Below is the technology industry news & trends report for January 2018. You can also check out our latest news & trends report to be in the loop of what’s shaping the tech industry landscape today.

The first month of 2018 generated many interesting trends worth watching. The cryptocurrency rush focused public attention on blockchain, spurring the growth of some blockchain startups that at least suggest some strange business ideas or are representative of a pure scam in many industries, including travel. Another big thing is voice interface. The number of people who prefer voice interaction to more traditional ones is expected to increase from 20 to 40 percent over the next three years. For instance, American Express invests in chatbot solutions to improve customer service. So, let’s dive into these nuggets as well as some of January’s other interesting news.

Unviable blockchain startups in travel will likely lead to ICO regulation

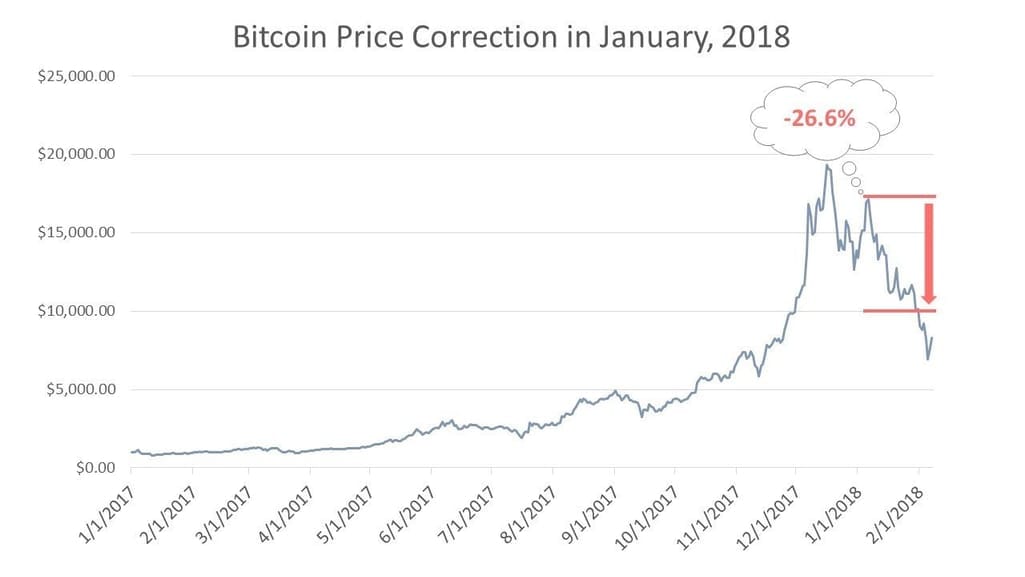

The cryptocurrency rush didn't die down even after a strong Bitcoin correction in January when the price plunged to $10,000. Skift, SITA, and Amadeus put blockchain on the list of the most disruptive technologies of the travel industry in 2018. Nevertheless, blockchain travel startups often fail to disrupt anything but investors' expectations. ICO money has brought many unviable projects to the industry. Companies like PallyCoin, TravelChain, and OjutCoin have inconsistent strategies and seem to be designed for their founders' enrichment rather than innovation.

Source: Coindesk

PallyCoin markets itself as a social network providing travel booking service. It also allows travelers to chat with each other and use internal coins for P2P transactions. OjutCoin is an ambitious startup which plans to raise money via ICO and buy own hotels and also run their transactions using own coin. The team promises investors to reach a modest $9 billion valuation of OjutCoin in the next five years.

Andrew Sheivachman, a business travel editor at Skift, believes these projects look suspicious to say the least. And there are already investor losses from ICOs in other industries. Recently, Security and Exchange Commission stopped an ICO of AriseBank. The alleged loss for investors could reach $600 million.

Facebook also stepped up to defend its users by banning crypto ads until the company learns how to distinguish fair projects.

This situation proves that the ICO and cryptocurrency market gradually drifts towards regulation and investor protection. But, currently, we encourage anyone investing to carefully analyse the project and ICO prior to emptying your wallet.

Fleet promises to disrupt transportation industry with freight GDS

Fleet, a logistic tech startup, raised $10 million from Lufthansa Cargo and a flock of other investors in a Series A round. The company aims to disrupt the freight industry by launching a new global distribution system (GDS). The platform will aggregate rates and automate a freight delivery booking workflow. Fleet targets small companies as a core customer group as these businesses are suffering from complicated workflows around export-import operations. These barriers lead small companies to inefficient spending. Fleet claims that the cargo industry lacks proper IT infrastructure: Data exchange is cumbersome and time-consuming. And Fleet plans to fix that with a cargo GDS.

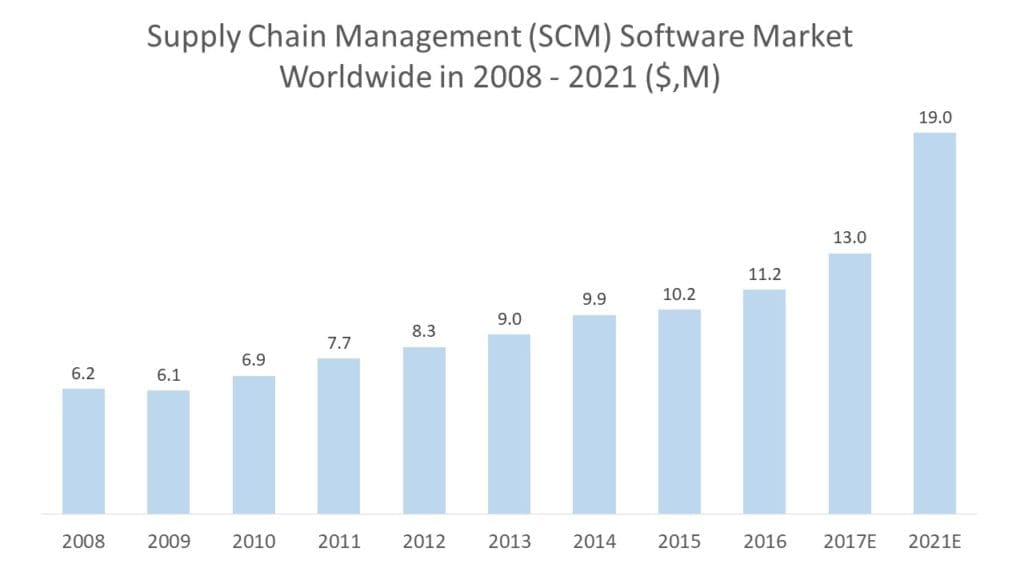

The logistics industry looks very promising as digital transformation pushes demand for IT services and software. Supply chain management (SCM) software market reached $11.1 billion in 2016, according to Statista. And demand will significantly grow over the next five years.

The executives of logistic companies should set new software implementation as a key priority for 2018-2021, working with Fleet or other travel tech providers.

Source: Statista

Gartner: Self-service analytics market will outperform custom data science projects by 2019

Gartner claims that analytics and business intelligence (BI) become increasingly more commoditized. People that don’t professionally do data science will produce more analytics with self-service tools than specialized data science teams by 2019.

Due to developments in IoT, AI, and cloud, companies leverage a lot more opportunities to gather and process data than a decade ago. BI platforms simplify the access to data analysis, and the widespread data-driven culture increases the number of self-serve analytics users. Gartner issued several recommendations on how to build a strong foundation for analytic platforms.

Source: Gartner

Earlier, Gartner predicted that BI and analytics software market would reach $18.3 billion in 2017 and climb up to $22.8 billion by 2020. The market will be driven by the inflow of new customers, high analytics accessibility, and real-time data processing.

Finance, manufacturing, and retail companies will be the major BI spenders. So, defining and configuring data science strategies is another priority for businesses as the access to analytics becomes more democratized.

Main disruptive trends in the Fintech industry

CB Insights Fintech trends overview says that traditional financial institutions compete more with each other rather than with fintechs. Large banks actively invest in startups working on data analytics, blockchain, financial software, and payments.

The capital market infrastructure will become a focus area for the industry players. In 2018, financial institutions will be investing in cloud migration, data collection, and development of open APIs. These innovations will boost development of new financial products and increase efficiency of banks.

A tech giant, Amazon, will also engage in the financial industry. The corporation has already established cash deposits, payment, and small business lending. It's expected that the company will become active outside the US as well. Moreover, Amazon is partnering with Berkshire Hathaway and JPMorgan to enter the insurance business and extend its involvement in the financial services.

The Venture capital funding in fintech hit $16.6 billion in 2017, which is a new historic high. As demand for innovation remains hot, customer experience, blockchain, open APIs, and AI are the major technology opportunities in finance.

Currently, there are two viable paths for brick and mortar companies to embark on digital transformation fast: acquiring white-label solutions from fintech providers or hiring a technology consultancy. Relying on in-house engineering teams will take more time and investment in proper talent acquisition and IT infrastructure.

How chatbots can improve patient experience across healthcare industry

Chatbots expand to the healthcare industry solving simple customer support tasks. The technology use is still quite limited, but it already helps with patient triage and administrative tasks, like visit scheduling. Today healthcare chatbots are utilized both by large hospitals and small practitioners. For instance, Brett Swenson, an MD, used a chatbot assistant to send invitations to flu vaccination. The physician claims that results were amazing. The chatbot campaign response rate accounts for around 30 percent versus average 1 percent across other channels. The messaging platform demonstrates nearly 100 read rate.

Many vendors like Catalia Health, Florence, SimplifiMed, Your.MD offer messaging solutions to solve routine medical tasks. The most sophisticated of them even use AI and integrate with EHR systems.

The implementation of voice and messaging interfaces becomes a critical advancement for the medical industry. It will be especially helpful among elder patients who are often confused with using mobile and web apps. The use cases of chatbots certainly aren’t limited by the mentioned few and medical institutions are yet to discover more.

Voice assistants change the face of retail

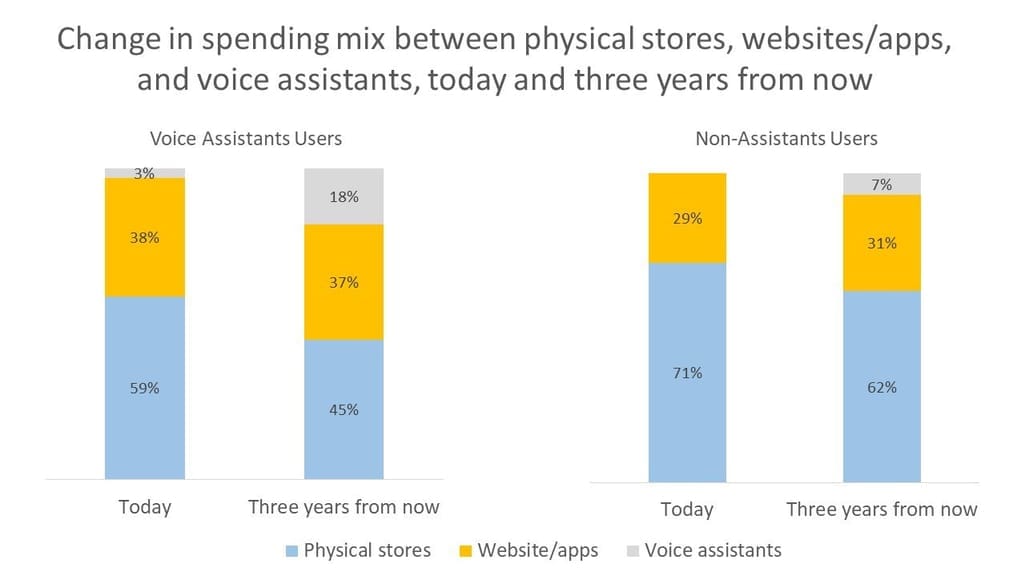

Capgemini predicts that voice shoppers will become a core customer segment by 2021. The company surveyed 5,000 consumers in the US, the UK, France, and Germany. The voice-based buyers will reach 18 percent compared to 3 percent of total consumer force.

The research also claims that voice shoppers are ready to spend 500 percent more than others. Good language-based tools remove a lot of friction from the customer journey, eliminating such problem as manual input of purchase details.

Voice assistant technologies are mature enough to enter the eCommerce as proved by Amazon Alexa. So, the retail industry should get ready for this strategic shift and start researching the SDKs for Apple, Google, and Amazon assistants to provide timely integration and match the market demand.

Source: Capgemini

American Express aims to improve customer experience with personal assistant technology

American Express acquired Mezi, an AI-based travel assistance startup. Company's chatbot can help check in, book a room, reschedule a flight, or order a meal on board. Mezi combines machine learning algorithms with human-support, which allows for providing quick and personalized customer service. Details of the deal were not disclosed but the startup had raised about $12 million since 2015. Mezi and American Express worked previously on the pilot project of an assistant which helped card-holders to book travel services via mobile.

As travel management companies need more automation, AI-based assistants is one of the main paths today.

Angular 6 beta arrives

Angular 6 beta became publicly available last month. The new version of famous JavaScript framework will continue the development trajectory set by previous versions. Angular 6 will be smaller, faster, and easier to use. Google added a new renderer called Ivy and a backward-compatible generic type. The technology continues to be focused on progressive app development.

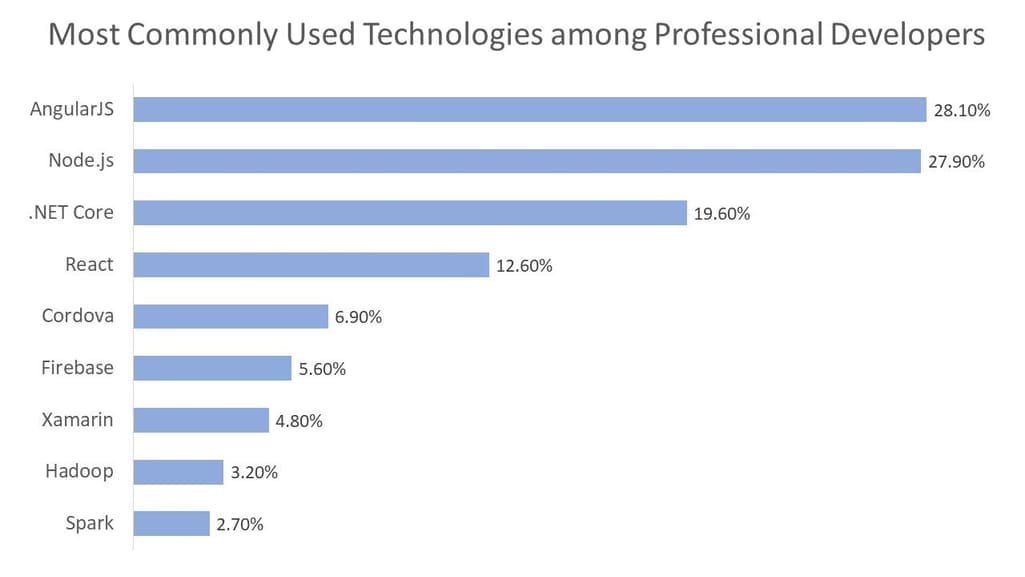

Angular remains the most popular framework among professional developers outperforming Node.js and React. About 28.1 percent of Stack Overflow respondents mentioned it as the most commonly used one. At the same time, many developers put Angular on the list of the most “dreaded” technologies. And it looks like Google is striving to repair this reputation.

If you’re considering the framework, we discuss these points in our article about the pros and cons of Angular development.

Source: Stackoverflow

Lyft is getting into corporate travel

Lyft expands its Concierge program to all organizations. The program allows corporate travelers to book rides. Business representatives must set up a Lyft Business account and attach a payment card to start using the service. Rides can be booked in advance and also on behalf of another person.

The digitalization of the business ground transportation market means that companies won't have to deal with checks or phone calls to track employee expenses. The growth of automated get-around services in corporate travel challenges the rest of the players to keep up. They should focus on improving customer experience and information exchange.

Final word

The popularity of smart assistants will keep growing over the coming years. The technology allows for automating customer support in travel, healthcare, and finance. Voice-driven interactions will engage elder groups of users. Using chatbots for patient support, Mezi acquisition by American Express, and robo-advisor projects of the largest banks serve as solid evidence that technology is viable and gaining momentum.

But before the movement reaches wide adoption, chatbots and voice-based interfaces must overcome the challenges related to understanding and interpreting customer requests. Currently, bots can’t replace sales representatives or doctors. Such advanced AI is yet to be developed.