Tourist taxes have been a fixture in many countries for decades, evolving alongside the rise of tourism. However, numerous renowned destinations, from Venice to Bali, have implemented new or increased existing tourist taxes in the past year. These political decisions have sparked vigorous debates in the press and social media.

The surge mirrors the mounting pressure of overtourism amid growing climate concerns. But do tourist taxes really provide solutions? Let's try to understand how they affect the travel industry.

What is tourist tax

A tourist tax is a fee that some countries or cities charge visitors during their short-term stay. In the US and Europe, travelers most often deal with a tourist tax imposed on guests in lodging accommodations. It's usually a small amount, a few dollars per night. The accommodation provider collects the fee on the government's behalf. Notably, the tax is not included in the price and is always invoiced separately.

Overnight travelers are not the only ones who have to shell out extra money on top of other travel expenses. Sometimes, specific tourist taxes also apply to daytrippers. In addition, entry taxes are paid on arrival at the airport in some highly sought-after tourist destinations. It all depends on the place’s popularity and the ingenuity of local authorities.

What tourist taxes are spent on

The original idea behind the tourist tax was to ensure that tourism would benefit local communities more than inconvenience them. However, the additional fees could also profit travelers themselves, provided that the authorities' policies are reasonable.

There are several basic strategies for utilizing the funds raised as tourism tax:

The revenue goes into a common pool at the city or state level to cover various non-tourism-related spending. Politicians stick to the “tourists don't vote” principle: Easy money can be collected from visitors to cover budget holes.

The money is used to address the negative impact of overtourism, (a term that's been used for the past decade to describe a phenomenon of mass tourism when the number of visitors exceeds the destination’s capacity, resulting in crowds, rising prices, and a loss of nature. Maya Bay Beach in Thailand or Rome's Trevi Fountain in August are clear illustrations of overtourism). According to Bali's governor, 70 percent of the revenue from the island's new tourist tax will be spent on waste management.

The payment is levied to reduce the number of tourists, and officials do not even consider it necessary to disguise this fact. For instance, simultaneously with the increase of a tourist tax Amsterdam launched a targeted Internet campaign for “inconvenient” tourists visiting the city for alcohol, sex, and drugs, with the blunt admonition “Stay away." And the head of the Venice Tourism Board, when introducing the new tax for daytrippers, frankly admitted that all revenues would be used solely to cover operating costs. “The objective is not to close the city, but not let it explode,” — added Mayor Luigi Brugnaro.

The money is used to support specific initiatives that improve the visitor experience — finally, a win-win strategy. As an illustration, the Icelandic Tourist Board's website details hundreds of projects funded by the tourist tax: developing whale-watching infrastructure, protective fencing of natural hot springs, and building parking lots and toilets near the most popular sites.

Is city tax the same as tourist tax?

The tourist tax has many names, that differ not only from country to country but also from city to city. For example, it is Taxe de Séjour (tax on stay) in France. It is Kulturförderabgabe (cultural tax) in some German cities because part of it supports local cultural attractions. But in other German towns, it can be Kurbeitrag (spa fee) — guess why.

To make things easier, the tax charged by a European hotel is sometimes referred to as a city tax. It’s not an official name, but it makes sense because it’s a city that decides whether to charge visitors and how to spend the revenue received. In the Czech Republic, only Prague has a tourist city tax, and in the UK, it is only Manchester (although Edinburgh has been holding public hearings on this issue for several years).

In North America, the tourist tax is often called a bed, hotel, or occupancy tax. A city tax in the US, is usually a tax on the income of people who live or work in the city, in addition to federal or state income taxes.

How tourist taxes work

Comprehensive information about the specific tourist taxes travelers will encounter, anticipated expenses, and payment handling procedures should be provided in advance to ensure a seamless travel experience.

How tourist taxes are paid

Where to pay the tourist tax depends on its type. Apart from the confusing names, we can distinguish the following types of tourist tax:

An accommodation tax is charged at a hotel, B&B, motel, campground, apartments, etc., at check-out.

An airport tourist tax is paid when entering or departing from a country. For example, in Japan the fee, 1000 yen, or about $6, is paid to the cruise line or airline a person uses to leave Japan. In Bali, the entry tax can be paid either at a special counter at the airport or in advance online through the Love Bali website. In some Caribbean islands, unfortunately, the tourist taxes can be paid only at the airport or harbor, so the travelers may have to stand in line — nothing more effective than that to kill the buzz of a great vacation.

Here you can read an article about the main airport operations and the ways integrated software solutions can facilitate them.

Tourist taxes for cruise ship transit passengers typically target day visitors who don’t stay overnight in the city. In Amsterdam, for instance, the flat rate is $15 per person. Meanwhile in the Balearic Islands (Mallorca, Ibiza etc.) the “sustainable tourist tax” is $2.2 per person per day, whether the ship has been docked for a couple hours or a week. In both cases, tourists must pay through the cruise company, usually at the end of the journey, on top of port fees and other taxes.

Tourist taxes for day visitors who come into the city by land have so far been implemented only in Venice and are charged only on certain days like weekends and holidays. The schedule can be found on the Venice Access Fee website, where the fee can be paid online with the QR code provided. Another option is a special kiosk at the Santa Lucia train station. Tourists should keep the receipt in case of a random check. Trying to sneak in is too risky: The tax is $5.4, and the fine for non-payment ranges from $55 to $320.

How much is tourist tax

The tourist fee amount is set by local authorities and may change annually. The tax is based on a per-person calculation in some countries; in others, it's calculated per room, like in Greece. Sometimes it is a fixed tariff, and sometimes, it is a percentage of the accommodation cost. In France, the tourist tax varies depending on the municipality and the accommodation type (hotel, apartments, camping, etc.) and ranges from $0.2 to $5 per person per night.

The calculations can be quite complicated. Let’s say in Catalonia, standard tax rates depend on the hotel rating per person per night ($1 - $3.8). However, Barcelona also has a city tax, which, as of April 2024, climbed to $3.5, regardless of the accommodation facility's rating. Therefore, the fee for a stay in a 5-star hotel in Barcelona will be $7.3. It's not exactly a trifle, especially if a whole family is traveling.

You should also take into account the maximum length of rental subject to the tax. In Barcelona, it's only applicable for up to 7 days per year; in Bratislava this period is 60 days a year, and the rate is $3.25 per person, regardless of the star rating, everywhere except the Old Town, where it is $3.8.

Who doesn’t have to pay tourist tax

In some countries, such as Germany, the destinations do not levy the city tax for business travelers. Also, some other categories of visitors may be exempt from tourism tax. This decision depends on local authorities, but most often the “amnesty” applies to

- children under 14 years old, and sometimes as much as 18,

- people with disabilities plus one accompanying person,

- patients visiting medical institutions in the case of medical tourism,

- tour bus drivers,

- tour guides, and

- cruise ship crew members.

To qualify for an exemption, an individual must provide relevant documentation, such as a certificate or medical records. Business travelers must also demonstrate the professional purpose of their trip. For instance, in Berlin, this means presenting an Employer's Attestation from the sending company for corporate travelers or a Self-Attestation of Professional Necessity for independent entrepreneurs.

Do tourist taxes solve the overtourism problem?

Politicians promote tourist taxes as a way to reduce the negative impact of mass tourism. Although they invariably make headlines, the real impact is less tangible: Fees are usually too low to influence travelers' decisions to visit a country.

Venetians, for example, are well aware of this and even staged demonstrations against the tax on daytrippers in Venice. Local activists argued that the “Floating City” simply turned into a Disneyland with entrance tickets, while “the problem is not daytrippers, but the lack of affordable housing for locals.” However, this problem is certainly harder to solve than simply installing turnstiles at the train station.

A study on the role of tourist taxes in managing overtourism in five countries (France, the USA, China, Spain, and Italy) showed that the effectiveness of tourist taxes in solving environmental and social problems is questionable; it is important to combine monetary levies with other measures, including the smoothing of tourist peaks and targeted destination marketing.

The Amsterdam authorities appear to be following this strategy: In addition to constantly raising tourist fees, they have reduced the opening hours of bars, clubs, and sex businesses, banned marijuana smoking in public outdoor areas in the Red Light District, and are planning to convert part of the city center's hotels into residential or office space. City Hall seems determined to get rid of young troublemakers who come to the city for rowdy bachelor parties. However, it's obviously too early to judge the results. The number of tourists in Amsterdam in 2023 reached a near pre-pandemic level of 9 million — 20 percent more than in 2022.

An example of a success story is Dubrovnik, a medieval seaside town in Croatia popularized by Game of Thrones. During the high season, the Old Town is packed with tourists like a mini-Venice, and suffers from traffic jams.

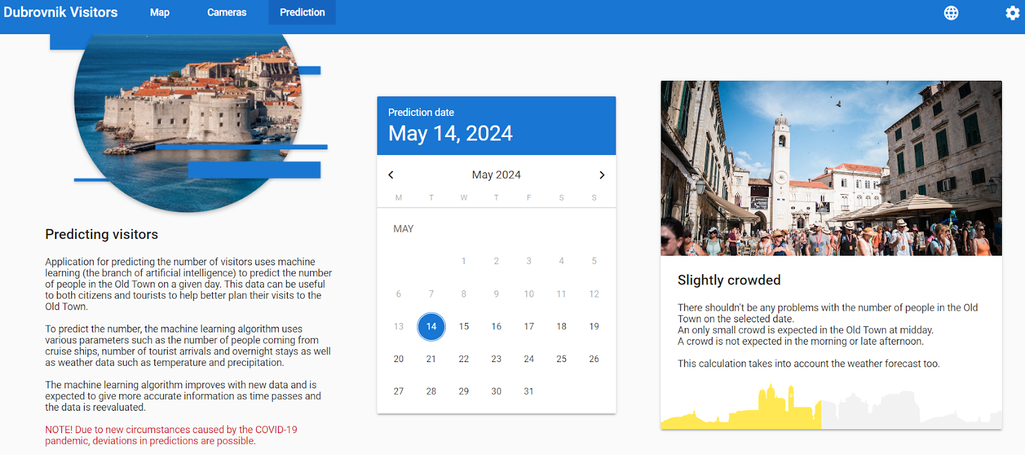

To tackle this challenge, the city authorities, along with implementing an additional tax on cruise ship berthing, in cooperation with the Cruise Lines International Association reorganized the schedule so that no more than two cruise ships per day would stop in the city. In addition, summer terraces of restaurants and tourist stands attracting crowds were removed from the main streets. Technology came in handy, too: a web platform predicting the number of visitors in the center on a given day and an interactive app that sends push notifications about alternative attractions outside the Old Town.

Web platform predicting the number of tourists in Dubrovnik based on machine learning algorithms. Source: Dubrovnik visitors

As a result of these comprehensive measures, crowds in Dubrovnik have visibly decreased, the tourist experience has improved, and locals' tourismphobia has declined. The funds raised from the new cruise ship parking tax are stated to be invested in developing transportation infrastructure — in particular, a futuristic electric boat tram.

What countries charge tourist tax

Bhutan was one of the first countries to decide to sell an “entrance ticket” to visitors. The tourist tax was introduced there in 1974 when the previously isolated country opened its doors to travelers. Over the past five decades, many countries have adopted this idea. Twenty-one of the 27 European Union member states impose an accommodation tax; it also exists in most US states.

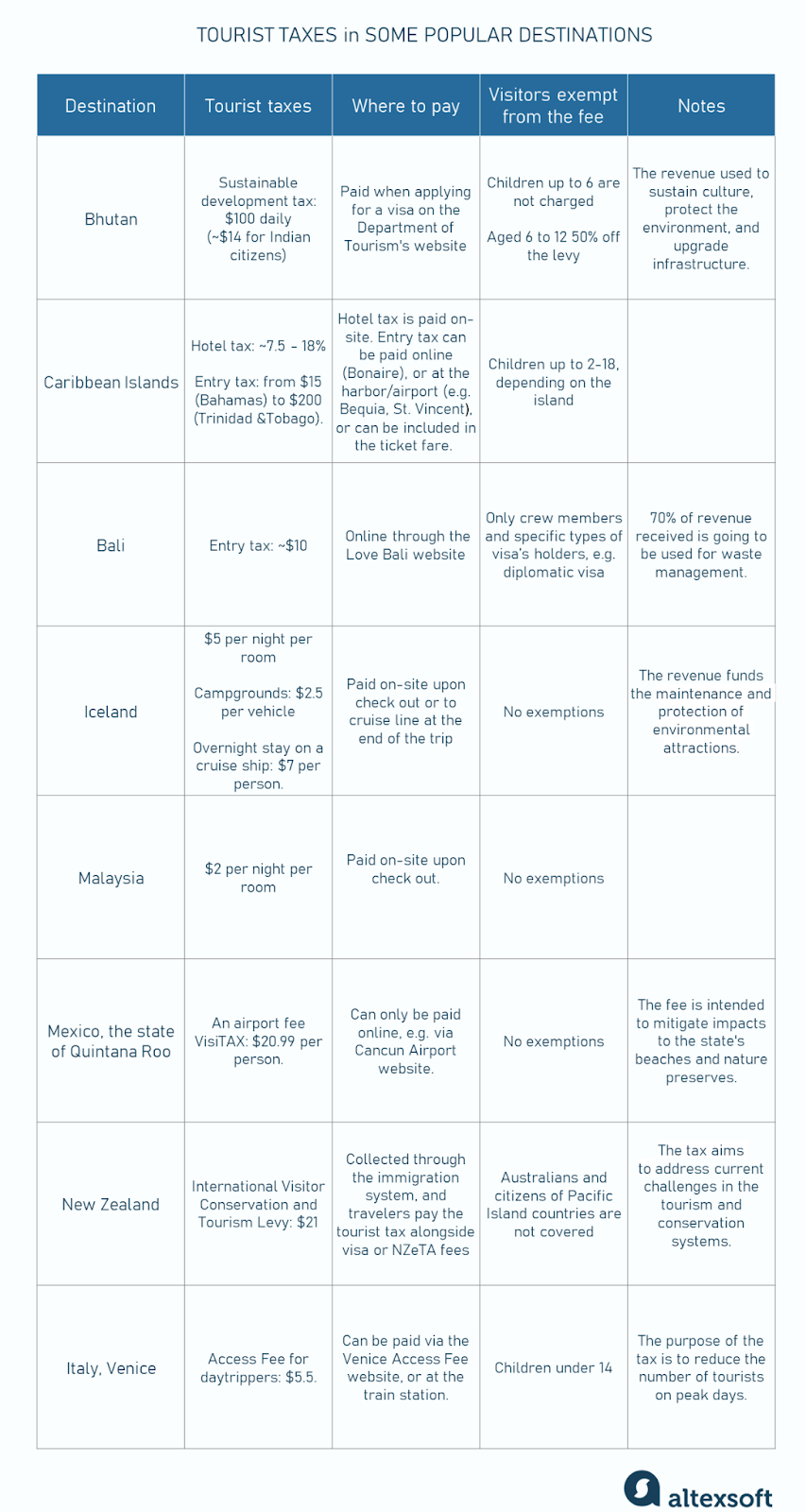

Tourist taxes come in many different flavors

Typically the tourist tax is not included in the room rate. If vacationing with the family in a popular destination, the amount added to the hotel bill can catch a person off guard. Therefore, it's wise for a traveler to check with the hotel or the local tourism board before the trip to anticipate the extra cost. Below, we'll explore a few examples.

Bhutan. The tourism tax in Bhutan is called the sustainable development fee (SDF), and the price is striking. Back in 2022, the Himalayan kingdom charged international travelers $200 per night, but the amount has since been halved. In 2024, the daily fee is $100 (but only about $14 for visitors from India). Children under 6 are not taxed, and those aged 6 to 12 are eligible for 50 percent off the levy.

Caribbean Islands. Almost all of them charge an accommodation tax, and the price varies from island to island. For example, in Barbados it is 7.5 percent, in Jamaica 10-15 percent depending on the class of hotel, and in the Dominican Republic 18 percent. In addition, most islands have an arrival or departure tax. The amount ranges from $15 (Bahamas) to $200 (Trinidad and Tobago), but it is often included in the airline or cruise ticket fare and is therefore a hidden cost.

Indonesia. Travelers must pay Rp 150,000 (approximately $10) when entering Bali.

Iceland. The lodging tax is back in force after a pandemic break. Hotel guests must pay ISK 666 ($5) per night per room; campgrounds and motorhome parking lots charge ISK 333 ($2.5) per night per vehicle. An overnight stay on a cruise ship is 1,000 ISK ($7) per person.

Malaysia. In 2024, the countrywide flat-rate tourist tax is RM 10 ($2) per room per night, regardless of hotel rating.

Mexico. Depending on the state, lodging tax rates range from 2 to 5 percent. Besides, the state of Quintana Roo, home of the largest resort centers like Cancun and Playa del Carmen, established an airport fee VisiTAX in 2021. VisiTAX is $20.99 per person and is charged to all visitors without exception, including children and diplomatic personnel. According to the local tourist authorities, the fee is intended “to mitigate impacts to the state's beaches and nature preserves and to deter sargassum.” The amount is not included in airfare; VisiTAX can only be paid online, and the easiest way to do so is on the Cancun Airport website. Intermediary sites are also available but charge additional fees for their services. The code received after payment must be presented at the airport checkpoints in case of a random check.

New Zealand. The International Visitor Conservation and Tourism Levy (IVL) of NZ$35 ($21) is paid on entry. It is collected through the immigration system, and travelers pay the tourist tax alongside visa or NZeTA fees. Australians and citizens of Pacific Island countries are not covered.

US. The state of Hawaii has one of the highest lodging taxes. The basic rate is 10.25 percent, but an additional 3 percent is charged in Honolulu. This money pays for lifeguards and hiking trail maintenance, among other things.

How to mitigate the possible negative impact of tourist taxes

No one likes hidden costs and additional surcharges. And unsurprisingly the local authorities that benefit from these charges don't face the angry tourists, but the employees of travel agencies, hotels, and cruise companies who collect the tax certainly do.

Therefore, the travel industry's reaction can be quite fierce. When Amsterdam first introduced the Day Tourist Tax for transit cruise passengers in 2019, two cruise lines, Cruise and Maritime Voyages (CMV) and MSC Cruises, canceled stops in the city because of the tax. CMV, in particular, cited late notice, as the new tax was officially confirmed two months before it went into effect.

But these are extremes, of course. It is possible to sweeten the bitter pill. The recipe is simple: Train staff to present a tourist tax properly to clients. This will help the hotel avoid reputational losses, especially since extra charges are not the fault of the accommodation provider.

An experiment conducted in the Italian region of Puglia showed that tourists informed that the new city tax aimed to preserve local nature and architecture were willing to pay nearly five times as much as those who received no explanation about the purpose.

Relevant information can be obtained from local tourist authorities. And perhaps an explanation about funding for a conservation project, a music festival, a museum, or new hiking trails will soften the hardest heart.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.