Georgia and its major city Atlanta already enjoy a reputation as the national health IT center. Now, the capital of the “New South” pursues a larger goal of becoming the world’s number one healthcare hub.

With its world-class hospitals, research facilities, a thriving startup ecosystem, a range of healthcare IT firms, and technology consulting providers, Atlanta has the potential to tackle various global challenges, which are not limited to the COVID-19 pandemic.

This article reveals what fuels the health IT boom in the city, and which problems the local tech companies already successfully address.

Atlanta health IT landscape

As we already said, Georgia and Atlanta abound with health-related companies. The state hosts

- 230 hospitals with 247,000+ healthcare practitioners and technical occupations,

- 225 health IT companies, employing over 30,000+ specialists,

- 65 health organizations with global reach including the Centers for Disease Control and Prevention (CDC), the Carter Center, the Task Force for Global Health, and the American Cancer Society that collectively influences 154 countries. No other city in the US can boast the same concentration of healthcare non-profits;

- 40+ higher education institutions including Emory University, Georgia State University, and Morehouse School of Medicine that run research projects and offer health academic programs. Recent graduates can obtain the practical skills they need to kick-start their career in the industry via talent development programs like Boom Lab— a division of ThreeBridge Solutions, that provides consulting services to medical device, pharmaceutical, and pharmacy benefit management (PBM) companies from the Fortune 500 list; and

- 20+ startup hubs, incubators, accelerators, and co-working spaces facilitating innovations in healthcare.

Moreover, Atlanta is the birthplace for Healthcare Information and Management Systems Society (HIMSS), a health IT pioneer founded in 1961 at the Georgia Institute of Technology. Now, the company has the status of a global thought leader that reimages health via technologies. HIMSS experts see it as their mission to improve patient services and reduce healthcare costs worldwide.

But what exactly has the city to offer to the world in terms of digital solutions? Below we’ll explore segments of healthcare where Atlanta IT firms have a significant footprint.

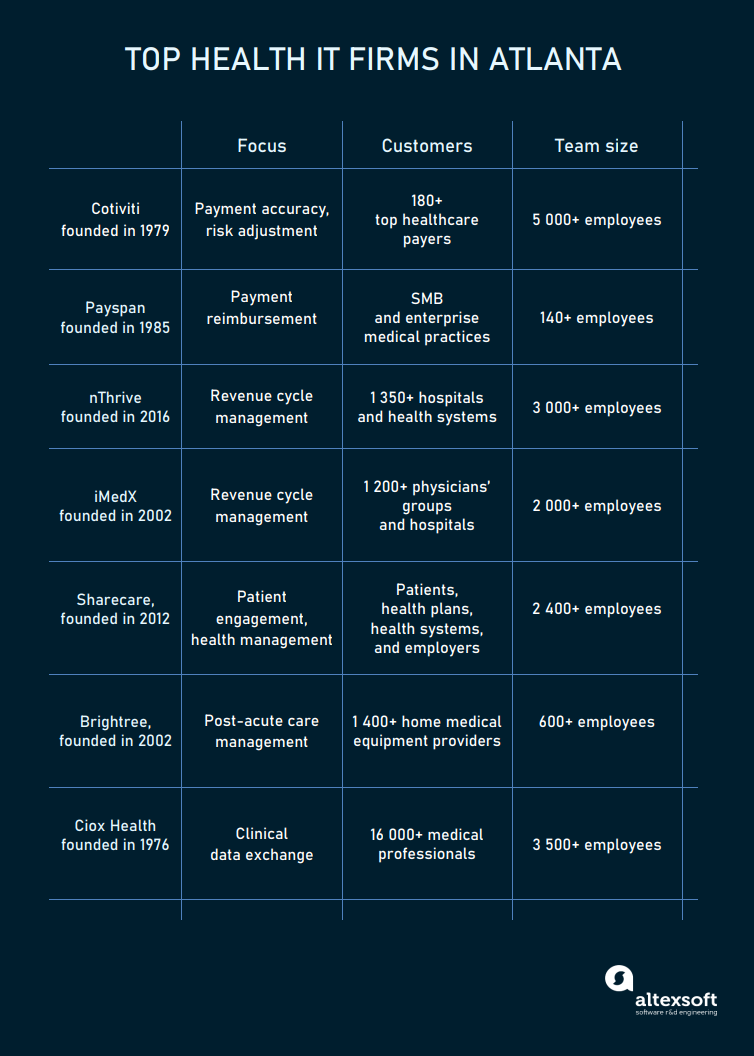

Leading healthcare IT companies headquartered in Metro Atlanta.

EHR systems and practice management

The digital transformation process in healthcare facilities starts with the adoption of an Electronic Health Record or EHR system. It lies at the heart of the entire IT environment allowing for collecting and storing data that relates to patient health and treatment.

Today, EHR software providers typically complement these basic features with practice management modules — including

- electronic prescribing (eRx),

- laboratory ordering,

- medical billing,

- patient scheduling,

- and more.

Considering all the complexities of EHR implementation, such vendors usually deliver tech consulting services as well.

Heavyweights: how Allscripts put an end to Eclipsys

In Atlanta, the first EHR and practice management software vendor — Eclipsys Corporation — appeared in 1995. The company had thousands of clients among hospitals, clinics, and physician practices worldwide. For seven consecutive years, up to 2009, Eclipsys led the industry as the top provider of computerized physician order entry (CPOE) systems integrated with their EHR. But in 2010 this story of success ended abruptly — Eclipsys was acquired by its rival Allscripts, headquartered in Chicago.

Currently, Allscripts holds 5 percent of the EHR market share which makes it one of the top ten vendors in the sector. One of its 20+ US offices is located in the Atlanta metropolitan area.

Smaller vendors: Azalea Health helps rural hospitals

Two other EHR vendors in Atlanta are Azalea Health focusing on mobile solutions and rural hospitals and Medicat providing EHR software for colleges and universities.

It’s worth noting that over 95 percent of hospitals across the US already use certified EHR systems. Yet many of them lack the functionality to meet the requirements of modern healthcare. These multiple gaps create business opportunities for other health IT providers.

Payment accuracy and revenue cycle management

To treat patients and save lives, hospitals need to stay financially healthy. And that’s where digital tools could really come in handy. Atlanta is home to a number of leading companies focusing on the economic side of healthcare. This is not a big surprise: The city boasts a rich fintech ecosystem and is recognized as a national leader in payment solutions, no matter the industry.

Heavyweights: Cotiviti, nThrive, and others boost revenue for hospitals

Cotiviti is one of the most recognized providers of payment accuracy and risk adjustment products, driven by analytics. In February 2020, the company introduced Caspian Clarity, a new unified platform that combines clinical and financial datasets, and aggregates data on 40 percent of Americans. The platform enhances existing solutions and brings additional clarity to end-to-end payment processes. Besides actionable insights for clients, Cotiviti creates jobs for 5000 specialists.

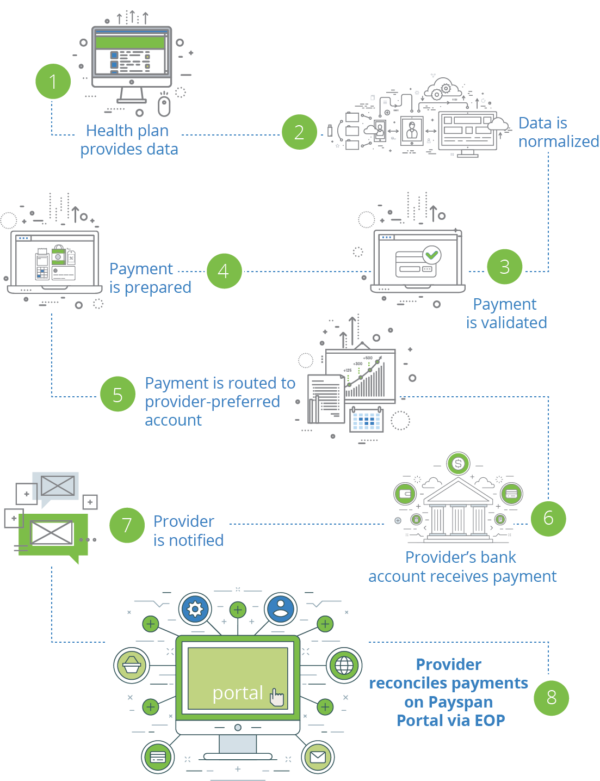

Payspan maintains leadership in reimbursement automation and electronic payment processing. It connects 600+ health plans with 1,3 million provider payees and 100+ million patients, representing the largest network in healthcare reimbursement. The company moved its headquarters to Atlanta from Jacksonville (Florida) in 2013 and has grown threefold since then.

Reimbursement automation via Payspan Portal

nThrive addresses key financial challenges in healthcare through its Patient-to-Payment suite of solutions. It covers the entire revenue cycle which is defined by the Healthcare Financial Management Association (HFMA) as “all administrative and clinical functions that contribute to the capture, management, and collection of patient service revenue.” In other words, everything that happens from the moment of an initial appointment to final payments.

In addition to technologies, nThrive offers consulting services and education programs. It serves more than 1350 clients by the efforts of over 3000 employees. By the way, in 2019 the company was certified as a Great Place to Work for the third year in a row.

iMedX is often mentioned among top e-prescribing systems. But in fact, the company has technologies and expertise to optimize every step of the revenue cycle. This encompasses appointment management, medical transcription, coding services, and data analytics. 1200+ clients prefer iMedX to other vendors and 2000+ employees contribute to the company’s success.

Streamline Health boosts financial performance of healthcare enterprises with a cloud-based eValuator Revenue Integrity Program. The solution identifies accuracy issues prior to billing, enabling hospitals to prevent money leaks and denials. The company is not as large as the above-mentioned players. Nevertheless, it stays competitive and profitable — not least because of partnerships with heavyweights like Allscripts, Peak Health Solutions, Epic, Meditech, and Cerner.

Revenue cycle management in Atlanta is also represented by Change Healthcare, a global company headquartered in Nashville, Tennessee, with 120+ offices and 15000+ employees worldwide.

Smaller vendors: Patientco and Clinigence streamline payments

Despite the fact that the niche is crowded with business giants, there is still enough place for startups. Smaller players fix separate financial issues rather than offer large and costly end-to-end solutions.

Among them are

- proCARE portal that automates physician compensation management,

- Patientco aiming at better patient payment experience, and

- Clinigence complementing EHR systems with Business Intelligence add-ons to improve clinical and financial performance.

Profitability is vital for any business, and healthcare is no exception. However, even the world-best revenue management tool won’t raise incomes if consumers — or, in our case, patients — are not happy with services. So, let’s move to the next healthcare aspect Atlanta’s IT firms focus on — patient engagement.

Patient engagement

The key idea behind patient engagement is to involve patients in the decision-making process arming them with complete information about available treatment options, medications, procedures, and every single step of their health journey. According to HIMSS, such an approach “contributes to improved health outcomes.” Technologies allow hospitals to keep patients informed both remotely and on-site.

In Atlanta, engagement solutions are provided by several companies of different sizes plus one global player.

Heavyweight: Sharecare improves health management globally

Sharecare is a project by Jeff Arnold who also founded WebMD, the first online publisher of medical news. The platform connects patients, doctors, health systems, and health plans. It enables users to compare prices on drugs at 67,000 US pharmacies and provides tons of information on health and wellbeing.

In 2020, at the height of the COVID-19 pandemic, Sharecare broadened its reach: It launched a telehealth platform, integrated with Amazon Alexa’s voice service to answer 80,000+ questions on health topics, and acquired several digital tools including MindScience, a suite of apps focusing on mental health, and WhiteHatAI, a healthcare payment integration solution. The company also partnered with Forbes Travel Guide to help luxury hotels, spas, and restaurants worldwide mitigate challenges posed by the pandemic.

Currently, Sharecare partners with 10,000+ healthcare providers and 180+ organizations including the largest health insurers, Walmart, and Amazon. It creates jobs for 2400+ employees.

Smaller vendors: know-how from Patientory, Loyal, and Gozio Health

Atlanta startups offer different ways to enhance patient engagement and improve their experience.

Patientory extracts data from EHR systems like Epic, Cerner, or Allscripts and other health-related databases. It enables patients to store their medical data on the blockchain-based platform, easily access it via a mobile app, and share records with their doctors, caregivers, or family members.

Loyal comes with a suite of patient engagement solutions. It combines a data management platform, a tool for collecting patient feedback, a patient-side app to search for providers and schedule appointments, and an AI-driven chatbot.

Bioscape Digital equips hospitals with a tablet-based patient engagement platform that combines text, audio, and visual information. Tablets with the intuitive interface can be installed in lobbies, emergency rooms, and wherever visitors may need guidance.

Gozio Health mobile platform helps people find their way from home to the waiting rooms in hospitals and navigate them within the healthcare system. It also assists in managing patient flow and gathers feedback from visitors to analyze their engagement.

Unfortunately, in many cases, the road to recovery is longer than the way from home to the hospital’s lobby. Post-acute care may take weeks, months, and years. And it also needs technologies for better outcomes.

Post-acute care and home care

Post-acute care (PAC) — both at home and in specialized facilities — is a growing sector that accounts for 15 percent of total Medicare spending. Atlanta has award-winning solutions to bring PAC services to the new level.

Heavyweight: Brightree changes the home health industry

Brightree was created by an owner of a home medical equipment (HME) company for… other HME owners. Knowing specific pain points and challenges his peers face, Steve Elrod and his team founded Brightree. Today, 18 years later, it serves 1,400 HME providers and 489,000 + patients, leading the pack in the home health software industry. The Brightree team comprises 600 employees, including 150 software developers.

Brightree offers tools for billing management, ePrescribing, inventory management, documentation, retail, and sleep therapy. The company also took a hand in the development of post-acute EHR systems for hospices and home care, which are now a part of the MatrixCare software suite. Both companies were acquired by ResMed, a developer and manufacturer of medical equipment from San Diego.

Smaller vendors: Trella Health and CareValidate mitigate risks of claims

Meet two up-and-coming companies promising to drastically lower the cost of post-acute care.

Trella Health is a preferred vendor and partner of the National Partnership for Hospice Innovation (NHPI). Having access to 100 percent of Medicare claims, the company’s digital platform analyzes 1,2 billion claims annually and delivers insights to 10,000 post-acute care providers, home health agencies, and hospices, enabling them to do better care plans.

CareValidate focuses on older adults. Its smart app allows family members and care professionals to monitor the quality of care at home and in senior living facilities. The startup also has a telematics solution for insurers. It combines machine learning, IoT, and mobile sensing to catch warning signs — like changes in heart rate or unusual movements. This enables insurers to timely intervene, prevent incidents, and mitigate the risk of claims.

Obviously, timely, accurate and complete information is key for large improvements. This leads us to the next fruitful area — health information services (HIS).

Health information services

To some degree, any healthcare solution provides services of this type. However, there are companies focusing on extracting, storing, and delivering information in the first place. Access to data and data exchange is their bread and butter. Here are two prominent examples from the Atlanta area.

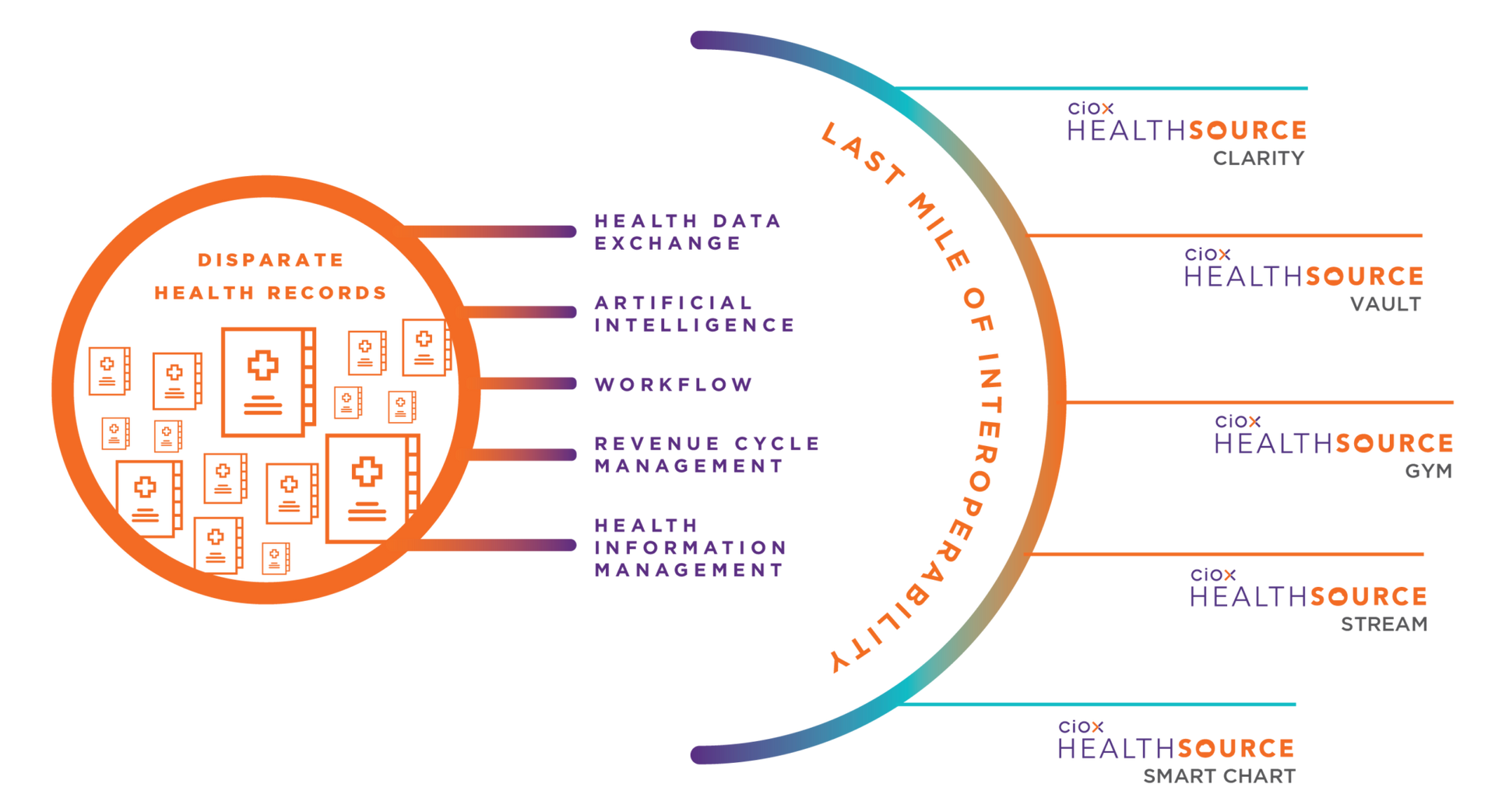

Heavyweight: Ciox Health uses AI and NLP for smooth data exchange

Ciox Health, the US leader in healthcare informatics, fulfills 40 million requests for protected medical records each year. It benefits from the ability to “release, acquire, enhance, and deliver medical records and clinical data from anywhere across the United States.” The company’s clients — health plans, employers, and government agencies — use the HealthSource platform to securely extract data from structured and unstructured datasets and create individual medical profiles to make better decisions.

HealthSource data platform facilitates seamless exchange of medical information.

The platform is driven by AI and natural language processing technologies. It also addresses interoperability challenges, streamlining data exchange. Currently, three out of five hospitals and 16,000 medical professionals in the US rely on Ciox technologies.

Smaller vendor: HealthLink Dimensions keeps data on all physicians in one place

HealthLink Dimensions benefits from a specific database of 2.7 million healthcare professionals extracted from 500+ sources and verified by the firm’s proprietary algorithm. The company can provide information you need on request. Also, clients may connect their CRM systems to the database via API. These information services are popular among pharmaceutical and medical device retailers, hospitals, and health plans, which need data on doctors for marketing or professional purposes.

Top health IT jobs and salaries

In this article, we reviewed sectors of health IT with a strong concentration of Atlanta-based vendors. There are dozens of other noteworthy companies, and their number will only increase, due to the growth of the healthcare industry, demand for cost-cutting solutions and for rapid responses to emergencies.

More health software vendors mean more jobs in health IT. As of today —- according to the recent survey on the US tech workforce — healthcare services are the second largest sector in Atlanta, while the tech industry is ranked fourth.

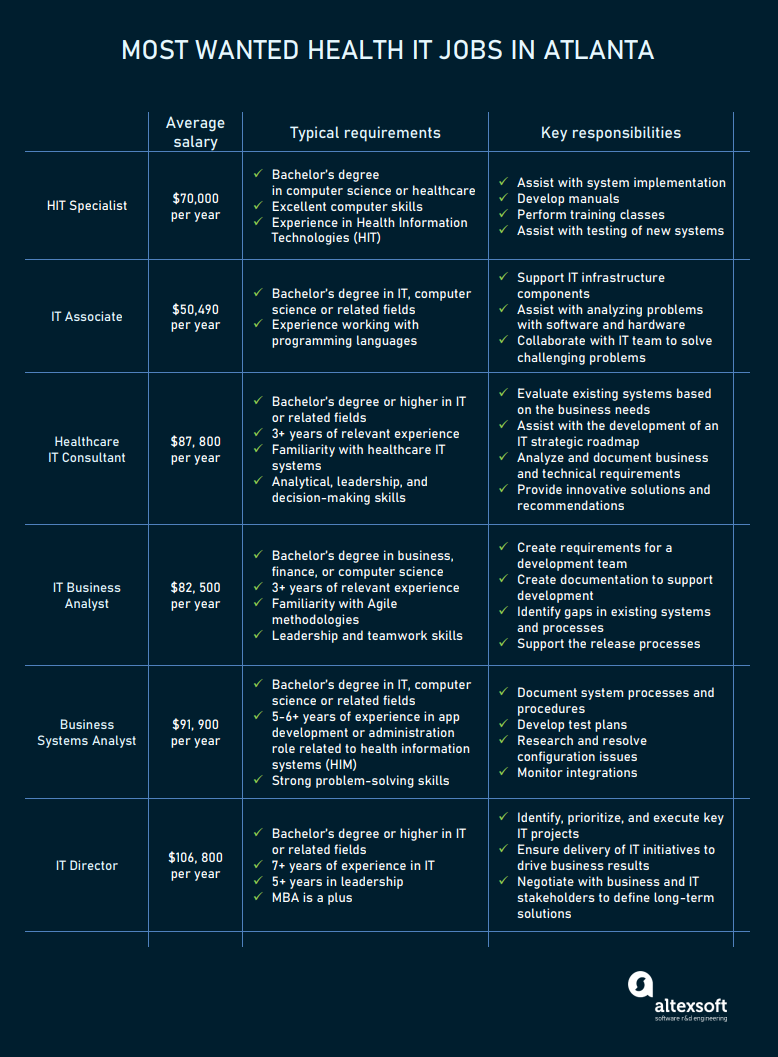

Job opportunities created at the confluence of two rapidly evolving industries are broad and diverse. Based on ZipRecruiter data, most in demand health IT specialists in Atlanta right now are

- Health Information Technology (HIT) Specialist,

- IT Associate,

- Healthcare IT Consultant,

- IT Business Analyst,

- Business Systems Analyst, and

- IT Director.

For more details, take a look at the table below.

Most popular healthcare IT vacancies.

The next boom is on the way

Atlanta expects to enjoy the next startup and job boom once the healthcare innovation hub — think Atlanta Tech Village — opens its doors. The idea to create such a campus was announced two years ago by the Georgia Global Health Alliance. For now, three locations are under consideration to build the district that will attract international investments and talent. And finally make Atlanta “the go-to place for global health”.