Revenue – or money generated by a company’s business activities – is one of the most important measurements of an organization's success. Understanding where revenue is generated and controlling these money streams are crucial for effective business performance and development. So today we discuss revenue streams and their types, as well as explore some diversification strategies and management approaches.

What are revenue streams?

A revenue stream is basically the company’s source of income. For example, a software development business's main revenue stream can be building apps for corporate clients, while a retail store earns from selling products to individual customers.There can be one or several revenue streams that generate money for a company, depending on its business and revenue models. To clear up the terms and better understand the connections,

- a business model is a broader concept describing how a company creates, delivers, and captures value, while

- a revenue model, being part of the business model, is a plan that shows how the company is going to generate income. A revenue model defines revenue streams.

Revenue models in the software business

Okay, let’s get back to revenue streams. A diversified mixture of income sources makes a company more stable and resilient, especially when the market, customer preferences, and economic conditions are changing. Even if one revenue stream suffers a negative impact, chances are that the others can still generate income. And although multiple revenue streams require more management effort, diversification always presents additional opportunities.

A well-known example from the world of big tech is Microsoft, whose revenue comes from a variety of sources, including Office products and services, Azure and other cloud services, gaming, search advertising, and more. Another shining example of diversifying revenue streams is Amazon, which earns from online stores, third-party seller services, AWS, advertising, etc. We’ll talk more about diversification in one of the next sections, so bear with us a bit.

So let’s see the main types of revenue streams that you can implement in your business.

Revenue stream types and examples

All revenue can be generally divided into operating and nonoperating. Operating revenue is generated by the company's primary business activities, while nonoperating revenue comes from other sources and usually includes interest revenue, dividend revenue, and so on.

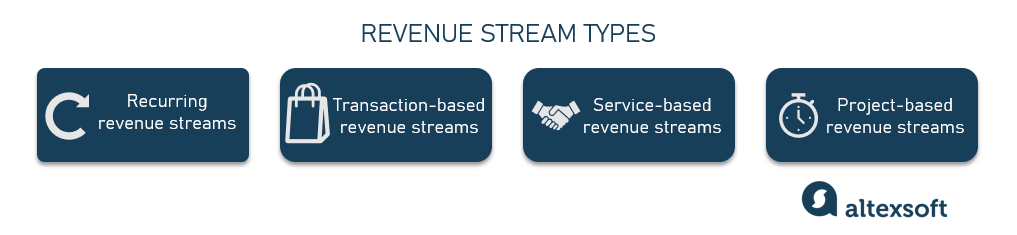

Operating revenue streams can then be divided into two fairly broad groups: recurring and non-recurring (or single-payment). The latter can be further subcategorized into transaction, project-based, and service-based revenue streams. We’ll describe them one by one.

Revenue stream types

Recurring revenue streams

The main revenue streams for: Netflix, Google Ads, Amazon Web Services, PayPal

As the name suggests, the payments within a recurring revenue stream are ongoing or coming in on a regular basis. Those are typically fees for some continuing services, including the following.

Subscriptions and memberships – charging a recurring fee for access to a product or service. Some examples are regular merchandise delivery (e.g., magazines, beauty products, meals, etc.), gym passes, streaming video services, online storage space, and so on.

Renting, leasing, or lending – allowing customers to temporarily use your assets for a fee, e.g., renting out apartments or leasing vehicles.

Brokerage – getting a commission from transactions settled with you as an intermediary, as freight brokers or payment gateway providers do.

Advertising – selling advertising space on either online platforms or offline media resources.

Affiliate marketing – promoting other products or resources or referring customers to them for a fee or commission.

Even though any of these revenue types can be single-payment or canceled at any time, they mostly imply generating a fairly consistent income flow. That’s why recurring revenue streams are usually the most stable, predictable, and manageable.

Transaction revenue streams

The main revenue stream for: Walmart, Ford, American Airlines, Starbucks, Uber

This type is considered the most common one as this revenue stream is generated by sales operations. If you sell any goods or services on a single-time basis, that’s a transaction revenue stream. Most retail, wholesale, and eCommerce businesses rely on this type of revenue stream. This group also includes companies that provide single-time services (from haircuts to plumbing to flights to software licenses).

Service-based revenue streams

The main revenue stream for: Accenture, PwC, Deloitte, McKinsey

In this case, the fee for services rendered is calculated on an hourly basis. All advisory and consulting firms (in such areas as finance, law, taxes, etc.) fall under this category. So do virtual assistants, therapists, coaches, and other specialists who basically sell their time.

Note that often, such services are provided on a regular basis. If a defined amount of work for a fixed fee is charged on an ongoing basis, then such revenue can be considered recurring.

Project-based revenue streams

The main revenue stream for: Bechtel, Epam, Gartner

Here, revenue is generated upon successful completion of the entire project. If the project is lengthy, there can be several transactions, which are usually connected to specific milestones. Industries that mainly operate on project-based revenue streams are construction, website or software development, event planning, interior/exterior design, marketing, research, and so on.

Revenue stream diversification examples

As we said above, diversification is the key to stability, so now we’ll look at how some of the world’s biggest companies expanded their revenue stream portfolios to increase customer reach and drive profit.

Walmart revenue streams: not only retail

The well-known retail giant we started this post about turns out to have a variety of revenue streams. The company itself divides its operations into three major reportable segments: Walmart US, Walmart International, and Sam's Club. However, in terms of revenue models and streams, we can single out the following.

Transaction-based revenue includes

- in-store sales – Walmart operates 10,500+ stores and clubs in 20+ countries, serving 230 million customers annually;

- eCommerce sales – Walmart sells merchandise online from both retail brands and Sam’s Club; and

- fulfillment fees – Walmart offers storage and fulfillment services to merchants who sell on the Walmart Marketplace platform.

Recurring revenue includes

- membership fees – Walmart Plus membership provides benefits like unlimited free delivery, fuel discounts, early access to product deals, and more for $98/year, while Sam’s Club is a membership-only warehouse club with two plans of either $50 or $110 annually; and

- advertising – Walmart Connect is a platform that brands can use to promote their products through various channels, including online, in-store, and sponsored media across the web.

Walmart still makes more than half of its money from selling groceries, but it doesn’t rely only on retail sales as it did before. It managed to build an entire ecosystem of various services around such a simple thing as selling cheap, everyday merchandise to lower-income shoppers.

Apple revenue streams: not only iPhones

Of course, we can’t bypass the largest company in the world in terms of market capitalization (as of today, Apple is worth around $3 trillion). What started off as a small personal computer manufacturer in the late 1970s has now become a multinational giant generating revenue from

- sales of devices, including iPhones, iPads, AirPods, wearables, accessories, etc.;

- advertising in the App Store and Apple News app;

- commissions on paid apps and in-app purchases;

- subscriptions to its numerous services such as iCloud+, Apple TV, Apple Music, etc.; and

- payment service fees through the Apple Card credit card and the Apple Pay processing platform.

Apple’s 12-month revenue as of June 2023 is $383.933 billion, and even though iPhone sales account for more than 50 percent of the company’s revenue, the share of other segments keeps growing.

Tesla revenue streams: not only cars

Tesla is the world’s biggest electric vehicle producer, having grown to a compound 12-month revenue of $94.02 billion. It has sold over 4.5 billion vehicles since its founding in 2008, and EV sales (together with charging accessories and related software) are still its main source of income. But not the only one. Tesla also develops other business directions, namely

- energy generation and storage,

- auto leasing,

- regulatory credits, and

- other services (parts, paid Supercharging, vehicle insurance, etc.).

In addition, Tesla heavily invests in R&D and is now earning its place as a player in the AI and tech market. It currently develops its own autonomous robots, chips, supercomputers, neural networks, and so on – all of which have the potential to become other significant revenue streams for the company.

TripAdvisor revenue streams: not only advertising

If we look closely at the biggest free travel review website in the world, we’ll see that it has multiple revenue streams that together have already generated $1.67 billion in 2023:

- advertising and Sponsored Placement fees,

- subscription fees from the TripAdvisor Plus membership program, and

- commission and booking fees from host listings.

And it’s not only TripAdvisor itself that makes a profit but also its diverse portfolio of subsidiaries that operate on various business models, including Bokun.io, Viator, Cruise Critic, FlipKey, TheFork, and others.

How to manage revenue streams?

Depending on your stage of business development, you probably either need to plan on your revenue streams, create them, or monitor their performance.

Defining revenue streams

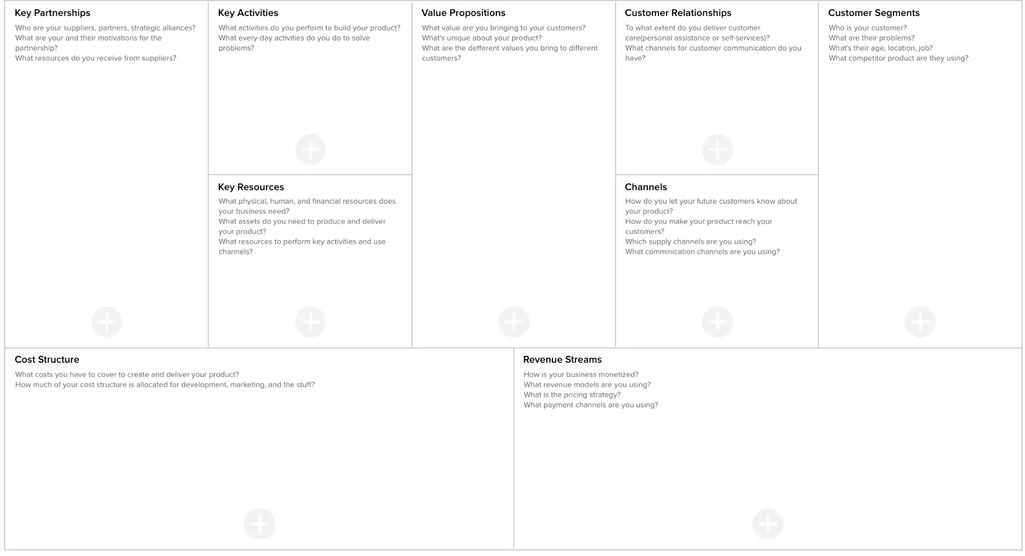

If we look at the widely used Business Model Canvas introduced in 2010 in the book Business Model Generation, we’ll see that revenue streams must be formulated as one of the nine building blocks of the entire business strategy.

Feel free to use our online Business Model Canvas Template to formulate your own business ideas and organize all the essential components. We also have a detailed explainer on how to approach and fill out the BMC.

Classic Business Model Canvas

To start identifying revenue streams, you have to define your target customer groups, their needs, and the value proposition for each of them – since each customer segment typically generates a separate revenue flow. Based on that understanding, you can ascertain the main revenue-related factors.

Revenue model. Which revenue model type to implement?

Pricing strategy. How to approach pricing? Should it be fixed or dynamic? Should you set prices based on demand, value, or competition? Can you afford to offer discounts, free trials, buy now pay later programs, delayed payments, or other incentivizing methods that will impact your bottom line?

Willingness to pay. Will your customers pay the price you set? What’s the maximum price your customers will pay for your product or service? What can encourage them to pay more?

Payment channels. Online or offline? Cash, card, bank transfers, digital wallets, or other payment methods?

To answer all these questions, you’ll have to conduct thorough, in-depth market research and find out what your competitors offer, at what price, and what your target customers think about the current state of things. Only after detailing your revenue streams will you understand what revenues to expect, their certainty and potential cyclicality, as well as possible ways to maximize them.

Creating revenue streams

There’s no one scenario that will work perfectly for every business in any industry. But the general algorithm for creating revenue streams coincides with the BMC in many aspects:

- Identify your target customers and their needs.

- Develop a value proposition for your products or services that addresses the needs of the specific customer segment you defined.

- Research your competition and their offerings to evaluate market opportunities and potential profitability.

- Calculate your costs and define pricing for your products or services.

- Launch new products or services.

- Monitor performance and market conditions closely and adjust as needed.

Diversifying your revenue streams will increase stability, so once you’ve established your main workflows, think about expanding your income portfolio.

Monitoring revenue streams

Revenue management suggests a number of KPIs that you can monitor in any industry to understand how your revenue streams are performing. Here are some of them:

- Gross revenue,

- Net revenue,

- Revenue growth rate,

- Average revenue per customer/user,

- Average transaction value,

- Customer lifetime value (CLTV),

- Churn rate,

- Customer acquisition cost (CAC),

- Sales Conversion Rate, etc.

Obviously, any industry also has its own metrics to monitor cash flows. For example, the main revenue-related KPIs in hospitality include Revenue per available room (RevPAR), Total revenue per available room (TRevPAR), Revenue per available customer (RevPAC), and so on.

Read about these and other hotel KPIs in our dedicated post.

Analyzing your revenue streams will help you better understand your business, evaluate its financial health, define weaknesses and opportunities, and make more accurate forecasts.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.