Working with numerous travel booking projects – and driving them to success – , we’ve ascertained the main metrics an OTA should use to stay competitive and make data-driven decisions.

We’ve grouped the metrics into five categories, each addressing an OTA’s pivotal uncertainties.

Acquisition analytics. How do you acquire more qualified traffic? These are metrics for determining the most effective channels, adverts, metasearch engines, and conversion from them.

Demand analytics. What’s the current travel market demand? Here you collect data about the most popular destinations, dates, traveler trends, segments, etc.

Revenue analytics. How do you generate more income? These metrics analyze the performance of our commissions in regard to competitor prices.

Supplier analytics. How do you choose the best suppliers? This is all about supplier performance including infrastructure, inventory, data quality, etc.

Costs and profit analytics. How is the business doing in general? Here we can see specific articles about our spendings and earnings.

Usability and product analytics. How convenient is our website? Usability metrics explain customer behavior on the website/app, user journey, etc. Here we are considering additional but equally necessary product metrics for an OTA as an eCommerce business.

Acquisition analytics

OTAs exist in a highly saturated market. To survive, they need to be different. Or cheaper. As we already covered in the article about marketing a travel agency, a company in this industry faces tough competition and inherently becomes invisible if it’s not targeting its niche market and audience.

Acquisition channels

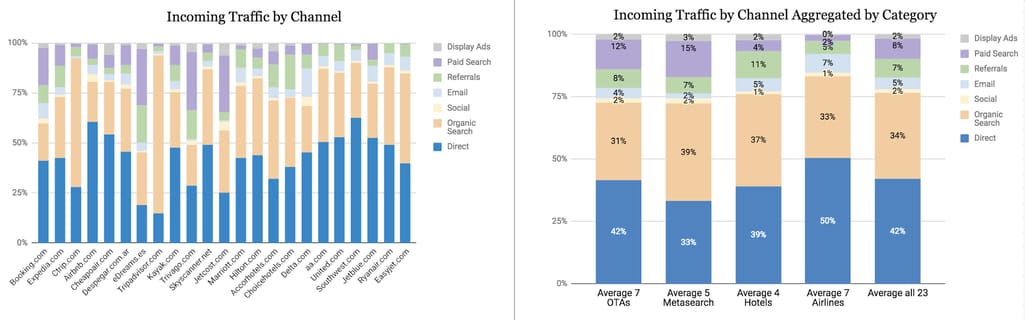

Looking into the frequenсy of visits to the OTA website, it’s worth separating the amount of traffic gained from each channel:

- organic traffic from search engines

- travel aggregators and metasearch engines

- web adverts (Google AdWords), and

- other social media platforms, direct traffic.

A large share of direct traffic isn’t always a sign of a strong brand. It could also reflect lower online marketing activity.

Graphics showing traffic by channel for the largest online travel websites, Source: Mauricio Prieto

Conversion

Travelers visit several websites before making a purchase. How many of your visitors become customers? The conversion rate is a dependable indication that they found a better deal elsewhere. In the travel industry, a few interpretations are used.

Using Look-to-Book stats in Google Analytics Source: Revenue Hub

Visitor-to-Book. It’s the number of website visitors per reservations made. If this indicator is low, it may mean that you’re attracting a lot of unqualified leads. It won’t show you though if they bounced because of the rates or simply because your ad campaign was ineptly targeted.

Availability-to-Book. This is the number of availability requests per made reservations. This metric considers people who looked for dates that weren’t available.

Visitor-to-Look. It’s the number of website visitors per booking engine requests. A low rate may indicate that you need to improve how you display search results.

Look-to-Book. This is the number of booking engine requests per reservations. It’s the clearest indicator for justifying ROI. It’s also the most accurate for understanding how your pricing stacks up against the competition.

Metasearch analytics

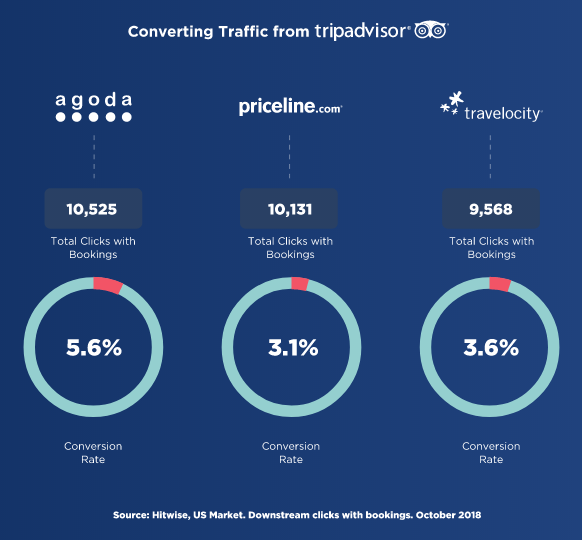

An OTA is usually listed on a few aggregators and you need to stay aware of which ones work better than others and adjust your distribution accordingly. This is a balancing act of comparing traffic, Look-to-Book ratio, and markup to determine which metasearch yields greater benefit. A more popular one may bring you better visitor numbers, but people coming from small local aggregators may book more often.

Metasearch engines capture a lot of useful data regarding how OTA is viewed and searched for, as well as where it stands in contrast to its direct competitors. These insights can significantly help an agency unlock the spots where they can win market share.

Purchasing web analytic reports from metasearch, an OTA can obtain valuable information about their performance, such as

- quality ratings,

- search data including the number of bidders for each search, and

- traffic stats compared and sorted by device, carrier, market, etc.

A traffic report with the conversion rate from TripAdvisor metasearch for Agoda, Priceline, and Travelocity OTAs, Source: Hitwise

Using this data, you can compare and distribute your offers among different engines, basically determining the best value strategy for your business.

Demand analytics

To match customer demand with proposition, travel product managers team up with the marketing crew. They consider the following statistics gathered from external reports and owned search engine data.

Popular or uncovered destinations. What is your audience searching for? That’s how you will choose suppliers because local offerings have much higher likelihoods of being booked. However, sometimes less popular destinations don’t have online visibility and you can tap into a unique market by finding smaller suppliers and becoming their exclusive distributor.

Sought-after dates and length of stay. There’s also seasonal demand. In the summer people ditch their metropolises for shorelines, while winter finds many eyeing Christmas markets in Europe. Rio is nothing but a crowd during Carnival in February. All these disparate factors should be taken into account, as you change rates, inventory, and search results to put the increase in demand in your favor.

Traveler segmentation. A travel product manager usually knows the defining attributes of their typical customers. Some destinations like Paris are trendier with couples, Las Vegas is certainly a place for partiers, while Hong Kong is the global business center. Tracing such nuances, OTAs get a chance to dream up unique offerings suitable for each traveler.

Revenue analytics

The travel distribution market is a complex network of suppliers and third-party channels that make surviving in it a delicate task. If OTAs feed off the deals with suppliers, revenue managers help make the most use of these deals. They do it by developing flexible prices that help OTAs stay profitable but keep the prices low. Here’s what they use for that.

Operating metrics

An OTA’s operating results are represented through metrics that give a clear-cut view of the business. This includes gross bookings, revenue margin, and revenue by segment.

Gross bookings. The gross bookings metric shows the total retail value of transactions booked on the website, including different charges and fees, irrespective of cancellations and refunds. Your gross bookings will grow with the business as you acquire a bigger market share.

Revenue margin. This metric represents the percentage of gross bookings that an OTA keeps as a company revenue.

Revenue by service type. This is your revenue fragmented by all travel services you provide. It allows you to see your most successful products, compare the dynamics, and allocate your marketing costs accordingly.

Commission rules performance

As an OTA, you may have a flat commission rate and apply it all over the board, but it actually makes more sense to use flexible commissions, to make sure your prices are always as competitive as possible. That’s why commission rules exist. Analyzing which rules perform better and adjusting them accordingly can make a big change.

https://youtu.be/G8OGOoS96vI

Say you have a rule that applies the lowest commission to all flights to London, as it’s a popular destination with tons of available flights. But data may indicate that it’s not always the correct logic. For example, people may agree to pay more for Turkish Airlines flights as they expect better service, so it’s possible to apply a higher commission for Turkish Airlines flying to London. You may also see a curious dependence from the traffic source, or dates, or bundled vs solo trips.

AI-driven predictive analytics can offer a more grounded approach to defining commission sizes. In this case, OTAs will be able to analyze individual situations and find unique solutions that would be increasing, decreasing or even holding the markup percentage depending on the data insights.

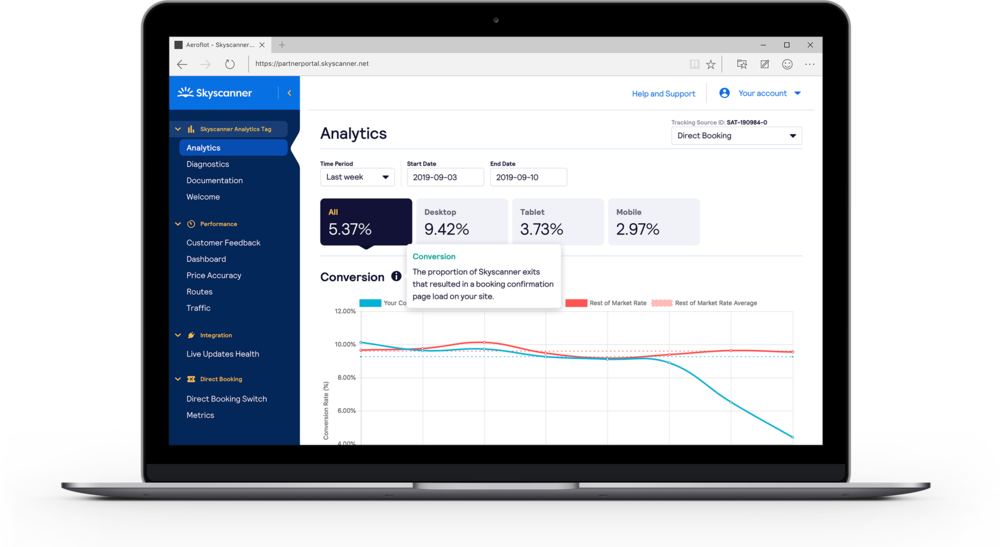

Competitor pricing analytics

A revenue manager (RM) basically uses competitor pricing analytics. If an OTA is selling products for a popular itinerary, the competition is high. Other deals can easily poach customers if their tags are cheaper. On the other hand, if an OTA offers a rare find, it can afford to speculate a bit.

Partner analytics provided by Skyscanner

Partner analytics provided by Skyscanner

Supplier analytics

An OTA survives thanks to its exclusive contracts with suppliers. To offer better prices, you need to first negotiate them with the right providers, from global distribution systems (GDSs) to bed banks or hotels and airlines directly. Working in conjunction with revenue managers, travel product managers choose the right combination of suppliers based on these factors:

Infrastructure. What type of connectivity does it provide (booking website, XML API, RESTful API)? How often does it have timeouts? How long are response times?

Quantity and quality of supply. On one hand, OTAs should focus on the number and location of inventory items the supplier offers. On the other hand, they also should consider how these inventory options compare to the ones on competitors’ websites. If a supplier offers you only indirect flights for a city pair while your opponents already have nonstop flights, this product won’t do you much good.

Rates. How cheap or expensive are their prices? Suppliers can offer different rates on different conditions, so it makes sense to compare them before committing.

Performance. As we’ve already mentioned, RMs actively contribute to choosing suppliers and monitor income obtained via each supplier to renegotiate better commissions. Once they see how each product performs, they can optimize inventory availability. If the demand for a hotel or flight route is climbing, it’s a sure sign to order more. But if the inventory regularly fails to pay off, it's time to reduce its quantity if not totally abandon its support.

Costs. Different suppliers have different costs. For instance, getting flight data from GDSs may be more expensive per API call than getting it from consolidators or partner OTAs. Given that an OTA may have multiple connections with suppliers that provide intersecting inventories, it’s worth tracking costs associated with using different APIs. This data will be useful to tweak the way a search engine works and which suppliers it accesses.

Costs and profit analytics

An OTA’s biggest expense is marketing. At least it should be. For example, within Expedia’s $2,886 million of expenses in the third quarter of 2018, 57 percent went to selling and marketing, 15 percent was allocated for technology development, and 8 percent went to administrative costs.

Selling and marketing costs. These are the expenses that come from traffic generation via paid channels, ads production and distribution, activities related to building brand awareness, affiliate marketing, etc.

Product development. This includes technology costs for engineering, constructing infrastructure, designing, testing, and maintaining it.

Administrative expenses. All personnel-related costs, both in-house and external go here.

Amortization of intangible assets. Your website, patents, and goodwill are intangible assets that add credibility to your business. You need to estimate the value of the asset (for example, the booking engine) and report the value decrease or increase over the years. The longer you haven’t updated your website, the lower the amortization expense.

Now that we know where OTA money goes, how can they make sure their investments are justified?

Although it may seem like an OTA is successful and growing, sometimes it may be a delusion. A good practice is to calculate the value a single customer contributes to the business. That’s what unit economics is about and it equals the ratio between customer lifetime value and customer acquisition cost.

Customer lifetime value - This is the revenue that an OTA makes within the time that a single customer is actively making bookings before this customer churns.

Customer acquisition cost (CAC) - Aiming to grow, OTAs can decide to invest more in acquisition channels, but it’s not always the right move. Using CAC, an OTA can calculate how much it costs to attract each new customer. This will help them see when forcing growth makes no financial sense and spend money wisely.

Usability and product analytics

Speaking of the overall travelers’ booking funnel, it’s vital to detect the drop-off points, either on metasearch, OTA website, or mobile app. Agencies must know when their potential customers cancel and where they go next. This way they’ll be able to figure out how to win them back. Data about searches and clicks, purchase history and types of accommodation or flight class help personalize travel offerings and sell the right room/flight to the right customer at the right price.

It’s important to make sure that customers are satisfied with new features, additional inventory, or updated booking flow. But how can an OTA know whether something is right or wrong with the customer's behavior?

Actions per session. Tracking actions users perform on the website and the time it takes them, OTAs can compare the popularity of a certain feature from the time of its release till now. Comparing these metrics between the churned and retained customers, OTAs can figure out what made users leave their website and how to improve user interaction in the future.

The number of site visits. This has to do with customer retention showing how often they come back to the OTA website. Comparing these stats across different user groups, OTAs can forecast their behavior.

A/B testing. Both previous metrics are used in A/B testing for before-vs-after analysis. It helps make decisions about features and UX elements, helping to understand the changes in customer behavior.

Customer satisfaction score (CSAT). Another way to approach usability analysis is by simply asking users for ranking. CSAT can indicate either the general impression of the product or tackle some part of it like a new filter for sorting out search results.

To avoid usability mistakes firsthand, check our article on UX practices for booking websites.

Sustainability metrics. What an OTA wants are customers who make bookings, one after another. And what they fear is that some users will ditch them after some negative experience. Calculating retention and churn rates, agencies can evaluate the productivity of their efforts.

For a complete list of product metrics, check our dedicated article.

Data in OTAs' hands

In the traditional distribution chain of travel services with GDSs at the heart, OTAs are more privileged than their suppliers as they have direct access to customer data. They can look behind the curtain and see what caused the user to book a hotel, purchase a flight, or rent a car. Unlike airlines and hotels, who only get the leftovers of that data if a person makes a reservation through a third party.

OTAs take advantage of having a better opportunity to understand the customer. That data collection is getting bigger and smarter. It’s used to target customers with optimized search results, specific sort order and filters, and even the number of results because some buyers can be overwhelmed if they see more than five. OTAs could go even further and pass their discoveries on to their partners in terms of what could be done to increase the value of their services, particularly how to make their offers more available to different customer tiers. That’s the example some of the big leaders are setting. Besides property management capabilities, Expedia Partner Central and Booking.com Extranet provide businesses with the necessary data to make informed decisions.