Hundreds of flights canceled. Thousands of passengers stuck at airports. Family events missed. Vacations spoiled. Travel plans screwed up. Million-dollar deals tanked. A scene from an apocalyptic movie? No, we're describing real-life situations caused by small failures in a computer system. Something that happens quite often nowadays.

As late as last summer, British Airways canceled more than 100 flights and delayed another 200 because of IT outages that involved two components of their passenger service software — one that was responsible for online check-in and the other that managed flight departure.

And that episode was not a one-off. It was just another reminder of overall aviation IT fragility, caused by different factors, from aging technologies to poor communication between different components to the introduction of immature solutions.

In this article, we’ll discuss airline software suites, their major modules, and available modern solutions created to change the current state of things for the better.

PSS, ARS, and CRS: their meaning and a brief history

If travelers are stranded at the airport due to IT disruptions, a passenger service system (PSS) is likely to be blamed for this. PSS is a software suite that supports all transactions between carriers and their customers, from ticket reservations to boarding. Its mission is to keep operations running smoothly, and failures in its work can cost airlines tens of millions of dollars in lost revenue.

A modern PSS is a complex structure, combining dozens of tools and applications that automate a wide range of passenger-related activities. Historically, this huge multi-task entity has grown from its core component— an airline reservation system (ARS), also called a central or computer reservation system (CRS).

The first CRS that appeared in the 1960s was SABRE (Semi-Automated Business Research Environment), which later evolved into one of three major global distribution systems (GDSs). Developed by IBM for American Airlines, the pioneer system could update seat occupancy in real time, create passenger name records (PNRs), and print tickets. The innovation cost American Airlines a whopping $40 million (nearly $348 million in 2019 prices) and took 400 man-years to prepare functional requirements, write program specifications, and complete coding. You can learn the detailed story of Sabre in our video:

Flight distribution explained

It comes as no surprise that after the introduction of the first CRS other airlines preferred to use IBM’s expertise rather than doing everything from scratch. SABRE’s successors benefited from the same operating system called Transaction Processing Facility (TPF), designed to handle a high volume of transactions on mainframe computers.

Three generations of PSS

Currently, three generations of PSSs coexist in commercial aviation.

The first generation: legacy systems

Many early adopters of passenger service software still rely on TPF in their daily IT operations. On the one hand, legacy systems continue to meet the basic industry requirements: they process high volumes of transactions, proving to be super-fast, reliable, and relatively secure. On the other hand, the “antiquated" technologies are expensive to maintain, rigid, and hard to integrate with newer applications the airline could take advantage of.

But the main issue associated with legacy systems is that they hinder airlines from increasing profits. Modern travelers want mobile access, convenient forms of payments, rich content, a high level of personalization, loyalty programs, and other commodities — something that outdated systems just can’t offer. As a result, airlines miss the opportunity to generate new revenue from providing additional services.

The second generation: patchwork of old and new technologies

Migrating to a new PSS could take several years and cost millions of dollars. So, a lot of airlines try to find a middle ground between legacy systems and customer pressure.

To leverage technologies from the past century and urgent passenger needs, carriers use middleware, or software enabling them to link new applications and interfaces to their mainframe programs. This approach led to the uprising of the second-generation platforms, which essentially amount to a patchwork of integrations, not always correctly synced and perfectly adjusted.

While on the whole, the second generation of PSSs is more passenger-friendly, it lacks reliability because of inconsistencies across components.

The third generation: service-oriented approach

Today, providers of PSSs are switching from monolithic to service-based design — either service-oriented architecture (SOA) or microservices. This approach allows for building complex applications as suites of small, scalable, separately maintained and deployed modules. Airlines can add, update, or change components when necessary while not disrupting the entire system.

In the SOA scenario, software components communicate with each other via Enterprise Service Bus (ESB) using messaging protocols. Microservices are often thought to be the next step of SOA evolution: Components are completely independent, use separate databases, and exchange data via HTTP-based REST or Thrift APIs.

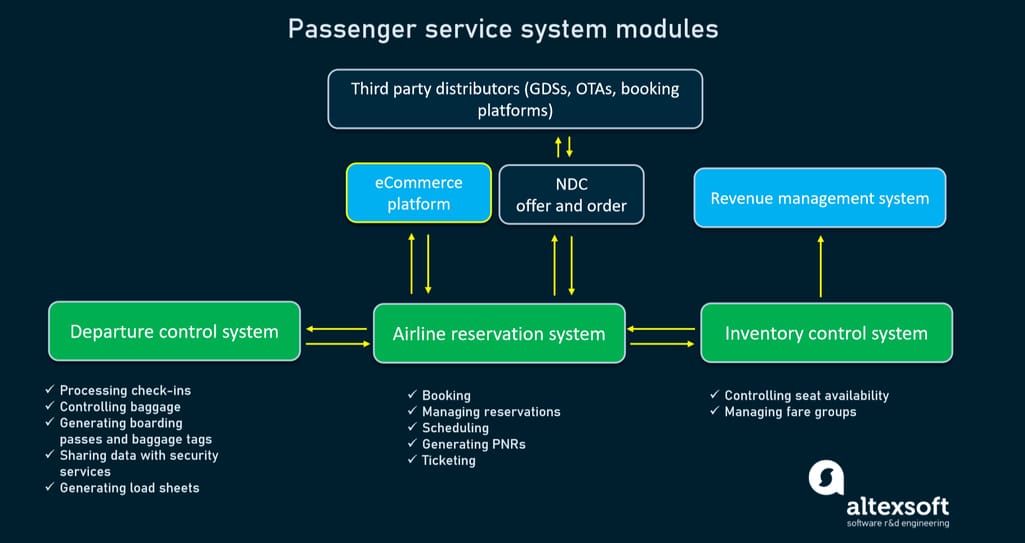

Main PSS modules: three pillars of passenger services

Every PSS has customer-facing solutions to communicate with users — be it a website, mobile app, chatbot, or kiosk at the airport. However, the crucial part of operations goes behind the scenes. Primary daily tasks of the PSS are distributed among three subsystems: an airline or central reservation system, an airline inventory system (AIS), and a departure control system (DCS). Each of them deserves a bit more consideration.

Passenger service system structure (main and additional components)

Central reservation system

At its core, an airline or central reservation system serves as a database for flight schedules, available seats, fares and rules for each booking class, and passenger profiles. Apart from storing flight-related information, its major functions include:

- managing reservation requests and cancelations;

- displaying flight schedules, available seats, and prices in response to requests from passengers or intermediators (travel agents, call centers, General Distribution Systems or GDSs, Online Travel Agencies or OTAs);

- generating Passenger Name Records (PNRs) — personal codes, containing data on travel dates and itinerary, ticket details, baggage, and the passenger’s name and contacts; and

- ticketing — issuing tickets (either paper or electronic) and storing ticket records.

To perform its tasks, the CRS is integrated with a flight booking engine and interfaces with passenger touchpoints such as the airline’s website, GDSs, OTAs, and third-party booking platforms.

Airline inventory system

The primary goal of an airline inventory system is to control the availability of seats in different cabins and manage fare groups or buckets. The AIS opens or closes fare buckets according to the rules set by an airline.

It is worth noting that the AIS often (but not necessarily) comes as an integrated part of the airline reservation system. Otherwise, the two modules constantly exchange information for timely updating.

Departure control system

A departure control system (DCS) handles passengers at the airport, from check-in to boarding. Namely, it streamlines the following operations:

- processing passenger check-ins from all touchpoints — service counters, self-check-in kiosks, mobile and web apps;

- checking weights and controlling baggage;

- generating and printing boarding passes and baggage tags;

- sharing information with security services; and

- generating load sheets that contain weight and balance data related to a particular flight (including the weight of the aircraft, fuel, crew, passengers, baggage, cargo, mail, and pantry).

The DCS interacts with the airline reservation system to confirm and update information on passengers and bookings.

Additional PSS components: creating a one-stop shop for travelers

Modern airlines tend to complement their key PSS modules with software streamlining other critical operations. Here are some of the most useful (and therefore popular) solutions to integrate with the core system.

Revenue management system

Not unlike hotels, airlines strive to maximize their revenue by “selling the right seats to the right passengers for the right price and at the right time.” As we mentioned earlier, the inventory system checks occupancy and assigns prices to seats following the predefined rules. But who creates the rules?

Airlines delegate this challenge to revenue managers and revenue management systems (RMS) with the following capabilities:

- collecting and analyzing historical booking and sales data to spot buying patterns and trends;

- forecasting demand utilizing historical data and other inputs like fluctuations in customer behavior, market trends, and competitors’ strategies; and

- recommending booking limits to maximize the expected flight revenue.

Pairing deep domain expertise with the power of machine learning allows carriers to develop an effective pricing strategy. Our recent video offers an insight into how it works in practice.

Dynamic pricing in aviation

Retailing platform

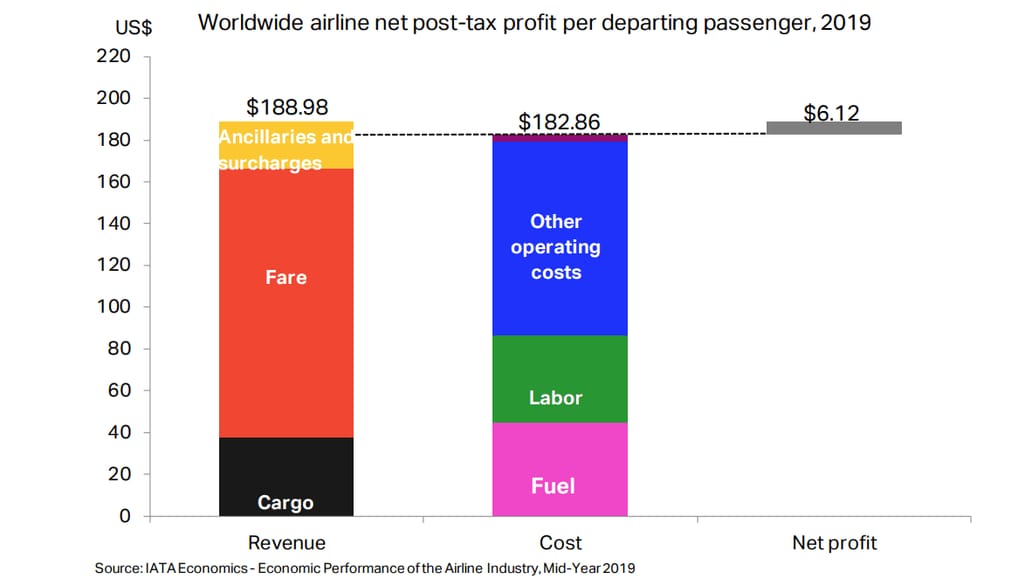

According to the International Air Transport Association (IATA) report, as of mid-2019, airlines generated about $189 of revenue per departing passenger on average, including the base fare, cargo payments, and ancillary services. At the same time, they spent almost $183 on fuel, salaries, and operating expenses to deliver each traveler to their destination. So, the net profit was just $6.12 per passenger — just a bit more than the price of a Big Mac in the USA ($5.58).

Average revenues and costs per departing passenger in 2019. Source: IATA Economics

Regarding a highly competitive environment, a carrier can’t raise base fares dramatically without losing customers to rivals. This makes ancillaries or revenue generated from products and services beyond the core transportation the most promising and reliable source of profits in the modern airline industry.

In 2019, average revenue from ancillary services already reached $24 per passenger, indicating a 10 percent rise compared to 2018. And in the future, fees charged for excess baggage, extra legroom seats or onboard WiFi will become an even more significant ingredient of an airline’s success.

To boost revenue airlines should shift from selling bare tickets to selling flight experiences. And the first step to this goal is turning websites and mobile apps into intelligent eCommerce platforms. The typical set of must-have features that delivers a competitive edge includes:

- convenient payment options;

- content-rich catalogs of available ancillaries;

- content-rich catalogs of complementary products and services — such as car rentals, excursions, attraction tickets, travel cards, and more;

- shopping cart functionality; and

- AI-fueled tools to personalize offers, loyalty programs, and recommendations, using dynamic pricing and bundling.

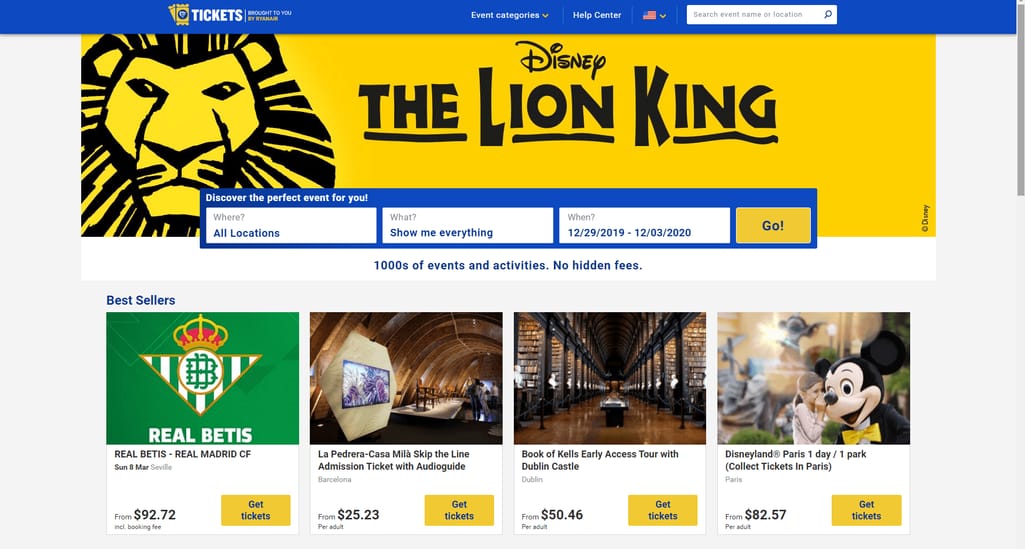

Apart from flights, Ryanair website offers tickets, cars to hire, rooms to book, and rich content on travel destinations. Source: Ryaniar. com

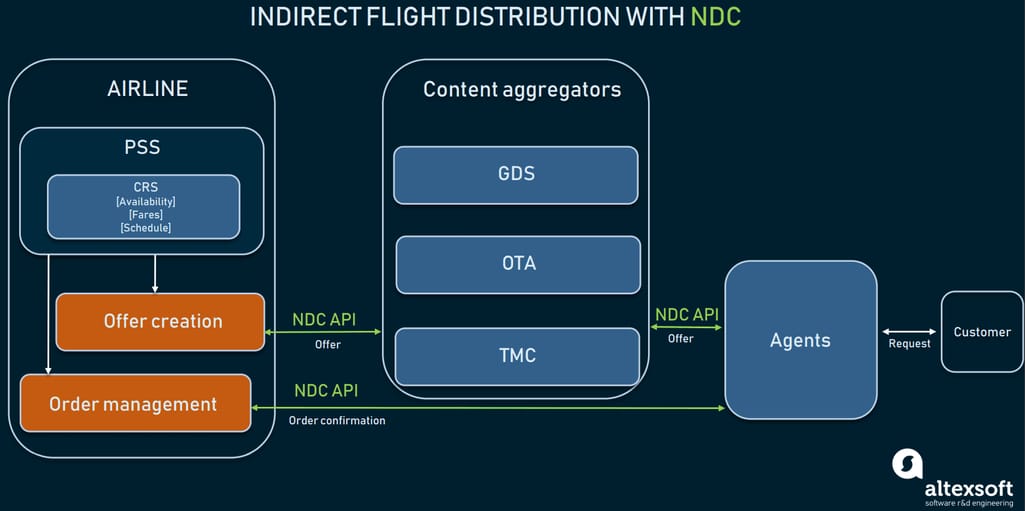

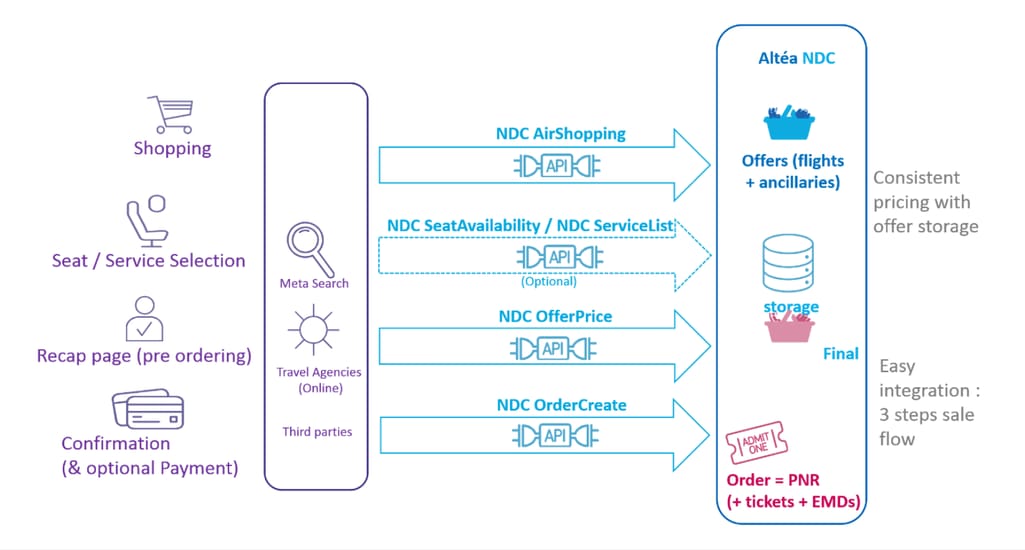

NDC offer and order management platform

eCommerce websites allow airlines to sell additional services directly to their customers. However, for merchandising tailored offers via third-party channels, they need to enable the IATA’s New Distribution Capability (NDC). This standard is developed to deliver rich content around flight options and additional services using a suite of XML messages. You can read more about the benefits of NDC in our article — NDC in Air Travel.

How does an airline tap its existing software into the NDC environment? The most common answer is via an NDC offer and order management system, running in parallel with an airline's PSS. A carrier can either hire a tech team to develop a customized platform compliant with the NDC Standard or connect its reservation system to a third-party solution like FLX NDC API, t-Retail or NDC Gateway.

Many leading providers of passenger service software deliver their PSSs with a pre-installed NDC-enabled offer and order management module or sell it as an additional component that easily integrates with the core system.

When choosing among NDC-enabled offer and order management platforms or PSSs, you should consider NDC certificates, granted by IATA to IT providers. The certificate level shows the real capability of a particular technology to receive and send NDC messages (offers and orders). With level 1 no longer available, there are three options left.

Level 2 — offer management: allows airlines to deliver rich content (texts, videos, pictures) via distribution channels and sell not only traditional seat/fare pairs, but also:

- ancillaries,

- baggage options,

- seat choices, and

- flights bundled with extra services.

Level 3 — offer and order management: in addition to level 2 benefits, it enables carriers to:

- finalize an offer price, taking into account additional data like frequent flyer credentials or credit card fees,

- create orders from offers and display it to end customers,

- change and update orders, and

- issue EMDs (Electronic Miscellaneous Documents, introduced by IATA to sell ancillary services).

Level 4 — full offer and order management: gives an airline overall control of shopping, booking, payment, and ticketing, including order cancelation.

Indirect flight distribution with NDC: Airlines have offer and order management systems that interact with their PSS

ONE Order certification — a program, announced by IATA in January 2019. ONE Order idea merge all current passenger-related records (PNR + e-ticket + EMD) into a single reference order. At the time of writing this article, ONE Order is just a concept; however, several airlines and IT providers have already received corresponding certificates. The list of early adopters included SABRE, Amadeus, Lufthansa Systems, and JR Technologies.

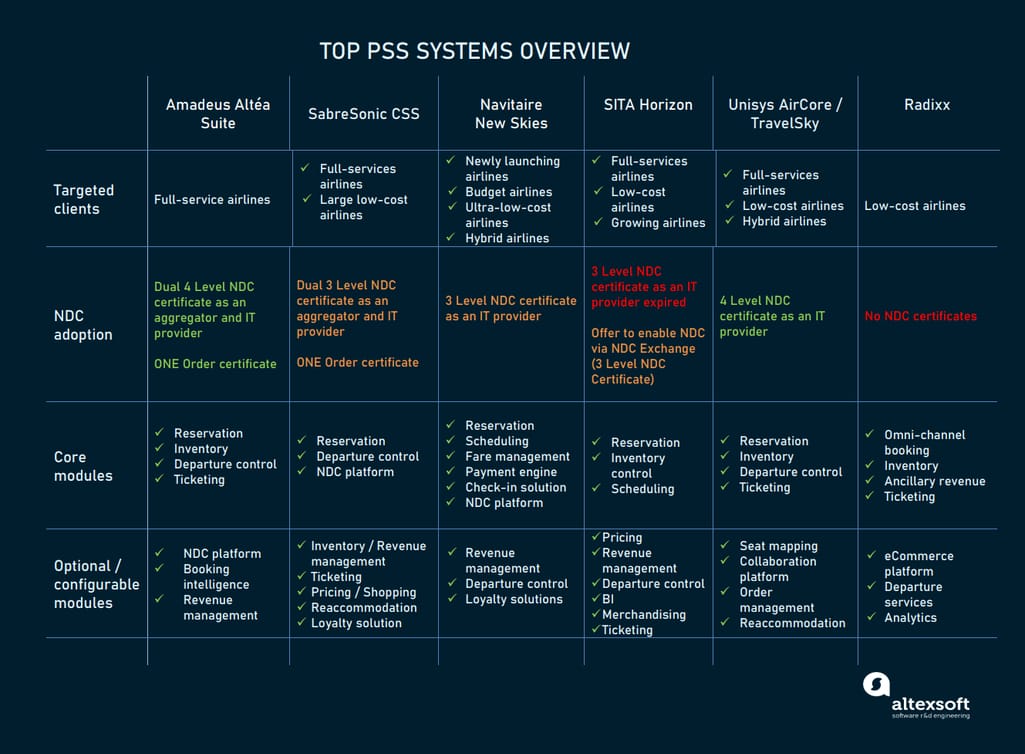

Three leaders of passenger services

A PSS is not a usual application you can simply download from Google Play or order from an outsourced development team. While many IT providers offer separate passenger-related software solutions or can help you with integrations, only a few players provide off-the-shelf full-scale systems. Below, we’ll compare three leaders, which together hold over 60 percent of the air reservation market.

Comparison of most popular passenger service systems

Amadeus Altéa Suite

Key clients: large full-service carriers — Air Canada, Austrian Airlines, Bangkok Airways, British Airways, Brussels Airlines, Cathay Pacific, Cyprus Airways, Flybe, IAG, Japan Airlines, KLM, Lufthansa, Qantas, Southwest Airlines, Swiss International Airlines.

Do you remember the episode involving British Airways we started this article with? Just to let you know: The system crashed that unfortunate day was Amadeus Altéa, the global leader on the PSS market and the number one solution in Europe and Africa.

No technology is immune to faults. But Amadeus, the world’s largest GDS, obviously makes attempts to alleviate the pain of passengers and minimize airlines' losses. Not for nothing, its PSS includes a number of innovative solutions to prevent customer dissatisfaction or proactively address problems at all steps.

Altéa Reservation ensures seamless integration between partner airlines, allowing them to share fares, and customer and booking information. It facilitates connecting flights, thus enhancing the customer travel experience. On top of all, the reservation system provides passengers with real-time information on flights, notifying them of delays and cancellations.

Altéa Inventory is equipped with revenue management tools that help live experts set optimal prices, identify high-value customers, and instantly respond to competitors’ actions. Apart from inventory control, it automates schedule management operations, updates seating and wait-list access rules based on customer value, and finds the best flights if a passenger needs to be re-accommodated.

Departure Control (DC) aids passengers in their journey through all digital channels, from online check-in to printing bag tags and receiving a boarding pass directly on a smartphone. The technology also keeps an eye on the baggage using an innovative “track and trace” solution.

The best part of the DC module is compensation management tools. Using traveler profiles and data about the type of disruption, the software quickly calculates the right repayments for each customer. Such a proactive approach proves to make stranded passengers a bit less unhappy.

The system also includes a flight management component to control and optimize load distribution within the airplane so that the airline can achieve the perfect balance and reduce fuel costs.

The ticketing component covers all ticket management functions: issuing electronic and paper tickets, ticket changes, and generating EMDs from ancillary sales.

Amadeus Altéa NDC solution supports end-to-end NDC shopping along with offer and order management capabilities. Amadeus has a dual Level 4 certificate as an aggregator and IT provider delivering all benefits of full control over offer and order processes.

A shopping to booking flow via Amadeus Altéa NDC. Source: Amadeus

SabreSonic Customer Sales and Service (CSS)

Key clients: large full-service airlines — Aeroméxico, Aeroflot, Alaska Airlines, American Airlines, Ethiopian Airlines, LATAM Airlines, Vietnam Airlines; large low-cost airlines — JetBlue, Volaris, WestJet.

The second-largest PSS is undergoing a transition period, moving from mainframe computers to microservices architecture. It aims to replace middleware solutions that don’t always work well together with a unified cloud-based platform. The migration has lasted for over a decade, and as for 2019, about 11 percent of Sabre’s code still remains in the in-house data centers. SabreSonic CSS is expected to completely relocate to the cloud by 2023. Currently, airlines can take advantage of several modernized modules and new integrated tools.

The reservation system features advanced customer-management tools for recognizing repeat customers and introducing frequent flyer programs. Similar to Amadeus Altéa, the module supports alliances and partnership between carriers that leads to more convenient flight connections for travelers. It also gives access to comparative market data, enabling airline managers to make informed decisions and adjust their strategies.

The inventory module offers real-time inventory control and data exchange. It supports O&D (origin and destination) revenue management techniques such as advanced fare qualification and interline proration.

Departure Control comes with a new check-in solution that allows airline personnel to track their passengers at each point of service. It is integrated with a weight and balance application, which guarantees efficient flight loading.

The ticketing component not only issues e-tickets and EMDs but also handles exchange and refund operations and allows airlines to track all sales activities using convenient reporting and reconciliation tools. It supports interline partnerships via an electronic ticketing hub and enables passengers to use different payment options including credit cards, PayPal, e-Bank, and more.

SabreSonic Web is an NDC-enabled eCommerce platform, integrated with a booking engine and offering ultra-fast shopping. It features tools for targeted merchandising of ancillaries via all check-in channels — mobile apps, websites, and kiosks. Airlines can also take advantage of pricing add-ons, loyalty solutions, built-in analytics, and revenue reports. Sabre received a dual Level 3 NDC certificate as an aggregator and IT provider.

Navitaire New Skies

Key adopters: budget, ultra-low-cost cost, and hybrid carriers — AirAsia, Eurowings, FLY ONE, Gol, IndiGo, Italo, JetStar, LEVEL, Ryanair, Scoot, Swoop, Transavia, TUI, Vueling, Wizz Air.

Owned by Amadeus Group, New Skies meets the requirements of low budget airlines critically dependent on revenue from ancillary services. Navitaire’s PSS is marketed as a digital “e-commerce first” platform, equipped with tools for merchandising, personalization, and analytics. Below, we’ll mention key modules.

The reservation system is built on top of the highly scalable Internet Booking Engine. It integrates with customized booking applications, avoiding GDS fees. The system leverages all the benefits of extensive airline partnerships provided by Amadeus.

Schedule Manager synchronizes schedules with inventory, creates enhanced seat maps, and makes real-time updates.

Fare Manager creates and modifies fares based on predefined rules and ATPCO (the Airline Tariff Publishing Company) standards. To enhance the passenger experience, the tool supports multi-currency fares.

Travel Commerce is a powerful eCommerce platform tightly integrated with the reservation system and NDC environment (Navitaire has a level 3 NDC certificate). It helps airlines sell standalone ancillaries as well as fare and ancillary bundles via multiple distribution channels. Besides, the platform incorporates travel services from third-party suppliers, allowing carriers to generate revenue from merchandising event tickets, city tours, car rentals, and more.

The advanced payment engine enables real-time processing of payments, directly connecting with credit card networks. Airlines can easily add additional payment options in consideration of the preferences of their passengers. The engine comes with a set of useful tools and services, including fraud prevention and dynamic currency conversion.

Check-In Solution offers passengers check-in via cell phones, tablets, or kiosks. They can also make baggage fee payments and buy ancillaries.

Sticking to the low-cost business model, New Skies PSS doesn’t include departure control or revenue management systems. They come as separate modules, and carriers are free to buy and install them later.

Minor players with big ambitions

Smaller providers of PSS solutions also follow a customer-centric strategy and stick to а modular design so that airlines can buy only what they need, avoiding excessive payments.

SITA Horizon

The SITA Horizon Passenger Management and Distribution system provides all essential PSS building blocks for both low-cost and full-service carriers. Horizon markets itself as a GDS-neutral solution which guarantees seamless access to all available distribution channels. Here’s a list of the system’s core modules.

Horizon Reservations controls booking and inventory operations, allowing managers to recognize most valued customers, differentiate prices, and develop inventory and ancillary strategies in consideration of current market conditions.

Horizon Ticketing is responsible for issuing both e-tickets and EMDs.

Airline Revenue Management automates inventory control enabling airlines to increase occupancy on low-demand flights and boost the yield on high-demand flights.

Airfare Price ensures proper application of fare rules, unbundles current fares to boost revenue from ancillary services, and automates ticket repricing and refunding.

Departure Control Services can support multiple carriers, automating check-in, boarding, and aircraft load planning. It accepts passenger name lists from any reservation system and interfaces with e-ticketing databases of any type.

Business intelligence tools collect data from the reservation, ticketing, and departure control modules for deep analyzing, identifying trends and presenting results through comprehensive visualizations.

Horizon Merchandising is an omnichannel platform for selling ancillary services during and after the initial booking. It delivers ancillary prices and offers to direct channels like websites, mobile apps, and kiosks at airports.

As for the end of 2019, SITA’s NDC certificate had expired. Instead of the pre-implemented NDC solution, the PSS provider offers airlines adoption of new distribution capabilities via a separate marketplace NDC Exchange, developed in partnership with ATPCO (The Airline Tariff Publishing Company). The ATPCO / SITA solution holds 3 Level NDC certificate.

Unisys AirCore / TravelSky

AirCore from Unisys Corporation is a GDS-neutral platform, which was adopted by Chinese aviation IT giant TravelSky to enhance passenger air transportation in China.

For your reference, TravelSky is a leading provider of IT solutions for China’s air travel industry. The first client migrating to the Unisys AirCore passenger system under the authority of TravelSky is Air China. This carrier alone generates nearly 50 million flight queries and one million booking requests per day.

AirCore is available globally via the Microsoft Azure cloud. The PSS includes 12 modules that cover all core operations, including reservation, inventory, ticketing, and departure control. Apart from essentials, AirCore markets the following enhancements:

- Seat map management creates rules and assign prices for different seating options.

- Timeline collaboration platform for travelers uses predictive analytics to develop personalized offers, based on customer profiles.

- Predictive re-accommodation identifies passengers impacted by flight delays and cancelations and offers them alternative flights to their destinations.

- Order management controls both NDC and non-NDC orders and boosts ancillary sales (the company’s 4 level NDC certificate covers all offer and order possibilities).

Radixx

Radixx is known for its best in class PSS for low-cost carriers, based on a microservices architecture. In October 2019, the company became a part of Sabre Corporation. Let’s see what benefits — apart from the wide customer base — attracted the tech giant.

An omni-channel internet booking engine integrated with an eCommerce platform provides limitless opportunities for personalized offers and customizations. The set of available features includes:

- low fare calendar display,

- shopping cart for ancillary sales,

- upsell opportunities at every step of booking flow, and

- multilingual interface.

Real-time inventory management is enhanced with an ancillary revenue module that helps managers set optimal prices and develop bundled offers to generate additional profits.

Go Touch mobile solution speeds up all pre-flight preparations at the airport, reducing queues. Besides, it enables airline agents to sell ancillaries not only during booking processes but also in the airport lounge or at the gate.

The analytics and revenue optimization platform hosted on Amazon Web Services (AWS) creates data reports and visualizations for making better business decisions. Managers can access the platform from the desktop, tablet or mobile phone.

Radixx hasn’t got any NDC certificates, but things may change soon due to the acquisition of the brand by Sabre.

Can't fly? Then buy

For years, airlines didn’t pay much attention to their passenger service solutions, lagging behind other industries in terms of catering customers. But growing demands of travelers and new merchandising opportunities provided by the NDC standard, at last, got things moving. Carriers — even those sticking to the low-cost model — started investing in the PSS and innovating their IT platforms born in the past century.

Experts predict that in the near future travelers will enjoy a flight shopping experience similar to buying from Amazon or other eCommerce websites. Will it prevent delays and cancelations? Nope. But maybe passengers will find a little consolation in discounts and unique offers of travel experiences at reduced prices.

How the T&A industry works