From price comparison sites to embedded insurance at checkout, the digital transformation is not only redefining how insurers reach customers but also expanding the market by making products more accessible and tailored to modern consumer behavior.

A J.D. Power study found that customer satisfaction is significantly higher when digital platforms are used as the first point of contact, rather than traditional channels. For example, 53 percent of new auto insurance buyers choose digital channels to begin their customer journey, while only 29 percent opt for agents and 18 percent use call centers.

This trend prompted us to examine the growing impact of digital technologies on insurance distribution. In this article, we’ll explain how selling insurance online works, break down the core sales models, walk through customer journeys, and explore key trends. We interviewed Asher Gilmour, an expert in insurance technology, to gain more in-depth industry insights.

Insurance distribution channels

What is insurance retailing?

Insurance retailing is the process of selling insurance to consumers through various channels, methods, and practices. The goal is to reach end customers and offer them a product, such as life, health, auto, or home insurance, that fits their needs.

Key insurance distribution stakeholders

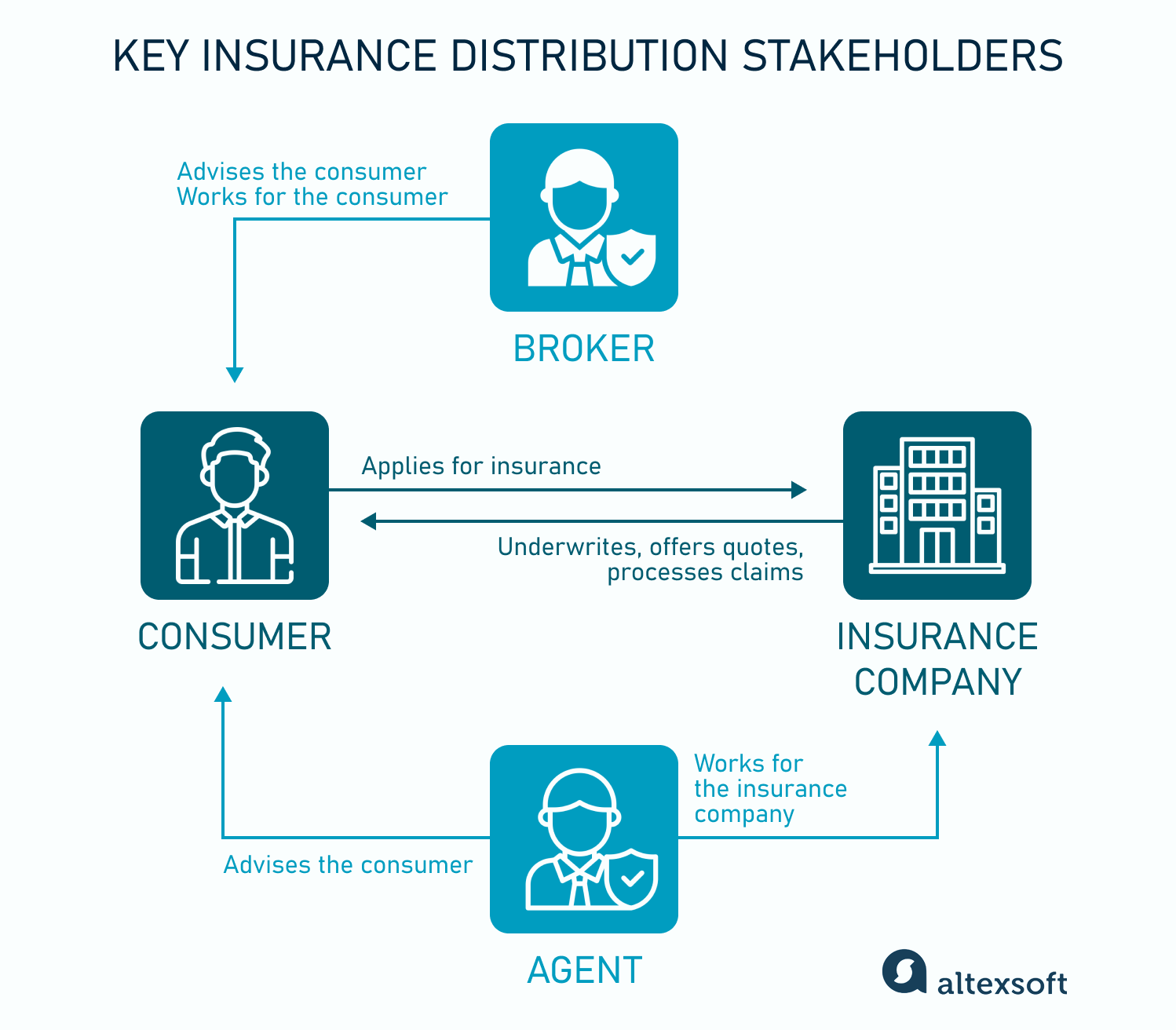

Insurance distribution comprises all the pathways through which insurance products move from insurers (the producers) to policyholders (the end consumers). Here are the key stakeholders involved.

Consumers are individuals or businesses that purchase insurance products. They seek financial protection against defined risks (e.g., auto accidents and health events). Consumers are motivated by price, coverage breadth, service quality, and brand trust.

Insurance companies provide insurance products and are the underwriters. They design policies and define coverage limits, exclusions, deductibles, and endorsements (insurance add-ons). Insurers evaluate individual or portfolio-level risk using credit scores, driving records, health data, etc.

Agents are licensed representatives authorized to sell insurance products. They can be either captive agents, who sell policies for only one insurer, or independent agents, who work with several insurers. Their role is to match customers with policies offered by the insurers they are affiliated with.

Since agents have contracts with insurance companies, they can often bind coverage (finalize and activate an insurance policy) directly and are compensated through commissions paid by those insurers.

Brokers are independent intermediaries. They represent customers rather than insurers and source policies from multiple carriers to find the best fit. While they get commissions from insurers, they may also charge advisory fees.

Brokers do not typically have the authority to bind coverage on behalf of insurers. Instead, they guide the customer through the decision-making process and then work with insurers to complete the transaction.

Although not strictly part of the distribution, the next stakeholder is critical to the insurance landscape and definitely worth mentioning.

Third-party service providers include claim adjusters who investigate, estimate, and negotiate claim settlements and risk assessors who provide actuarial models and catastrophe modeling. Insurance companies engage external experts whenever a claim or underwriting decision presents heightened complexity or regulatory scrutiny.

After major disasters (hurricanes or earthquakes), the volume and complexity of claims can overwhelm internal teams, especially small companies. Other scenarios include significant losses, complex liability investigations, fraud detection, and specialty lines underwriting.

“It is actually very common for insurers to outsource.” Asher Gilmour shares. “For example, Sedgwick is a popular company (especially in the US and the UK) that does claims adjustments worldwide.”

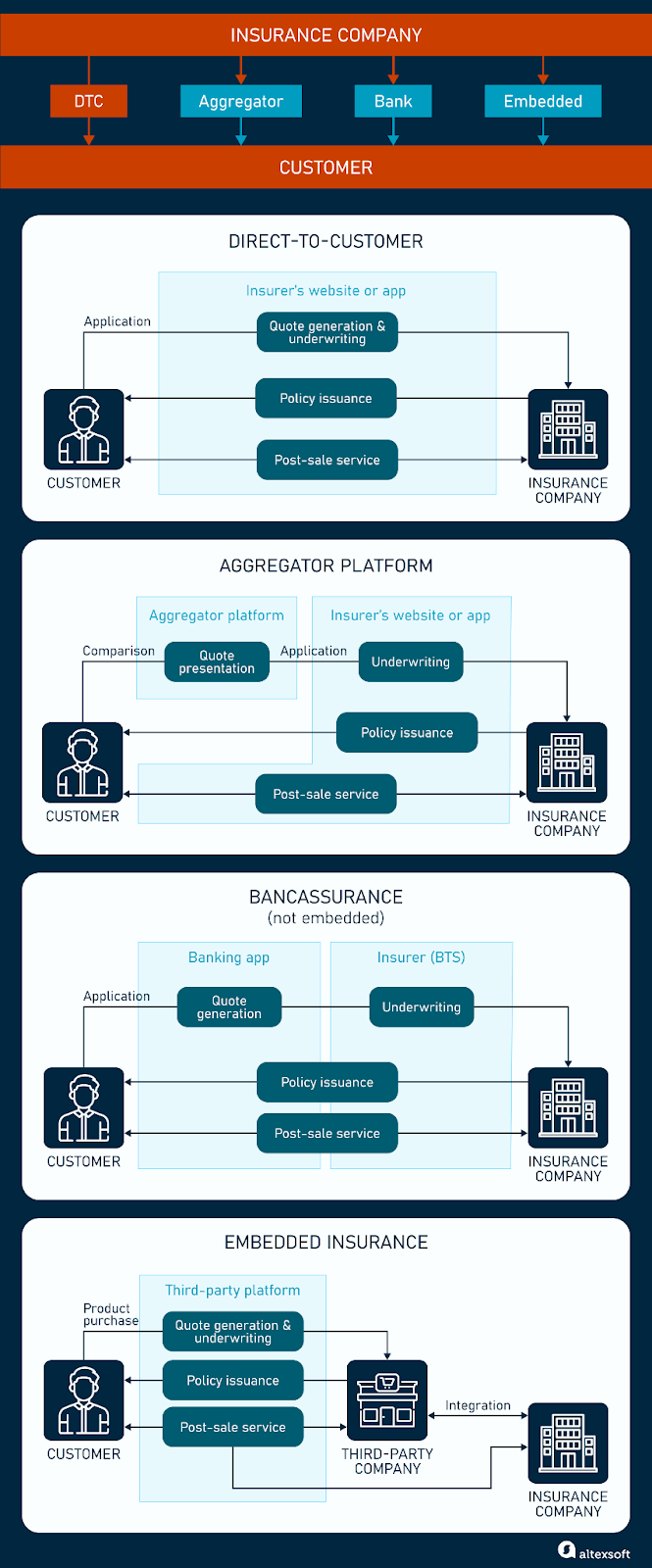

With the key stakeholders in insurance distribution now defined, let’s explore the primary online insurance sales channels: direct-to-consumer (DTC), aggregators, bancassurance, and embedded insurance. For each, we’ll walk through typical customer journeys and highlight the main challenges they face.

DTC: From quote to claim without a middleman

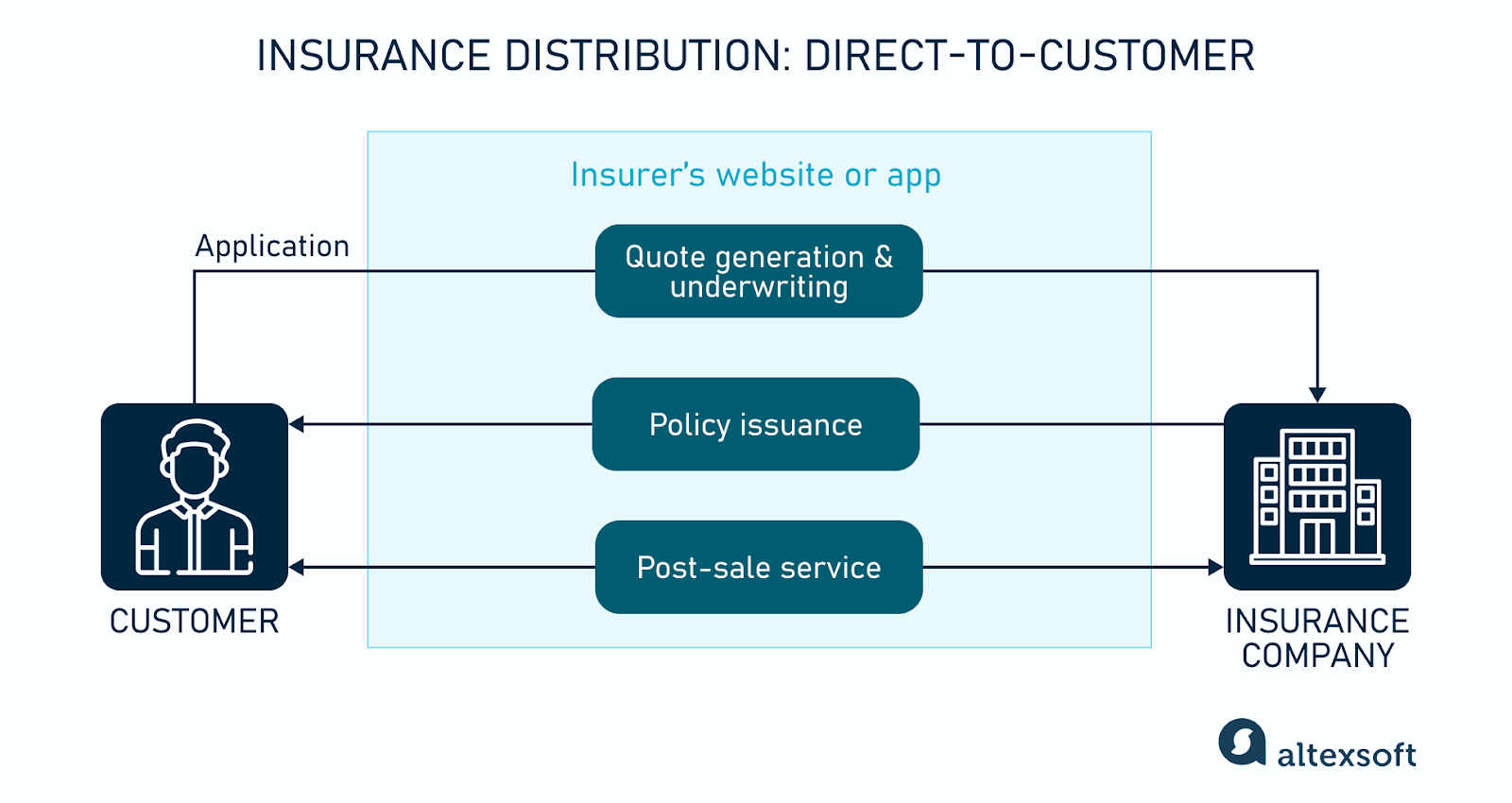

Direct-to-Consumer (DTC) distribution occurs when insurers bypass intermediaries and sell their products on their sites or apps. This model gives carriers complete control of customer data and the entire user experience, but requires significant investment in digital platforms and brand marketing.

Direct online sales comprise all personal lines — car, property, travel, health, etc.

Customer journey

Before the internet, direct sales often meant mail, telephone, or in-branch sales. Carriers like GEICO and State Farm sold auto insurance by phone and mail long before going fully digital. Buyers would call for quotes or work with captive agents in an office.

DTC insurance distribution

Now, customers reach an insurer’s site or app and fill out a digital quote form. Here’s what the process looks like.

Quote generation and underwriting. On the insurer’s site or app, the customer enters information relevant to the product:

- for auto insurance – details like vehicle model, driving history, and mileage,

- for health or life – age, medical history, and lifestyle information,

- for property – address and dwelling features,

- for travel – trip duration and destination.

This data is used to assess risk, set premiums, customize terms, and define the coverage. Additional data sources may also be consulted. For example, insurers query electronic health records or prescription databases (for life and health policies) or telematics data from driving apps (for auto policies) to refine the risk profile.

Most straightforward applications are accepted instantly—a clean driving history might pass automated checks. Complex or high-value cases (e.g., a life insurance proposal with a smoking history) trigger manual reviews.

Finally, the insurer’s quoting engine calculates a premium based on predefined rating algorithms.

Policy issuance. The user accepts the quote, provides an e-signature, and may pay online. At this point, the customer becomes a policyholder directly on the insurer’s books—a policy number is generated, coverage terms are locked in, and the contract is created.

The system generates the policy contract (often as a PDF) and emails it or makes it available in a customer portal.

Post-sale service. All future services (renewals or claims filing) are handled through the same website or app. For example, renewal quotes are automatically generated before policy expiration, and reminders are sent via email or app notifications.

Key challenges for DTC insurers

Here's what DTC insurers are up against, and why solving these problems matters.

Intuitive digital platform. “You'd be surprised how many insurance companies don’t even have a consumer-facing website. You can’t view your current policies online or make payments—you must go through an agent,” Asher Gilmour shares.

And even when digital channels exist, poor UX (such as long forms or unclear next steps) can lead users to drop off early in their journey. An insurer’s online portal must make it effortless for customers to get a quote and manage their policy without friction. By minimizing clicks and cognitive load (e.g., vehicle lookup by license plate, instant address verification, easy e-signature workflows, or prefilled customer profiles), DTC insurers can reduce abandonment.

Trust-building. To win customers away from aggregators and bancassurance partners, DTC insurers must establish credibility and nurture ongoing relationships beyond the initial sale. This starts with transparent pricing (breaking down the components of an insurance quote) and social proof (user reviews, case studies).

Post-purchase, loyalty can be cemented through tailored policy recommendations, bundled offers, or usage-based discounts and rewards. Failing to maintain the relationship after the policy is sold can cost missed opportunities for upselling or cross-product marketing.

Ranking. To boost visibility, insurers must focus on ranking higher on aggregator platforms and in search engine results. On aggregator sites, placement often depends on factors such as price competitiveness, coverage clarity, and user reviews. SEO is essential for the search engine results page. It includes using relevant keywords, high-quality content, and fast-loading websites.

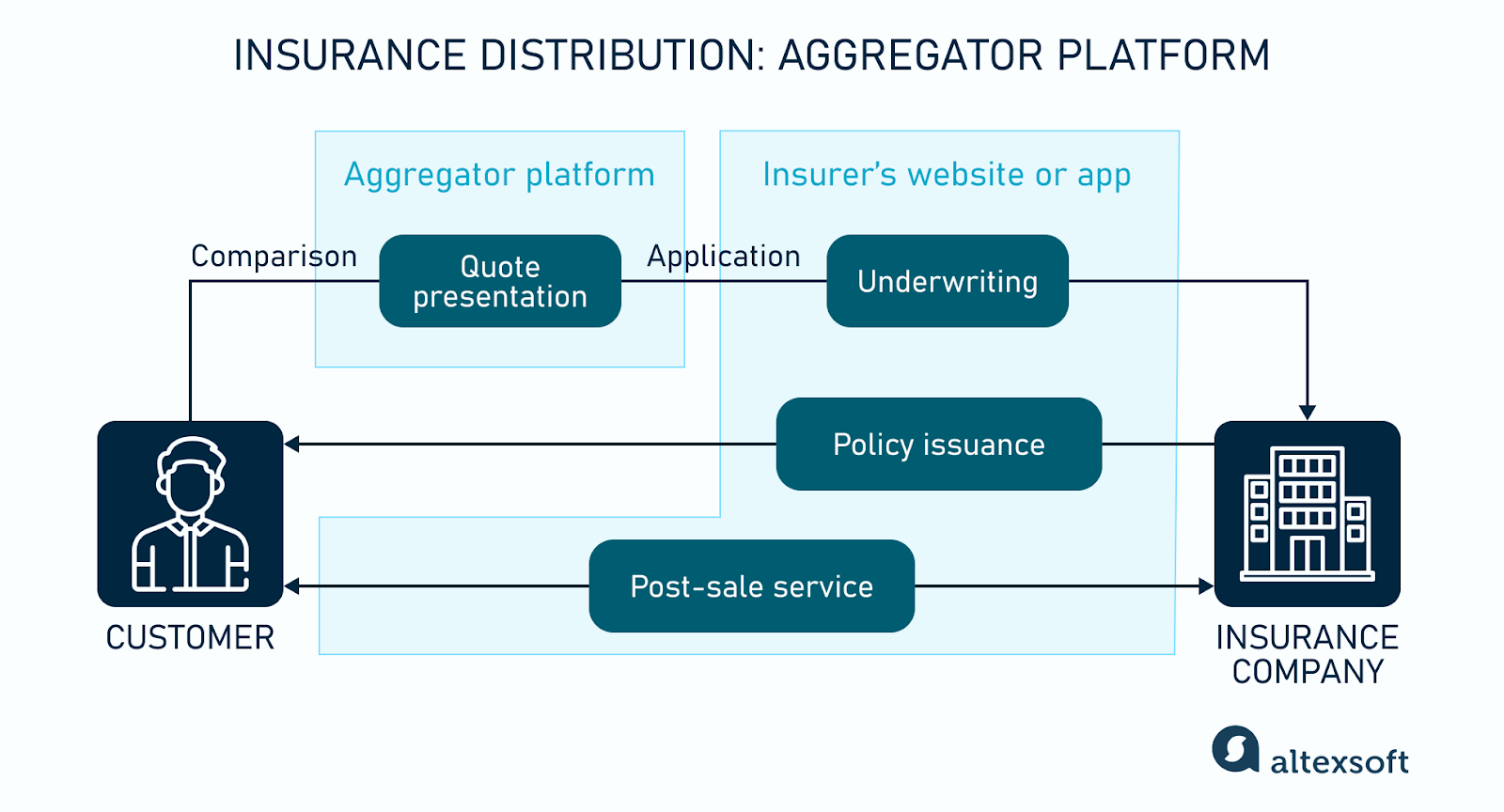

Aggregator platforms: One click, many quotes

Aggregator platforms are third-party websites or apps that let customers shop and view multiple offers side by side. They present quotes from different insurers for the same type of coverage, enabling customers to compare pricing, benefits, exclusions, and other criteria.

Insurance aggregators, like Compare Club, are increasingly leveraging advanced data analytics infrastructures to offer more personalized recommendations and streamline the quote comparison process.

Aggregators excel as a channel for price-conscious, personal-line buyers who do not have a preference for a particular carrier.

Customer journey

Before online aggregators, customers compared insurance by contacting agents or brokers individually. There was no single portal, making comparisons manual and time-consuming. Only with the rise of the internet were the first comparison platforms introduced, such as Confused.com, in 2002.

Now, comparison sites let customers shop insurance quotes from many carriers in one place. Let’s see how it works.

Insurance distribution via aggregators

Quote generation. The customer provides the necessary details, just like in the DTC model. The aggregator’s platform then queries each insurer’s quoting engine via APIs to generate comparable quotes. The site then presents multiple options (often customizable by coverage level) from partner insurers.

Underwriting. Aggregators do not underwrite. Instead, they pass the lead and data to the insurer for underwriting. The aggregator may do simple screening, such as verifying age or ensuring that personal information isn’t missing, to prequalify the user.

Policy issuance. The aggregator’s role usually ends at the initial quote. The customer is redirected to the insurer’s site to complete the purchase, following the same DTC flow outlined earlier.

Post-sale service. After the customer completes the purchase on the insurer’s portal, the insurer handles the post-sale experience, such as policy management, renewals, claims, and customer service.

Key challenges for aggregators

Here are the main challenges that may hold aggregators back.

Comprehensive offerings. If an aggregator fails to list key insurers or insurance lines, users may feel the platform is incomplete or biased, pushing them to search elsewhere. It’s best to cover all relevant lines (car, home, travel, etc.) and have many insurers to provide a wide range of options. For example, Confused.com compares more than 160 carriers.

Transparent pricing. It’s important to disclose how quotes are ranked (by price, ratings, or sponsored listings) and ask all the relevant questions before redirecting the customer to the insurer.

“The process can be frustrating. When not all the necessary questions are asked upfront, the customer might get a different price than what was shown on the aggregator platform,” Asher Gilmour explains. “Once the insurer pulls you onto their site, they ask you additional questions, and the final price can be much higher.”

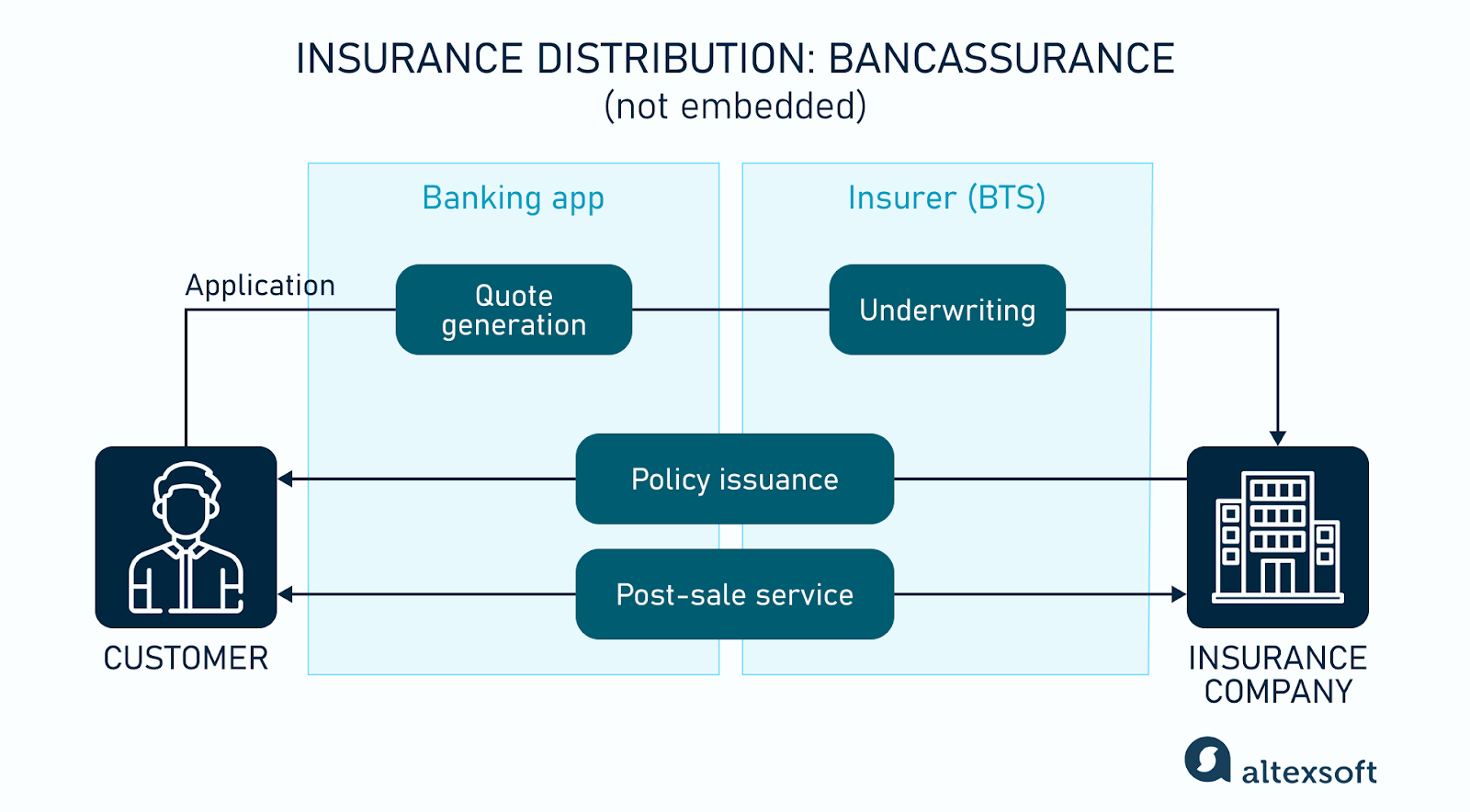

Bancassurance: How banks and insurers partner

Bancassurance is a partnership between a bank and an insurance company in which the bank offers and sells insurance products directly to customers. These products are typically promoted through the branches or online portals, leveraging the bank’s customer base.

This model benefits both parties—insurers gain access to a large pool of potential clients, while banks earn a commission on the policies sold.

Typically, banks sell mortgage, life, annuities, and health insurance, often cross-selling to deposit or loan customers.

Customer journey

Offline bancassurance is a branch-based channel in which bank staff cross-sell products from partner insurers. For example, if a customer opened a savings account or took a loan, bank staff would offer bundled insurance, such as life or home insurance.

Digital bancassurance involves integrating insurance offers into online banking platforms and apps.

Insurance distribution via banks

Quote generation. Many banks embed insurance quotation engines in their banking platforms. For example, a bank loan application may include a checkbox to add payment protection insurance, automatically quoting on-screen.

For other types of insurance (life, health, property, or casualty), the customer fills out the usual questions. However, the process is faster and simpler because the bank already holds much of the customer’s financial and personal data, such as age, income, marital status, and credit history.

Underwriting. In bancassurance, underwriting still follows the insurer’s core guidelines, but again, it’s often more streamlined. For example, credit-linked insurance may be simplified-issue (requiring only basic questions), since the bank has already assessed the borrower’s risk profile when approving the loan.

For insurance that is not credit-linked, the insurer receives the application data collected via the bank channel to perform the full underwriting.

Policy issuance. Once payment is received and underwriting is cleared, the insurer issues the policy, often co-branded with the bank.

Post-sale service. After the sale, servicing a bancassurance policy is a shared effort. The bank acts as the first point of contact for basic requests (like changing address or beneficiaries), while the insurer may handle more complex tasks (claims).

Key challenges for bancassurance

Even with an established customer base and digital infrastructure, banks can face obstacles when integrating insurance into operations.

Training and culture. There may be questions about whether bank employees possess the same level of expertise as licensed insurance agents or brokers when it comes to advising customers on their insurance needs.

To ensure customers receive accurate guidance, banks must provide comprehensive insurance training programs for their staff.

Embedded selling. Poorly timed or generic offers can feel intrusive or irrelevant, leading to customer annoyance. It’s crucial to align insurance offers with relevant banking events to make the product feel timely and personalized. For example, banks can provide home insurance when a customer is approved for a mortgage or propose travel insurance during online foreign currency transactions.

In the next section, we’ll take a closer look at embedded insurance as a standalone distribution model that goes far beyond bancassurance.

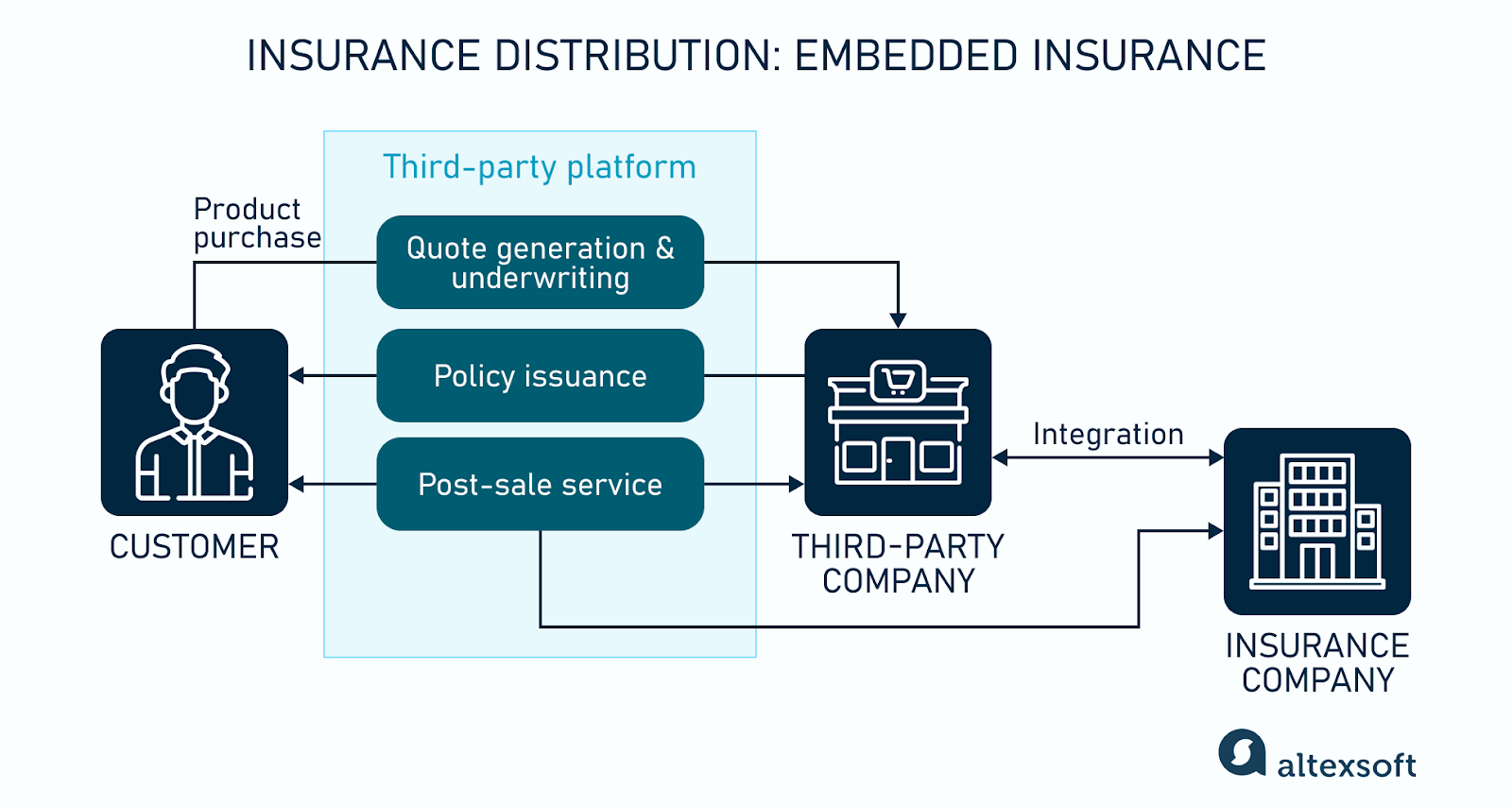

Embedded insurance: Coverage at the point of sale

Embedded insurance is purchased within the commercial transaction of another product or service, rather than through a separate, standalone policy purchase. It is a hot trend, with its market size expected to grow from $210.9 billion in 2025 to $950.6 billion by 2030, at a CAGR of 35.14 percent. This surge is driven by customers who expect seamless, on-demand services, and embedded insurance meets this by offering instant coverage.

Another reason for this growth is that by partnering with various platforms (airlines, eCommerce sites, auto dealers, etc.), insurers access customers they might never reach through agents or direct channels.

In 2024, travel insurance—including both traditional and parametric products—dominated the global embedded insurance market, holding a 36 percent share. Electronics and mobility followed.

Customer journey

Embedded insurance bundles directly into the customer journey, like adding warranty coverage when buying electronics.

Insurance distribution via embedded insurance

Quote generation and underwriting. When a customer selects a product or service, the platform automatically offers an insurance option tailored to that specific purchase. Underwriting is automated and much simpler compared to traditional insurer-led processes.

“The best example is travel insurance,” Asher Gilmour explains. “You book a flight, and then you’re asked, ‘Do you want to buy travel insurance as well?’ It’s all integrated, and you don’t even know who the insurer is. There is some underwriting involved, but it's not in-depth. If you're under 70 and don’t have any medical issues, you can easily purchase the insurance.

“Another example is credit card insurance. When you buy things with your card, you're actually covered. If something goes wrong, you can contact your credit card company and get your money back.”

Policy issuance. Once the customer accepts the insurance offer, the policy is issued instantly, and documentation is sent electronically. For example, eCommerce platforms like Amazon offer purchase protection insurance that is activated immediately on checkout.

Post-sale service. Claims and customer service can be handled either by the insurer or the platform that sold the insurance, depending on their arrangement. Returning to the travel example, booking platforms usually enable customers to file claims for trip disruptions directly through their website or app.

Key challenge in embedded insurance

While embedded insurance offers unmatched ease, it still has its hurdles.

Integrations. Embedding insurance into third-party platforms demands technical integration and alignment with the customer journey. Delivering accurate insurance quotes instantly within a host app or site requires robust APIs and clean data inputs from partners.

Low insurance literacy. Embedded offers are often accepted as part of a checkout flow, giving users just seconds to decide on coverage they may not understand. A good practice is to include optional “Learn more” links for customers who want deeper information without slowing down the flow. There must be an educational layer to help the customer evaluate risks, compare options, or understand exclusions.

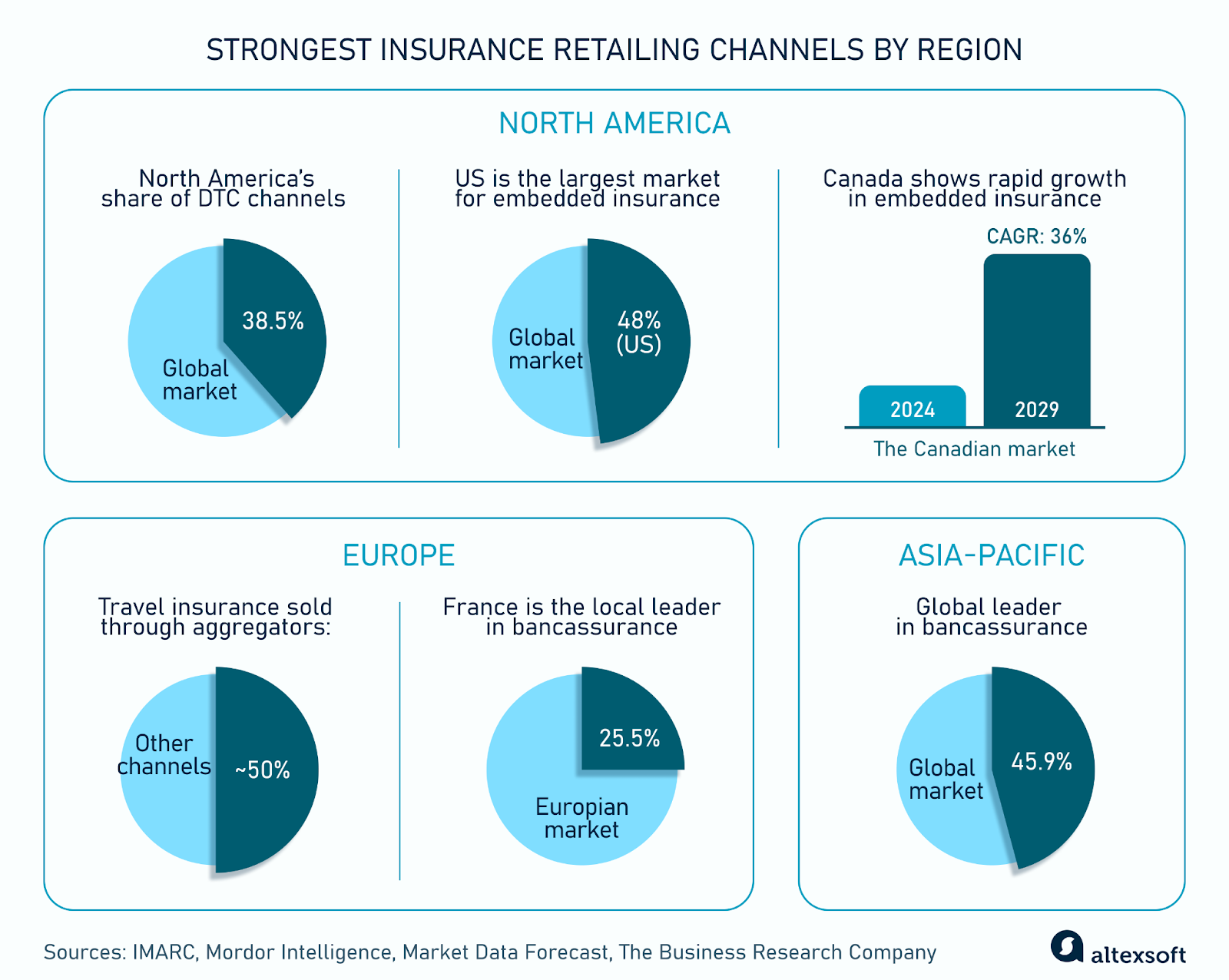

Strongest insurance retailing channels by region

Let’s break down the regional dynamics and highlight the leading players shaping the market.

Key figures

North America has the most advanced DTC channels, capturing over 38.5 percent of the global market share in 2024. This dominance is due to the major players in the region being long-standing incumbents with extensive customer bases, such as State Farm, GEICO, Progressive, and Allstate.

According to Mordor Intelligence, North America is also the fastest-growing market for embedded insurance. The US held a 48 percent share of the global embedded insurance market in 2024. The Canadian market is expected to grow at a CAGR of 36 percent from 2024 to 2029, fueled by development in automotive, retail, and financial services.

Europe is the most aggregator-centric region with carriers like MoneySuperMarket, Confused.com, Check24, LeLynx, and more. For example, nearly 50 percent of policies in the European travel insurance sector are sold through aggregator platforms. Asher Gilmour added, “...in the UK, car insurance is also mostly bought online through aggregators.”

AltexSoft has hands-on experience in this area, having built a machine-learning model for a quote predictor of a car insurance aggregator. The tool forecasts and offers users an average cost for insurance based on a few parameters. For training, we used 20 percent of the initial dataset provided, including the most recent entries. We chose the LightGBM algorithm for quote prediction and integrated it with the client’s widget.

France is the local leader in bancassurance, holding the highest share at 25.5 percent of the European bancassurance market in 2024. This dominance is attributed to the maturity of bancassurance in the region, where the model originated. As a result, major banks like BNP Paribas and Crédit Agricole have long-standing partnerships with insurers.

Asia-Pacific (APAC) leads the global bancassurance market (valued at $1.5 trillion), accounting for over 45.9 percent of the market's share in 2024. For comparison, the North American bancassurance market size was valued at $53.53 billion in 2024, which is only 3.5 percent of the global market.

APAC is also expected to be the fastest-growing in terms of aggregators from 2025 to 2029. Some of the major players include Ping An Insurance, AIA Group, Great Eastern Life, and ANZ Banking Group.

The role of AI in insurance retailing

AI is transforming insurance by automating decision-making and pattern recognition in various processes. For example, a SAS survey found that 89 percent of insurers plan generative AI investments for 2025, and two-thirds use GenAI weekly. Experts note that claims and underwriting are prime examples of how GenAI helps humans in the loop extract insights to make better decisions.

Asher Gilmour shared more instances of AI agents' use cases in insurance: "There's an insurance app that monitors your travel. As soon as you arrive in a new country, the agent verifies your location and checks whether your current insurance policy covers that destination, notifies you, and suggests actions to complete insufficient or improved insurance coverage.

“At the time of a medical emergency abroad, the app will suggest the most suitable clinics in the area to go to, both for getting better quality treatment and optimal costs.

“In countries like the Netherlands, where travel insurance is often paid monthly or yearly depending on travel frequency, such an app could also review your usage patterns and suggest purchasing the necessary insurance on your behalf."

Lemonade, a digital-native insurtech offering property, pet, and car coverage, saw its gross profit surge 90 percent YoY in the fourth quarter of 2024. The company attributed this growth to its AI-driven underwriting model, regulatory rate approvals, and portfolio adjustments.

Today’s customers want more than just competitive pricing—they expect speed, simplicity, and more security. In response, insurers are embracing new technologies and modernizing their approach.