Guest or non-employee travel, once a minor aspect of travel and expense (T&E) management, has now emerged as a crucial business function. This shift is fueled by the growth of remote work, hybrid models, and the gig economy, where organizations engage external talent and experts on demand.

Yet, many companies still lack a standardized, automated approach to managing these trips. Their existing corporate travel programs often fall short when it comes to handling nonemployees. We spoke with experts who shared insights on the obstacles businesses face and the technologies and best practices that can help address the challenges.

What is guest travel

In corporate travel, guest travel refers to business trips of nonemployees arranged and paid for by a company. This category covers the following cases:

- talent acquisition—job candidates invited for final interviews;

- gig economy workforce—independent consultants, contractors, and project-based workers;

- stakeholders and partners—vendors, clients, board members;

- experts—event speakers and visiting researchers; and

- affiliates—students, interns, and employee family members.

According to the Global Travel Business Association, nearly 70 percent of finance and HR professionals throughout the US and Europe reported a rise in guest travel over the past year. These trips may account for up to one-fifth of a company’s total travel spend—and in sectors like healthcare, higher education, life sciences, oil and gas, and business consulting, the share is even higher.

These travelers are actually guests of the organization’s finance program. They don’t have a piece of corporate plastic in their wallets, nor do they have access to the sponsored booking channel.

Much of the guest sector is still managed through spreadsheets, emails, and manual workflows. The result: data blind spots, compliance risks, delayed reimbursements, and an inconsistent traveler experience that can quietly damage an organization’s brand.

Guest travel automation and the challenges it addresses

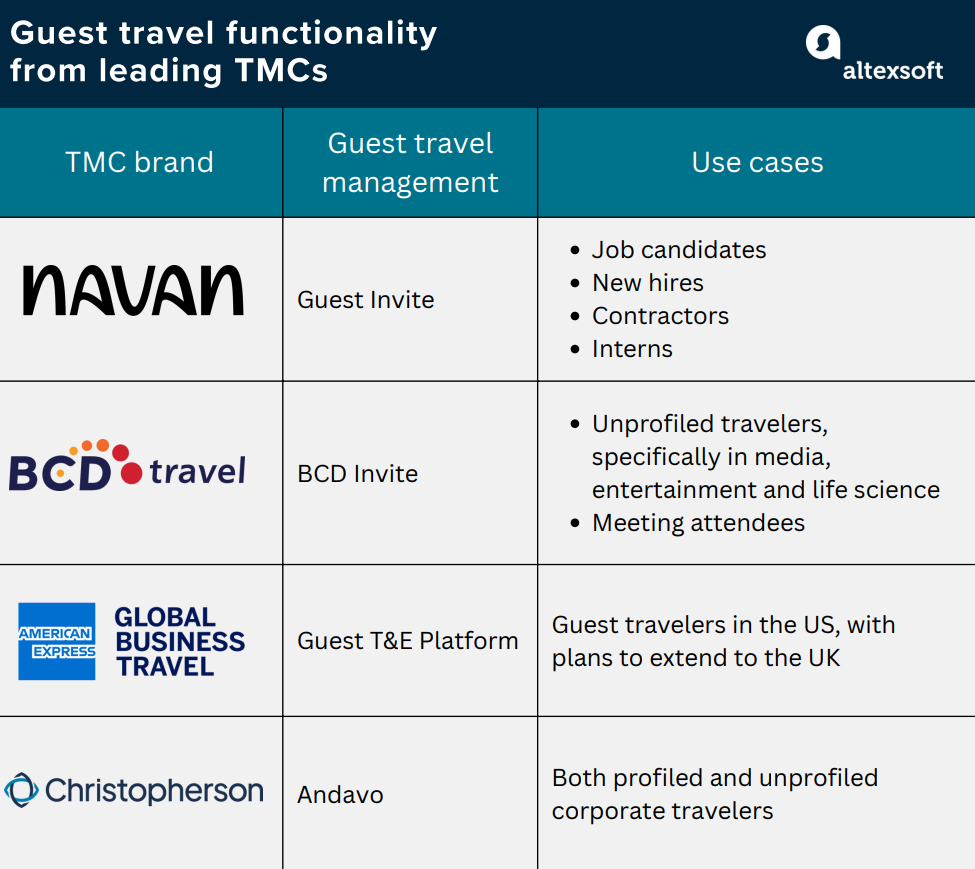

Recognizing the growing challenge, leading travel management companies (TMCs) have developed specialized tools to automate the oversight of nonemployee trips. Navan was among the first movers with its Guest Invite solution, simplifying bookings for contractors and interviewees. In 2023, BCD Travel introduced BCD Invite—a platform purpose-built for unprofiled workers—while American Express Global Business Travel (Amex GBT) entered the space in 2025 with its Guest T&E Platform, which debuted in the US and is set to expand to the UK in 2026.

Guest travel management from TMCs

More recently, a wave of next-generation platforms has emerged, embedding guest travel functionality at their core. Andavo, launched by Christopherson Business Travel in 2024, addresses long-standing issues such as card-not-present payments, compliance, and policy control. Similarly, Juno, a new entrant focused exclusively on guest and extended workforce travel, promises a more agile, API-first approach to managing short-term and nonemployee trips—a sign that the market is evolving beyond traditional TMC frameworks.

“Guest travel has always been a function of almost every corporate booking tool for quite a while. It's not a new concept. But, clearly, further development was done in this area,” admits Aash Shravah, VP of Sales and Client Success at Traxo, a centralized data platform for corporate travel managers.

In the sections below, we’ll explore the core challenges of guest travel and how modern technologies are reshaping the way organizations handle it.

Security risks

Managed corporate travel heavily relies on employee profiles—digital records that store the information needed to book business trips for a specific individual within a company. A typical profile includes, but is not limited to

- personal information—full name, date of birth, contacts;

- passport and visa details;

- payment details—for example, corporate card assignments;

- job details—department, role, seniority level;

- travel preferences; and

- loyalty program numbers.

This data is securely housed within the organization’s online booking tool (OBT), integrated with other enterprise platforms—like corporate T&E systems and HR software.

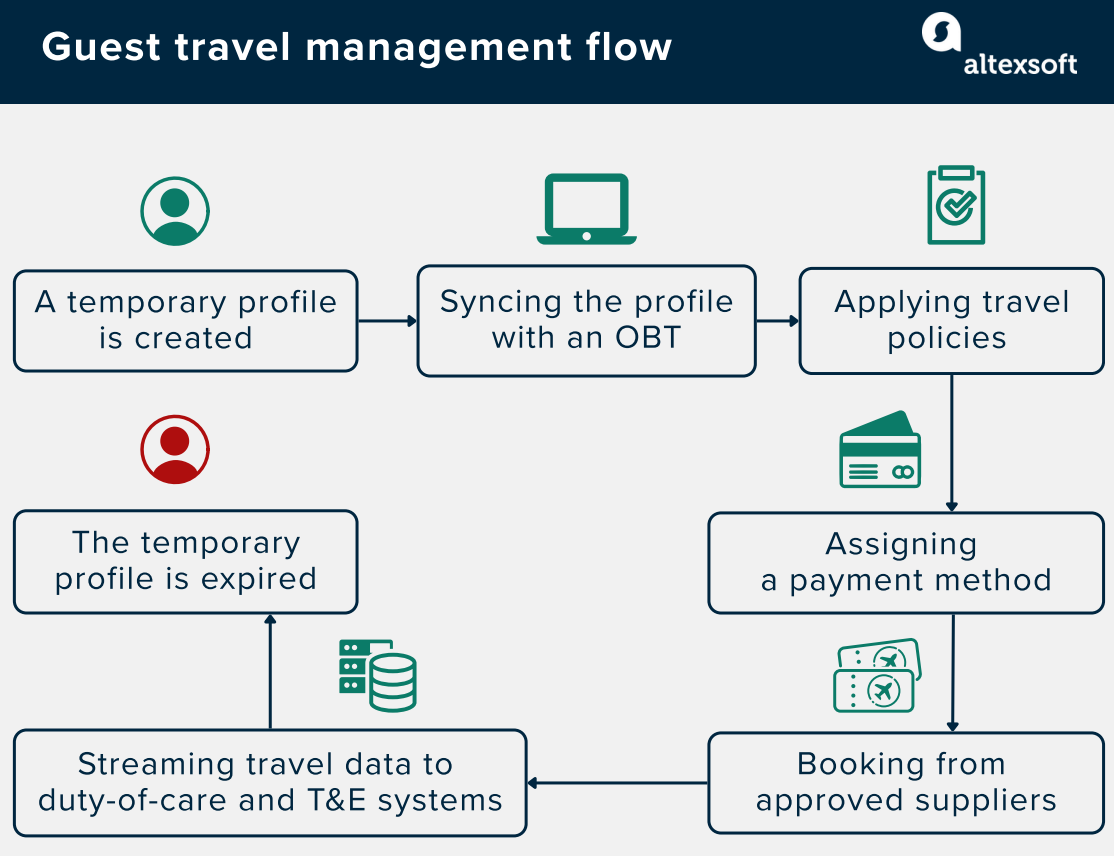

At the same time, information about job candidates, clients, or contractors is often gathered ad hoc—through phone calls or emails—creating gaps in data safety. The modern fix is the temporary travel profile.

Guest travel management flow with a temporary profile created

“We send a secure link so guests can enter their personal and payment details in an environment compliant with PCI DSS (Payment Card Industry Data Security Standard—AltexSoft),” explains Josh Cameron, Chief Operating Officer at Christopherson Business Travel (CBT), describing how the feature works on the Andavo platform. “The travel manager marks it as a temporary profile, which automatically expires after a certain period—though that can be adjusted for long-term contracts.”

Miriam Fois, Sales Director at BCD Travel, points to a similar mechanism with BCD Invite. “The profile can be linked to a single trip or multiple bookings,” she says. “Once the job interview or contracting work is complete, the guest can’t continue to make reservations under that profile.”

The temporary profile also resolves several other challenges: It serves as a key safeguard of policy compliance while also ensuring the guest’s safety and a smooth trip experience.

Out-of-the-policy bookings, reporting gaps, and inconsistent travel experience

When guests book flights or hotels through consumer platforms, they can easily—and often unknowingly—violate company travel policies. Beyond compliance issues, this approach creates fragmented workflows in HR, payment, reporting, and duty-of-care systems, resulting in data gaps, limited visibility, and an inconsistent travel experience.

By contrast, a temporary profile in a corporate system grants nonemployees access to the online booking tool, which will automatically apply the right rules, budget limits, preferences, and frequent flyer numbers. These bookings will also take advantage of negotiated corporate rates, offering discounts and perks that public sites can’t match.

“We put in place extra security protocols and checks to validate if the travel is compliant and going to be covered,” explains Miriam Fois. “The reservation also feeds into reporting and duty-of-care systems, meaning that while your guests are on the trip, they’ll receive travel alerts and notifications through the mobile app—the same experience as any regular employee.”

Another way to prevent out-of-policy reservations is to handle bookings through a dedicated travel advisor. “We’ve built a structured process for that,” says Josh Cameron. “Our advisor creates several travel proposals, and using our technology, the guest or their coordinator can select an approved option and confirm it instantly.”

However, not every company is willing or able to process guest travel via OBT. In this case, platforms like Traxo can step in. It leverages parsing technology to extract travel information directly from booking confirmation emails, which can be forwarded by a non-profile traveler or a travel arranger. It can also be automatically sourced via corporate email systems. No matter where or how the guest booking is made, Traxo can make it instantly visible to corporate managers. “We also share this information with third-party partners, such as duty-of-care providers, to ensure all travel is tracked and supported from start to finish,” adds Aash Shravah.

Lack of spending visibility and reimbursement delays

Unmanaged guest travel involves the use of cash or personal credit cards to pay for trips, making it challenging for travel managers to track spending in real-time. This not only increases the risk of fraud and policy violations but also leads to delays in reimbursement.

With the proper technology in place, the company can leverage multiple payment methods and select the option that best suits the guest type and policies.

For example, Navan Guest Invite allows travel managers to choose a corporate card on file—a centralized (lodge) card associated with the company for covering travel expenses—as the payment method for guest trips. In this case, the company’s dedicated credit line covers flights and accommodations within policy limits, while shielding the card details from the non-employee. This setup eliminates reimbursement, as all expenses are prepaid.

However, traditional centralized cards with static numbers are becoming outdated, as they are increasingly replaced by more secure virtual credit cards (VCCs)—temporary card numbers generated for specific transactions.

“I'm surprised by how many people still use central billing concepts in the industry," Aash from Traxo notes. “It involves a single card being used in multiple cases, which is risky. Virtual cards, however, are the way forward. Unfortunately, they’re still one of the most underutilized tools in travel. The only explanation I have is that people haven’t yet adopted virtual cards in their personal lives."

VCCs offer a way to impose constraints on the booking process. A travel manager can set the exact amount, limit the merchants, and specify an expiration date. These controls provide much stronger protection against fraud and policy violations compared to static cards. Like a central card, VCCs also remove the need for a painful reimbursement process.

“We recommend using our virtual card program so that travelers don’t have to submit receipts for air and hotel expenses,” Josh from CBT explains. “It’s a bit trickier with incidentals, but we have a simple flow to handle it. If travelers make purchases like parking or meals with a virtual card, they can take a picture of the receipt or forward a digital receipt to the Andavo platform, where it will be parsed and attached to the travel record.”

Beyond technologies: What else to consider to keep guest travelers happy

While technology certainly plays an important role in streamlining guest travel, there are several other key factors to consider to ensure a positive experience for guest travelers while protecting travel managers from operational strain.

Not all guests require profiling. This is a critical point for organizations that host guest travelers, since profiling can be resource-intensive and may not always be necessary. As Miriam from BCD Travel points out, not every guest requires a detailed profile, especially for one-off trips: “For example, a spouse traveling for a conference wouldn’t typically have a profile in the system, but their preferences and loyalty memberships should still be honored.”

A clear travel policy with tiers is paramount. By establishing distinct levels within the guest travel policy, companies can ensure that both high-priority guests and more routine travelers are cared for adequately. As Aash suggests, “You can’t lump guest travelers into one category. VIP guests should be treated differently from regular ones, as their needs and expectations are often higher.”

It’s not all about automation — personalization is a must. While automation has its place in streamlining travel processes, personalization remains crucial when dealing with guest travelers. Aash highlights the importance of considering individual preferences: “Travel is emotional. If you’re bringing in a prospective customer, for example, this is an opportunity to create a human element. Personalizing the experience—whether it's asking about their preferred airline or hotel—can make a big difference.”

Guest travel lacks scalability. Guest travel, by nature, is hard to standardize because it involves a broad range of individuals with diverse requirements. Aash acknowledges the challenge: “Yes, it’s not scalable to ask every guest about their preferences, but it’s the right thing to do. This is where AI can help by offering insights into individual expectations, making the process at least more manageable.”

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.