Insurtech is transforming insurance from a rigid, paperwork-heavy industry into a digital, data-driven ecosystem. By combining technology with insurance expertise, insurtech companies are redefining how policies are created, distributed, and experienced.

In this post, we explore the current insurtech landscape, key trends across segments, and the technologies and companies shaping the future of digital insurance.

Insurtech market overview

What is insurtech and how does it reshape the insurance industry?

Insurtech — short for insurance technology — refers to the use of digital technologies to modernize how insurance products are designed, priced, sold, and managed.

Technologies that are currently driving the most value in the sector are

Other technologies being explored are digital twins, IoT, edge computing, and agentic AI.

Over the past decade, insurtech companies have challenged traditional insurers by applying advanced tech to historically time-intensive, manual workflows across the entire value chain: from initial underwriting and risk assessment to claims processing and customer service.

As a result, insurers are shifting to more efficient operations and offering more personalized products to customers.

Insurtech market

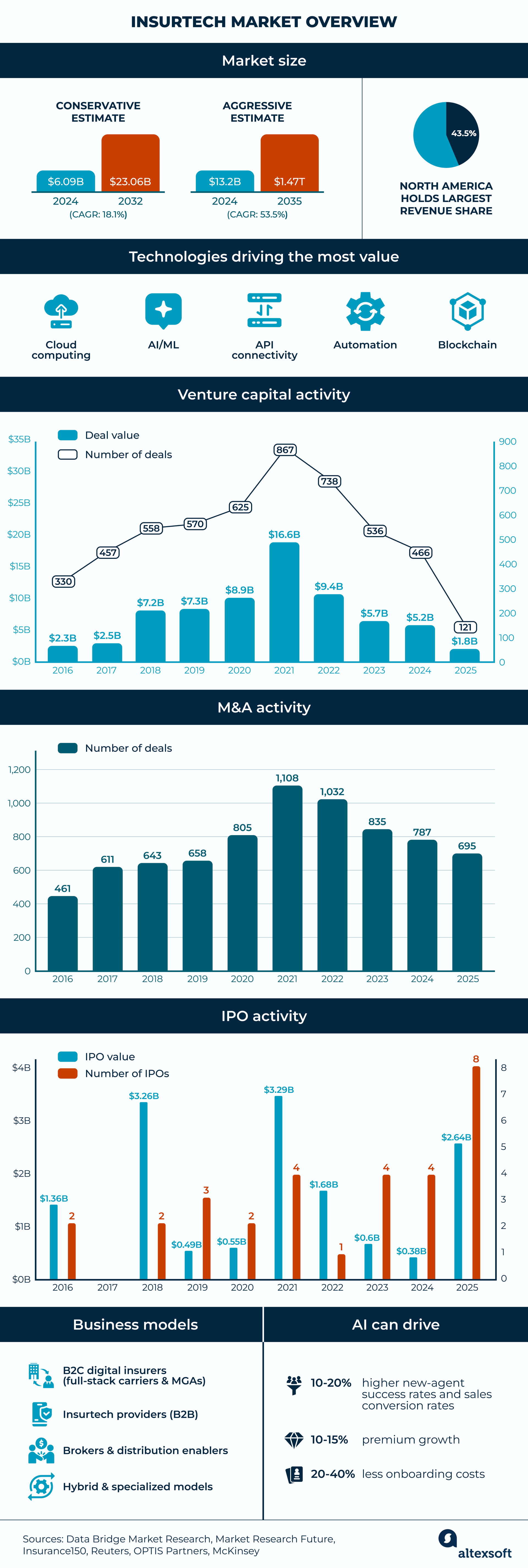

The valuation of the global insurtech market varies significantly based on the scope of inclusion—ranging from pure software providers to full-stack digital carriers. Here are several forecasts.

Data Bridge Market Research estimates the insurtech market at $6.09 billion in 2024 and expects it to reach $23.06 billion by 2032, at a CAGR of 18.1 percent. This conservative estimate largely reflects the revenue of dedicated technology providers and SaaS platforms servicing the industry, signaling a massive growth runway as legacy carriers continue their digital transformation.

Grand View Research expects the market to reach $152.43 billion by 2030, growing at a CAGR of 52.7 percent from 2023 to 2030.

Market Research Future values the insurtech market at $13.2 billion in 2024, and expects it to grow to $1,471.86 billion by 2035, at a CAGR of 53.5 percent.

The range is massive – but all major indicators point to robust, double-digit expansion that outpaces the traditional insurance sector.

Regional dynamics

The global adoption of insurtech is uneven, driven by differing regulatory environments and consumer needs.

North America dominates the market, holding the largest share of revenue (43.5 percent) due to a mature venture capital ecosystem and high adoption of cloud-based platforms by Tier 1 carriers.

Despite its dominance, North America faces challenges with market saturation and the need for insurers to differentiate themselves amidst fierce competition.

Asia-Pacific represents the fastest-growing region. Rapid urbanization and a mobile-first population in markets like India and Southeast Asia are driving demand for microinsurance and embedded products.

Europe continues to lead in regulatory innovation but faces challenges with cross-border data privacy regulations, which could slow down the adoption of embedded and cloud-based solutions.

Drivers of expansion

The market's expansion is underpinned by several key drivers.

Visible results from tech adoption. Even though it demands high investment, AI is already delivering measurable impact across insurance operations, affecting costs, revenue, and efficiency. For example, McKinsey estimates that AI can drive

- 10-20 percent improvement in new-agent success rates and sales conversion rates,

- 10-15 percent increase in premium growth,

- 20-40 percent reduction in costs to onboard new customers, etc.

This is why tech adoption has moved from “experimental” to “critical infrastructure” for incumbent carriers.

Watch how AI reshapes insurance

Consumer demand. The “Amazonification” of consumer expectations — shaped by digital-first platforms — has raised the bar for speed, personalization, and convenience. Customers increasingly expect instant quotes, transparent pricing, and seamless digital experiences, pushing insurers to modernize legacy systems and redesign products around user needs.

Regulatory adaptation and support for innovation. While regulation presents certain limitations, it increasingly provides clearer frameworks for digital insurance products.

In the US, the National Association of Insurance Commissioners (NAIC) has issued model bulletins on the use of AI systems, focusing on governance, bias mitigation, explainability, and overall responsible use of AI models. This allows insurers to deploy AI solutions, provided outcomes remain transparent and auditable.

In the UK, the Financial Conduct Authority (FCA) regulatory sandbox enables insurers and insurtechs to test products with real customers under controlled conditions. Similarly, the European Insurance and Occupational Pensions Authority (EIOPA) provides guidance on cloud outsourcing, digital distribution, and AI governance, helping insurers scale cloud-native systems across markets.

In Asia, the Monetary Authority of Singapore (MAS) actively supports parametric and API-driven insurance models through dedicated sandboxes and regulatory guidance.

Growing investment. Investment from both venture capital (VC) firms and established insurers fuels expansion by providing insurtechs with the capital needed to build technology, scale distribution, and absorb early losses as new models mature.

Investment activity in insurance

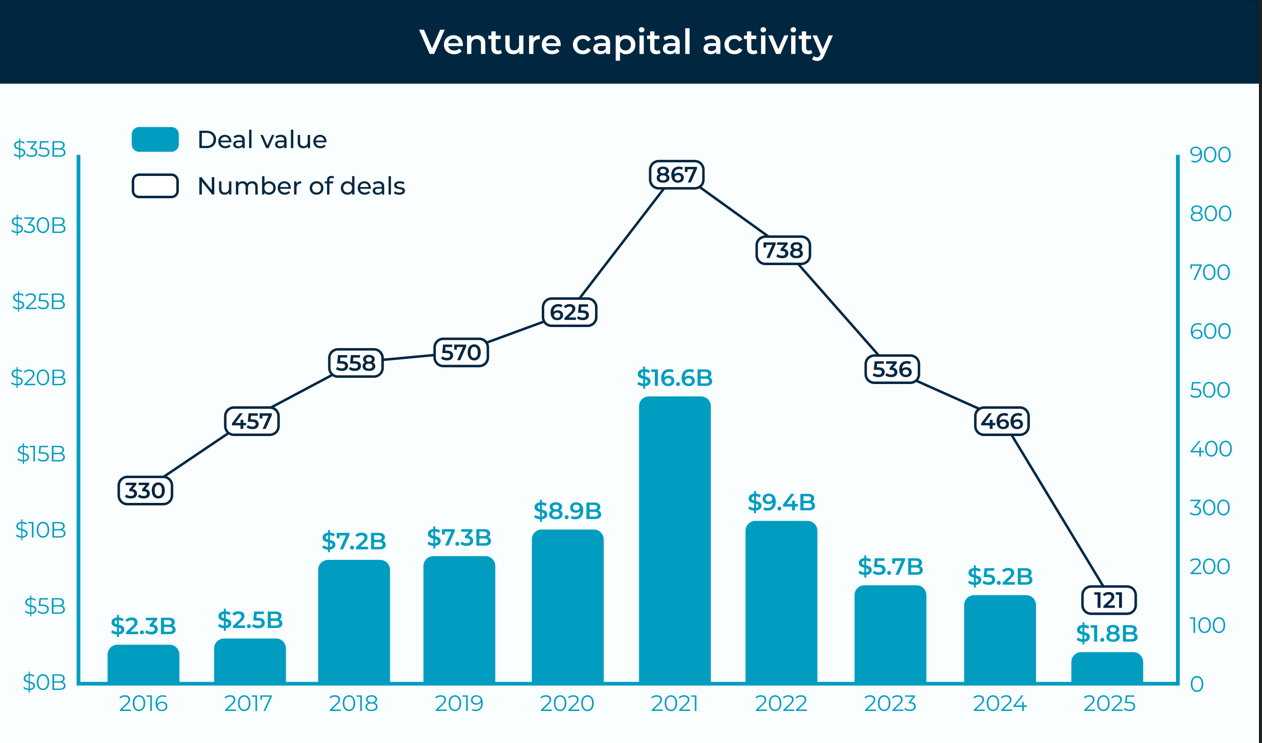

Since insurtech is mainly represented by young, digital-native startups, understanding the capital dynamics is essential. Lately, the funding environment has shifted away from a “growth at all costs” approach toward unit economics and profitability.

Funding

According to Insurance 150, after peaking in 2021 — when insurtech funding reached $16.6 billion across 867 deals — the market entered a correction as rising interest rates reshaped investor priorities.

In 2022, total funding fell to $9.4 billion, followed by a sharper decline to $5.7 billion in 2023 and a further drop to $5.2 billion in 2024.

Insurtech VC deal activity by year. Source: Insurance 150

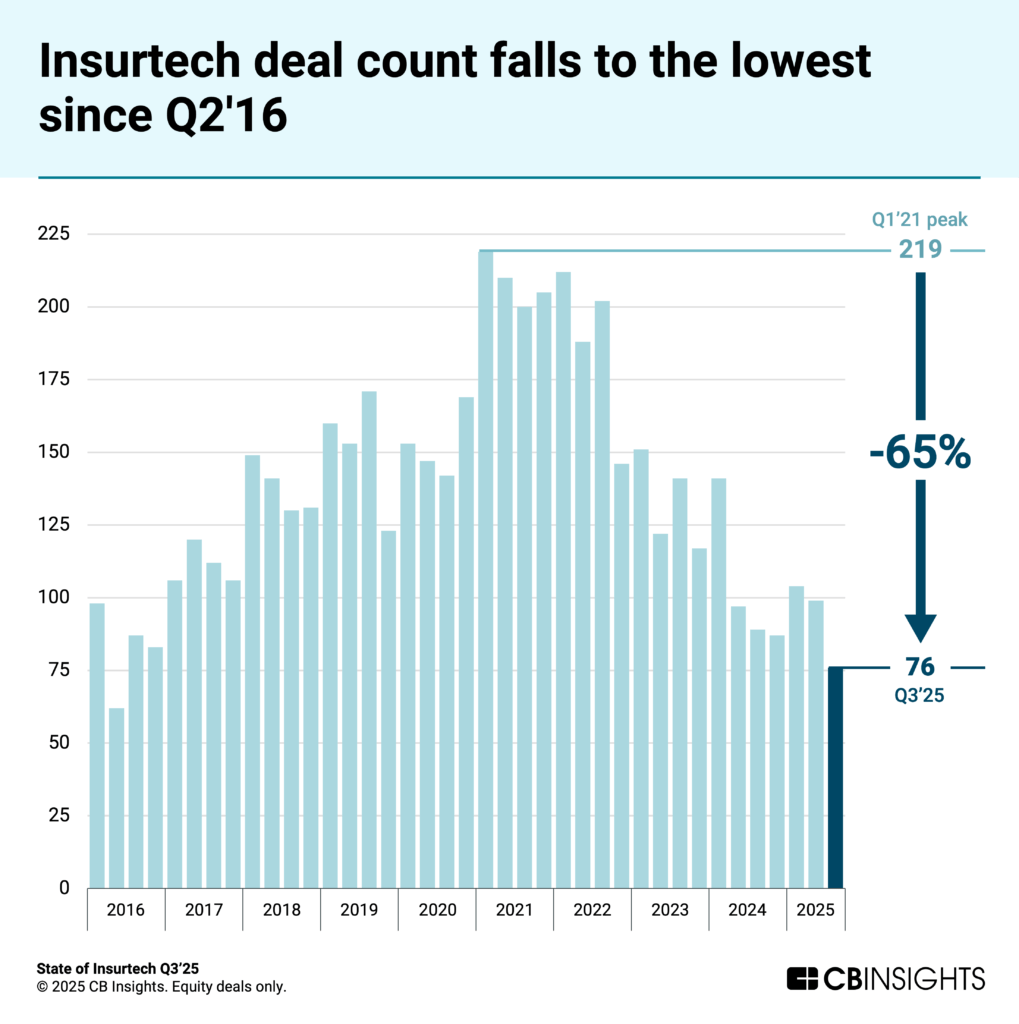

By Q1 2025, investment activity remained subdued, with just $1.8 billion raised across 121 deals. The slowdown deepened by Q3 2025, when deal volume dropped to 76 — the lowest level since 2016 and 65 percent below the Q1 2021 peak of 219 deals.

Transaction volume in all segments (property and casualty, life and health, etc.) declined quarter over quarter, underscoring sustained investor caution throughout the sector.

Quarterly insurtech deal count. Source: CB Insights

As investors now prioritize sustainable profitability, fewer deals occur, but with greater selectivity and a focus on mature players.

Mergers and acquisitions

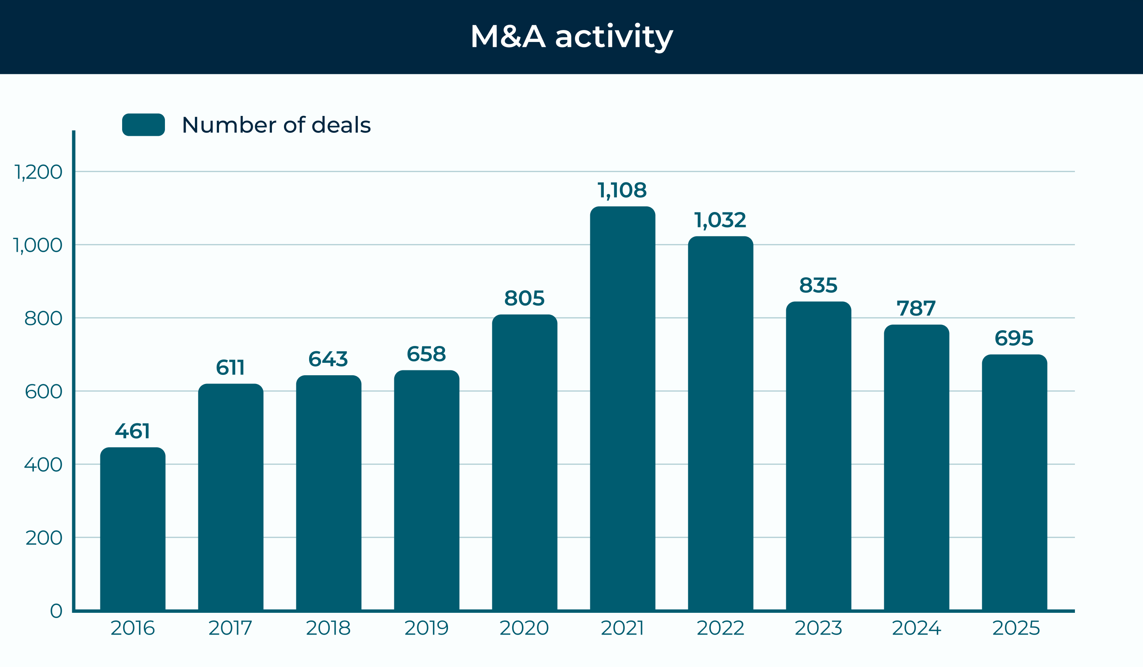

M&A remained an important — though more measured — growth lever for the insurance industry in 2025. According to the OPTIS Partners 2025 M&A Report, a total of 695 deals were announced in 2025 — a 12 percent decline compared with 787 deals in 2024, bringing activity closer to pre-boom levels seen in 2019.

M&A activity. Source: OPTIS Partners

The buyer pool also narrowed, with fewer active acquirers, reflecting a more disciplined and selective market. Large, strategic deals remained prominent, such as

- Arthur J. Gallagher & Co. acquired AssuredPartners for $13.5 billion;

- Brown & Brown acquired Accession Risk Management Group for $9.83 billion;

- Aquarian Capital announced its acquisition of Brighthouse Financial for $4.1 billion;

- Sompo Holdings agreed to acquire Aspen Insurance Holdings for $3.5 billion – just 3 months after Aspen’s IPO (the deal is expected to close in the first half of 2026); and

- Munich Re acquired Next Insurance for $2.6 billion.

The report also noted that the pace of deal activity and the number of buyers have been decreasing since 2021, signaling a consolidation phase, mainly driven by private equity-backed buyers.

IPO

Despite the M&A slowdown, public markets showed life. The number of insurance-related IPOs on US exchanges hit its highest levels since 2005. A total of 8 companies were listed in 2025, collectively raising $2.64 billion, with major contributions from Accelerant Holdings, Slide Insurance, Aspen Insurance, and Neptune Insurance.

While concerns over falling insurance prices and tariff-driven higher claims persist, bankers expect the industry's strong growth to attract investors. Companies like Ethos Technologies, SafePoint Insurance, and ACKO are reportedly preparing for IPOs in 2026.

Unicorn landscape

Noteworthy privately held insurtech players that dominate in both funding and valuation include

- Devoted Health (US, health insurance provider): $2.26 billion raised, $12.6 billion valuation;

- Coalition (US, cyber insurance and security services): $800 million raised, $5 billion valuation; and

- Alan (France, health insurance provider): $747 million raised, $4.5 billion valuation.

As insurtechs grow, traditional carriers are not standing still. Incumbents like Allianz, AXA, and Zurich are effectively becoming “hybrid” insurtechs, actively developing their own digital capabilities, as well as acquiring smaller providers to enhance their stacks.

Insurtech by business model: where investment goes

The insurance ecosystem can be categorized by business model. Capital allocation for these models also reveals where investors see the strongest growth and scalability. While early funding favored digital insurers that resembled traditional carriers, recent years have seen a shift of investment toward capital-light, infrastructure-driven models with clearer paths to profitability.

Note that we included both venture-backed, private companies, along with more mature firms that have already gone public.

B2C digital insurers (full-stack carriers and MGAs): traditional model that loses ground

These companies operate as insurers (or MGA-led carriers), owning the customer relationship and often the underwriting economics. They focus on simplifying products, automating underwriting and claims, and delivering a fully digital experience.

Companies in this category operate using a traditional, easy-to-understand model, offering direct access to premium pools and a clear revenue growth trajectory.

The 2020-2021 IPO boom brought the first generation of full-stack insurtech carriers (Lemonade, Oscar Health, Hippo, Root Insurance) to the public markets, each raising over $1 billion in capital.

However, all of them later experienced sustained stock price pressure, reflecting a change in investor attitude. Though late-stage startups such as Devoted Health or Alan still raise significant funds, the market has pulled back from this model due to high capital requirements and volatility.

Insurance technology providers (B2B): capital-light model that attracts the largest share of investment

These insurtechs do not sell insurance. Instead, they provide the infrastructure that enables insurers, MGAs, and brokers to modernize operations. Some focus on a single insurance vertical, such as health or property, while others build segment-agnostic platforms used across multiple lines of business.

This category now attracts the most consistent and durable capital inflows. Investors favor SaaS economics, long-term contracts, and low regulatory and balance-sheet exposure. Crucially, this model scales with the industry’s overall digitization — regardless of which carriers ultimately win market share.

Core platforms and systems of record power mission-critical insurance workflows and are deeply embedded in carrier operations. It’s the largest subsegment with such established providers as Guidewire, which reached a market capitalization of nearly $20 billion at its peak in late 2025 before pulling back, and Duck Creek Technologies, which raised over $1 billion prior to its IPO and was later taken private in a $2.6 billion transaction — a strong signal of long-term infrastructure value.

Venture capital remains active in this space as well. For example, Zinnia, a life and annuities insurance technology provider, raised $300 million in 2024, reflecting continued investor confidence in modern core platforms for complex insurance products.

AI-driven claims, fraud, and decisioning subsegment has seen sustained venture funding as insurers automate cost-heavy workflows. London-based unicorn Tractable has raised approximately $185 million to scale its AI-based damage assessment platform. Similarly, Paris-based Shift Technology reached unicorn status after raising $220 million, reflecting strong demand for AI-powered fraud detection.

Pricing, underwriting, and analytics platforms have also attracted substantial capital. Akur8 raised $120 million in 2024 to expand its AI-driven pricing models, while Earnix raised approximately $290 million in 2025, reinforcing investor confidence in data-driven pricing and risk optimization as core components of modern insurance stacks.

Brokers and distribution enablers: new models that gain traction

Brokers, digital marketplaces, and distribution enablers occupy the front end of the insurance value chain. Unlike carriers, they do not carry underwriting risk. Instead, they connect customers to carriers and shape how insurance is discovered, purchased, and managed.

From a capital perspective, traditional brokers generally attract private equity and strategic acquisition capital, while digital distribution platforms and marketplaces draw venture and growth funding.

Brokers and consolidators. Brokers focus on advisory services, risk placement across multiple carriers, and client relationships. Their growth is driven primarily by M&A roll-ups, with stable revenue and a defensible position in commercial insurance.

Brown & Brown and Hub International have executed hundreds of acquisitions over the past decade, consolidating tens of thousands of agency locations and driving predictable cash flows.

Marketplaces (digital distribution platforms). Digital marketplaces combine brokerage access with technology-driven customer experiences, often supporting both direct and agent-assisted distribution. They benefit from network effects — matching consumers with multiple carriers — and data-driven personalization.

Policygenius is a prominent digital insurance marketplace founded in 2014. The company has raised over $276 million in total funding, including a $125 million Series E round in March 2022 led by KKR. In 2023, Policygenius was acquired by Zinnia, underscoring strategic demand for distribution platforms that control customer access and data at the point of purchase.

Wefox is another example worth mentioning. It raised over $1.6 billion and reached a $4.5 billion valuation at its peak in 2022, though it later underwent significant restructuring and asset sales in 2024-2025 to refocus on its core profitable segments.

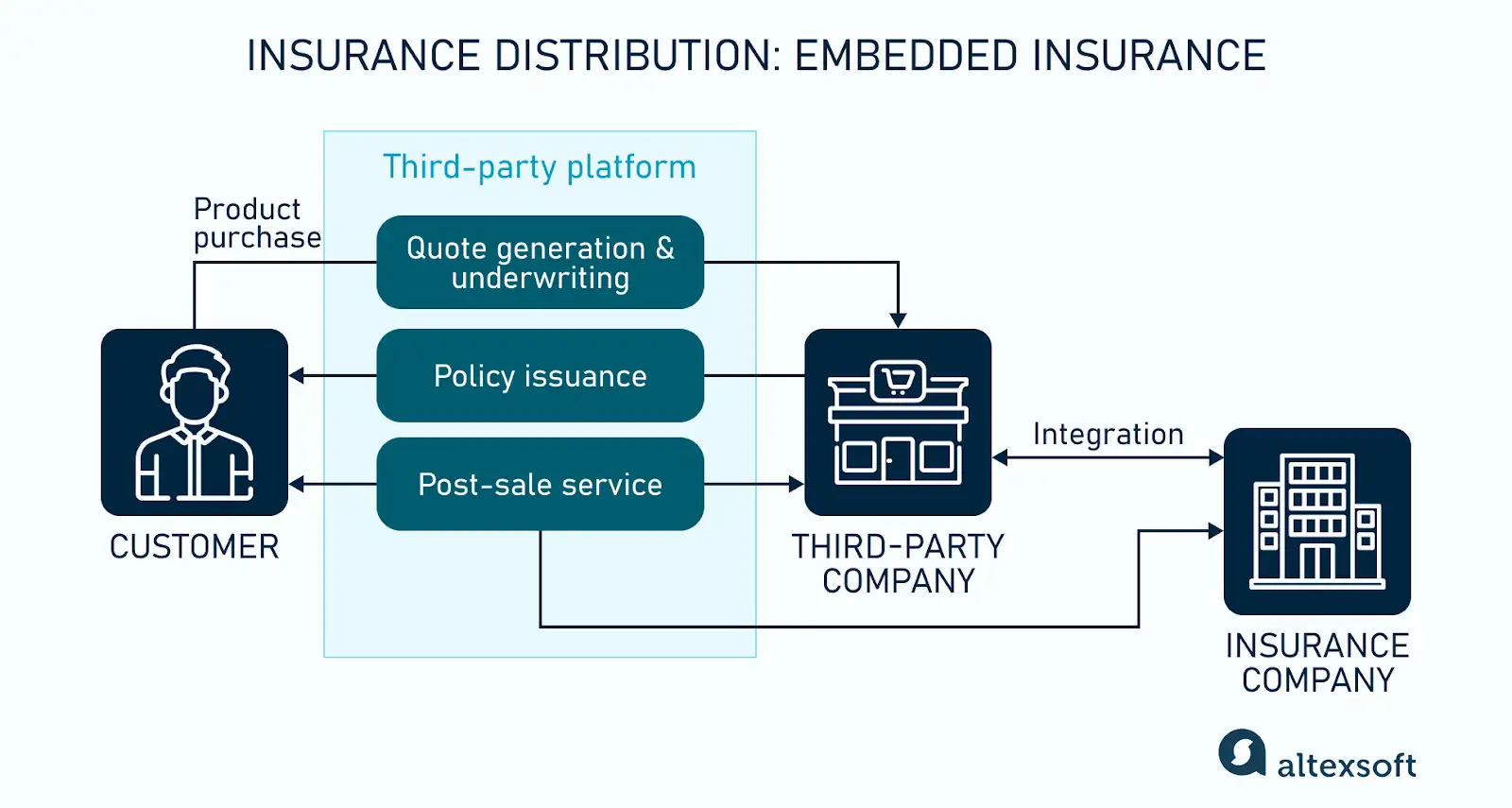

Embedded insurance and API-driven enablers. Today, embedded insurance is gaining traction — that’s coverage offered directly on noninsurance platforms such as travel bookings, eCommerce checkouts, mobility apps, or fintech products.

How embedded insurance works

Embedded models position insurance as a contextual service rather than a standalone purchase, fundamentally changing how insurance is distributed and consumed.

The companies in this category attract investor attention with asset-light models, recurring platform revenue, and exposure to massive distribution channels without carrying underwriting risk.

In this category, bolttech has raised close to $1 billion and achieved a $2.1 billion valuation, becoming one of the largest embedded platforms globally. Cover Genius, offering embedded insurance across travel, retail, and mobility partners, has raised over $240 million, reaching unicorn status. Additionally, established incumbents such as Allianz and AXA have been actively developing their own embedded products.

Hybrid and specialized models: niche products and services

Hybrid and specialized insurtechs focus on specific, high-impact risk categories rather than broad insurance coverage. These companies typically combine insurance with risk prevention, monitoring, or intelligence, creating differentiated offerings aligned with structural macro trends such as rising cybercrime, climate volatility, and supply-chain disruption.

From an investment standpoint, this segment attracts targeted, high-conviction capital rather than broad-based funding. While the total addressable markets are smaller than mass-market P&C or health insurance, investors value these models for their defensibility, pricing power, and alignment with noncyclical risks.

A prominent example is Coalition, which combines cyber insurance with continuous security monitoring and risk mitigation tools. Coalition has raised over $800 million and reached a valuation of around $5 billion, illustrating strong investor confidence in cyber insurance as both a protection and prevention business. Its model reduces loss ratios by actively lowering risk, not just pricing it.

In the climate and catastrophe space, Descartes Underwriting focuses on parametric insurance products that trigger payouts automatically based on predefined environmental data, such as rainfall levels or wind speed. The company has raised more than $150 million, backed by institutional investors betting on data-driven climate risk transfer as traditional catastrophe models face increasing strain.

Key insurance verticals: trends and challenges

Experts predict that the next five years will be defined by the rigorous application of agentic AI, the ubiquitous presence of embedded protection, and the transition of the insurance value proposition from paying claims to preventing losses.

While digital products continue to reshape the industry, insurers face shared challenges in data privacy, regulatory fragmentation, integration with legacy systems, and systemic risk management.

Life and health insurance

The life and health sector is moving away from invasive medical exams toward algorithmic underwriting. By leveraging data from wearables, prescription histories, and electronic health records, insurers can issue policies in minutes rather than weeks.

The main challenge is balancing speed and accuracy with strict data privacy requirements and maintaining consumer trust in automated decisions.

Notable insurtechs: Clover, Oscar Health, Alan, GoHealth, Devoted Heath

Property/auto insurance

In P&C and auto domains, the focus on prevention over payout is especially strong. IoT integration (smart home sensors, telematics) allows insurers to monitor risks in real time—detecting a water leak or safe driving habits—and price policies accordingly.

The challenge remains in integrating these data streams into legacy core systems at scale.

Additionally, the automotive sector represents the frontier of embedded innovation, driven by the rise of connected vehicles and real-time data. Tesla Insurance illustrates this shift by using live driving data to dynamically price risk, bypassing traditional proxies and pushing incumbents toward telematics-based models to avoid adverse selection.

At the same time, traditional automakers are embedding insurance directly into the vehicle purchase journey through partnerships and in-house programs, signaling a broader move toward data-driven, OEM-integrated insurance offerings.

Notable insurtechs: Lemonade, Hippo, Root Insurance, Amplify

Travel insurance

Travel is heavily utilizing newer approaches and products, like embedded insurance and parametric policies. Instead of filing a claim for a cancelled flight, travelers can now receive automatic payouts the moment a flight is flagged as delayed in the airline's system. This seamless, “invisible” insurance experience is setting the standard for customer expectations across the broader industry.

Travel insurance faces challenges around heavy reliance on third-party data for parametric payouts and fragmented cross-border regulation.

Notable insurtechs: Faye, Battleface, Blink Parametric

Business insurance

Business and commercial insurance is being transformed by digital distribution and automation, particularly for small and mid-sized businesses. Insurtechs are simplifying complex policies, speeding up underwriting with industry-specific data, and embedding coverage in accounting, payroll, and eCommerce platforms.

At the same time, demand is growing for specialized products such as cybersecurity insurance and climate-related parametric coverage, which address rising digital and environmental risks.

The main challenge lies in handling complex risks while maintaining the simplicity SMBs expect.

Notable insurtechs: Ergo Next (formerly Next Insurance), Coalition, Hiscox, Descartes

Summing up, the current insurtech market is more about rewiring the insurance industry, rather than disrupting it. The divide will not be between “incumbents” and “insurtechs,” but between organizations that successfully transition to AI-driven, data-centric, and prevention-oriented business models – and those that remain tethered to reactive, paper-based legacy systems.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.