This is a guest article by Benoit Ratinaud from WeDploy

Friends and revenue manager colleagues, have you ever felt a certain frustration when observing empty seats at a football game or a concert? Could revenue management be the solution for optimizing ticket sales and guaranteeing more volume? In the ticketing market, including sports venues, theatres, concerts, and festivals, resistance to change hinders the adoption of revenue management (RM).

Despite characteristics favorable to the implementation of RM (perishable inventory, limited capacity, variable demand), why is this concept struggling to establish itself?

To understand this issue, it is essential to look at the potential benefits for ticketing. Indeed, this approach would optimize prices based on demand, fill the venues more, and increase revenue for organizers.

So, if the advantages seem obvious, what are the reasons for the reluctance to adopt practices and tools? Why do some sports clubs even snub this logic by offering free tickets to home fans? What parallel could be made against other industries using RM such as airlines or hospitality?

In this article, we will explore the issues and challenges related to this sector. We will seek to understand the reasons for resistance to change and propose ways to overcome these obstacles.

What is the context of revenue management and what are the challenges?

Let’s explore the context and challenges of the ticketing market, particularly regarding revenue management.

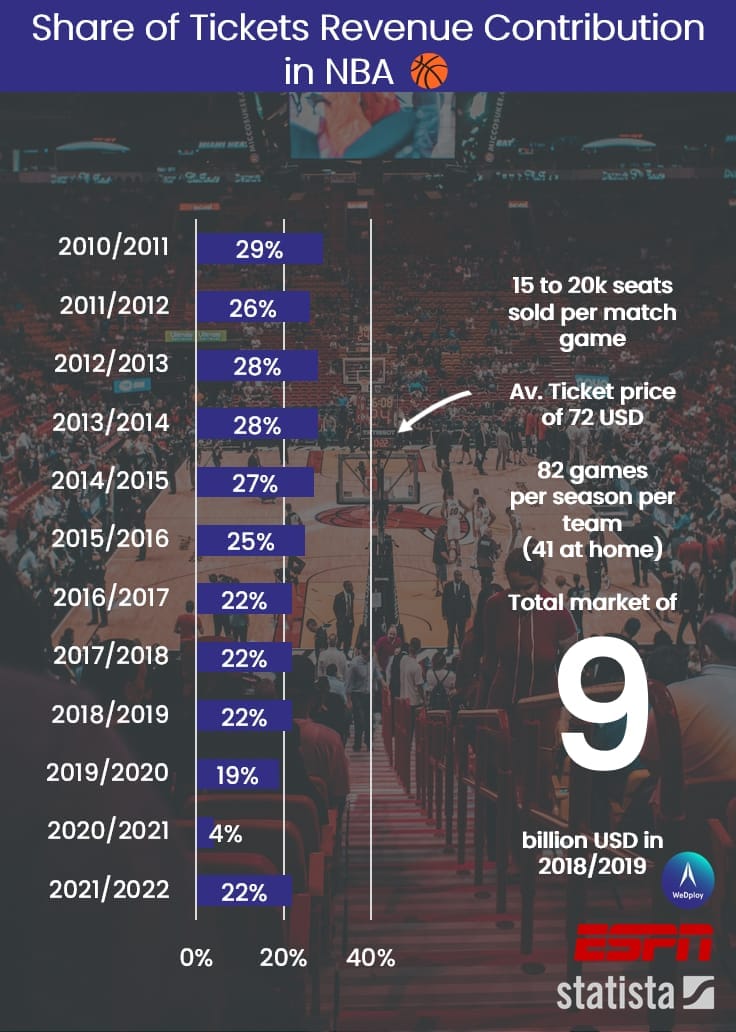

The first element to put on the table is the share of revenue related to ticketing that can vary depending on the structure observed.

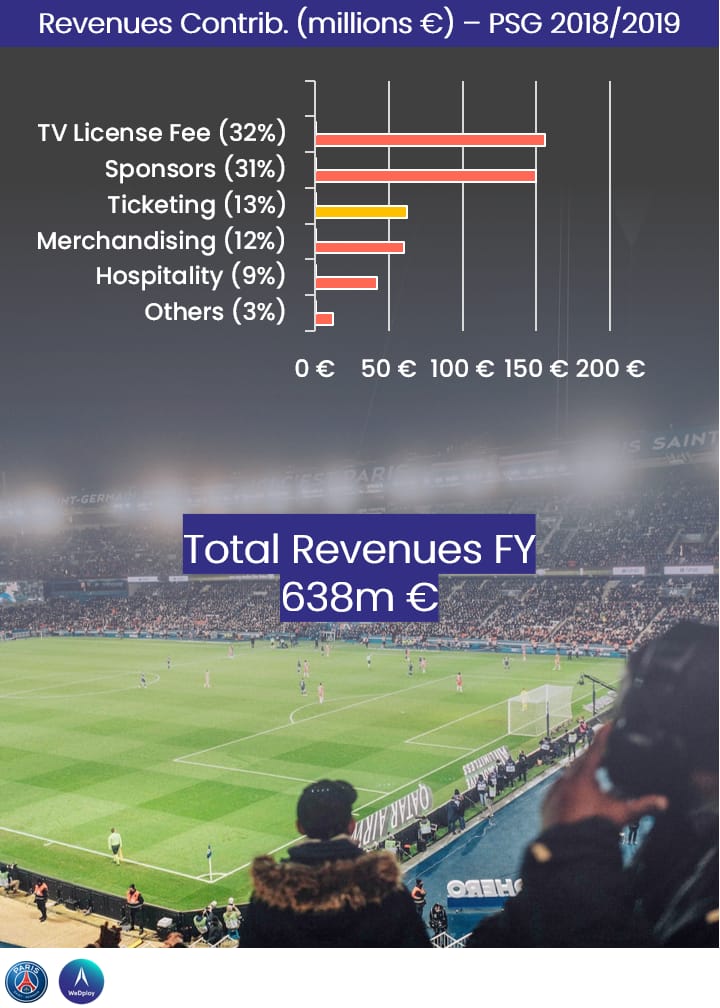

PSG Case Study

If we take the example of French Ligue 1 Football club, Paris Saint-Germain, ticketing represented 13 percent of revenue for the 2018-2019 season (pre-COVID). Here we exceed 60 million euros. The performance is colossal, with all games being sold-out!

Combined with the hospitality revenues (VIP seats and executive boxes), the total is over 100 million euros. Only TV licensing and sponsors (Coca, Amex, Orange…) represent more in terms of contribution.

Paris Saint-Germain ticketing revenues. Souce: Paris Saint-Germain Annual Report 2018/19

According to the Deloitte Football Money League study, among top European football clubs, only Arsenal FC and Tottenham Hotspur FC have greater revenue contribution from ticketing.

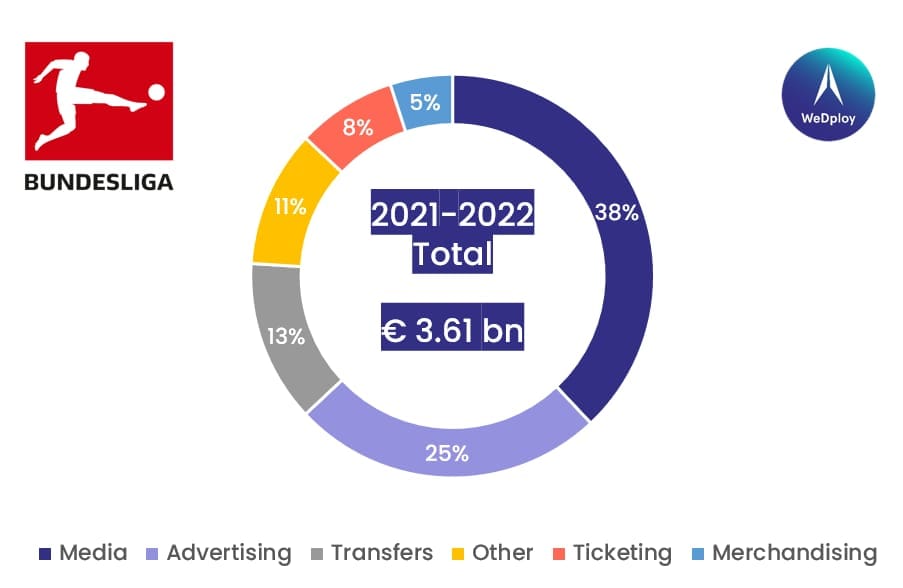

Bundesliga and NBA Case Study

At the scale of first and second division football clubs of the German Bundesliga, the share of revenue related only to ticketing (excluding executive boxes and VIP) would be around 8 percent. While the average might hide some disparities, it again constitutes millions of euros of revenue for a sports structure.

German Bundesliga revenues. Source: DFL 2022 Economic Report

And that goes even higher when we look at the NBA tickets market, totaling $9 billion in 2018-2019 league, with about 20 percent of revenue contribution!

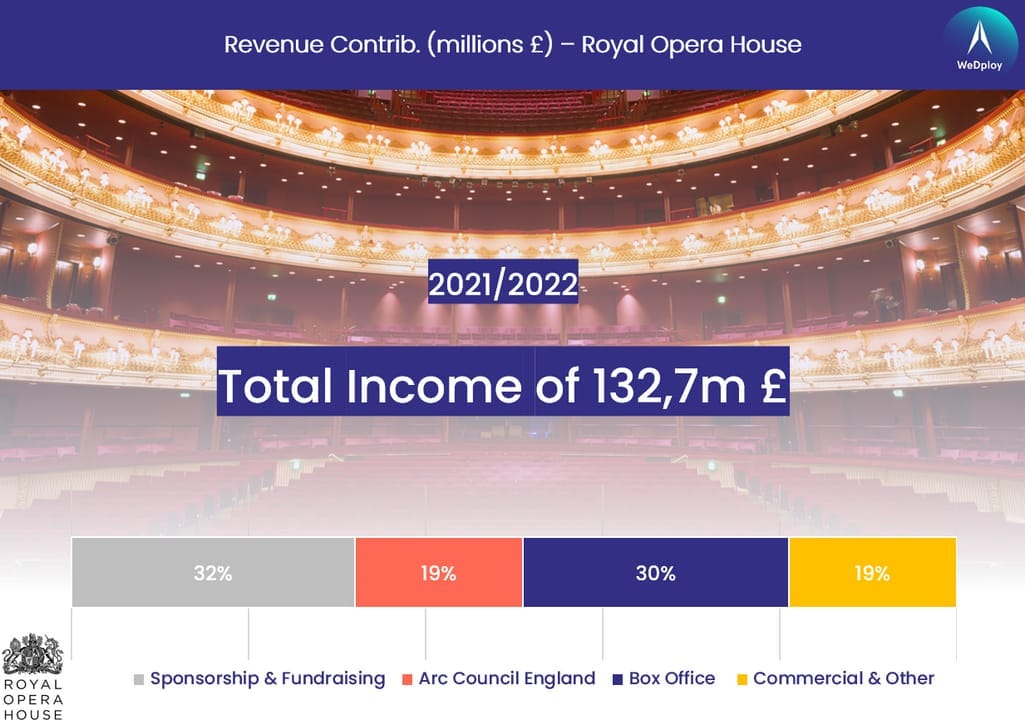

London Royal Opera House Case Study

Last example here, for public entertainment venues such as theatres and concert halls, the breakdown of revenue is generally as follows:

- ticketing for shows,

- bar and catering,

- private patronage,

- public subsidies, and

- other: merchandising, sponsoring.

Without obtaining exact figures (depending on the type of structure and region), revenue related to ticketing constitutes obviously significant amounts.

If we look at the Royal Opera House in central London (Covent Garden), according to their latest activity report, box office could generate up to 30 percent of the total income, approximately £40 million.

London Royal Opera revenues. Source: ROH Annual Report 2021/22

Since we now see that there are significant money-making opportunities, this is probably a good place to assess the relevance of revenue management.

Adjusting prices according to supply and demand allows maximizing sales and achieving increased profitability. Everyone realizes that their train fare or airline ticket will be more expensive on the eve of holidays, right?

In the sports or cultural ticketing market, note that the conditions for applying revenue management are generally met.

However, this practice still encounters resistance in the ticketing market.

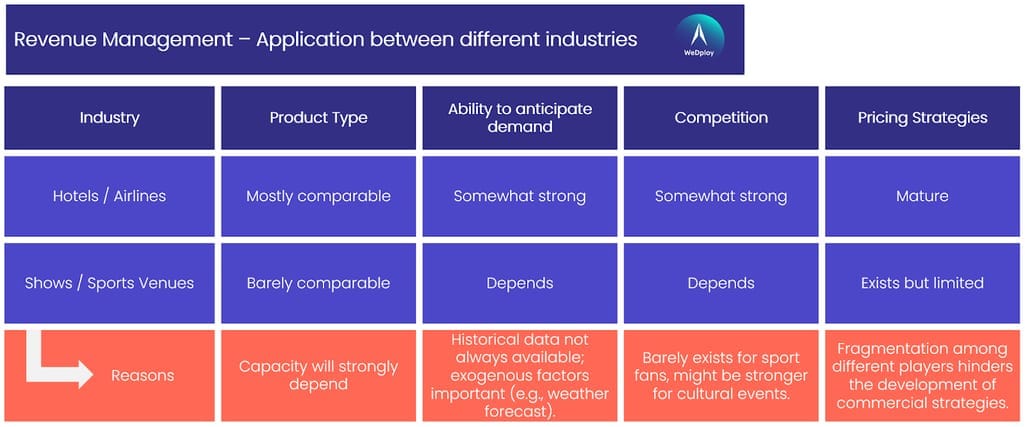

Are there significant differences compared to mature industries in revenue management such as hospitality or car rental?

Going to a concert, supporting one's rugby team, or enjoying the theater is quite different from a more standard service like mobility or accommodation. We are talking about an experience; we touch on emotion. Thus, several differentiating elements can be highlighted.

The nature of the products. Mature industries such as hospitality, airlines, and railway companies often sell standardized products with relatively fixed and comparable capacity. However, ticketing for sports and public entertainment venues is sometimes more complex with unique and/or ephemeral events. Since it’s about the quality of the show, the total inventory can be different depending on location and infrastructure.

Predictability of demand. Hospitality or railway generally has more predictable demand models due to the nature of their products and their market experience. On the other hand, demand for events can vary considerably based on factors such as seasonality (month, day of week, time of day), artists or sports figures and even the weather.

Competition. Again, established industries observe more intense competition, which means that the implementation of RM can be decisive for maintaining a competitive advantage. Conversely, the ticketing industry is not about raw competition but more about alternatives.

Pricing Strategies. Finally, the last axis here rests on the complexity of RM and pricing models. From one side, mature industries have sophisticated models supported by technological tools. International groups possess significant resources to develop or integrate them. Similarly, there are more jobs available, more training, and therefore more talent to cultivate and develop these approaches. On the other side, the fragmentation of hospitality actors using ticketing limits this knowledge sharing.

Pricing strategies across industries

Without talking about revenue management, what are the current levers available?

We will not talk here about dynamic pricing and complex systems; however, several powerful levers are already commonly applied, allowing revenue growth for operators. Here are the main ones.

Differentiated Pricing by Seat Category. Adjusting prices according to the location and comfort of the seat allows optimizing revenue by offering more precise pricing and consideration of customer preferences.

Ticketmaster providing different prices based on seat section

Discriminatory Pricing. Discriminatory pricing involves offering different prices based on specific characteristics of customers, such as age, student status, or place of residence. Already widespread, it offers reduced rates to young people to attract a wider audience and to encourage family attendance.

New York Yankees providing student discounts

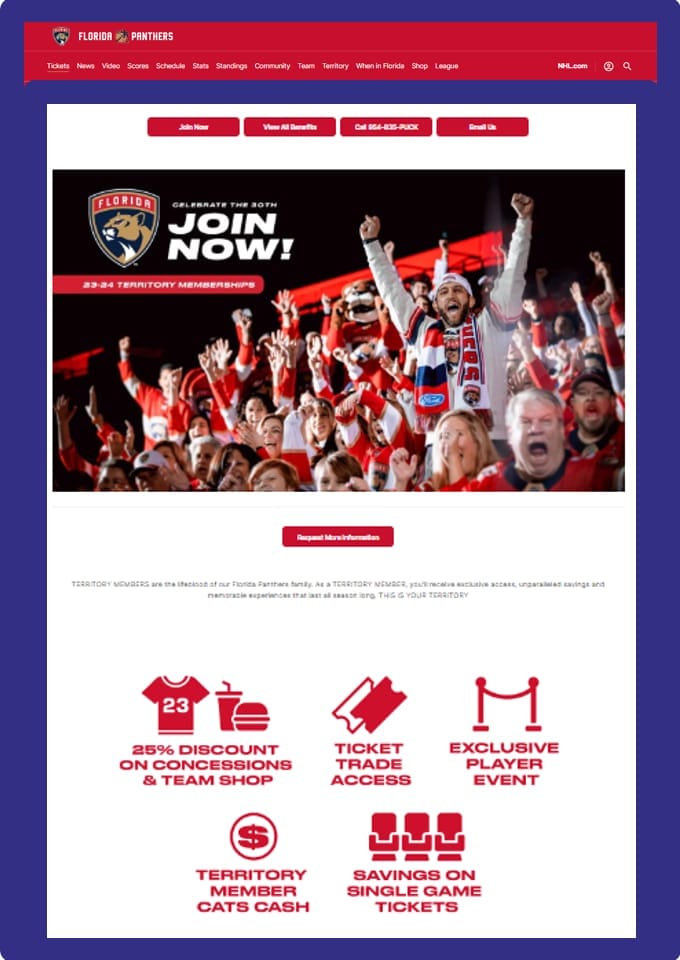

Subscription and Package Management. Offering subscriptions or packages including several events helps retain customers and ensure recurring revenue. Pricing can help determine the most attractive offers for different customer segments.

Florida Panthers providing discounts for a season pass

Distribution Channel Management. It's important to identify the most efficient and suitable sales channels for each event. This can include direct sales at ticket offices, official websites, mobile apps, social networks, or third-party online sales platforms. As commissions are impacting bottom line, the organizer must correctly select inventory stock and venue to not trim the profitability.

Groupon offering a special price for AS Roma Football Club match games

Specific Offers for Groups and Corporate Grids. Offering special rates for groups or companies can increase the occupation rate of events. To protect the paid average fare from high discounts, it’s usual to observe complementary catering services and/or exclusive advantages, also enabling tailoring the experience.

The Burgtheater in Vienna offering group discounts

Cross-selling. Cross-selling involves offering complementary products or services when purchasing a ticket, such as merchandising, food and drinks, special experiences, or other services (cancellation flexibility, parking). By using a pricing and data spectrum, it is possible to analyze customer preferences and buying behaviors to offer tailored deals and increase revenue per customer. This strategy also improves the customer experience by facilitating access to relevant services.

Accor Arena offering CXL insurance to generate incremental revenues

Here is a quick summary of the main pricing levers available.

Pricing levers and strategies

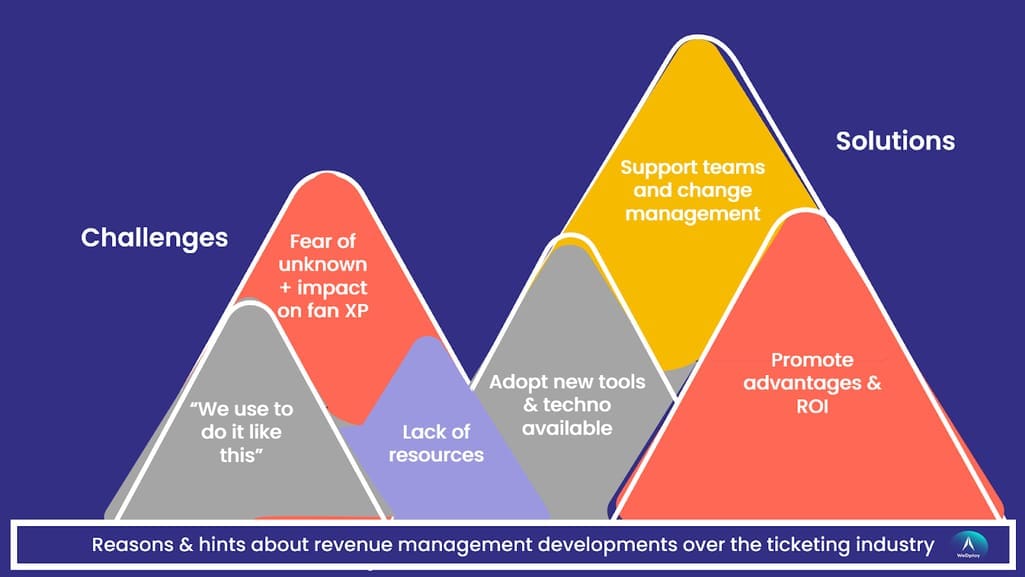

What are the main reasons for resistance to change?

In this section, we will examine the main reasons for resisting change in the ticketing market, especially regarding the adoption of revenue management.

Fear of the Unknown and Complexity. One of the main reasons for resistance to change is the fear of the unknown and complexity. Revenue management can be seen as a sophisticated approach, difficult to implement, and especially to justify. In comparison to sectors like airlines or hotels, the ticketing industry has fewer software solutions offering advanced revenue management or pricing modules. The process of integrating such technology, a key focus of WeDploy, can be opaque, necessitating robust change management efforts.

Unlike more mature industries, the practice of revenue management in ticketing directly impacts a part of the fan base and the overall the customer/fan experience. (Just see the reactions of Taylor Swift fans when they could not get tickets for the concerts at the end of 2022... 😄).

Disappointed fans after Taylor Swift ticket released

German football club Fortuna Dusseldorf or French Paris FC are also interesting examples. They chose to offer free tickets for home fans at every game! They’re creating a loss of revenue but tend to balance it with an increase in sponsorship.

Entrenched Habits and Difficulty in Adopting New Methods. Another major reason for resistance to change lies in entrenched habits and the difficulty in adopting new methods.

Ticketing professionals often have practices established for years, and changing these habits can be a challenge. It may be difficult to convince the sector stakeholders of the need to change their traditional pricing methods in favor of pricing and revenue management.

Lack of Resources and Training. Finally, the lack of resources and training constitutes a significant obstacle to the adoption of revenue management. Ticketing market operators may not have the necessary financial, human, or technological resources to implement this strategy.

Moreover, adequate training is essential to ensure a successful implementation of revenue management, and this training can be costly or difficult to find. The flow of knowledge in more mature industries is somewhat natural. Knowledge is acquired in established groups. Then career changes and job changes make techniques and practices flow to more modest actors.

How to Overcome Resistance to Change?

It's essential to promote the advantages of revenue management to convince sector players of the value of this approach.

Promoting the advantages of revenue management. By highlighting the potential benefits, such as revenue optimization and better demand distribution, it will be easier to generate interest and encourage the adoption of revenue management. Remember, yield doesn't necessarily imply a price increase or fluctuations every half hour!

And beyond the impact on the top line, introducing RM would also improve customer experience, especially in scenarios where the customer wants to buy tickets on the secondary market.

Qcue, an American actor specializing in dynamic pricing, for example, highlights the realization of 35 million price changes generating $300 million of incremental revenues.

Qcue dynamic pricing. Source: Qcue

With an ROI approach, private actors naturally have a role to play, it's in their interest. Public authorities also need to focus on the subject to boost their local industry, at the risk of being slowly overtaken by the system.

Offering suitable tools and trainings. To facilitate the adoption of revenue management, it's crucial to offer tools adapted to the needs of sector actors. This is about professionalizing the sector; there's a significant opportunity as aging tools probably haven't helped to introduce new commercial levers.

The consolidation of private actors seems to be leading to higher resources available to do so (e.g., Fnac Darty and CTS EVENTIM in France, See Tickets absorbing Digitick and Paylogic, Viagogo buying StubHub). As seen in more mature industries in revenue management, this can be considered an opportunity for the future:

The players in the show are concentrating, and their providers are doing the same. The race for size will continue between operators because the technologies are expensive to develop intelligent and innovative ticketing.

Involving and accompanying teams in change. Another important aspect in overcoming resistance to change is, of course, the involvement and support of teams throughout the transition process. This involves sales and distribution teams, but also reception staff, often at the forefront of ticket sales.

In summary, overcoming resistance to change in the ticketing market could be articulated around 3 axes: communication, training, and suitable tools.

Challenges and solutions in the ticketing industry

Conclusion

Finally, the journey to dismantle the walls of resistance to change within the ticketing industry is one that navigates through three distinct yet interconnected pathways:

- ROI approach to demonstrate RM outcome,

- empowerment of teams through educational initiatives, and

- technological solutions adoption.

Effective communication serves not just to inform but to inspire a shared vision, transforming skepticism into advocacy for RM practices. Training is the cornerstone of competence, equipping individuals with relevant skills to leverage RM to its full potential. Moreover, without the right instruments at their disposal, even the most enlightened of strategies can falter. It is here that suitable, user-centric tools come into play, grounding the RM philosophy in the practical with measurable outcomes.

This observation leads us to an intriguing and relevant question for our readers and the broader community: What is the future of dynamic pricing in the ticketing industry, particularly in Europe? While the US market seems to be ahead in adopting this strategy, how soon can we expect to see a similar trend in European markets? How will this pricing strategy alter our experience of acquiring tickets for events we eagerly await? Will it result in more accessible events for everyone or pose new challenges for consumers and vendors?

What are your thoughts on the impact of dynamic pricing on ticket sales? Have you experienced scenarios where dynamic pricing either benefited or hindered your ticket purchasing experience? Share your stories with us!

Benoit Ratinaud, a seasoned expert in the tourism sector, brings a decade of rich experience from his time with industry leaders like Hilton, Louvre Hotels Group, BlaBlaCar, and TheFork. His journey in the field has shaped two core convictions: the untapped potential of revenue growth levers in the industry and the need for technology to play a more significant role in boosting productivity. Benoit and WeDploy are equipped to provide comprehensive support for both strategic and operational aspects of revenue management. Reach out on LinkedIn or on WeDploy Website.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.