Corporate travel is an essential part of modern business operations, with professionals constantly on the move for client meetings, conferences, and other events. This results in a growing need for effective expense management solutions, underscored by the GBTA (Global Business Travel Association) prediction that annual corporate travel spending will reach $1.4 trillion by 2024.

For businesses, having clear travel and expense (T&E) policies is essential, guiding employees in submitting claims and expenses appropriately. To ensure control, transparency, and efficiency in T&E management, companies rely on expense management software. However, in today's data-driven landscape, simply managing expenses isn't enough. It's the leverage of analytics that takes it to a higher level.

Analytics in expense management refers to the systematic examination of data related to a company's spending. The goal is to uncover valuable insights to optimize cost structures, identify unusual expenses and irregularities, and ensure adherence to budgetary guidelines. This empowers businesses to make well-informed choices, simplify expense management, and enhance the overall travel experience for employees.

This article will explore diverse use cases and provide examples of companies using advanced technologies that further enhance the effectiveness of analytics. These innovative solutions offer a wide range of advantages and contribute to streamlining processes, ultimately transforming the way organizations approach expense management. At the end, we’ll share our thoughts on the future possibilities of the technology in T&E.

Automated policy compliance monitoring

Noncompliance with expense policies is one of the biggest challenges for finance departments. It encompasses various issues, such as individuals exceeding prescribed hotel standards, missing out on available discounts, or including personal expenses in their submissions. Identifying these patterns can be quite complex, especially when relying on manual reviews of numerous individual expense submissions stored in spreadsheets.

After employees submit their T&E reports, finance teams are tasked with the labor-intensive process of gathering all trip reports from managers and manually scrutinizing them for compliance with T&E guidelines. In cases where violations of these policies are identified, the finance team must communicate with the employee to request adjustments or clarifications regarding their travel report, possibly leading to a return of the report, either in part or whole. This manual and time-consuming process can have several adverse effects. For example, it can result in overlooked claims that may be fraudulent or actionable data that may remain hidden unless reviewers know exactly what to look for.

Since this practice can harm a business's financial health, it's imperative to find more efficient and accurate methods for handling T&E reports.

Artificial intelligence (AI) emerges as a valuable solution to this problem. It can help meticulously assess expenses to ensure they adhere to established rules and policies. To achieve this, a company configures the software with its T&E policies that include rules and guidelines for travel bookings, expense categories, spending limits, preferred vendors, and other parameters. Policy configuration procedures vary for each tool, so it is recommended that businesses directly engage with the software's representatives for specific guidance.

For example, Oversight AI monitors all transaction data, identifying non-compliance and mitigating spending risks. It conducts a thorough analysis of invoices, payments, and vendor data across all entry points. One of Oversight AI's standout features is its ability to identify and prioritize high-risk transactions. It prompts action to review exceptions, address concerns, and tackle the underlying causes of confirmed issues. The tool provides real-time alerts for any irregular spending or personal purchases that deviate from employees’ business objectives.

Concur Detect by Oversight is another example of a tool that ensures enhanced policy compliance by automatically reviewing expense and receipt data. It identifies suspicious spending, controls out-of-policy expenses, and analyzes trends to uncover fraud or repetitive misuse. The tool also automates the approval of low-risk expenses, which allows auditors to concentrate their efforts on addressing reports where potential issues or risks are identified. This streamlines auditing processes and ensures that employees are reimbursed more quickly.

Preventing and detecting expense fraud

Having discussed the challenges of policy noncompliance, we now shift our focus to a more deliberate financial concern — expense fraud. While the former often stems from careless mistakes or oversight, expense fraud involves intentional manipulation to deceive the system for personal gain.

Expense fraud poses a significant challenge, impacting businesses of all sizes. Here are the most common types of expense fraud to be aware of:

- falsified receipts, where employees submit fabricated receipts claiming fictitious expenses;

- duplicate expenses, with an attempt to claim reimbursement multiple times for the same expense;

- overstated expenses, where legitimate costs are inflated to gain additional reimbursement.

The good news is that innovative solutions can effectively detect fraud. These technologies provide the tools to detect and prevent fraudulent activities, ensuring integrity in expense management processes.

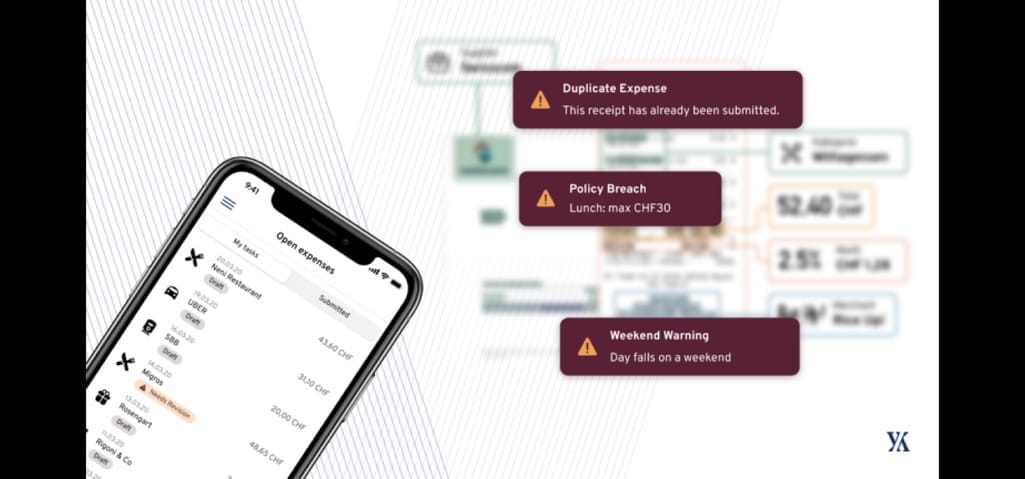

Yokoy can issue alerts for duplicate expenses, policy breaches, and weekend warnings. Source: Yokoy

For example, Yokoy supports midsize and large companies in preventing employee expense fraud through AI-powered automated policy enforcement. If an employee attempts to submit an expense claim that exhibits unusual or suspicious patterns, the software can either outright reject the expense or send it to a manager for closer review. This is achieved by setting custom rules based on the company's specific policies and harnessing AI technology to promptly identify and flag potentially fraudulent activities as they occur in real time.

Data visualization

Data visualization is a crucial part of analytics. It entails the presentation of expense data through an array of visual formats, such as charts, graphs, and dashboards, designed to translate intricate financial information into easily digestible visuals. Such representation empowers decision-makers with the ability to promptly discern spending patterns, pinpoint unusual expenses, and strengthen expense control.

Premier Insights, by American Express Global Business Travel (GBT), is a notable example of a data visualization tool designed to provide companies and their travel managers with a complete view of their travel programs.

For organizations using separate platforms for specific needs like controlling costs and bookings, it can be challenging to manually pull and break down all data and identify areas to prioritize. In fact, 78 percent prefer a single platform to manage their T&E processes. Premier Insights integrates American Express Corporate Cards and travel booking data into a single platform and provides access to a comprehensive, single-source view of an entire travel program, offering a simple way to consolidate and analyze travel data.

“We created Premier Insights to centralize everything that can impact the efficiency of a travel program, allowing travel managers to spend less time pulling data and more time enhancing their travelers’ experiences. As a result, they can engage in smarter decision-making, drive program efficiencies, and achieve cost savings,” said Christine Ourmières-Widener, Chief Global Sales Officer.

An example of a risk scoring dashboard. Source: Emburse Analytics

Another data visualization tool worth mentioning is Emburse Analytics. It provides dashboard reporting for informed decision-making and in-depth data exploration. The tool generates charts to depict spending patterns within an organization, department, or specific vendors. In addition, Emburse Analytics features risk-scoring dashboards that assess various risks according to predefined criteria, aiding organizations in identifying areas for compliance reinforcement.

Predicting future expenses

Leveraging predictive analytics entails significant advantages in T&E management. By analyzing historical data, companies can get accurate forecasts of future expenses. This allows organizations to allocate resources more efficiently and make data-driven decisions about future expenditures.

Rydoo Insights can predict a company’s upcoming expense claims based on past experiences

But instead of relying solely on historical averages, predictive analytics can also take into account various factors like seasonality, external events, and suppliers for better precision.

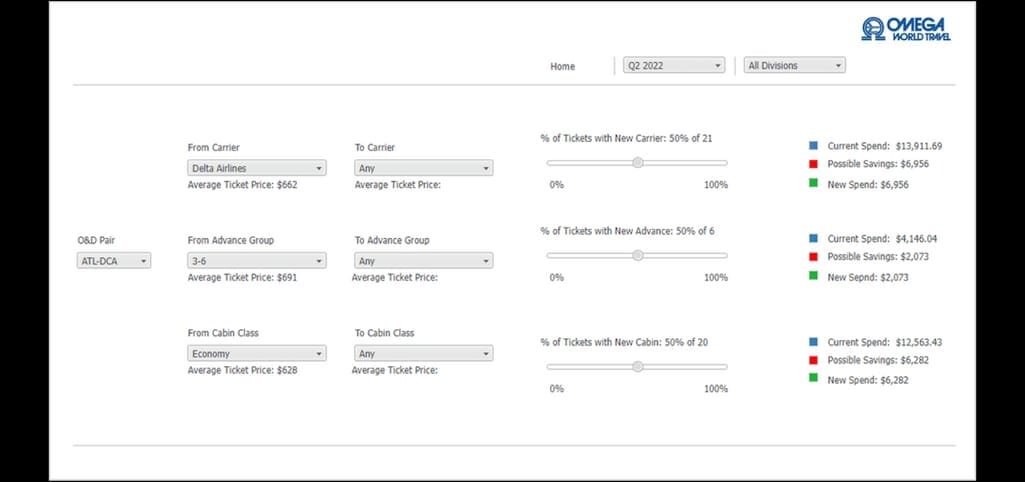

The What-If Scenarios Dashboard. Source: Omegalytics

Omega’s proprietary web-based reporting system offers valuable assistance through predictive analytics. Omegalytics is a customizable tool for viewing data, granting users enhanced control over their data visualization. This system incorporates predictive analytics to help users anticipate future trends. For example, the What-If Scenarios Dashboard provides valuable insights into potential cost savings. This is achieved by making adjustments to vendor usage and traveler behavior.

Immediate assistance for informed decision-making

Employees traveling for business face a range of challenges while booking flights and accommodations, managing expenses, and adhering to company policies. The absence of immediate guidance can result in inefficiencies and frustration. On the other hand, travel managers and finance teams struggle with their own difficulties, such as identifying best cost optimization opportunities, which often involves time-consuming data analysis.

Access to an AI travel expert addresses these issues. This not only aids employees in making travel-related decisions but also supports travel managers and finance teams by providing quick insights, recommendations, and cost-cutting strategies.

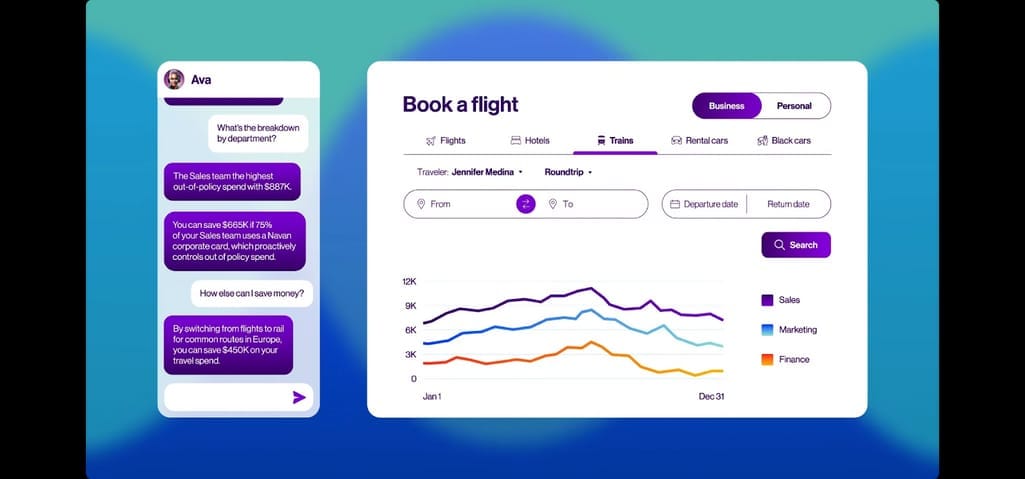

Navan offers Ava, a chatbot with the capabilities of a personal data analyst and an expert in T&E management. Ava's core functions include analyzing spending data, offering insights on T&E queries, proactively identifying potential cost-saving opportunities, and even providing granular carbon emission details. The tool can also provide context on suggested bookings and promptly scour the Navan database of reviews to help travelers plan their stay. Moreover, Ava can generate executive summaries of its findings, ensuring users have immediate access to valuable information. The AI chatbot maintains records of interactions and consistently enhances its understanding of spending patterns to deliver tailored advice.

An example of Ava recommending a way to reduce travel expenses. Source: Navan

Ava utilizes OpenAI's GPT-4 APIs for data analysis, focusing on complex spending data and insights. The tool is aimed at enhancing the financial performance of corporations by optimizing their travel budgets while also serving as a travel expert to address a wide range of questions.

Learn more about the potential of GPT models from our dedicated article on ChatGPT implementation in travel.

Machine learning for immediate receipt capture

The days of manually entering receipts are gone. ML-driven expense automation systems use advanced optical character recognition (OCR) technology to capture and process expenses in real time, eliminating human errors and saving time. Employees no longer need to handle manual data entry. Instead, they simply scan and upload, leaving OCR technology to extract details and compile them into expense reports. While this specific case is not directly connected to analytics, it's worth including in the article as it represents a notable technological advancement that greatly benefits expense management processes.

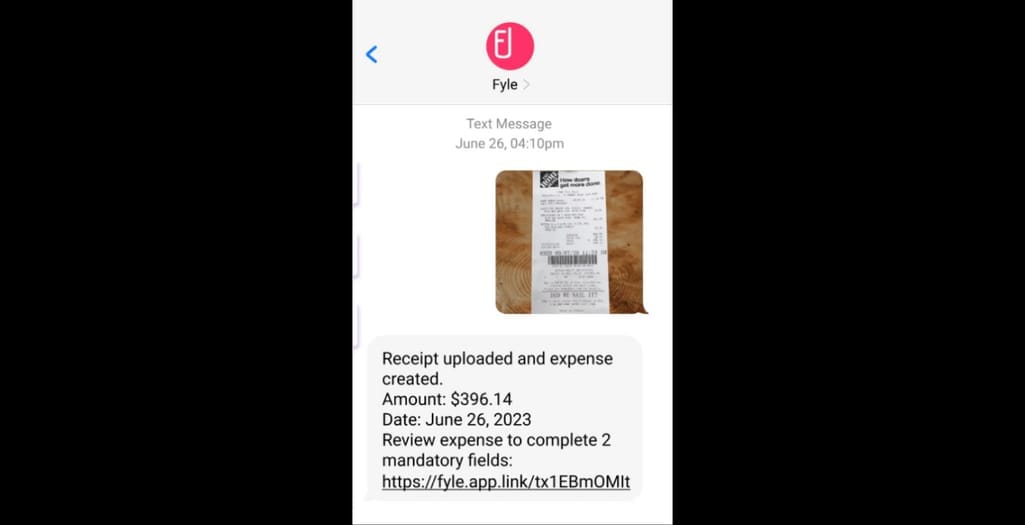

An example of Fyle extracting expense information from a photo of a receipt. Source: Fyle

For instance, Fyle simplifies expense submission by enabling users to send a picture of their receipts via text. It automates data entry and submission of expenses, ensuring a user-friendly experience with no learning curve. Fyle states that this streamlined approach boosts the speed of receipt collection by 48 percent, leading to quicker book closure for organizations.

This feature employs AI and OCR technology to extract expense data from various sources like email receipts, paper receipts, and electronic invoices, eliminating the need for manual data entry.

Another notable tool for receipt capture is ExpenseIt, a service integrated into the SAP Concur mobile app that allows users to turn paper receipts into digital expense reports. Employees can take pictures of their receipts directly through the app, and ExpenseIt will automatically translate the photo into structured expense details. Users have the flexibility to review and edit this information if needed before submitting it.

Personalizing travel experiences

A positive travel experience significantly contributes to employee satisfaction and productivity, making personalization in travel a key factor. Organizations can utilize analytics to personalize T&E policies. The process begins with an analysis of feedback, which informs the customization for each trip. Then, the managers can review the employee’s preferences to include some of them in the policies. For example, after analyzing frequently used amenities and room types, managers can decide to incorporate some of the options into employees' travel policies, thereby enhancing personalized experiences in hotels. This approach not only boosts employee satisfaction but also enhances policy compliance and fosters loyalty to the organization.

An advanced system takes this further by analyzing frequently used routes, accommodations, and tariffs. It can identify employees' travel preferences, such as preferred hotels, flight times, and travel days, and collects this data over time. When booking, the system presents frequently selected options first, saving time and reducing the need for repetitive searches.

ITILITE provides a travel booking platform that offers personalized options from an extensive selection of flights and hotels. It also provides policy configuration and live-traveler location tracking. By analyzing past travel and expense data, this AI-powered T&E management software can discern individual preferences and offer tailored suggestions for future trips.

Streamlining expense reporting processes

In a manual T&E management system, delays in reimbursements often stem from several factors. Employees may forget or put off expense reporting and tracking due to the time-consuming and tedious nature of these tasks, resulting in late submissions of expense reports. This initial holdup sets the stage for further delays in the process.

Rushing to complete an expense report at the last minute can lead to manual data errors, including incorrect expense entries, missing receipts, and a failure to adhere to policy guidelines. As a consequence, the submitted expense report may require multiple rounds of revisions and back-and-forths between the approver and the employee before it meets the necessary standards for a final audit.

An example of Zia providing a reminder for unreported expenses. Source: Zoho

Zoho's AI assistant, Zia, proactively notifies users about pending tasks, such as unreported expenses, unsubmitted reports, unsubmitted trip requests, and failed receipt scans. The tool ensures that users are promptly informed of any required actions, facilitating a faster and more streamlined expense reporting process.

The potential of advanced technologies in T&E

For T&E management, AI has achieved noteworthy progress, transforming the way businesses handle their financial operations, from automating expense reporting to enhancing compliance and cost control. Seventy-six percent of decision-makers say increasing automation to improve efficiency and productivity is a high or critical priority, with two-thirds citing a more automated T&E platform as a way to accomplish that priority.

However, this transformative journey has only started. While we utilize the significant advancements accomplished thus far, let's explore a couple of examples of conceivable future possibilities.

Real-time policy adjustments. Rigid travel expense policies can sometimes lead to violations and necessitate manual interventions. For example, when a business traveler books accommodations or plane tickets to New York at a price exceeding the policy limit, they typically get flagged for violation. However, there are situations where lower-priced options for New York travel aren't available. In such cases, there's a need for an automated adjustment to the policy that considers the prevailing travel prices in that location at that time.

The solution lies in leveraging advanced technology that can swiftly analyze data, recognizing the absence of more cost-effective options in real time. This approach would ensure that employees aren't flagged for violations, eliminate the need for manual interventions by management, and expedite the reimbursement process within the finance department.

Read our article about dynamic pricing in airlines to understand how airlines adjust their pricing and the influencing factors behind these changes.

Swift travel disruptions response. Unexpected disruptions like flight delays, cancellations, or diversions can present a significant challenge for employees on the move. When such situations arise, travel managers are tasked with rebooking flights and finding alternative routes promptly to ensure that business travelers reach their destinations. For example, our client Cornerstone has implemented an effective solution for proactive airline disruption management, featuring a comprehensive web dashboard. It allows travel managers to track the status of corporate travelers and swiftly respond to any disruptions.

However, the integration of more advanced technology may change the way these challenges are addressed. Travel managers should be able to receive immediate and continuously updated alerts, keeping them informed about global emergencies before they cause travel disruptions. This would allow for making swift decisions to address potential disruptions.

Moreover, advanced technology could also find and suggest new travel alternatives, a task that could take longer for travel managers to accomplish themselves. This would streamline the rebooking process, ensuring that travelers can reach their destinations as quickly and safely as possible.