Parametric insurance is reshaping the landscape of travel risk management by offering fast, transparent, and automated coverage based on predefined parameters. Let’s explore this concept in depth and compare its role in the travel industry to traditional insurance.

If you need a bigger picture, we have broader insurance retailing and travel insurance overviews in separate posts.

What is parametric insurance?

Parametric insurance is a type of coverage that pays out automatically when a predefined triggering event occurs, bypassing a traditional claims assessment process.

In the travel sector, this means if a specific event, like a flight delay or extreme weather, meets the agreed parameters (e.g., a flight delayed by 2+ hours or rainfall above a certain threshold), the insurer automatically provides compensation or services to the traveler.

Importantly, compensation is predetermined rather than based on the actual financial loss incurred by the insured party.

Also, the payout is trigger-based, so the traveler does not need to file a claim or submit proof. Instead, the system uses external data to validate the event and deliver the benefit instantly.

Additionally, benefits aren’t limited to cash, but can also take the form of

- airport lounge access voucher,

- hotel booking,

- air ticket for another flight, or

- other assistance, delivered in real time as the disruption unfolds.

Beyond automatic cash payouts, parametric travel products can offer perks like lounge visits, hotel upgrades, or theme park tickets… There are lots of things in the travel world where the marginal cost to deliver is very low, but have consumer value.

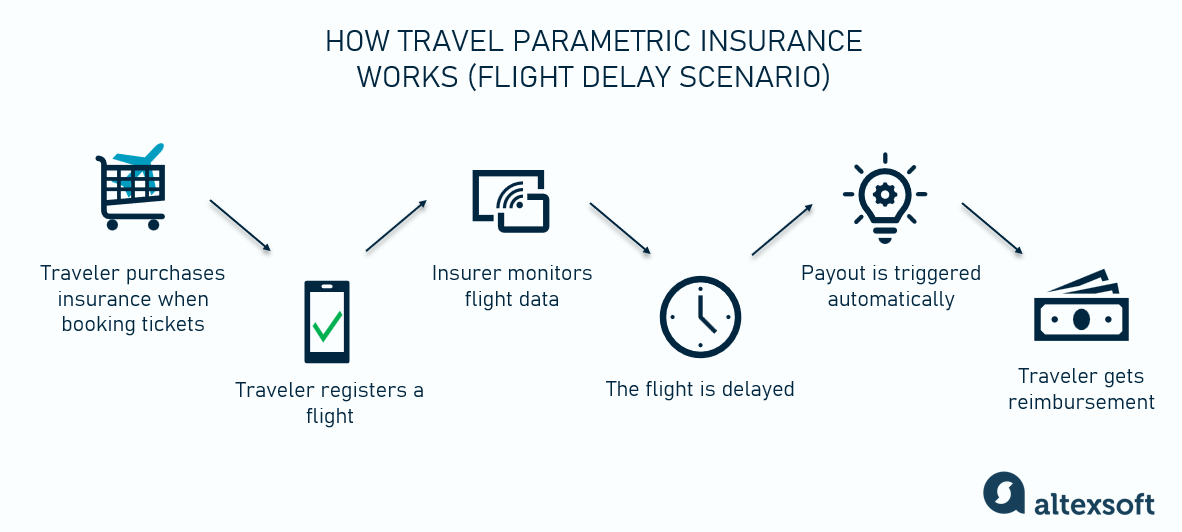

Here’s an example of how it works.

Parametric insurance for delayed flights

Purchasing insurance. Parametric insurance can cover scenarios often excluded by traditional policies. Standard travel insurance rarely compensates for delays shorter than 6-12 hours or for rained-out activities. Parametric insurance fills these gaps.

Let’s say you’re booking a flight from New York to Paris. The OTA offers you a parametric flight delay insurance during the booking. The policy covers delays over 2 hours, costs $20, and provides a $100 payout or lounge access if the flight is delayed. The trigger event is a 2-hour delay verified by official airport data.

You purchase the insurance, which is now linked to your flight and will activate once the flight status is verified.

Registering the flight. Most policies would require you to register your flight online at least 24 hours before the scheduled departure time to qualify for compensation.

Data monitoring. The insurer or its tech partner tracks flight statuses using data from the airport, airlines, and flight tracking services.

Event happening. On the flight day, the airline announces a delay exceeding 2 hours due to weather.

Triggering the insurance payout. The insurer confirms the 2-hour delay using flight status data – no claim form, receipts, or proof required from you. Once verified, the system sends you a notification and suggests options – cash payout or lounge voucher.

Reimbursement. Let’s say you choose to receive cash compensation. The system calculates and processes the $100 payout based on the policy terms. The payout is transferred to your payment method (credit card/bank account) within minutes. You receive a real-time notification confirming the payout and the reason for the compensation.

Afterwards, you can review your policy details anytime via the mobile app or website.

The Accenture report revealed that one-third of claimants aren’t satisfied with their insurance claims handling, and among them, 60 percent cited settlement speed as the main issue. CoinLaw claims that 88 percent of customers report immediate payouts as a primary reason for choosing parametric over traditional insurance.

It’s also about transparency and trust. As Mark Seddon, CEO at Pact, a UK-based insurtech, once said, “The key is the lack of moral ambiguity. Neither those who determine the triggers, nor those claiming, can manipulate the triggers.”

Payouts are based on objective, third-party data and previously agreed to terms, ensuring both the insurer and traveler know exactly when and how much will be paid. This transparency reduces disputes and builds customer trust by eliminating ambiguity and fine-print exclusions.

The history, evolution, and current state of adoption of parametric insurance

Parametric insurance has existed for decades in sectors like agriculture (addressing risks of weather disasters), sports and entertainment, and life/health insurance. However, its use in travel is recent. AXA's Fizzy platform, launched in 2017, was one of the first to automate flight delay insurance via blockchain smart contracts, offering claimless, instant payouts. However, it was discontinued by 2019 due to low market demand.

At about that time, insurtech startups like Blink Parametric, Setoo, and Koala started emerging. Eventually, they helped bring parametric solutions to travel insurance, offering automatic benefits for flight delays and trip disruptions.

The COVID-19 pandemic accelerated parametric insurance adoption because it caused widespread travel disruptions that traditional policies struggled to cover efficiently. Such an unpredictable, high-risk environment made faster, trigger-based payouts more appealing.

2021 marked a notable funding rally in insurtech startups. Just like in other industries, new, agile, digital-native businesses are faster at developing and adopting innovative solutions than large, established insurers. As a result, insurtech firms became the main driving force behind the growth of parametric insurance, pushing forward the adoption of new models.

In 2023, Amwins reported a 500 percent increase in submissions, showing a growing consumer enthusiasm.

Current state of adoption

Today, parametric insurance continues to gain global momentum. In 2024, it was estimated to be a $16 billion market – though it’s still a small share of the global insurance market, which is roughly $8.1 trillion.

Big names like Allianz, AXA, Munich Re, and Ping An still primarily focus on natural disasters. Besides agriculture and energy, which take 40 and 25 percent of the market respectively, parametric is also entering the cybersecurity, manufacturing, maritime, logistics, and other sectors.

Meanwhile, in travel, “adoption is still at an early stage, far from mass adoption," as Peter Dingle shared. Travel parametric insurance is now sold by a handful of global insurers, including Manulife, TuGo, Baloise, Blue Cross, Zurich Insurance, etc.

In addition, some travel providers have also been getting involved, including Marriott, TUI, GolfNow, etc. We’ll talk more about these and other resellers in the distribution section.

Most providers partner with insurtech firms to enable travel disruption coverage. For example, MAWDY, a part of the MAPFRE Group, the largest Spanish insurer, partnered with Blink Parametric to provide flight disruption coverage as part of their premium travel policies. In their case study, they shared some results of the first 11 months after the feature rollout.

Particularly, MAWDY claimed to have achieved an 11 percent increase in the adoption of the premium product and a 21 percent increase in the average policy premium. They also noted that 35 percent of claimants used Lounge Access, while 65 percent opted for a Cash payout.

Another parametric insurance provider, Sensible Weather, reported selling 400,000 policies in 2024. Its coverage was added to 30 percent of theme park bookings, 10-15 percent of high-value accommodation bookings, and 11 percent of event ticket purchases.

Blink Parametric has also commented that its partners see 5-10 percent in total sales after deploying parametric flight delay or cancellation solutions.

All these figures show that travelers are generally interested in parametric insurance and that it can become a lucrative revenue stream for insurance providers.

A look at the cost side of parametric products

Besides, parametric insurance often involves lower costs for insurers. Since payouts are automatically triggered based on predefined conditions, the need for a traditional claims process—including claims adjusters, paperwork, and investigations—is eliminated.

This streamlined process reduces administrative costs and processing time, making it more cost-efficient. Additionally, by using real-time data to verify events, insurers can minimize the risk of fraudulent claims, further reducing costs.

On the other hand, insurers must carefully weigh the cost of payouts against the savings in claims processing when assessing the financial risk of travel parametric insurance. As Peter explained, the cost of parametric insurance would be too high if it’s paid out every time.

Replacing a traditional insurance product like-for-like with an automatic payout 100 percent of the time is going to be more expensive to provide. So just slotting it into a policy in replacement of the existing clause won’t work commercially — they'll never sell any policies because it’ll be too expensive.

What makes parametric products more attractive to include is non-cash benefits, which may cost the insurer little but offer high value to the customer. Additionally, breakage is a crucial factor to consider. Parametric insurance often requires customers to register their flight in advance, and only a portion of them may do so. High breakage levels reduce the number of actual payouts, making it more cost-effective for the insurer.

Key use cases for parametric insurance in travel

Parametric insurance addresses typical travel concerns – and delayed flights are the most widespread use case.

Flight delays/cancellations

Flight disruptions are a common issue: In 2024, 236 million passengers experienced delays or cancellations in the US alone, which is approximately 1 in 4 flyers.

Flight delays are covered in many ways, from traditional travel insurance to credit card policies to airline compensation. However, the issue lies in the long delay threshold – often 3, 6, or even 12 hours. In addition, travelers must file a claim to receive compensation – which they rarely do.

Parametric insurance addresses both problems. It monitors flight status in real time, triggering automatic benefits if a delay exceeds a set threshold, often lower than in traditional scenarios, e.g., 2 hours. Then travelers can immediately receive a lounge pass or cash payout, and in cases of cancellations or extended delays, it may even cover hotel stays or rebooking.

Baggage delay or loss

SITA reports that due to tech improvements, the number of mishandled baggage items has been decreasing over the years. But still, there were 6.3 mishandled bags per 1000 passengers in 2024 – or a total of 33.4 million bags.

Traditional insurance covers delayed baggage, but it usually kicks in after a certain waiting period, like 12 or even 24 hours. The traveler must then submit a claim with evidence, which typically takes many days to process.

Meanwhile, parametric insurance allows the traveler to receive the payout immediately after reporting the lost baggage to the airline, getting the tracking number (Property Irregularity Report or PIR number), and submitting it to the insurer.

The insurer uses airport data to verify delays and instantly recognize missing luggage. It then automatically provides travelers with a fixed payout (e.g., $100 after 30 minutes), allowing them to buy essentials without waiting for traditional insurance claim processing.

Some policies (e.g., JTC’s Smart Luggage) also include another, larger payout in case the luggage is proven lost.

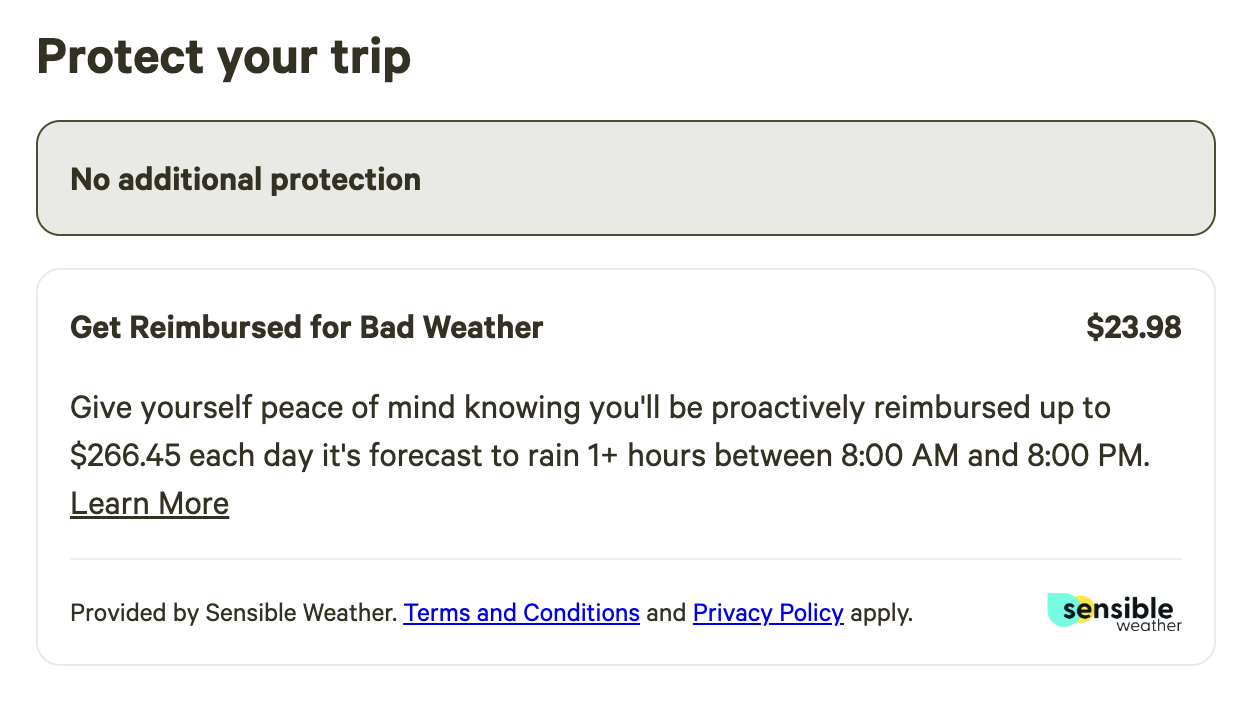

Extreme weather and trip experiences

Parametric insurance offers weather-indexed coverage, such as payouts for

- rain on a beach trip (e.g., over 50mm of rain per day),

- insufficient snow for skiing (e.g., less than 10 cm of snow on a specific day), or

- intense heat waves on city breaks (e.g., 40°C for more than two days).

For example, InterContinental Singapore now offers a Rain Resist Bliss Package. They track rainfall data captured by the National Environmental Agency Weather Station. When rain duration exceeds 120 cumulative minutes within any 4-hour period during daylight hours, the payout is triggered, and a traveler gets a voucher for one night.

Another example is Hipcamp, a marketplace for camping sites. It partnered with Sensible Weather to cover weather disruptions like rainfall or high temperatures.

Weather insurance

Other travel disruptions

Parametric models can cover niche scenarios like missed connections, traffic delays, or public emergencies. While still nascent, these policies can potentially provide instant responses using real-time data, offering coverage where traditional insurance offers limited or delayed help.

Parametric insurance providers and distribution channels

As we touched on earlier, parametric-like solutions can be included in credit card packages (Visa and Mastercard provide lounge access benefits to select cardholders) or come as airline ancillaries. But here we want to talk about the direct and embedded types of parametric insurance distribution.

Before we get to the key players, let’s briefly describe the main distribution models.

Direct to consumer (DTC). Insurers sell their products directly to consumers through their websites/apps, bypassing intermediaries.

Bancassurance. Banks sell insurance as part of their credit card or other programs (mortgages, loans, savings accounts, etc.).

Aggregators. Aggregators are third-party platforms that provide quotes from various insurers, allowing consumers to compare multiple offers side by side.

Embedded. Insurance is purchased as part of another product or service transaction (e.g., travel package), rather than as a standalone policy. The customer isn’t redirected to an insurer’s site to buy insurance; instead, they stay on the same platform and have a seamless digital experience.

As of today, the main distribution channels are DTC and embedded in the travel product booking flow. So let’s discuss the key players involved in selling parametric insurance.

Insurance companies: B2C direct distributors

Key names: Manulife, TuGo, Baloise, Blue Cross, Zurich Insurance, MAWDY, Collinson

Key responsibilities: underwriting, designing and pricing policies, authorizing and processing payouts, ensuring regulatory compliance

As we mentioned, traditional insurers and MGAs are beginning to offer parametric travel insurance. Currently, it is mainly offered as an add-on to existing policies, as it is still a relatively new product that customers may not fully understand or see tangible value in purchasing as a standalone offering.

These companies underwrite the parametric insurance policy and assume the financial risk.

They distribute the new insurance using their established networks, customer base, and financial infrastructure. The distribution itself is similar to traditional travel policies, as parametric coverage is typically included as part of the overall package. Consumers can find such hybrid policies on insurers’ websites or through agents/brokers.

In addition to the companies mentioned above, some examples of such insurers that have recently added parametric coverage are Trawick International and Open Insurance.

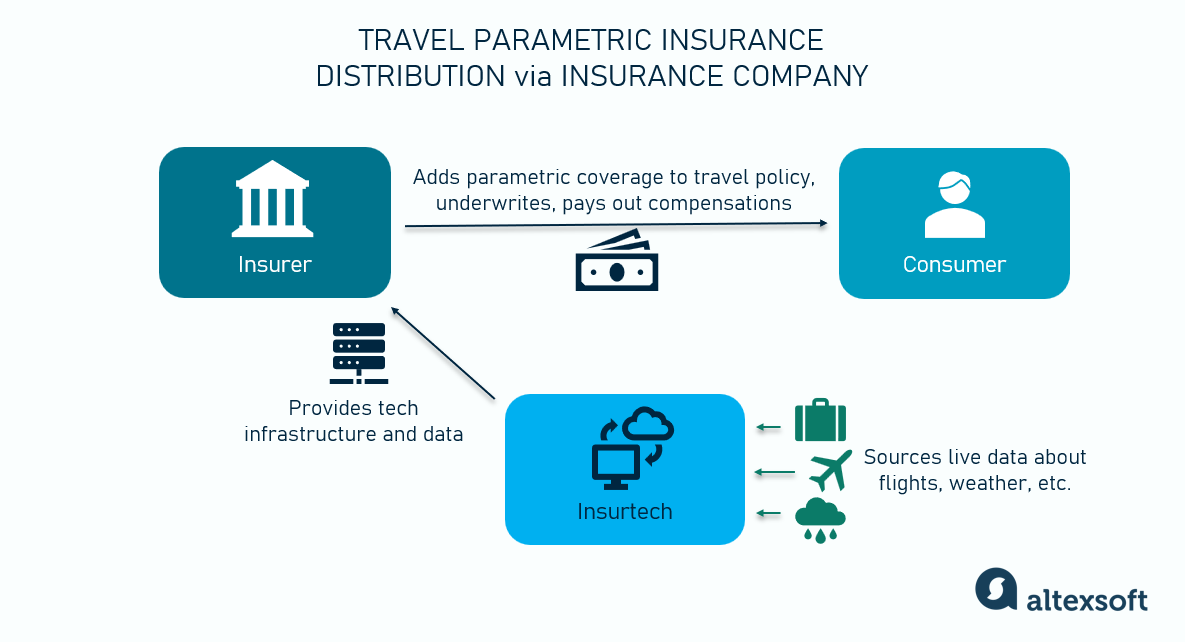

A distribution scenario via an insurance company

While these insurers provide the underwriting capacity and financial support for parametric policies, they rarely build the necessary infrastructure from the ground up. In most cases, they partner with technology providers to manage the real-time data monitoring and payout mechanisms.

For big insurers, using an insurtech for a pilot program can be cheaper and faster than building on their own legacy platforms.

As Peter explained, “It’s typical new product issues: legacy platforms, regulatory stuff, and the day-to-day grind… It’s much easier to work with somebody who just takes the problem away, sorts it, and then eventually — if it looks scalable and valuable — you’ll either buy the startup or build it yourself into your core platform."

Insurtech startups: B2B2C tech providers

Key names: Blink Parametric, Sensible Weather, Koala, Setoo (now part of PassportCard Labs), Cover Genius, WETTERHELD

Key responsibilities: developing technology and integrating with insurers and resellers, data collection, information transfer, customer support

Insurtech startups basically drive the adoption of parametric insurance. They do not sell the product – instead, they develop the underlying technology and platform and sell it to distributors as a turn-key, white-label solution.

They also act as a technology intermediary that facilitates the flow of data between the reseller (travel company), the customer, and the insurer.

Data integration is one of their critical differentiators. Parametric insurance hinges on reliable, instantaneous data. In travel, this means collecting feeds like

- global flight status (for departure/arrival times, delays, cancellations) from data providers such as FlightStats, FlightAware, Flightradar24, OAG, etc.;

- baggage tracking data from systems like SITA’s WorldTracer;

- weather data from government agencies, meteorological and geophysical monitoring stations, and third-party data providers;

- satellite data, etc.

These data feeds are accessed via APIs and integrated directly into insurers’ platforms, allowing continuous monitoring of coverage parameters.

But it’s not only about data and technology. Insurtech firms also make partnerships to provide nonfinancial benefits, e.g., access to airport lounges. Additionally, they are often involved in other processes.

New entrants like Blink don’t just integrate data — they build the customer journeys and supporting processes that make these products work in practice.

For example, Cover Genius provides a fully embedded solution for selling travel insurance – including a parametric Delay Valet. The company offers services such as designing and bundling policies, claims processing automation, handling multiple payment methods, and customer support at all stages. It also has an AI-enabled recommendation solution that suggests optimal policies.

Insurers and other resellers partner with one or several insurtech firms to use their technology. For example, Baloise offers 3 parametric insurance products:

- Fair weather – in partnership with German start-up WETTERHELD,

- Insurance for flight delays – in partnership with Irish insurtech Blink Parametric, and

- Baggage delayed – also with Blink Parametric.

Sometimes, bigger companies acquire insurtech startups to add parametric products to their portfolio. At the same time, the startup benefits from the established brand reputation. As Carl Carter, UK Country CEO of CPP Group, commented after acquiring Blink Parametric, “Because CPP is already partnered with banks, financial institutions, and travel insurers globally, we already have strong access to those distribution partners for Blink’s parametric solutions.”

Most insurtech startups operate in a particular niche. For example, Blink Parametric specializes in flight and baggage delays, Koala works with various transportation types, and Sensible Weather is obviously all about weather disruptions.

Travel companies: B2C resellers

Key names: Hopper, Amadeus, Marriott, First Choice, Klook

Key responsibilities: selling insurance as an optional add-on, collecting customer details, collecting payments

Travel agencies and OTAs have started offering embedded parametric insurance policies to customers when booking their travel, particularly for flight delays or cancellations.

Peter believes that "The opportunity is to sell parametric products through existing booking or service processes with partners — not as stand-alone products, because customers don’t wake up wanting to buy them… So selling through travel platforms, OTAs, or as a credit card benefit is more effective — it fits naturally into what customers are already doing."

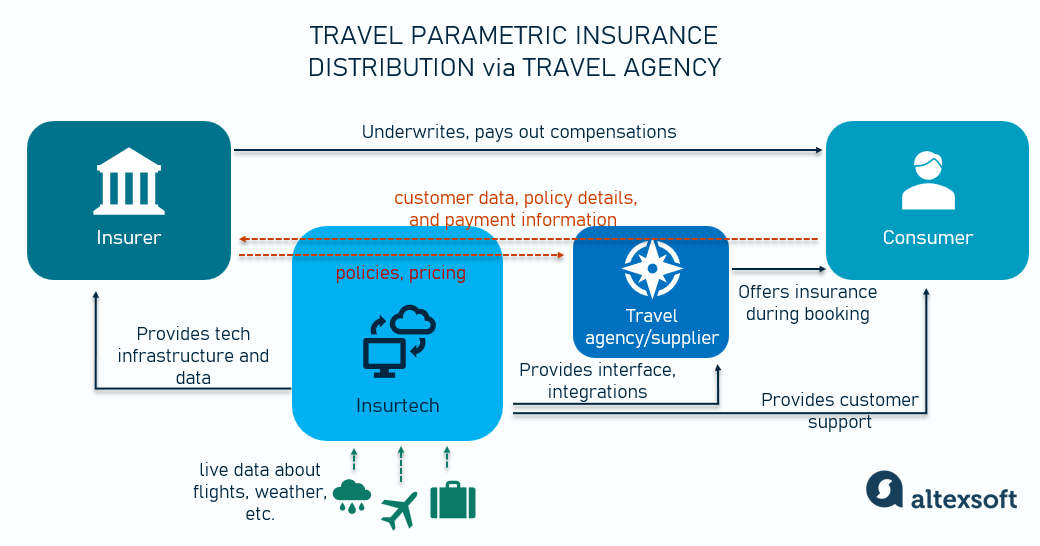

So, a possible – but not the only – distribution scenario can look like this:

- An insurer partners with an insurtech company that provides tech infrastructure for parametric insurance and calculates the risk model.

- A travel company partners with an insurer and offers insurance policies to travelers when they book travel products.

- An insurtech company monitors live flights, weather, and other data. Once the event happens, it verifies the event and triggers the payout.

- The insurer compensates the traveler based on the agreed terms.

A distribution scenario via a travel agency

For example, Amadeus, one of the leading GDSs and major travel insurance aggregators, has been actively incorporating parametric products into its offerings. It partnered with Setoo to include various parametric insurance options (weather guarantee, flight delays, etc.) in its policies. After Setoo merged with Pattern Insurance (now part of PassportCard Labs), Amadeus expanded their partnership to offer more insurance products.

Read about Amadeus API integration in a dedicated post.

Meanwhile, Hopper, one of the fastest-growing OTAs, has been developing its fintech solutions. In fact, it’s estimated to make more revenue from add-ons than from travel products themselves. And although Hopper’s disclaimer states that its Premium Disruption Assistance “is a rebooking service and is not an insurance product,” it has all the features of a parametric insurance: When a flight is delayed by more than 2 hours, Hopper sends a notification offering the option to either rebook a different flight or receive a full refund.

Some other early adopters among travel companies are

- Marriott Homes & Villas partnering with WeatherPromise to offer guarantees against rainy weather;

- First Choice, a part of TUI group, offering "Weather Guarantee" to reimburse in case of unfavorable weather conditions;

- Klook working with Zurich to add Blink Parametric-powered flight delay lounge access to its travel insurance plans;

- Val Cenis, a ski resort in France, adding an optional "Weather Guarantee" to their lift ticket purchase, etc.

A travel company collects and transfers customer data, policy details, and payment information to the insurer via an insurtech platform. As for payments, it depends on a company's operating model.

Agency model – an OTA doesn’t process payments. It does not retain the insurance premium but takes a commission for facilitating the sale. This is the most common model of operations for OTAs selling third-party insurance products.

Merchant model – an OTA acts as a merchant of record, collecting and processing payments. It sets the markup it retains, passing the premium to the supplier. This model means more tech and regulatory complexities for the OTA, especially in the insurance sales.

So most OTAs prefer the agency model – or market their products as non-insurance services (e.g., Hopper with its parametric-like offerings) to avoid the regulatory burden.

Parametric insurance users

While we mainly talked about individual consumers, businesses and even governments can benefit from parametric insurance. In fact, if we zoom out and look at the general parametric insurance market, 50 percent of policyholders are enterprises and 40 percent are governments. But of course, it’s different in travel and such use cases are few.

For example, in 2018, the Bali authorities purchased parametric insurance to mitigate the impact of a volcanic eruption. However, the volcanic ash levels didn’t meet the predefined thresholds, so the payout wasn’t triggered, despite the tourism industry suffering significant losses.

Parametric insurance can also serve as a risk management tool for travel businesses, much like it does for agriculture. Arbol’s Business Interruption Insurance is an example of such a product.

With this type of coverage, golf clubs or beach resorts can protect themselves from a decline in visitors—and revenue—due to bad weather, such as rainfall. Hotels can also insure their property against physical damage from natural disasters, covering financial losses from repairs and reduced occupancy.

What’s next for parametric insurance

The question isn’t just whether parametric insurance will stay — it’s how you design a smart product and put it in front of the customer at the right time and in the right way so they’re willing to buy it.

We can see that global adoption is on an upward trajectory, becoming a standard component of travel risk management. We’ll likely see more partnerships between insurers and travel industry players (OTAs, airlines, hotels, cruise lines) to embed these coverages directly into booking processes, as well as continued growth in consumer awareness of “instant insurance” benefits.

However, traditional insurance isn’t going away. Experts from Descartes Underwriting, a provider of corporate parametric insurance solutions, believe that parametric models will complement – not replace – traditional cover: “They do different things. Traditional insurance is essential for loss-based coverage. Parametric provides clarity, speed, and flexibility. Together, they create a stronger, more agile risk strategy.”

Of course, the road ahead isn’t that smooth and straight. Some challenges highlighted by the International Association of Insurance Supervisors (IAIS) include

- basis risk – payouts may not match actual losses, leading to potential overpayment or underpayment;

- complexity and novelty – both consumers and insurers may struggle to understand how parametric insurance works and determine appropriate coverage parameters;

- regulatory challenges – existing insurance regulations may not accommodate the unique features of parametric policies; and

- data reliance – there might be a lack of accurate and reliable data, both historical and current.

We can expect that, as technology continues to evolve, the adoption of parametric insurance will grow, offering travelers more flexibility, convenience, and security during their journeys.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.