Imagine you’re about to open an intercity bus service. How would you price tickets not only to cover expenses for each route but also to achieve a certain level of revenue to grow and develop your business? Would you consider fixed costs, competitor prices, or both?

The reality is that you’ll need a more sophisticated pricing strategy to fit into today’s highly competitive market and be flexible enough to adjust to any changes. The two biggest tasks businesses have to address in this regard are revenue management and price optimization.

We talked with experts from Perfect Price, Prisync, and a data science specialist from The Tesseract Academy to understand how businesses can use machine learning for dynamic pricing to achieve their revenue goals.

Dynamic pricing strategy 101 and key approaches

Dynamic pricing is the practice of setting a price for a product or service based on current market conditions. It’s commonly applied in various industries, for instance, travel and hospitality, transportation, eCommerce, power companies, and entertainment. Businesses reap the benefits from a huge amount of data amid the rapidly evolving digital economy by adjusting prices in real-time through dynamic pricing. “Dynamic pricing uses data to understand and act upon any number of changing market conditions, maximizing the opportunity for revenue,” says Alex Shartsis, founder and CEO of Perfect Price.

Dynamic pricing can be used in various price setting methods. According to Yigit Kocak of Prisync, the three of the most common methods are cost-based, competitor-based, and demand-based.

- Cost-based pricing “adjusts prices dynamically according to business costs and keeps profit margins on a certain level.”

- Competitor-based pricing takes into account competitor pricing decisions.

- Demand-based pricing speaks for itself: Prices increase with growing consumer demand and dwindling supply, and vice versa.

Each of these pricing strategies brings various benefits when executed right. Let’s discuss how businesses can improve their performance with dynamic pricing and what are the pitfalls.

What you gain: Advantages of dynamic pricing

Pricing automation. Businesses that implement dynamic pricing can completely or partially automate price adjustments – depending on their needs. Pricing tools evaluate a large number of internal (stock or inventory, KPIs, etc.) and external factors (competitor prices, demand, etc.) to generate prices that align with a company’s pricing strategy.

Increased competitiveness. The ability of a business to respond to current demand, rationally use its inventory or stock, or develop a brand perception through specific pricing decisions allows it to stay afloat no matter what the current market condition is. For instance, an airline can secure itself from bad sales during a low-demand season or before an upcoming departure day by putting tickets on sale.

What to beware: Disadvantages of dynamic pricing

Customer alienation and backlash. Generally, people accept price drops and increases when booking accommodation or flights, which isn’t the case for retailers and car rental companies in particular. “Customers don’t like to feel like they’ve paid more than other people for the same product or service. Such a pricing strategy can lead to bad reviews, complaints, or worse. One case for customer alienation is that when users put an item in the basket without purchasing the item and after a day or so, they'll get a discount code for the abandoned cart item,” explains Kocak.

Regular customers may get offended once they see that a seller gives a discount to shoppers that take their time before the checkout. Poising a rhetorical question that the customer must ponder, the expert asks, “So why are regular shoppers treated badly although they bring more value to the business?”

Uber’s dynamic pricing, for instance, may cause “some issues” during implementation, thinks data scientist Stylianos Kampakis. The expert recalls cases when clients were charged preposterous fees for short rides due to extremely high demand, for instance, on the New Year’s Eve.

Such cases generally gain a lot of publicity - rarely the good kind. For example, a story about Edmonton Uber customer Matt Lindsay who was charged $1,114.71 for a 20-minute long ride appeared in numerous newspapers. Passengers tend to complain about their bad experiences on the Internet despite being notified about surge rates via the app or warned by drivers (the situation with Matt).

The risk of the race to the bottom. Price transparency is one of today’s market traits: Consumers can find which merchant provides an item or service of interest for a cheaper price in several clicks or taps. Competition is intense, and some businesses rashly cut prices in response to their competitors. That way, they risk losing a price war they have started. The race to the bottom is full-on when a company deliberately charges less and decreases their profit margins.

One of the ways to deal with these challenges is to make data-driven pricing decisions. Some dynamic pricing implementations monitor and analyze data about market movements, product demand, available inventory, competitor prices, customers’ digital footprints, as well as website events (i.e., the most viewed pages products/services, abandoned carts, clicks on content times) and come up with the most reasonable price to be shown. In addition, these tools usually allow for specifying price limits.

Approaches to dynamic pricing: Rule-based vs machine learning

In terms of software architecture, two types of dynamic pricing solutions are available on the market.

A rule-based system operates using a knowledge base containing rules – facts about a problem based on domain expert knowledge. These rules are represented in the form of “if-then” statements. When software detects a pattern in data, an inference engine – part of such software – defines a relationship between rules and known facts. Then an appropriate rule is executed, and software acts accordingly. So, rule-based systems rely solely on the “built-in” knowledge to respond to the current state of the environment in which they work.

Rule-based solutions for dynamic pricing implement rules written to meet a specific organization’s business needs. The lack of flexibility means that a rule-based system can’t adjust, add, or delete rules in response to a changing environment to be able to respond to unusual or unpredictable events. As new items are added or room or seat inventory grows, these tools require more and more manual maintenance. One has to add new rules or modify the existing ones, ensure that rules aren’t duplicated, and still align with the current business goals.

Data science specialist Stylianos Kampakis notes that rule-based dynamic pricing has the same issues that rule-based systems have in general: “While they are transparent and easy to understand, they can't reach the performance of ML systems, with the exception of very simple problems.”

Software powered by machine learning follows a different logic: It gains knowledge from data (data mining) to find the approaches to solving a problem itself, without direct programming. The more data is being fed to a machine learning system, the more it learns from it and improves its performance. In other words, such software doesn’t need detailed instructions on decision-making in a given situation.

Alex Shartsis notes that dynamic pricing is a problem really only AI can solve. The expert opposes rule-based systems to AI and machine-learning-based ones and says the former aren’t a good solution for any dynamic pricing due to lack of flexibility.

According to Alex, the best use-cases of AI and ML-based dynamic pricing solutions typically involve large amounts of daily transactions where demand fluctuates and consumers are willing to pay a dynamic price. “Most people aren’t willing to pay a dynamic price for their morning cup of coffee, but they are willing to pay a dynamic price for airfare, for example,” the specialist adds.

So what difference does machine learning make when used for dynamic pricing? AI and ML allow for more extensive data analysis, which results in richer solution functionality. Pricing software with built-in machine learning pricing models has the following features and capabilities:

Granular customer segmentation with cluster analysis. These solutions can uncover hidden relationships between data points representing customer characteristics, including behavior patterns, and determine customer persona groups with high accuracy.

A large number of variables for plenty of items are considered. Competitor and attribute-based pricing are some of the influencing factors that must be assessed for a price recommendation:

- External factors like industry trends, seasonality, weather, location;

- Internal ones like production costs and customer-related information, for instance, search or/and booking history, demographic features, income, or device, and finally willingness to pay, make sense.

“Our software works with massive amounts of data, both internal and external. Depending on the use-case, we might incorporate a wide variety of data on weather, traffic, competition, etc.,” says Shartsis.

KPI-driven pricing. Businesses can set up a product to align pricing recommendations with performance metrics of interest, for instance, margin, turnover or profit maximization, inventory optimizations, etc.

Real-time market data analysis without complex rules. It's possible to automatically optimize prices to changing demand and market conditions in real-time without specifying complex pricing rules.

Price elasticity calculation. These solutions give users the capability to define price elasticity to predict whether customers will accept a new price before taking a pricing decision.

Business rules in such dynamic pricing solutions can be used as additional settings.

Use cases of pricing optimization and revenue management with dynamic pricing

Dynamic pricing isn’t about changing prices per se. A company’s purpose is to define an equilibrium price where demand meets supply and therefore both sides – service provider and customer – agree that a set price is fair at a given time. In this context, a customer's willingness to pay serves as a reference point. Dynamic pricing can be used as a tool in two different pricing strategies: revenue management and pricing optimization. Ultimately, these strategies differ by industry and the products they supply. Here's how dynamic pricing works in the airline industry.

Airlines use quite sophisticated approaches to pricing their tickets

The primary goal of revenue management is to sell the right product to the interested customers, at a reasonable cost at the right time and via the right channel, which applies to businesses with fixed, reservable inventory like flights or hotel rooms. (We previously discussed best revenue management practices for hotels). And the practices of revenue management originate from the travel industry, where products are limited and perishable meaning that they lose their value at some future time, but can be booked in advance.

Within pricing optimization, businesses predict to what degree consumer purchasing behavior (demand) is altered with the change of cost for products and/or services through different channels. Unlike revenue management, it's used to measure how sensitive customers can be to price changes of goods that generally cost the same. Pricing optimization is mostly used in retail, where the price itself becomes one of the leading drivers of purchase.

In this section, let’s discuss how transportation, hospitality, and eCommerce businesses approach dynamic pricing.

Transportation: dynamic price optimization for ride-share companies

Transportation network companies (TNCs) like Uber or Lyft became powerful competitors to transportation authorities and taxi companies across continents. Public transit companies in the US are losing passengers, noticeable since 2015. According to researchers from the University of Kentucky, for each year after TNCs enter a market, heavy rail ridership can be expected to decrease by 1.3 percent and bus ridership – by 1.7 percent. The more people use ride-share services, the stronger this effect is. Authors estimate that after eight years ridership decrease may reach 12.7 percent.

Ride-share companies strive to maximize revenue from their growing rider and driver community. “Dynamic pricing manages capacity constraints, by increasing or decreasing prices to ensure demand matches supply,” says Alex from Perfect Price. “An example of this is Uber surge pricing, which ensures cars are still available by pricing some passengers out of the market while making driving more appealing for drivers.”

The company uses machine learning to forecast “where, when, and how many ride requests Uber will receive at any given time.” Special attention is paid to predicting demand during extreme cases, such as sporting events, concerts, holidays, or adverse weather.

The rideshare giant enables a multiplier (i.e., 1.8x or 2.5x) on every fare when the number of customers in a neighborhood is bigger than the number of available drivers. Demand may be extremely high on New Year’s Eve, Halloween, Friday or Saturday night, or during public events. Fares are updated in real time, and the value of a multiplier depends on the scarcity of free drivers. Riders get notifications about increased prices and must agree with current pricing before looking for a car.

Surge pricing notification in the app. Source: Uber Cebu Trips

Uber also considers seasonal changes to impact their multipliers. Since extreme events like New Year’s Eve happen once a year (yeah, we know how obvious it sounds, but that’s not the point), researchers have to deal with a lack of data – data sparsity. To solve this problem, they use a custom LSTM (long short-term memory) model, a type of artificial recurrent neural network with the ability to remember information for long periods of time. These models show good prediction results with time series data – data containing observations taken at regular intervals. Observations are numerical values.

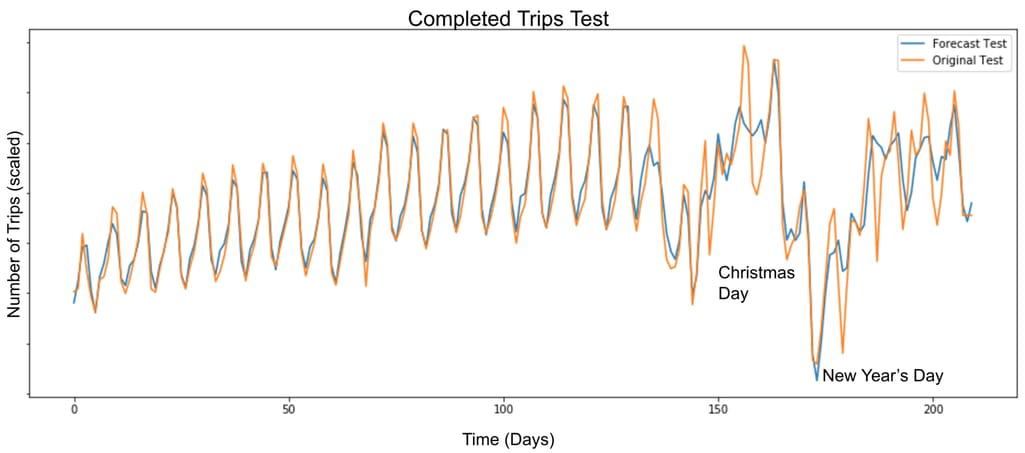

The specialists used five-year historical data about trips completed every day across the US throughout seven days before, during, and after major holidays like Christmas Day and New Year’s Day.

This graphic shows predicted and actual completed trips over a 200-day period in one city:

One of the holidays predicting demand for which was the most difficult is Christmas Day Source: Uber Engineering

Being able to evaluate a multitude of variables that influence demand, Uber defines a price that corresponds to the market state at a particular time to optimize its operations.

Hospitality: effective inventory allocation with flexible room rates

Static hotel pricing became economically inefficient with developing online distribution and transparent prices. In 2004, Hilton and InterContinental started experimenting with dynamic pricing. A year later, Accor joined the party, as well, Hyatt and Starwood implemented flexible pricing models for some of their corporate clients.

Machine-learning-based pricing can be considered the next evolutionary stage of this pricing technique.

Hotels leverage machine learning to support their pricing and inventory management decisions with insights extracted from large amounts of internal and external data. We devoted a whole article to the use of machine learning for revenue management and dynamic pricing in the hotel industry, so check it out if you want to learn more.

Starwood Hotels (a part of Marriott since 2016) uses data analytics to match room prices with current demand. In 2014, the hospitality company introduced its Revenue Optimizing System (ROS) in which it invested more than $50 million.

ROS integrates internal and external data and analyzes it in real time to forecast demand and suggest optimal rates. Internal data includes past and current reservations, cancellation and occupancy, booking behavior, room type, and daily rates. Reservation behavior and customer type (transient traveler or one person from a large group attending a specific event) influence pricing recommendations.

The revenue management software also takes into account climate and weather data, competitor pricing, booking patterns on other sources, checking whether concerts or other public events take place in the property area.

Room rates that correspond to ever-changing market conditions allow the hotel chain to effectively allocate inventory while maximizing revenue. According to David Flueck, who’s now Senior Vice President, Global Loyalty, the ML-based system has helped Hilton to increase demand forecasting accuracy by 20 percent since 2015.

eCommerce: machine learning-driven pricing optimization for a fashion retailer

Increasing number of retailers with brick-and-mortar and online stores are gradually joining the ranks of AI and ML practitioners from other industries to respond accurately to changes in demand.

Back in 2013, price intelligence firm Profitero revealed that Amazon made more than 2.5 million price changes daily. To help you imagine the scale of repricing activities by the eCommerce company, offline retailers Walmart and Best Buy were making 54,633 and 52,956 daily price changes respectively during November that year.

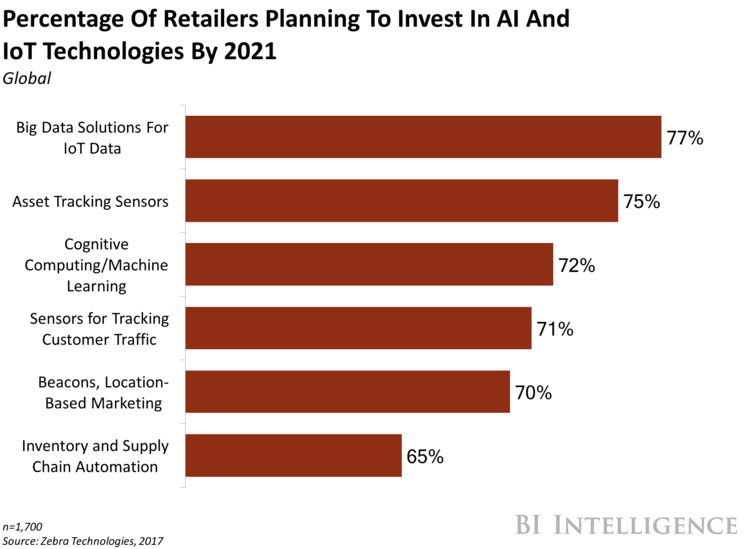

And Business Insider discovered that 72 percent of retailers plan to invest in AI and ML by 2021.

Practical goals that retailers set for investment into AI and IoT technologies. Source: Business Insider

As an example, let’s find out how researchers Kris Johnson Ferreira, Bin Hong Alex Lee, and David Simchi-Levi from the Harvard Business School and Massachusetts Institute of Technology addressed the price optimization problem for a flash sale website with designer apparel and accessories using machine learning.

Rue La La is the online-only fashion retailer that organizes one to four-day-long discounts (AKA events) on collections of similar items (AKA styles). Items that were sold during the event and for which merchants didn’t need to plan a subsequent sales event are called first exposure styles. Sales of these garments account for the lion's share of the retailer’s revenue. That’s why the management needed software that would support their pricing decisions and forecast demand.

“Since a large percentage of first exposure items sell out before the sales period is over, it may be possible to raise prices on these items while still achieving high sell-through; on the other hand, many first exposure items sell less than half of their inventory by the end of the sales period, suggesting that the price may have been too high. These observations motivate the development of a pricing decision support tool, allowing Rue La La to take advantage of available data in order to maximize revenue from first exposure sales,” the authors explain.

Researchers completed the project in two stages. First, they developed a demand prediction model for first exposure items.

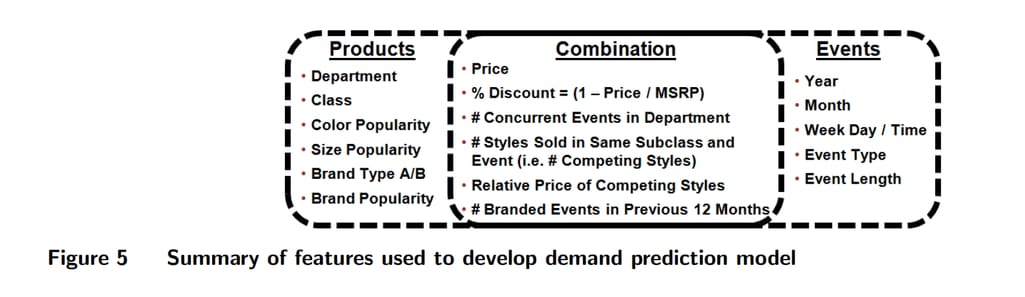

Sales transactions data from the beginning of 2011 until mid-2013 with time-stamped sales of items during specific events were used for model training. “This data includes the quantity sold of each SKU (dis), price, event start date/time, event length and the initial inventory of the item,” reveal the specialists.

The retailer also shared product-related data, such as brand, color, size, MSRP (manufacturer’s suggested retail price), and hierarchy classification. Goods were organized like this: each item (across all sizes) belongs to a style, a set of styles form a subclass, subclasses are parts of classes, and classes aggregate to form departments. These features – the price of a style, discount, and, relative price of competing styles – are connected with price. And the demand for a specific style depends on the price of competing ones. The price of competing styles acts as a reference price for shoppers. The reference price represents a price that a customer is ready (willing) to pay for an item or service.

Features for a demand prediction problem. Source: Analytics for an Online Retailer: Demand Forecasting and Price Optimization

Secondly, the scientists used the demand prediction data as input into a price optimization model to maximize revenue. A final algorithm that solves the multi-product price optimization problem while taking into account reference price effects was implemented in a pricing decision support tool for the merchant’s daily operations.

“We quantified the financial and market impacts of our tool for styles in various price ranges using a field experiment with Rue La La that lasted six months and that included 6,000 products,” said David Simchi-Levi in the 2017 article in MIT Sloan Management Review. “In the end, the decision support software led to a 10 percent increase in revenue for the company. This increase in revenue translated into a direct impact on profit and margin.”

Building an ML-based dynamic pricing solution: factors to consider

If off-the-shelf products lack some features that are necessary for your business, consider building your own solution. Of course, product development requires significant resources: a team of domain experts, developers, data science specialists and other employees, enough time and budget to make it all work.

Here are the factors worth considering for implementing a dynamic pricing strategy with a dedicated solution.

Feasibility of the dynamic pricing strategy

Alex Shartsis recommends businesses determine whether demand for goods or services is elastic or inelastic: “The most important factor to take into account is whether dynamic pricing is a fit for your business. Are your customers willing to pay a dynamic price for goods or services?” Price is considered inelastic when increasing it leads to, by percentage, a smaller drop in demand greater than the price increase.

For example, people will continue using electricity or water despite daily price fluctuations during the day. Demand is also inelastic for gasoline. Authors of the meta-analysis titled Review of Income and Price Elasticities in the Demand for Road Traffic Phil Goodwin, Joyce Dargay and Mark Hanly determined that if the real price of fuel goes and stays up by 10 percent, the volume of fuel consumed will drop by about 2.5 percent within a year, building up to a reduction of more than 6 percent in the longer run.

On the contrary, when consumers can easily find an alternative to a product/service that became more expensive, demand is elastic (i.e., a pair of jeans from X brand), so you may consider dynamic pricing.

Extensive and high-quality data

Data is an internal component for building any system with a machine learning model in its core. And structured and clean historical data (data about past events) is a must for training a well-performing model because the accuracy of model outputs depends on the quality of data. You can find more information about basic techniques for dataset preparation in our dedicated article.

Model training entails “feeding” the algorithm with training data for the analysis, after which it will output a model capable of finding a target value in new data. In our case, a target value is numerical – an optimal price.

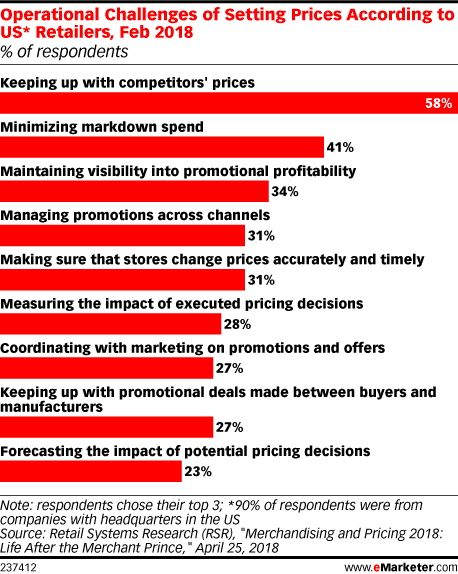

The dataset should contain data points representing as many variables as possible: historical prices for each service or product along with information about consumer demand, as well as internal and external influencing factors we mentioned before. Data with competitors’ prices are also crucial for making informed decisions. In fact, 85 percent of retailers who participated in the April 2018 study Retail Systems Research admitted that keeping up with competitor prices is their greatest challenge.

Operational difficulties that US retailers face when setting prices. Picture source: eMarketer

Stylianos Kampakis adds that data on customer price sensibility can be a bonus: “If a company has the possibility to even experiment with prices to understand the price sensitivity of different products, this would also be an immensely valuable source of information.”

Setting pricing boundaries in a model

It’s crucial to specify price minimums to keep margins on a desired level and maximums to match brand identity with prices. For instance, McKinsey experts advise retailers to include competitive guardrails to avoid pricing items too far above competitors. For background items (the opposite to key value items – items driving value perception the most) a price gap larger than 30 to 50 percent can demotivate a customer to shop in a store again.

Tracking performance and allowing for price adjustments

The solution may allow users to specify in which intervals of time they need prices to be changed. The founder of Perfect Price notes that the tool can update prices automatically, and does so as frequently as every few minutes, weekly, or monthly depending on the application.

A good practice to evade customer backlash is to check outputs by a dynamic pricing model, thinks Stylianos Kampakis. “For that purpose, it is best to do A/B testing with a small part of your user base to see how users will react,” explains the data scientist.

Monitoring model performance and adapting features (pricing factors in this case) are also necessary: “Make sure that you update the model at regular intervals. For example, if you are an online retailer, factors like fashion trends might make your model outdated. Hence, you need to establish a process for updating the model which can be repeated every year or quarter,” adds Kampakis. Data scientists consider the speed with which data becomes outdated to plan model performance testing.

Conclusion

The importance of an effective pricing strategy for running any business is hard to deny. Companies with an online presence are working in a highly competitive environment when a consumer can easily compare prices for goods or services (even when planning grocery shopping) and choose the offer that meets their needs and purchasing power.

At the same time, entrepreneurs can benefit from technology advances that come with the increase in computing speed, decrease in data storage, and greater availability of data for exploratory analysis to respond to changing market conditions with reasonable prices.

Dynamic pricing can be applied for both revenue management (where inventory is perishable and limited in quantity) and pricing optimization. In this context, machine learning allows businesses to implement dynamic pricing on a large scale while taking into account hundreds if not thousands of pricing factors, including price elasticity, and showing specific prices to customer segments with corresponding willingness to pay.