As travel habits shift toward longer stays, hospitality providers respond with tailored offerings to meet the growing demand. Let’s take a closer look at the global extended stay hotel market, explore how it’s shaping up, and consider whether this trend is here to stay.

Extended stay hotel market in numbers

What is an extended stay hotel?

Extended stay hotels (also called apartment hotels, long-stay hotels, or serviced residences) are properties designed for people who need accommodation for longer periods – weeks or even months.

While policies vary, most apartment hotels require a minimum stay of 5 to 7 days. There’s typically no maximum – you can stay as long as you want (and keep paying). Moreover, many brands offer special rates for guests who stay for a month or longer.

For example, Extended Stay America, one of the major aparthotel brands, sees 70 percent of its guests stay for a week or more, and around 50 percent of visitors stay for a month or more. For the sake of comparison, different sources say the average length of stay in the global hotel industry varies between 1.8 and 2.2 days.

David and Jean Davidson have stayed in several Travelodge hotels, the UK, since 1985, and moved out in 2007 only due to renovation. They paid £90 per week to have all housework done, spending around £100,000 total ($200,000 in today’s USD). Davidsons’ longest consecutive stay was over a decade in Gonerby Moor Travelodge, which even renamed a room in their honor.

Source: World Record Academy

Long-stay hotels typically offer more than a standard hotel room as they have a kitchenette, larger living areas, and workspace. Typically, you can also expect such amenities as

- fitness center,

- self-serve laundry facilities,

- weekly housekeeping,

- recreational facilities, etc.

Most properties also have a front desk and room service, combining hotel convenience with the comforts of home.

A studio-like extended stay room in the Residence Inn. Source: Álvarez-Díaz & Villalón

Today, many long-stay properties, especially on the upscale side, also offer tech enhancements. Those include contactless check-in, digital keys, virtual concierge, in-room voice controls, etc.

The evolution of extended stay hotels

The concept of extended stay hotels was pioneered by Jack DeBoer, who founded Residence Inn – the first all-suite hotel – in 1975. In 1987, the scaled chain was sold to Marriott, and Jack DeBoer established Summerfield Hotel Corporation in 1988 with a similar idea. In a few years, Hyatt bought it.

By that time, competitors had taken over the new format: Homewood Suites by Promus Hotel Corporation opened in 1989 and was acquired by Hilton in 1999. The largest dedicated operator of long-stay hotels – Extended Stay America – was founded in 1995.

The supply of long-stay offerings grew significantly at the end of the 1990s and early 2000s. Then there was another boom following the 2008 crisis. After that, growth slowed down – until the post-pandemic era.

So let’s look at why the extended stay model has been on the rise lately.

Factors fueling demand for extended stay hotels: key guest categories

The continuous demand for long-stay hotels is driven by several key factors.

Remote work and bleisure trends. During the pandemic, remote work accounted for about half of the work hours in the US. The number of digital nomads surged by almost 50 percent to nearly 11 million people in the US alone.

After that spike, the growth continued – but at a slower pace. In 2024, 18 million people in the US described themselves as digital nomads.

Recent terms like bleisure, workations, digital nomads, and laptop luggers highlight a global trend of combining work and travel. Long-stay hotels offer a convenient, cost-effective lodging solution for those embracing this lifestyle.

What is bleisure

Relocation, reshoring, and other long-term business travel. While many companies embraced the remote work model, there are still a lot that favor the in-office approach. And in some industries, relocating workers for projects that require on-site presence is almost inevitable (e.g., engineering, construction, oil and gas, etc.).

Infrastructure development is growing globally, driven by strong support from both the public and private sectors. An estimated $64 trillion will be needed for physical infrastructure over the next 25 years. Projects such as factories, tunnels, and bridges typically span several years and require thousands of workers. In the US alone, over 60,000 government-funded projects were launched under the Biden administration.

Additionally, the reshoring macrotrend – when many companies bring manufacturing and operations back to local markets – is fueling demand for long-stay hotels. In 2024, 244,000 jobs were announced in the US via reshoring and foreign direct investment (FDI).

Seasonal work also falls in this category.

So employees on long-term assignments, especially those with families, often prefer aparthotels to traditional accommodations. For those undergoing permanent relocation, these hotels serve as an ideal temporary solution while they search for longer-term housing.

Medical tourism. Patients who travel for prolonged treatment, those recovering from surgery, and their families or caregivers who require temporary accommodation also often prefer extended stay hotels.

Healthcare workers, such as traveling nurses and doctors on assignments, contribute to the demand as well. Long-stay hotels with proximity to hospitals or clinics offer these travelers a convenient, comfortable place to stay.

How medical tourism evolved

Housing shortage. The ongoing housing crisis continues to impact many markets. About half of US renter households (over 21 million) spend more than 30 percent of their income on housing costs, classifying them as cost-burdened. In 2024, the housing supply gap almost reached 4 million homes.

With affordable housing scarce and mortgage rates high, many individuals turn to serviced residences as a temporary lodging option until they can secure permanent housing.

Besides remote work, business projects, or housing transition, people stay in serviced residences while studying, doing renovations, or taking leisure trips.

This growing demand is also being addressed by other players. Let’s take a look at who extended-stay hotels are competing with.

Comparing extended stay hotels, traditional hotels, vacation rentals, and corporate housing

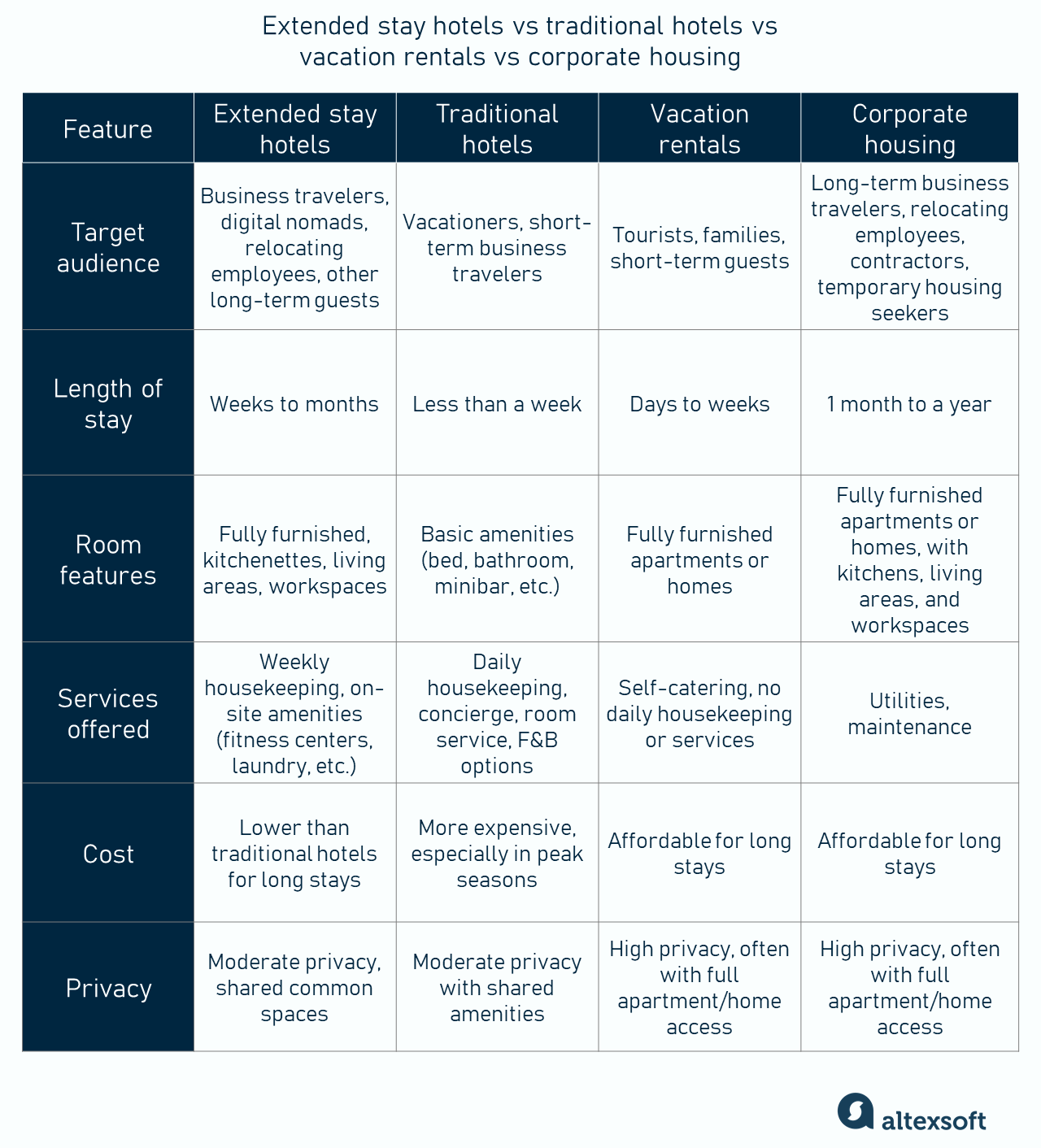

Obviously, there are many types of temporary accommodation, each with its own features, pricing, target guest segments, etc. So let’s look at the most popular ones and how they compare to aparthotels.

Accommodation types that cater to long-term stays

Traditional hotels mainly focus on short-term stays, typically providing a wider range of services. They cater primarily to vacationers and short-term business travelers. While they can accommodate long-term guests and even provide discounted rates, the cost is usually higher, especially during peak seasons.

Vacation rentals include a wide range of properties, from homes and apartments to luxury villas, typically rented for short- or mid-term stays. While they offer a private, home-like experience with varying amenities, they generally lack the services provided by extended stay and traditional hotels.

Corporate housing provides fully furnished apartments or homes for long-term stays only, typically ranging from one month to a year. Catering mainly to business professionals and relocating employees, it provides essential utilities and maintenance but fewer services than extended stay hotels. While similar to vacation rentals, corporate housing targets a different audience and is designed for longer stays.

Extended stay hotel market

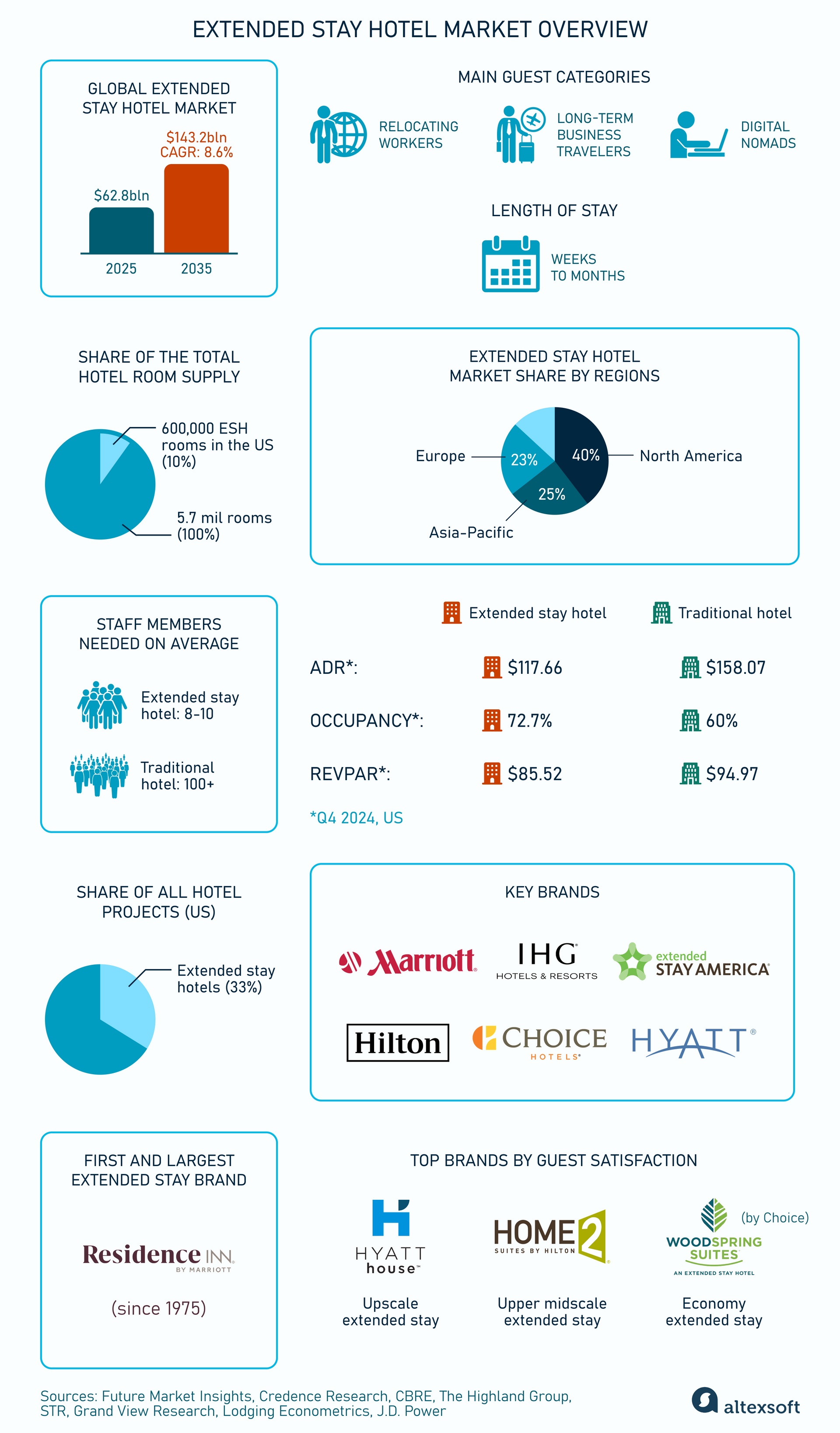

According to Future Market Insights, the global extended stay hotel sector is valued $62.8 billion in 2025 – around 7 percent of the entire travel accommodation market. It’s expected to expand to $143.2 billion by 2035, with a CAGR of 8.6 percent.

North America holds over 40 percent of the global extended stay hotel market, making it the largest and most mature market. At the end of 2024, there was an estimate of almost 600,000 extended-stay hotel rooms in the US, which is over 10 percent of the total supply of 5.7 million rooms.

Asia-Pacific follows with a 25 percent market share, driven by economic expansion, urbanization, and rising demand in countries like China, India, and Japan. Europe accounts for around 23 percent market share.

Operational overview

Compared to traditional hotels, long-stay properties are recognized for higher margins. Experts agree that such properties are cheaper and easier to manage. With less frequent guest turnover, they require fewer housekeeping supplies. There’s also lower F&B expenses and, most importantly, lower labor costs.

Greg Juceam, the CEO of Extended Stay America, shared that in a well-run aparthotel, you only have 5-6 check-ins a day, so your front-desk staff can also be involved in other operations (cleaning, administrative, etc.). He estimated that for an average 120-room hotel, you need 8-10 full-time staff members. Meanwhile, in a traditional full-service hotel, it can be way over a hundred people.

Also, the Extended Stay Hotel Market Report by Grand View Research shows that the majority of bookings for extended stay hotels (52 percent) come from direct channels, which means they pay fewer commissions to OTAs.

Performance metrics

As proven by the 2008-2009 downturn and the pandemic, extended stay hotels typically show greater resilience during crises and economic slowdowns. In 2009, the US hotel industry recorded the lowest occupancy rate in history – 54.6 percent. Meanwhile, the extended stay segment performed better, with occupancy dipping to “only” 64.2 percent.

As for the pandemic, the Highland Group Extended-Stay Hotel Reports show that after a short slip in 2020, the sector revenues recovered swiftly in 2021.

Jan Freitag, national director for Hospitality Market Analytics at CoStar, noted that "Even when room demand for regular hotel rooms evaporated in early 2020, extended-stay hotels showed that there is always demand from customers such as first responders, traveling nurses, construction crews, and people relocating for family or professional reasons. This made the performance of the sector, if not recession-proof, then at least recession-resistant.”

Here’s just one example of the sector resilience: In 2020, Extended Stay America reported $1.02 billion in revenue – just 15 percent less than in 2019. The company didn’t close a single property and didn’t lay off staff. As Greg Juceam explained, in a time of global uncertainty, people don’t buy a home or sign long-term rental agreements. Instead, they make temporary decisions – and ESA was there with options.

After the pandemic, all major KPIs have shown steady annual growth. When comparing the performance of US long-stay hotels to the entire hotel industry in Q4 2024,

So while the rates in aparthotels are generally lower, higher occupancy levels ensure a more stable revenue flow.

US extended stay hotel market KPI dynamics. Source: The Highland Group

Major extended stay accommodation providers

Big hotel brands see the potential of the long-stay segment, especially after the pandemic. Experts from CBRE, the leading commercial real estate services and investment company, report that “Over the past 10 years, globally recognized hotel brand families have expanded their extended-stay portfolios by more than 50 percent – a CAGR of 7.1 percent versus 3.2 percent for the US market as a whole.”

Such activity in the segment is explained by a big supply and demand imbalance. According to Matt McElhare, the VP of Choice Hotels, “Extended stay demand represents about 20 percent of all lodging demand in the U.S., and extended stay supply is about 10 percent.”

So the extended stay hotel model lures investors and developers due to its operational efficiency, faster returns, and stable demand. The development costs are significantly cheaper too: The median cost to develop limited-service and midscale extended-stay hotels ranges from $160,000 to $170,000 per room, while upscale extended-stay hotels are around $250,000 per room. Full-service hotels have a median cost of over $400,000 per room, and for luxury ones median exceeds $1,000,000 per room.

Ned Washburn, director of RREAF Holdings’ extended stay program, believes that “They’re what investors are gravitating to. There’s a lot less risk, a lot less capital required, they are faster to cash flow, and, essentially, it’s a stronger revenue stream for the investor.”

So in 2022-2023, many of the major chains rolled out new brands that cater to long-stay demand – mainly in the midscale segment. Let’s talk about the biggest players.

Major extended stay providers

Marriott

As we mentioned above, Marriott International was the first global chain to add an extended stay brand to its portfolio with the purchase of Residence Inn in 1987. Since then, it expanded its extended stay options, which now also include TownePlace Suites, Marriott Executive Apartments, and Element Hotels.

Residence Inn, the pioneer of the long-stay segment, still leads in terms of property count, operating 870 hotels in 15 countries. It offers upscale accommodations with fully-equipped kitchens, free breakfast, and grocery delivery service.

While Marriott mostly operates in the upscale segment, it is now moving into the midscale field with the StudioRes brand (initially announced as Project MidX Studios). With over 40 properties in the US and Canada expected to open by the end of 2027, the debut StudioRes hotel opened its doors in June 2025.

Hilton

Hilton Worldwide is another prominent player in the extended stay market, offering several brands that cater to long-term guests, providing spacious, pet-friendly suites with full kitchens and complimentary breakfast.

Homewood Suites includes 540 locations and has 160 more in the pipeline. Home2 Suites boasts over 700 open hotels, with more than 750 in development – the largest pipeline among all chains.

The J.D. Power North America Hotel Guest Satisfaction Index Study named Home2 Suites the best upper midscale extended stay brand for two years in a row.

In May 2023, Hilton also introduced LivSmart Studios (previously known under the working title Project H3), a new, lower midscale brand specifically targeting stays of 20 nights or more.

The story of Hilton

Extended Stay America

Extended Stay America (ESA) is perhaps the most well-known name in this space. And for good reason: Founded in 1995, ESA was one of the first to establish itself as a national brand dedicated solely to extended-stay properties and has continued to grow steadily ever since.

Today, it boasts over 700 hotels across the US and operates three distinct brands: Extended Stay America Premier Suites, Extended Stay Suites, and Extended Stay America Select Suites.

ESA focuses on mid-priced accommodations for guests staying weeks or months at a time. Known for its fully-equipped kitchens and flexible stay options, ESA caters to business professionals, digital nomads, families, and others in need of long-term housing solutions.

Choice

Choice Hotels operates over 500 extended stay properties under 4 brands: Everhome Suites, WoodSpring Suites, MainStay Suites, and Suburban Extended Stay. With over 350 hotels under development, it has one of the biggest pipelines and also the fastest-growing economy extended-stay portfolio in the industry.

Unlike other big guys with upscale offerings, Choice mostly caters to cost-sensitive visitors. Choice’s WoodSpring Suites had the crown of the best economy extended stay brand in 2023 and 2024.

Lately, the brand begun a gradual shift in its focus to the upscale space.

Choice is also known for efficiently converting traditional hotels into extended stay properties with its Lobby in a Box and Kitchen in a Box solutions. These turnkey packages allow hotels to quickly transform their spaces: Lobby in a Box helps repurpose lobby areas into multifunctional spaces for long-term guests, while Kitchen in a Box equips rooms with fully functional kitchens.

Hyatt

Hyatt Hotels Corp. operates over 130 apartment-style hotels under the Hyatt House brand. It was named the top upscale extended stay brand by the J.D. Power Index for 3 years in a row.

In 2023, Hyatt also launched Hyatt Studios, a new, upper-midscale extended-stay brand. The first properties are expected to open in 2025.

Some other hotel brands that provide long-stay options are

- IHG with Atwell Suites, Candlewood Suites, Holiday Inn Club Vacations, and Staybridge Suites brands;

- BWH Hotel Group (the parent company of Best Western) with Executive Residency, @Home, and SureStay Studio brands;

- Wyndham with Hawthorn, WaterWalk, and ECHO Suites (under construction) brands; and

- Red Roof Inn with its HomeTowne Studios.

Of course, it’s not only industry giants. Some smaller focused brands are AKA Hotel Residences, stayAPT Suites, Cheval Residences, Zoku, etc.

All these players see the potential in the long-stay trend. So they respond to the increasing demand for extended stay options by diversifying their products, expanding globally, and tailoring their services to guest needs. Most of them offer franchising opportunities, providing established operational frameworks.

Extended stay sector challenges

The extended stay hotel sector, while growing, faces several key challenges that can impact its further development.

Lack of specialized hotel management software. Implementing new technologies is crucial for operational efficiency and guest satisfaction, but most hotel products are designed for a traditional model and may not address the needs of long-stay properties.

The extended-stay PMS must include such back-office functionality as

- flexible pricing with a system of discounts for long-term stays,

- automated weekly/monthly billing,

- no-front-desk options when staff can be contacted online for remote assistance,

- corporate billing since most guests are business travelers,

- booking system for amenities like coworking spaces, etc.

Guest-facing features should be similar to those of a traditional PMS, i.e.,

- communication platforms,

- mobile check-in/checkout,

- keyless entry, and

- digital concierge services.

As we mentioned above, upscale extended stay hotels are increasingly digitizing, but the overall adoption rate is still low. Another reason for that is that tech implementation requires a significant investment.

Competition. The extended stay market is developing rapidly. The current pipeline is massive: In the US alone, one-third of all hotel projects are in the long-stay category, as shown in quarterly Lodging Econometrics’ US Hotel Construction Pipeline Trend Reports. All the major industry brands have been expanding their extended stay portfolio.

A growing number of extended stay properties, as well as alternatives like vacation rentals and corporate housing, make the space crowded. So operators must offer competitive pricing, additional services, and keep up higher standards to maintain their value when compared to these alternative lodging options – and that may affect margins.

High construction cost. A pressure for all hotel developers, increasing land and construction costs are another challenge to entry and expansion, especially in urban areas where space is limited. Additionally, the growing complexity of local zoning laws, regulatory requirements, and high interest rates can cause delays in new developments.

Mark Knott, VP at real estate consulting firm Project Management Advisors, believes “The cost of debt to develop any project type is increased. Post-pandemic, [it] has leveled off, but it hasn’t come down. Combined with inflated construction costs and now inflated debt costs, what used to be very safe development deals are now put on the margins. That creates smaller returns for investors and in turn, get harder to push forward.”

While the extended stay sector faces challenges, it is also evolving to meet changing market demands and keep pace with broader industry trends.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.