The hype around the blockchain technology has not been subsiding for several years. Step by step, the society approaches the wide adoption of the distributed ledger in the daily life. And financial services are currently the hottest area for this change. As we’ve already mentioned in our article on opportunities in insurance technology, payments and reinsurance seem to be the main spheres of adoption. At the same time, the technology also has a great potential in other industries.

But many people, even from the financial services, still have hard time understanding what kind of a beast blockchain is. And how a fintech company can employ blockchain to boost ROI. Let's get deeper into blockchain monetization and find out all that.

What is Blockchain?

Blockchain is a technology which allows making transactions (including those besides payments) between parties and storing all records in a highly secured and distributed database that can hardly be hacked or tampered.

Please note that we use the term distributed ledger interchangeably with blockchain. However, there’s a slight difference in meanings. The distributed ledger can be nearly any system with decentralized design but it doesn’t necessarily employ the chain of blocks structure. But in this story, we’ll be talking about the blockchain realization of distributed ledger.

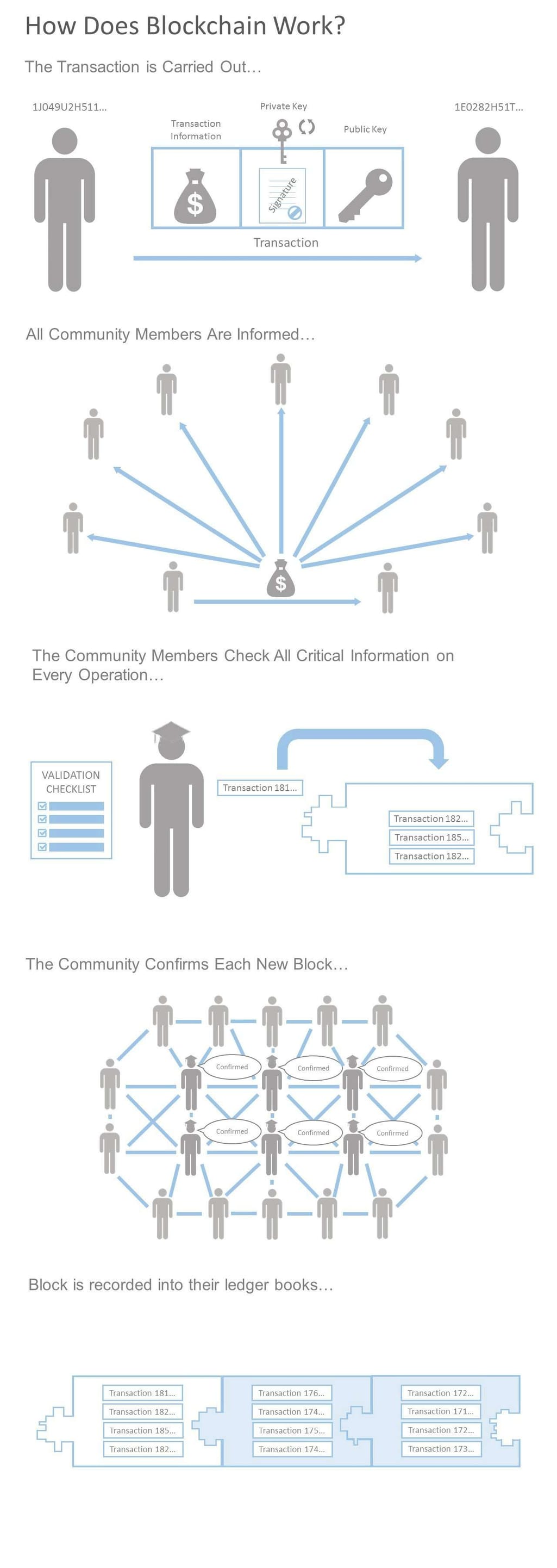

Let’s explore how blockchain works in simple terms.

- Imagine there is a group of people who often borrow money from each other. Every one of them has own ledger book to keep notes about their transactions.

- Some of them from time to time don’t play fair and add fake records to each other’s books to avoid paying back. These fraud events bring much mistrust into the community. Nobody is confident that he or she will successfully get money back.

- Let’s imagine that one day a clever bookkeeper decides to overcome this problem presenting an interesting idea to the community. He suggests everyone from the group to keep a copy of a public ledger book that would include all operations between group members instead of keeping individual books where notes can be easily altered.

- The bookkeeper suggests that all information about each transaction (a sum of money, a receiver, a lender, etc.) is encrypted with a special mathematical function called hash. Hash looks like a random set of symbols but it contains the transaction information and information about the previous transaction that happened between community members.

- When any transaction is carried out all community members are informed.

- The community members check all critical information on every operation (like duplications) and if there are no duplications, the operation is considered valid and trustful.

- When several deals are confirmed, people consolidate them into blocks. Every block has its own hash and each block hash also contains information about the previous block, similar to the way transactions are connected. Blocks are needed to simplify the process as it’s faster to calculate hash for blocks than to do the same calculations per transaction.

- The community confirms each new block as reliable and records the block with its hash into their ledger books.

- So why does this help against fraud? Now unfair members of the community have to decrypt and rewrite the whole chain of all transactions in all books in order to alter any record and avoid paying their debts.

In real life, ledger books can be servers or personal computers of users. By distributing the storage and making all operations heavily reliant on the previous ones, blockchain ensures high information security. This way of recording and encrypting data can be used for any transaction, not only those associated with financial operations.

Differences and Similarities Between Public and Private Blockchain Networks

Essentially, there are several important things to mention before diving deeper into cryptocurrencies, payment systems, reinsurance operations, and smart contracting. We should remember what’s common for all blockchain systems:

- It is a decentralized database which provides a real-time access to the historical records for all participants of a peer-to-peer network.

- Several confirmations from participants are required to determine a transaction as valid.

- All operations between parties are proven by digital signatures and secured by cryptography.

- The technology is highly resistant to scam and manipulations

- Each blockchain element is time-dependant

- The blocks of transactions could be customized with different terms (if-then-else), which allows adding different conditions to the standard mechanism

Each blockchain system is based on a private or public P2P network. This is a fundamental thing which allows the technology to fit well for different tasks in fintech.

Public Ledger

Blockchain based on the public ledger (commonly simplified to public blockchain) provides access to information for all participants and allows for writing records to the database without any permission. The lack of trust in such database requires introducing additional complexity to the process.

For example, in case of Bitcoin, the community uses mining. As we mentioned above, blockchain stores transactions data in encrypted blocks. The role of a miner is to create a block and thus provide a proof of work confirming its validity. Then a miner receives the financial reward for doing it.

Here are the specifics of the implementation. Bitcoin uses hash to encrypt data. But the hash isn’t only generated based on previous operations, it also has target hash conditions that add this additional layer of complexity. Basically, miners have to find a specific variable that would match the target hash by enumerating billions of variables. That’s pretty heavy in terms of computations as miners have to solve a complicated mathematical operation, or rather their hardware has to. But even this isn’t enough to complete a block.

At the same moment of time, multiple transactions can be added to multiple uncompleted blocks. The miner who appears to be the first in completing his or her own block is the winner. And as thousands of miners compete for adding the new block, the process of miner selection becomes close to stochastic. This ensures data reliability as unpredictable selection of a miner makes it nearly useless for anyone trying to meddle with the block completion.

Private Ledger

A network based on the private ledger is the opposite to the public one - mining isn’t required. It is like a private club. The approach is commonly used in cases when the information is secured by confidential agreements or private contracts. The system also differs from Bitcoin and other cryptocurrency blockchains like Ripple or Ethereum by the types of underlying protocols.

Fintech Applications of Blockchain (excluding Bitcoin)

What are the use cases in finance? The fintech business is not only about the high flight of technical minds. It’s also about generating cash and getting profits through the use of emerging technologies. So let’s talk about the ways to make money using blockchain.

Identity and Reputation

Companies working in this segment provide services of verification of personal identity using public databases. The blockchain technology is deployed to store both results of verification and ID information in the system. This provides compliance with know your customer (KYC) and anti-money laundering (AML) regulations.

The core value provided by such businesses is fraud prevention, which is particularly revolutionary in scams detection. Blockchain has proven to be much more secure than the classic approach to personal verification in public databases. The data in public sources can be changed, but the results of previous verifications stored in blockchain will help find inconsistencies.

Who are the players? These are companies like BlockScore, Civic, and Netki. Most of them provide services to financial institutions - banks, insurance companies and security brokers.

They would typically charge the client per each transaction verification or for a time limited subscription licence.

Payments Market

Companies in this segment use blockchain to carry out transactions for third parties providing advanced security in billing operations. They also support the following:

- provide reporting and invoicing tools to merchants

- carry out operations with digital cash using own private blockchain

- convert payments to local currency and vice versa. (In this case, a provider is responsible for successful money transfer to the counterpart)

Generally, there are two types of companies: first deal with cryptocurrencies and use Visa or Mastercard networks to carry out transfers in local currencies. The large players in this field are Abra and Bitpay. Others deploy their own networks or payment clearing services for local currencies based on blockchain, like Ripple.

Such businesses charge fees per transaction or per ATM use. Some of them are issuing own cards or partner with Visa and MasterCard. Payment companies usually provide own wallets to store money or partner with other players on the wallet market.

Digital Wallet

Wallets businesses are similar to the payments systems at first glance. In fact, their nature is different enough. They enable managing cryptocurrencies, accounts, or any other assets, via an interface. What they strive for is smooth user experience. Such applications help people send money or pay with their Bitcoins, Ethereums, Dashs, etc. So what’s the difference compared to payments apps?

Wallets usually don't process any the transactions or do any clearing payments. They just provide management tools for keeping cryptocurrencies. The main players are Jaxx, Luno, and Trezor. What about monetization here? Jaxx, for instance, bets on integration with third-party services and doesn’t charge any transaction fees. The company plans to earn revenue from internal advertising. So now it is focused on creating high quality user experience. Luno charges fees for withdrawal, trade (for operations at the exchange), deposit, etc.

At the same time, there are completely different models. Trezor sells physical wallets - hardware devices that operate as virtual ones. Some companies make money by providing vault services for keeping multiple cryptocurrencies.

Accounting, audit, and taxes

No matter how advanced the technology becomes, we still have to pay taxes, use some form of accounting services, and require audit. The widespread use of cryptocurrencies and the automation trend have lead to creation of blockchain accounting solutions, one of which is Libra.

Libra helps solving tax issues when using cryptocurrencies. The idea behind it is pretty simple. The system collects data about user activities from wallets, defines the tax, and provides some accounting and reporting features.

Today the company works on solutions for internal auditors and regulators. The system can help a wide range of potential clients, from individuals to professional service providers. Users sign up for free and get access to basic functions. Advanced features like tax assessment require annual subscription. In some cases, accounting platforms would allow users to purchase specific reports separately without charging for subscription.

Cryptocurrency Exchange

As everybody knows, any currency is a commodity. Cryptocurrencies aren’t an exception. If you want to buy or sell goods, you go to Amazon. If you want to trade stocks you go to the New York stock exchange. If you want to be a happy owner of Bitcoins, Dash, or any other digital asset you will go to the cryptocurrency exchange. The Bitcoin Rush only heats up the interest to this segment. Recently, the Bitcoin price hit nearly $2,500 per coin, according to Coinbase.

Marketplaces help buyers and sellers meet. When the transaction occurs, counterparts swap assets, and the exchange marketplace gets its fee, according to current pricing. The only thing that differs the digital currency exchange from the common one is the absence of such intermediaries as brokers. The common marketplaces are Coinbase, Gemini, and Kraken.

Mining-as-a-Service

As we mentioned before, mining is the process of solving difficult mathematical problems when working with cryptocurrencies. Mining can be a business of itself. It requires lots of computational resources and electricity to power hardware.

But besides miners, there are companies like Bitmain and Genesis Mining that provide services and products to help miners do their work. The players of this segment make money on selling on-premises mining hardware or providing access to their computing facilities on a contract basis. The model works similar to cloud computing making it a sort of mining-as-a-service business.

Financial Services Infrastructure: Smart Contracting

Companies operating in this segment of blockchain ecosystem act as the smart contracting environment providers.In addition to all typical benefits of blockchain, special case scenarios can be added to contracts in these environments, such as time tracking or automated conditions verification. These environments are currently used to sign corporate loans, private equity deals, and reinsurance contracts.

Notable examples of such businesses include Symbiont and Axoni. Axoni, for instance, sells a licence for using their ledger API that allows their clients to integrate any corporate infrastructure with the system.

Final word

It’s likely that you’ve first heard of blockchain because of Bitcoins or other cryptocurrencies. Obviously, the financial market is a best fit niche for such a high level of security. And today increasingly more fintech companies are building businesses around blockchain. Besides cryptocurrencies, the technology can bring a lot of benefits to other spheres by cutting costs, mitigating the risk of deals with untrusted parties, and reducing time for processing.

Blockchain drives an important and disruptive trend in the world of finance. As the adoption grows, we see how various intermediaries decrease in number, the ecosystem gets decentralized, and thus becomes more secure and agile.

Today blockchain also aids in better collaboration between different players. Fintech companies - standing on the front of innovation - cooperate with traditional organizations and regulators, rather than competing for the market.

As technology gradually approaches mass adoption in the financial industry, players from other spheres start recognizing the potential of it. The most promising areas beyond finance today are healthcare, retail, and travel.