The notion of the “death of a travel agent/advisor” has been a recurring theme since the emergence of Expedia and Travelocity in the late 1990s. Yet, three decades on, travel advisors are still very much in business.

Today, AI tools reshape the industry and the question arises again: Is the travel advisor profession over? In this post, we’ll explore how the travel advisor role is evolving and which strategies can help you stay relevant in the changing environment.

Travel advisor market overview

What is a travel advisor?

A travel advisor (also sometimes called travel consultant or travel designer) is a professional who designs, plans, and manages travel experiences for clients. Rather than simply being a booking middleman, a travel advisor combines destination knowledge, industry contacts, and personalized service to craft trips that fit the traveler’s tastes, preferences, and needs.

What do travel advisors do

Travel advisors perform a range of tasks:

- consultation and personalized recommendations;

- itinerary design and bookings;

- curated experiences beyond logistics;

- access to perks, upgrades, and insider deals; and

- on‑trip support and problem-solving.

As they learn client preferences over time, travel advisors typically become long-term travel partners.

A Phocuswright study revealed that the main travel advisor specialties are

- family travel (90 percent),

- luxury travel (74 percent),

- adventure travel (61 percent),

- affinity group travel (47 percent), and

- theme parks (39 percent).

To provide better service, travel advisors often go on familiarization, or FAM, trips – educational journeys organized by tourism boards, hotels, cruise lines, or tour operators to give first-hand experience with a destination or product. This makes their recommendations more accurate and trustworthy.

Travel advisor associations and consortia

Travel advisor associations and consortia play a key role in professionalizing the industry. Only 6 percent of travel advisors have no affiliations – the vast majority belong to at least one host agency or consortium. However, all of them serve different purposes.

American Society of Travel Advisors (ASTA) is the leading trade association and advocacy body in the US, representing the industry before federal and state legislatures.

Virtuoso is an invitation-only luxury travel network that connects travel agencies to top-tier travel suppliers. For industry professionals, it serves as an exclusive consortium that provides access to high-level supplier relationships and resources. Meanwhile, for travelers, booking through a Virtuoso advisor unlocks VIP perks—such as upgrades, credits, and exclusive experiences—that are unavailable to the general public or through standard booking engines.

Travel Leaders Network (a division of Internova Travel Group) is one of the largest global consortia, offering marketing, technology, training, and supplier agreements to thousands of agencies.

Signature Travel Network is a member-owned travel cooperative with strong supplier leverage, specializing in luxury, cruises, and experiential travel.

Travel agent vs travel advisor

In 2018, ASTA, the industry’s largest trade association, formally changed its name from the American Society of Travel Agents to the American Society of Travel Advisors to reflect how the profession has evolved. The change signals that travel professionals today are no longer just booking intermediaries or agents of suppliers; they provide advice, expertise, and value beyond transactions.

In 2025, ASATA, the Association of Southern African Travel Agents and Travel Advisors, followed suit.

The main difference between a travel agent and a travel advisor lies in the scope of their services and the nature of their client relationships.

A travel agent typically focuses on reservations, handling logistics like flights, hotels, and transportation. Their role is often transactional, as they assist clients with straightforward bookings and one-time arrangements.

In contrast, a travel advisor takes it a step further with a more consultative approach. Rather than just making bookings, they offer personalized trip planning and ongoing support, think crafting a proper packing list, suggesting a travel insurance plan, or even handling traveler anxiety.

At the same time, the lines between the two roles are sometimes blurry. That’s why it’s difficult to separate the two market segments completely.

Travel advisor market overview

Taken together, the data paint a clear picture of a large, growing, and increasingly affluent market.

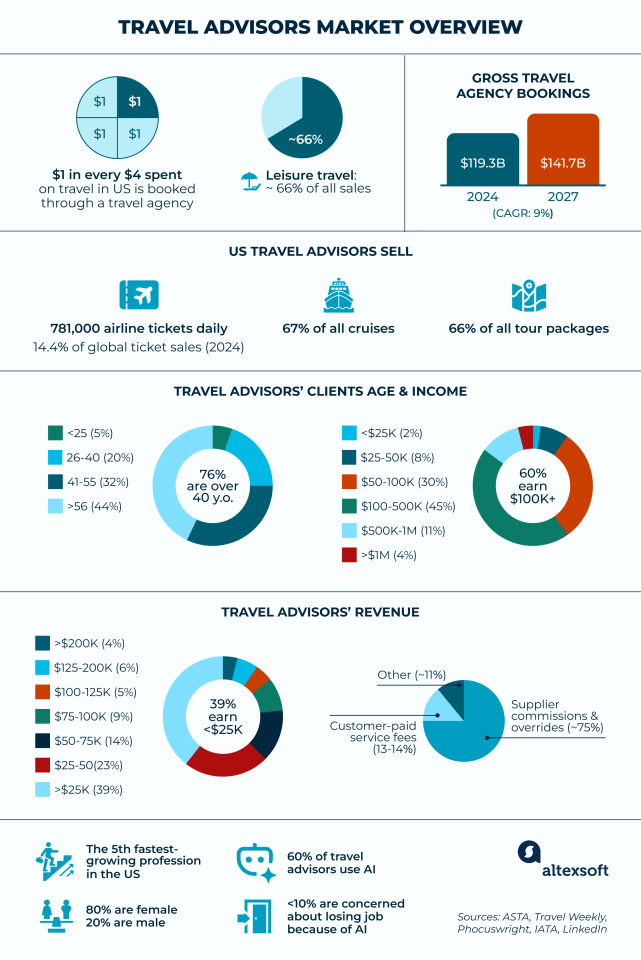

Sales data. The American Society of Travel Advisors (ASTA) reports that $1 in every $4 spent on travel is booked through a travel agency.

Gross travel agency bookings in 2024 totaled $119.3 billion. With a projected growth rate of 9 percent over the next two years, they anticipate $141.7 billion in sales by 2027.

According to ASTA, in the US, travel advisors sell

- 781,000 airline tickets daily (a total of $99.2 billion in annual sales in 2024),

- 66 percent of tour packages, and

- 67 percent of all cruises.

Arranging leisure travel dominates, accounting for around two-thirds of all sales.

Client profile. Phocuswright research shows that 73 percent of travel advisors’ clients are over 40 and 58 percent have incomes over $100k.

Another study, the Travel Industry Survey 2025, estimates that almost half of travel advisor clients fall within the $100k–$500k income range, highlighting their stronghold in the luxury market.

Advisor income. Newer advisors tend to make less than more experienced ones. Among the highest earners, most have been in the industry for at least 11 years, with nearly one in four reporting annual incomes of $100k or more. In general, 39 percent of advisors earn less than $25k per year and another 23 percent fall within the $25k and $50k range.

Around three-quarters of revenue comes from supplier commissions and overrides. Customer-paid service fees make up only 13-14 percent of revenue. However, as the market evolves and supplier commissions decline, travel advisors are increasingly moving toward a fee-based model.

To know more about the revenue structure, read our detailed breakdown of how travel agents get paid.

Job data and advisor profile. As per the LinkedIn annual Jobs on the Rise report (2025), travel advisors are the 5th fastest-growing profession in the US. The report also states that most jobs are in big cities (New York City, Los Angeles, Miami) and the current gender distribution is 80 percent female and 20 percent male.

Travel Weekly estimates that two-thirds of travel advisors work as home-based independent contractors and another third work for a travel agency.

Lately, new entrants have been replacing retirees: 35 percent of travel advisors entered the industry in the last 5 years.

All this data shows that both travelers and industry professionals still see strong value in travel advisors, and the role is far from extinction. That said, the challenge posed by AI is very real.

The tech challenge

Self-service platforms, genAI, and the latest developments in agentic AI challenge the traditional role of travel advisors by automating many tasks they once handled. OTAs remain the dominant booking channel for hotels and flights. And a 2025 survey by Skift and McKinsey found that 60 percent of travelers have used AI-based tools for trip planning.

AI-powered chatbots and travel assistants can compare prices, find accommodations, and create customized itineraries tailored to various needs. Additionally, AI can now provide bespoke recommendations by analyzing past travel behavior and preferences, a level of personalization that was once the domain of skilled advisors.

And as AI agents develop, they can even book the entire trip for you. So is it really the end for travel advisors? Will technology replace human experts anytime soon?

Limitations of AI

For routine business travel or straightforward leisure weekends, AI’s efficiency and speed are unbeatable.

However, AI is not infallible. Skift’s State of Travel 2025 report revealed that nearly half of travelers receive generic or non-personalized suggestions, and 39 percent have encountered outdated or incorrect information.

There’s also a liability issue. Who is responsible when the AI makes a mistake? The landmark case of Moffat vs Air Canada established a chilling precedent for AI deployment. A traveler was given incorrect information about bereavement fares by the airline's chatbot. The airline argued that the chatbot was a separate legal entity and that the passenger should have verified the information on the website. The court rejected this defense, ruling the airline liable.

All these limitations contribute to the infamous “Trust Gap.” Skift’s report states that although 93 percent of respondents trust AI for providing travel information, only 2 percent are currently willing to allow the fully autonomous AI tool to “take the wheel”—to make and modify travel bookings without human oversight.

The value of travel advisors over tech platforms

Just as I don’t buy dinner from a vending machine, I don’t buy something as important as travel from a low-cost / low-service provider. The customer service travel advisors provide cannot be replicated by AI. The trust that travel advisors build with their customers is authentic and it’s what we stake our reputation on.

Travel advisors themselves aren’t worried much about AI destroying their business – less than 10 percent of them expressed concern about this.

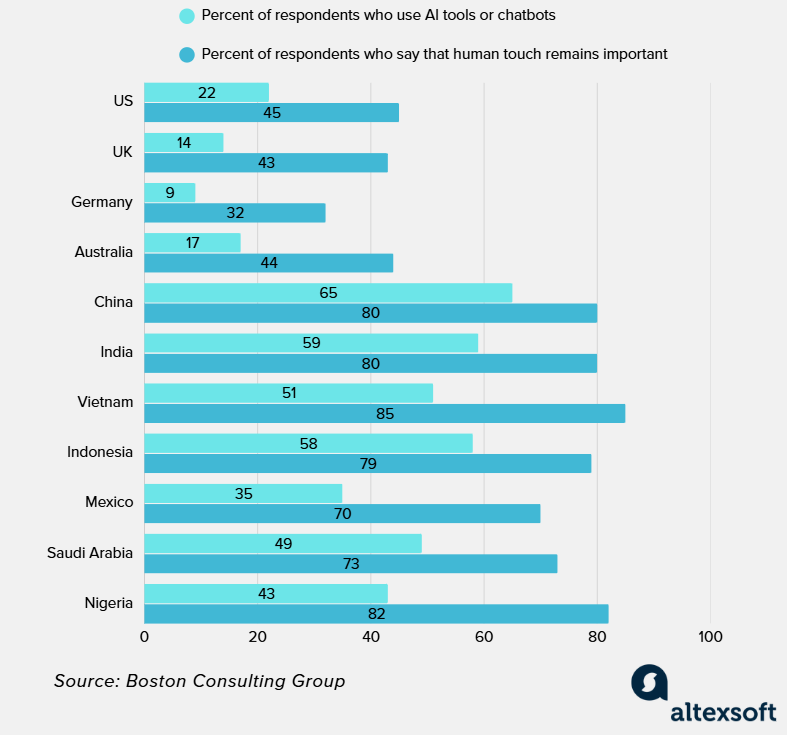

They know that for travelers seeking meaning, human connection, flexibility, and uniqueness — especially when complexity or emotion is involved — a travel advisor remains indispensable. Research from BCG proves it, showing that the need for human touch beats AI tools in all surveyed countries.

BCG survey on the importance of human touch during travel planning

Also, ASTA research states that half of the travelers are more likely to use a travel advisor today than they were in the past.

Tailored selection and exclusive inventory

Travelers who plan trips with OTAs often experience “information overload.” Advisors solve this psychological barrier. They act as “decision architects,” narrowing the 50 options down to 3 that best account for the client’s needs.

You might say that genAI does the same. Well, not quite. Have you heard about the "Invisible Hotel" phenomenon?

A recent study by Spotlight Communications revealed that AI search engines prioritize “machine-readable credibility” — a core principle behind GEO (Generative Engine Optimization). In practice, this means AI systems favor brands with massive digital footprints, structured data, and high citation volumes. Consequently, many ultra-luxury boutique hotels—which may rely on exclusivity and word-of-mouth—are effectively invisible to AI.

If a traveler asks an AI for the "best luxury hotel in Tuscany," the algorithm will likely return the same five famous properties (e.g., Four Seasons, Rosewood) that dominate the training data. It will miss the 10-room, family-owned palazzo that offers a far superior, authentic experience – but lacks a sophisticated digital presence.

The advisor's value lies in knowing the places that the algorithm does not. They curate a portfolio of “un-Googleable” experiences. Marketing in this sector effectively becomes: “I can show you the world that ChatGPT doesn't know exists.”

Insider perks

Many advisors have built relationships with hotels, local guides, and tour operators. That opens access to upgrades, exclusive services, or “off‑book” perks that most AI or OTA systems can’t guarantee.

For example, if you are a member of Virtuoso, you can offer your clients perks like spa/shopping credits, room upgrades, complimentary breakfast, etc.

Managing complex

For multi‑destination journeys, complicated group travel, special‑needs trips, or bespoke luxury experiences, advisors use their own FAM-based knowledge, intuition, and personal networks to design and adjust plans in ways AI often can’t match.

For example, an advisor may redesign a family trip to balance different ages, energy levels, and expectations. In luxury travel, advisors often coordinate private transfers, exclusive access, and last-minute changes — adjusting plans in real time based on weather, local events, or client preferences. And such in-trip support is another advantage.

Crisis support in real time

When a trip goes smoothly, the advisor's role is often invisible. When it goes wrong, their value is infinite.

When flights are cancelled, visas are delayed, or unexpected disruptions happen, a human advisor can step in as advocate, communicator, and problem‑solver. That’s why clients are often willing to pay for the "insurance" of having a resourceful advocate.

This kind of service remains a key differentiator – not only because of creative, proactive assistance but also due to emotional support in critical situations.

Empathy and emotional understanding

A travel advisor understands more than travel data: They appreciate a client’s tastes, fears, and hopes. They prioritize emotional intelligence—mapping itineraries to life goals and moods—to create value that data points cannot capture. AI might recommend a well‑rated hotel, but only a human can sense when a client may prefer tranquility over luxury, or adventure over comfort.

When asked about the reasoning for working with an advisor, travelers reported to Phocuswright that personal relationships and expertise matter most.

How can travel advisors thrive: the essential toolkit

72 percent of advisors have a positive outlook on the future.

In the predigital era, travel agents acted as gatekeepers to the global distribution systems (GDSs), providing the only viable access to airline and hotel inventories. Today, travelers can easily find this information with their smartphones. As a result, a travel advisor who simply books flights or hotels no longer adds significant value.

Now, modern advisors are evolving into “Lifestyle Architects,” similar to private bankers or wealth managers. So here are some ideas to help you stay relevant in a changing environment.

Focus on exclusive inventory, complex trips, and niche experiences

Simple, one-off hotel bookings are best left to OTAs. Advisors should instead focus on high-friction, high-value travel. i.e., cruises, expedition travel, and multistop itineraries. These trips involve coordination across suppliers, destinations, and timelines — areas where human judgment, relationships, and experience still outperform automation.

Also, remember that where generalists struggle, specialists win. Advisors who deepen their expertise in high-yield niches — such as wellness travel, adventure and expedition travel, luxury cruises, culinary tourism, or sustainability-focused travel — become harder to replace. Niche knowledge allows advisors to charge more, sell with confidence, and attract clients who value expertise over price.

Implement client retention strategies

Long-term relationships are one of the strongest competitive advantages advisors have. Effective strategies include

- personalized post-trip follow-ups,

- proactive trip ideas based on past behavior or life events, and

- “memory-keeping” — tracking preferences, anniversaries, favorite hotels, disliked airlines, etc.

Advisors who maintain presence between trips evolve from service providers into trusted travel partners. And technology helps build such a partnership.

Adopt the hybrid "Bionic" model

Technology should be treated as a force multiplier, not a threat. Today, it’s hard to imagine a travel advisor’s work without a solid software toolkit that includes

- itinerary building tools to accelerate planning;

- booking platforms and travel aggregators to manage reservations;

- CRM tools to store client preferences, travel history, and personal details, and to enable personalized campaigns;

- digital marketing/SMM tools to maintain an online presence; and

- communication tools for fast, consistent follow-ups.

Many travel agencies also use supporting software such as website builders, form builders, payment tracking solutions, business intelligence (BI) tools, and more.

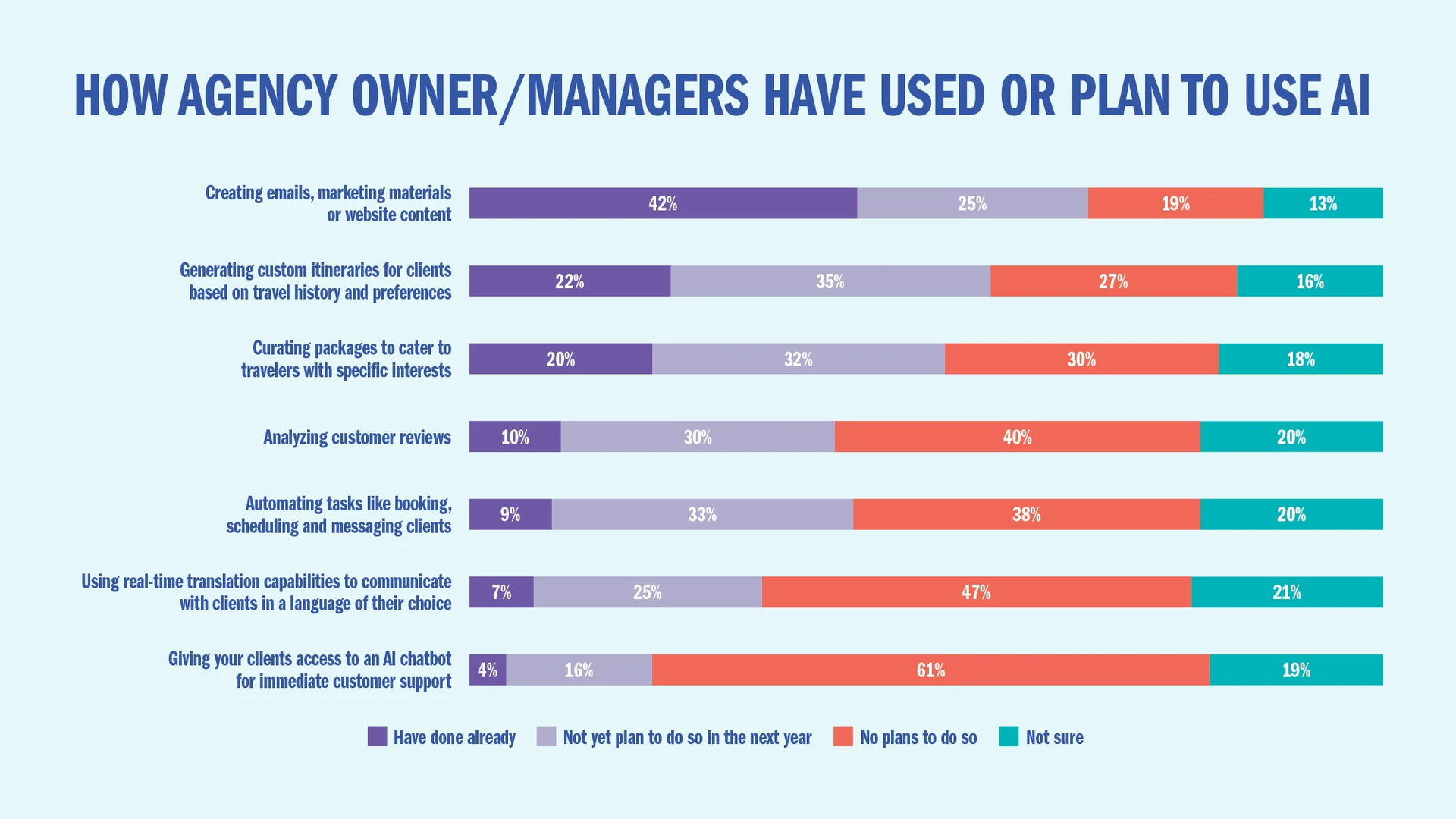

On top of that, generative AI is becoming a standard part of the workflow — nearly 60 percent of advisors already use AI tools to streamline client communication, support marketing activities, and draft itineraries.

How AI supports travel advisor workflows. Source: Travel Industry Survey 2025

To build a modern tech stack, advisors typically choose one of two paths: joining a travel advisor network that provides integrated, ready-made systems – or taking a DIY approach and selecting tools independently.

Shift toward fee-based service

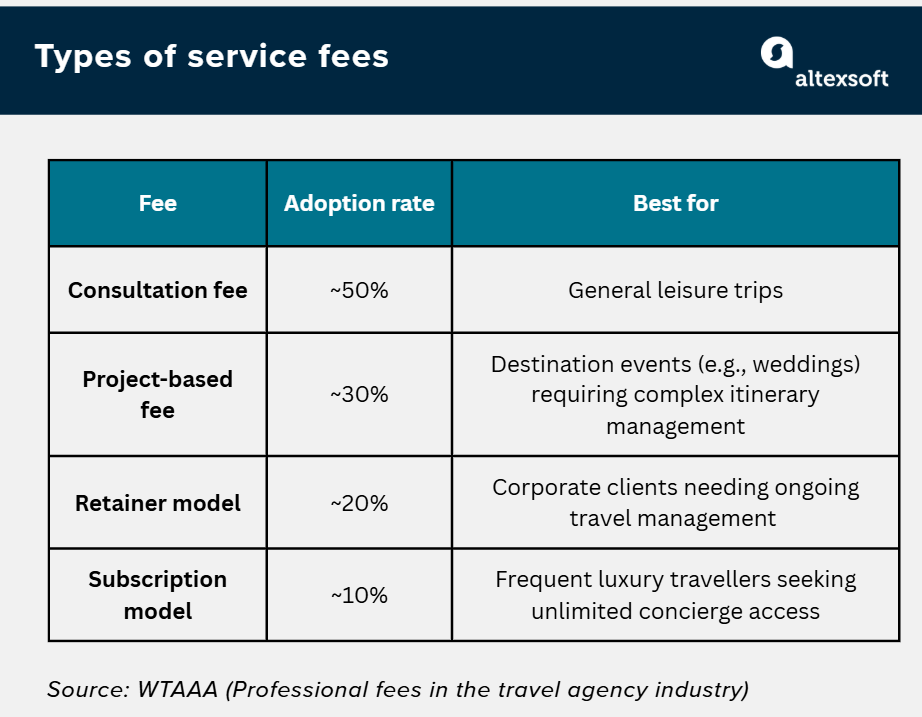

Finally, as we already mentioned, many successful advisors are moving toward professional service fees. As WTAAA reports, around half of travel advisors currently charge a fee.

Most adopt a hybrid approach, combining fees and supplier commissions.

There are several types of service fees.

Consultation fees are usually one-time charges paid before planning begins. You might charge $150-$300 for an in-depth consultation that covers destination insights, recommendations, and a preliminary itinerary outline. The fee is nonrefundable and doesn’t require booking.

You can apply the consultation fee toward the planning cost if the client proceeds with a booking – or treat them as separate charges.

Project-based (planning) fees can be calculated as a flat rate ($50-$500, depending on the project complexity) or a percentage of the trip cost. It covers services such as booking flights and hotels, creating custom itineraries, and providing travel planning advice. Additional fees may apply for passport and visa assistance, travel insurance, or emergency support.

Some advisors work on a retainer model, charging a monthly or annual fee for ongoing support.

Finally, subscription or concierge models offer annual memberships that include priority service and added perks. Tiers range $500–$5,000 per year.

Types of service fees. Source: WTAAA

Fees stabilize revenue and reduce dependency on commissions. Agencies report 12–20 percent profit margins on fee-based transactions versus <5 percent on commission-only bookings.

Besides, in a world where booking itself is cheap or free, charging for expertise, planning, and advocacy helps validate the advisor’s role as a professional — not a middleman.

The road ahead for travel advisors

The travel advisor profession is not dying; it is bifurcating. The “middle” of the market—routine bookings, budget travel, and simple logistics—will be almost entirely subsumed by agentic AI and advanced OTAs. The booking agent who simply does reservations will cease to exist.

However, the travel advisor will thrive by occupying the high ground of complexity, luxury, and human connection. While AI and self-service tools excel at speed, efficiency, and data-driven personalization at scale, the demand for travel advisors continues to increase.

The secret is that you don’t win by competing with technology on speed or price. You win by combining digital tools with human insight — designing travel experiences that algorithms alone can’t replicate.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.