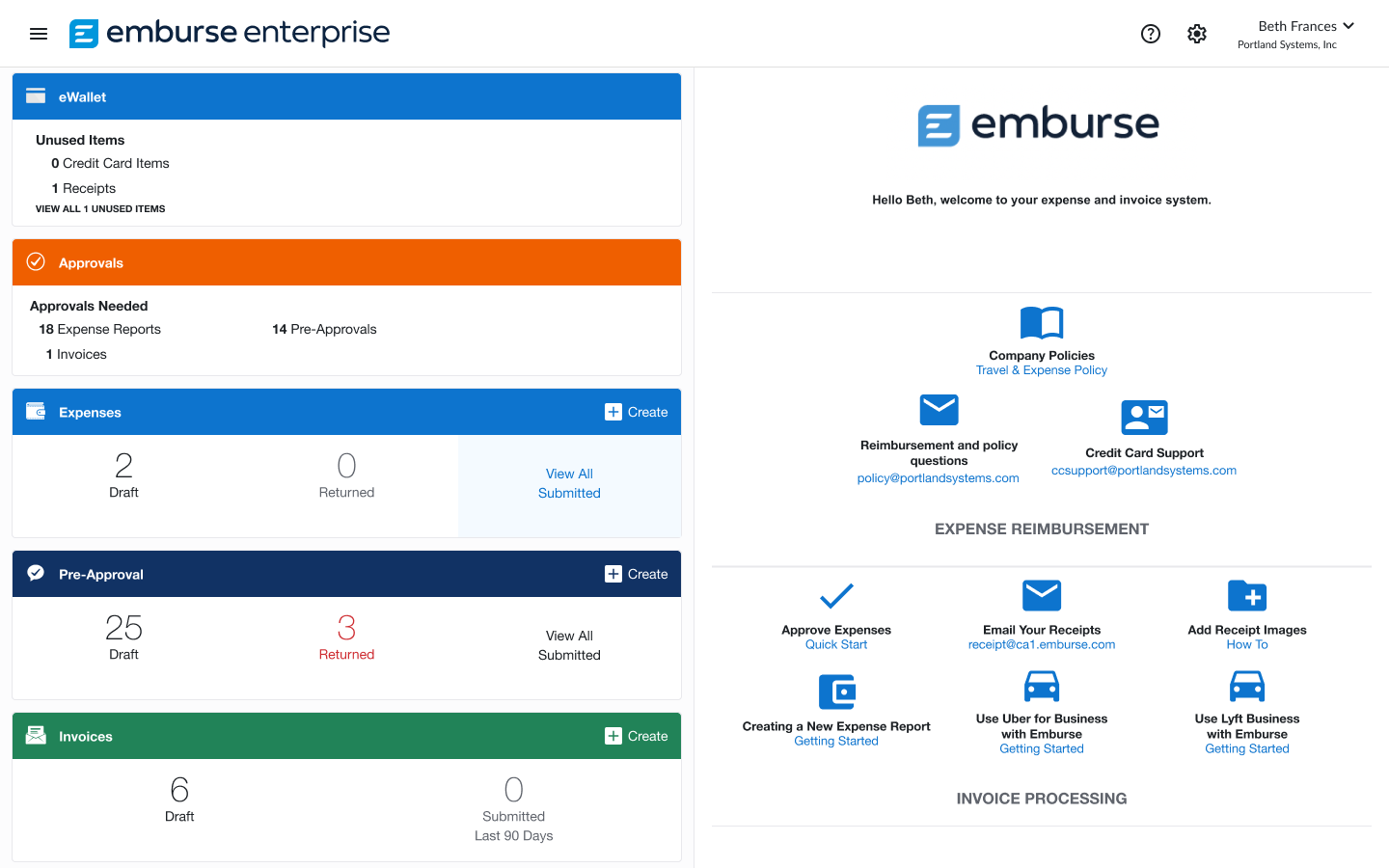

Emburse Enterprise interface. Source: Emburse

Payments. The company prompts customers to use Emburse virtual and physical cards issued by Celtic Bank. They dramatically simplify setting spending restrictions, tracking transactions, capturing receipts, and reporting.

Integrations. Besides embedded connections with other Emburse products, customers can benefit from ready-to-use integrations with third-party services — accounting and ERP platforms (Xero, QuickBooks, Sage, SAP, Oracle, etc.), HR software, CRM (Salesforce), payroll and tax compliance systems, payment solutions (PayPal, Stripe), travel management companies (Perk, Concur Travel), and more. See the full list here.

Pricing. Each tool in the T&E suite comes with its own pricing plan. So the total cost will depend on what you choose.

Customers. Emburse has offerings for organizations of all sizes, from micro-businesses to global corporations. Among companies using their T&E software are Sabre and Hard Rock Hotel, Microsoft and Estee Lauder, Garmin, and more.

What users like about the product: tracks for duplicate receipts, ease of use, configurability, and compatibility with other systems.

What users dislike about the product: OCR errors, poor after-sales support, and limited reporting capabilities.

Expensify: A simple solution for SMBs, startups, and remote workers

Expensify is one the world’s most widely-used expense tracking and reporting app. In 2020, they extended their platform with Concierge, a virtual assistant able to reserve travel according to the company’s policies and employee’s preferences, save trip details, and re-book flights in case of cancellations. All bookings are complemented with free safety services (alerts, emergency transportation, medical advisory, etc.). Concierge is available for free with any pricing plan by Expensify.

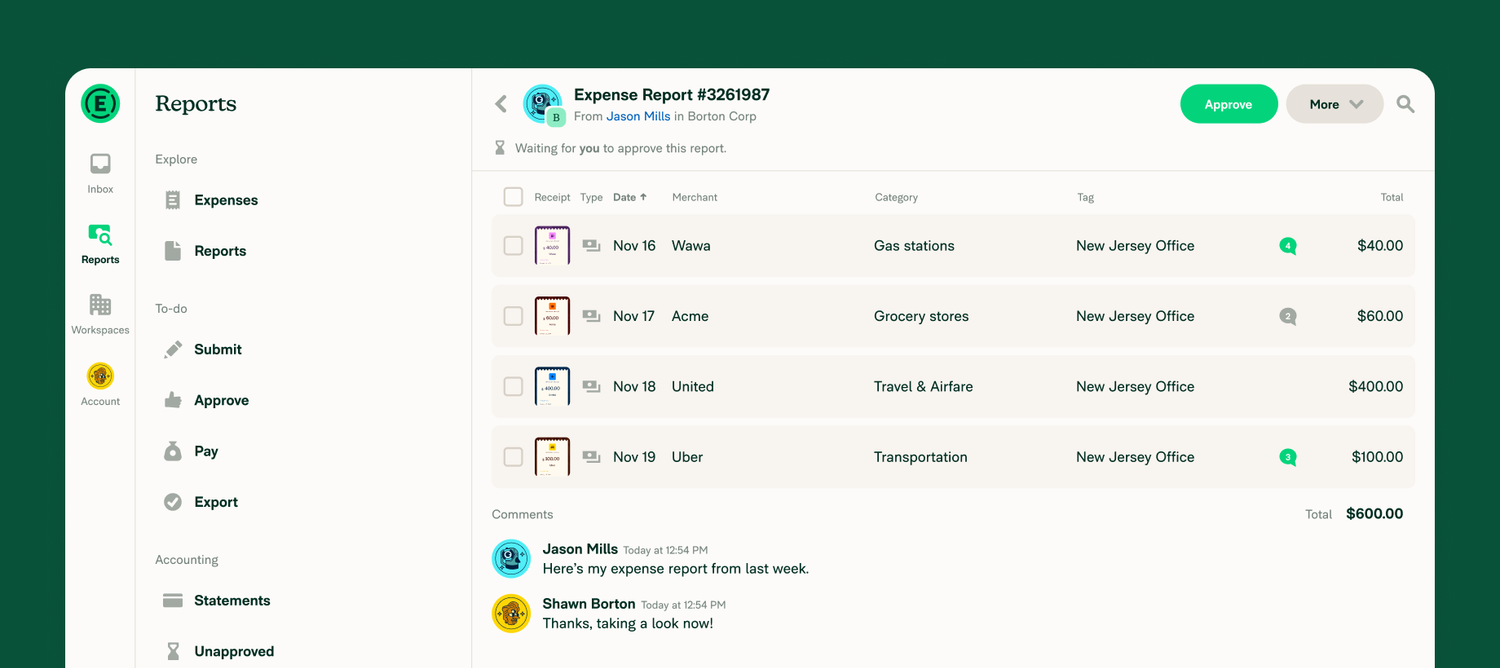

Expenses report. Source: Expensify

Payments. Expensify automates expense tracking, checks purchases against policies, and syncs all transactions with its branded corporate credit cards. The virtual version can be set up in a few minutes once your employees start using Concierge. Cardholders get a one-to-two percent cashback on every payment. Expensify makes donations to help fight social injustices from every trip booked with their cards.

Besides Expensify Business Cards, clients can use other payment options —debit and credit cards, ACH, and PayPal.Me. Yet, the number of available alternatives is limited.

Integrations. Expensify has out-of-the-box connections with accounting software like QuickBooks, Sage, and Oracle NetSuite, as well as HR and tax management solutions, travel platforms (Egencia, Perk, etc.), and more. It also maintains integrations with Uber, Lyft, Bolt, HotelTonight, Trainline, and other travel service providers to automatically upload receipts to Extensify. See the full list of integrations here.

Pricing. The company offers a free version with basic features and two pricing tiers costing $5 and $9 per user per month. Yet, you get them for free as well if you meet a minimum monthly spend with an Expensify Card.

Customers. Currently, the app has over 12 million users. Companies employing Expensify are mostly located in the US. The majority of them have 50 to 200 employees. The platform is also popular with non-profit organizations (NPOs), schools and universities, self-employed people, remote workers, and startups. Among clients are LG Hooker (real estate), Vend (retail), GrowthForce (accounting), and representatives of many other industries.

What users like about the product: free or low-cost pricing plans, minimal learning curve, ease of use, and a great receipt scanning feature.

What users dislike about the product: poor customer service for small businesses and the self-employed, as well as the limited number of third-party cards supported.

Fyle: Expense management built for finance teams and employees

Fyle is a modern expense management platform that focuses on making expense tracking and reporting seamless for both employees and finance teams. Known for its user-friendly design and powerful integrations, Fyle enables real-time expense capture from everyday tools like Gmail and Outlook, supports reporting expenses and per diems, allows managing credit card reconciliation, and setting up easy approval, including via a mobile app.

Overview of Fyle’s Perk (formerly TravelPerk) integration

Payments. While Fyle doesn’t issue its own cards, it works with any existing Visa, Mastercard, Amex or virtual credit card. It supports ACH reimbursements to employees and integrates card feeds for easy reconciliation.

Integrations. Fyle offers direct integrations with accounting software like QuickBooks Online, NetSuite, Sage, and Xero. It has a direct integration with Perk.

Pricing. Fyle offers tiered pricing starting with a basic plan for small teams for $14.99 and scaling to custom enterprise packages.

Customers. Fyle serves mid-sized businesses across industries including tech, professional services, education, and nonprofits. Customers include DataStax, Kiteworks, Freshworks, and Halo.

What users like about the product: seamless Gmail/Outlook integration, ease of use, fast reimbursements, and strong customer support.

What users dislike about the product: limited travel booking features, occasional sync issues with certain banks, and the absence of a built-in corporate card offering.

Navan: Focusing on employee safety and satisfaction

Navan (formerly TripActions) is a unified, AI-based T&E management app with the end user at the center of attention. Besides functionality common to most T&E solutions, it provides 24/7 travel support and runs a rewards program: Employees who choose cheaper travel and save money for their company earn incentives that can be redeemed for personal trips. Companies, in turn, get a 2-percent cashback for every hotel stay booked with Navan.

As for the reimbursement process, it enables travelers to be refunded within 2 days or less in 45 countries and 25 currencies. Navan also captures and reports VAT transactions.

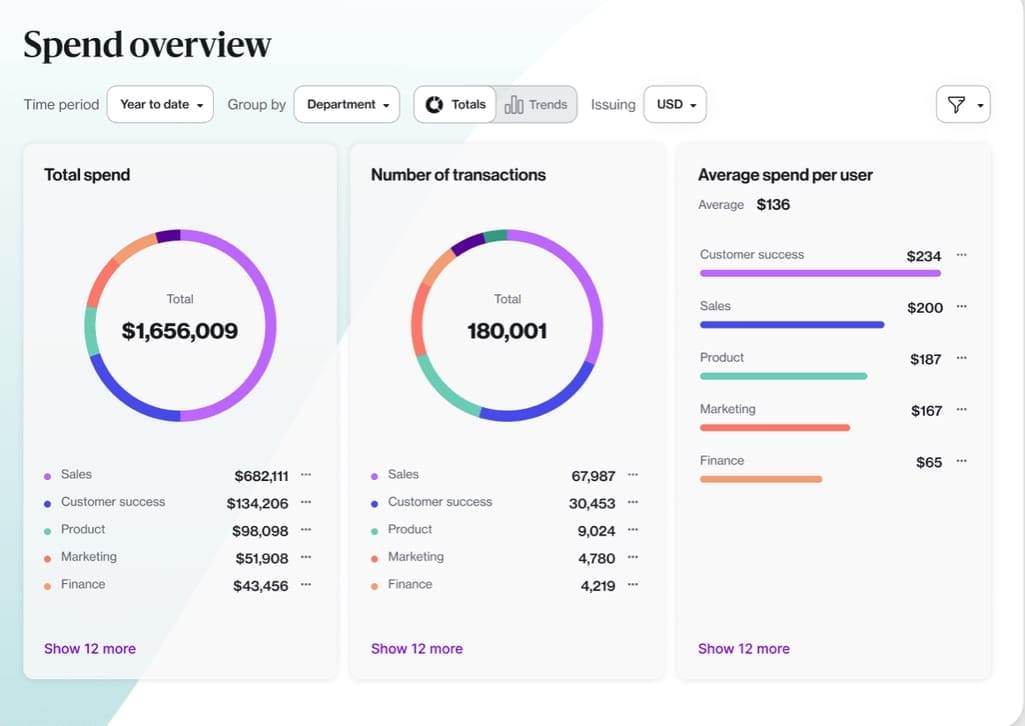

A real-time reporting feature. Source: Navan.

Payments. Navan partnered with Stripe to issue both virtual and physical corporate cards — Navan Expense — for one-time or recurring payments that eliminate the need for manual reconciliation. Spend controls are auto-enforced, so an employee can spend only the approved amount at the point of sale. You can also link your existing Visa or Mastercard to the Navan platform.

Integrations. Navan integrates with different HR and accounting platforms, CRMs, and other software to run core business operations. It also comes pre-connected with a plethora of services and apps to facilitate travel.

The company partners with large hotel chains (Marriott, Hilton, and Accor), eight major airlines (including American Airlines, Delta, Lufthansa, and British Airways), and a couple of car rental companies (Budget Rent a Car and Hertz). Yet, if you look for something more specific, you probably won’t be able to book it via Navan. View the marketplace here.

Pricing. Navan has two pricing tiers — for companies with up to 100 employees and for larger enterprises. It also provides a free trial for the first 50 monthly active users — you only need to pay for live travel agent support.

Customers. As the pricing policy clearly shows, Navan targets businesses of all sizes. Among globally known companies using Navan are Lyft, Zoom, Twilio, and SurveyMonkey.

What users like about the product: intuitive interface, incentive programs, and the ability to make changes to itineraries on the go.

What users dislike about the product: merging personal and business travel into a single trip, limited partnerships with travel suppliers, and a limited number of controls.

Ramp: A modern finance automation platform with a free tier

Ramp positions itself as more than just an expense management solution — it’s a finance automation platform with full-fledged reporting, procurement, and accounting tools under one interface. It supports seamless custom corporate card creation, expense capture using OCR, automatic payments, intelligent approval, and custom travel policy management.

Overview of Ramp’s travel features

Payments. Ramp issues Visa commercial cards via its banking partners, Celtic Bank and Sutton Bank. All cards have enhanced security, support Apple and Google Pay, support cashback and have partner rewards and deals from dozens of products.

Integrations. Ramp offers deep integrations with leading accounting platforms like NetSuite, QuickBooks, Sage Intacct, and many more. It also connects with leading productivity systems, HR software, and travel platforms such as Perk and Egencia.

Pricing. Ramp is free to use – it monetizes through interchange fees on card transactions. But there’s also a Plus tier for $15 per user per month, which supports custom travel policies, for instance. You can also get custom pricing if you need full customization.

Customers. Ramp claims to cater to everyone from startups to enterprises. Notable users include Poshmark, Glossier, and Quora.

What users like about the product: intuitive interface, fast implementation, robust automation, seamless accounting sync, and real-time insights.

What users dislike about the product: poor customer service, limited customization of approval workflows, and occasional sync delays with accounting systems.

Zoho Expense: A customizable tool for small and medium businesses

Zoho Expense is travel and expense reporting software with mileage tracking through GPS. It can scan receipts in 15 different languages, settle fast reimbursements, and get quick insights into spending. Its self-booking module, powered by GetThere, offers the best prices and a wide range of flight options, including low-cost carriers. Users also receive alerts on price drops to rebook tickets at lower rates.

Travel expense managers can benefit from the platform’s unique features — an add-on to the Google Chrome web browser and the ability to manage a lot of expenses on one page.

Zoho Expense overview

Payments. You can connect your personal or corporate cards, both debit and credit, to Zoho Expense.

Integrations. Zoho Expense is pre-connected with all major accounting and ERP solutions (Oracle, SAP, Sage, Xero, and more) and many business apps like Google Workspace, Office 365, and Slack. You can automate the uploading of ride receipts by linking to Lyft and Uber. Zoho Expense is natively integrated with other Zoho products. See the full list of connections here.

Pricing. Zoho offers pricing plans for businesses of all sizes, along with free trials. Small businesses (up to 3 users) can start for free. Paid subscriptions range from $3 to $8 per user per month. See details here.

Customers. Zoho mostly serves small (up to 100 employees) and medium (100 to 500 employees) businesses. Yet, it also has clients among global companies — for example, Puma and LogiNext. Its free version attracts self-employed people.

What users like about the product: ease of use, extensive reporting, and solid customization.

What users dislike about the product: a limited number of controls, lengthy onboarding, and poor customer support.

How to select and integrate a travel and expense management tool

Introducing a new solution to your tech ecosystem requires the collaboration of different departments and connecting multiple pieces of existing software. So, to make the best choice and seamlessly adopt the new system, consider our tips.

Think about your organization’s needs and pain points

At this juncture, determine what your requirements are and the type of solution that will fit your unique needs best. Answer these questions to outline your current situation:

- How many employees do you have and how many of them regularly travel?

- What other services would you like to integrate with a T&E platform?

A line-up of accounting integrations for Expensify

- Who will be managing your T&E efforts, and do they need training?

- How tech-savvy are your employees? How receptive are they to revolutionary changes?

- Do you want to allow employees to book on their own? Do they want to have more freedom during corporate trips?

Travelers, the financial department, the IT team, and top management will all be involved in company travel expense management. You need to understand their work processes. Ask your employees directly how they currently keep track of expenses and what they’d like to see improved. Your CFO will help you understand what organizational data is being analyzed and what kind of reports the company is lacking.

Determine the project budget and your financial expectations

It’s critical to understand how much money your company can allocate for the new software, what you expect to earn in return, and when. Since automating all the processes at once can be too resource-intensive, you can start by buying a module to modernize the most critical part of your T&E cycle.

Also, consider running a prototype project with a tech partner if you haven’t found the out-of-the-box solution that fits your requirements and points you towards custom development.

Pay special attention to integrations

Typically, the biggest concern about adopting new software is how to integrate it with internal processes. So first, assess the connections you need to make and determine whether a new tool is compatible with your existing systems.

Usually, T&E solution providers thoroughly describe how they plan to sync up your data, how long implementation will take, and what requirements the software has. You can also initiate your own technical feasibility study to assess what it will take to build all the required integrations and whether you will need help from third-party developers.

Explore a provider’s security profile

What are you doing to make your organization’s data secure? And how does a vendor store your sensitive data in the cloud? Though public cloud services allow you to scale more easily and reduce costs, there’s almost no guarantee that this data will be stored safely. Consider what the loss of this data will mean for your organization and the people who work in it.

The easiest way to check a vendor’s security profile is by reviewing certifications, accreditations, and standards. Check if they comply with information security standard ISO27001, the Payment Card Industry Data Security Standard (PCI DSS), and the General Data Protection Regulation (GDPR).

Carefully assess technical support

Using a cloud service means that all setup, implementation, and technical support will be managed remotely. When searching for a software provider, ensure they have a professional approach to remote project management, comprehensive guidelines, and FAQs that will help you resolve technical issues independently. Also, try to check beforehand how fast their technical support reacts to your questions. Low response and lack of help from providers may disrupt your T&E process, outweighing all the benefits of rich functionality.