“87% of companies feel digital transformation is a competitive opportunity. However, only 46% were investing in the development of digital skills.”

Source: Capgemini and MIT research

In light of the recent disruption wave, many industries have come to understand the importance of digital technologies in any modern business. While retail and travel were pretty quick to innovate, many more conservative industries and sectors are still lagging behind.

This is a part our series on digital transformation, where we identify the major trends shaping the future of business and talk about some outstanding companies that are already reaping the benefits of innovation. In this article, we will focus on digital transformation in the financial industry & banking.

Digitization Strategies in Finance and Banking

Until recently, consumer banking and finance have been quite slow to innovate. Burdened with overcomplicated legacy systems and outdated technologies, the long-established industry leaders were unable to compete with the newcomers who were actively disrupting the market.

However, financial organizations are currently becoming more customer-centric, adapting to growing consumer expectations and needs. Among the key strategies they adopt in this regard are:

-

Legacy system modernization

Replacing the outdated systems with customer-centric solutions and user-friendly design is one of the major challenges financial organizations have to face. Without a solid foundation, any digitization initiative is doomed. Thus, legacy system modernization should remain a top-of-the-agenda item for financial institutions and banks.

-

Simplified financial services

From customer-friendly online/mobile platforms to various add-ons, major organizations see digital transformation as a way to provide faster and easier access to day-to-day financial operations. Such a transition to direct banking will result in improved efficiency through reduced investments in tangible assets. Physical branches and offices might soon become extinct as more services will be provided remotely, through online or mobile channels.

-

Improved security

With advances in biometric recognition, financial institutions can offer more secure and reliable ways to identify a user, verify any transaction, or provide access to personal information. Using voice/facial recognition, fingerprints, iris scanning, or even multi-factor authentication instead of passwords should be a priority for any modern financial brand.

-

Transforming customer service

As any other service industry, finance and banking need to rethink their customer service tools and strategies. Instead of forcing a client to come to the bank or call support, some brands are already successfully providing customer service using convenient and familiar channels, such as instant messaging apps (Facebook Messenger, Whatsapp) or event social networks.

-

Adopting data science and AI

By collecting, analyzing, and applying vast amounts of data, financial organizations can gain a deeper understanding of their internal processes and business performance, and improve them accordingly. The insights sourced from historical data facilitate identification of trends and prediction of possible risks, thus helping companies make informed decisions and navigate the implications. Moreover, personal financial advisors and AI-based assistants are among the hottest fintech trends that many established organizations are currently adopting.

The following financial brands exemplify prominent, forward-thinking, digital organizations.

Capital One: Agile Bank with Data-Backed Customer Strategy

One of the leading digital banks, Capital One has always invested heavily in technology and innovation. Founded in the early 1990s, the company has been at the forefront of innovation ever since, being among the first companies to make extensive use of customer data for risk prediction and customized product offerings.

In 2014, the company switched from a traditional waterfall approach to the more flexible and responsive Agile project management methodologies, introducing them across the whole organization. This, as Rob Harding, CIO at Capital One, once mentioned in an interview, became a very important part of their digital journey.

Capital One was the first US bank to implement a mobile wallet using contactless NFC payments based on host card emulation (HCE) on Android devices. In 2016, the company also became the first one to offer voice-activated financial transactions using Amazon's Alexa virtual assistant.

Source - Amazon Alexa Skill for Capital One

Besides, Capital One has shown a great interest in data science: Predictive analytics and risk assessment have been at the core of the company’s strategy from day one. In a case study by Capgemini Consulting, the company’s CIO Robert M. Alexander stated, “Essentially, what we were doing in the ‘90s was leveraging the power of data to custom-tailor products to our customers.”

Currently, the company conducts over 80,000 big data experiments every year. Many of these experiments turned out to be successful, resulting in 87 percent improvement in customer retention and reducing the cost of customer acquisition by 83 percent over a period of 2-3 years.

The company has also launched Capital One Growth Ventures to foster innovation outside of the organization, focusing mostly on the projects in the fields of data and infrastructure, payments and commerce, and security and authentication. Among the startups Capital One has invested in are Chain - a leading enterprise blockchain platform, Cylance - a global provider of cybersecurity products and services, and H2O.ai - a scalable machine learning API.

MasterCard: Security-First Digital Financial Services

This global financial services corporation remains one the world’s leading financial services providers, having adopted a huge number of innovative products and strategies. Its integration with Android Pay and proprietary Masterpass digital payment service allows for fast, simple, and secure payments, be it online, in-store, or in-app purchases. The Masterpass system is successfully implemented as a part of the robotic interface, aimed at enhancing customer experiences on-site. Built in collaboration with SoftBank and Aldebaran Robotics, humanoid robot Pepper is powered by MasterCard’s system and currently accepts payments across multiple Pizza Hut locations.

Pepper, a customer service robot, created in collaboration with SoftBank and Aldebaran Robotics (image source)

MasterCard is actively adopting biometric recognition technologies, allowing its cardholders to verify transactions through facial recognition or fingerprints. The company even plans to expand this feature to include heartbeat recognition.

Moreover, the company is tapping the potential of data science and AI to fight fraud and provide real-time business insights on revenue, market share, customer demographics, and competitors to its customers.

RBS (Royal Bank of Scotland): Customer-Centric Mobile Bank

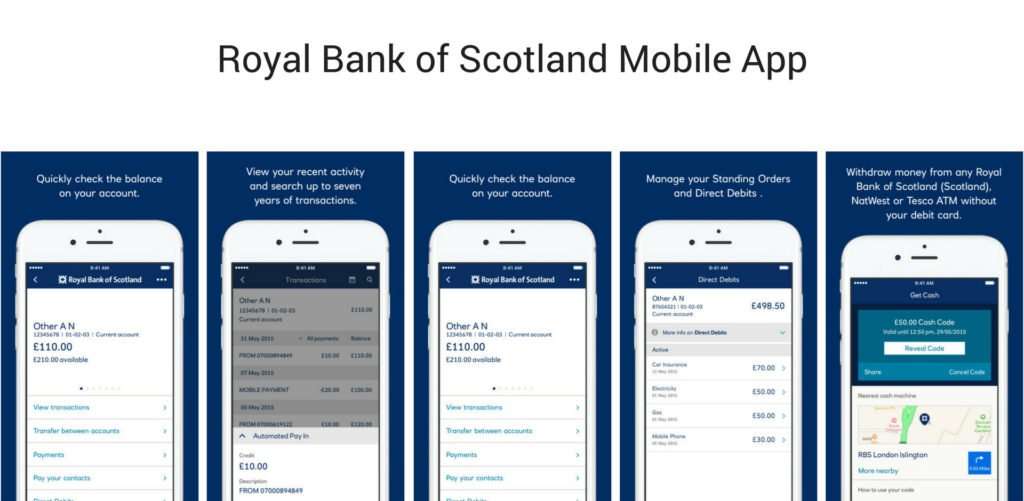

Founded in 1727, this European bank is among the most digitally advanced financial service providers worldwide. Since opening up its innovative technology center last year, the company has introduced a number of successful digital solutions.

RBS is one of the first financial organizations using an advanced human-like AI tool to help its staff process support queries and provide better customer service. The company is also offering 24/7 customer support through Twitter. Furthermore, the bank introduced a new interpreter service, allowing hearing-challenged customers to chat with support using British Sign Language.

Similar to MasterCard, RBS integrated Touch ID for improved security and efficiency and Apple Pay for contactless payments and convenient banking on the go. By extending its mobile banking app with a number of additional features, from applying for a loan or credit card to managing overdrafts, the company has reached 4 million mobile users.

Source: RBS Mobile App on the AppStore

Allstate: All-in-One Digital Insurance

The second largest insurance company in the USA and the largest one publicly held, Allstate Corporation is a 90-year old enterprise. Yet, the forward-thinking company is actively pursuing digital initiatives in a number of business fields.

The company has a full-featured online portal as well as its mobile equivalent, Allstate Mobile. In addition to digitizing traditional insurance services, the company has implemented several complementary products. One of them, the Digital Locker app, provides a simple way to keep track of your property, such as furniture, electronics, appliances, or even jewelry, by creating a visual mobile inventory.

Another application, Motor Club, offers 24/7 support for car owners. A user can request roadside assistance in case of emergency, regardless of his/her location, thanks to GPS and wide network of service providers across the USA.

As many other financial brands, Allstate understands the value of data. Its recent initiative, Arity, focuses on data science and predictive analytics. The project has evolved into a standalone unit, which, according to Allstate CEO Tom Wilson, will help “incorporate new data sources and enhance analytical capabilities in ways that we weren’t able to do when it was embedded in the insurance company.” The company’s products, APIs and SDKs, are generally available through the Developer Portal.

For more inspiration and best practices of digitization in insurance, read our latest article - Insurance Technology: 7 Disruptive Ideas to Transform Traditional Insurance Company

JPMorgan Chase & Co.: Capitalizing on Cloud Technologies

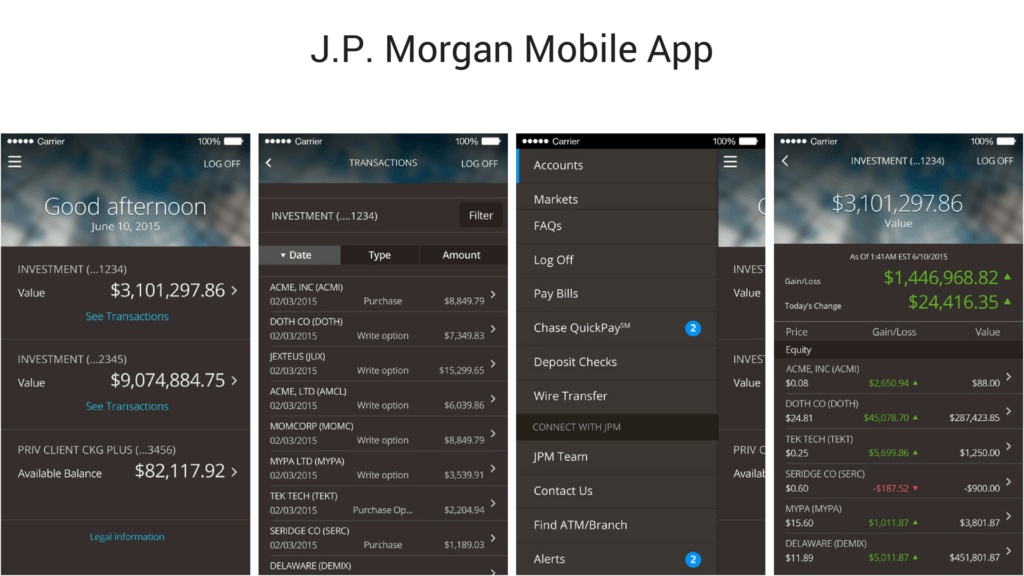

In his Annual Report 2015, the company’s COO, Matt Zames, stated that the company served nearly 40 million digital customers. At that time, the multinational holding company was spending approximately 30 percent of its technology budget (which accounts for more than $9 billion) on innovations.

JP Morgan started its digital transformation from within, adopting a BYOD approach as a part of its enterprise mobility strategy. This allowed more than 100,000 employees to access business applications securely using their personal mobile devices. The company is actively using real-time collaboration tools to optimize internal processes and increase productivity.

With its recent partnership with InvestCloud, JP Morgan plans to introduce advanced digital wealth management capabilities for individual investors. The initiative focuses on enabling “user-driven online investing through easy-to-use dashboards, additional mobile functionalities, and seamless account opening.” The company plans to add more capabilities to the product “to enrich client interactions with advisors, and further personalize the integration of J.P. Morgan’s market insights.”

Source - J.P. Morgan Mobile App on AppStore

The company is also betting big on cloud technologies. Over 90 percent of JP Morgan’s new infrastructure relies on its own private cloud environment. In addition to that, the company introduced a public cloud solution in 2015, adopting a hybrid model for faster access to both internal and external resources.

A solid cloud infrastructure allows the company to pursue AI initiatives. One of its most significant products, Contract Intelligence (COIN), is an ML-based program which automates the process of reading and interpreting commercial loan agreements. This process, which used to consume over 360,000 hours of work annually, currently can be done in seconds and with fewer errors.

Conclusion

Last year, financial technology companies all over the world scored over $36 billion in funding, based on the data provided by the Financial Technology Partners. With the next wave of fintech being upon us, traditional financial institutions are desperately looking for ways to adapt to the changing market conditions and stay competitive and relevant to the modern customer.

Some of them are actively acquiring or partnering with disruptive startups to compensate for the lack of internal innovative initiatives. Others invest in building proprietary technologies. What they all have in common is the understanding of the inevitable: Traditional financial services as we know them might soon be extinct. Right now, you either disrupt or you will be disrupted.

To learn more about how digital transformation reshapes different industries, see other articles from the series.

- Digital Transformation Stories: How UPS, Amazon, JD.com, Delta and Maersk Change Transportation and Logistics Industry

- Digital Transformation in Retail: How Starbucks, IKEA, Walmart, and Sephora Revolutionize Industry

- Digital Transformation Stories: How JetBlue and Marriott Advance Travel Experience