Airlines operate on razor-thin margins. Aircraft are expensive to acquire and maintain, seats—the core product—are perishable, and competition is intense. Amid these pressures, there is a narrow pricing corridor where fares are both competitive and economically viable. That’s why revenue management—and the tools behind it—is so critical for airlines.

In this article, we explore revenue management systems (RMSs) for airlines. You’ll learn about the core functions of modern RMS platforms, compare solutions from different providers, and understand when building a custom RMS actually makes sense.

What is RMS

A revenue management (RM) system is software used by airlines and other travel businesses to optimize pricing, inventory control, and overall profitability. It analyzes large volumes of historical and real-time data to forecast demand, support pricing decisions, and adjust availability in sales channels.

Airlines were pioneers of revenue management, as the industry's pricing complexity required a high degree of ingenuity and proactive thinking. Early attempts to forecast demand and adjust fares accordingly relied largely on the intuition and judgment of industry practitioners. However, major carriers soon realized that manual approaches were unreliable and began investing in analytical software. For example, Delta Air Lines developed its first computerized dynamic pricing model in the early 1980s.

According to 2024 industry statistics, airlines accounted for 38 percent of all RMS users in the travel business, with more than 26,000 active systems in operation. On average, airlines reported a 14 percent increase in route profitability driven by revenue management.

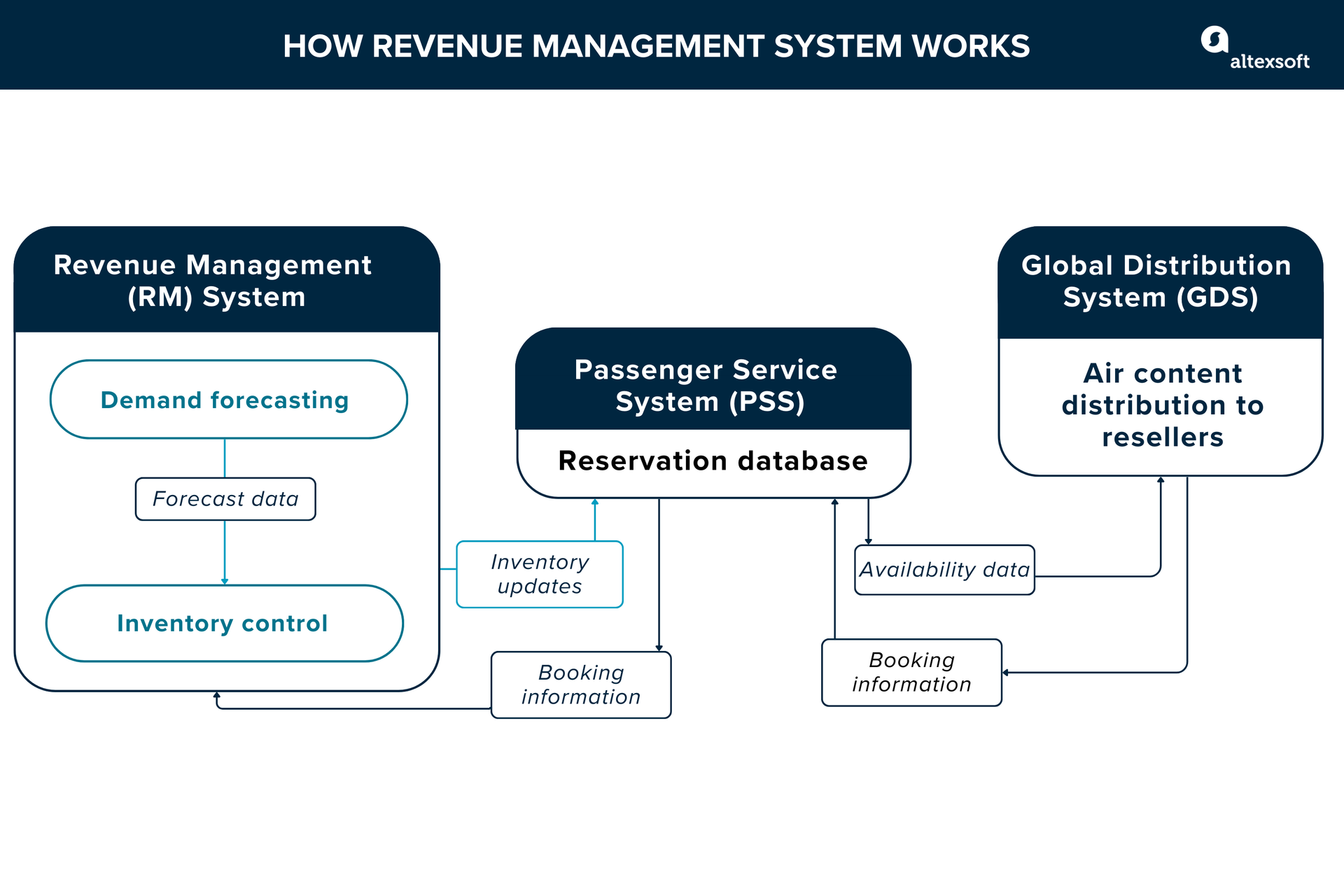

How RMSs work

Historically, RM systems were built around fare classes (fare buckets) with predefined prices. Today, they increasingly support two models in parallel: the classical RM approach and real-time dynamic pricing capabilities aligned with Offer and Order (O&O) management, a modern way to create and sell airline products. This shift is enabled by cloud-native, microservices-based architectures that can scale computation and decisioning in real time.

What classical RMSs can do

Revenue management is commonly described as selling the right product to the right customer at the right time for the right price. In classical RM, this is achieved by forecasting demand and controlling availability throughout fare buckets. Each bucket corresponds to a distinct airline product, combining a price level with specific conditions such as refundability or change restrictions, and is distributed through a one-letter Reservation Booking Designator (RBD) like Y, J, M, or K.

Now, let’s look at the functions of a traditional RMS in more detail.

Core revenue management system modules

Demand forecasting. A core function of an RMS is to predict future demand by analyzing historical bookings and fares, seasonality patterns, and observed booking behavior. Forecasts can be generated at a granular level, for example, by flight leg (a single flight segment between two airports), entire itinerary, departure date, or point of sale (POS).

Historically, demand forecasting relied on statistical models, including time-series analysis, booking-curve methods (how occupancy changes over time as you get closer to arrival), and regression-based approaches. Over the past decade, machine learning techniques have been increasingly adopted, enabling RMSs to incorporate more variables, capture more complex demand patterns, and improve accuracy up to 40 percent. And it yields to financial results: Research from PROS indicates that a 10 percent boost in forecast accuracy leads to a 1 percent increase in revenue.

Regardless of the modeling approach, demand forecasts remain a foundational input for downstream optimization. In classical systems, they feed inventory control, while in more modern setups, they also inform real-time price adjustments.

Inventory (bid-price) control. Rather than setting prices directly, the module controls seat availability in predefined fare classes and price points. It applies a logic often described as fare fencing to limit access to lower fares when expected future demand indicates that inventory should be preserved for higher-value bookings.

Why flight fares constantly change

At the core of the fare-fencing framework is the bid price—the minimum acceptable revenue for selling one additional seat. Bid prices are derived from demand forecasts, remaining capacity, and time to departure, and can be calculated either at the leg level or at the network, or origin-and-destination (O&D), level, where the value of a seat is assessed in the context of the passenger’s full itinerary.

If a fare’s expected revenue falls below the current bid price, that fare—along with all lower-priced fare classes—should be closed to protect capacity for higher-value demand. The output of this module is a set of booking limits or availability controls, such as instructions to close or reopen specific reservation booking designators (e.g., “Close Q, keep M open”).

These instructions are sent downstream to the passenger service system (PSS), which enforces availability decisions and propagates updates across distribution channels, including GDSs, the airline’s website and mobile app, and directly connected resellers.

Overbooking control. The module calculates optimal overbooking levels for each flight based on historical no-show and cancellation behavior, expected show-up rates, and the cost of denied boardings. Its objective is to maximize expected revenue by accepting bookings beyond physical capacity to a calculated threshold, balancing additional ticket sales against bumping costs.

Group and allotment control. This module evaluates whether a large booking request is economically viable by estimating its displacement cost—the revenue the airline would forgo by allocating seats to a group instead of higher-yield transient demand. Based on this assessment, the system supports accept, reject, or counter-offer decisions.

Performance monitoring. The performance monitoring module tracks how revenue management decisions perform relative to forecasts and targets throughout the booking lifecycle. It analyzes key indicators such as load factor, yield, revenue, spoilage (empty seats), spill (lost demand due to closed availability), and denied boardings. These insights are used to identify forecast bias, control errors, and structural demand changes, and they feed back into demand forecasting, inventory control, and overbooking modules to recalibrate models and parameters over time.

New era modules: price optimization

Classical revenue management systems do not set prices directly. Instead, fare creation and inventory control are intentionally separated. Fares are predefined by dedicated commercial teams and published as discrete fare classes through Airline Tariff Publishing Company (ATPCO). This separation reflects both technical constraints (pre-filed fares, fare-class structures) and organizational governance, where pricing decisions are managed centrally and updated far less frequently than availability.

As the industry moves toward New Distribution Capability(NDC) and the O&O (Offer and Order) management model, airlines gain the ability to dynamically adjust offers at the time of shopping. This reduces the traditional separation between pricing and revenue management, making pricing engines an integrated component of RM-driven offer optimization.

Continuous pricing. Continuous pricing involves constructing a price dynamically at the time of shopping and is primarily feasible in direct and NDC distribution channels, where the airline owns the offer.

Unlike the traditional fare-bucket approach with fixed price steps between classes (for example, a jump from $150 to $210), continuous pricing allows an airline to deliver any price in a defined range, such as $193 or $204. By enabling finer price increments, this approach reduces lost sales caused by coarse price gaps and helps avoid underpricing customers with a higher willingness to pay.

Under continuous pricing, the offer can be tailored based on current market conditions and demand signals. In more advanced implementations, the price may also reflect customer-related attributes such as loyalty status or past booking.

A study from MIT found that airlines implementing segmented (based on passenger segmentation) continuous pricing can achieve revenue gains of 3- 6 percent in realistic competitive scenarios.

Although continuous pricing offers clear advantages, adoption throughout the airline industry remains limited. Even among airlines that have implemented it, continuous pricing is typically combined with traditional fare classes rather than used as a fully standalone pricing model.

For example, United Airlines maintains 26-letter fare buckets in its core RMS but applies a supplemental continuous pricing engine in NDC/direct channels, choosing a continuous quote only if it is not lower than the bid price and meaningfully different from the filed fare. "We are not going to do a continuous price that is $5 cheaper than the filed fare," United VP of sales strategy and effectiveness Glenn Hollister explained. "We will just use the filed fare at that point. But if the RMS says we should sell this [ticket] for $25 less or $50 less, then we would use continuous pricing."

Ancillary revenue management. This module handles pricing and inventory for add-on services (baggage, seats, meals, etc.) to boost non-ticket revenue, which has become vital for airlines amid declining base fares. The ancillary revenue module enables real-time dynamic bundling and personalized offers based on a traveler's loyalty status or trip purpose.

Leading RM solutions and providers

To support airline revenue managers and travel-tech teams in selecting appropriate solutions, the following section provides an overview of widely used revenue management system providers.

Some of them are enterprise-level and preferred by major full-service carriers (FSCs); others welcome small local airlines and low-cost carriers (LCCs); some have a few decades of history; others are promising startups. Some are supplied as an additional module of a passenger service system (PSS); others are PSS-agnostic (can be integrated with any PSS). Although the market is relatively small, there is enough to choose from.

Major airline RM platforms, listed in alphabetical order, and their clients. Note that some carriers leverage several products from various vendors.

Amadeus airline revenue management solutions

Amadeus offers a broad, modular revenue management portfolio that reflects both its long-standing legacy in classical airline RM and its more recent push toward continuous pricing and modern airline retailing.

Network Revenue Management is Amadeus’s traditional network-based RM system, primarily used by full-service carriers operating hub-and-spoke networks. It focuses on Origin-and-Destination (O&D) optimization and fare-class-based inventory control, and is closely integrated with the Altéa PSS, reflecting a classical RMS architecture.

Segment Revenue Management (SRM) is a leg-based RM solution that optimizes demand forecasting, availability, and pricing decisions at the individual flight-segment level. It is typically used by airlines with simpler networks or as a complement to network-level RM, depending on operational complexity and organizational setup.

Segment Revenue Management Flex (SRM Flex) is a cloud-native, next-generation RM solution for faster optimization cycles, higher automation, and improved usability. It features a modern web interface and supports near-real-time data ingestion. SRM Flex is commonly deployed with Navitaire New Skies PSS and is positioned primarily for low-cost and hybrid carriers. The product incorporates technology and design elements originating from Kambr, which Amadeus acquired in 2022.

Air Dynamic Pricing uses AI-driven models to go beyond pre-filed fares and determine optimal, potentially continuous price points at the time of shopping based on demand conditions, customer segmentation, and market context. Airlines may deploy it in hybrid modes that still respect ATPCO and legacy distribution constraints, but the core capability is price-centric rather than inventory-centric. It is primarily designed to support airline-controlled offer construction in direct and NDC channels.

Ancillary Dynamic Pricing uses AI to create the best offers for an unlimited number of price points, considering your margins, demand signals, customer context, booking stage, and prevailing market conditions.

Clients: Singapore Airlines, Qantas, Finnair, Qatar Airways, Alaska Airways, British Airways, Southwest Airlines, Eurowings, Jeju Air, IndiGo, FLYONE, and more.

Sabre airline revenue management solutions

An air distribution giant couldn’t miss the opportunity to offer its own revenue management solutions.

Its traditional, GDS- and PSS-centric revenue management products are combined in the Pricing and Revenue Optimization suite. While these solutions are rooted in classical RM concepts, the suite extends beyond legacy capabilities by incorporating pricing automation, faster availability refresh cycles, and retail-oriented components.

Revenue Optimizer serves as the core RM engine, responsible for demand forecasting and network-level inventory optimization. It provides intelligent decision support that helps analysts understand market conditions, customer behavior, and revenue opportunities, bringing forecasting, pricing insights, and inventory decisions together in a unified workflow. Revenue Optimizer is natively integrated with SabreSonic, Sabre’s PSS, to compute RM decisions

Fare Manager and Fare Optimizer help airlines improve their published fare pricing processes. Rather than manually creating and filing fares, these tools provide an analysis of market context, historical performance, and business rules to recommend competitive price points. They support fare creation, rule management, competitive benchmarking, and automated fare filing workflows with ATPCO, allowing carriers to react more quickly to competitor pricing and market dynamics.

Dynamic Availability enables the RM engine to refresh seat availability more frequently and closer to the time of shopping. It uses ML models to continuously re-evaluate whether specific RBDs should be opened or closed based on the latest booking activity, remaining capacity, and market signals derived from the Sabre marketplace. Rather than changing fares or prices, the module optimizes bucket visibility, allowing availability controls to better reflect current demand and competitive conditions.

Dynamic Retailer enables airlines to construct, bundle, and price ancillaries and flight-related offers using retailing and personalization logic. These offers are then delivered via airline-controlled and NDC-enabled points of sale.

The suite also includes Group Optimizer to help airlines make the most of group bookings and Market Intelligence to facilitate smarter retailing and sales analysis.

Another step forward is SabreMosaic Offer Management, a modular, PSS-agnostic suite designed to support airlines moving toward offer-based retailing and, with selected components, toward classless pricing. SabreMosaic is a set of AI-driven capabilities that can sit alongside existing PSS and RM platforms.

Air Price IQ dynamically optimizes airfare price points during shopping. It incorporates signals such as remaining capacity, booking patterns, inferred trip intent, and traveler segmentation to determine the most appropriate price for a given passenger. The module can operate alongside fare buckets or filed fare logic and is often used in hybrid setups.

Air Ancillary IQ adjusts ancillary price points and recommends the most relevant ancillaries or bundles for each shopping context.

Upgrade IQ offers travelers the chance to bid for upgrades via tailored messaging at any stage before their journey.

Continuous Revenue Optimizer (СRO) is positioned by Sabre as a core enabler of classless revenue management. Moving beyond traditional fare buckets, CRO generates continuous, optimized price recommendations for each shopping request, using AI-driven models to estimate willingness to pay and optimize revenue at the individual offer level.

CRO is powered by Sabre IQ, an AI layer that combines Sabre’s proprietary optimization algorithms with large-scale demand, shopping, and booking data from the Sabre Travel Data Cloud. Sabre states that airlines deploying CRO can achieve up to 3.5 percent uplift in overall revenue without adding capacity, based on internal modeling and early customer results.

Clients: CRO was developed in partnership with Riyadh Air. Other major carriers like LATAM, Virgin Australia, GOL Linhas Aéreas, Hainan Airlines, Air Serbia, and Aeromexico also leverage Sabre revenue management tools.

PROS Offer Optimization

PROS (Pricing and Revenue Optimization Solutions) is a cloud-based SaaS platform specializing in revenue management across multiple industries, with airlines as one of its core verticals. The company originated from airline optimization research conducted in the 1980s in close collaboration with American Airlines, whose revenue management challenges and operational data served as a foundational use case for PROS’s early forecasting and optimization models. As a result, PROS is widely regarded as one of the most mathematically mature revenue management vendors.

PROS is particularly recognized for its willingness-to-pay (WTP)–based approach to airline revenue management, which represents demand on a continuous price–demand curve rather than relying exclusively on discrete fare steps. These continuous demand representations are embedded into forecasting and optimization processes, enabling bid prices, inventory controls, and pricing recommendations to better reflect how passengers respond to different price levels.

In practice, this methodology is delivered through two core modules—PROS Revenue Management and PROS Real-Time Dynamic Pricing. The latter functions as a recommendation engine, calculating optimal price points between predefined fare levels based on estimated customer price sensitivity. This hybrid approach allows airlines to move toward Offer Management while still mapping dynamically generated prices to booking classes in real time, ensuring compatibility with legacy fare-class–based systems.

Other RM-related modules offered by the platform are

- PROS Dynamic Ancillary Pricing that leverages AI to set prices for add-ons based on real-time shopping and booking data; and

- PROS Group Sales Optimizer that allows airlines to use real-time, dynamic-based pricing for groups.

PROS products are PSS-agnostic and easily integrate with shopping engines, CRMs, airline reservation and inventory systems, and other platforms.

Clients: The platform declares 130+ client airlines, including Lufthansa Group, Aeromexico, TAP Air Portugal, Etihad, Air China, Hawaiian Airlines, Japan Airlines, flydubai, Cathay Pacific, JetBlue, and others.

Aviator by Maxamation

Maxamation (formerly Resource and Revenue Management) was founded in Australia in 1997 by Peter Brewer and Ian Johnson, both former airline revenue management specialists at Qantas and British Airways, respectively.

Aviator is Maxamation’s flagship product—a cloud-based revenue management suite, launched in 2019. Aviator focuses on robust classical RM, including bid-price-based inventory control, overbooking optimization, and analyst-driven workflows with a strong emphasis on transparency and explainability. This position appeals to airlines that seek a high degree of automation while continuing to rely on human expertise and traditional GDS distribution. According to Maxamation, customers typically achieve revenue improvements in the range of 4 to 20 percent.

The platform distinguishes itself as the only RM solution that optimizes every future flight in an airline's schedule every night. Additionally, Aviator was the first system in the industry to fully incorporate competitive fare data directly into its optimization logic.

In addition to RM software, the platform includes a specialized business intelligence tool, Aviator Insights, that provides BI/reporting for RM teams.

Clients: 60+ airlines, mainly local, like Fiji Airways, Cayman Airways, Air Senegal, ASL, Solomon Airlines, VietJet Air, REX, and others.

Lufthansa Systems revenue management solutions

Lufthansa Systems used to have a classical RM ProfitLine/Yield suite combining network- and segment-based revenue engines. Now, though, the company offers only a few ready-made supporting revenue management products in the Commercial & Financial suite.

Revenue Integrity acts as a filter before the RM system performs its final calculations. It improves data quality, identifying and removing unproductive bookings—such as duplicate reservations, fictitious names, or seats held past their ticketing time limit.

ProfitLine/Price is a fare management system that monitors competitor prices and market trends to suggest optimal price points the airline should offer. It then automates the process of filing these prices with ATPCO.

Group Sales Tool is a web-based portal for travel agents that allows them to request group seats. It pulls the bid price from the core RM engine and compares it against the group’s request and the airline's expected revenue, ensuring that a group of 30 people doesn't displace 25 individual passengers who would have paid significantly more.

Clients: Lufthansa Group airlines (Lufthansa, SWISS, Austrian Airlines, Brussels Airlines, Eurowings, Air Dolomiti, Discover), SunExpress, RwandAir, Condor, and others.

FLX ONE Revenue Management by Accelya

FLX ONE, developed by Accelya, is a modern airline retailing and O&O platform. As part of its Offer Management capabilities, FLX ONE brings together revenue-related optimization logic, dynamic pricing, and shop-and-price workflows to enable real-time offer construction during the shopping process.

FLX ONE Revenue Management provides airlines with tools to respond more quickly to market changes by applying optimization logic and control rules. According to Accelya, the module evaluates a broad set of demand, market, and operational signals and allows airlines to select models and adjust parameters for specific markets or individual flights. Accelya reports that airlines using its RM capabilities can achieve revenue uplifts of up to 20 percent, depending on implementation scope and operating context.

FLX Dynamic Pricing uses real-time inputs and estimated price sensitivity to recommend price points for fares and ancillaries at shopping time. The module is designed to create a transition path from traditional fare filing toward more value-driven and flexible pricing approaches in an Offer & Order framework

FLX Shop and Price acts as the execution layer, combining availability inputs, pricing logic, and business rules to return fully priced offers in response to shopping requests from supported distribution channels.

The company emphasizes flexible integration into existing airline retailing stacks and is PSS-agnostic, with integrations to 28+ reservation systems.

Clients: 70+ carriers, including Iberia, Air Europa, Frontier Airlines, Oman Air, Cebu Pacific, and a growing number of hybrid and LCC operators.

FLYR

FLYR is one of the most visible AI-native startups in travel, founded in 2013 in California and backed by significant venture capital. It provides a modern retailing Offer & Order Management platform aligned with IATA’s NDC and ONE Order principles.

Just like Accelya, it brings together forecasting, pricing, retailing, and merchandising into a unified commercial flow. It is designed to support high levels of automation, using AI to generate recommendations while still allowing airline oversight.

Revenue Optimizer and Dynamic Pricing are key components of FLYR’s Offer Management capabilities. Together, they enable airlines to construct and price offers dynamically at shopping time, rather than relying solely on pre-filed fares and static bundles.

A distinguishing feature of FLYR is its support for experimentation. Airlines can run live A/B tests on pricing, bundles, and offers to evaluate what performs best in the market. The analyst interface exposes a broad set of performance metrics—reported by FLYR to exceed 150—with interactive drill-downs and trend visualization.

Clients: Avianca, Air New Zealand, Cyprus Airways, Azul, Virgin Atlantic.

Fetcherr

Fetcherr is a successful Israeli startup that offers AI-driven predictive pricing. The platform leverages its own Large Market Model (Gen AI framework trained on massive amounts of public and proprietary market information, such as pricing dynamics, demand elasticity, competitive behavior, and inventory constraints).

Fetcherr uses reinforcement learning technique for continuous pricing. It means that models learns how to act best through many attempts and failures. The algorithms may iterate thousands of times per day in simulated environments, making the platform particularly attractive to airlines willing to experiment with more adaptive, non-static pricing strategies.

A key differentiator for Fetcherr is its privacy-first design. The platform positions its optimization logic around the product and context—such as route, departure date, cabin, and market conditions—rather than individual passenger identities, helping airlines address regulatory, security, and governance requirements. In addition, Fetcherr’s “Glass Box” capability provides explanations for AI pricing decisions, aiming to give revenue teams visibility into why the system recommends specific actions.

Clients: Delta, Virgin Atlantic, WestJet, Azul, and smaller carriers.

Now, after exploring ready-to-use systems, let’s look at another option.

When does it make sense to create a custom RM solution?

Alongside ready-to-use revenue management platforms, airlines can also pursue custom-built solutions. While commercial systems offer broad, mature functionality, they are not always the best fit for every airline or every stage of revenue management maturity.

The decision to build rather than buy depends on airline size, business model, strategic goals, etc.

For large airlines: differentiation and control

For major carriers, custom revenue management solutions are often a strategic investment rather than a cost-saving exercise. At scale, airlines may want to:

Implement proprietary pricing logic or mathematical models that are not available—or not flexible enough—in commercial platforms;

Differentiate from competitors by embedding unique commercial strategies directly into pricing and ancillary logic. For example, Ryanair has long been a proponent of the "build" strategy, utilizing its in-house tech hub, Ryanair Labs, to create custom tools that support its low-cost DNA. Ryanair’s Brainer, a machine learning pricing engine, allows dynamically pricing carry-on bags using up to 20 different parameters, a strategy that has increased bag revenue alone from 24 to 34 percent of total ancillary income.

Interface seamlessly with a carrier’s existing tech stack, bypassing the integration hurdle and allowing you to leverage your own rich expertise, as in the case of the Lufthansa Group.

For smaller airlines: flexibility, speed, and focus

Smaller or mid-sized airlines often choose the "build" route to address specific gaps where commercial platforms may be too rigid or over-engineered. For these carriers, custom development is about agility and niche optimization:

Focusing on the specific market. Local carriers want to concentrate forecasting on variables that matter most to their unique market, such as extreme seasonality or high-frequency commuter behavior.

Avoiding senseless charges. Commercial RMS platforms can be expensive and overly complex, especially when only a fraction of their functionality is actually needed.

Rapid prototyping and testing. Smaller organizations are often nimbler. A custom RM module allows a small carrier to act as a "test lab," rapidly deploying and iterating on new pricing strategies.

That was the case when AltexSoft developed a dynamic pricing system for UP family brands, including an international tour operator, Join UP!, and a private low-cost and charter carrier, SkyUp. The airline needed proof of value before committing to a large-scale transformation.

Over three months, we prepared and cleaned years of booking and price data, experimented with multiple predictive models, and ultimately used a combination of regression and tree-based forecasts to estimate how occupancy responded to price changes and short-term booking patterns.

We then translated model outputs into practical price recommendations delivered multiple times per day to revenue managers. This custom system gave the airline actionable pricing guidance, demonstrating that data-driven suggestions could increase revenue by 3–5 percent even with basic models. It proved the concept and laid the foundation for further refinement with more advanced analytics and broader data feeds.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.