Though insurance is often seen as a paperwork-heavy, manual industry, it has always relied on data, mathematical analysis, and statistics. When the AI hype began, its potential to drive value for insurance seemed clear.

As a result, many companies, from established carriers to insurtech startups, quickly launched AI initiatives. A 2025 survey by the National Association of Insurance Commissioners (NAIC) found that 84 percent of health insurers already use AI and machine learning (ML) to some extent.

However, despite the hype and promising early demos, many AI pilots have struggled to scale, casting doubt on their ROI and long-term impact. Alongside this, risks related to hallucinations, bias, and data security remain.

Let’s move beyond the hype and explore whether AI is truly adding value to the insurance industry, the challenges it presents, and how companies should approach its adoption.

AI in insurance

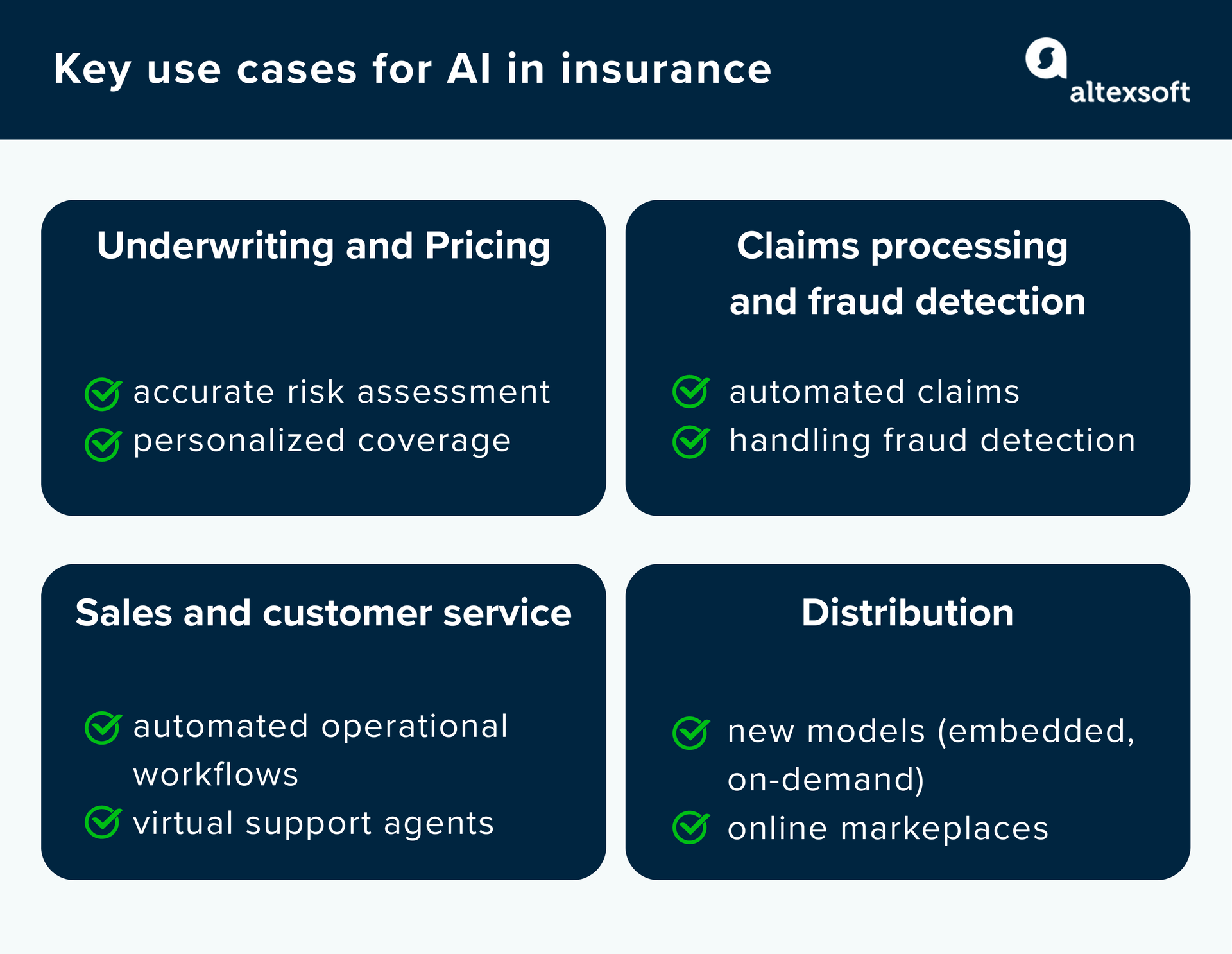

AI in underwriting and pricing: driving personalization

Historically, underwriting relied primarily on broad risk categories, with limited ability to differentiate pricing within those segments. For example, drivers with perfect records paid the same as those with risky driving habits, and healthy individuals were grouped with those who had medical conditions. This approach was simple but not precise.

As a result, insurers often missed out on potential profits, while customers felt they were overpaying for coverage that didn’t truly match their individual risk.

AI is changing that by enabling a more personalized approach as insurers now incorporate new types of data.

AI in Action: How It Changes Insurance

Fahad Shaikh, former VP and Head of Data & AI Strategy at Aviva Canada, now advising insurtech AI startups, shared some examples: “Underwriting is becoming far more data-driven. In auto insurance, telematics data now gives insurers a much clearer view of driving behavior, allowing them to assess risk more precisely rather than relying on broad categories.

“In property insurance, computer vision models analyze satellite and property imagery to identify risk factors—such as whether a home has a swimming pool—without asking the customer. These data-driven insights improve both efficiency and accuracy, while directly shaping underwriting and risk assessment decisions.”

One example here is Arity, a mobility data and telematics platform spun out of Allstate. It claims to employ two trillion miles of driving data to generate safety scores for insurers, enabling them to offer personalized pricing – enabling what’s called usage-based insurance (UBI). Now, instead of estimating coverage based primarily on age or ZIP code, premiums can reflect how smoothly—or recklessly—people actually drive.

Or take Daido Life – one of the leading Japanese insurers. They developed an AI-powered medical underwriting algorithm that analyzes various health-related data points, such as medical history, lifestyle choices, and diagnostic information. The AI suggests a preliminary risk assessment and recommends personalized coverage.

Other global insurers such as Allianz, Swiss Re, Zurich, Manulife, and QBE are following a similar path, enhancing their underwriting workflows with AI.

Carriers realize that AI helps personalize premiums and make more precise underwriting decisions, reducing what used to be a multiday process to just minutes. For example, UK insurer Hiscox slashed some of its commercial underwriting times from 3 days to just 3 minutes with the help of AI.

As for tangible results, BCG estimates that AI implementation in underwriting increases revenue by 25 percent, with the potential to reach 41 percent in the future.

But AI’s role in underwriting isn’t to replace human underwriters. Instead, it’s designed to assist them by providing supporting signals and explanations for its outputs, thus improving decision confidence when combined with human review. Another BCG study found that this collaboration between humans and AI can increase underwriting efficiency by up to 36 percent, and as more advanced AI systems emerge, these gains are expected to grow even further.

AI in claims processing: increasing speed and accuracy

Claims processing has traditionally been slow, paperwork-heavy, and costly, often accounting for up to 80 percent of total operational costs. Today, this core workflow benefits most from AI.

Automated claims handling

One of the most common applications of AI in claims processing is intelligent document processing (IDP). AI-based IDP tools use computer vision (CV), optical character recognition (OCR), and natural language processing (NLP) technologies to automatically extract and organize information from documents.

For example, in auto or property claims, AI-based tools analyze customer-uploaded photos and videos to assess damage and estimate repair costs.

IDP tools are often complemented with robotic process automation (RPA) to create an end-to-end automation workflow.

This allows insurers to provide faster responses, especially for simple claims. Insurtechs like Lemonade have demonstrated the ability to pay out standard, simple claims in as little as three seconds. This speed translates into lower administrative costs (up to 50 percent) and improved customer satisfaction, which research shows is most strongly influenced by how quickly claims are settled.

For more complex claims, though, AI only acts as an assistant to human handlers – yet. Alan Walker, an independent business consultant on insurance digital transformation, believes that straight-through claims processing isn’t far off: “Straight-through processing with AI is possible, as shown by Lemonade’s high claim volume, though their simpler products and smaller scale make it easier.

“Aviva, with larger and more complex products, also uses AI for some end-to-end processing, but in complex cases, AI supports humans rather than fully replacing them. While full automation in complex claims is rare, it’s achievable for larger insurers in the near future.”

Fraud detection

Insurance fraud causes over $300 billion in losses in the US alone. Fraudulent claims can account for up to 20 percent of all processed claims, which highlights the need for more sophisticated detection tools.

Traditional fraud detection methods often rely on basic rules, such as flagging multiple claims from the same address or unusually high repair costs. However, as fraudsters increasingly use genAI to create highly convincing fake evidence, like doctored medical records, deepfakes, or accident photos, the arms race between fraud prevention and fraud creation continues.

ML models can identify subtle anomalies and hidden patterns that might not be visible to human investigators. AI can detect deceptive language, flag inconsistent claimant information, identify manipulated photos, and even perform network analysis to uncover sophisticated fraud rings involving multiple claimants, medical providers, and repair shops. AI’s role here is essential, but it must constantly evolve to stay ahead of new tactics.

With higher fraud-detection accuracy, insurers can catch more fraudulent claims. This not only protects the insurer’s bottom line but also benefits policyholders by keeping premiums lower and speeding up the processing of legitimate claims.

AI in sales and customer service: higher satisfaction and efficiency

Gone are the days of dumb, programmed bots with useless predefined replies. Today, LLM-based chatbots and voicebots are reshaping the customer service experience, particularly for younger, tech-savvy consumers.

These systems can hold flexible, human-like conversations and, when integrated with backend systems like CRMs and claims management tools, can handle tasks such as onboarding, recommendations, claims processing, and customer feedback collection—managing a significant portion of customer interactions.

Beyond reactive service, AI can analyze customer data to predict significant life events, such as a home purchase or the birth of a child, and proactively recommend relevant coverage adjustments. Bots can be programmed to customize the tone, style, and communication channel based on individual customer preferences, to ensure each interaction feels personal and supportive.

Most large insurance companies have already adopted these virtual agents. In some cases, AI has even outperformed human agents. Alan recalled a case when “Allstate in the US has used LLMs to generate draft emails and letters, with a human reviewing them before they are sent out. While it improves the consistency and accuracy of their communications, the surprising benefit is that the AI agent actually writes with more empathy than the typical claims handler. This has resulted in a fantastic customer experience.”

This shift to AI-driven customer service allows insurers to respond faster and reduce operational costs. It also leads to better customer experiences, increased loyalty, and higher retention rates.

AI is also transforming sales by automating administrative tasks, which can take up over 50 percent of agents'/brokers’ time. It uses predictive analytics to prioritize leads and recommends the next best actions, such as cross-sell or upsell opportunities, based on customer data.

Matt Clifford, life insurance expert and consultant, explained how it works: “It's all about how you can translate data-driven insights to help identify and close sales – or how the carrier can help inform the agent of when a sale is most likely, that the demand is highest, and there's the greatest opportunity to close a sale.”

Besides, Alan believes that agentic AI has huge potential to streamline internal knowledge management: “Put an agent on top of vast data stores, and you can query complex underwriting guidelines, you know, those thick manuals on guidelines. Use an agent to just query that data and ask, ‘So does this particular risk fit our appetite?’ or ‘Review this application and point out inconsistencies’ or 'Review this application and suggest some follow-up questions’—all with an LLM.”

Fahad agrees that straight-through processing will soon be possible with agentic AI: “Agentic AI will soon enable straight-through processing for low-risk journeys. These AI agents will be able to read full submissions, access external data sources, and make decisions autonomously, only invoking human intervention when necessary. This shift toward full automation, powered by MCP [Model Context Protocol] connectivity, is closer than we think.”

AI in distribution: new models

AI also transforms insurance distribution and retailing, powering the emergence of entirely new models and products.

Embedded insurance refers to coverage sold as an additional product on noninsurance platforms, such as travel, eCommerce, mobility, or fintech. For example, when purchasing a car, customers can be offered auto insurance as part of the transaction.

Embedded insurance providers like Cover Genius or Coverdash rely on AI to tailor policy recommendations, instantly quote products, and handle claims.

Another rising trend is on-demand insurance – flexible, short-term coverage that can be activated when needed, such as for a one-hour car drive. AI plays a critical role in assessing risk in real time, dynamically pricing policies, and adjusting coverage based on changing circumstances. Some providers in this niche are Cuvva, Zego, and Flip.

AI also powers marketplaces like bolttech and Insurify, which use AI to match users with the policies that fit them best.

Challenges for AI adoption in insurance

BCG data shows that despite clear value potential, only 7 percent of insurance companies have successfully scaled their AI systems. Another survey by Ernst & Young estimates that failed or poorly governed AI initiatives can result in multimillion-dollar financial losses.

While AI promises efficiency, real‑world deployment faces concrete issues.

Legacy tech

Legacy technology is a major barrier to AI adoption in insurance. Many companies have outdated systems that can't handle real-time data processing. Additionally, managing diverse data types, including unstructured data like images and emails, remains a challenge, limiting AI’s potential.

Poor or siloed data and integration problems

Many insurers struggle with fragmented, inconsistent, or incomplete data, which makes reliable predictions harder to achieve. A 2025 survey found that over half of the executives in the financial and insurance sector distrust their own data.

Companies struggle with issues like duplicate records (59 percent) and siloed datasets (52 percent). As Matt Clifford shared, “So much insurance carrier data is held in data silos. It's on hard drives or legacy mainframe systems.”

These data challenges are directly hindering innovation, as companies report 52 percent of AI projects fail due to poor data quality.

Accuracy and bias concerns

AI models are continuously improving, but hallucinations are still a big concern. Recent studies suggest that hallucination rates in controlled, simple tasks can fall below 2 percent, while remaining significantly higher for complex reasoning, sometimes exceeding 33 percent.

Also, AI models can unintentionally discriminate if the training data reflects past biases. For example, risk scores might unfairly penalize certain demographic groups unless safeguards are in place.

Regulatory and accountability challenges

Regulators around the world are still figuring out how to govern AI in financial services. Insurers must ensure AI tools comply with consumer protection laws, data privacy rules, and fairness standards.

And as the world digitizes, those standards change. For example, in the US, the National Association of Insurance Commissioners (NAIC) has released model bulletins on the use of AI systems, focusing on governance, bias reduction, explainability, and responsible AI practices.

Similarly, the European Insurance and Occupational Pensions Authority (EIOPA) provides guidance on cloud outsourcing, digital distribution, and AI governance.

While national regulations aim to stay up to date and provide clearer frameworks for digital insurance products, they naturally impose certain limitations, including

- automatically testing for bias,

- transparently documenting decisions,

- adapting to new fraud schemes in real time, and

- maintaining audit trails at scale.

And the question of accountability remains. Who is responsible for AI mistakes? After several high-profile incidents, many insurers have become more cautious and are trying to limit their exposure by seeking regulatory approval to exclude AI-related liabilities from their policies.

Other issues insurance companies face include a lack of business line support, a lack of skilled talent, and inadequate collaboration between the business and tech functions.

How to approach AI adoption in your insurance company

To avoid becoming another failed pilot statistic, our experts recommend seeing AI adoption in insurance as a stepwise, value-driven, and people-centric journey.

Go with a staged roll-out

Alan Walker advises starting with high-impact, low-complexity workflows that can deliver quick wins and “have low regulatory sensitivity.”

For example, simple tasks like email drafting or meeting note summarization are excellent starting points to familiarize employees with AI and build trust. At this stage, change management is key: Many employees fear job displacement, so leadership must emphasize that AI is meant to augment human work, not replace it.

As AI is gradually introduced, the next step is to spread it across core workflows such as underwriting, claims processing, and customer service. Also, AI-based document management systems can streamline document analysis, enabling faster processing and more accurate results.

The ultimate goal is to integrate AI across the organization, breaking down silos. This will allow data to flow seamlessly between departments, creating a cohesive ecosystem where AI supports decision-making at every level.

Fix the basics

We’ve already touched on poor data quality in most organizations. If your data is still trapped in PDFs, siloed spreadsheets, or fragmented systems, no AI model, no matter how advanced, will deliver the value you're expecting. AI needs clean, integrated data; without it, results will be inconsistent or unreliable.

Invest in data unification, for example, by adopting Logical Data Fabric technologies to connect your disparate systems and create a unified data layer. This approach ensures that all your data—whether it's coming from CRM systems, claims management tools, or external sources—flows seamlessly into a single, accessible source of truth.

Once you have your data prepared, you need to establish proper data management practices.

Focus on data governance and human in the loop

Historically, insurers manage vast amounts of sensitive data. Integrating multiple internal and external datasets for AI systems increases the risk of data breaches and cyberattacks.

Additionally, AI models, particularly genAI, can perpetuate biases, leading to unfair outcomes in areas like pricing and claims handling.

Implementing robust data governance frameworks helps mitigate these risks and ensure that AI systems are transparent, ethical, and in compliance with regulations.

Fahad recommends focusing on traceability: “Just like any IT system, AI systems—especially agentic ones—must be highly observable and traceable. You need to fully inspect how decisions are made, log the data sources, and trace each decision. If an AI makes a claim, it should cite the data source; if it can't make a decision, it should log that it called a human. The same rigor applied to traditional systems—like logging and tracing—should be applied to AI to ensure transparency and accountability.”

So document the development of AI models, conduct quarterly bias tests, and maintain comprehensive audit trails.

Also, a human-in-the-loop approach, especially in complex decisions, is a must. Establish clear decision-making protocols that specify when AI should make decisions and when cases should be escalated to humans.

Productize AI adoption and track KPIs

Fahad advises companies “to productize AI rather than treat it as a series of experiments. Take a product-minded approach, with clear scope, timelines, and ownership, and hold teams accountable for delivering measurable outcomes.”

It’s essential to set clear KPIs to track the success of AI initiatives. As Fahad framed it, “Implement AI not for the sake of AI, but with a focus on what really matters to the business—reducing loss ratios, cutting expenses, shortening cycle times, speeding up claims processing, and improving customer service. These are the KPIs that truly move the needle for the CFO.”

Aligning AI projects with business goals ensures they drive meaningful results and justifies continued investment.

Buy or build?

When considering AI solutions, insurers must decide whether to build their own tools or buy off-the-shelf products.

For example, for fraud detection, some insurers build proprietary solutions (e.g., Claims GenAI by Swiss Re), some outsource development to external partners (e.g., Zurich partnering with Quantexa), while others implement ready-made third-party systems from specialized software providers such as Shift Technologies, Friss, or Verisk.

The decision depends on your needs, resources, and long-term strategy. As a rule of thumb, Alan recommends that insurers should prioritize buying existing AI solutions over building: “Buy when you can, build only when you must—if you have a unique use case or data that can’t be integrated into existing solutions. But even then, remember that AI is evolving so rapidly that what you build today may soon be surpassed by a third-party solution that’s just as good, if not better, than what you've created in-house.”

Summing up, staying up to date with AI advancements is not just about innovation—it's also an economic necessity. The future of insurance belongs to those who can effectively bridge the gap between potential and execution. Insurers who invest in solid data foundations, prioritize human oversight, and leverage AI in core workflows will win the race.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.