In many companies, corporate travel is one of the largest expenses, but it’s also prone to leaks, inefficiencies, and frustrated employees.

Successful management of travel expenses isn’t just a policy or a tool – it’s a connected ecosystem of people, systems, workflows, and data. This article breaks it down in full and then explains different approaches for adopting the modern T&E management process.

Overview of the state of T&E in 2025

What is travel and expense and what it includes

Travel and expense management (often called T&E) is the process of controlling the business travel budget to have visibility over costs and preemptively minimize them.

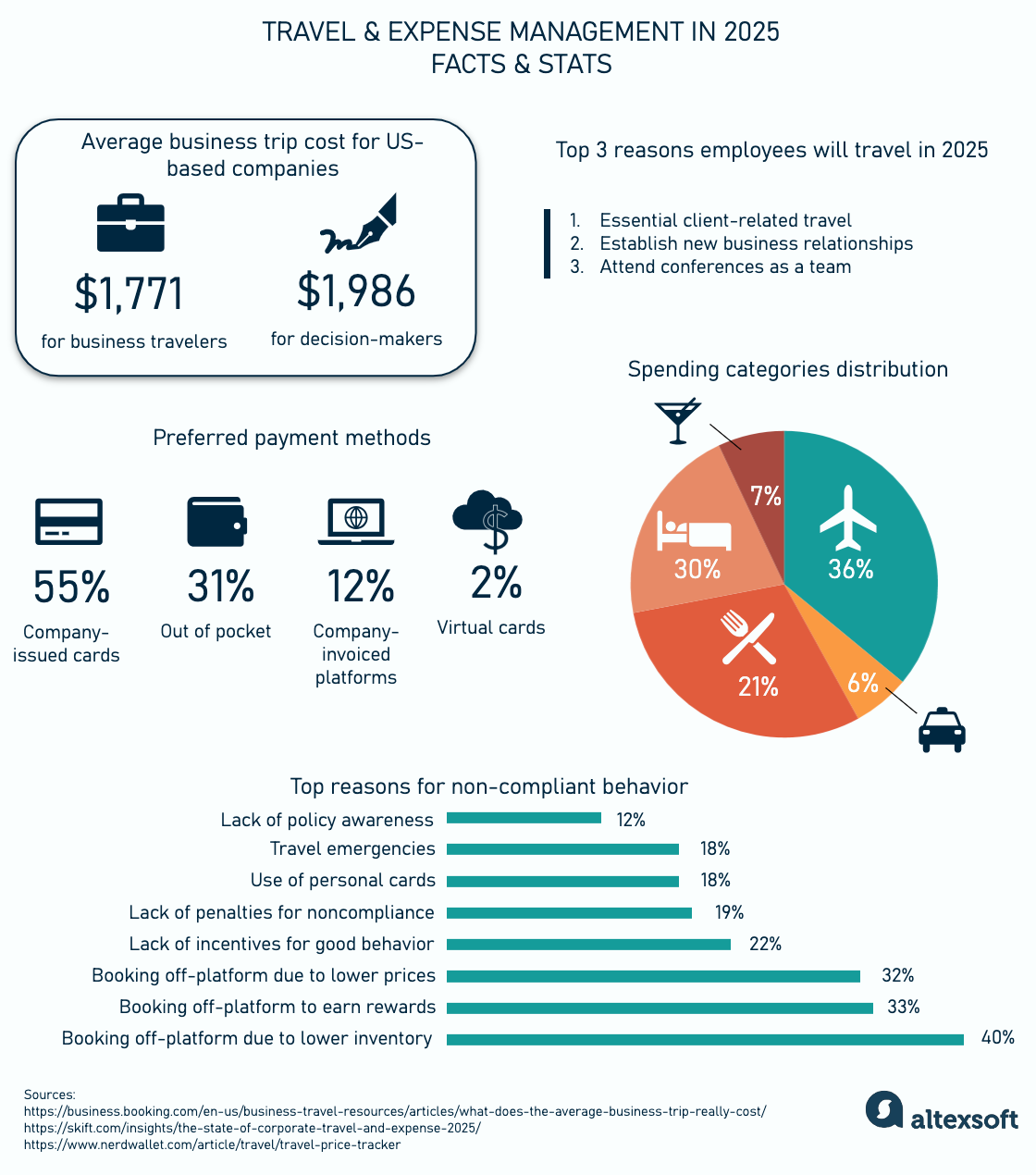

A typical business trip cost for US-based companies is $1,771 for business travelers and $1,986 for decision-makers. The bulk of the cost comes from a few core categories: lodging, around 30 percent of total spend, followed by airfare (36 percent), and meals, responsible for over 20 percent.

But trip costs don’t stop there. A full travel bill often includes a wide range of additional expenses, such as

- ground transportation (car rentals, ride shares, etc.),

- international calling or mobile data,

- event registration and venue fees (for MICE travel),

- corporate gifts and partner hospitality,

- business entertainment, and

- duty of care services (such as real-time tracking or emergency support)

In today’s increasingly global and hybrid business environment, travel expenses are not just larger – they’re more fragmented, resulting in many challenges that weaken the travel management process.

Travel and expense challenges

For one, policy enforcement is an ongoing challenge. Even with a clearly written travel policy, companies often struggle to ensure that it’s actually followed. Employees make dozens of small decisions on the go and each one has financial implications.

Then there’s the issue of data visibility. One trip might involve ten receipts from five different platforms. Without real-time integration across systems, finance teams often don’t have a full picture of what was spent, when, or why – until long after the fact.

The employee experience adds another layer of complexity. In many organizations, employees are the ones booking trips, paying out of pocket, saving receipts, and submitting reports. If the process is clunky, time-consuming, or confusing, it doesn’t just create friction – it leads to mistakes, frustration, and even non-compliance.

Fraud (intentional or not) is also a persistent risk. Whether it’s duplicate expenses, inflated tips, or personal items hidden in reports, T&E is a common target for small-scale misuse.

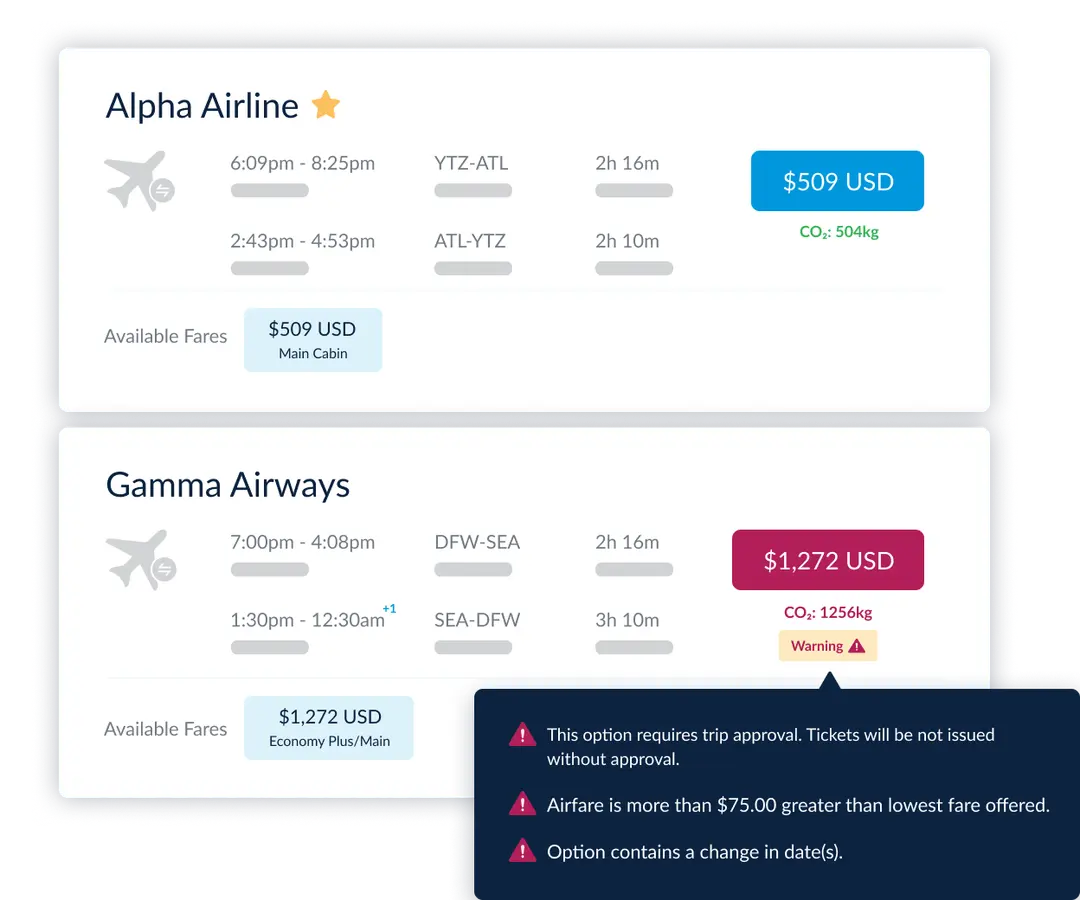

Flagging policy violations for corporate flight booking. Source: Zoho

Finally, there are reimbursement delays, which affect both morale and trust. When employees purchase travel upfront, they expect timely repayment. Delays caused by unclear policies, missing receipts, or approval bottlenecks create frustration and can even discourage future travel.

T&E is inherently decentralized, fast-moving, and employee-driven. It requires a unique kind of system – one that combines automation, real-time data, and user-friendly tools to bring structure to what is otherwise a very human, unpredictable process.

So let’s talk about what it takes to create the ecosystem that tackles each of these challenges, automates processes, and encourages employees to follow them.

Travel and expense ecosystem

The T&E workflow actually begins before the trip ever happens – when employees make travel plans or book their flights and hotels. At this point, the system should already be working in the background to guide compliant behavior. Further, we will describe every layer of the ecosystem in detail.

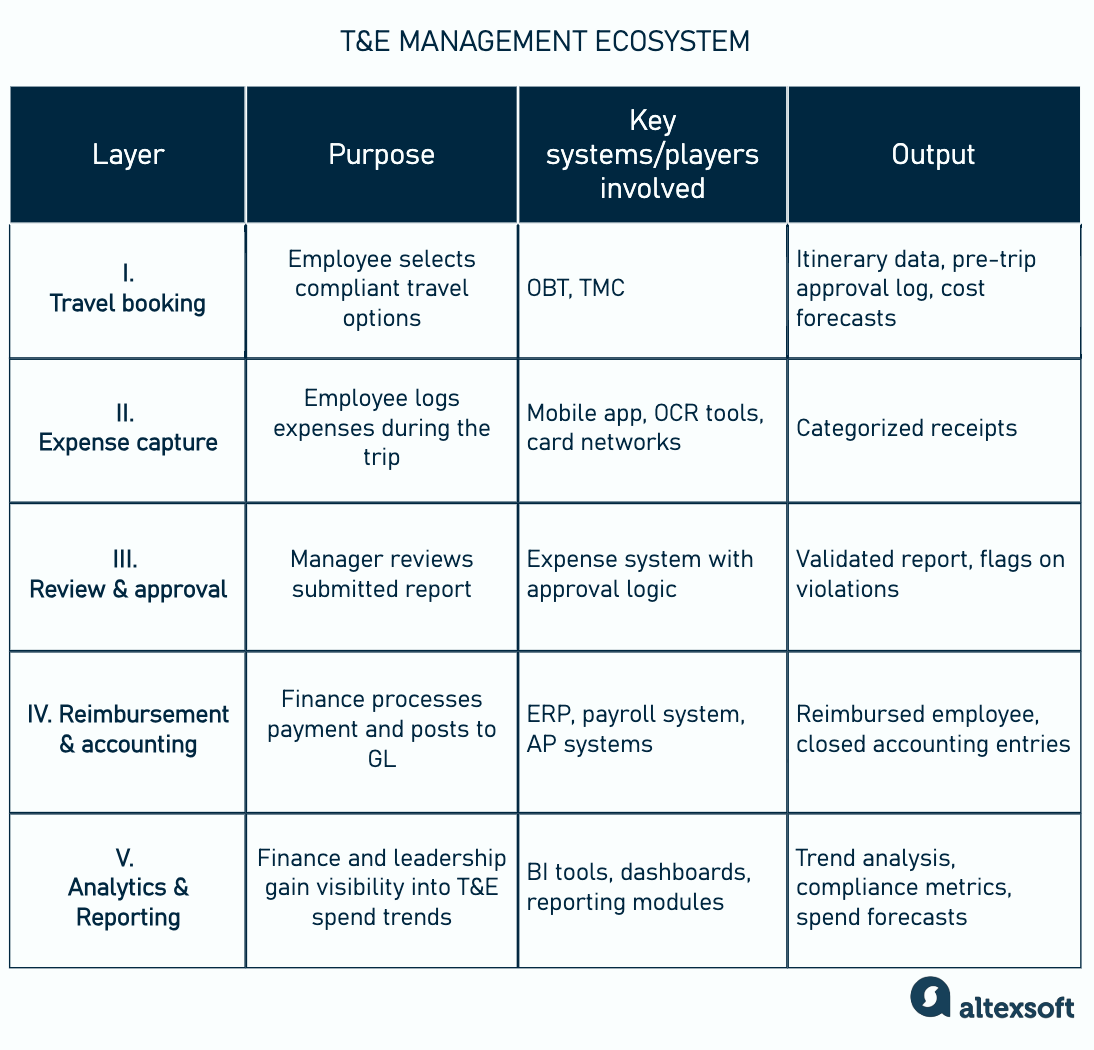

Overview of all layers within the T&E process

But what transforms all these layers into a tightly integrated ecosystem? The glue that holds it together? Data, integrations, and analytics.

Data as the common thread

Each layer of the T&E stack generates and consumes data. Booking platforms capture itinerary details – flight numbers, hotel names, check-in dates – that become anchors for downstream processes. At the expense layer, merchant names, amounts, tax rates, and timestamps are gathered. Review and approval workflows add context: who signed off, when, and why. Reimbursement and accounting layers tag payments with GL codes, tax classifications, and cost centers.

Consider these layers:

- An employee books a hotel through a corporate online booking tool or a corporate travel management platform like Navan or SAP Concur Travel.

- Then the reservation details are pushed into the expense system, creating a pre-trip shell that organizes subsequent charges.

- When the hotel is paid with a corporate travel card, the transaction is automatically connected to the booking, categorized under Lodging, and fed to an accounting system.

This data flow is supported by the platform’s integration capabilities.

The power of integrations

True unification happens when your T&E stack communicates with surrounding enterprise systems. A well-integrated platform might connect to

- HR systems to pull in employee roles, departments, and approval hierarchies;

- ERP or accounting software like NetSuite, SAP, or QuickBooks to sync expense categories, project codes, and tax data;

- corporate card providers (Amex, Visa, Mastercard) for real-time transaction feeds and automated reconciliation;

- communication tools like Slack or Microsoft Teams for instant notifications about policy violations, pending approvals, or missing receipts; and

- tax engines for global VAT/GST calculation and reclaim.

For instance, when an employee submits an expense from a business trip in Germany, the system can automatically calculate the applicable VAT, code it correctly in the ERP, and pass that data to a tax engine for reclaim processing – all without requiring manual input.

Integrations also close the loop with all teams. A CFO looking at month-end reports sees real-time T&E data already categorized and posted to the general ledger. An HR manager reviewing travel trends can access dashboards showing who’s traveling, how often, and how that aligns with duty of care policies.

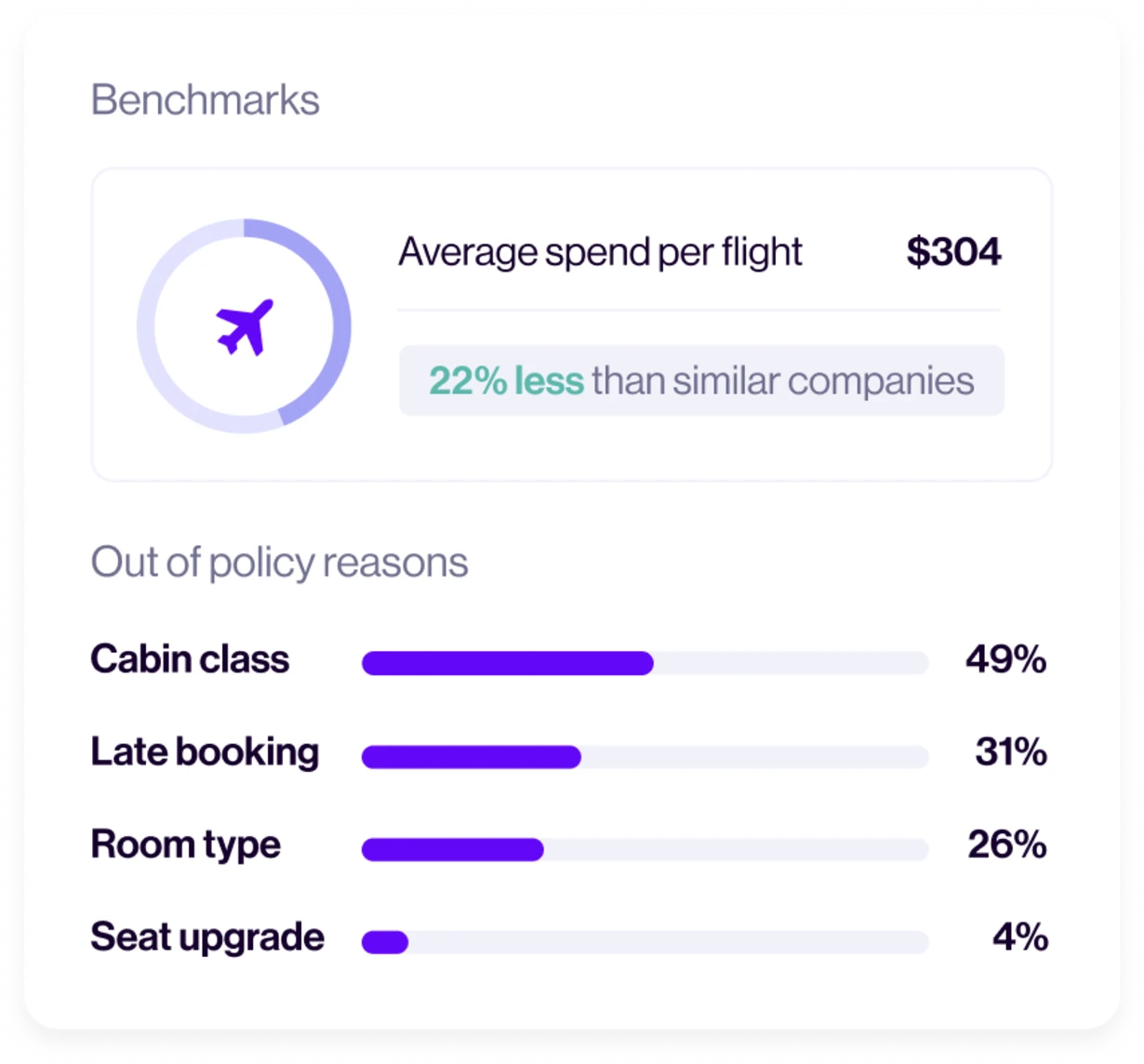

Analytics turn spend into insight

Once data flows freely, it becomes fuel for analytics. A unified T&E ecosystem enables companies to move beyond reactive tracking (How much did we spend last quarter?) to proactive decision-making (Which departments are trending over budget? or Which vendors give us the best ROI?).

For example, a company might discover that employees in one department consistently book more expensive hotels than peers. Analytics can help pinpoint the reason: Maybe they travel to cities with fewer affordable options, or maybe they’re unaware of policy limits. Either way, the insight enables smarter decisions, not just reactive enforcement.

Now that it’s clear how the ecosystem works, let’s talk about the layers within it.

The foundation: the travel and expense policy

The T&E policy is the foundation of the overall corporate travel program that holds the entire ecosystem together. Without it, companies face ambiguity, overspending, and inconsistent practices across teams and regions. At its core, a T&E policy, which is often drafted by a company's corporate travel department, defines

- what’s allowed,

- what’s reimbursable, and

- how employees should handle travel-related spending.

But it’s more than just a static document – it’s a living framework that must be clear, accessible, and easy to follow in practice.

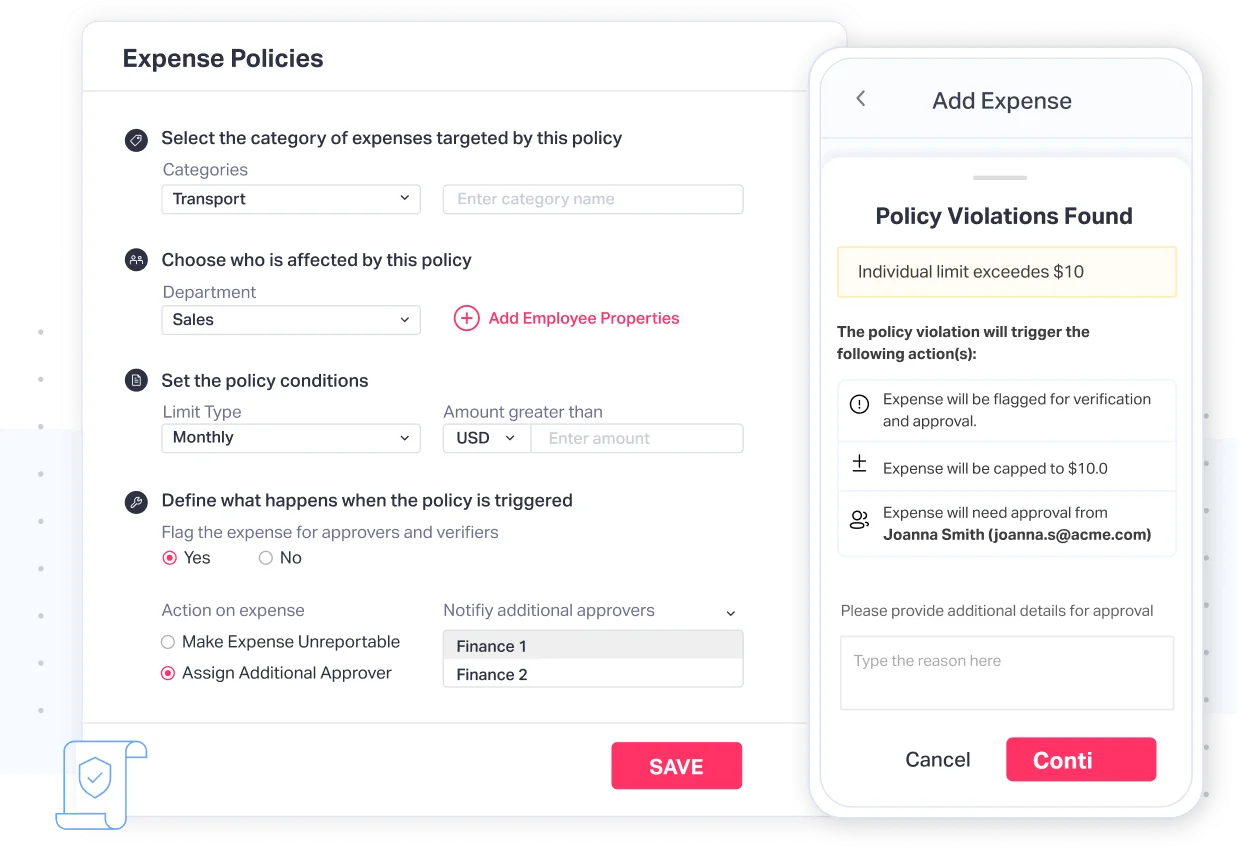

Setting up your travel expense policies and the alert for policy violations. Source: Fyle

So what should a solid T&E policy be like?

Embedded. Today, companies no longer rely on distributing PDF policy documents and hoping for the best. Instead, they embed the policy directly into their systems, so that the rules are enforced in context, during the booking or expense process itself. For instance, if a hotel exceeds the allowed nightly rate, the system might flag it immediately, or even prevent the booking unless an exception is preapproved.

Adaptable. Smart T&E teams continuously analyze spend data and traveler behavior to fine-tune their policies, tightening where abuse is common, or relaxing rules where they’re unnecessarily burdensome.

Clear. A great policy is written in plain language, not legalese. It anticipates edge cases and provides real examples. And most importantly, it’s actively communicated – not just handed out during onboarding, but referenced regularly through training, FAQs, and automated reminders in T&E tools.

In short, the T&E policy is not just a rulebook – it’s a strategic document. When thoughtfully designed and properly integrated into workflows, it becomes the blueprint for efficient, compliant, and traveler-friendly operations.

I. Travel Booking Layer

Once a policy is in place, the next key pillar of the T&E ecosystem is the travel booking process. This is where employees begin making choices that directly impact both company spend and the traveler experience.

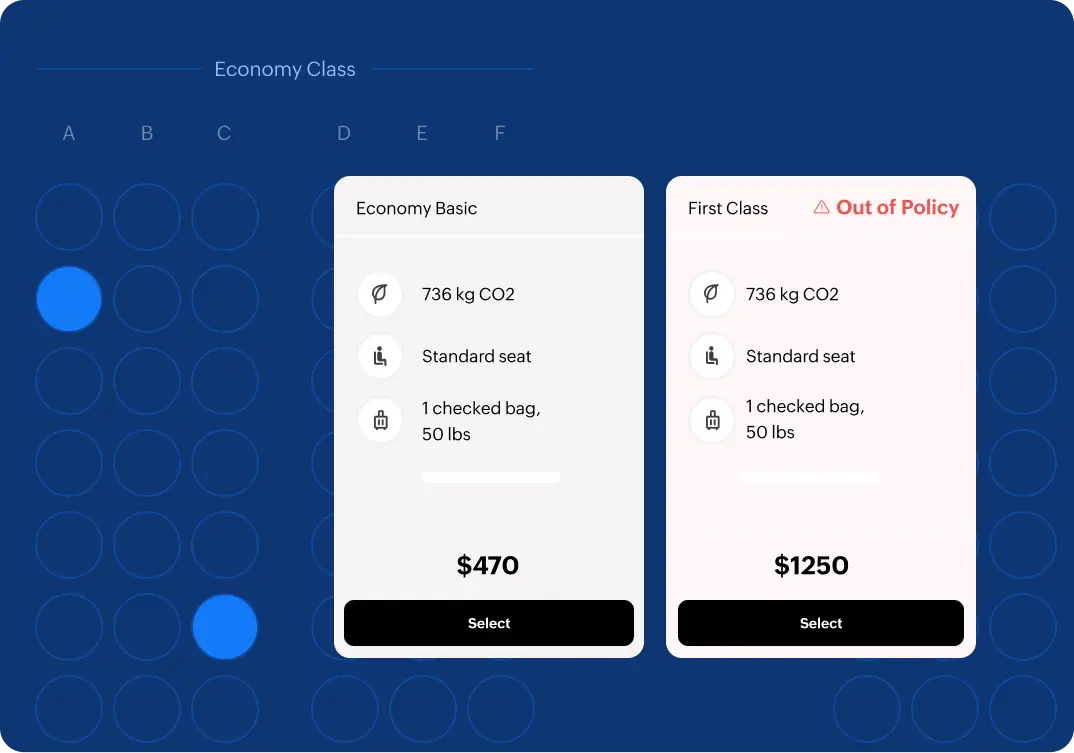

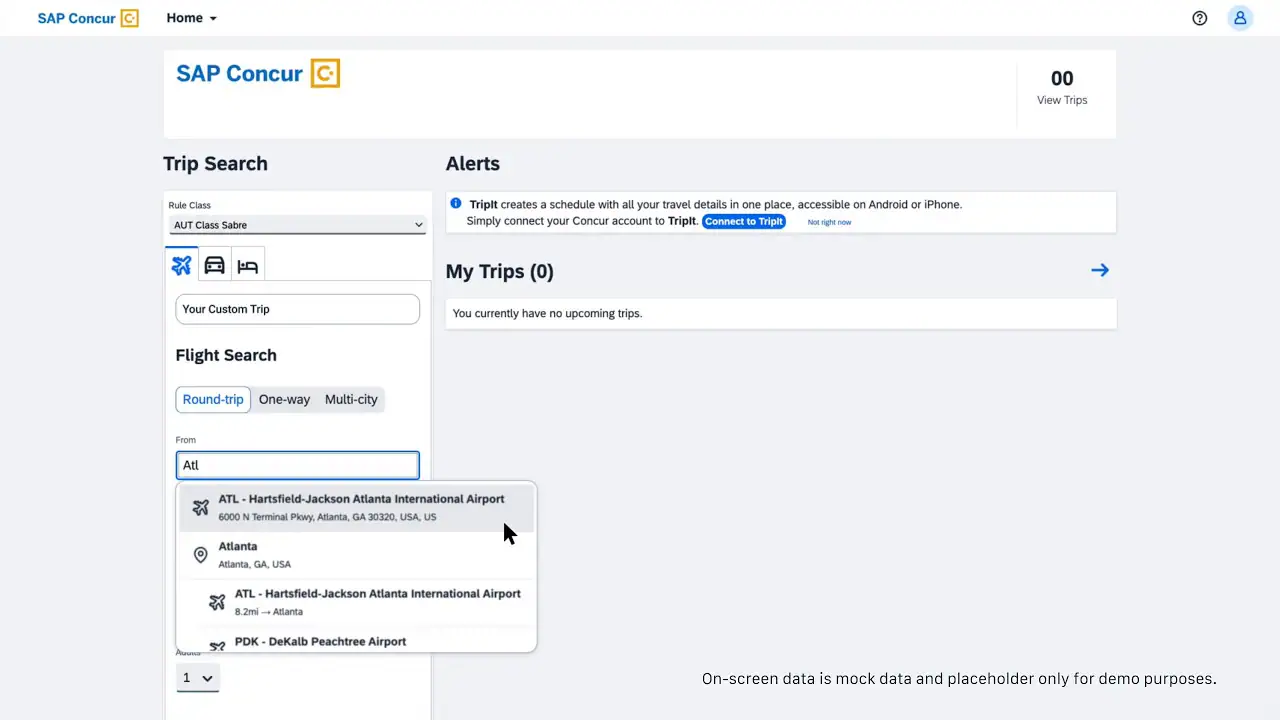

Example of a corporate travel booking interface. Source: SAP Concur

How does it work?

Traditionally, employees would book travel on consumer platforms like Expedia or Booking.com, then submit expenses afterward. While fast and familiar, this decentralized approach creates headaches: noncompliant bookings, missing data, and poor visibility for finance teams.

That’s why more organizations now adopt centralized booking tools or rely on outside services.

- Online Booking Tools (OBTs) that allow employees to search for and book business travel online.

- Travel Management Companies (TMCs) that offer curated services for more complex or international bookings that can also provide self-booking tools.

These providers allow employees to book within company policy, using preapproved vendors, negotiated rates, and built-in compliance checks.

What functions does it serve?

Modern booking systems do more than just offer flights and hotels.

Policy embedding. These systems are built to embed corporate travel policy directly into the user experience. For example, if an employee tries to book a business-class flight for a short domestic trip, the option can be automatically flagged or blocked. This way, employees don’t have to memorize policy details – the system guides them to the right choices.

Integration into the expense system. Once travel is reserved, the itinerary data is pushed into the expense system. This early data capture creates a trip container, a shell around which expenses can later be grouped, making reporting and reconciliation easier. It also lays the groundwork for automated expense population as corporate card charges and physical receipts come in.

Duty of care and traveler visibility. Booking systems also serve a duty of care function. They give travel managers and HR teams real-time visibility into where employees are, especially in high-risk regions or during emergencies. They can track itinerary changes, help locate travelers, and respond quickly if disruptions occur.

II. Expense Capture Layer

After travel bookings and the trip itself, employees begin the process of submitting their expenses. This includes gathering flights, hotels, meals, transportation, and other receipts and entering details into expense reports.

Uploading the photo of the receipt for approval and reimbursement. Source: Navan

How does it work?

Traditionally, employees collected paper receipts throughout their trip, then manually entered each item into an expense report after returning. This time-consuming and error-prone process often led to missing receipts, incomplete data, policy violations, and frustration for both travelers and finance teams.

Today, companies are shifting to automated and real-time expense capture features that dramatically improve accuracy and speed.

Corporate card feeds allow the automatic import of transactions into the expense system, often enriched with merchant data and tax details.

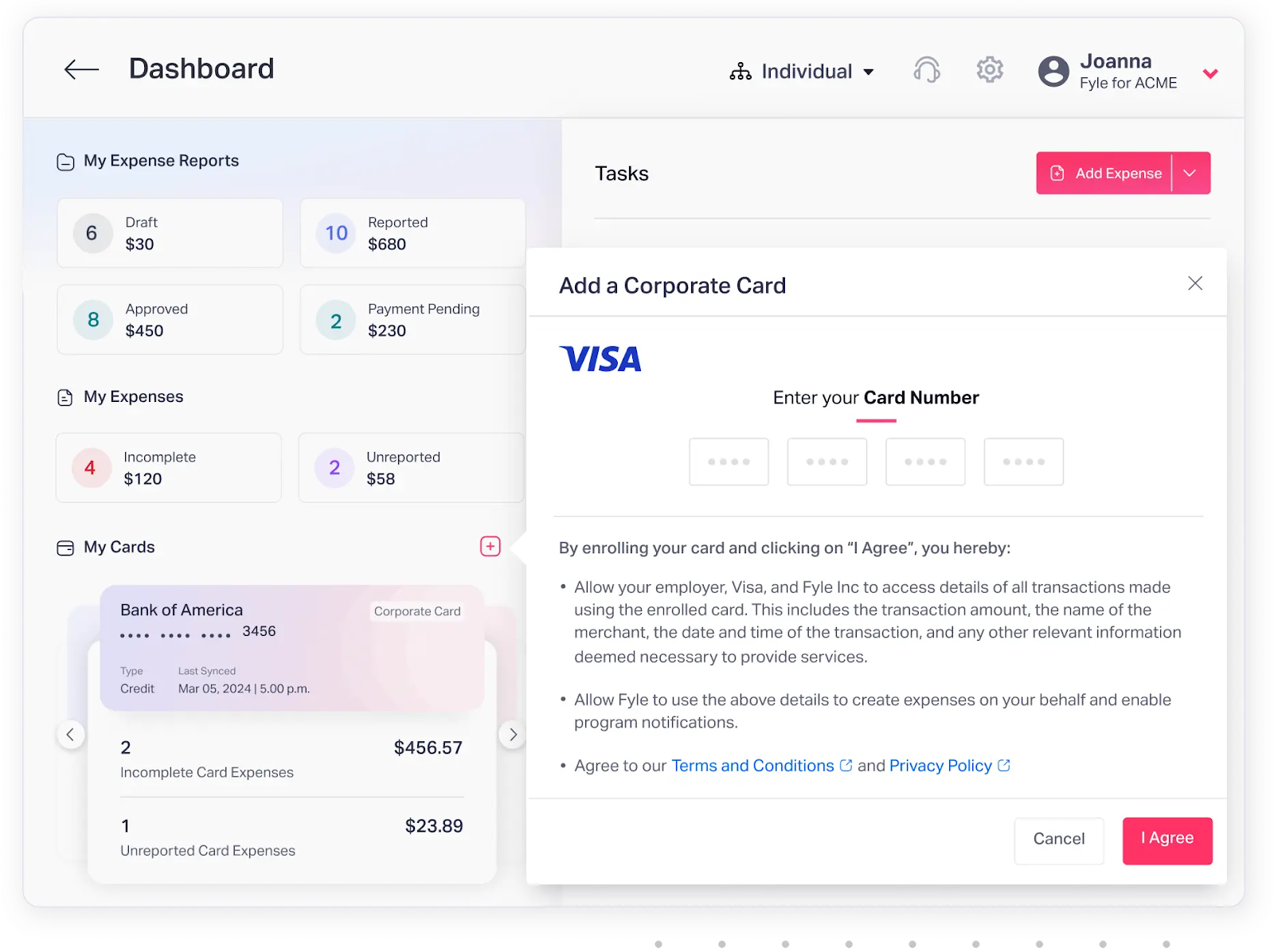

Enrolling corporate cards in the system. Source: Fyle

Receipt scanning apps help employees snap photos of paper receipts via mobile apps. OCR (optical character recognition) and AI extract key information like date, vendor, and amount.

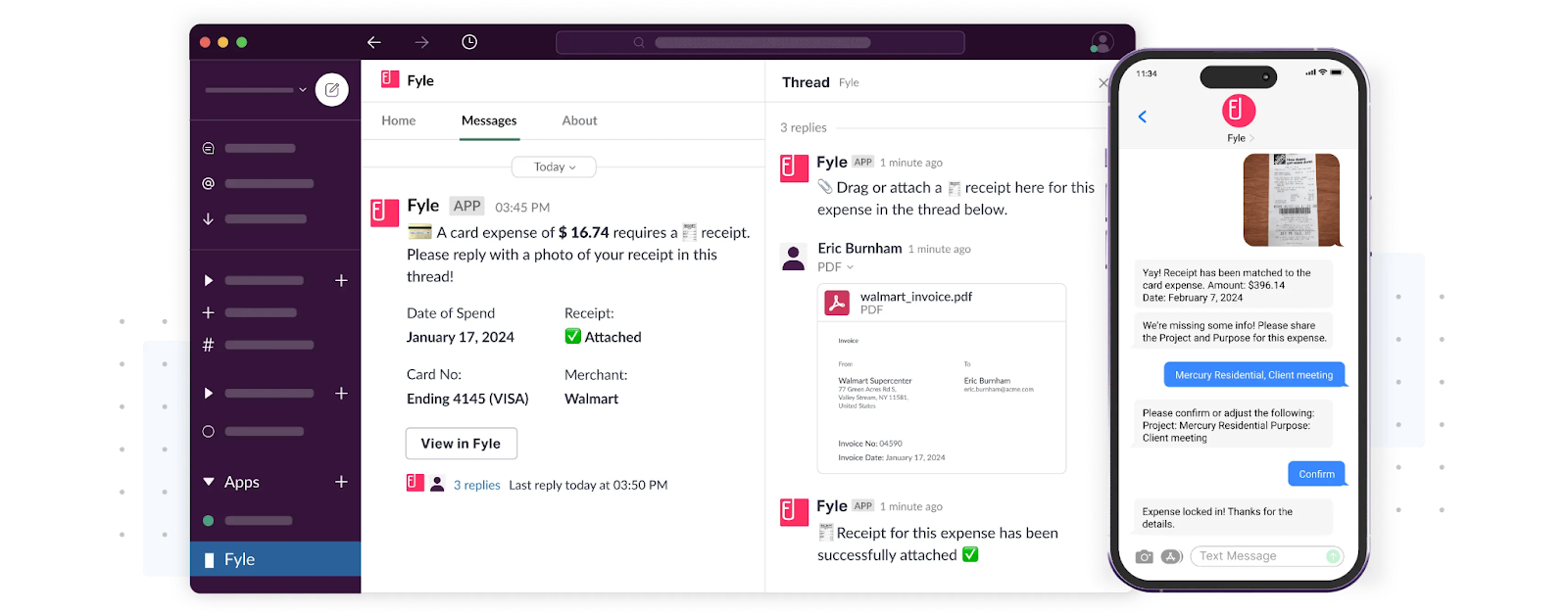

Employees can be notified of transactions via text or Slack. Source: Fyle

Email parsing can scan inboxes for digital receipts (Uber, airlines, hotel confirmations) and push them directly into the expense report.

Instead of building expense reports from scratch, the system now assembles a draft report in the background, which the employee can quickly review and submit.

An increasingly important piece of the expense capture layer is the use of virtual corporate cards. A virtual card is a payment option linked to a real card account. It’s issued for a specific amount of money to a particular recipient. Thanks to a preset spending limit and an expiration date, it allows employees to spend company funds directly while reducing fraud possibilities.

You can read more about this payment model and VCC providers in a dedicated article.

What functions does it serve?

The expense capture layer is where finance, compliance, and employee experience intersect. A modern system must deliver on all three fronts.

Real-time data visibility. The layer ensures that expense data is captured and categorized automatically, so finance teams gain access to near real-time spend data. This helps with budget monitoring, forecasting, and detecting irregularities early. It also reduces the delay between the time money is spent and when it shows up in internal reports.

Audit trail and compliance. Every captured expense includes metadata: receipt images, timestamps, location, user comments, and policy flags. This builds a clean, searchable audit trail for both internal and external review – crucial for companies in regulated industries or those preparing for tax audits.

III. Review and Approval Layer

Once expenses have been captured – via card feeds or receipts – they move into the review and approval process. This is where the human element comes back in: Managers and finance teams assess whether submitted expenses are legitimate, policy-compliant, and correctly categorized.

The system automatically flags transactions for manual approval. Source: Emburse

In the past, managers had to sift through spreadsheets or paper reports, cross-referencing receipts and manually checking for violations. Today, modern T&E systems automate much of this process, allowing reviewers to focus only on exceptions.

How does it work?

Here's how it typically works.

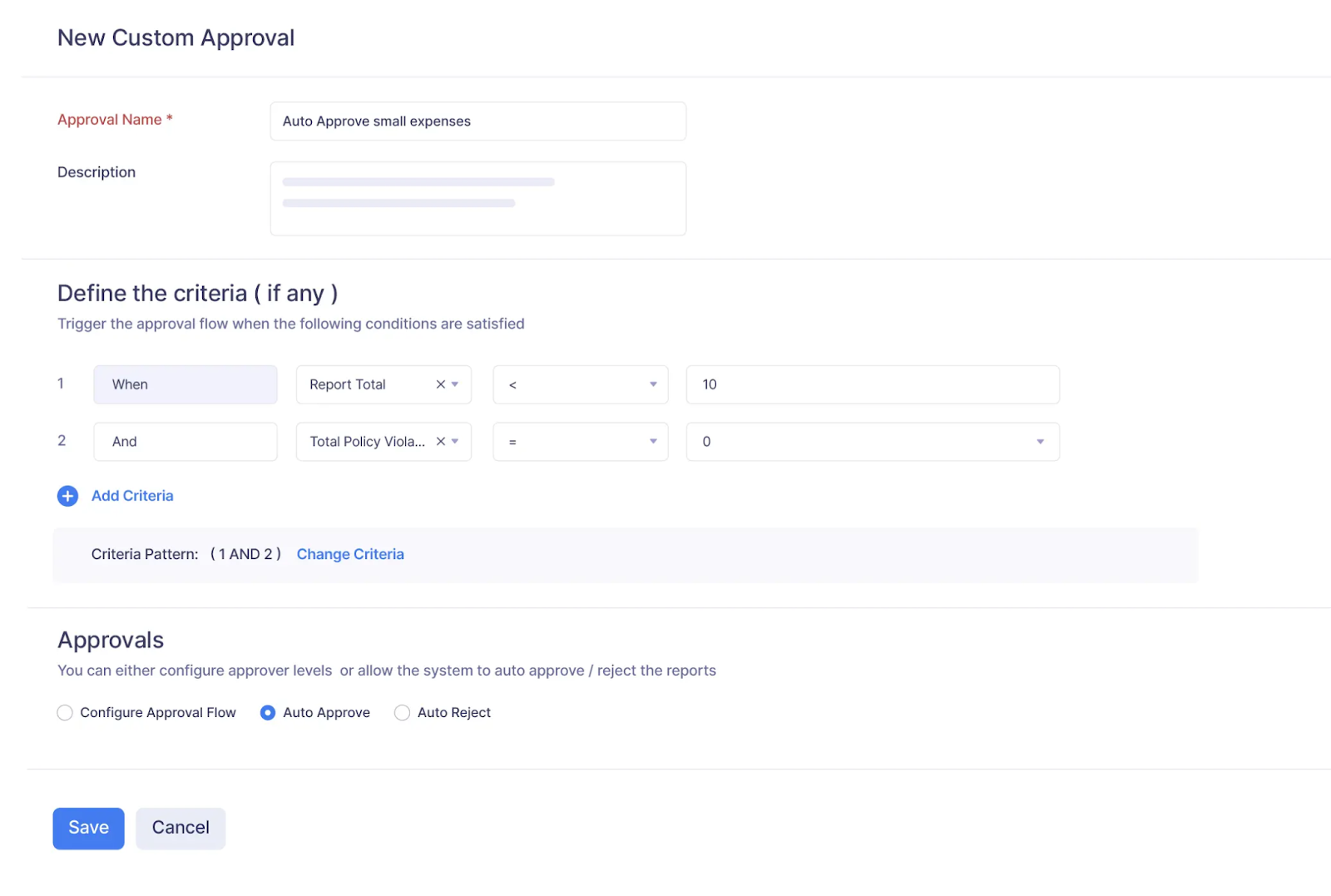

Policy rules built into the system. When employees submit an expense report, the system runs a set of policy checks in the background. If everything is compliant, the report can move through without manual intervention.

Automated flagging. Expenses that exceed limits, lack receipts, or fall outside standard categories are flagged for manager review. This reduces noise and speeds up approvals.

Customizable workflows. Companies can configure who approves what. For instance, team leads might review direct reports’ expenses, while anything above a certain threshold goes to finance or senior leadership.

Admins can create custom workflows for easy automated approval. Source: Zoho

Audit trail capture. All actions (edits, comments, approvals, and rejections) are logged for transparency and compliance.

More advanced systems also surface contextual data to help managers make decisions faster: Was this trip preapproved? Was it more expensive than similar trips? Were any policy exceptions granted in advance?

What functions does it serve?

The review and approval layer balances control with employee autonomy.

Financial oversight. For finance and management teams, it’s a checkpoint for enforcing policy and catching fraud or errors. For employees, it’s an opportunity to correct mistakes or clarify unusual charges. This stage also helps ensure that only valid expenses move forward to payment, protecting company funds and improving audit readiness.

Simplified approval. Automated workflows streamline the process by routing expense reports to the right manager based on project, department, or spend level. Policy violations are automatically flagged with explanations, and some systems offer real-time coaching to help approvers make better decisions. The result is a faster, more consistent review process with fewer bottlenecks.

IV. Reimbursement and Accounting Layer

Reimbursement is an important step in the T&E process whenever the employee purchases travel out of pocket.

Traditionally, companies relied on slow, often manual processes – cutting physical checks or wiring reimbursements once or twice a month. That left employees waiting and finance teams scrambling.

Modern systems automate this layer, linking expense approvals to both payroll and accounting systems.

How does it work?

The modern reimbursement process looks like this.

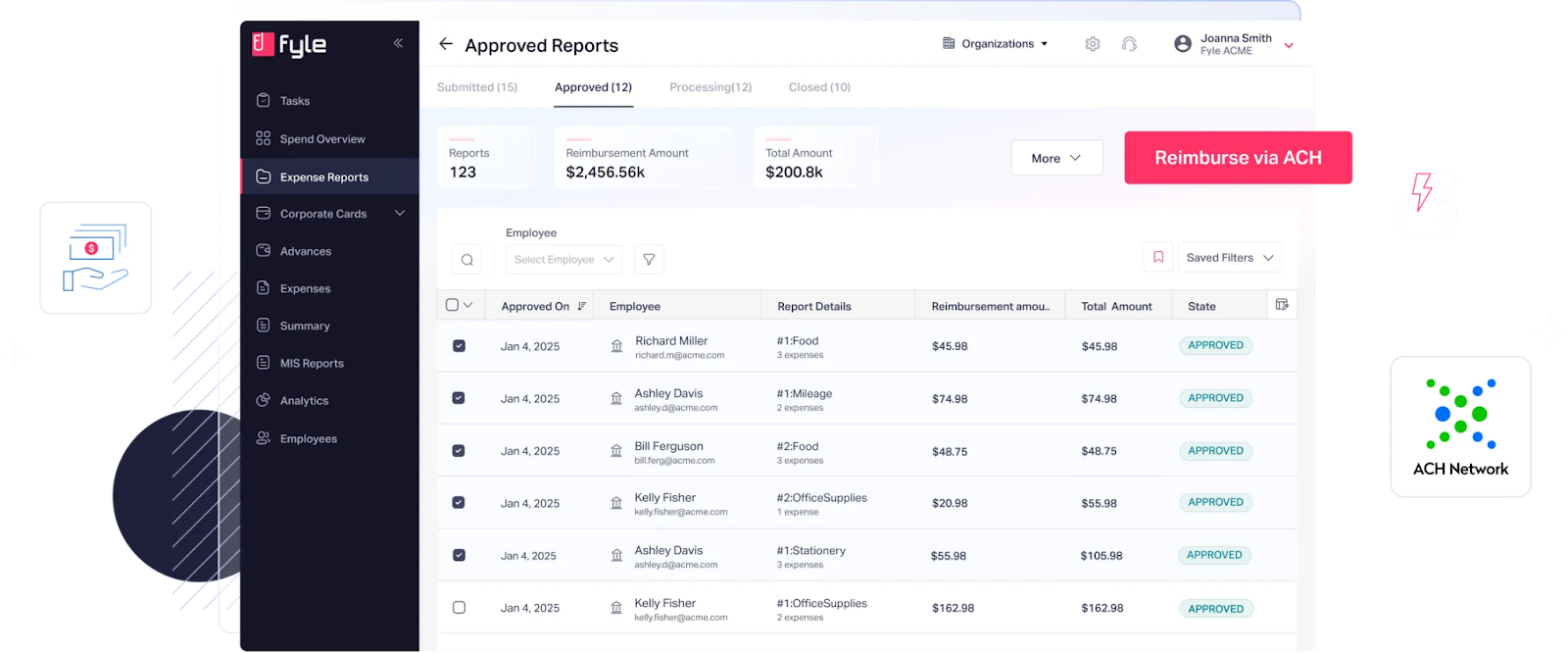

Reimbursement automation. Once a report is approved, the system pushes the reimbursement request to accounts payable or payroll. Employees receive funds directly in their bank accounts, sometimes within 24-72 hours.

You can pay multiple employees with a single click. Source: Fyle

ERP/GL integration. Each expense is categorized and coded during capture and approval. When the report is finalized, these codes flow directly into the general ledger, reducing the need for manual reentry.

Currency and tax handling. For international travel, the system can convert currencies, apply appropriate exchange rates, and even calculate VAT or GST reclaim opportunities.

Advanced platforms also offer dashboards where finance teams can monitor outstanding reimbursements, identify bottlenecks, and ensure accurate accruals.

What functions does it serve?

This layer serves two key purposes.

First, it ensures timely and accurate reimbursement to employees, which directly impacts their satisfaction and trust in the process. Second, it reconciles all approved expenses with the appropriate accounting categories, cost centers, and budgets – ensuring that T&E spend is reflected accurately in the company’s books.

An effective reimbursement and accounting process also supports regulatory compliance by properly categorizing expenses for tax purposes, managing VAT/GST reclaim, and providing clean documentation for audits. For multinational organizations, this may involve multicurrency support and local tax rules as well.

V. Analytics and Reporting Layer

Once expenses are captured, approved, and reimbursed, the final layer of the T&E ecosystem is analytics and reporting.

How does it work?

In earlier generations of T&E processes, expense data was buried in spreadsheets, siloed across departments, and reported weeks or months after the fact. That made it hard to see trends, identify waste, or enforce policy improvements.

Modern T&E platforms change that by offering real-time dashboards, prebuilt reports, and powerful data exports, often integrated directly with BI tools like Tableau, Power BI, or Looker.

Real-time dashboards show T&E spend by team, department, location, or category.

Preconfigured reports track key metrics:policy violations, average trip costs, reimbursement times, budget vs. actuals, etc.

Custom queries and exports allow finance and operations teams to slice and dice the data for deeper analysis, audit preparation, or strategic planning.

Leading systems also use AI to spot anomalies or flag outlier behaviors, like unusually high spending in specific regions, or frequent travelers who never book through the company tool.

What functions does it serve?

Analytics transforms raw T&E data into strategic insight. It helps companies spot policy violations, control costs proactively, and make informed adjustments to their travel programs. Real-time dashboards and reports enable finance teams to track spend, identify outliers, and improve forecasting, while also ensuring compliance and simplifying audits.

You can improve your travel program by comparing it to benchmarks. Source: Navan

By making expense data transparent and actionable, this layer supports smarter decision-making and greater accountability throughout the organization.

Travel and expense management automation approaches

So how do you combine these different layers into a cohesive T&E management mechanism? Depending on your budget and how often your company has to execute T&E processes, you can approach it in four ways.

Travel management companies (TMCs). Large corporations with thousands of employees worldwide typically use the services of travel management companies. Global TMCs such as American Express, BCD Travel, and CWT provide branded software and have a division of skilled travel agents at your disposal. The services of TMCs include special pricing agreements with major airlines and hotel chains, travel policy development, crisis management, and, of course, travel and expense management.

Business Travel and Corporate Travel Management, Explained

Note that many companies employ a TMC but continue to use their existing software. In this case, the travel management company adapts to the third-party systems.

See our dedicated article, where we compare four main TMCs.

Travel and expense management platforms. Companies of all sizes can benefit from T&E products as they cover the entire travel and expense management process, have a modular architecture, so you can buy features separately, as needed, and often provide low-cost pricing plans for small companies. This approach is popular among businesses that either don’t require full corporate travel support or can’t afford it. These products include Navan, SAP Concur, Expensify, Fyle, Zoho Expense, and more. But, as we said before, T&E software can be combined with TMC services.

Travel & Expense Management Systems, Explained

Multi-goal expense management modules. There are a lot of expense management platforms not specifically designed for T&E management purposes. They don’t provide capabilities like booking, travel tracking, etc. Still, many companies find this option useful, integrating an off-the-shelf expense module into their ERP systems.

Proprietary or custom solution. While this approach allows you to cover all your unique business needs, it’s too time-consuming and resource-intensive to be feasible for most companies, especially small and medium-sized ones.

The Human Layer: Training, Communication, and Culture

A powerful T&E platform can flag out-of-policy expenses, suggest compliant options, and generate dashboards, but it can’t make employees care. When people don’t understand the why behind policies or feel frustrated by the process, they find workarounds: booking outside tools, skipping receipts, delaying submissions.

That means that it’s crucial to explain not just what employees can or can’t do, but why it matters.

- Booking through the approved system ensures duty of care and better rates.

- Submitting expenses on time helps the company close books faster and reimburse fairly.

- Avoiding certain vendors supports sustainability goals.

So what can you do to help create a culture of thoughtful spending?

Onboard new employees into the T&E process. Create a welcome guide or short video walkthrough showing how to book travel, submit receipts, and get reimbursed. Write and maintain a single source of truth (e.g., an intranet page or Notion doc) with links to policies, step-by-step guides, and contact info.

Push updates and notifications. Vendors change, rules evolve, and company priorities shift. Ongoing communication keeps everyone aligned and reduces friction. For example, send quarterly updates or emails when policies are updated (e.g., new per diems, blacklisted airlines, sustainability initiatives).

Create support channels. No matter how smooth the system is, things will go wrong. Make sure employees know who handles technical issues with the booking or expense tool, etc. Fast, empathetic support turns T&E from a source of stress into a seamless background process.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.